by Naman Agarwal

Published On May 11, 2025

(Official Release : https://www.pib.gov.in/PressReleasePage.aspx?PRID=2127370)

India and Pakistan have seen a fresh flare-up since April 2025 when Islamist militants attacked Hindu tourists in Kashmir (26 killed), prompting India’s “Operation Sindoor” on May 6, 2025 a tri‐service air-and-missile strike on nine terrorist sites in Pakistan/PoK. Pakistan condemned the strikes as a “blatant act of war” and claimed to have shot down Indian jets. Prior incidents (e.g. 2016 Uri strikes, 2019 Balakot) similarly led to brief market shocks . Data show that the Nifty’s average drawdown in five major India–Pakistan crises (Kargil ’99, Parliament ’01, 26/11 ’08, Uri ’16, Balakot ’19) was only 5.3%. In most cases the index rebounded into strong gains over six months (1999 and 2008 rallies exceeded +35%). Consistent with this pattern, the May 2025 strikes barely dented markets; the Nifty 50 and Sensex opened lower but closed slightly higher (+0.1%) on May 7. India’s currency also held firm: the rupee weakened only 0.2% against the dollar on May 7 .

Military/cyber: Skirmishes along the Line of Control are frequent. Both sides routinely accuse each other of cyber-attacks on critical infrastructure . Pakistan-based terror groups (LeT, JeM) continue to threaten India, while India has upgraded surveillance and launched surgical strikes (e.g. 2016 Uri, 2019 Balakot) to deter infiltration. India has also temporarily suspended Pakistan’s Most Favoured Nation status in trade and halted LOC development projects as pressure measures.

Diplomatic: Tensions have spilled into the UN and diplomatic channels. India recently moved to revoke water allocations under the Indus Waters Treaty and froze the Permanent Indus Commission after the 2025 strikes. Pakistan has raised Kashmir at the UN and lodged formal protests. Both countries have expelled diplomats and slashed high-level dialogue since 2019. Internationally, India has tightened visa and trade controls (e.g. withdrawing MFN status), while Pakistan seeks Chinese and Middle Eastern support. Notably, despite New Delhi’s “muscular response” to terror attacks, analysts stress that unless fundamental links (trade, currency, inflation) are disrupted, market impact remains limited.

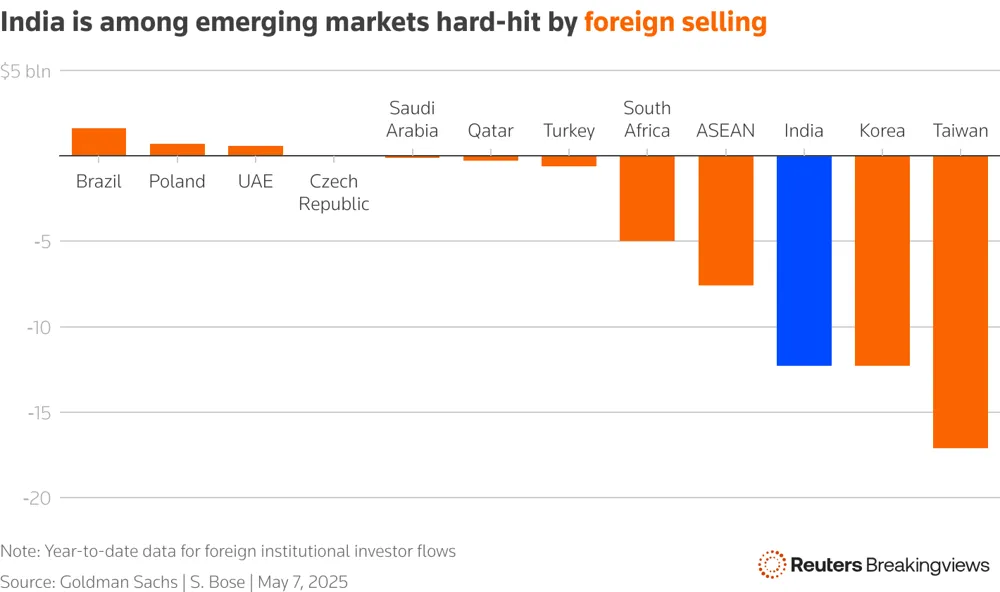

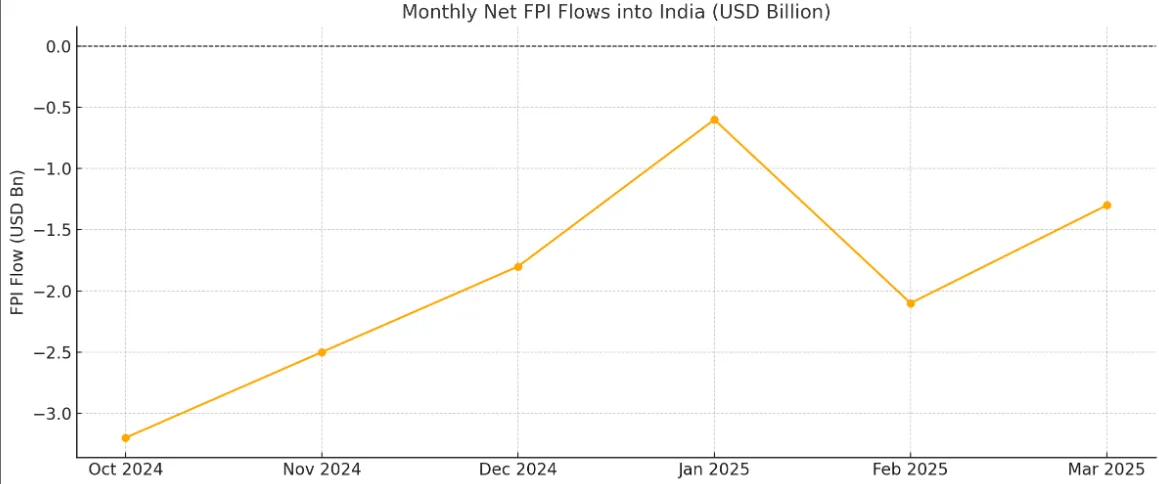

Market/Economic Impact: Historically, India’s markets treat Pakistan crises as temporary shocks. For example, after the Feb 2019 Balakot strikes the Nifty fell only 1.8% before rallying. In the recent May 2025 strike case, India’s Sensex and Nifty not only avoided major losses but rallied modestly by day’s end. FII investors, however, have become cautious: Reuters notes India saw some of the largest foreign outflows among emerging markets in early 2025. These outflows are shown in the chart below, which highlights that India’s net FPI flows have been sharply negative (blue bar) compared to most peers. Oil prices and currency also matter: high global oil (70–80 USD/bbl) keeps India’s import bill large, pressuring the trade deficit and rupee. Indeed, the rupee slide to historic lows (₹87/USD) by early 2025 as oil costs rose and U.S. rates stayed high.

Chart: Foreign institutional flows (USD billions) into emerging markets in 2025. India (blue) saw among the largest net outflows, reflecting heightened investor caution amid geopolitical and global uncertainties.

Phase | Key Event | Market Impact | Geopolitical Signal |

Phase 1 – Trigger | Terror attack in Pahalgam, Kashmir (Date: April 27, 2025) | Nifty -0.6%, INR slight dip | Sparked military and diplomatic crisis |

Phase 2 – Retaliation | Operation Sindoor: Indian air/missile strikes on PoK and terror camps (Date: May 6, 2025) | Flat close after early dip | Precision response showing India’s military edge |

Phase 3 – Posturing | Artillery buildup, cyberattacks, heightened surveillance | Defense stocks surge ~15% | Strategic pressure without full escalation |

Phase 4 – De-escalation | Diplomatic messaging via UAE, UN intervention | Markets stable, low volatility | Controlled escalation, signaling for peace |

Phase 5 – Drone Warfare Escalation | Pakistan launches 300–400 drones across Indian cities, India responds via S-400 & counterstrikes | Airports closed, defense stocks rally, civilian disruptions | New era of asymmetric warfare, increased risk of escalation |

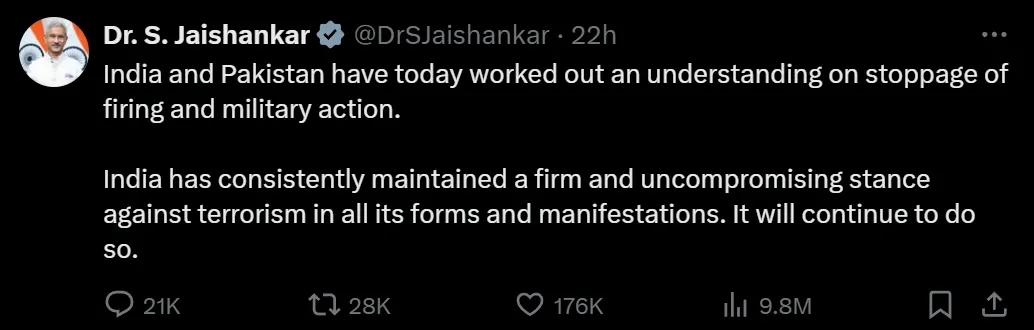

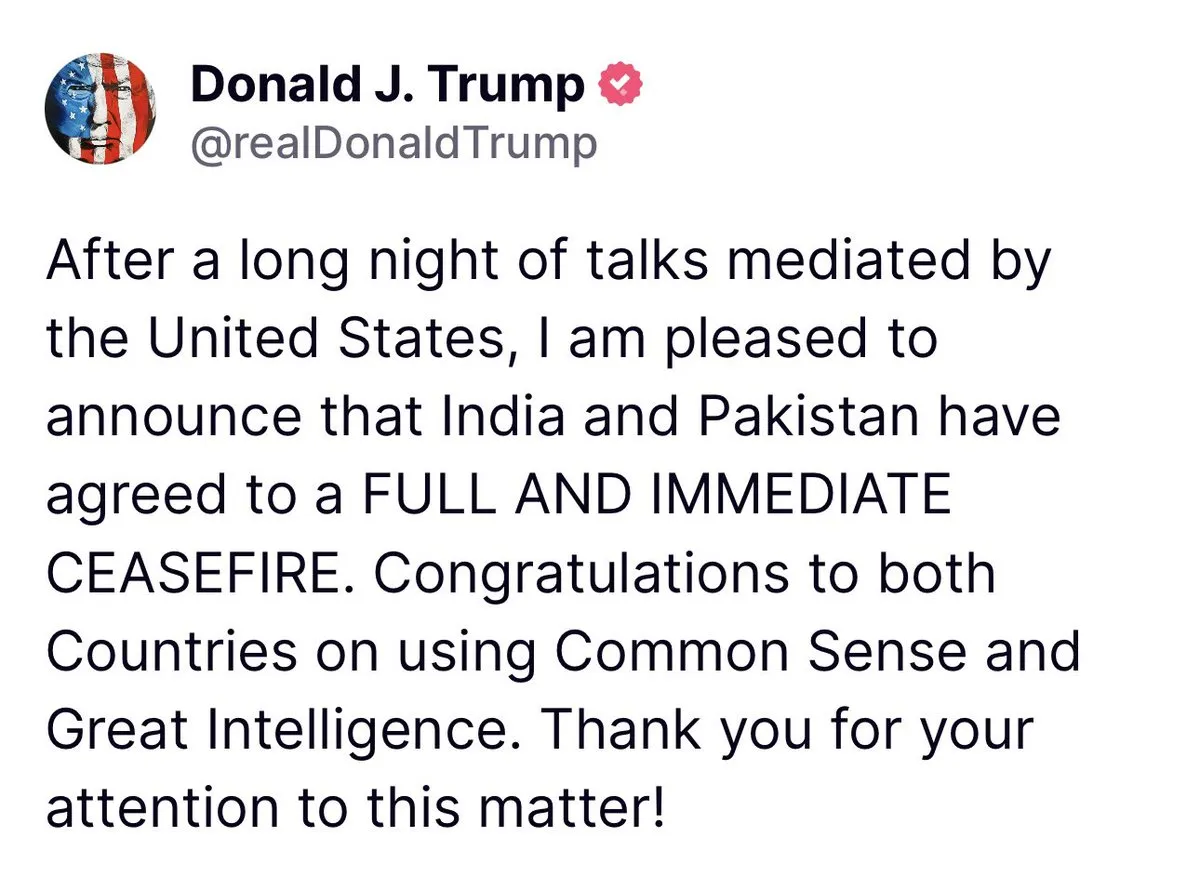

Phase 6 - Cease Fire | Both countries agreed to a ceasefire with immediate effect. (Date: May 10, 2025) | Market Closed (Saturday) | Firing halted , India Stating “Any Future Act Of Terror By Pak To Be Considered Act Of War” |

( X - https://x.com/DrSJaishankar/status/1921183635274608685 )

( X - https://x.com/realdonaldtrump/status/1921174163848401313?s=46&t=wKH0vnkycxZ9ChJTbjZSew )

Geopolitical conflicts between India and Pakistan have historically led to short-term volatility in stock markets, but Indian markets have shown strong resilience and recovery. Pakistan's stock exchange, however, tends to suffer prolonged downturns due to economic instability.

Below is a summary of major conflicts and their impact on the Indian stock market (Nifty 50 & Sensex):

Event | Date | Market Reaction | Recovery Time |

Kargil War | May-Jul 1999 | Sensex fell 0.8% | 1 month |

Indian Parliament Attack | Dec 2001 | Sensex fell 0.7%, Nifty fell 0.8% | Few weeks |

Mumbai 26/11 Attacks | Nov 2008 | Sensex gained 400 points, Nifty gained 100 points | Immediate |

Uri Attack & Surgical Strikes | Sep 2016 | Market fell 2% | Few days |

Pulwama Attack & Balakot Air Strikes | Feb 2019 | Market dipped 1.8% | Weeks |

Operation Sindoor | May 2025 | Sensex fell 0.2%, Nifty fell 0.3% | Same day recovery |

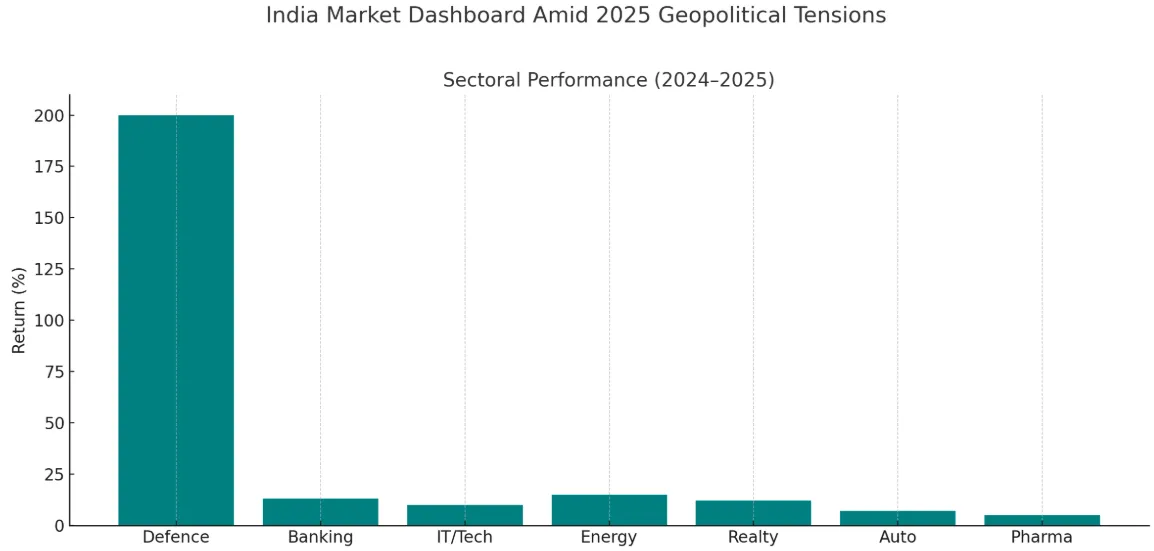

Different sectors react differently to geopolitical tensions:

Sector | Impact |

Defence & Aerospace | Stocks surge due to increased government spending |

Banking & Finance | Volatility due to risk perception |

Oil & Energy | Prices fluctuate based on global supply chain disruptions |

IT & Tech | Limited impact, but investor sentiment may cause temporary dips |

Consumer Goods | Generally stable, as domestic demand remains unaffected |

Pakistan's KSE-100 index has historically suffered larger declines compared to Indian markets:

Operation Sindoor (2025): KSE-100 plunged 5%, marking a cumulative 10% decline since April 23.

Pulwama Attack (2019): Pakistan's market fell 7% over two weeks.

Uri Attack (2016): KSE-100 dropped 4.5%.

Foreign Institutional Investors (FIIs) continue investing in India, supporting market stability.

Domestic Institutional Investors (DIIs) play a crucial role in absorbing shocks.

Pakistan struggles with capital flight, leading to prolonged market downturns.

India’s equity markets have been buoyant overall, even as geopolitical noises linger. In 2024 the Nifty 50 (+18.7%) and Sensex (+17%) were among the world’s best-performing major indices. The chart below ranks global index returns in 2024, with India near the top. Despite mid-2025 conflicts, the rally has extended into 2025: for instance, on April 23, 2025 the Nifty hit a fresh high (24,328) driven by tech stock gains. By late March 2025 the Nifty was roughly flat YTD (+0.2%), reflecting mixed forces (global monetary easing vs local tensions). Sectoral performance has varied:

Defence: The Nifty India Defence index has soared 200% over the past two years. Government defense spending and “Make in India” pushed defense manufacturers to multibagger returns. For example, Hindustan Aeronautics Ltd (HAL) nearly tripled in two years (+206%), Bharat Dynamics Ltd (BDL) doubled (+200%), Bharat Electronics Ltd (BEL) almost tripled (+192%), and others like BEML and Paras Defence were up 126–151%. These gains far outpaced the 35% rise in the Nifty 50 over the same period. Breaking into new self-reliance projects (fighter jets, missile systems, shipbuilding) underpinned this surge.

Banking: Financials were relatively strong in early 2025. As reported, in Q1 FY2025 the Nifty Bank index gained 1%, ranking it second-best among NSE sectors (behind metals) while the Nifty 50 fell 0.9%. However, this was driven by only four large private banks (ICICI, Axis, Kotak, HDFC); most PSU banks lagged. Over one year (through Mar 2025), the Bank Nifty was up 13% reflecting loan growth and steady margins after rate cuts.

IT/Technology: The Nifty IT index remains strong – tech services firms have generally benefited from global digitization. For example, Infosys, TCS and Wipro all rose significantly in H2 2024. In April 2025 the IT index jumped 0.7% (a day’s move led by HCLTech +7.7%) after optimistic earnings and easing Fed rate worries. Year-to-date (Mar 2025), IT is one of the market’s outperformers (+10%). India’s software exporters get roughly 60% of revenue from the U.S., so U.S.– China trade war fixes and Fed cuts are tailwinds.

Energy/Oil & Gas: This sector is tied to crude prices (40% of world’s oil passes near India). In July 2024 energy stocks rallied after positive news: Reliance Industries jumped 2% and ONGC 4% on block trades, helping the Nifty Energy index rise 2%. However, higher oil globally (+20% in 2024) has pressured India’s trade deficit and rupee. Key stocks like ONGC, Indian Oil (IOC) trade near multi-year highs due to volume growth, while Gulf Oil, Petronet LNG (LNG importer) also benefit from sustained demand. Over 2024–25, Nifty Energy is up 15%.

Others: Autos, metals, and realty were mixed. Notably, realty/Nifty Realty was the second-best sector in early 2025 (post-budget boost), reflecting infrastructure spending. Consumption and pharma stocks have held up on domestic demand. Cybersecurity-specific firms are small-cap but India’s broad IT and defense push have indirectly boosted related technologies.

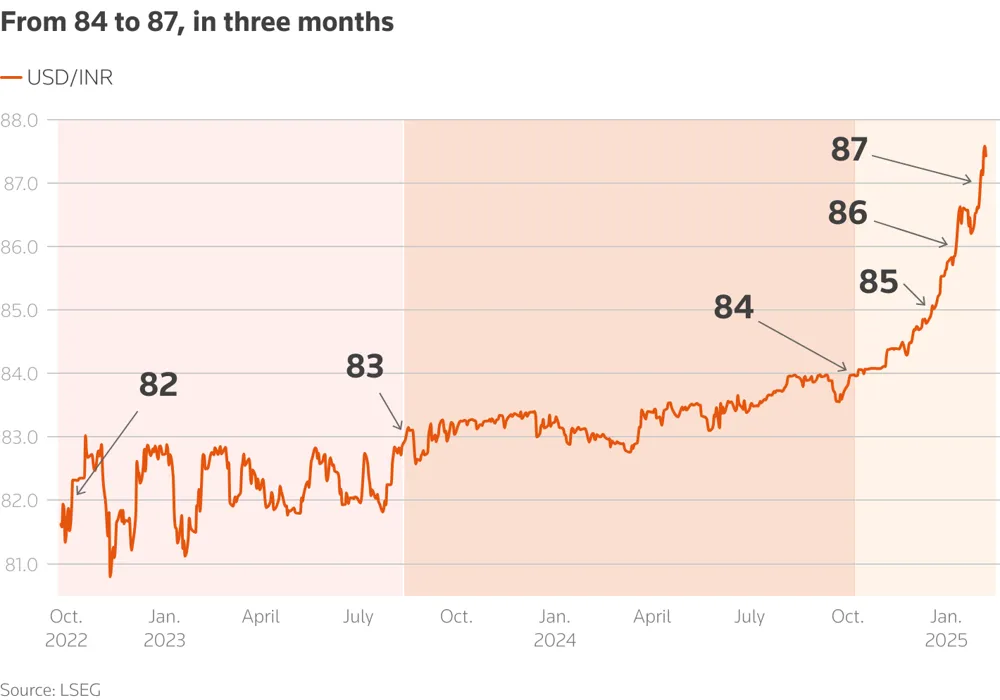

Key economic indicators have broadly held up despite conflicts. Foreign portfolio flows into India were net-negative in late 2024–2025 , reflecting global volatility and some risk-off amid regional tensions. Nevertheless, India’s macro fundamentals (GDP growth 7%, inflation 5–6%) continue to attract investors. RBI interventions helped keep the rupee relatively stable. The chart below traces USD/INR over the past two years: the rupee has slid from ~₹82 (late 2022) to ₹87 in early 2025, driven largely by external factors like U.S. Fed policy and oil prices.

Chart: USD/INR exchange rate (Oct 2022–Jan 2025). The rupee weakened from ~82 to ~87 per dollar, reflecting oil import costs and global rate shifts.

In summary, while India’s geopolitical tension command headlines, financial markets have absorbed them without derailing the bull trend. Investors point out that as long as conflicts stay limited, India’s large domestic economy and policy stability keep markets anchored. Historical analogies (e.g. 2019 Balakot, 2020 Galwan) suggest corrections are short-lived. Sector-wise, defense and infrastructure names have been the big winners of the recent geopolitical environment, while banks and IT have also held up well. External factors (global liquidity, commodity prices, Fed moves) have arguably been more influential than borders. Nonetheless, any serious escalation could test this resilience; for now, markets remain bullish on India’s growth story, with only measured wariness about near-term risks.

India’s northern border disputes with China, frozen since the 2020 Galwan clash, saw cautious thawing in late 2024. In October 2024 the two sides struck an agreement to resume patrolling and began pulling back troops from the last stand-off points in Ladakh. By early 2025 officials said frontline armies would remove forward structures and revert to 2019 positions. EAM Jaishankar has acknowledged “issues” will persist but can be managed without war. PM Modi and Xi met at BRICS (Oct 2024) and pledged to rebuild trust, while resumed talks have aimed to prevent future clashes.

Trade and Technology: The border standoff had strained economic ties. China is India’s top trade partner (imports $100–120B/year) and a major FDI source, but India has restricted Chinese tech/telecom firms (e.g. 5G vendors) and tightened RFI rules post-2020. Jaishankar noted the 2020 dispute “impacted several aspects…from trade and technology to air travel”. Since late 2024 both sides have gradually worked to restore business, regular trade talks resumed and some flights have restarted but Beijing remains cautious.

Military/Cyber: Both armies remain on alert along the LAC. India continues infrastructure build-up (roads, airstrips) in border areas, matched by China. China’s cyber surveillance and disinformation campaigns in India are perennial concerns. Notably, India was the world’s #2 most-targeted nation by cyber attackers in 2024 (after the U.S.), with 95 Indian entities hacked. Many attacks hit finance, government and telecom firms, reflecting strategic rivalries. India is ramping up cyber defenses and indigenous IT capacity in response.

Market/Economic: Unlike India–Pakistan cases, recent India–China border easing actually boosted sentiment. Asian investors cheered the troop pullback: tech and consumer stocks rallied on hopes of relaxed supply chain jitters. (For instance, in April 2025 India’s IT index led gains amid talk of U.S.–China trade de-escalation.) Long term, large-scale conflict would undoubtedly spook markets, but analysts see less direct impact from India–China friction than from global factors. Past episodes support this: after the 2020 Galwan skirmish, the rupee weakened 1% but then recovered as both sides disengaged. In the broader context, India’s focus on domestic growth and macro stability has kept foreign investors engaged despite sporadic China tensions.

India’s relations with Sri Lanka have grown strained over security and influence issues. Maritime disputes (especially fishermen in the Palk Strait) flare regularly: Sri Lankan Navy often detains Indian fishing boats, provoking fishermen protests in Tamil Nadu. Recently China has been accused of stoking anti-India sentiment in Sri Lanka’s Tamil north: “China may be fishing in the troubled waters of Northern and Eastern Sri Lanka,” the Economic Times reports, citing meetings between Chinese officials and local fishermen to exploit grievances against India. Northern Sri Lanka hosts several Indian-funded projects (ports, power plants), and India fears China will establish a strategic foothold there. Lanka’s new government under President Dissanayake still relies on Chinese investment (e.g. Trincomalee, Pulmoddai minerals) while seeking Indian support to stabilize the economy.

Economic/Trade: India is a key trade partner (exports $3.5B, imports $3.1B in FY2023). Economic ties include large lines of credit (India lent $3B for food and fuel) and investments . Sri Lanka’s debt crisis and austerity have slowed business (inflation hit 60% in 2022). Any diplomatic chill can disturb commerce: for example, Tamil Nadu’s agitation sometimes pressures Lankan authorities (or vice versa). India is also Sri Lanka’s largest tourism source, so unrest can dent that sector.

Strategic: India fears any Chinese military base in Sri Lanka. The Hambantota port (leased to China) and Colombo’s growing naval presence are watched closely. In response, India has sought to deepen ties with the new Sri Lankan government to prevent strategic losses.

Market/Economic Impact: Sri Lanka’s crisis has only a modest effect on Indian markets (Sri Lanka’s economy is 0.6% of India’s). However, sector stocks in India with SL exposure (like Adani Ports or HDFC Bank with Lankan subsidiaries) need to monitor risk. Currency moves have been mostly dominated by global factors (e.g. oil). Recently, as SL imported fuel through Indian credit, Indian oil companies faced payment risks but no major defaults have hit, thanks to Indian support. Overall, India sees Sri Lanka more as a strategic partner than competitor, so economic linkages remain intact even amid rivalry with China.

India–Bangladesh ties have cooled since Bangladesh’s 2024 political upheaval. After Bangladesh’s Awami League government fell (Aug 2024) and its erstwhile PM Sheikh Hasina fled to India, protests against India surged in Dhaka. In December 2024 India’s Foreign Secretary flew to Dhaka to “clear the cloud” over bilateral ties. Both sides made conciliatory statements, with India reaffirming desire for “positive, constructive” relations and Bangladesh promising to address concerns (attacks on minorities, water-sharing, border incidents).

Trade and Transit: Bilateral trade is robust ($16B total annually) and benefits both economies. Yet some policy moves unsettled Dhaka . Notably, India abruptly withdrew a key transit agreement that allowed Bangladeshi goods to cross India en route to Nepal/other neighbors. Dhaka called this a “big blow” that undermined decades of trade facilitation. The fallout showed how political rifts can translate into economic losses.

Diplomatic: Bangladesh accused India of sheltering Hasina (currently in India for medical care) and demanded her extradition. India, in turn, sought assurances against attacks on cultural and religious sites. The governments have denied border flare-ups and recommended joint patrols. Both sides recognize deep interdependence (shared history, culture, connectivity), and have repeatedly asserted that ties should overcome temporary political storms.

Market/Economic Impact: As of 2024–25, trade in goods has continued; India remains Bangladesh’s largest export destination and investor. In the stock market, Bangladesh tensions are of minor direct influence. However, Indian companies with Bangladesh links (e.g. firms supplying power projects or consumer goods) watch policy shifts. Remittances, labor flows, and river water agreements (e.g. Teesta) are more immediate issues. Notably, Bangladesh’s new leadership has courted Chinese investment (e.g. CPEC pipeline, digital connectivity) which India views warily. Still, analysts believe the economic fundamentals compel both countries to smooth differences. (For example, soon after December 2024’s meeting, Bangladesh’s interim PM met India’s PM at a BIMSTEC summit.) Recent history suggests that even sharp diplomatic rows (as in 2024) tend to ease once leadership stabilizes, limiting any lasting hit to trade or investment.

Turkey has historically supported Pakistan in various conflicts due to shared geopolitical, cultural, and strategic interests. The two countries have a long-standing relationship that goes beyond military cooperation and extends to trade, diplomacy, and mutual defense.

( Asisguard Songar Drone (Made by Turkey) , used by Pakistan to attack India

Know More About Drone : https://www.moneycontrol.com/news/india/all-about-turkey-s-asisguard-songar-drone-pakistan-used-to-target-india-13019349.html )

Geopolitical Alignment

Shared Strategic Interests: Both Turkey and Pakistan are significant players in their respective regions. Turkey, located at the crossroads of Europe and Asia, and Pakistan, strategically positioned in South Asia, share concerns over regional stability, especially in relation to India, Afghanistan, and their roles within international organizations like the UN and the Organization of Islamic Cooperation (OIC).

Islamic Solidarity: Both nations share strong cultural and religious ties, being Muslim-majority countries. Turkey's support for Pakistan can be seen in the context of Islamic solidarity, particularly when Pakistan faces external pressure or conflict with other nations.

Counterbalancing India: Both countries view India as a regional competitor, with Turkey historically providing support to Pakistan in its conflicts with India, such as during the Kashmir issue. This support, while sometimes subtle, strengthens the alliance between Turkey and Pakistan.

Military and Defense Cooperation

Joint Military Exercises: Turkey and Pakistan frequently conduct joint military exercises, enhancing their cooperation in defense matters. This includes training, sharing military technology, and strategic collaboration.

Weapons and Equipment: Turkey has supplied Pakistan with military hardware and technology, including drones, artillery, and air defense systems. This strengthens Pakistan’s military capabilities, particularly in counterterrorism and border security operations.

Historical Military Support: During the wars between Pakistan and India (especially in 1965 and 1971), Turkey expressed political support for Pakistan. While Turkey did not engage directly in military action, it played a diplomatic role in supporting Pakistan in the international arena.

Trade Relations and Economic Ties

Turkey and Pakistan have deepened their economic ties in recent years. Trade between the two nations has been growing, and they have worked together to strengthen economic cooperation.

Key Trade Details:

Trade Volume: The bilateral trade volume between Turkey and Pakistan is substantial, with both nations seeking to increase their commercial ties. In recent years, the trade volume has exceeded $1 billion annually, with both countries aiming to boost this figure further.

Exports and Imports:

Pakistan’s Exports to Turkey: Key exports from Pakistan to Turkey include textiles, rice, leather products, and agricultural goods.

Turkey’s Exports to Pakistan: Turkey exports machinery, motor vehicles, iron and steel, and electrical machinery to Pakistan.

Free Trade Agreement (FTA): Pakistan and Turkey have been negotiating a Free Trade Agreement to further enhance bilateral trade. This agreement aims to eliminate tariffs and trade barriers on goods and services, making it easier for businesses in both countries to engage with each other.

Investment: Turkey has shown interest in investing in various sectors in Pakistan, including infrastructure, energy, and defense. In return, Pakistan has welcomed Turkish investments in its own infrastructure projects, particularly in transport and urban development.

Historical Ties:

Shared History: The two countries share a history of mutual support dating back to the early 20th century. During the Turkish War of Independence (1919-1922), Pakistan, which was then part of British India, expressed solidarity with Turkey under the leadership of Mustafa Kemal Atatürk.

Post-Independence Relations: After the independence of both countries, Turkey and Pakistan maintained a strong relationship, frequently aligning on issues of defense and regional stability. They have cooperated in various global forums, including the United Nations and the OIC.

Strategic Partnerships: Over the decades, the strategic partnerships between Turkey and Pakistan have evolved, particularly through defense and diplomatic cooperation. The 21st century has seen both countries further solidify their ties, with a particular emphasis on counterterrorism, military technology transfer, and cooperation on energy security.

In conclusion, Turkey’s support for Pakistan, especially in times of conflict, can be attributed to a combination of strategic interests, shared cultural and religious ties, and historical military cooperation. Trade relations between the two nations are also robust and have continued to grow, contributing to an increasingly strong bilateral relationship.

The Balochistan conflict, often overshadowed by larger regional dynamics, is one of South Asia’s most entrenched and violent internal insurgencies. Rooted in decades of ethnic, economic, and political grievances, the Baloch nationalist movement has demanded greater autonomy or full independence from Pakistan, citing systematic exploitation of the province’s vast mineral wealth, especially in areas like Gwadar, Sui, and Chagai. The discontent dates back to 1948, shortly after Pakistan’s creation, when the princely state of Kalat was forcibly annexed—sparking the first armed rebellion. Since then, there have been five major uprisings, with the most intense beginning in 2004 and continuing intermittently to the present day.

Over the years, several Baloch separatist groups have emerged, including the Baloch Liberation Army (BLA), Baloch Republican Army (BRA), and Baloch Liberation Front (BLF). These groups have carried out a series of coordinated attacks targeting Pakistani security forces, the Frontier Corps, railway infrastructure, natural gas pipelines, and more recently, Chinese workers and assets tied to the China-Pakistan Economic Corridor (CPEC). Their operations are typically concentrated in the rugged southwestern parts of the province, leveraging guerrilla tactics in the mountainous terrain.

During the India-Pakistan military tensions of 2025, particularly in the aftermath of Operation Sindoor, the conflict in Balochistan took on new strategic dimensions. With Pakistan’s military heavily deployed along the eastern border facing India, Baloch insurgents seized the opportunity to escalate operations internally. Intelligence reports suggest that BLA and allied groups launched over a dozen attacks in January–March 2025 alone, including ambushes on military convoys in Kech and Panjgur, and sabotage of gas pipelines in Dera Bugti.

The Baloch insurgency, therefore, became a significant “second front” for the Pakistani military during its standoff with India. Analysts note that this dual-pressure situation exposed structural vulnerabilities in Pakistan’s internal security apparatus, as troops were redeployed from restive areas to the frontlines, leaving strategic installations exposed. While the insurgents are still far from achieving full territorial control, the events of 2025 underscored the enduring volatility of Balochistan and the risks it poses to Pakistan’s national cohesion—especially during periods of external conflict.

https://www.newsonair.gov.in/baloch-liberation-army-launches-major-attack-in-balochistan/ )

India’s geopolitical landscape in 2025 remains fraught with complexities from targeted military strikes in Pakistan to managing strategic balances with China, and navigating fragile relationships with Sri Lanka and Bangladesh. While these developments stir diplomatic and regional tensions, their direct impact on India’s financial markets has so far been contained. Historical patterns show that Indian equity markets tend to absorb such shocks swiftly, reflecting investor confidence in the country's economic fundamentals and policy responses. The May 2025 Operation Sindoor airstrikes, like prior conflicts, caused minimal market disruption, underscoring the maturity and resilience of Indian investors.

From a sectoral standpoint, India’s defense sector has emerged as a key beneficiary of ongoing geopolitical uncertainty. Stocks in aerospace, defense manufacturing, and cybersecurity have rallied sharply, driven by increased government spending and domestic capacity-building. Simultaneously, banking, IT, and energy sectors continue to support the market’s upward momentum. While FPI outflows and a weaker rupee have posed headwinds, robust GDP growth, policy stability, and rising domestic inflows have helped sustain market performance.

Strategically, India is leveraging a calibrated foreign policy firm on security but pragmatic in diplomacy to balance regional instability with economic growth imperatives. Trade relations, cyber defense, and infrastructure resilience remain under the spotlight. Looking ahead, while sudden escalations cannot be ruled out, India's economic trajectory appears firmly rooted, with the equity market poised to weather geopolitical tremors, especially if macro and fiscal conditions remain strong.Worried about Nuclear weapons, this clip of PM Narendra Modi would ease up your mind and India’s stand ( https://youtu.be/ZFKPDrIZXRg?feature=shared ) .

In summary, India’s military assertiveness, regional diplomacy, and market dynamics in 2025 represent a nation prepared to defend its sovereignty without derailing its economic ambitions. India’s stand against terrorism stays clear , this ceasefire might not be a permanent solution to this war and may last longer than expected . Investors and policymakers alike must stay vigilant especially in sectors exposed to defense, energy, and global supply chains but the long-term outlook for India remains structurally positive.

Jai Hind !

Sources:

https://www.newsonair.gov.in/

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart