by Siddhart Agarwal

Published On Sept. 19, 2021

Systematic investment plans, or SIPs are increasingly popular among investors seeking a disciplined approach to building wealth. SIPs have been touted as being the ideal way to invest and build wealth over the long term. But what is SIP? And what is SIP investment? Every investment expert talks about SIPs so that investors might think they are the cure to all ills. But is investing systematically really as great as it is made out to be?

Simply put, a SIP allows you to invest a fixed amount of money at regular intervals into mutual funds or other investment vehicles. This method of investing promotes regular saving and takes advantage of market fluctuations, ensuring that you invest consistently without the stress of market timing. In this article, we’ll explore the what is SIP, benefits of SIP, how to start SIP, optimal times to invest in SIPs and identify who can benefit the most from SIP investments.

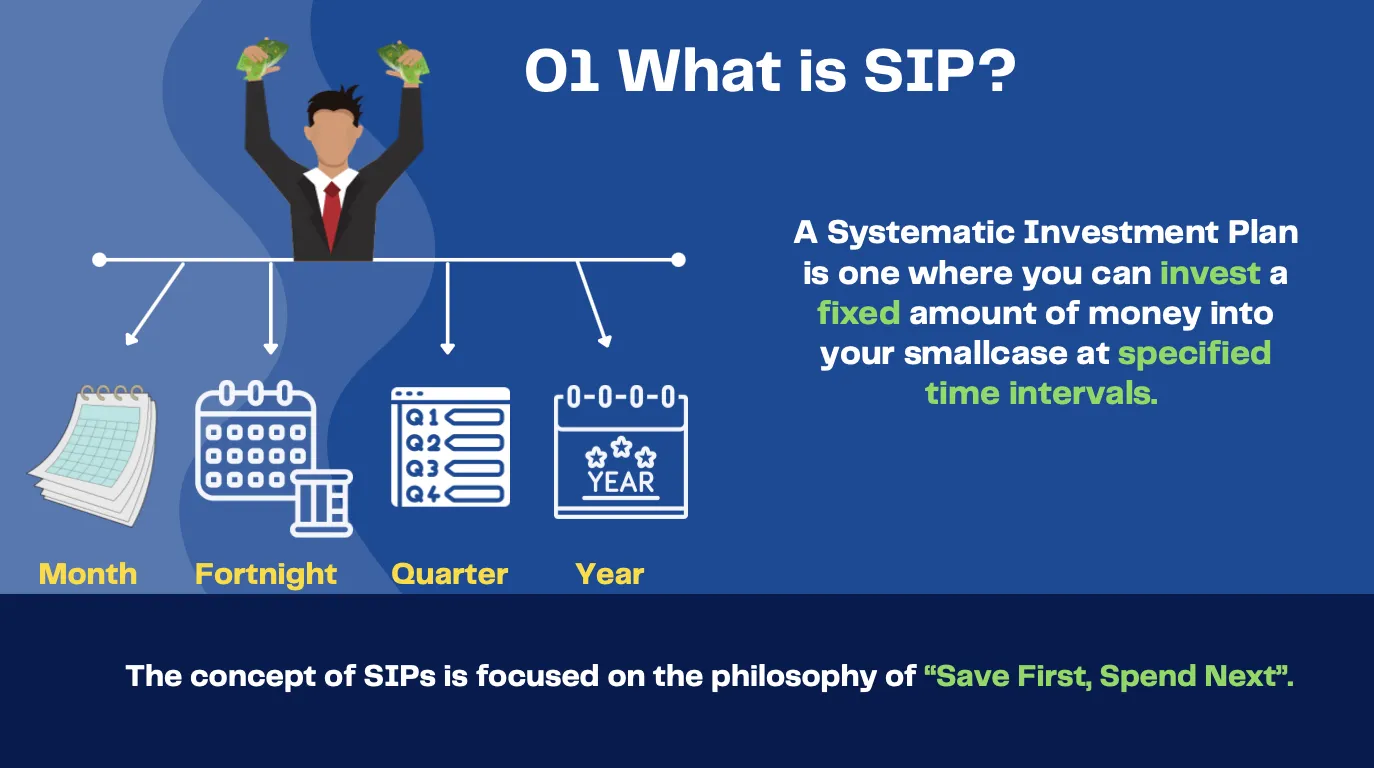

A Systematic Investment Plan is one where you can invest a fixed amount of money into your mutual fund, smallcase or any other investment vehicle at specified time intervals. The SIP feature is aimed at aiding you in developing a disciplined investment habit. The concept of SIPs is focused on the philosophy of “Save First, Spend Next.”

So, we have understood what is sip investment, let's look at benefits of SIP. Here are some benefits of SIP:

Disciplined Investing: SIP helps in cultivating a disciplined approach to investing. By investing a fixed amount regularly, investors develop a habit of saving and investing consistently, regardless of market conditions.

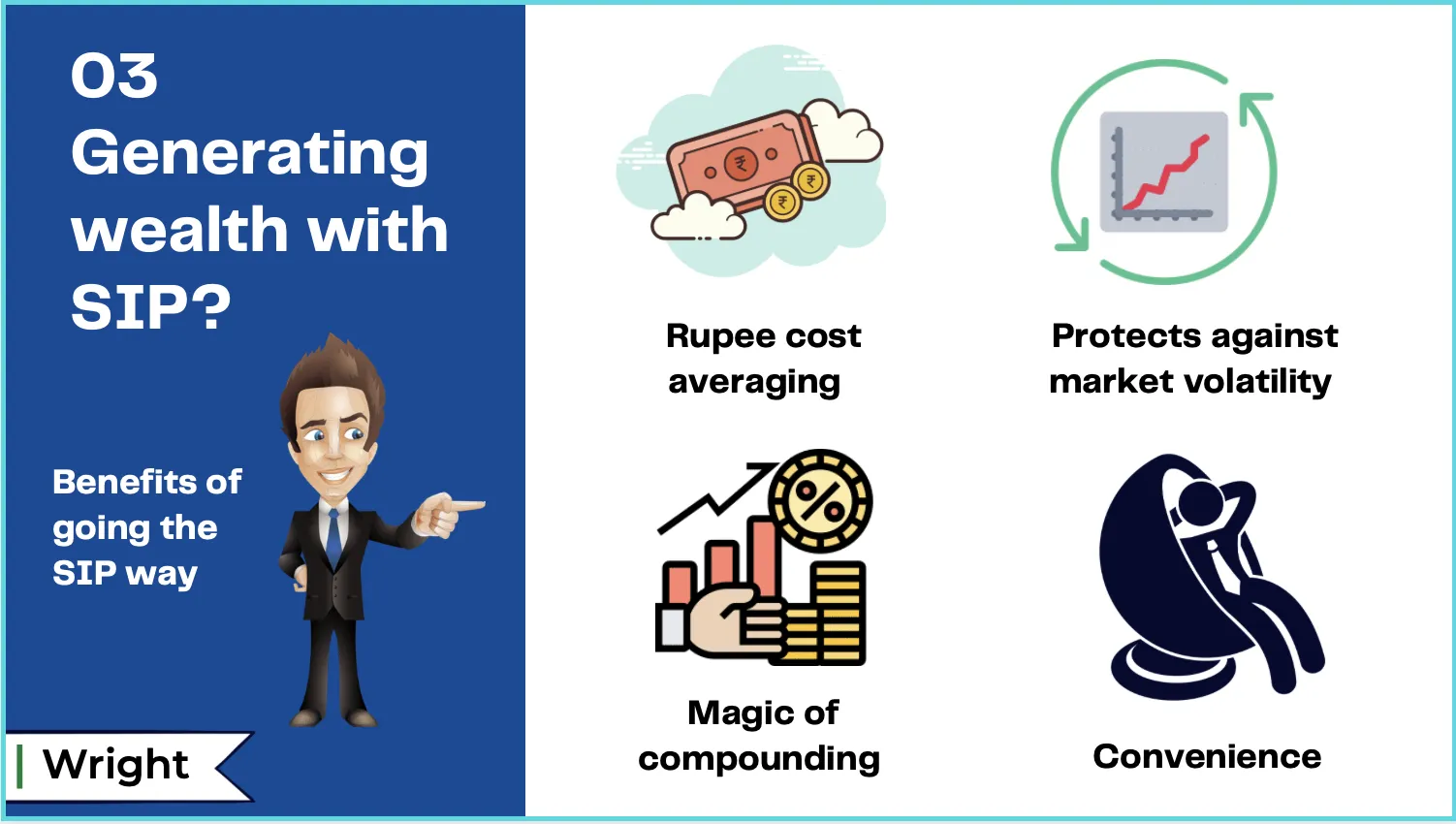

Rupee Cost Averaging: SIP allows investors to buy more units when prices are low and fewer units when prices are high. This strategy of investing at different price levels helps average out the cost per unit over time, reducing the impact of market volatility.

Flexibility and Affordability: SIPs offer flexibility in terms of investment amounts. Investors can start with a small investment and gradually increase their investment as their financial situation improves. This makes it more affordable for investors to participate in the markets.

Power of Compounding: SIPs benefit from the power of compounding. As investments grow over time, the returns earned in one period are reinvested, generating additional returns. The longer the investment horizon, the greater the potential for compounding to amplify returns.

Convenience and Automation: SIPs are convenient as they allow investors to automate their investment process. Once set up, investments are deducted automatically from the investor's bank account, eliminating the need for manual investment decisions.

Diversification: SIPs enable investors to diversify their investment across different asset classes, sectors, or funds. By spreading investments across a range of options, investors can reduce their exposure to individual securities and mitigate risks.

Professional Management: SIPs provide access to professional fund managers who manage the investment portfolio. These experts perform in-depth research, monitor market trends, and make informed investment decisions on behalf of investors.

Goal-oriented Investing: SIPs can be aligned with specific financial goals, such as retirement planning, education funding, or buying a house. By investing regularly and for the long term, investors can work towards achieving their financial objectives.

We have understood what is sip investment and the benefits of SIP professional management by expert fund managers who analyze the market and invest in various areas. Let's understand how to start SIP and how SIPs work can help you make your money grow faster.

In a SIP, mutual fund units are purchased at predetermined intervals based on the Net Asset Value (NAV). These units accumulate throughout your investment tenure and their value is credited to your account when you redeem them.

SIPs operate on two key principles: Rupee Cost Averaging and Compounding.

Rupee Cost Averaging: SIPs help mitigate market volatility by ensuring that you buy fewer units when markets are high and more units when markets are low. This approach minimizes your risk and results in purchasing units at a lower average cost.

Compounding: Regularly saving a small sum of money over a long period can have a significant impact through the power of compounding. For instance, investing Rs. 1000 per month with a 7% return, someone who starts at age 20 can accumulate a significantly larger investment corpus by age 60 compared to someone who starts at age 30. This highlights the benefits of early investing.

In conclusion, regular and long-term investments can yield substantial returns through the power of compounding.

Investing in a SIP can be highly beneficial for individuals looking to build wealth over time. The best times to invest in SIPs are:

When You Have a Regular Income: If you have a steady monthly income, starting a SIP ensures regular investments without the need for timing the market.

When Market is Volatile: SIPs allow you to take advantage of rupee cost averaging. Investing regularly during market volatility helps in averaging out the cost of units purchased.

Long-term Goals: If you have long-term financial goals like retirement, children's education, or buying a house, SIPs help in disciplined and systematic savings.

Beginning of Career: Starting early in your career maximizes the benefits of compounding. The earlier you start, the more wealth you can accumulate.

After Financial Planning: Post comprehensive financial planning, if you have identified your risk tolerance and investment goals, SIPs can be an effective investment route.

Lump-sum or, simply put, investing a specified amount of money in one go would involve a lot of brain-wracking, and as an investor, you would be hooked to time the market, i.e., to invest when the markets are down or during a correction.

However, as Nick Murray says … “It is all about time spent in the market and not timing the market.”

Whereas, with a SIP, you can invest small amounts at fixed intervals (weekly, monthly or quarterly) instead of making a one-time investment, and you do not need to worry about timing the market. Also, you don’t need to have a large amount of money to get started.

| SIP (Systematic Investment Plan) | Lump Sum Investment | |

| Investment Amount | Fixed small amounts invested regularly (monthly, quarterly) | One-time large investment |

| Market Timing | Reduces the need to time the market | Requires market timing to maximize returns |

| Risk Management | Mitigates risk through rupee cost averaging | Higher risk if invested at a market peak |

| Affordability | More affordable; suits investors with limited funds | Requires substantial capital upfront |

| Flexibility | High; can start, stop, or modify investment easily | Low; locked into the investment at the time of purchase |

| Discipline | Encourages disciplined investing habits | Requires self-discipline to invest periodically |

| Compounding Benefits | Benefits from regular compounding over time | Benefits from compounding but relies on initial investment growth |

| Market Volatility | Buys more units when prices are low, fewer when high | Entire investment exposed to market conditions at once |

| Suitable For | New investors, salaried individuals, risk-averse, long-term goals | Experienced investors, those with large capital, confident market timers |

| Emotional Control | Easier to manage emotions and stay invested during volatility | Difficult to stay invested during market downturns |

| Returns | Earns better during market lows | Earns better during market highs |

| Market crash | SIPs can protect investments from potential market crash | One-time investments can lead to a major loss during market crash, which happens often enough |

SIPs are suitable for a variety of investors, including:

By understanding the best times to invest and who should invest in SIPs, individuals can make informed decisions to optimize their investment strategy.

With a SIP, you can get started with your investment with a small amount and reap significant returns in the long run. It’s simple and the most convenient way of investing in the financial markets. In addition, SIP’s have benefits that would help you generate wealth.

Timing the stock markets is one of the most challenging things for an investor to do. Often, it is also not necessary because of the risks it carries. Investors often worry about when and how much to invest. SIPs take this worry away. A systematic investment plan is a disciplined way of investing a fixed amount at regular intervals. By eliminating the need to monitor the markets constantly, it helps protect the portfolio against market volatility.

Buy more when the price is low and less when the price is high. When you are investing via SIPs, you are investing a fixed amount on a specified date. If, on that date, the stock price is high, you will have a lesser number of shares and vice-versa. This ensures that you invest more at lower prices and less at higher prices, and hence your overall cost of acquisition gets averaged out.

It’s all about time in the market, not timing the market —the key to becoming wealthy is to start investing early and continue investing and stay invested. When you stay invested, you start earning returns on the new amounts you invest and the returns you have already made. This is called compounding, and it works like magic to help you build wealth.

SIPs are not automatically executed.

We will send you an email and WhatsApp & push notification to pay your SIP installment on every due date. No hassle of extra clicks for starting a SIP. It’s all in one place, making the process simpler & faster.

You have the flexibility to choose the SIP amount. So, if you initially want to start with small SIP amounts in your invested smallcase, you can do so. Then, once you get more comfortable, you can increase the SIP amount.

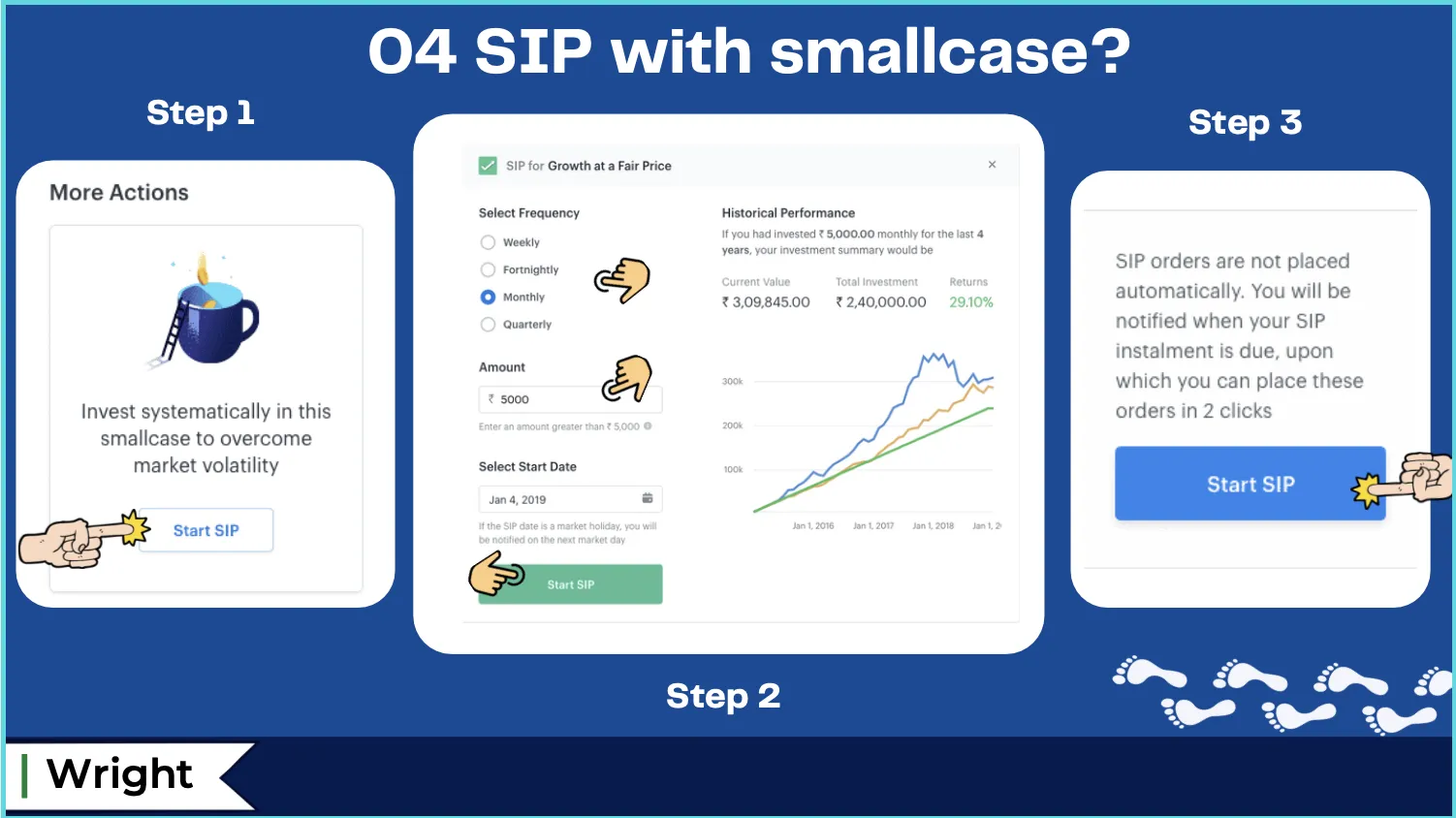

Check the SIP box while buying the smallcase (or)

Click on the Investments tab, click on the smallcase you want to set up SIP for and select start SIP from more Actions from the Investments tab.

In the SIP overview pop-up, you will have to select a frequency and start date for your SIP.

The frequency of investing in SIP can be weekly, fortnightly, monthly, or quarterly.

The amount for investing through SIP would be Rs. 5000 or greater, depending on the smallcase. You can also increase the amount you wish to invest.

Next, you will have to choose a start date for your SIP. Your SIP installment due date will be calculated from this date, depending on the frequency you have chosen.

The historical performance shows you an overview of what your investment would have amounted to at present if you had invested the said amount through SIP for the past three years.

After going over the things mentioned above, you can then click on the Save SIP button.

Upon clicking ‘Start SIP,’ you will be asked to confirm this action and informed that SIP acts as a reminder and does not automatically place orders on your behalf.

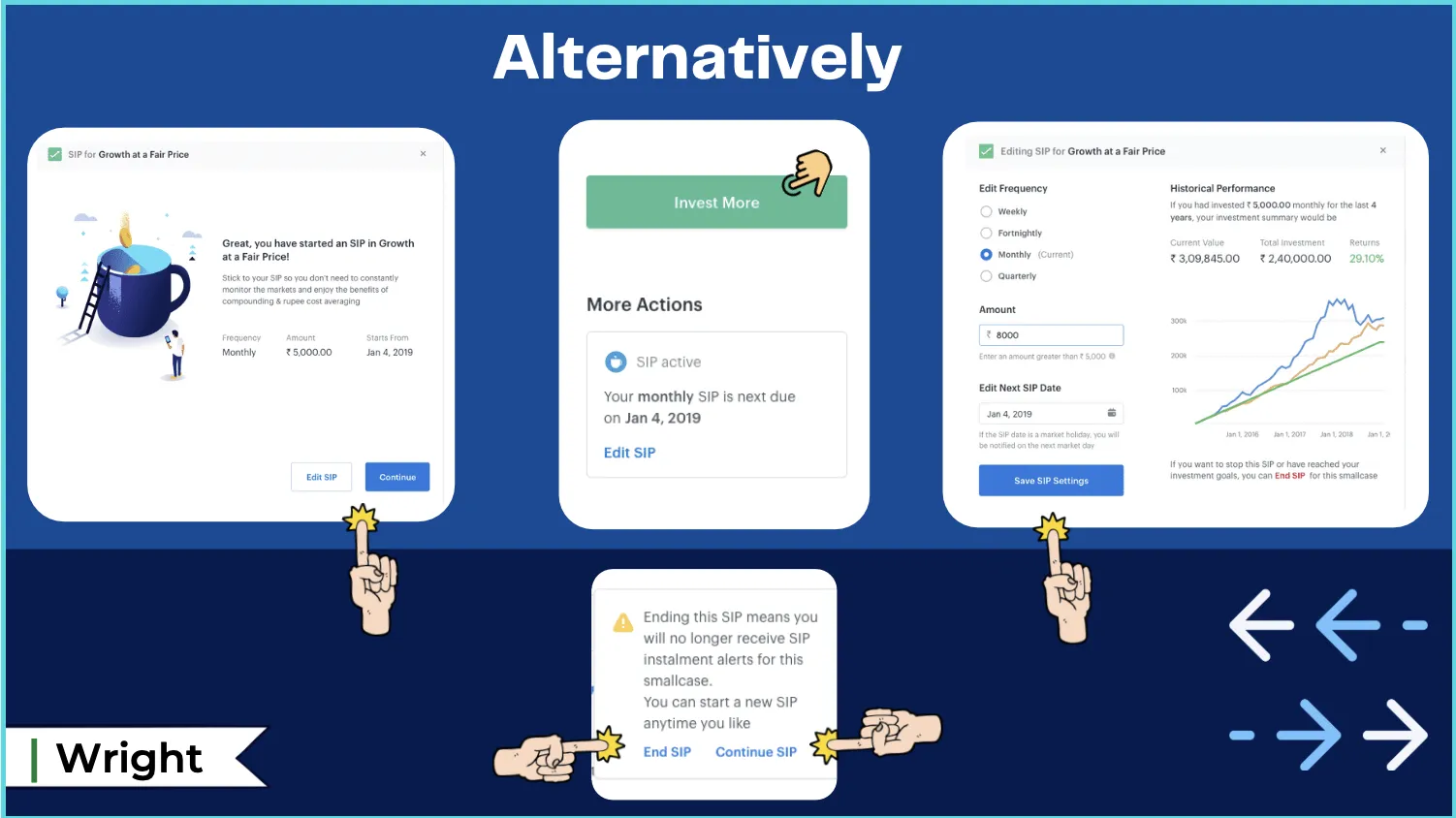

After confirming investing through SIP, you can click on ‘Continue’ to complete the process (or) if you want to make any changes to the frequency or start date, you can click on Edit SIP (You are free to edit your SIP at any time)

Alternatively, if you click edit, follow the steps below.

At the bottom of the Edit SIP window (below the performance chart), you have the option to ‘End SIP,’ which ceases your SIP installments for that smallcase (You are free to end your SIP at any time).

Choosing the right date for your Systematic Investment Plan (SIP) can make a considerable difference in your investment returns. While the performance of the investment asset and the amount you invest are undoubtedly crucial, the date of your SIP can also impact your investment journey. Here's how to choose the most suitable date for your SIP investment.

The first consideration when picking your SIP date is your cash flow. As SIP is a disciplined form of investment requiring periodic investments, it's essential that the SIP date aligns with your cash inflow. For instance, if you receive your salary on the first day of every month, scheduling your SIP a few days later (say, on the 5th or 7th) can ensure that you have sufficient balance in your account to fulfill the SIP obligation.

However, it's important to note that there's no 'perfect' date that guarantees higher returns. The Indian stock market does not exhibit any consistent monthly pattern that could be exploited for higher gains. SIPs work on the principle of rupee cost averaging, meaning you buy more units when the market is low and fewer units when the market is high. So, whether the market is high or low on your chosen SIP date, over the long term, the cost averages out. Thus, rather than trying to time the market, maintaining regular investments on a date that suits your financial cycle could lead to better returns.

Finally, diversification can also extend to SIP dates. If you invest in multiple SIPs, you could stagger the dates across the month to spread your investment. This strategy might help to further average out the costs and potentially reduce the impact of short-term market volatility on your investment. Spreading your SIP dates may reduce overload on your cashflow position, as you are staggering it over the month and can plan your expenses around this fixed amount. The downside is that since the money is in your account for that period you may be tempted to spend it. For such cases, you may consider investing into a liquid fund with zero exit/ entry loads. From here you can allocate capital per the SIP dates. Make sure to be aware of the redemption period. Remember, SIP is a long-term wealth-building tool, and patience and consistency are often more beneficial than attempting to time the market.

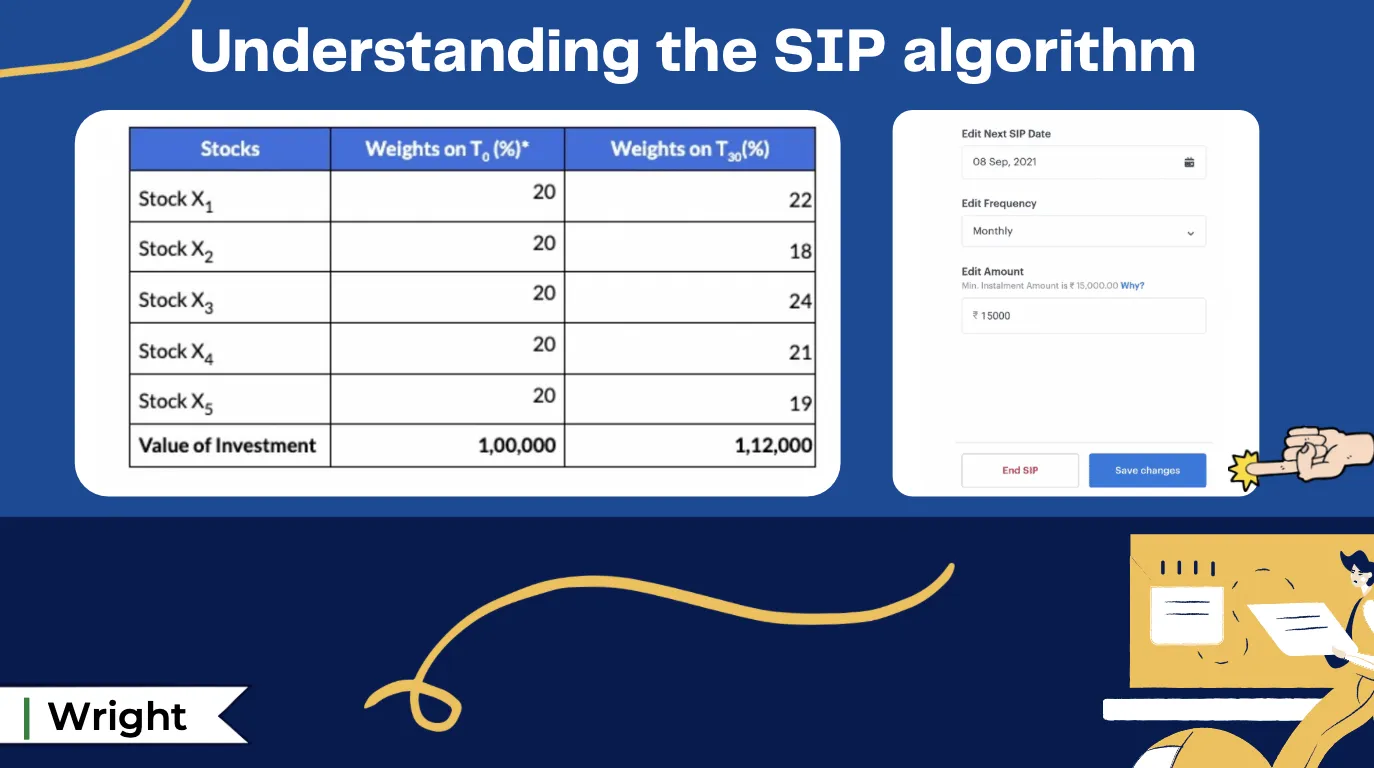

The above table shows the composition on the day of investment and your 1st SIP installment. The change in weights is due to the change in stock prices over time.

To simplify, let’s consider an equal-weighted basket. The logic would work the same way for custom weights too.

Initial Investment amount: 1,00,000

Monthly SIP instalment amount: 20,000

1. Calculate the number of shares based on the Total amount (Current value + SIP amount). On the day your SIP is due, the current value of your investment is 1,12,000. We calculate the total amount as (Current Value + SIP amount) = 1,32,000.

As per the above amount and the weights on T0, the number of shares to be bought will be calculated.

2. Calculate additional shares to be bought.

We then calculate the difference from existing holdings to form your SIP installment.

3. Determine the SIP amount.

The stocks that have deviated below from the ideal composition are preferred. The actual installment amount is calculated as New no. of shares * Market price of each stock.

4. In the next SIP installment, the same steps are repeated

Editing SIP configuration

Click on ‘Investments’

Click on your invested smallcase

Click on ‘Edit SIP’

Set the Frequency, SIP amount, and SIP date as desired

Click on ‘Save SIP Settings’

So, is regular SIP good or timing SIP at drawdown better??

Timing is better but difficult. Hence, for relatively new investors, it is better to start with regular SIP, get into the habit of investing and then look at the timing SIP bit later.

Read these articles to learn about key investment methodologies and concepts related to SIPs & Investment Advisors that can help you setup your portfolio:

Are there any risks associated with SIP investments?

Yes, SIP investments are subject to market risks. The value of mutual fund units can fluctuate based on market conditions, affecting the overall returns.

What are some tips for maximizing the effectiveness of SIP investments?

Some tips include investing for the long term, choosing funds with consistent performance, diversifying across different asset classes, reviewing and rebalancing your portfolio periodically, and staying disciplined with regular investments.

What are the different types of SIP available?

Different types of SIPs include equity SIPs, debt SIPs, balanced SIPs, and sector-specific SIPs. These types of SIPs invest in different categories of mutual funds based on their investment objectives and risk profiles.

How long should I continue my SIP investments to maximize returns?

SIP investments are ideally suited for the long term, preferably five years or more, to benefit from the power of compounding and average out market volatility.

Can I switch between different SIP funds or change my investment amount?

Yes, many mutual fund providers allow investors to switch between different SIP funds and change the investment amount. However, specific terms and conditions may vary among different fund houses.

What are some factors to consider when selecting SIP funds?

Important factors include fund performance, historical returns, expense ratio, fund manager expertise, investment objective, risk level, and suitability with your financial goals and risk appetite.

Are SIP investments suitable for long-term goals like retirement planning?

Yes, SIP investments can be suitable for long-term goals like retirement planning. By investing regularly and for the long term, SIPs offer the potential to accumulate a significant corpus over time.

Can I withdraw my SIP investments before the completion of the investment tenure?

Yes, you can generally withdraw your SIP investments before the completion of the investment tenure. However, it's important to check the terms and conditions of the specific mutual fund scheme as there may be exit loads or other penalties associated with early withdrawals.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart