by Siddharth Singh Bhaisora

Published On July 13, 2025

After a listless start to 2025, Indian equities have rediscovered their mojo. Front line indices are back near all time highs. On 8 July 2025 the Nifty 50 closed at 25,522 and the Sensex at 83,713, with financials leading the charge.

In May the Sensex and Nifty rose 1.7% and 1.9%, while mid caps shot up 6% and small caps an eye popping 10.6%. Capital goods, realty, metals, IT and autos topped the sector charts. A sharp rally late in July(e.g., a 1,000 point Sensex jump on 26 June) offset mid month weakness; the benchmark finally ended June almost flat, setting the stage for July’s push higher.

The advance-decline ratio for all BSE listed shares stayed above 1.0 for the fourth straight month in June, a feat last seen during the 10 month surge from April 2023 to January 2024. When advances consistently outnumber declines, breadth improves and rallies become self reinforcing exactly what is now visible across frontline, mid cap and small cap indices.

Month | Advances | Declines | Advance/Decline Ratio | Delivery (NSE + BSE, ₹ crore) | % Delivery |

Jun 25 | 2,374 | 2,177 | 1.1 | 25,818 | 45.1 |

May 25 | 2,449 | 2,027 | 1.2 | 21,375 | 44.8 |

Apr 25 | 2,509 | 1,996 | 1.3 | 19,506 | 44.7 |

Mar 25 | 2,324 | 2,209 | 1.1 | 21,382 | 48.9 |

Feb 25 | 1,858 | 2,598 | 0.7 | 15,269 | 43.5 |

Jan 25 | 2,108 | 2,354 | 0.9 | 16,697 | 42.7 |

Dec 24 | 2,239 | 2,264 | 1.0 | 18,948 | 45.5 |

Nov 24 | 2,312 | 2,125 | 1.1 | 17,405 | 43.3 |

Oct 24 | 2,160 | 2,259 | 1.0 | 19,809 | 45.8 |

Sep 24 | 2,207 | 2,242 | 1.0 | 25,104 | 46.0 |

Aug 24 | 2,269 | 2,152 | 1.1 | 26,229 | 46.3 |

Jul 24 | 2,314 | 2,085 | 1.1 | 29,034 | 44.7 |

Jun 24 | 2,428 | 1,918 | 1.3 | 31,851 | 44.5 |

Over the past 4 months the Nifty 50 has climbed about 15%, while the Nifty Midcap 150 and Smallcap 250 are up roughly 24% and 28%, respectively. All 3 indices are trading above key moving averages and India VIX remains subdued below 14, underscoring a “risk on” mood.

Period | No. of Months |

Mar 2025 – Present | 4 |

Apr 2023 – Jan 2024 | 10 |

Jul 2022 – Dec 2022 | 6 |

Sep 2021 – Jan 2022 | 5 |

Apr 2021 – Jul 2021 | 4 |

Apr 2020 – Feb 2021 | 11 |

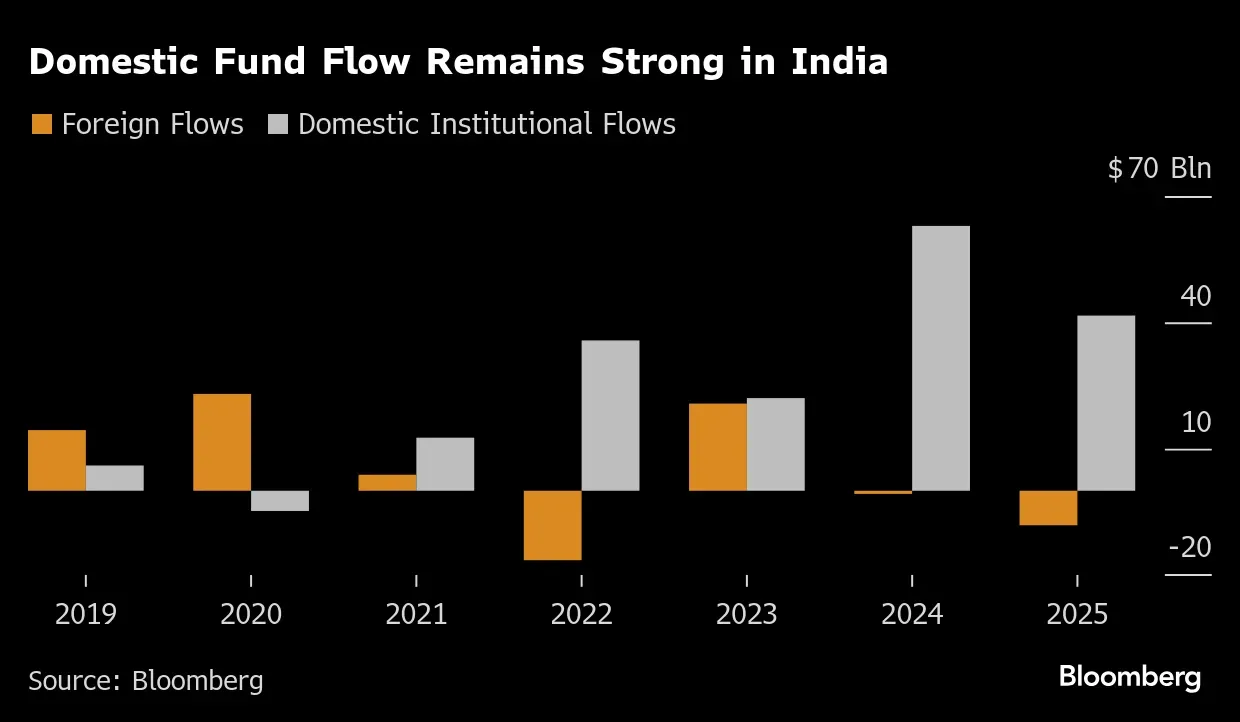

Foreign portfolio investors, net sellers earlier in the year, turned buyers in March even as they kept sizeable short positions in index futures. Those shorts have already been pared from a peak of about 110,000 contracts to just over 38,000, leaving ample room for a “short squeeze” that could accelerate gains.

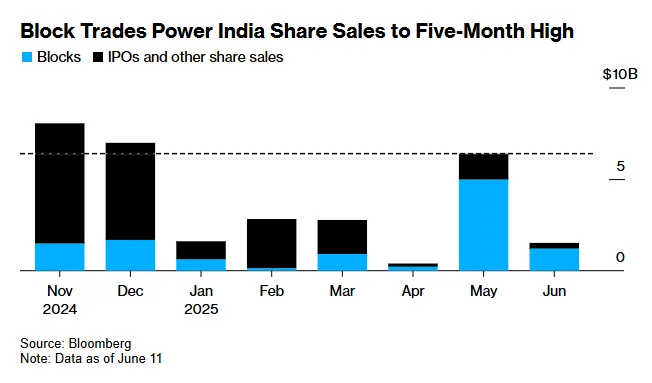

Meanwhile, the primary market pipeline has reopened: IPO approvals and promoter block deals are being absorbed without destabilising prices, signalling healthy demand for fresh equity. Macroeconomic headwinds Trump era tariff threats, geopolitical flare ups in South Asia and the Middle East have so far failed to knock the market off course, and expectations that Washington might soften its tariff stance add another tail wind.

Delivery volumes have risen steadily since April, helped partly by SEBI’s tighter rules on speculative turnover in small and mid caps, suggesting that incremental buying is coming from longer term investors rather than day traders.

GDP grew 7.4% y/y in Q4 FY25 while core inflation slid below 4%, giving the economy “Goldilocks” credentials. Underlying the price action are supportive fundamentals:

Monetary stimulus: On 6 June the RBI delivered a 50 bp repo rate cut (to 5.50%) and a 100 bp CRR cut, the steepest easing in 5 years. Cheaper funding immediately lifted rate sensitive banks, real estate and autos and signalled policy support if global growth slows.

Fiscal tailwinds & consumption push: The FY 2025 Budget raised the zero tax threshold to ₹12.75 lakh and trimmed slabs, a relief especially for the lower and middle income cohort. This could be the next demand engine. Higher disposable incomes are expected to broaden the post pandemic recovery beyond urban upper income segments.

Capex upswing: Government infrastructure spending, private sector balance sheet repair, and a nascent residential property revival are converging to restart the investment cycle that stalled during the global trade slowdown.

Sector specific catalysts: Power, renewables, defence, and real estate stocks benefit from the government’s continued capex push and “Make in India” localisation incentives. These pockets attracted both domestic thematic funds and FPIs in June, according to depository data.

Domestic liquidity & foreign flows: Equity mutual fund inflows jumped 24% to ₹236 bn in June, ending a five month slide. Retail SIPs have become a steady counter weight to FPI mood swings. FPIs bought ₹145.9 bn of equities in June (3rd straight month of inflows), 61% of it into financials; they trimmed ₹1.4 bn in the first week of July. Net buying resumed once valuations cooled and the RBI surprised with a rate cut.

The FMCG sector could be on the cusp of a cyclical upswing thanks to 4 converging tailwinds.

The government is weighing a rationalisation of GST slabs, potentially shifting several products out of the punitive 28% bracket and instantly widening margins.

An early forecast of a “good” monsoon should lift farm incomes and rural demand the single largest incremental driver of FMCG volumes.

The Union Budget tilted decisively toward consumption rather than capex, channelling spending power directly into households via targeted subsidies and tax reliefs.

Recent income tax cuts are already padding disposable incomes in urban India, encouraging a pick up in discretionary as well as staples spending.

Whether these macro boosters translate into sustainable earnings growth now hinges on execution. Companies must ride any GST relief to reinvest in pricing, innovation and distribution rather than merely protecting margins, while a normal monsoon still needs timely procurement and efficient rural supply chains to convert rainfall into sales. If FMCG managements deliver on those fronts and early volume trends post Budget are encouraging the sector could break its 5 year streak of underperformance. All eyes are on the upcoming quarterly results for confirmation that revenue momentum is tracking these supportive policy and seasonal shifts.

Companies and large shareholders raised about $6.4 billion via secondary share sales in May the busiest month since December 2024 powered chiefly by $5 billion of block trades. That momentum spilled into early June, where a further ten blocks pulled in $1.2 billion during the first week alone. A surprise, growth friendly rate cut by the Reserve Bank of India and fresh liquidity injections have reinforced the rebound, lifting the Nifty 50 well off its April tariff driven lows and prompting global investors to scramble for quick exposure through sizeable overnight deals.

Although year to date proceeds of $15.5 billion still trail last year’s record pace, bankers see consumer tech and financial services issuers leading a stronger second half pipeline. Valuation discipline remains tighter; some aspirants have already trimmed targets, but deal makers argue that steady earnings and resilient GDP growth provide ample room for billion dollar offerings before 2025 closes.

In May the Nifty’s 1 year forward P/E was at 20.4x, perfectly matching its 5 year average and only 10% premium to it 10 year average. This is well below the 25% premium seen at the 2021 peak; suggesting pricing is stretching but not yet extreme.

Mid and small cap multiples have normalised after their sharp May rebound. Together with EPS downgrades of barely 1% for CY 2026, the market is no longer “expensive” by recent history, just slightly rich versus longer term averages.

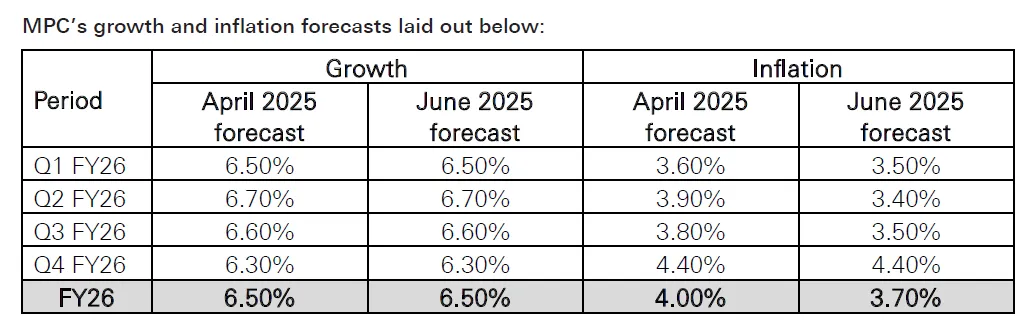

RBI unleashed a “policy bonanza” aimed squarely at reinvigorating growth. The MPC front loaded a 50 basis point reduction in the repo rate, knocking the policy benchmark down to 5.50%, the lowest level since early 2021, and lowering the standing deposit and marginal standing facility rates in tandem.

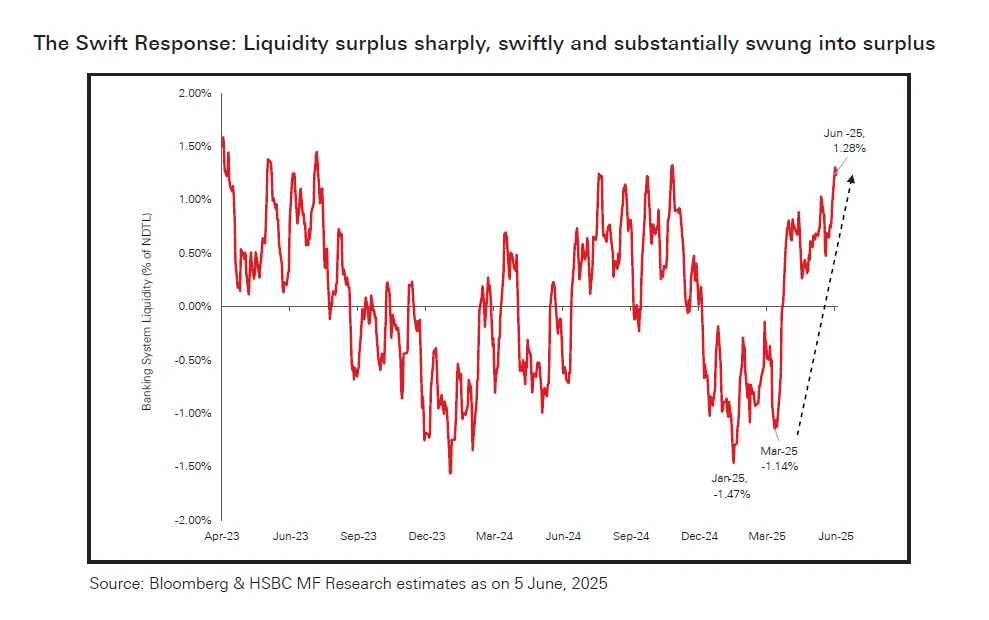

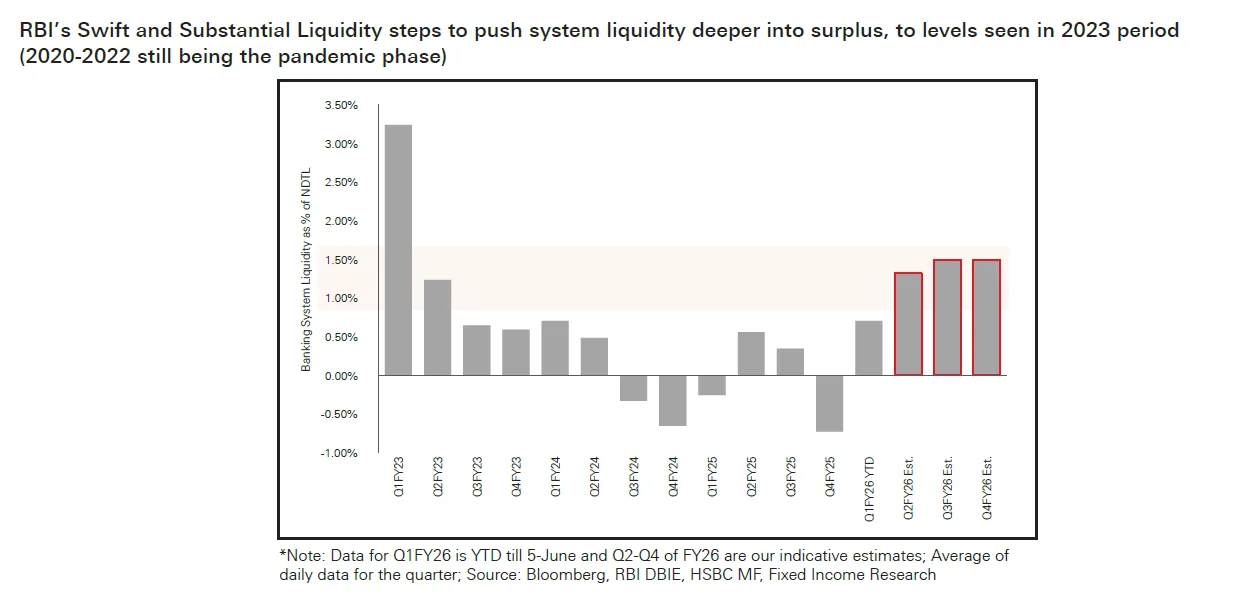

If the rate cut was the first part of RBI’s stimulus, the second was the decision to slash the cash reserve ratio by a full%age point to 3% of net demand and time liabilities. The CRR cut will be rolled out in four equal tranches beginning in early September and, by December, is expected to inject roughly ₹2.5 lakh crore of primary liquidity into the banking system. With banking system liquidity already hovering around 1.3% of NDTL in surplus, the additional infusion should ensure abundant funds well into FY 26, compressing short term money market rates and encouraging banks to transmit the policy easing quickly to borrowers.

The MPC found room for this aggressive manoeuvre because the inflation backdrop has grown more benign. Softer food prices, a forecast of a normal monsoon and subdued global commodity costs prompted the Committee to shave its CPI projection for FY 26 by 30 basis points to 3.7%. Yet even with price pressures ebbing, growth remains stuck at a projected 6.5%, respectable but, in the Governor’s words, “lower than our aspirations” for an economy of India’s scale. By acting decisively now, policymakers hope to jolt credit and consumption before external headwinds intensify.

Still, the central bank has not given markets carte blanche. By reverting to a neutral stance immediately after a jumbo cut, the MPC signalled that further easing is anything but guaranteed. The policy rate now sits only 110 basis points above the RBI’s fourth quarter FY 26 inflation forecast, leaving “very limited space” for additional stimulus unless incoming data soften further. For now, August is widely expected to be a pause, and the Committee has hinted that future decisions will be rigorously data dependent.

For financial markets, the message is clear: liquidity will remain plentiful, and the cost of capital has fallen sharply, but policymakers will not hesitate to change course if inflation rebounds or external shocks tighten global conditions. That balancing act is already reshaping yield curves; government bond yields have slipped, while corporate bond spreads in the three to five year bucket already compressed by 15–20 basis points have room to narrow further as investors chase carry. The equity market, meanwhile, is drawing support from lower discount rates and the prospect that cheaper credit will flow quickly into autos, real estate, capital goods and other rate sensitive sectors.

Risks, of course, remain. A pull back cannot be ruled out if global risk aversion spikes, unexpected spike in food prices, sharper than expected US slowdown, tariffs broaden or crude oil stages a sharp rally. Likewise, a sudden jump in India VIX above the comfort zone or a reversal in foreign flows would warrant caution. Equally, if banks prove reluctant to pass on cheaper funding to the end consumers, then this could blunt the stimulus. Still, the market has absorbed a string of negative headlines this year without meaningful damage, a telling sign of underlying strength.

But for now the central bank’s twin barrel approach front loaded rate relief buttressed by a liquidity wave has set the stage for a genuine revival in momentum, with the heavy lifting squarely in the hands of lenders, borrowers and investors to turn easy money into real economy gains. This revival rests on synchronised domestic flows, decisive policy easing, and an incipient recovery in mass market consumption. Global cross currents can still rock the boat, yet the ingredients for a durable bull phase, reasonable valuations, improving earnings breadth, and policy support, are falling into place. Investors may need to brace for bouts of volatility, but the underlying trend points to fresh highs as 2025 progresses.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart