Last month was a good month for the Wright portfolios. Our tilt towards smallcap stocks and financial stocks worked in our favour.

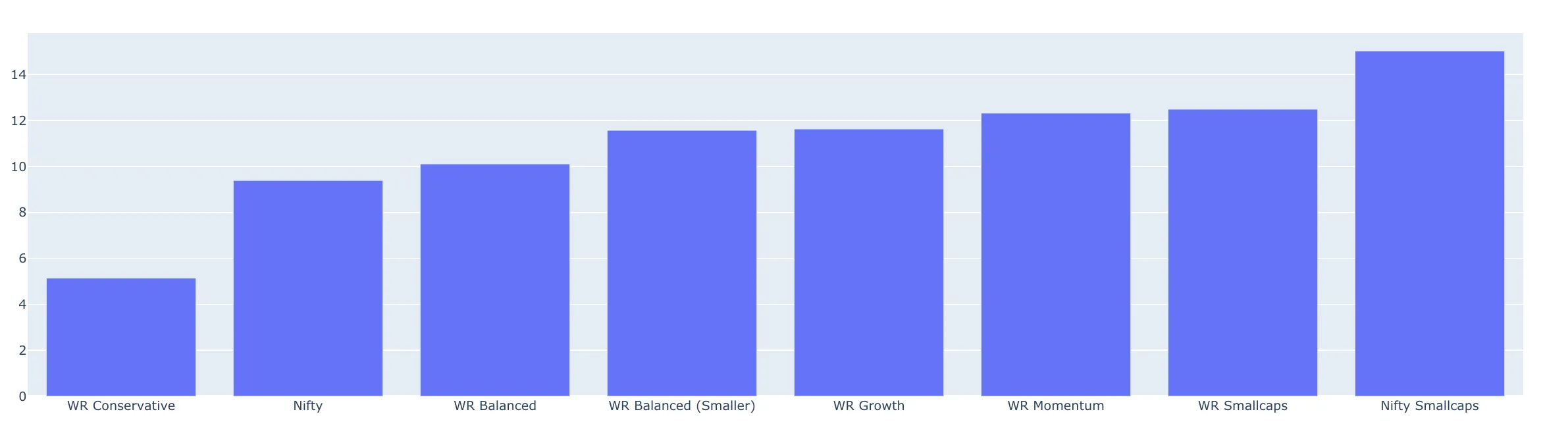

Here’s a snapshot of the performance.

The balanced portfolio shown below is continuing it’s consistent performance in the 16th month of being live!

We launched a new Momentum portfolio last month, read more about it here: https://www.wrightresearch.in/blog/wright_momentum

The bullish performance for the equities is continuing and we are cautiously optimistic. The optimism is built on the following facts:

We are cautious because the stimulus talks in the US are getting delayed and there could be a sell-off they don’t get clear.

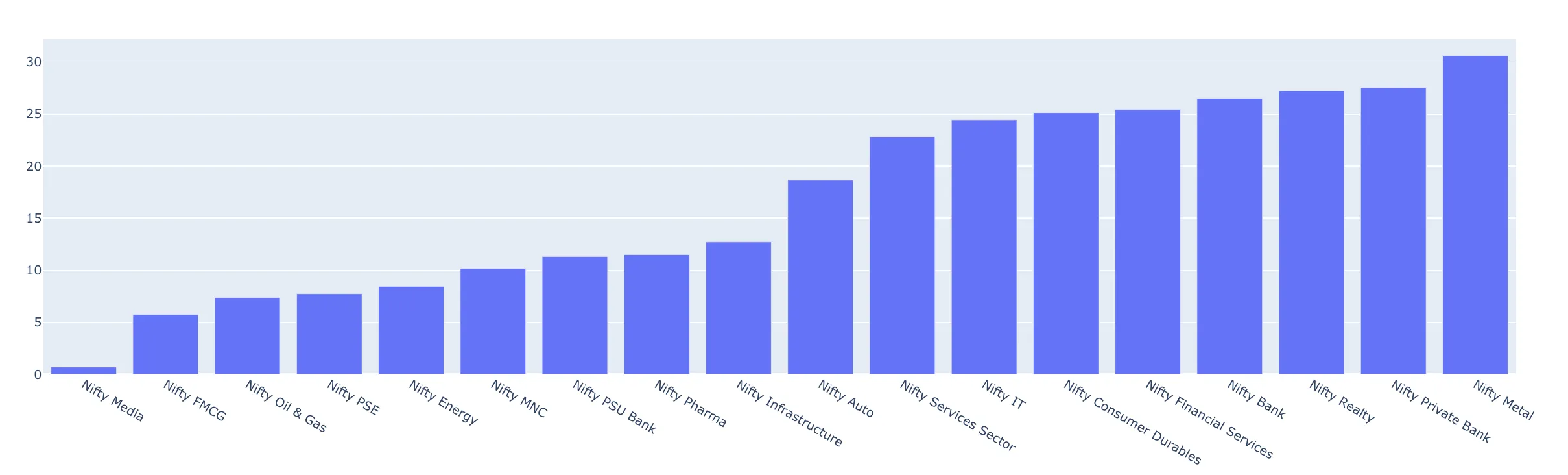

Cyclical sectors like Metals, Realty, Auto and Financials have really picked up pace in the last month as seen by the chart below, which is a good sign of recovery.

Our portfolio allocations are broadly the same but we are tilting a little towards the cyclical sectors by increasing allocation to cyclical stocks like TATAMOTORS, SAIL, CUMMINSIND.

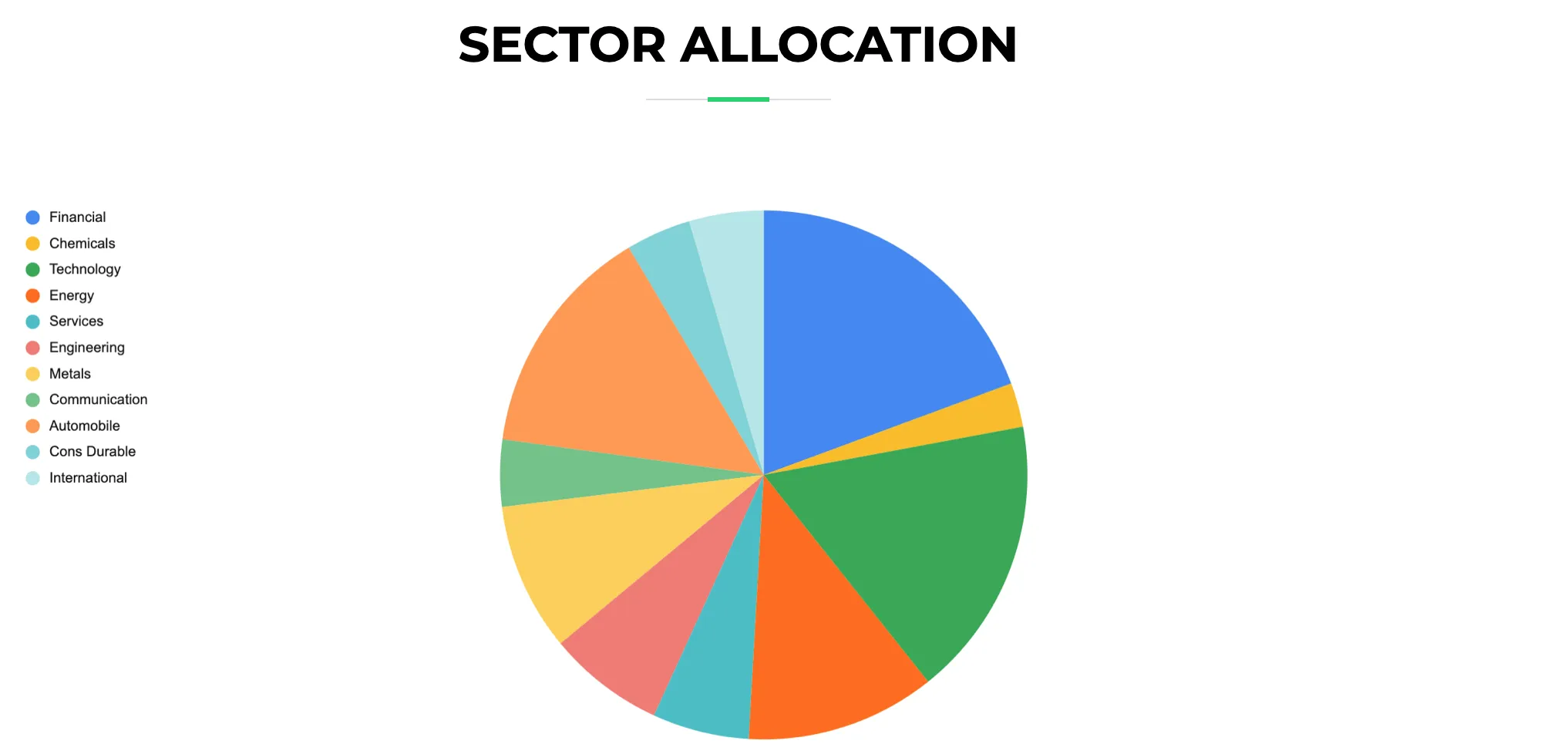

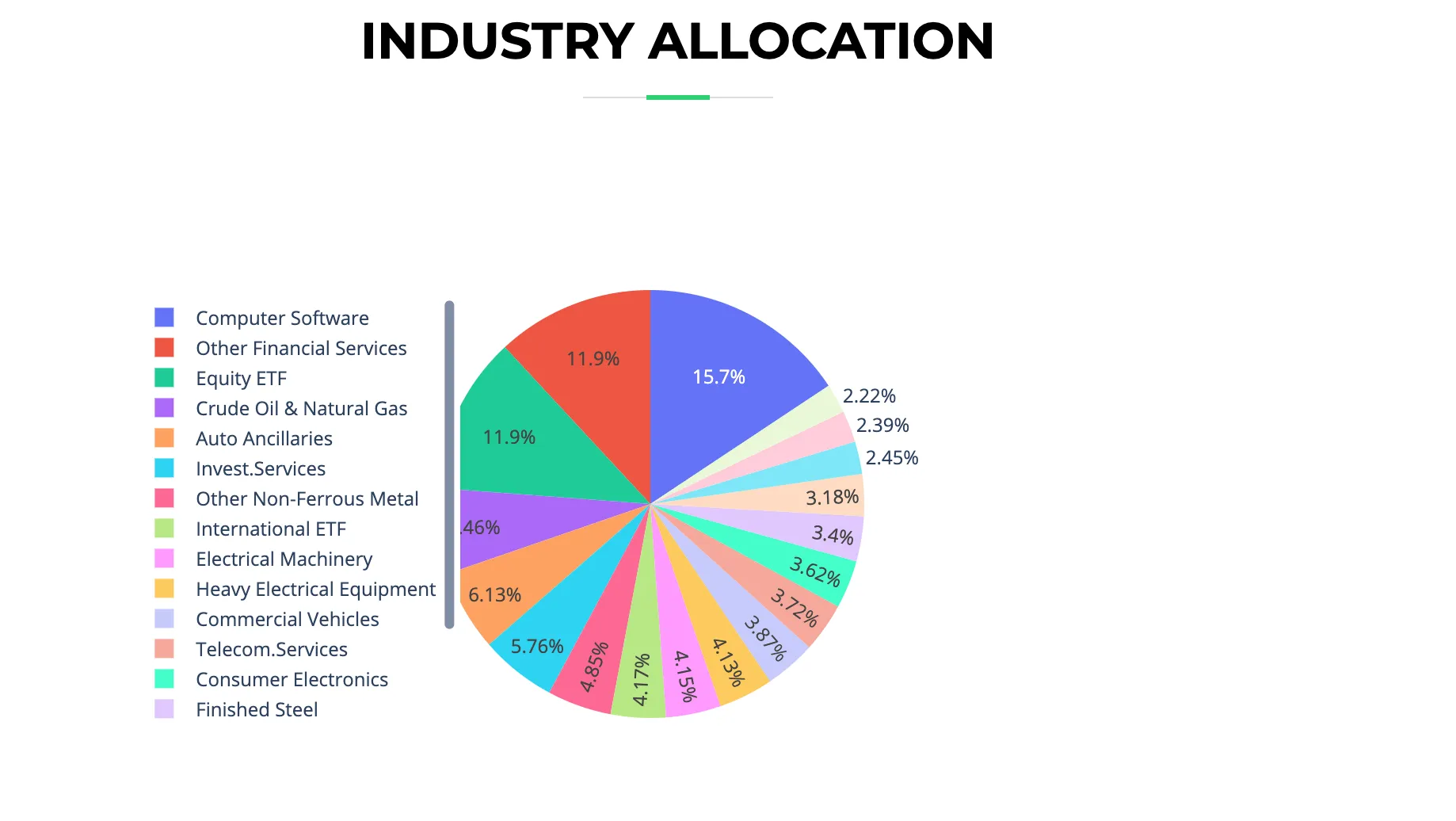

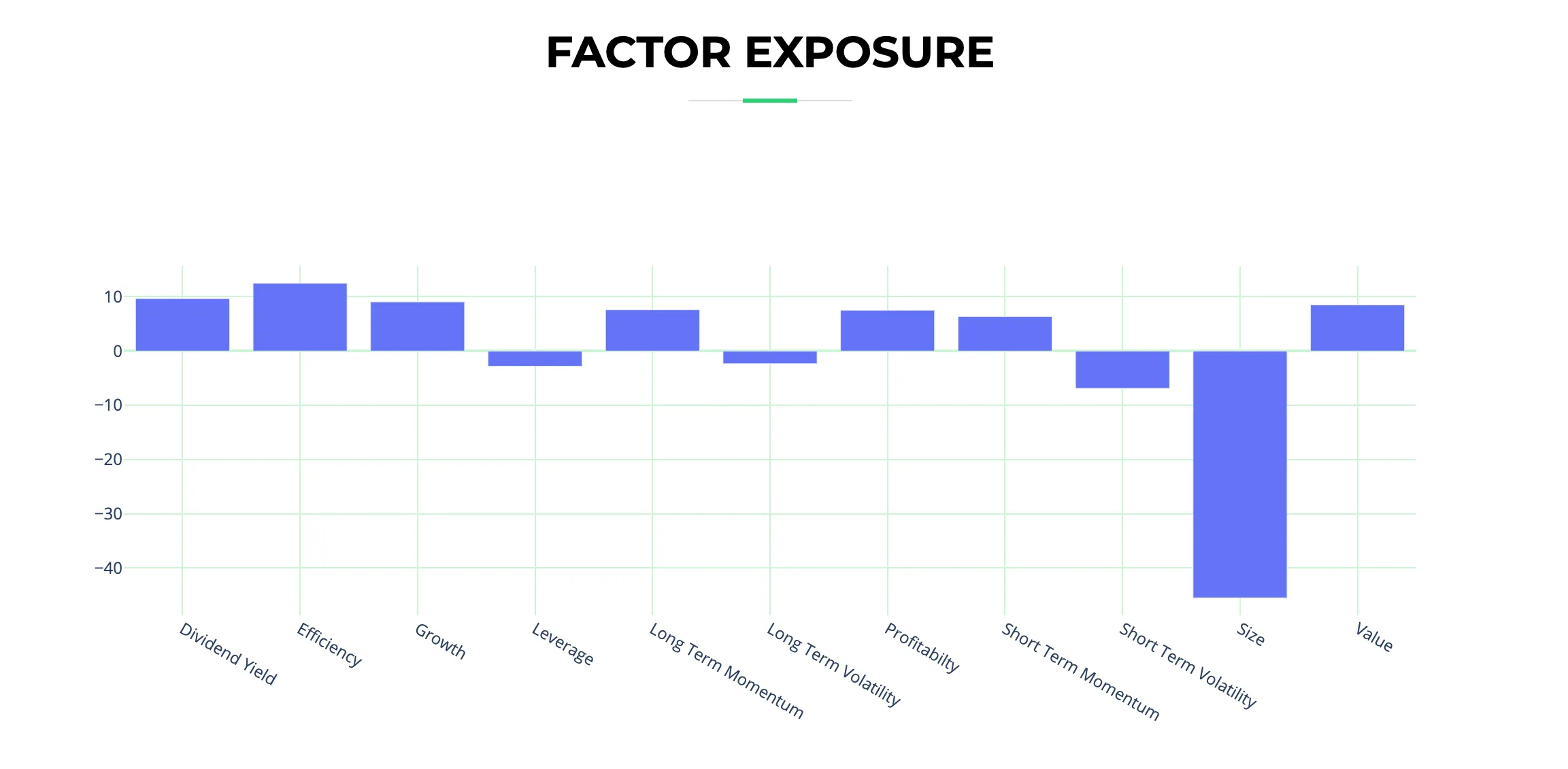

Here’s how the sector, industry & factor exposure looks like:

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

“I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product.”

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

“I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product.”

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

“I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product.”

By Prashant Sharma

CTO, Zydus

“I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product.”

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

“I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product.”

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

“I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product.”

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart