Budget 2022 is a Capex boosting budget which is prudent in other expenditures as the FM looks to contain the fiscal spending while enhancing growth. As expected in the election year, there is an increased focus on welfare schemes and agriculture. However, for India to keep up cyclical recovery, the government needs to focus on infrastructure. Therefore, the FM has increased the Capex investment target by 35% to 7.5 lac crore and announced critical investments and policies for infrastructure development via railways, metro systems, highways primarily through the PM Gati Shakti initiative. Railway and Logistics linked stocks, Capital Goods, Cement, and Real Estate will gain with this.

FM has focused on Fintech instead of Banking, Electric Vehicles, and Edtech instead of Education which has brought back focus to the new-age innovative sectors. FM has also kept an increasing focus on digitization, leading to gain for the platform companies and fintechs. FM has also given some relief to the pandemic hit hospitality sector. On the other hand, the budget has tried to contain crypto investments by increasing taxation.

The budget also announced healthcare, education, banking, and urban & rural development policies to decrease compliance burden through digitization and increase education and skilling.

Q. Where are markets headed post-budget?

The budget seemed to meet market expectations, and nothing unexpected was announced. The markets kept their opening buoyancy during the FM speech and have recovered well after the announcements. Banking stocks are leading the way!

The markets might focus on infrastructure spending and prudence in terms of Fiscal spending positively in light of the need for growth and the fears of Fed rate hikes. In addition, the welfare schemes for urban and rural poor were also urgently needed to boost consumption, and the market will not receive these poorly.

Sectors in the limelight will be infrastructure, logistics, cement, real estate, agriculture, digital & fintech players, sustainability, EVs.

Q. What stood out?

This is a Capex budget, and the FM has come out strong in terms of infrastructure spending. This would go a long way for India’s cyclical recovery in the next few years. Focus on digitization and reducing the compliance burden for various sectors was also a stand out of this budget. While the focus on welfare was there, the budget did not turn out populist, making it positive.

Top Sectors

After this budget, the top sectors will focus on infrastructure, logistics, cement, real estate, agriculture, digital & fintech players, sustainability, EVs.

Infrastructure linked sectors - Capital Goods, Logistics, Cement

The infrastructure budget increased 20% to 7.5 lac crore and is the biggest beneficiary. With the PM Gati Shakti initiative, policies for infrastructure development via railways, metro systems, highways were announced. Policies to ease the compliance burden, increase digitization and transparency were also announced. The key gainers will be logistic companies, cement stocks, capital goods, and real estate. Oberoi Realty, India cements, Honeywells are some stocks that have gained significantly since the budget announcements.

New Age Sectors - Digital, Fintech, EV

The budget has finally brought back the focus to stocks of the digital, fintech, and electric vehicle themes which have been underperforming for some time. The FM has kept a strong focus on digitization for inclusivity and banking penetration via Fintechs. She has also announced critical initiatives for the EV and green energy sectors like Battery swapping reforms, 19,500 Cr PLI for Solar PV modules, and green bonds. Edtech also received many mentions with plans announced to create digital education programs, portals, and a digital university. Paytm, Policybazaar, Tata Power, and Minda Industries would be stocks in focus here

Top Stocks

The biggest gainers post-budget will come from the infrastructure-linked sectors and new-age companies. Our top picks are:

Infrastructure linked stocks

L&T, Dilip Buildcon, Allcargo Logistics, Oberoi Realty, India Cements, Ultratech, Honeywells, Tata Steel, Container Corporation of India, IRB Infra

EV / Renewable

Tata Power, Amara Raja, Borosil Renewables, Adani Green

Digital, Edtech, Fintech

NIIT, Policybazaar, Nykaa

The Wright Pivot

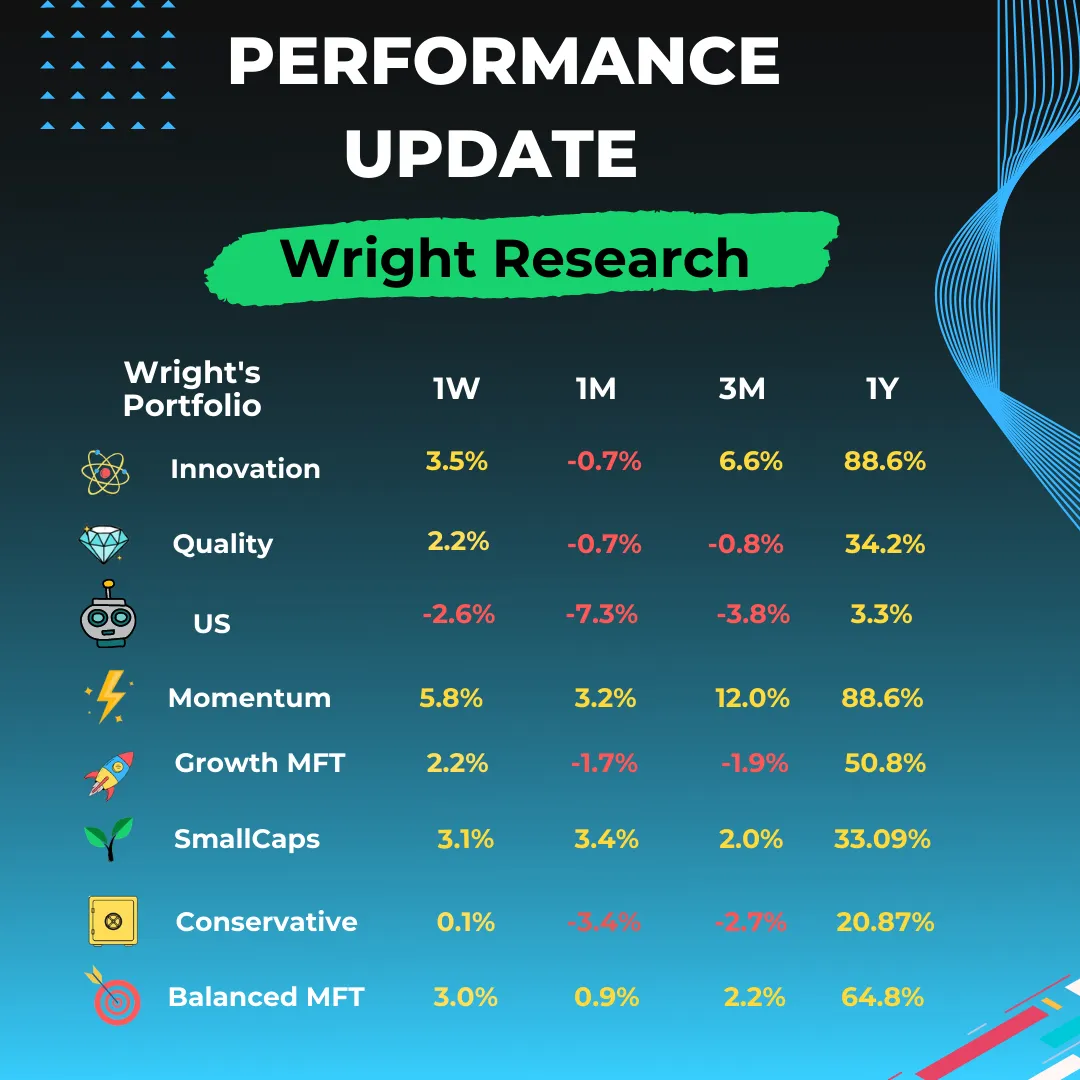

Our portfolios have been green much of the last few days and in the recent rebalance we pivoted to Banking, Infrastructure, and Real Estate as per the model. Our multi-factor model hints at a strong recovery of the momentum factor.

Q.Planning to subscribe?

Get 22% off

On all portfolios, till 5th February

Use coupon code: BUDGET22

Link to subscribe: https://wrightresearch.smallcase.com/

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart