The biggest USP for Wright Research portfolios is our strong investment philosophy. It is a great thing that this philosophy has also led to a fantastic performance.

Over the last three years, we have been through crises and some truly amazing times. We started our journey in July 2019, and just eight months into the business, we faced the 202 crash. But amazingly, that crash proved to be an excellent boost for our growth as our portfolios did amazingly well during March 2020.

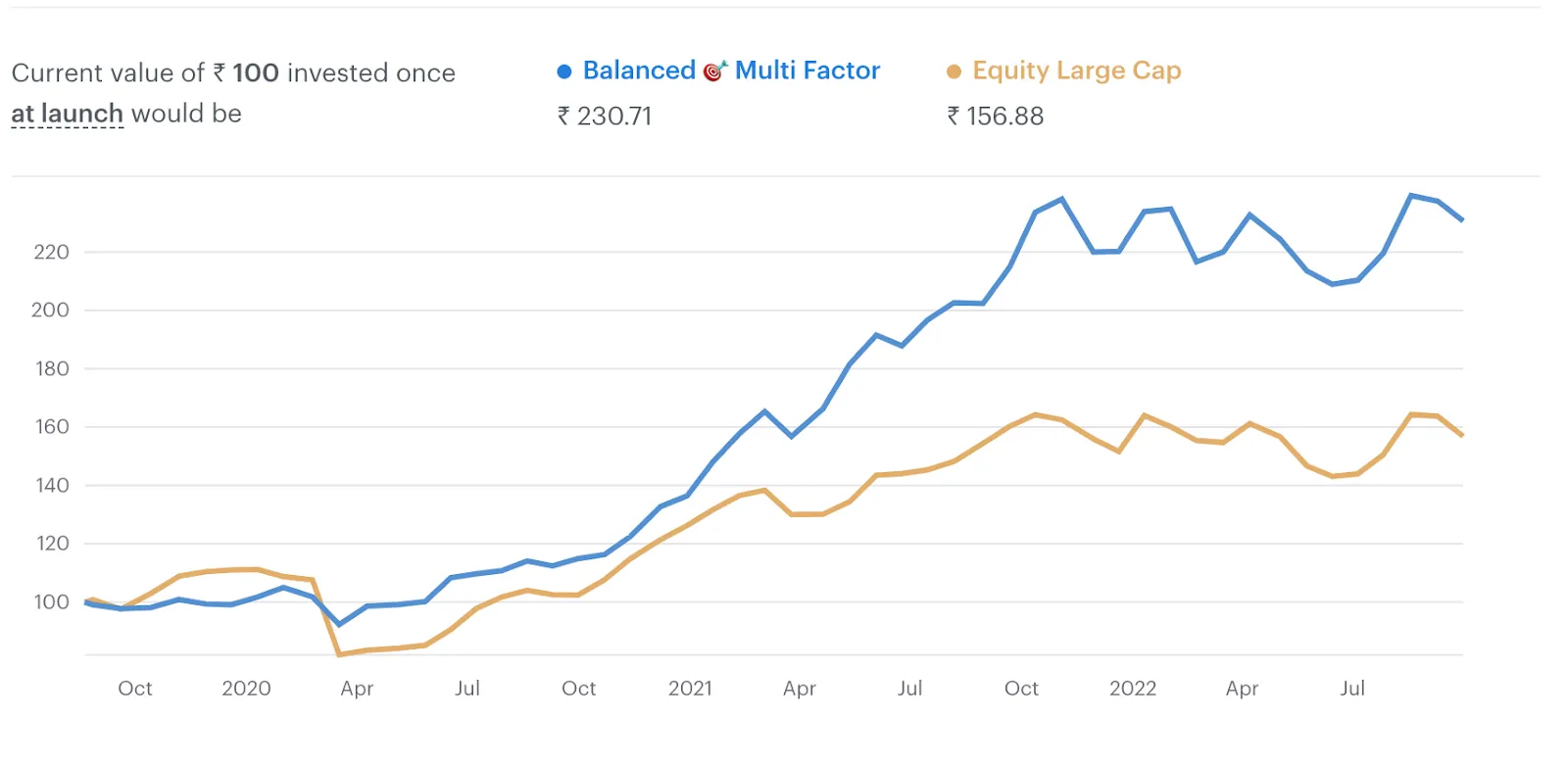

Our Balanced Multi-Factor, the flagship portfolio, only saw a drawdown of 15% when the market crashed 35% and therefore built up a significant outperformance. This was the juncture when people started recognising the strength of our methodology.

Then came the glorious bull market.

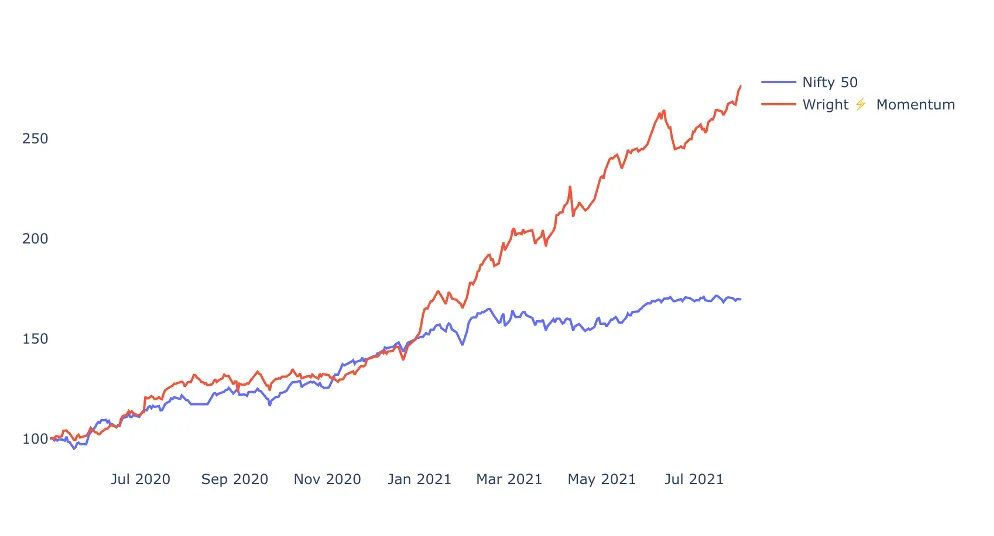

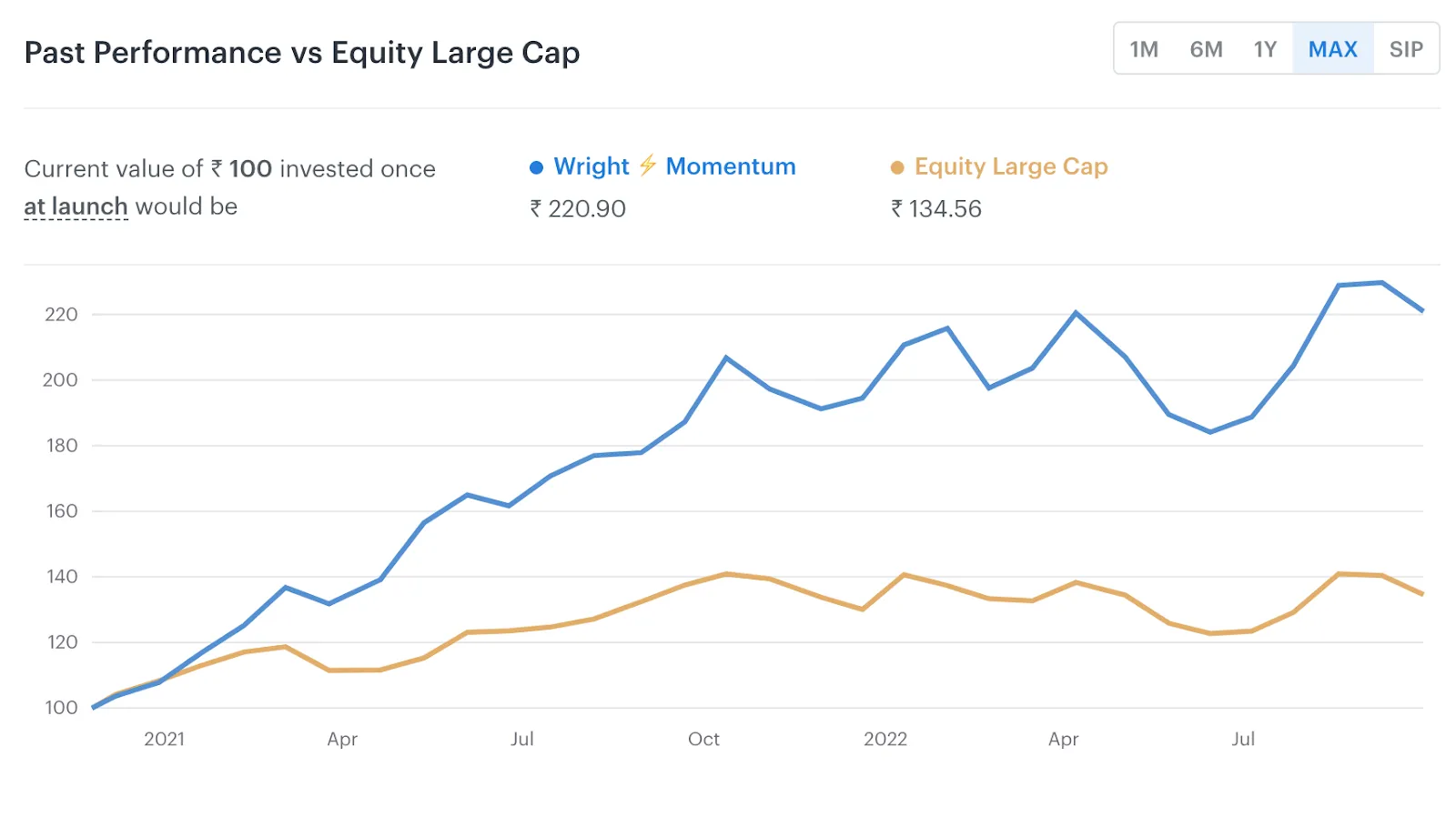

We launched the Momentum strategy to take advantage of the bull market. And so it did! During the bull market, Momentum was undefeatable, arguably the most used and best-performing momentum strategy on the street. Wright Research was now better known as Wright Momentum.

We launched some fantastic strategies, which have all shone. Here are the notable ones:

The balanced multi-factor strategy has seen it all. Three years, market crash, bull market and volatility. It has a 25% CAGR in 3 years, outperforming the index by 74%. The strategy's risk has been distinctly lower than the index.

Our most famous and best-performing strategy has had more than 50% CAGR in the last two years! It has outperformed the index by 86% in 2 years and has done well in good times and bad times.

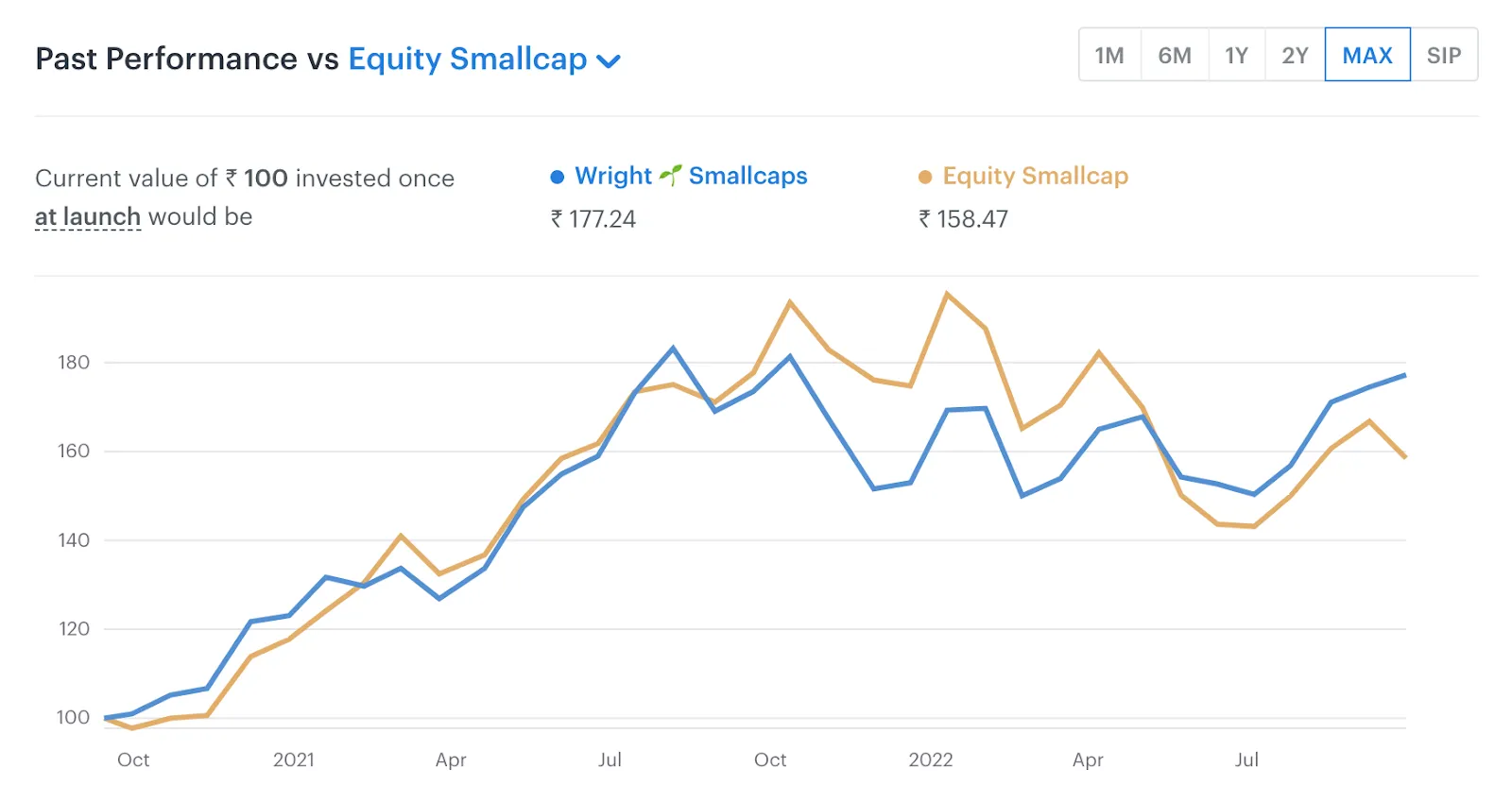

Our small-cap strategy has outperformed the high performing smallcap index in the last two years and has done so at a lower risk.

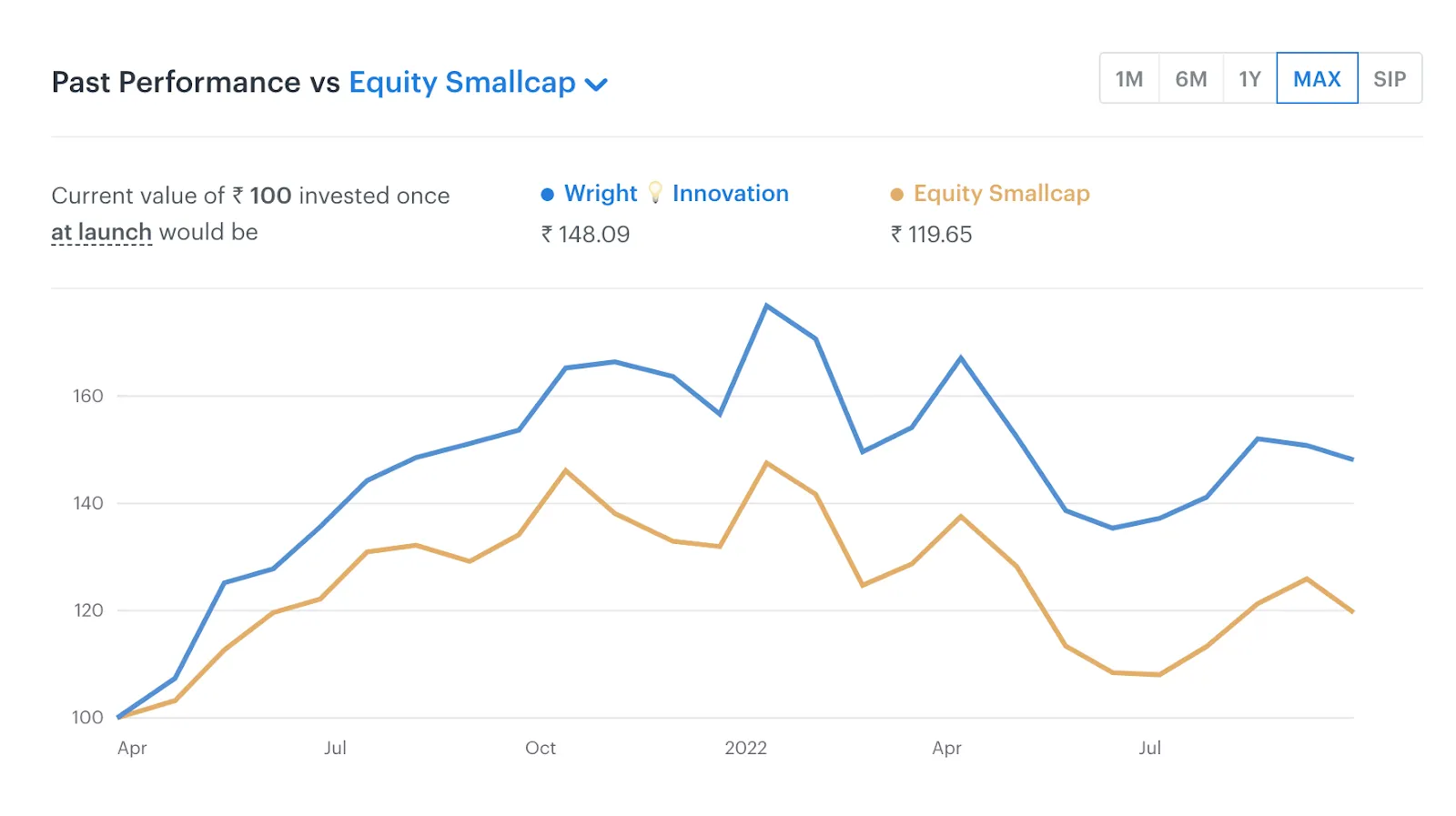

The innovation portfolio has had a 30% outperformance over the small-caps index in the last year, and this unique portfolio can prove to be the future winner.

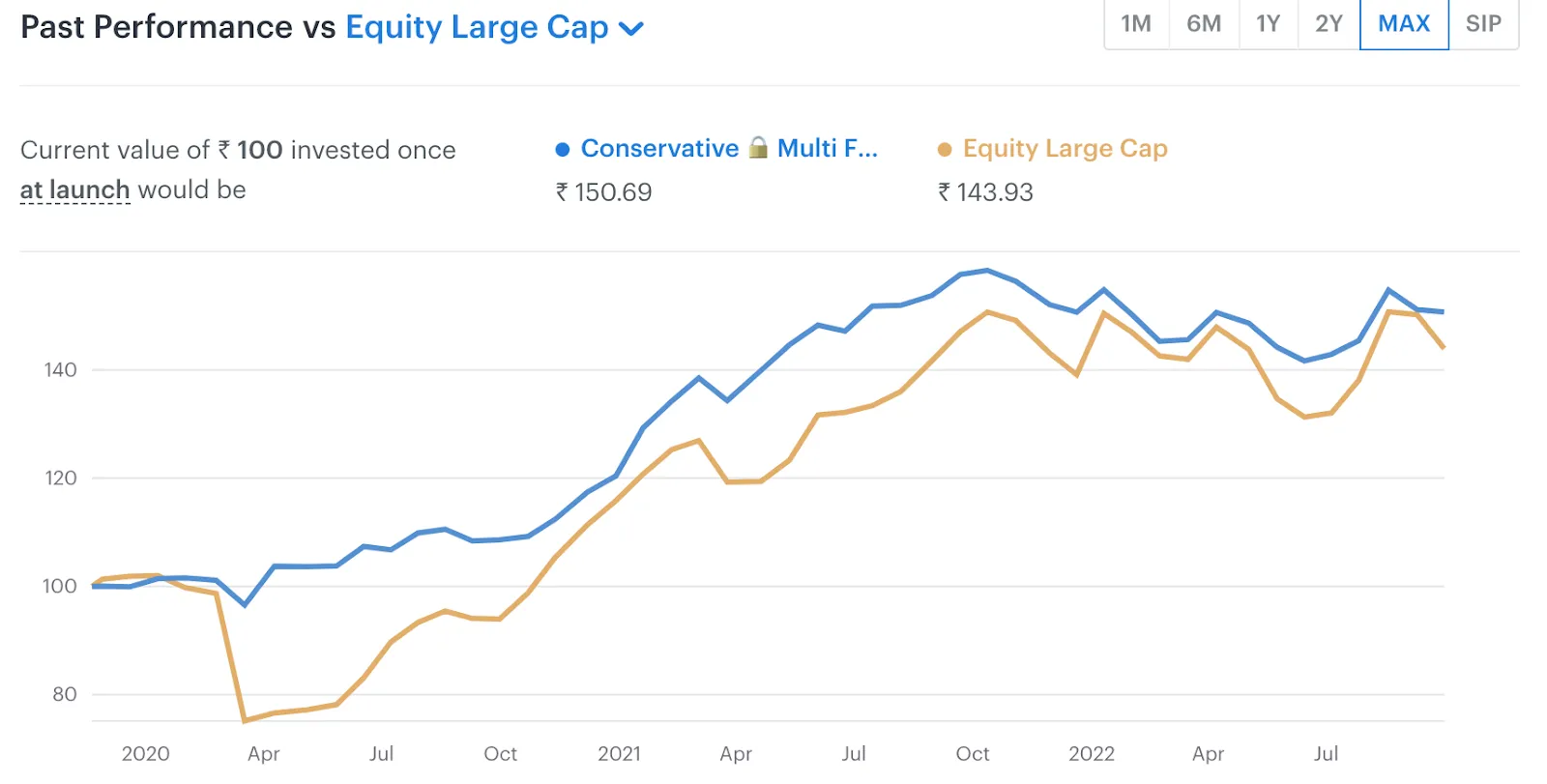

The Conservative portfolio by Wright Research does not win in terms of returns, but in terms of risk, it has been exceptional. It has almost half the risk as the index and still performs better than the broader market!

Our newest portfolio New India is an excellent bet for the next few years, and we are waiting for it to build its story!

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

“I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product.”

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

“I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product.”

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

“I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product.”

By Prashant Sharma

CTO, Zydus

“I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product.”

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

“I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product.”

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

“I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product.”

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart