by Naman Agarwal

Published On June 2, 2025

India’s private-equity and pre-IPO space has long featured marquee names like HDB Financial, Reliance Retail, and Chennai Super Kings. But over the last few years, the National Stock Exchange of India Ltd. (NSE) has eclipsed them all becoming the country’s most widely held unlisted company, with more than 100,000 shareholders and secondary market trades that have outperformed most listed large-caps.

Two key factors are driving this attention:

Explosive financial growth: Between FY19 and FY24, NSE’s revenue surged from ₹3,028 crore to ₹16,434 crore. Net profit grew from ₹1,708 crore to ₹8,306 crore over the same period, showing an incredible 5x and 4x growth respectively.

Impending IPO: Regulatory approvals are progressing, and recent private market deals have valued NSE at nearly ₹5 lakh crore ($58 billion), a re-rating of over 60% since 2023.

In this report, we explore the investment opportunity in NSE’s unlisted shares, with an in-depth look at its fundamentals, price history, valuation, risks, regulatory landscape, and the expected road to IPO.

Unlisted (or pre-IPO) shares are equity instruments issued by a company not listed on a recognised stock exchange. In India, they are typically bought and sold through off-market transfers, involving:

Private platforms or brokers

Registered AIFs and PMS portfolios

Bilateral trades recorded on NSDL/CDSL via Delivery Instruction Slips (DIS)

Settlement can take anywhere from T+2 to T+45 days, depending on verification and counterparty readiness. Legally, such trades are governed by the Companies Act, 2013, and SEBI’s Issue of Capital and Disclosure Requirements (ICDR) Regulations, 2018.

Incorporated: 1992

Headquarters: Mumbai

Core Businesses: Equities and derivatives trading, co-location and data services, SME platform (NSE Emerge), clearing and settlement

Key Shareholders: LIC (10.7%), SBI Group (12%), Temasek, PremjiInvest, Morgan Stanley, and thousands of HNIs and retail investors

NSE is India’s largest exchange and among the top 10 globally by equity derivatives volume. Its index division powers products licensed to global ETFs and funds.

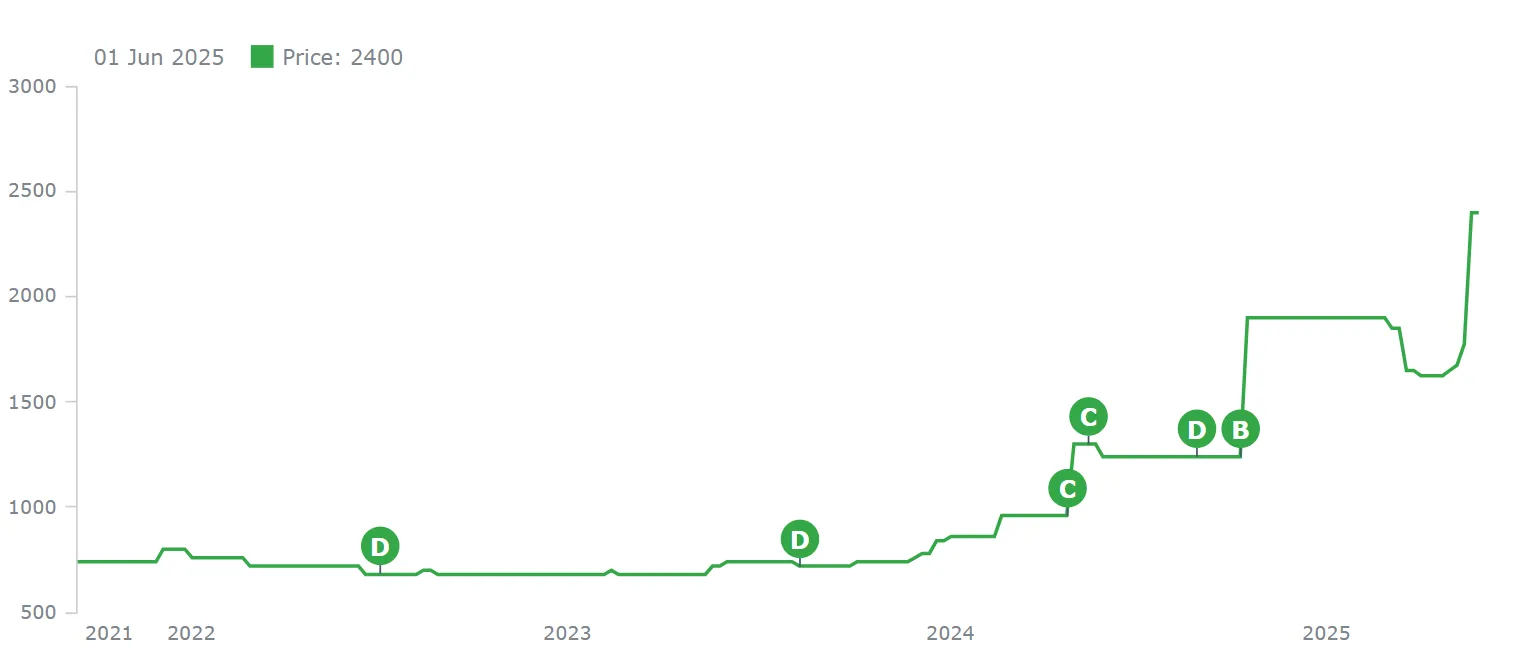

Since 2021, NSE’s share price in the unlisted space has experienced a meteoric rise:

Year | Avg. Price (₹) | Corporate Actions |

2021 | 740 | – |

2022 | 1,200 | – |

2023 | 1,500 | – |

2024 | 3,200 (pre-bonus) / 640 (ex-bonus) | 4-for-1 Bonus |

2025 (May) | 2400 (ex-bonus) | – |

Source : Unlisted Zone

On a like-for-like basis, NSE has delivered a >140% return in less than four years far outperforming Nifty-50.

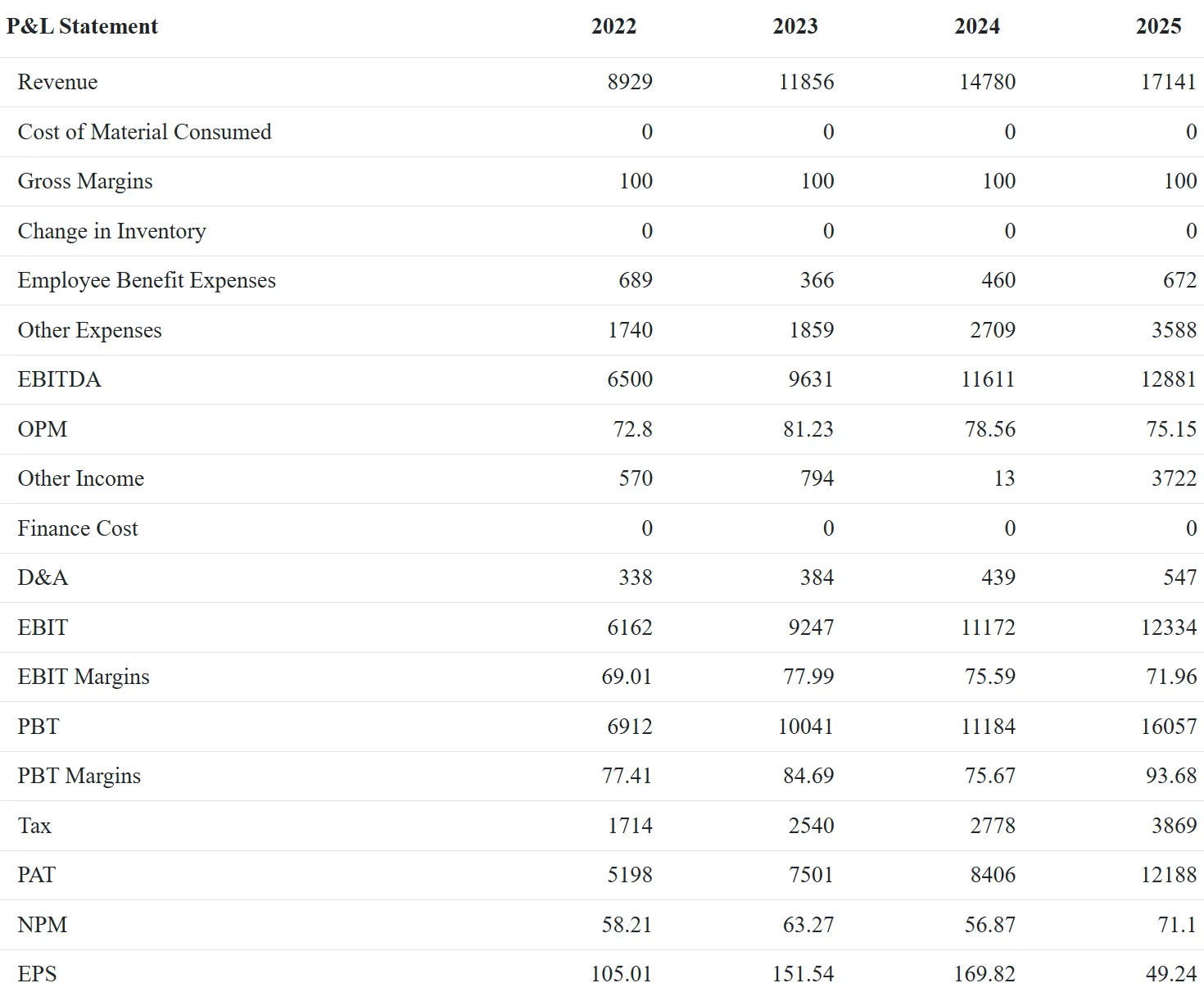

FY19–FY24 Performance

Revenue CAGR: 32%

Net Profit CAGR: 34%

EBITDA Margin: 73%

The exchange benefits from dominant market share in equity derivatives (over 73% of revenue), strong operating leverage, and growing income from data services and co-location fees. For the quarter ending March 2025, NSE reported a net profit of ₹2,650 crore, a 7% YoY growth, showing sustained momentum despite regulatory payouts.

Source : Unlisted Zone

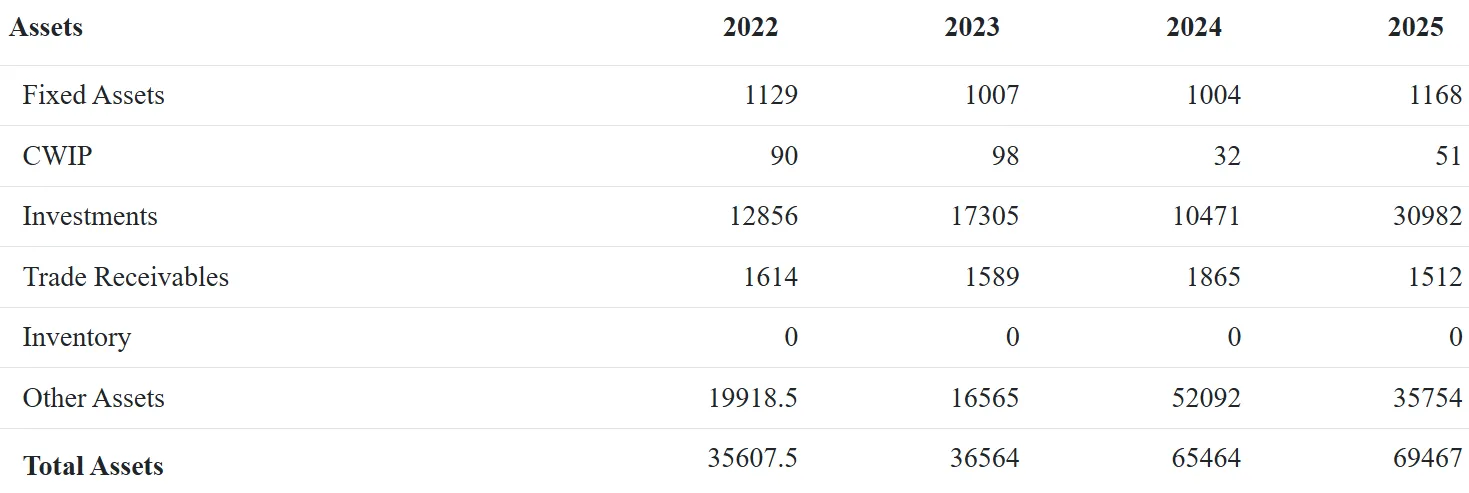

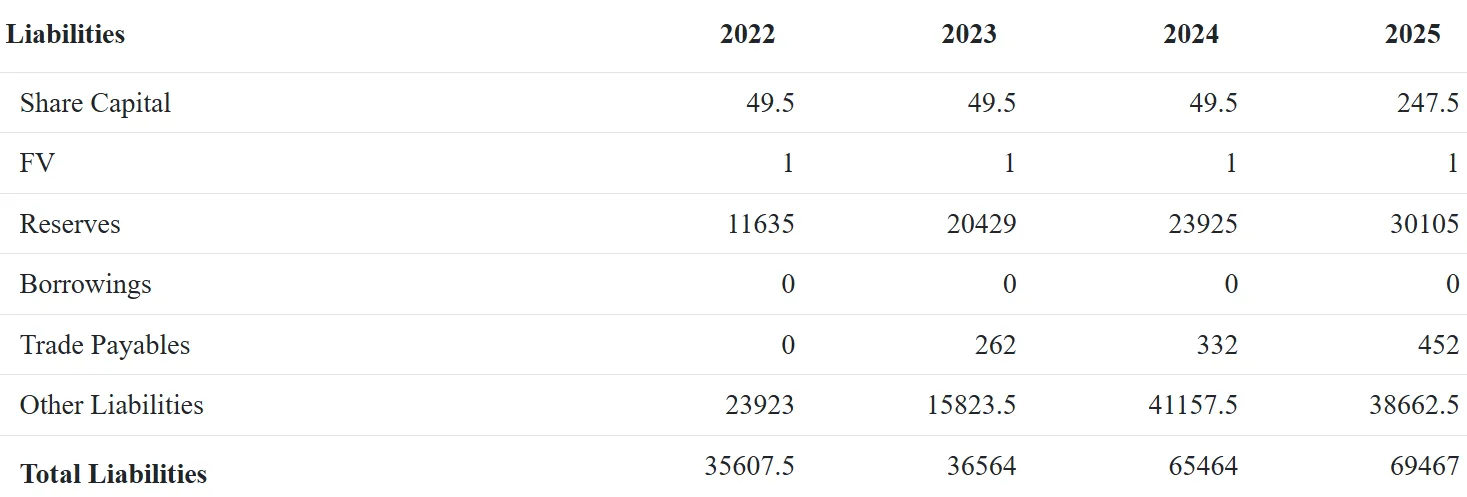

Balance Sheet

Source : Unlisted Zone

Operating cash flow in FY24 stood at ₹29,744 crore. NSE is debt-free and maintains a strong cash position, giving it a wide buffer for capex and contingencies. BSE Ltd, the only listed peer, trades at 27x FY26E earnings. NSE’s larger market share and higher profitability justify a premium, aligning its valuation closer to ₹5 lakh crore.

Risk Area | Description | Mitigation |

Regulatory | Ongoing scrutiny from SEBI; legal cases | Settlements underway, board overhaul |

Tech Outage | Exchange downtime or cyberattack | Large capex on IT & security infra |

Liquidity | Unlisted shares are hard to exit quickly | Use verified platforms, smaller lots |

IPO Delay | Governance issues could push listing | Internal clean-up progressing |

Valuation Compression | Overpriced IPO leading to correction | Anchor book and fair pricing essential |

NSE stands out due to its low capex model, annuity cash flow, and high ROE.

The IPO will follow SEBI’s process:

Internal Committee Review: Currently underway

Filing of DRHP and response to SEBI observations

Anchor investor round and roadshows

Book-building and listing

Assuming smooth regulatory clearance, market participants expect NSE’s IPO in FY26–FY27. Retail and HNI shareholders will face a 6-month lock-in post-listing.

Platforms: Stockify, UnlistedZone, UnlistedKart, PMS-linked AIFs

Minimum Investment: ₹25,000–₹2 lakh (varies)

Settlement Time: 3–21 days typically

Holding Format: NSDL/CDSL demat with label "UNLISTED"

Bid-Ask Spread: 3%–7% in normal markets; higher in illiquid weeks

Investors should perform due diligence, verify ISINs, and ensure SEBI-registered intermediaries are used.

Type of Sale | Holding Period | Tax Rate | Indexation |

Short-Term | < 24 months | Slab rate (up to 30%) | No |

Long-Term (before 23 Jul 2024) | ≥ 24 months | 20% | Yes |

Long-Term (after 23 Jul 2024) | ≥ 24 months | 12.5% | No |

Post-Budget 2024, the flat 12.5% long-term capital gains tax (without indexation) makes unlisted shares more attractive. Tax planning should account for this change when calculating post-IPO exits.

NSE’s unlisted shares offer a compelling mix of:

Strong growth

Consistent profitability

Likely IPO listing within 12–24 months

Improved tax efficiency

At the current price of ₹1,775 (ex-bonus), it trades at 23x FY25E earnings slightly lower than BSE despite superior metrics. For investors with patience, a long-term horizon, and capacity to handle illiquidity, NSE could be one of the most rewarding unlisted opportunities in India today.

Sources

NSE official website and investor presentations

SEBI circulars and press releases (2018–2025)

Business Standard, Economic Times, Mint (April–May 2025 issues)

UnlistedZone and Stockify price trackers

Budget 2024 – Income Tax Department documents

CapitalMind, Finshots, and PMSBazaar reports

BSE Ltd. financial statements and earnings calls

Private brokerage reports on NSE valuation

AIF/PMS industry newsletters (Apr 2025 editions)

Statutory filings from MCA (Ministry of Corporate Affairs)

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart