by Team Wright

Published On April 29, 2020

We completed 9 months of live performance and survived a market crash!

The unforeseen, once in a lifetime crash caused due to the economic impact of the loss due to the coronavirus blew up all major markets in March 2020. We survived and lived to tell the tale!

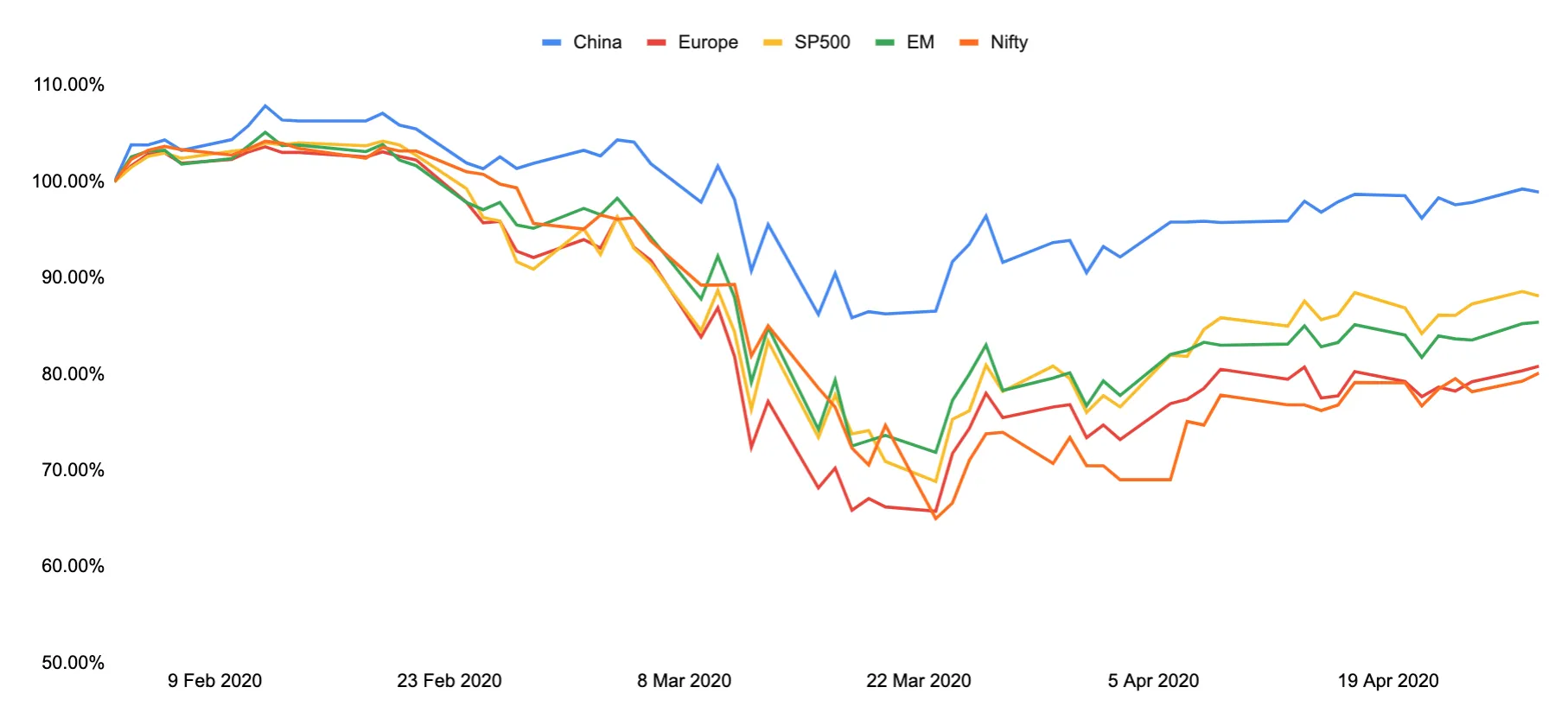

All major equity markets fell as much as 30% in March 2020 and the markets were filled with extreme fear and panicked selling.

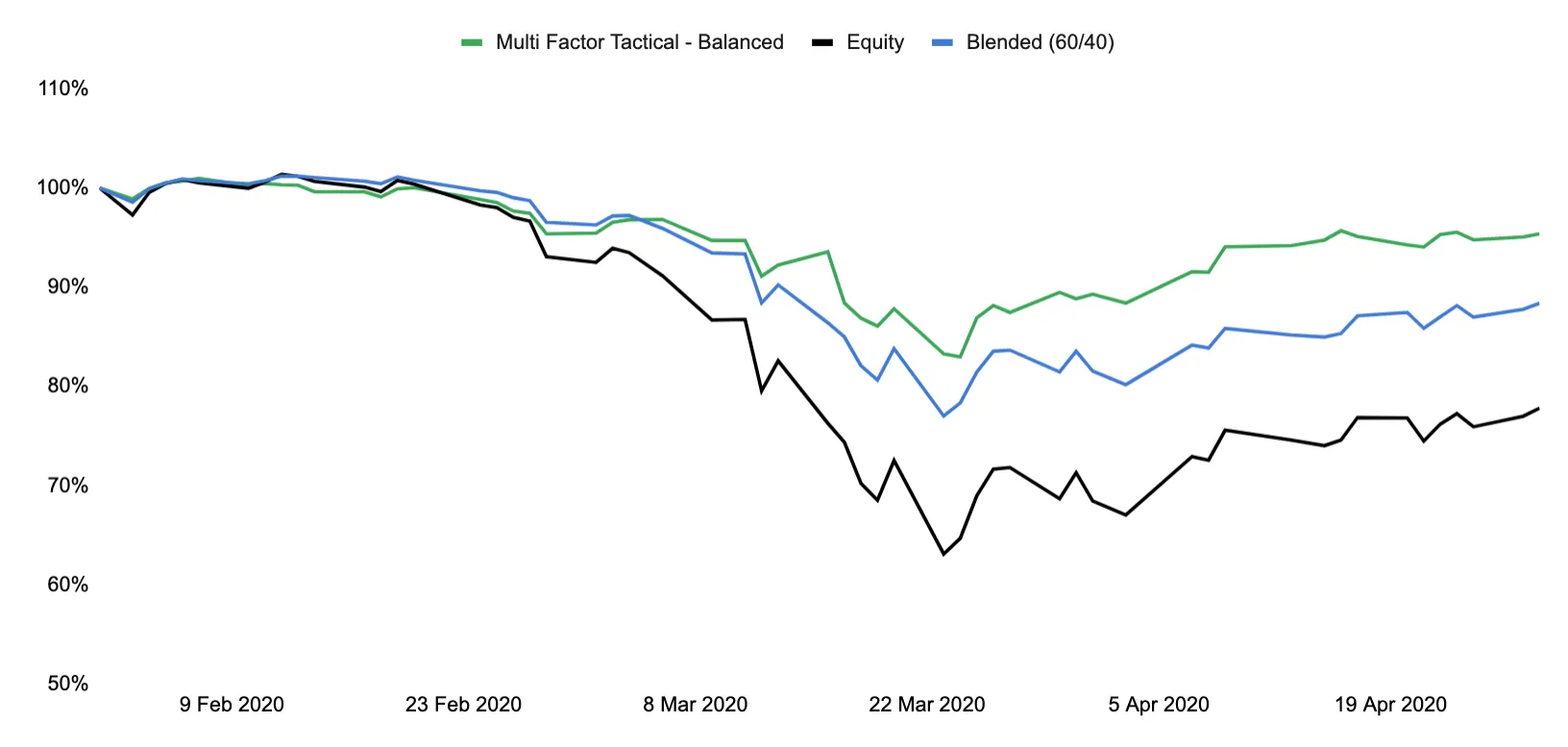

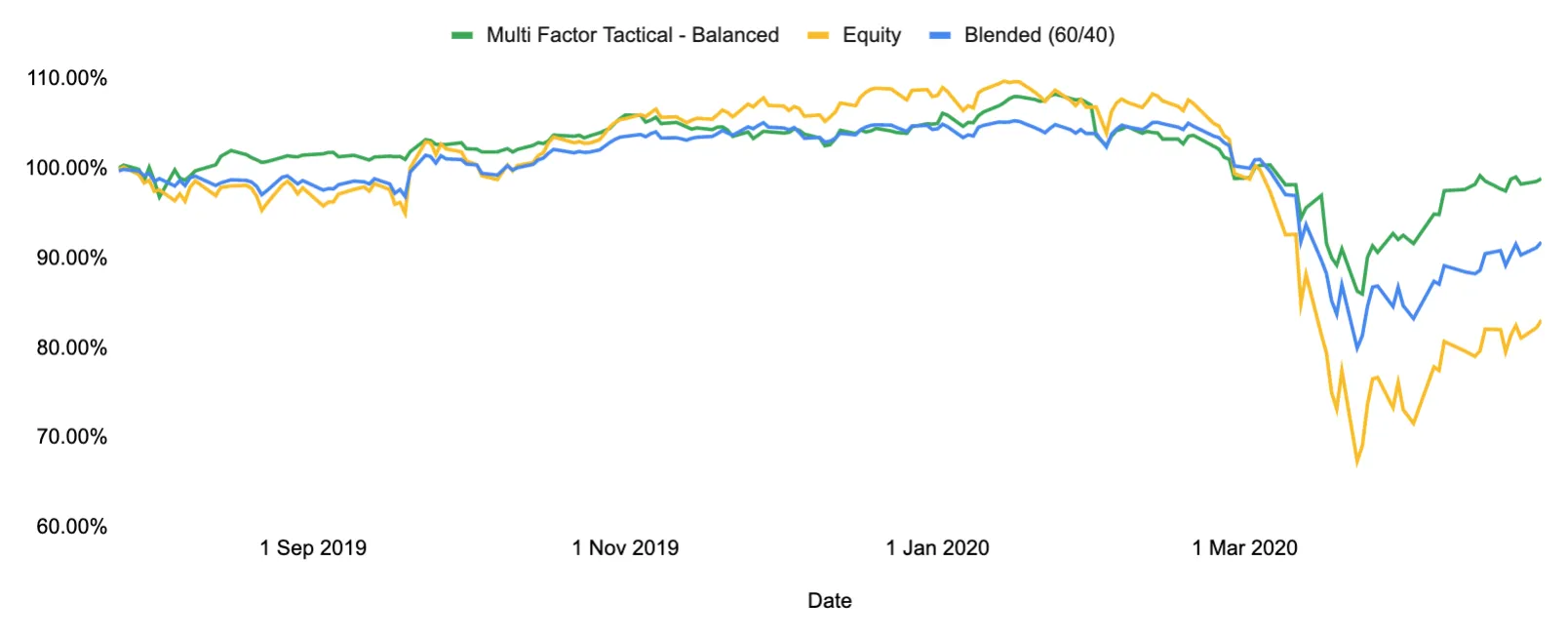

Our Multi Factor Tactical portfolios during the same period did exceedingly well for a long-only strategy.

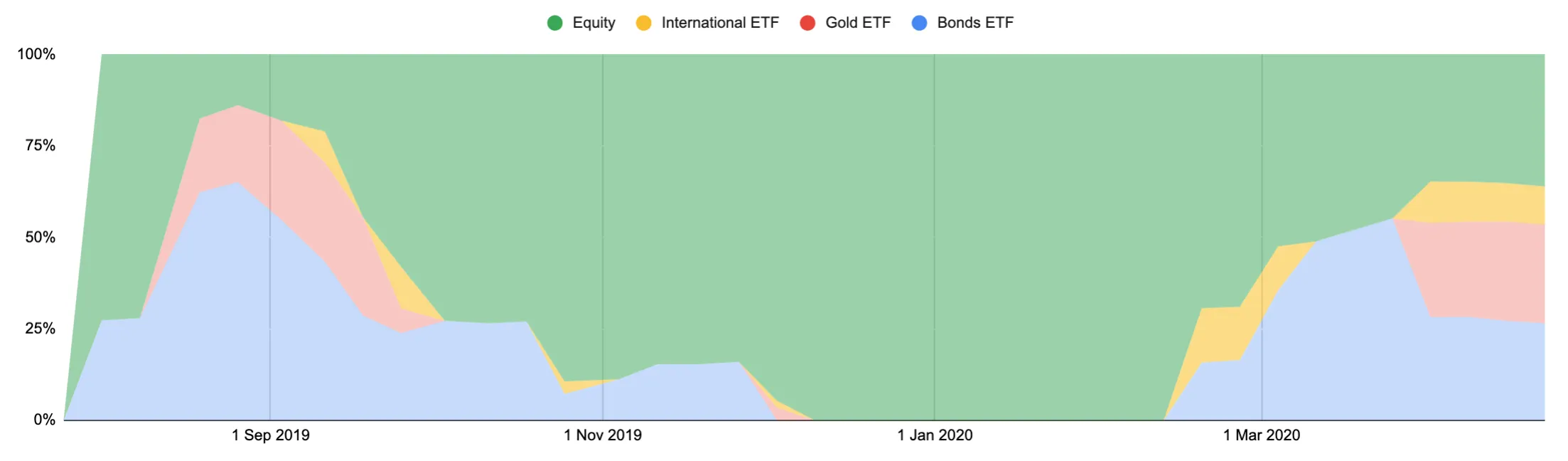

How did this happen?Our asset allocation modules which are based on apredictive regime shift modelmade us deallocate away from equities to bonds and liquid instruments early in February and March.

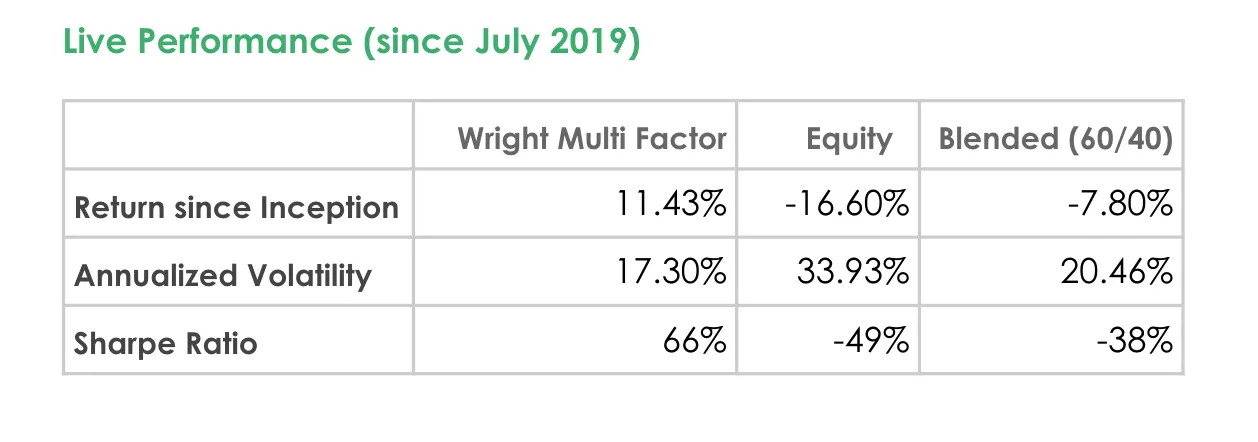

The performance since inceptionfor our strategies is outperforming the index by a big margin now.

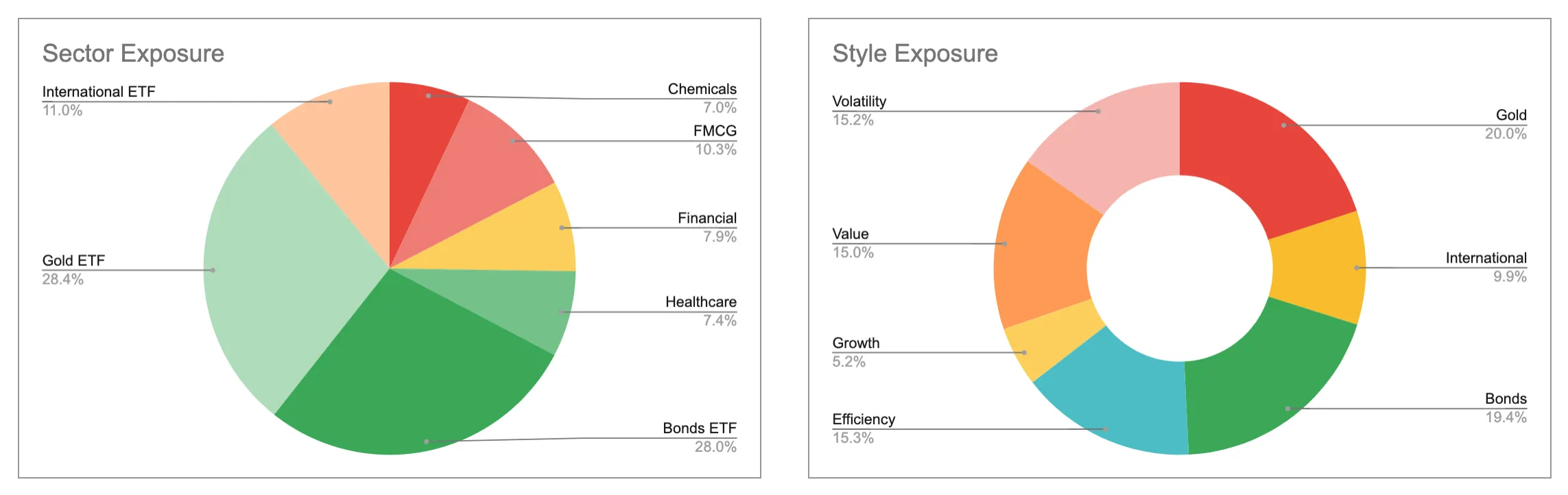

Going forwardswe are being cautious, we were deallocated from equities by upto 50% in April and invested into sectors like Pharma, FMCG and Financials. The styles or themes we were invested in were — low volatility, value and efficiency.

Now that the markets are recovering, in May we expect to have a higher equity allocation and larger allocation to risk.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart