At Wright Research, we believe that the market does not remain the same all the time. And as the market itself shifts its behavior, allocations within our portfolios also need to turn. This is why we like to follow a multi-factor approach in our stock selection and asset allocation.

This post will talk about our Multi-Factor Tactical strategies and how they can give you a steady above-market return in all market scenarios, helping you compound your wealth steadily at a tremendous rate.

We can breakdown the rationale of this strategy into two themes:

Dynamic Asset Allocation

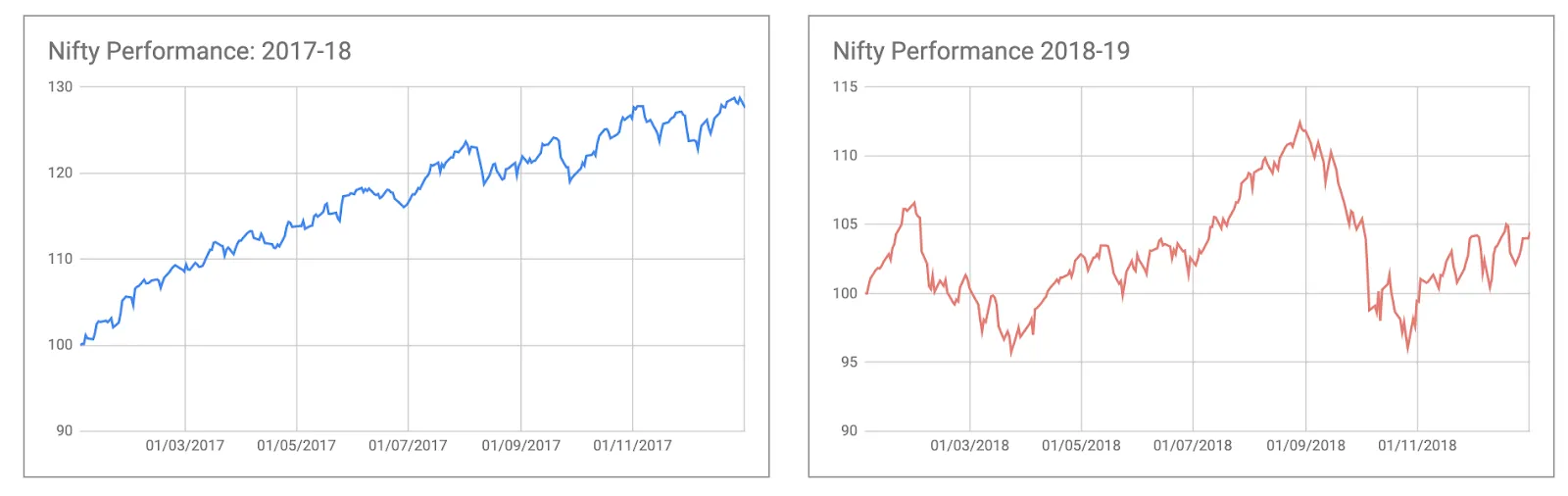

Let us look at the equity markets in the two recent periods — 2017 and 2018.

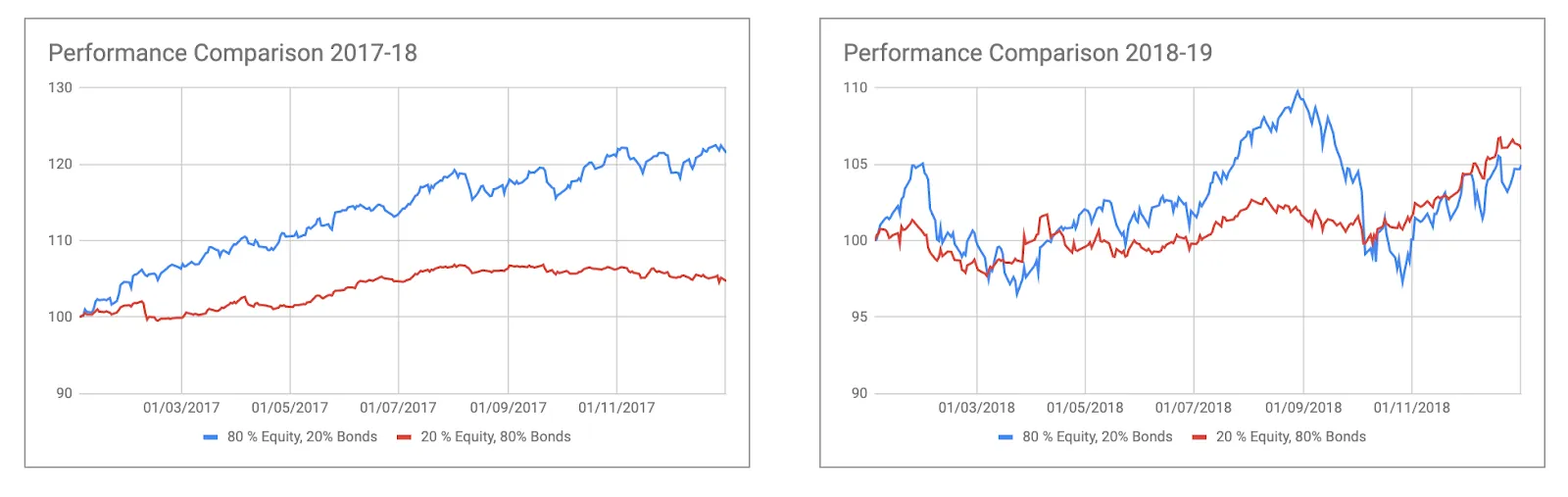

Look at two portfolios, one with high equity allocation and another with high bond allocations.

The equity majority portfolio had better performance in 2017, but the bond majority portfolio gave better risk-adjusted returns in 2018.

We choose the best asset mix using stocks along with bond and gold ETFs in the two different types of market regimes.

Regime Modelling

The regimes are predicted using a model that looks at short-term and long-term price patterns and economic data. We chase the equity market trend when the market is favorable and try to control the risk when it is not.

Stock Selection

While we trade bonds & commodities through ETFs, the choice of stocks in the portfolio comes from equity factor models or the popular name smart-beta. The individual equity buckets chase factors like:

Momentum or trend following

Value or choosing the undervalued stocks

Growth or picking high growth stocks

The quality or choosing the stocks with good earning quality

How has the performance been?

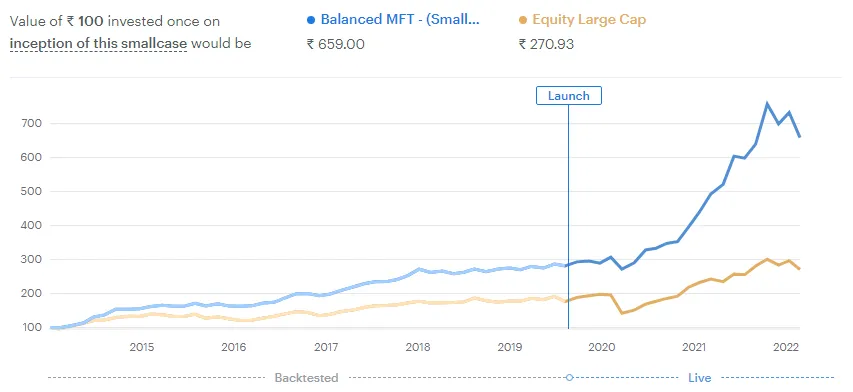

We have been live for two and a half years months since July 2019. Here’s what the performance has looked like:

The portfolio has done well in trending times of 2020 and 2021 and suffered much lower drawdowns during the market crash in March 2020.

The backtested performance of the model since 2014 looks like this:

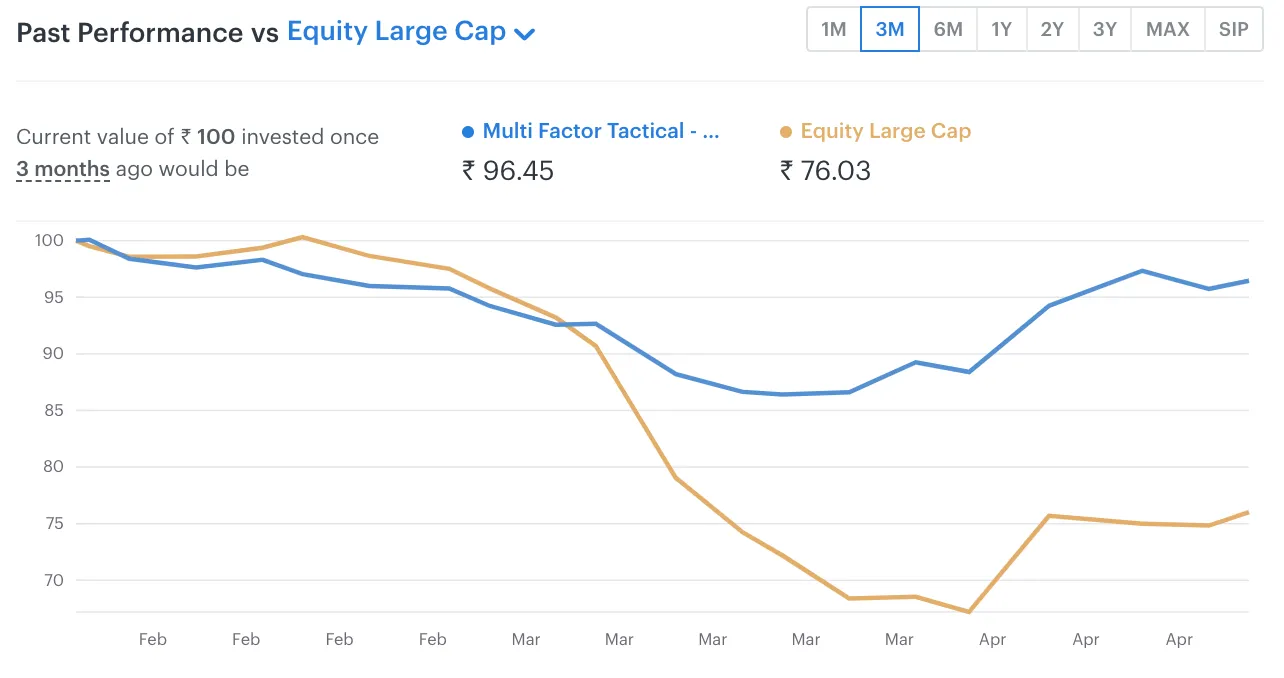

How does it perform during market crashes?

When the markets crashed in March 2020, led by coronavirus fears, our portfolios stood out based on the principles of dynamic asset allocation.

While the markets suffered a drawdown of ~30%, the portfolio only dropped ~15%

How can I invest?

Indian retail investors can invest via smallcase here: https://wrightresearch.smallcase.com/.

Details on the steps to invest and the plans are detailed here: https://www.wrightresearch.in/invest/

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart