by Sonam Srivastava

Published On March 7, 2021

In In the last couple of weeks, we have heard these terms - bond yields, commodity price rise, inflation while watching the equity markets countless times. Market participants expect rising bond yields and rising commodity prices to spoil the equity markets party sooner or later, similar to what happened after the 2008 crisis & recovery.

Let's try to understand where we stand now and how these factors can impact our portfolio returns.

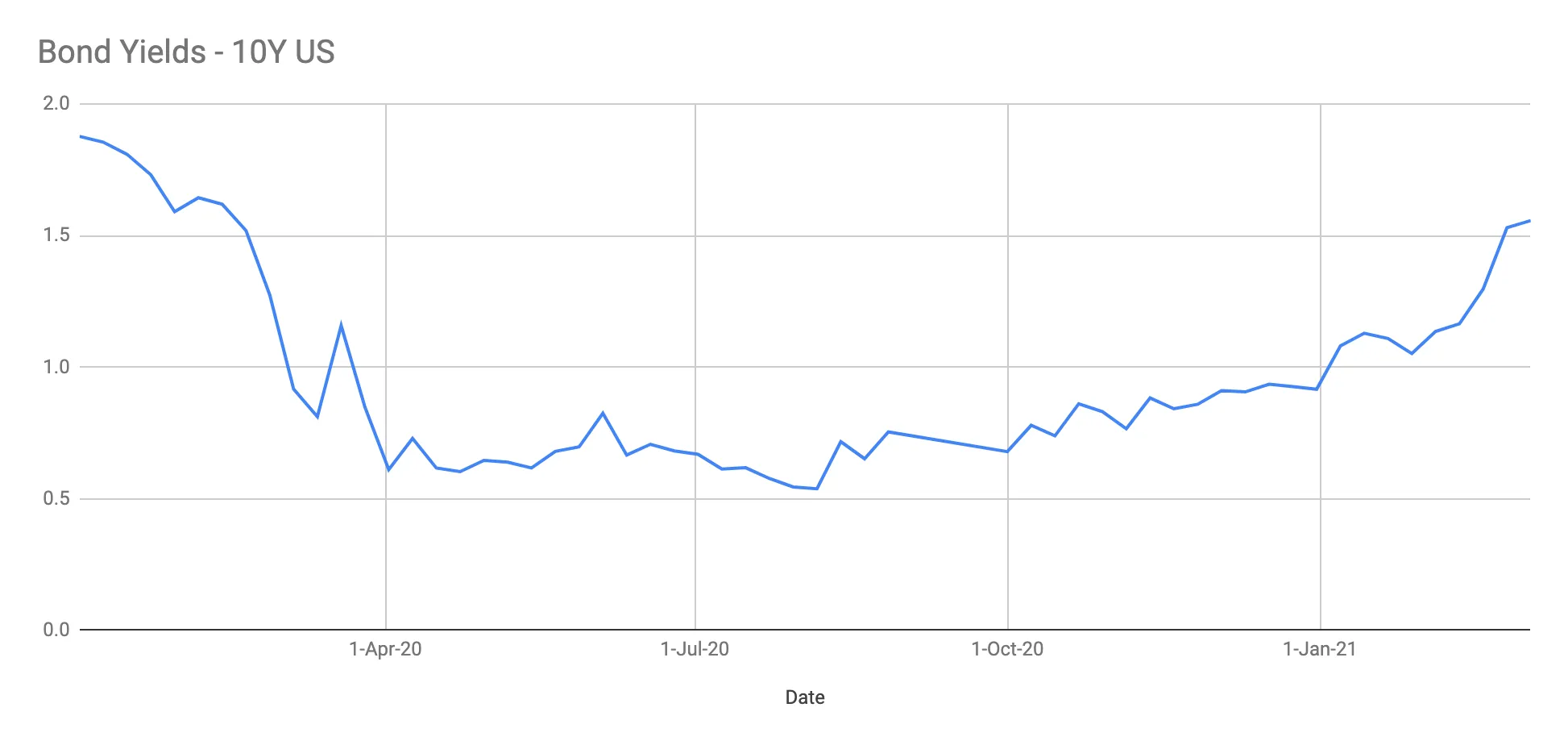

Bond Yields

The central banks have been enforcing a dovish economic policy. They try to keep the bond yields low to provide access to easy credit to businesses struggling during the pandemic. A dovish economic policy promotes growth in the economy and makes equity markets more attractive than bonds.

Bond yields in the US & India have been rapidly rising in the last few months despite the central bank efforts, causing hiccups in the equity markets. As the central banks do not suggest tapering of the stimulus just yet, the rising bond yields can be a good sign for the markets as they show that the economy is recovering.

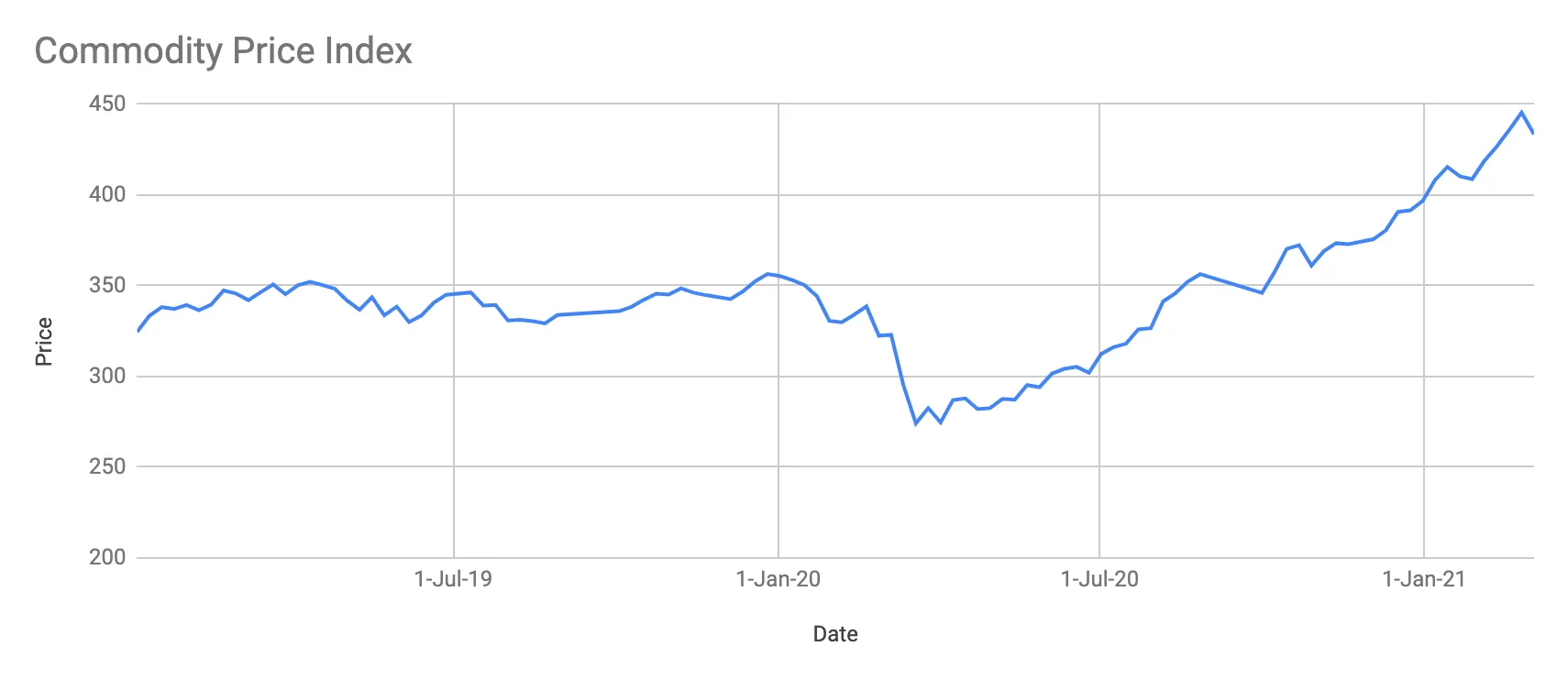

Commodity Prices & Inflation

Commodity prices have had a sustained period of a rise in the recent past. Copper prices are at a decade high due to the massive demand from China, and even crude prices have risen very rapidly because of increased demands. There are fears of increased inflation as commodities become expensive which could put pressure on the economy downwards.

The inflation in India seems to be comfortably within limits now, but there are a large set of Indian companies that might struggle if the commodity prices kept on rising.

Equity Market Expectations

As the economy shows sustained growth, the government's focus on development should keep the markets buoyed even though the rapid pace of change in equity prices could slow down as time progresses.

The bond yields, commodity prices will have a more considerable impact on the equity markets after the economy's recovery becomes much more transparent - but that still seems a bit far off. We think that cyclical stocks in India like metals, auto, cement & PSUs will have sustained growth even with these challenges. We find a reason to be majorly allocated to equities with selected stocks.

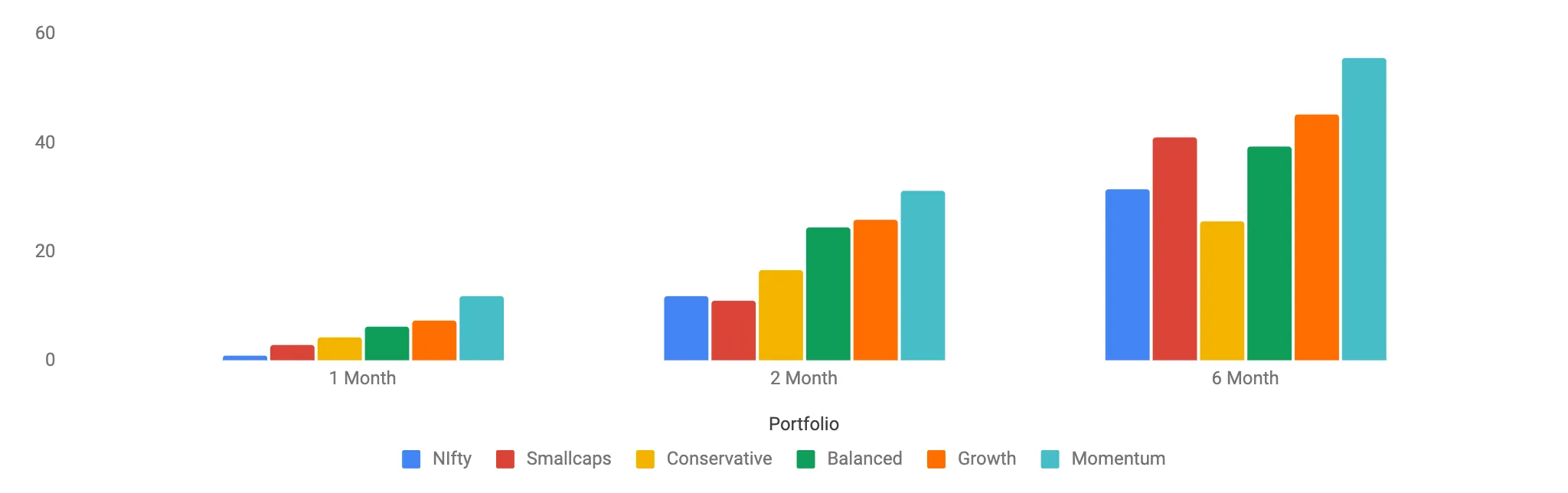

How our portfolios fared this month

All our portfolios have been outperforming the index in the last six months. The Wright Momentum is leading the pack with the highest performance.

We have recently made the momentum portfolio smaller in size with a minimum capital requirement of 25,000.

How we are rebalancing the multi factor portfolio?

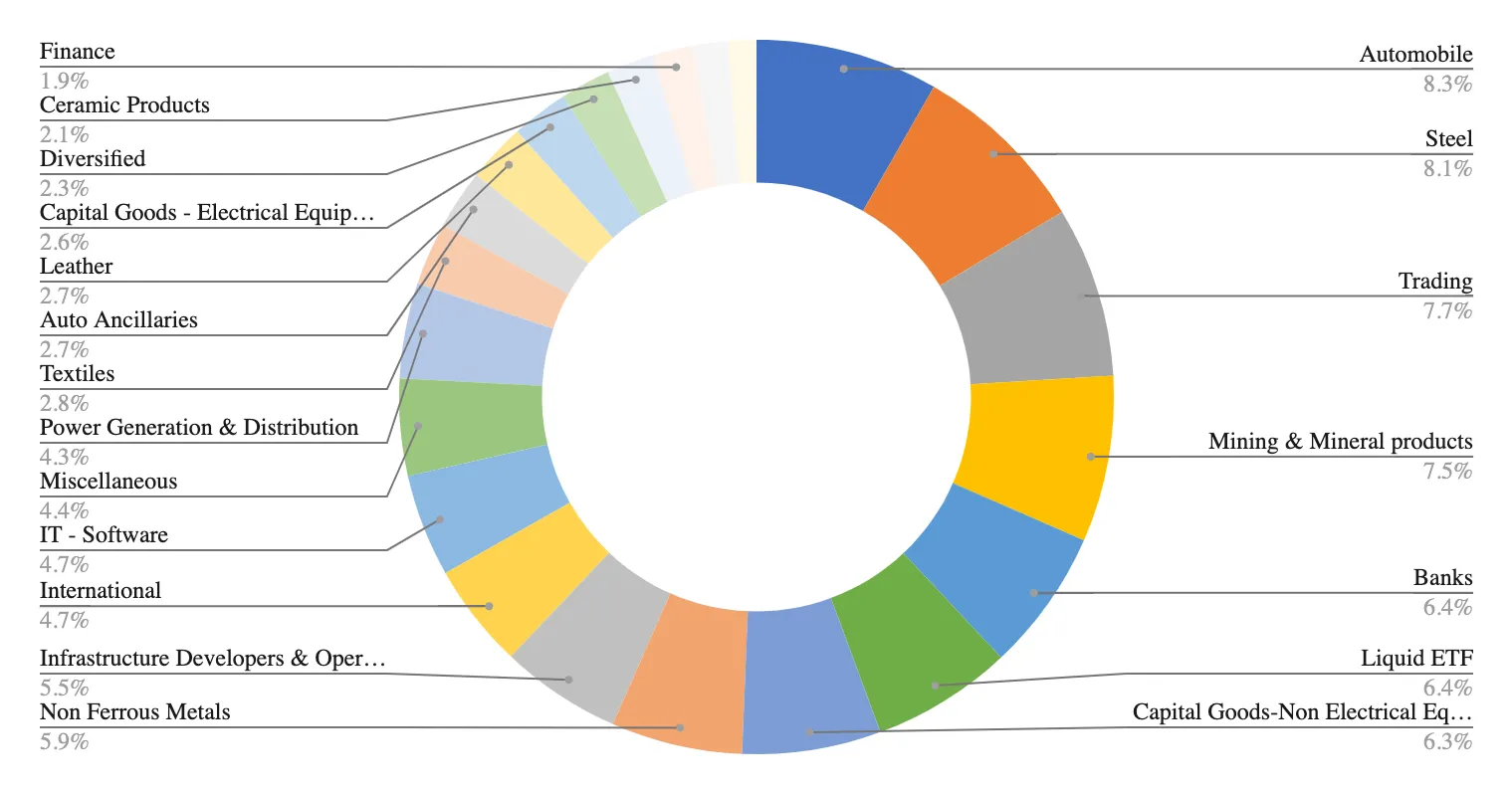

We are rebalancing the multi-factor tactical portfolios this week. These portfolios have an asset & factor allocation component. While they do have momentum as a factor, they also tactically allocate to factors like quality, growth, value, dividend, etc. Due to the diversification & tight risk controls, these portfolios outperform in any given market condition.

Our portfolio was heavy in cyclicals to begin with and this month we are adding Vedanta Ltd, Kudremukh Iron Ore Company and 2 more new stocks. We are removing Petronet LNG Ltd & Berger Paints from the portfolio.

Our current sector & asset allocation looks like this:

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart