India's export story to Mexico is facing a major turning point. From January 1, 2026, Mexico will impose steep tariffs of up to 50% on Indian products. This is a game-changer that will affect nearly 75% of India's $5.75 billion exports to the country. The move will hit almost every sector - from cars to smartphones, steel to textiles. Indian exporters who have spent years building supply chains and market share now face an uncertain future. This blog explains what is happening, why Mexico is doing this, and what Indian businesses should prepare for.

On December 10-11, 2025, Mexico's Congress approved one of the biggest tariff increases in recent history. The Mexican Senate passed amendments to the General Import and Export Tax Law that will add new duties to over 1,463 product categories from countries without a trade agreement with Mexico - and India is right at the top of that list. The new tariff structure becomes effective on January 1, 2026, and will remain in place for the entire year.

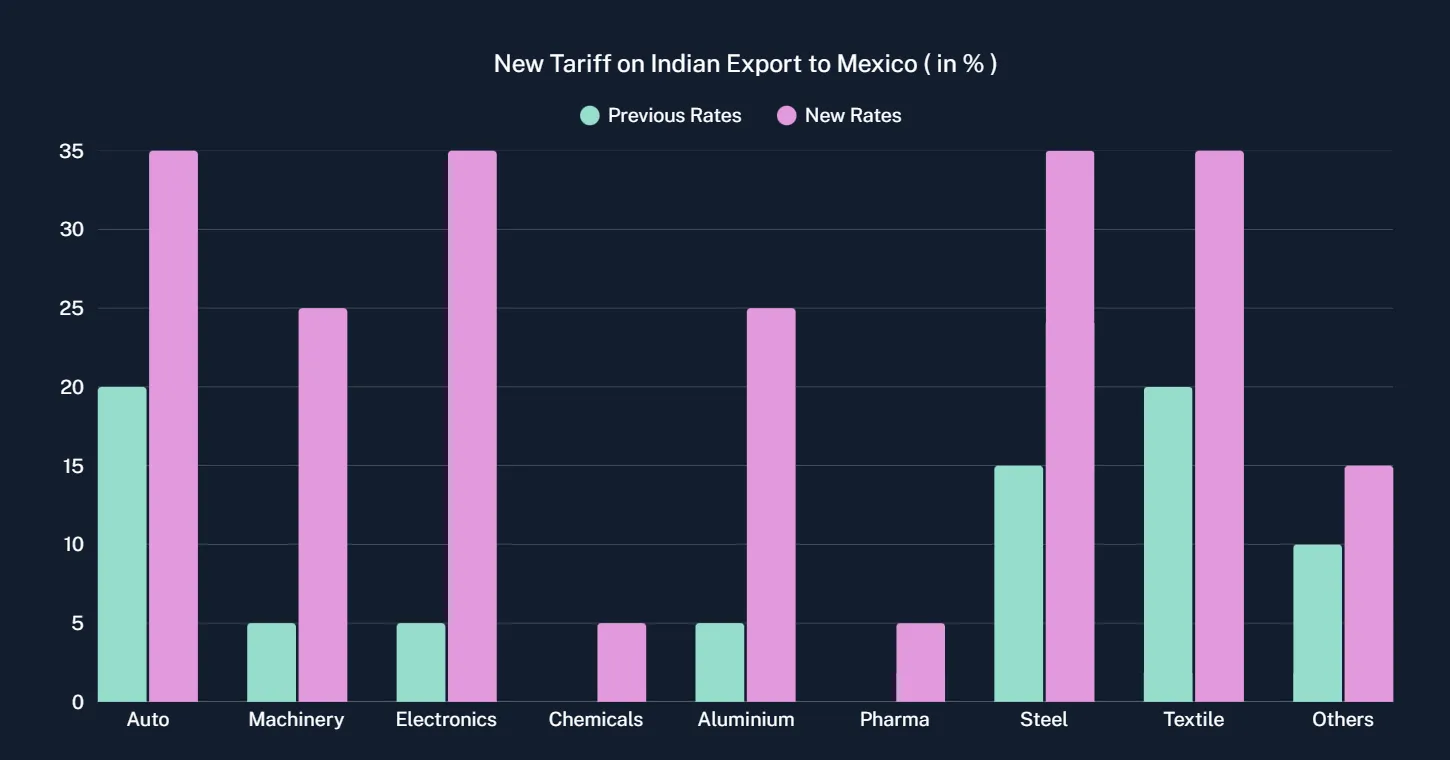

The tariff increases are not small. For most goods, duties will jump to between 25% and 35%. Some products, like steel, will face tariffs as high as 50%. This is a massive jump from the current rates, which range from 0% to 20% depending on the product. Think of it this way: if an Indian exporter was selling a product for $100 in Mexico, the tariff cost was maybe $15 to $20. Now, it will be $25 to $35, and sometimes even $50. This makes Indian products much more expensive and much less competitive.

The tariffs apply only to countries without a Free Trade Agreement (FTA) with Mexico. This means companies from the US, Canada, Japan, and Singapore will not be affected because their countries have trade deals with Mexico. But India, China, South Korea, Thailand, and Indonesia are left out in the cold.

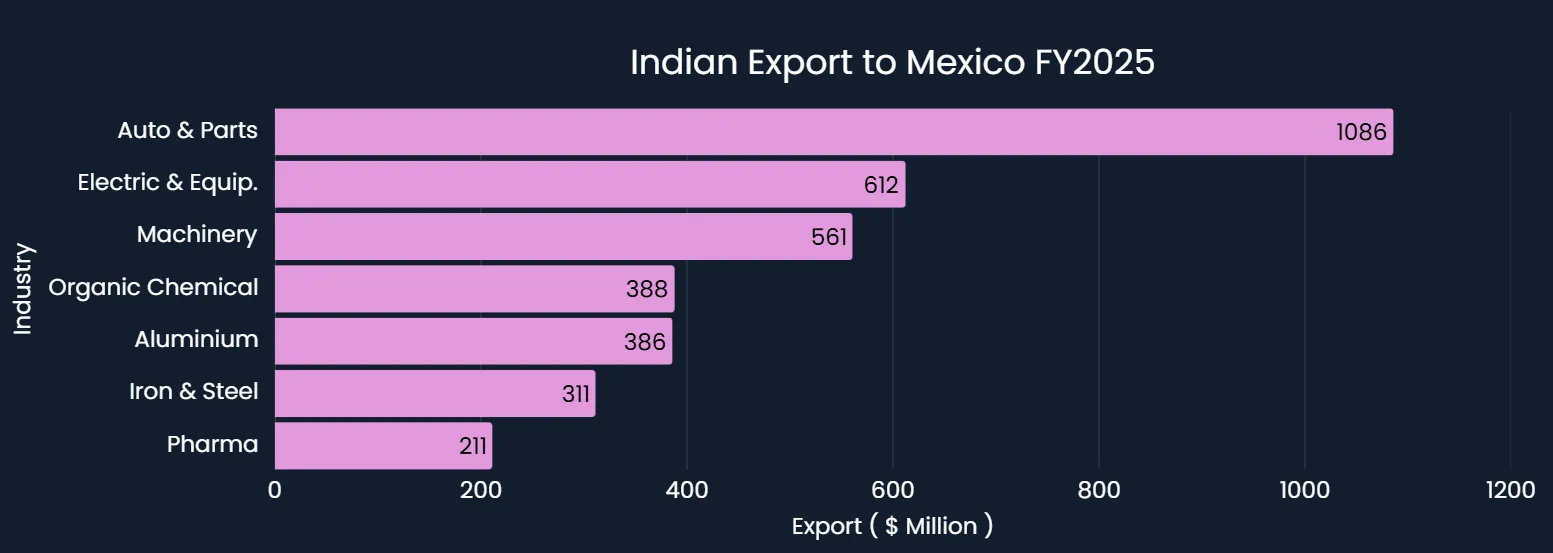

Indian Exports to Mexico by Sector (FY 2024-25), Source : Trading Economics

Mexico's government says the tariffs are meant to protect local jobs and boost domestic manufacturing. The Mexican Ministry of Economy claims these tariffs will protect around 350,000 jobs in the country. The government also plans to use the extra revenue - estimated at around $3.76 billion in 2026 - to help its fiscal budget.

But there is more going on. Mexico is also trying to follow the United States' lead on trade policy. The US has been pushing Mexico to reduce its imports from China and other Asian countries, and to buy more from North American suppliers. Mexico's "Plan Mexico" and the new tariff policy are all part of this strategy. By raising tariffs on Asian imports, Mexico is signaling to the US that it is serious about tightening North American supply chains and supporting the USMCA trade agreement.

Mexico's government also wants to encourage import substitution - meaning they want Mexican companies to start making products that are currently imported. This is similar to how Mexico used to operate before it joined world trade agreements. The idea is that if Indian and Chinese products become too expensive due to tariffs, Mexican and North American companies will fill the gap.

Almost every type of product India sells to Mexico will face higher tariffs. But some sectors are being hit much harder than others.

The automobile sector is India's number one export to Mexico, worth about $1.45 billion per year. This includes passenger cars, motorcycles, and auto parts. Currently, passenger cars face a 20% tariff. From January 2026, this will jump to 35% - a 75% increase in the duty cost. For auto components, tariffs will rise from 10-15% to 35%.

This is devastating for Indian automakers. Volkswagen, Hyundai, Nissan, Maruti Suzuki, Kia, and other brands manufacture cars in India specifically for the Mexican market. These are not expensive luxury cars - they are affordable, practical vehicles that Mexican consumers want. But with a 35% tariff, the price becomes too high. Some cars made in India for Mexico could become $3,000 to $4,000 more expensive than before.

Motorcycles are also badly hit. Indian motorcycle companies like Bajaj, Hero MotoCorp, and TVS export around $390 million worth of motorcycles to Mexico every year. These duties will jump from 20% to 35%. For a motorcycle that costs $3,000, a 35% tariff adds $1,050 to the price. Mexican consumers will switch to cheaper local or North American options.

Here is something shocking: Indian smartphones currently enter Mexico duty-free. They are taxed at 0%. But starting January 2026, they will face a 35% tariff. This is one of the largest single jumps in any sector. Indian companies like Lava, Micromax, and other smartphone makers saw Mexico as a growing market. Now, they are effectively being shut out.

Electrical machinery and equipment exports of over $612 million will also see major increases. Tariffs on these goods will jump from 5% to 35%.

Indian steel exporters face the worst tariffs of all. Flat steel products will face a 50% tariff - the highest rate Mexico is imposing. This likely means Indian steel will be completely priced out of the Mexican market. Steel exports worth $311 million face increases from 15% to 35%.

Industrial machinery, worth $548 million, will see tariffs rise from 5-10% to 25-35%. Aluminum exports of $386 million will move from 5-10% to 25-35%.

Mexico Tariff Rates: Before vs After (January 1, 2026)

Indian textile and garment exports worth $195 million will face tariffs rising from 20-25% to 35%. Ceramics will move from 10% to 25%. Plastics worth $137 million will jump from 5% to 25%.

These sectors are particularly vulnerable because Indian exporters have succeeded on price. An Indian garment maker could beat a Mexican competitor by offering 8-12% lower prices. With a 35% tariff, that advantage is completely wiped out.

Good news: pharmaceuticals are barely affected. Pharma products will only see tariffs rise from 0-5% to 0-10%. This is because Mexico knows that India is the pharmacy of the world - Latin America depends on affordable Indian generic medicines. Putting high tariffs on medicines would hurt Mexican consumers. So pharmaceuticals will remain a stable export business.

Let's put numbers to this impact. Indian exports to Mexico face a combined tariff increase of around 15 percentage points on average. On total exports of about $5.75 billion, this means Indian exporters will lose about $775 million to $800 million in revenue just from the tariff increase. That is money that companies and workers will lose.

For comparison, this is larger than India's entire annual pharmaceutical export to Mexico. The tariff hit alone is bigger than a major industry sector.

And that is just the direct tariff cost. There are secondary impacts too:

· Indian companies will lose sales volume because products become more expensive

· Some small exporters will stop selling to Mexico entirely

· Supply chains built over 15 years could be dismantled

· Indian workers in export industries could lose jobs

India has options, but none of them are great. India exports about $5.75 billion to Mexico but imports only about $2.9 billion from Mexico (mostly crude oil). This means India cannot easily retaliate with counter-tariffs - there is not enough Mexican imports to make retaliation worthwhile.

Instead, India's strategy is likely to:

1. Negotiate with Mexico - The Indian government will try to convince Mexico to lower tariffs or create exceptions for specific sectors. But this is unlikely to succeed because Mexico's Congress has already approved the measure.

2. Diversify to other markets - India can shift some exports to other Latin American countries or other regions. But this takes time and money, and other markets may already have Indian suppliers.

3. Absorb the cost - Some Indian companies will simply accept lower profit margins and try to keep selling at lower prices. But this is not sustainable for long.

4. Seek a Trade Agreement - India could push for a Free Trade Agreement (FTA) with Mexico. This would exempt Indian products from the tariffs. But negotiating an FTA takes 2-3 years minimum.

While Indian exporters suffer, what about Mexican consumers and businesses? The Mexican government expects the impact on consumer prices to be only about 0.2%. But this is hard to believe for some sectors.

For cars, motorcycles, and electronics, Mexican consumers will definitely see higher prices. Mexican businesses that use imported Indian parts will face higher production costs. In the short term, this could boost local manufacturers. But in the long term, without competition from Indian imports, Mexican manufacturers might become lazy and inefficient.

January 1, 2026 is just around the corner. Indian exporters have only a few weeks to prepare. The key question is: will these tariffs be permanent, or will Mexico take them back later?

The Mexican government has not said. If tariffs are temporary (lasting one year), companies might survive by reducing margins. But if tariffs become permanent, Indian exporters will need to completely rethink their business models.

For India's government, this is a wake-up call. Mexico showed that a major trading partner can shut India out without warning. India has no leverage because there is no FTA. India needs to move fast on getting FTAs with more countries and diversifying where it sells goods.

For Indian companies, it is time to act:

· Automakers: Consider moving some production to Mexico or negotiating with US-based factories

· Textiles: Look for alternative markets in Southeast Asia, Africa, and the Middle East

· Steel: Focus on other Latin American countries like Brazil and Chile

· Electronics: Explore African and Middle Eastern markets

· Pharmaceuticals: Keep exporting to Mexico - you are safe

Is Global Trade Breaking?

Mexico's tariffs are part of a bigger problem. The United States imposed 50% tariffs on Indian goods in August 2025. Now Mexico is following suit. Other countries are likely to do the same. This is the opposite of what happened for 30 years - when countries were lowering tariffs and making trade easier.

If this trend continues, global trade could break down. Countries will start protecting their own industries, supply chains will fracture, and consumers will pay higher prices everywhere. India, as an export-driven economy, will suffer the most.

The lesson for India is clear: depending on one or two markets is dangerous. India must diversify its exports to 50+ countries, not just rely on the US and Mexico. India must also move fast on trade agreements.

Mexico's new tariffs are a serious blow to Indian exporters, hitting nearly 75% of exports with tariff increases averaging 15 percentage points. The automobile sector, which is India's largest export to Mexico, faces a particularly severe impact with tariff increases from 20% to 35-50%. Electronics, metals, textiles, and machinery are equally hard hit. Only pharmaceuticals remain relatively protected due to Mexico's dependence on Indian generic medicines. While India's government will likely attempt negotiations and encourage export diversification, the fundamental challenge is that India lacks an FTA with Mexico and cannot easily retaliate with counter-tariffs. The immediate impact will be visible from January 1, 2026, with higher prices for Mexican consumers, disrupted supply chains, and significant revenue losses for Indian companies. For the longer term, this situation underscores the urgency of India pursuing bilateral trade agreements and diversifying export destinations beyond major markets like the US and Mexico.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart