Once a month, it makes sense for us to take a pause and look at the markets & macros to make sense of all the noise.

Despite near-term volatility, we do not see a significant impact on long-term prospects for investors.

The fall in the second wave of Covid cases is reassuring, and the current pace of vaccination looks optimistic. The recovery should lead to the normalization of economic activities. However, markets in the near term gyrate between greed and fear.

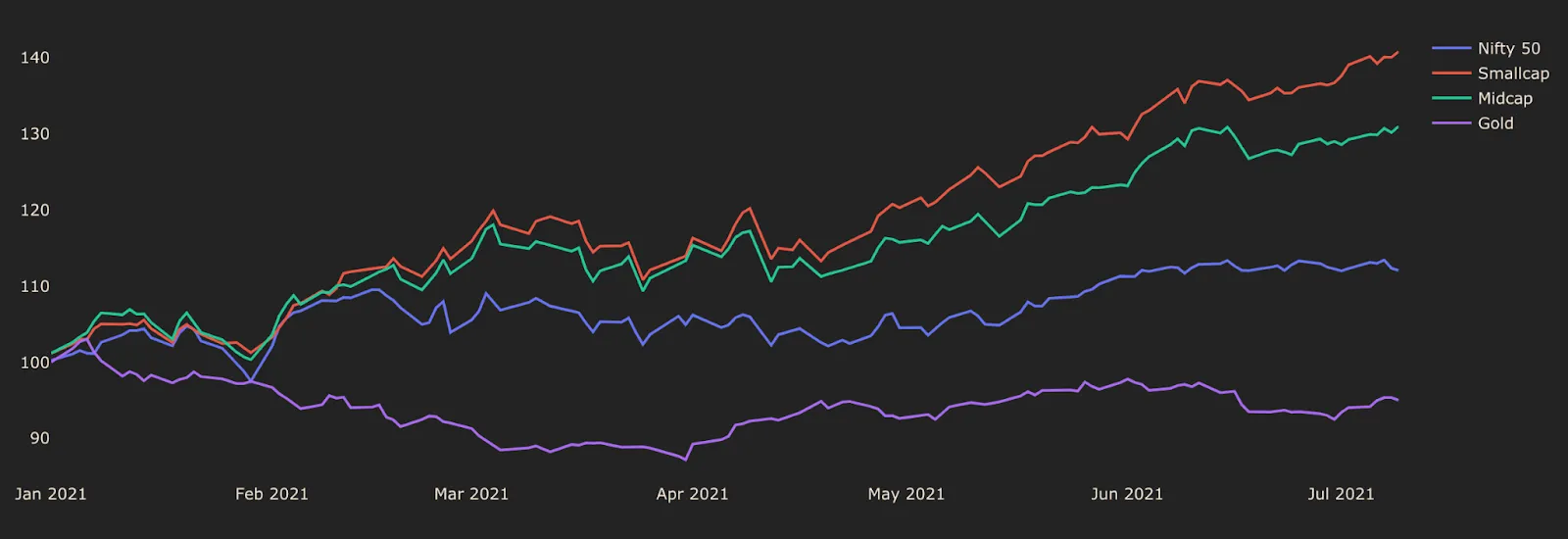

Broad Markets

Looking at broad market indices in 2021, we see that Smallcap index leads the Midcaps while Largecaps seem to be lagging!

The outperformance of smaller stocks is a typical sign of a bull market where the demand has reached the smaller companies in the economy.

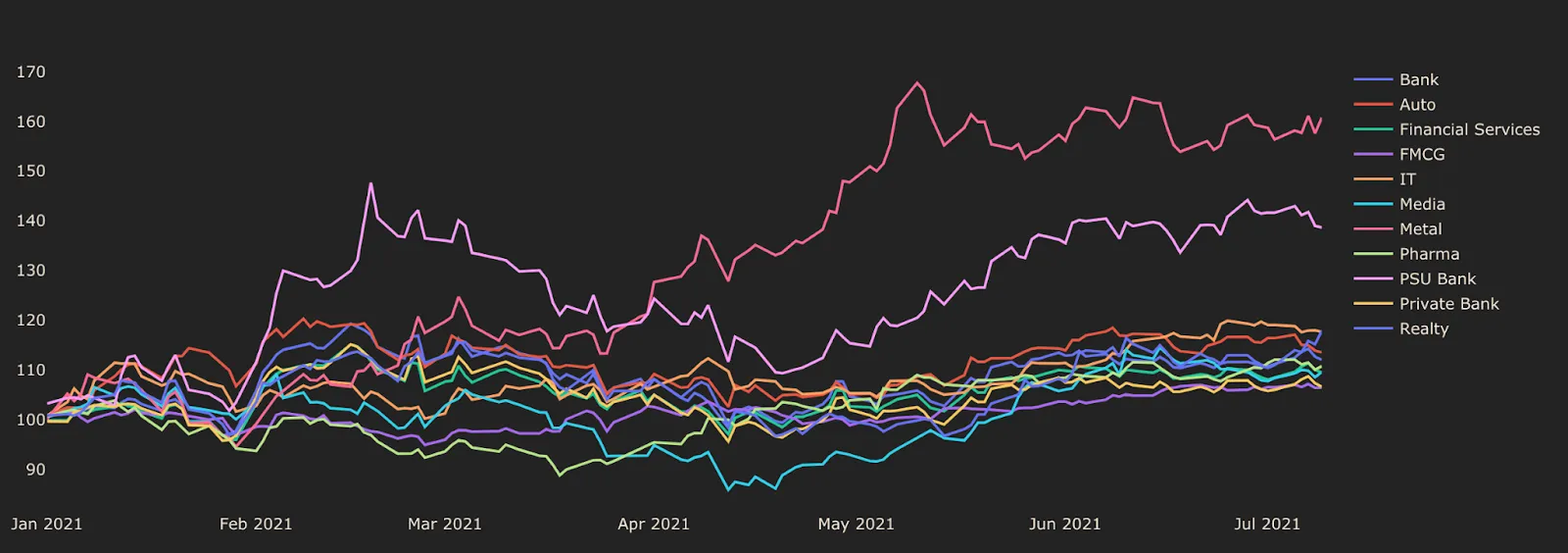

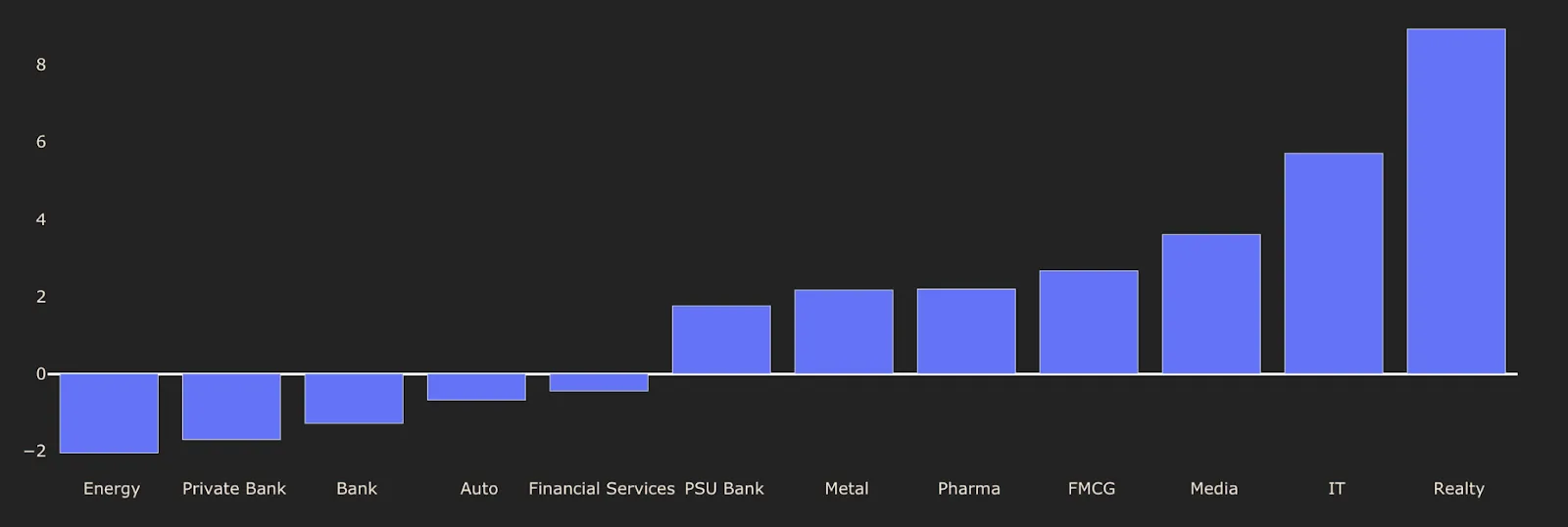

While 2020 was the year for IT and Pharma, Metals, PSEs, and PSU banks led the way in 2021.

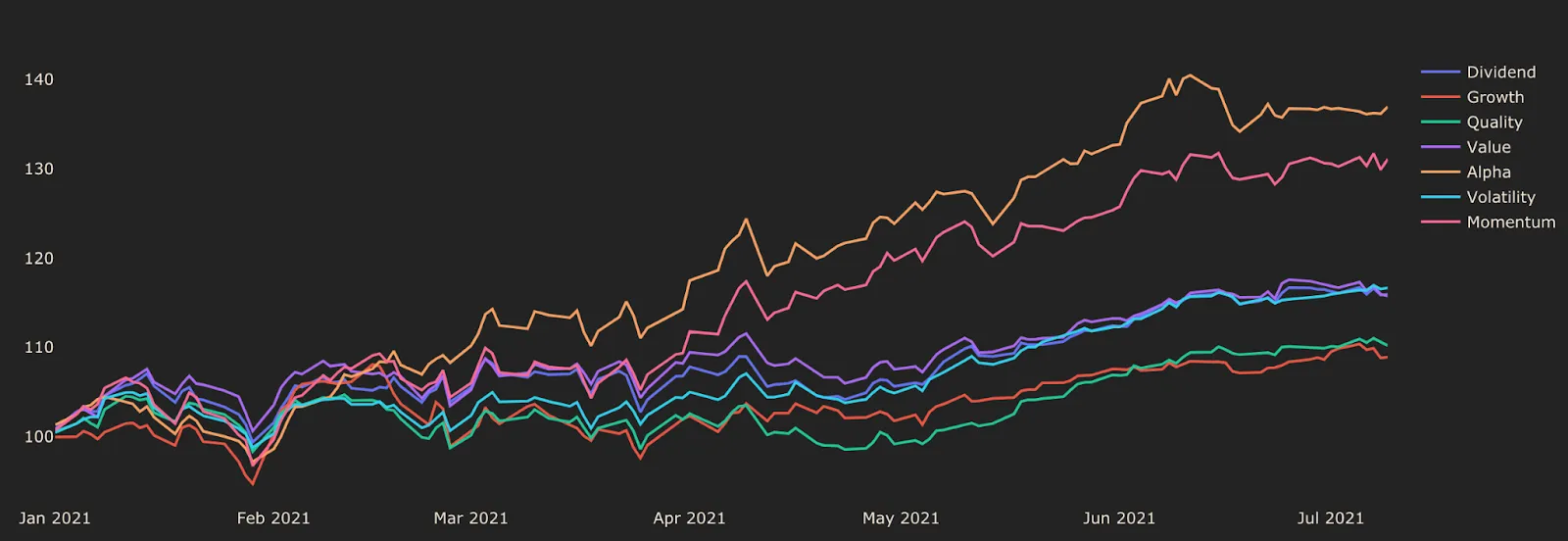

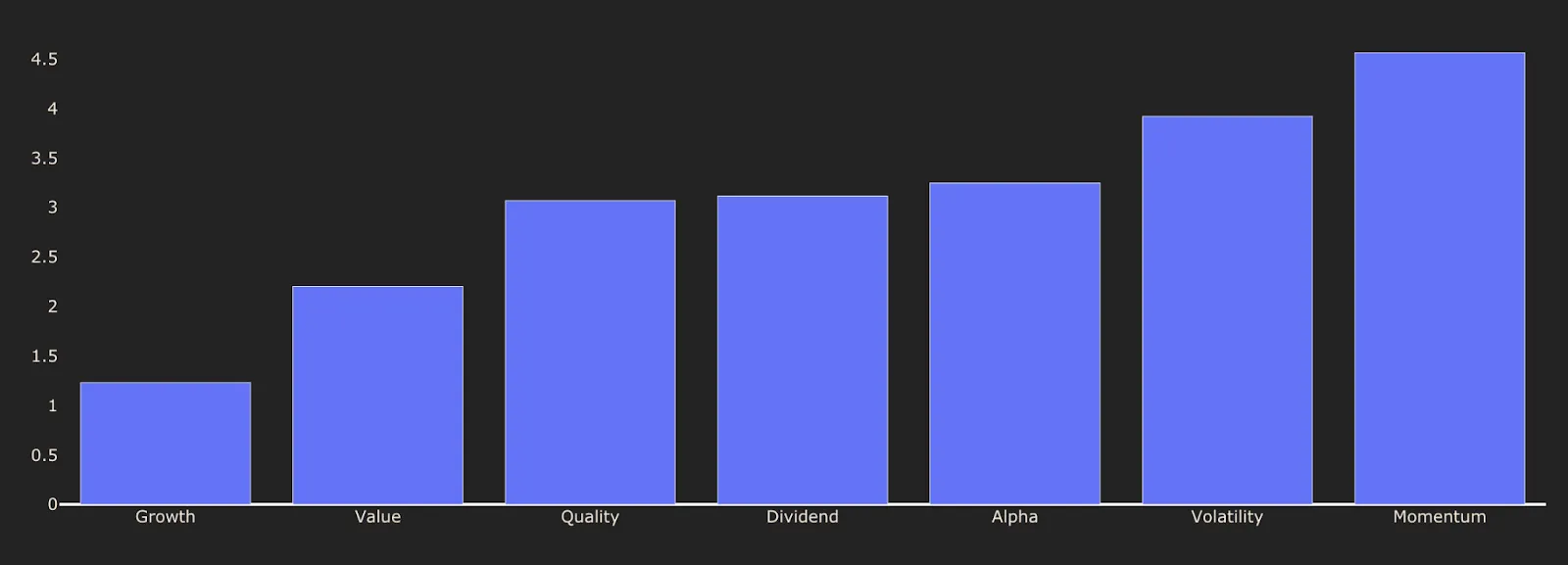

Factors

Momentum & Alpha have won the race in 2021, much like 2020.

Recently, in the last month, both Momentum and Alpha have taken a hit due to the debacle in Adani stocks, but they still lead the way.

Recently, in the last month, both Momentum and Alpha have taken a hit due to the debacle in Adani stocks, but they still lead the way.

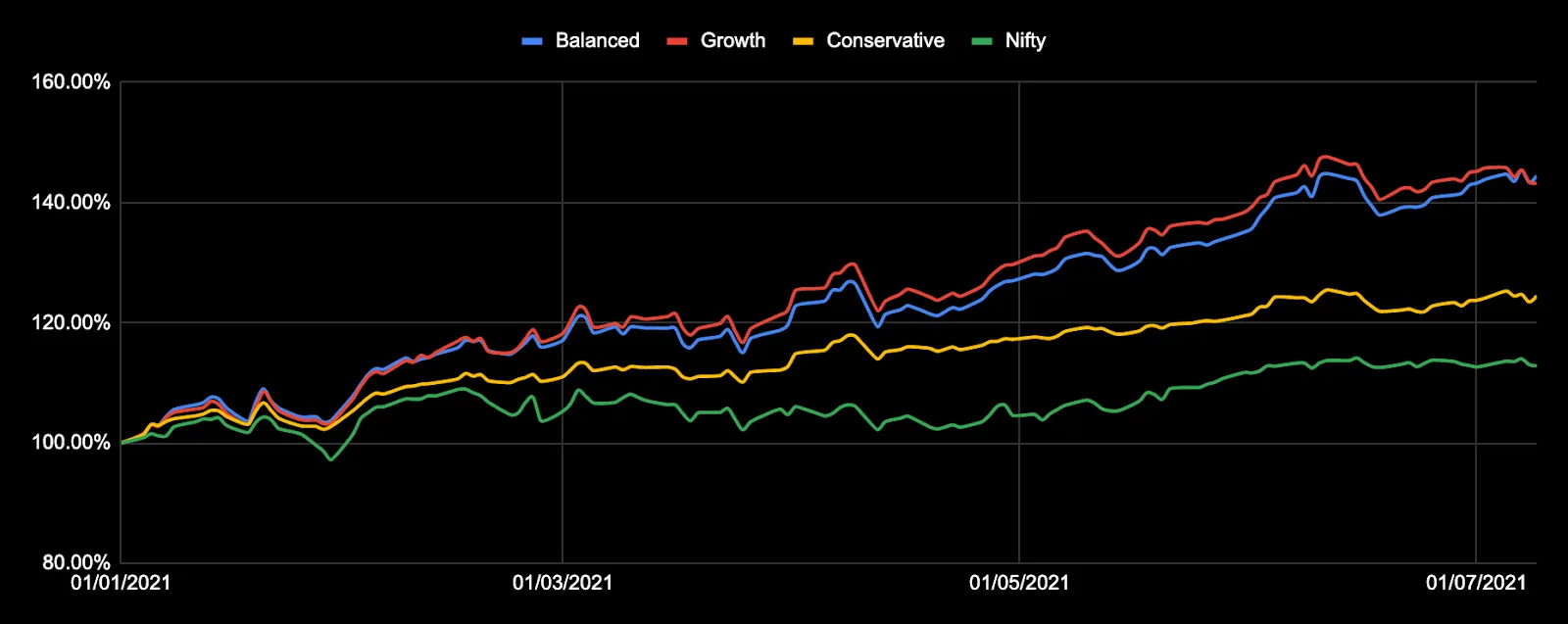

Performance

Performance

Let’s look at our multi-factor portfolios - balanced , growth & conservative first. We have allocated momentum & alpha in 2021, which has led to very good performance growth.

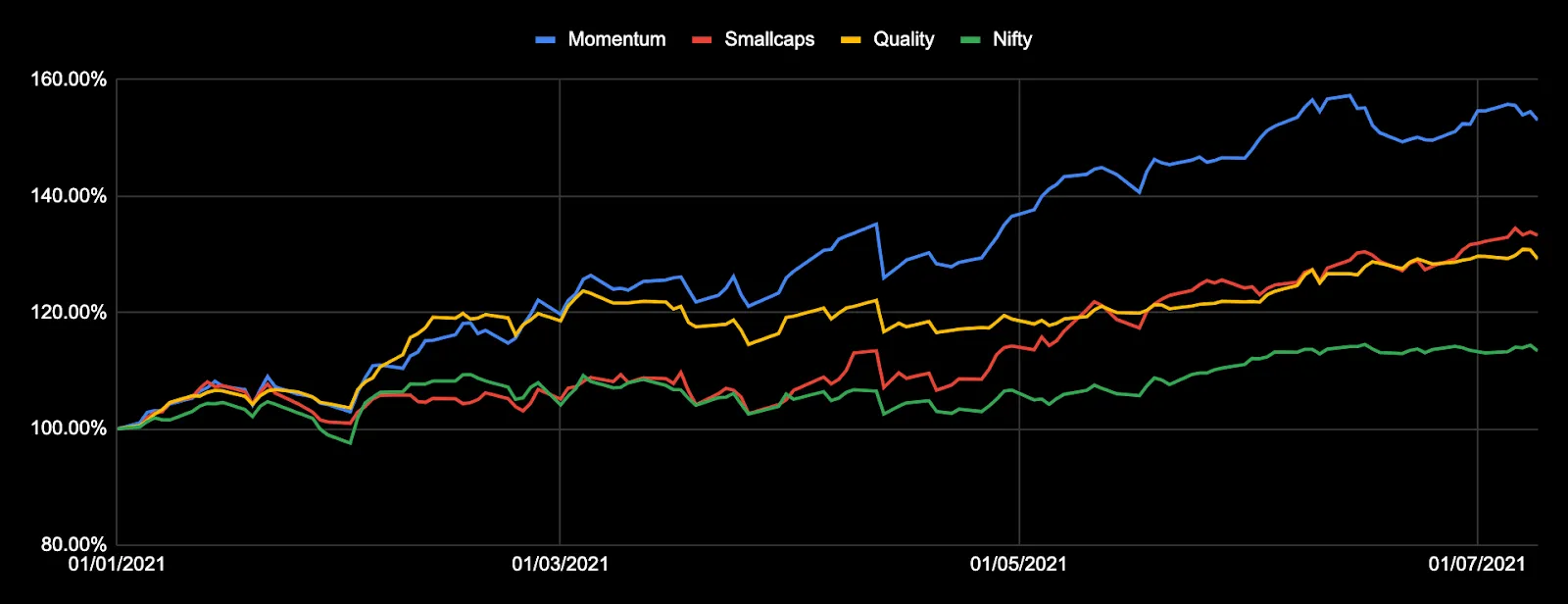

Among the thematic portfolios, momentum has seen very rapid growth, even though it was derailed in June by Adani stocks. Smallcaps & Quality have been picking pace recently.

Among the thematic portfolios, momentum has seen very rapid growth, even though it was derailed in June by Adani stocks. Smallcaps & Quality have been picking pace recently.

We see good outperformance over the index in all our core and thematic portfolios in 2021.

Hits & Misses

2021 has been good if you’ve been with us throughout the ride, but a relatively large number of subscribers have only joined us in June 2021. And June 2021 was chaotic! So there were a few misses:

We had a high allocation to Adani stocks, and Adani stocks had a free fall in the middle of June!

Our systems are not made to handle manual orders. Still, we decided to ask users to do manual selling to save their capital, which left much dissatisfaction among users getting late in updating their portfolios.

In the July rebalance of smallcaps portfolio, four highly illiquid symbols were added; people could not buy them, and a few who could, are unable to sell them in circuit.

We live and we learn. Wright Research is profusely apologetic for any inconvenience caused to our clients. Each client is special to us, and we will work with them to safeguard their capital. We are completing two years live on smallcase at the end of July, and these lessons have made us all the more motivated to be more proactive and diligent in the future. We value everyone’s trust that has taken us this far, as that is all that we have going for us!

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart