by Siddhart Agarwal

Published On Jan. 4, 2026

As we close out 2025, it has been a year that tested conviction more than optimism.

At the index level, markets looked calm. But underneath, leadership narrowed, dispersion rose, and returns became far more selective. The environment rewarded discipline, process, and risk control not broad participation or narrative-driven positioning.

This note reflects on what defined 2025, what we learned from it, and how we are thinking about 2026.

While headline indices remained resilient, a large part of the market struggled, market breadth weakened for much of the year. Fewer stocks were driving index returns. Many mid- and small-caps delivered flat or negative returns despite stable indices. This created a gap between “what the market looked like” and “what investors experienced.”

2025 was not a bull market, it was a market of dispersion. Stock selection mattered far more than market exposure. Thus the breadth deteriorated, the % of Nifty 500 stocks above 200-DMA fell from ~68% (Jan) to ~42% (Dec). Top 10 stocks contributed ~55%+ of Nifty 50 returns.

India outperformed other major economies with ~6.5% growth, driven by strong domestic consumption and services sector resilience. Global GDP growth slowed slightly to ~2.9% from ~3.1% in 2024. Regional variations showed the US at ~2.3%, Eurozone at ~0.7% and China at ~4.6%.Inflation eased notably, with US CPI dropping from ~3.4% (end-2024) to ~2.6%, while India CPI averaged ~5.2% within RBI’s tolerance band.

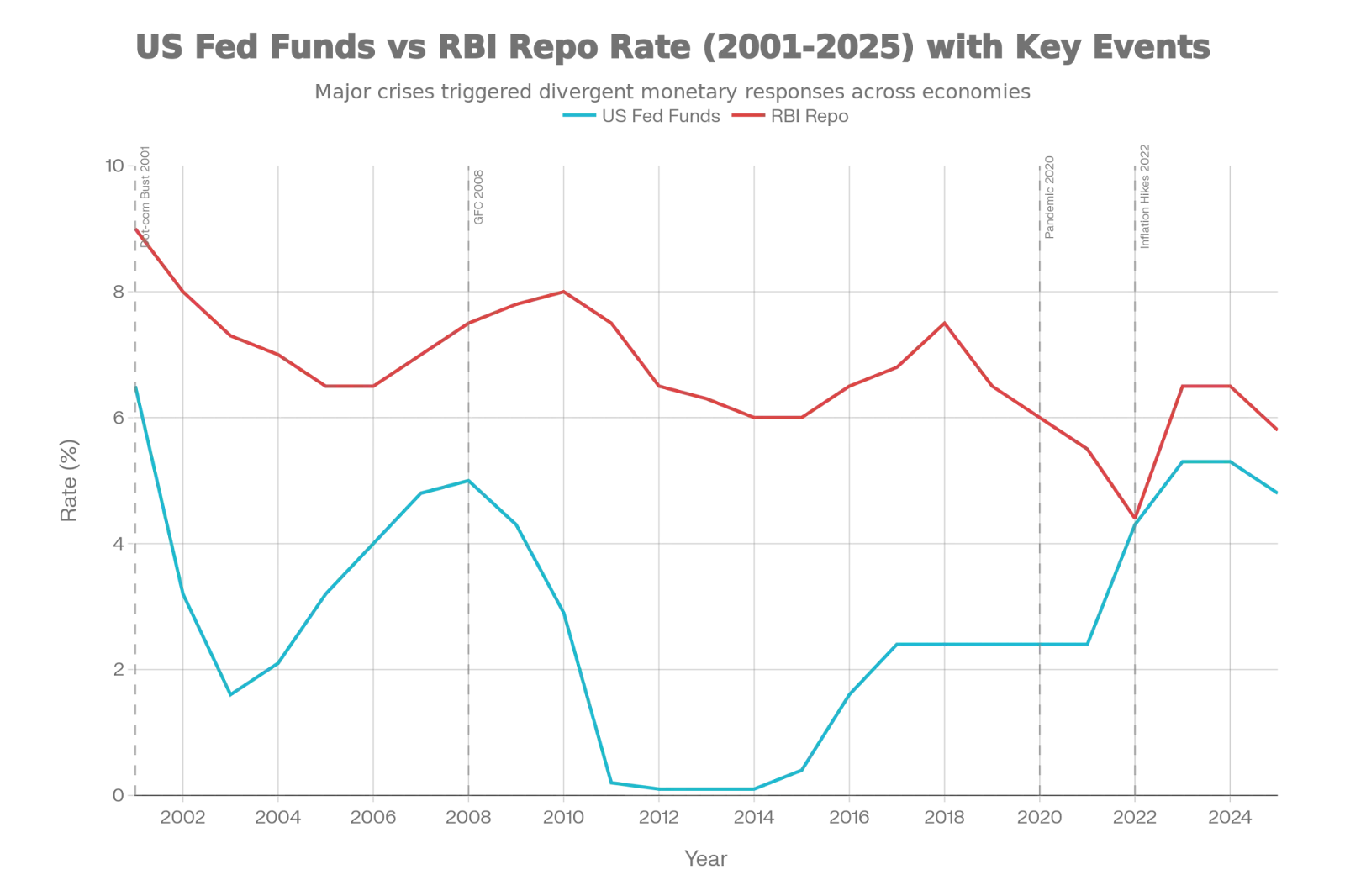

Policy rates remained steady, US Fed Funds at 5.25%–5.50% for most of the year, and RBI repo at 6.50%.

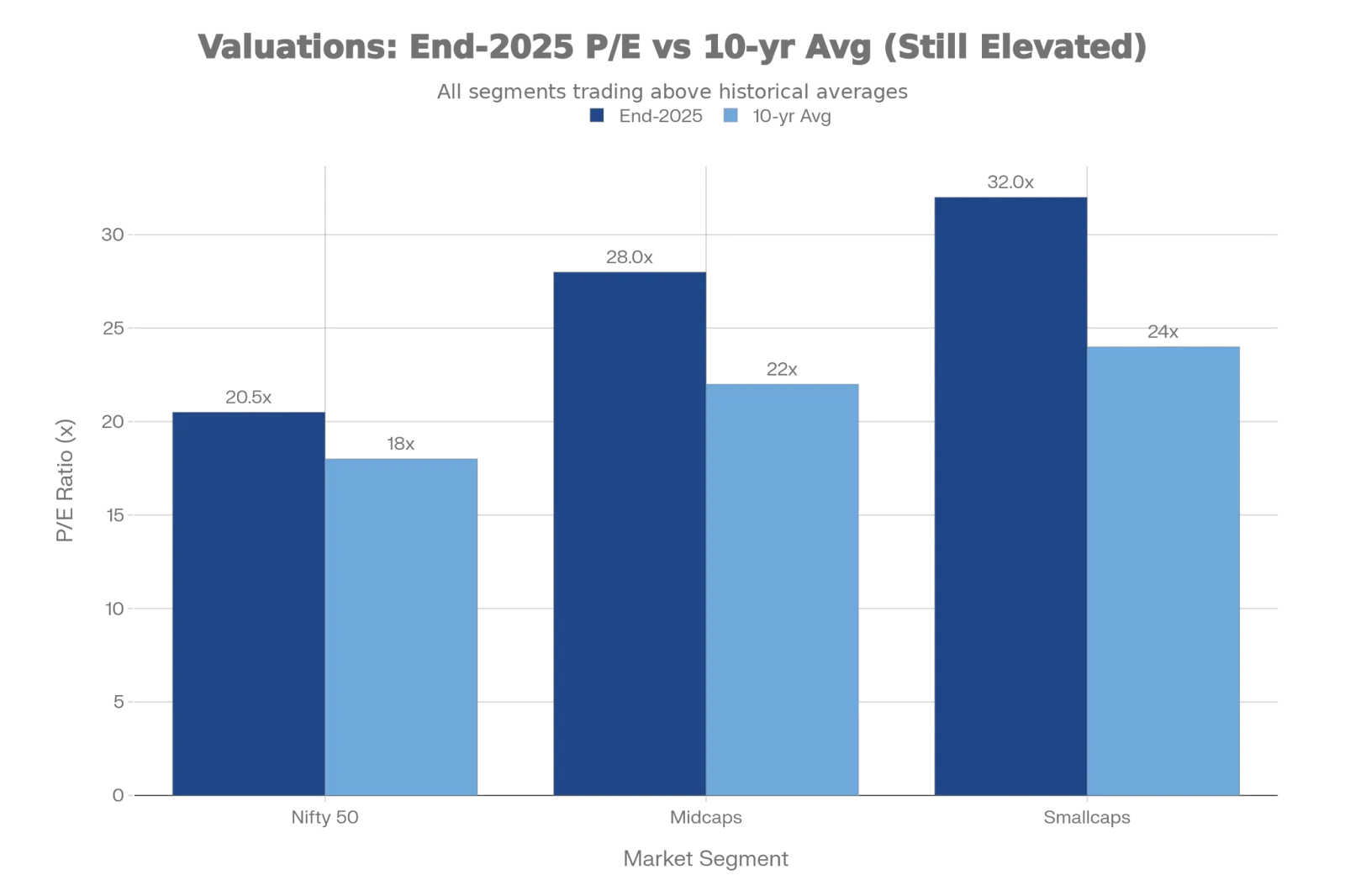

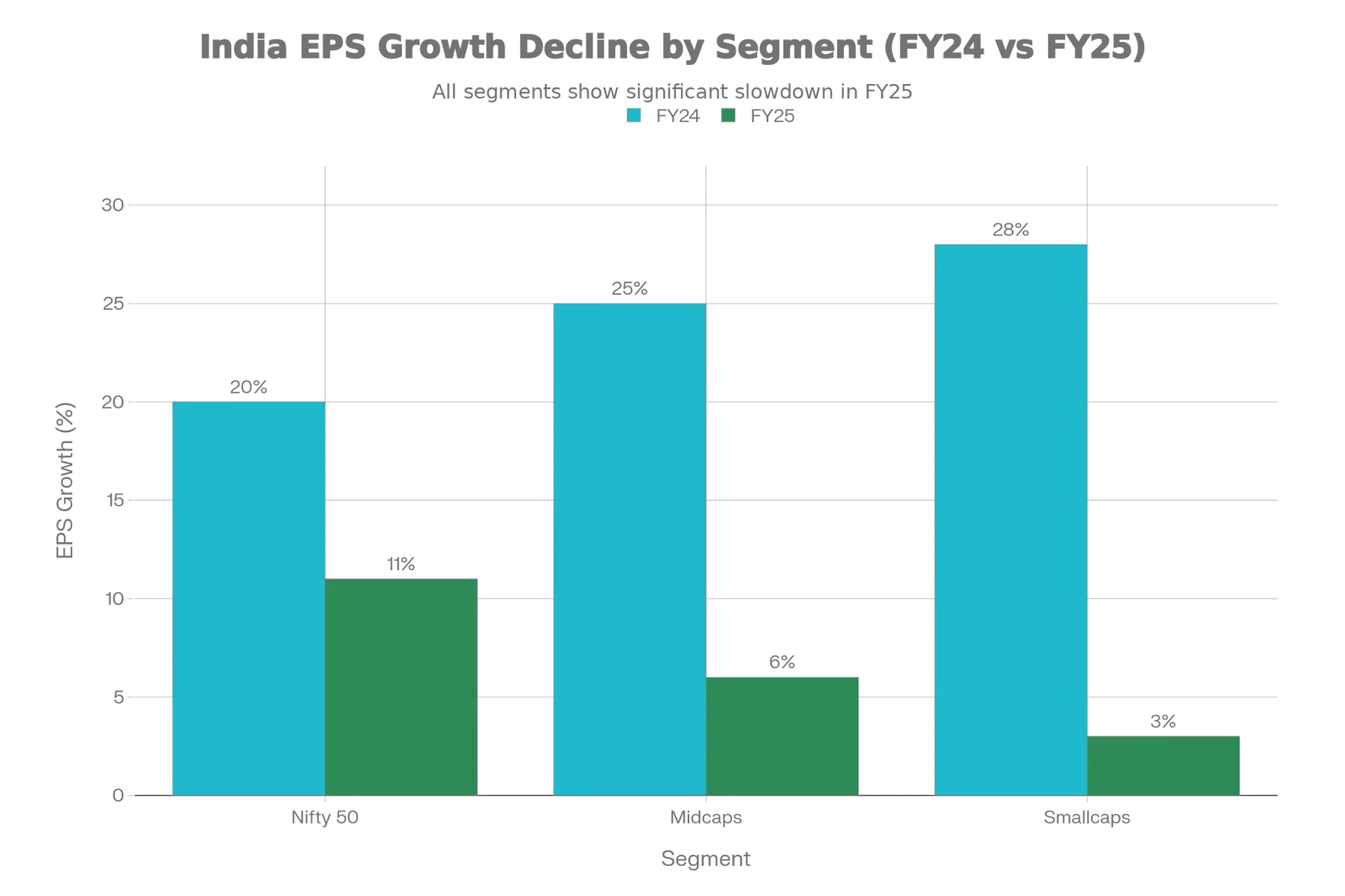

Across many segments, especially in mid and small caps. Valuations remained well above long-term averages. Earnings growth did not always justify price expectations. The margin for error was thin. This meant that even good companies delivered poor outcomes if expectations were already too high.When valuations remain well above long-term averages, it means investors are paying unusually high prices relative to fundamentals such as earnings, book value, or cash flow. In mid and small caps, this often happens when retail and institutional flows chase past performance, ignoring underlying fundamentals.

Largely returns were constrained not by bad businesses, but by expensive entry points. But still margin pressures increased These high expectations met moderate reality thus, hurting expensive stocks. Even after a muted year, valuations remained elevated, especially outside large caps.

Global liquidity was no longer a tailwind. Global capital became more selective. Risk appetite rotated rather than expanded. This made markets more sensitive to earnings, balance sheets, and execution and less forgiving of disappointment. 2025 shifted markets from “liquidity-driven” to “fundamentals-driven.Domestic flows remained robust in 2025, with SIP inflows hitting ~₹3.04 lakh Cr (up from ₹2.69 lakh Cr in 2024), while FPI turned sharply negative at -₹1.58 lakh Cr (vs mild +₹427 Cr prior).

Alongside the broader market dynamics, 2025 was also a meaningful year for our own strategies, not because it was exceptional in returns, but because it was revealing in behaviour. It tested our models, our risk controls, and most importantly our discipline.

The Factor portfolio experienced a challenging start to the year, followed by a gradual stabilisation and recovery. The first quarter saw a sharp drawdown, driven by weak performance in mid and small-cap factors, compression in value and quality premia, narrow market leadership concentrated in a few large stocksAs the year progressed, Volatility reduced, returns became more stable but modest and the portfolio avoided chasing late-cycle momentum or expensive narratives

This was not a failure of the framework, it was a period where the market did not reward diversification or valuation discipline.

Historically, such phases have been followed by reversion and our models are built to remain positioned for that rather than abandon the process at the point of maximum discomfort.

The Alpha portfolio showed more tactical movement through the year. It participated in upside phases when opportunities were present. It also saw sharper pullbacks during periods of sudden factor rotation and sector drawdowns This reflects the nature of the strategy being more responsive, more adaptive, and therefore more exposed to short-term noise

The biggest risk in 2025 wasn’t volatility, it was behavioural. The market is no longer uniformly rewarding risk.. Risk management matters as much as return generation. Process beats prediction. The below is our understanding of 2025 markets and macros: a) Growth doesn’t guarantee markets Strong GDP growth and macro fundamentals do not automatically translate to broad market returns

b) Dispersion is structural, not cyclical The gap between outperformers and laggards widened and stock selection mattered more than index positioning.

c) Currency & external balances matter External pressures translated into FX weakness and volatility, reminding us that capital flows still drive risk premia.

d) Policy buffers are active levers Monetary and fiscal settings remain accommodative relative to past tightening cycles and giving buffers to growth.

These lessons shape how we think about 2026.

We don’t see 2026 as a year of easy, broad-based returns. But we do see it as a year with meaningful opportunities for disciplined investors. Returns will likely be narrower but more rational. We expect continued dispersion between quality and weak businesses, earnings to matter more than narratives and Valuations to play a bigger role in determining outcomes. This favours selective positioning over index-like exposure.

India’s long-term growth drivers remain intact:

Formalisation

Capex cycle

Financialisation of savings

Infrastructure and manufacturing

But in the near term, outcomes will depend on earnings delivery, margin sustainability, balance sheet strength and real cash flows, not just growth stories.

We enter 2026 with a mindset focused on, protecting capital during drawdowns, avoiding permanent loss and staying flexible rather than fully committed to a single narrative. We are less concerned about missing upside than about being exposed to asymmetric downside.

We believe 2026 will reward investors who preserve capital when conditions are unfavourable, investors who deploy decisively when risk-reward improves and investors who stay emotionally neutral. Timing will matter less than preparedness.

2025 was a year of discipline, not celebration.

It reminded us that markets do not owe us returns, they reward the process.

2026 is unlikely to be easy, but it is likely to be interesting.

The edge will come from patience, selectivity, and risk awareness.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart