by Naman Agarwal

Published On Nov. 25, 2025

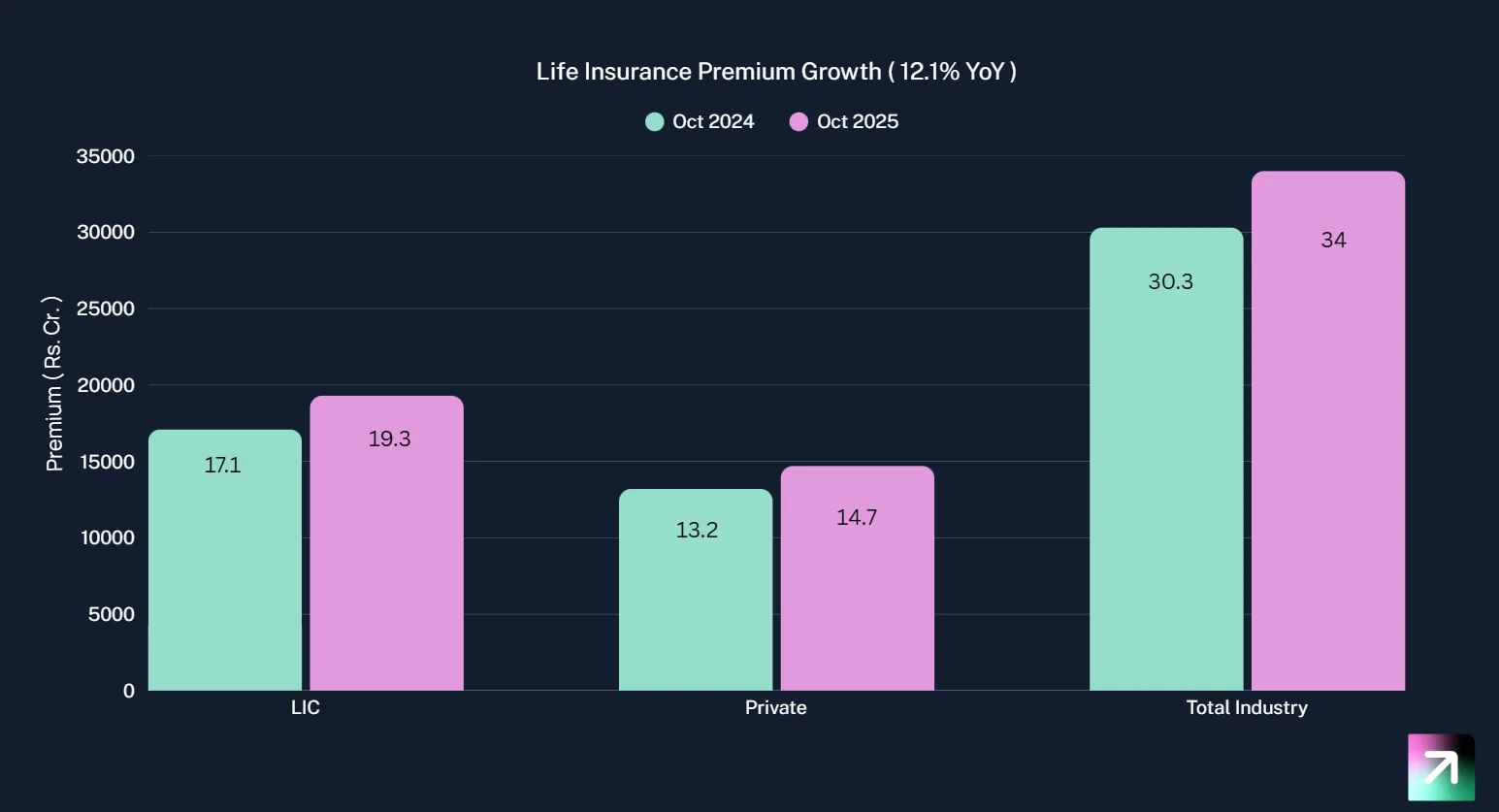

India's life insurance industry demonstrated remarkable momentum in October 2025, recording double-digit growth for the second consecutive month. New business premiums surged 12.1% year-on-year to Rs 34,007 crore, marking a significant recovery from the challenging months earlier in the fiscal year and underscoring the transformative impact of recent regulatory reforms on market dynamics and consumer adoption patterns. This resurgence reflects strengthened demand across individual segments, robust participation from both state-owned and private insurers, and the catalytic effect of the Goods and Services Tax exemption introduced on September 22, 2025. The sector's performance signals not only a rebound from previous volatility but also the beginning of a sustained growth trajectory that industry experts anticipate will extend through the remainder of the fiscal year and beyond.

India Life Insurance New Business Premiums: October 2024 vs October 2025 (Rs Crore)

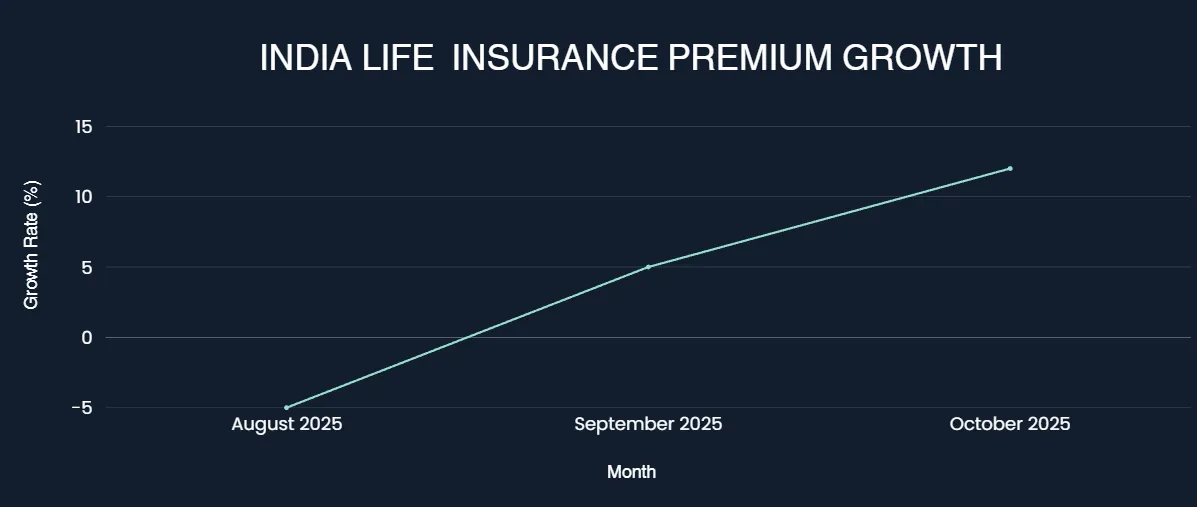

October 2025 marked a pivotal inflection point for India's life insurance sector, representing a decisive break from the contraction that had plagued the industry earlier in the fiscal year. The 12.1% year-on-year growth to Rs 34,007 crore stands in stark contrast to the 5.2% decline experienced in August 2025, highlighting the rapid shift in market sentiment and consumer behavior following the implementation of the GST waiver. This recovery, while slightly below the 13.2% growth recorded in October 2024, nonetheless reflects the normalization of market dynamics and the restoration of healthy demand patterns across multiple product categories.

The turnaround is particularly noteworthy given the challenging regulatory environment that has characterized the life insurance sector throughout fiscal 2024-25 and the early months of fiscal 2025-26. The industry had been grappling with significant structural changes, including revised surrender value guidelines implemented in October 2024 and the recalibration of commission frameworks, which had temporarily disrupted sales momentum. However, the GST exemption on individual life and health insurance premiums, which took effect on September 22, 2025, created a powerful tailwind that reinvigorated purchasing intent across consumer segments. The immediate impact was evident in October's numbers, where the combination of improved affordability and favorable base effects catalyzed renewed engagement from both existing customers renewing policies and new policyholders entering the market for the first time.

India Life Insurance Growth Recovery: August-October 2025 (YoY Growth %)

Life Insurance Corporation of India maintained its commanding market position in October 2025, collecting new business premiums of Rs 19,274.01 crore, representing a 12.5% year-on-year increase from Rs 17,131.09 crore in the corresponding month the previous year. While this growth rate appeared modest compared to the explosive recovery of prior months, it reflected LIC's substantial absolute contribution to the overall market. Notably, LIC's performance was underpinned by a remarkable 120.1% surge in individual non-single policy issuances, driven substantially by a favorable base effect from the previous year's regulatory disruptions. The state-owned insurer's retail annual premium equivalent grew an impressive 28% year-on-year to Rs 2,754.5 crore, demonstrating the effectiveness of its policy initiatives and distribution network in capitalizing on the GST-driven affordability improvement.

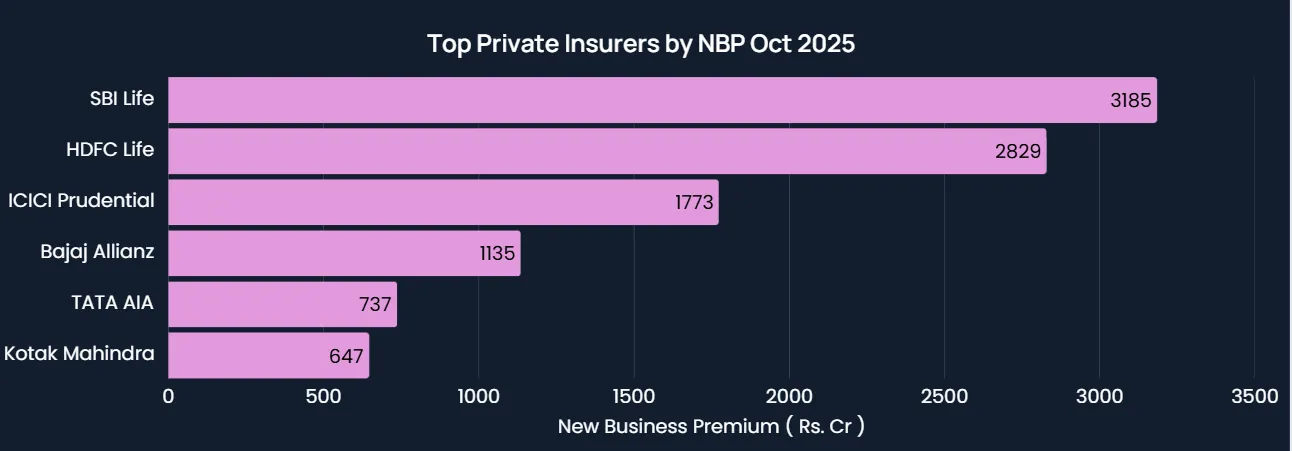

Private life insurers exhibited equally compelling growth dynamics in October, recording new business premiums of Rs 14,732.94 crore, representing an 11.5% year-on-year increase. This performance consolidated the private sector's trajectory of steady market share gains relative to LIC, reinforcing the competitive intensity within the sector. Among the major private players, SBI Life Insurance emerged as the clear market leader, posting new business premiums of Rs 3,185.01 crore in October 2025, reflecting a commanding 17.17% year-on-year growth. The insurer's success was built on diversified growth across individual and group segments, with particularly strong momentum in its core individual non-single premium category, which expanded 10% year-on-year. HDFC Life Insurance Company followed in second position with Rs 2,828.81 crore in October premiums, up 10.70% year-on-year, supported by consistent strength in its individual non-single premium segment. ICICI Prudential Life Insurance and other established players also maintained positive growth trajectories, though at more measured rates relative to the sector average.

Top Private Life Insurers: New Business Premiums in October 2025 (Rs Crore)

The exemption of Goods and Services Tax from individual life and health insurance premiums, effective September 22, 2025, represents one of the most consequential regulatory reforms in India's life insurance landscape in recent years. Under this reform, all new and renewal premiums for individual life policies are now charged at a 0% GST rate, eliminating the previous 18% tax burden that consumers previously bore. The implications are both immediate and profound. A consumer previously paying Rs 20,000 annually for term insurance now pays exactly Rs 20,000 instead of Rs 23,600, generating annual savings of Rs 3,600, or approximately 18% of the base premium. For endowment plans and unit-linked insurance policies, the impact extends to ongoing charges such as mortality charges and fund management expenses, effectively improving policyholder returns on investment components.

The reform addresses one of the fundamental barriers to insurance adoption in India: affordability. For lower and middle-income households that form the core of India's emerging insurance market, the GST represented a meaningful percentage increase in effective premium costs that often tipped purchasing decisions toward non-adoption or underinsurance. By scrapping the GST entirely, policymakers have directly reduced the cost of financial protection for millions of Indian households. The government's explicit rationale for this reform centers on accelerating progress toward the "Insurance for All by 2047" vision, acknowledging that insurance protection should be treated as an essential financial tool rather than a discretionary luxury.

Annual Premium Equivalent, or APE, represents a standardized metric that normalizes insurance premiums across different product types and frequencies, converting single-premium policies into annualized equivalents to facilitate meaningful cross-company and cross-product comparisons. This metric provides crucial insight into the quality and sustainability of the industry's growth trajectory beyond simple premium volume figures. In October 2025, the industry's retail annual premium equivalent grew an impressive 19% year-on-year to Rs 9,266.7 crore, representing a sharp reversal of the slowdown observed in September 2025 and significantly outpacing the previous year's 10.6% growth in October 2024. This substantial acceleration in the APE metric indicates that October's growth reflected not merely a temporary surge in single-premium policies but rather a meaningful expansion in the quality and durability of the industry's underlying business.

India's life insurance sector remains one of Asia's most underpenetrated markets despite decades of steady expansion. Insurance penetration stood at merely 2.8% of gross domestic product in fiscal 2024, far below the developed market average of 5.6%, while insurance density reached just $70 per capita compared to $3,182 in advanced economies. This profound gap between current penetration levels and developed market benchmarks creates what industry analysts term a "multi-decade opportunity" for sustained sector expansion.

According to PL Capital research published in September 2025, India's private life insurance sector is positioned to achieve compound annual growth rates of approximately 14.5% through fiscal 2035, supported by macroeconomic tailwinds including nominal GDP expansion at roughly 10.5% annually and households increasingly channeling savings into formal financial instruments. This projections contrasts with the sector's recent performance, where fiscal 2025-26 year-to-date growth stood at 8.2%, suggesting that as GST exemption benefits normalize and additional regulatory reforms take effect, growth acceleration remains plausible.

The long-term growth opportunity is underpinned by multiple structural drivers beyond temporary policy stimuli. Rising financial inclusion is expanding the addressable market into Tier-2 and Tier-3 geographic areas where insurance penetration remains critically low. India's expanding middle class, projected to reach 250-300 million households by 2030 from current levels, inherently elevates demand for financial protection and retirement planning solutions. Digital distribution channel expansion, including online policy purchase, AI-driven underwriting, and blockchain-enabled claims processing, should progressively reduce distribution costs and expand market reach into price-sensitive segments. Policy reforms addressing critical issues such as protection product affordability through the GST waiver and market democratization through platforms like Bima Sugam should collectively accelerate adoption rates beyond historical trends.

October 2025 represents far more than a single month of strong growth statistics for India's life insurance sector. The 12.1% year-on-year expansion to Rs 34,007 crore, driven by broad-based strength in individual recurring-premium products and supported by the GST exemption's affordability benefits, signals the beginning of a normalized growth cycle following the regulatory disruptions and market volatility that characterized fiscal 2024-25. The resurgence of individual non-single policies at 62.8% growth, combined with retail APE expansion of 19%, provides evidence that October's momentum reflects improvements in business quality and sustainability rather than temporary policy-driven spikes.

The sector's medium-term outlook appears distinctly favorable. The GST exemption and Bima Sugam platform launch represent transformative policy initiatives that should durably lower barriers to insurance adoption while expanding competitive participation and market transparency. Private insurers' continued market share gains, evidenced by 11.5% growth and leading players such as SBI Life expanding 17%+ year-on-year, demonstrate that competitive intensity and innovation remain powerful forces driving evolution. With insurance penetration still profound underdeveloped relative to developed economies, demographic trends supporting rising demand, and digital infrastructure improvements enabling deeper market reach, the Indian life insurance sector appears positioned for sustained double-digit growth extending across the medium term and beyond.

For policymakers, the October 2025 data validates the strategic decision to exempt life insurance from GST, demonstrating that affordability improvements translate directly into expanded market adoption and revenue growth for insurers at substantially lower cost to government compared to traditional subsidy mechanisms. For insurers, the challenge now involves executing on operational excellence, product innovation, and distribution expansion to capture market share within the expanding pie. For consumers, the reformed policy landscape creates genuine opportunities for enhanced financial security at reduced cost, advancing the government's vision of insurance access for all Indian households.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart