In the past few months and recent weeks there have been too many announcements to absorb. Furthermore, the global macro factors are also adding to investor ambiguity. So it makes sense to answer a few of the burning investor questions.

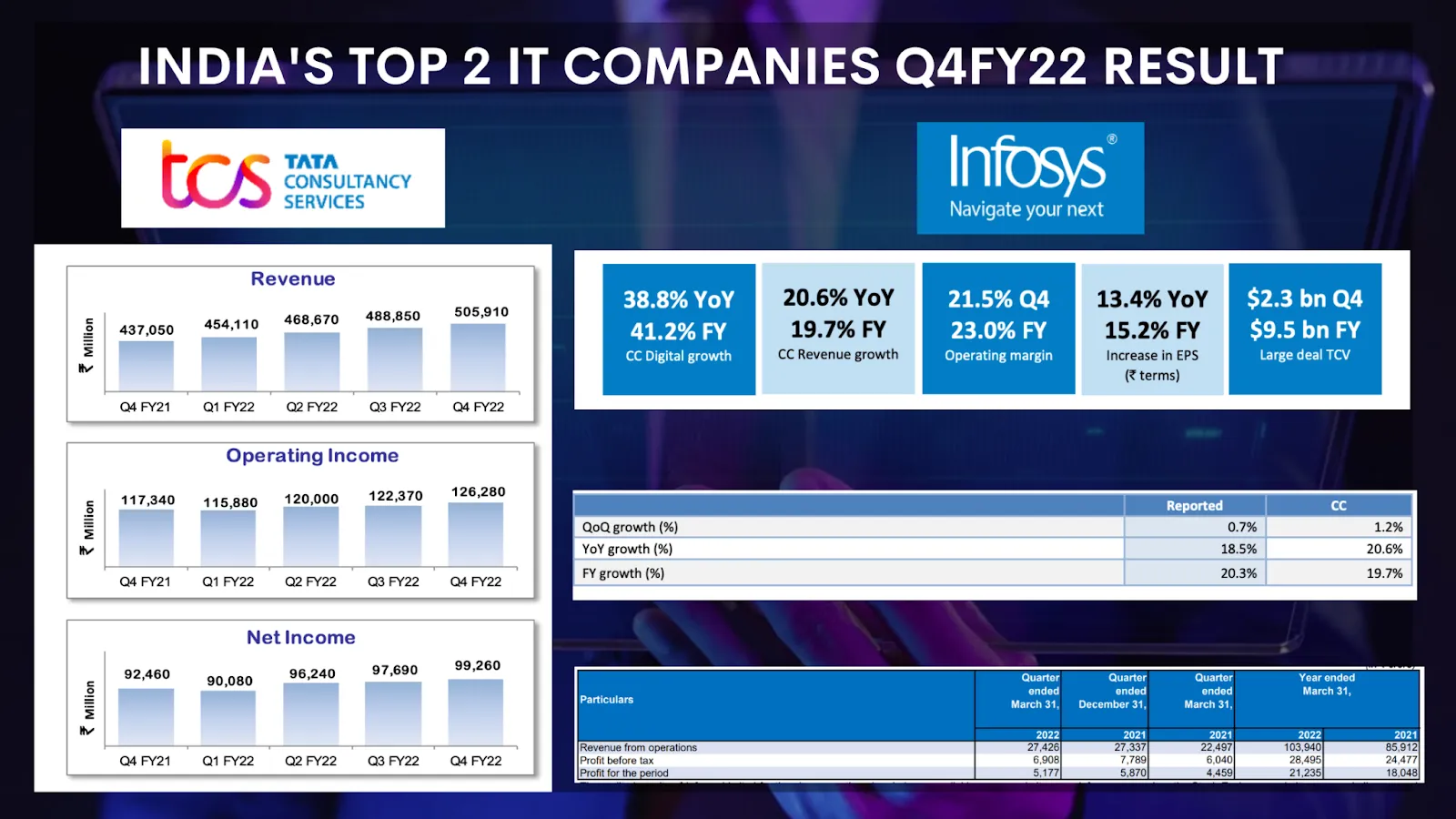

IT Earnings Report

IT Q4FY22 earnings report, its impact? Is it the right time to go overboard on these stocks? & What does the FED rate trajectory indicate?

Earnings season has become a great time to focus on IT stocks as the momentum in earnings and revenue growth continues. On a solid note, TCS has released a 7% YOY increase in net income, steady margins, beating street expectations, and closing FY22. The incremental revenue is the maximum ever for the company. A similar expectation of outperformance is expected in the other IT majors. As a result, the IT sector - both large caps and mid-caps are good to go overweight at the current time, as per our opinion.

The backdrop of the Fed hiking rates but the RBI keeping rates steady will cause the dollar to strengthen compared to the rupee. The dollar strengthening will support the Indian IT sector, which has a robust widening global order book.

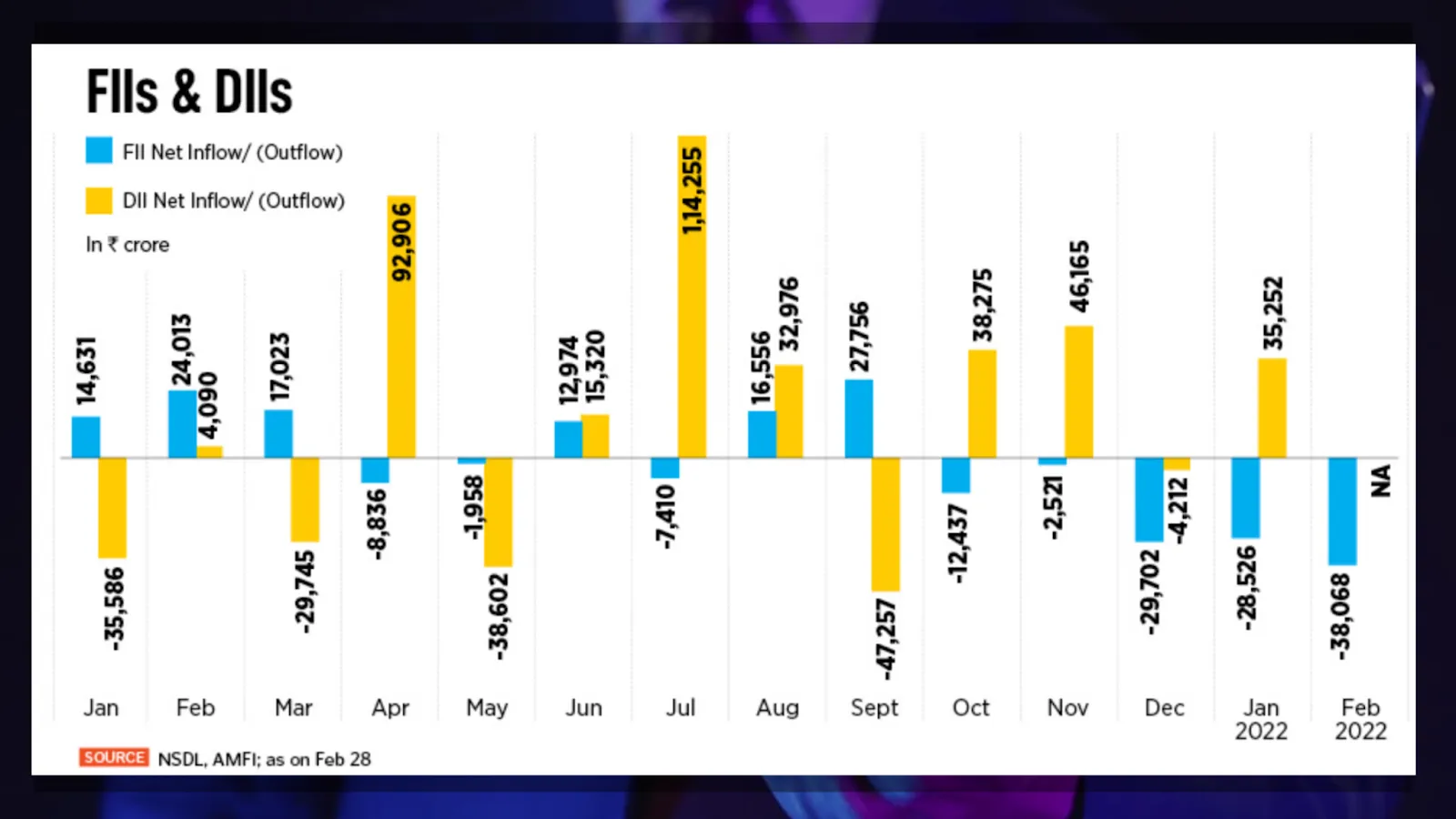

FII Selling

Is higher valuations compared to other Asian counterparts the only and major reason behind FII outflow?

The higher valuation of Indian stocks compared to their Asian counterparts is only one of the reasons for the FII outflow. The primary reason why FIIs are exiting an emerging market like India is the impending FED rate hikes, raising the equity risk premium for the Indian markets. In addition, the commodity inflation caused by the Ukraine crisis and the imminent trouble in the emerging markets like India, which are commodity importers, also dampens the global sentiment towards India. But as the crisis in Ukraine stabilises, and the market gets a breathing room, we expect the FIIs to come flooding back into the Indian economy, which is stronger than ever fundamentally.

FED Rate Hikes

Is the Fed rate trajectory already been priced in by the market? What are the bond yields indicating?

The US 10-year bond yield surged to hit a near three-year high after the consumer price inflation data showed a faster acceleration than economists had estimated. Most economists predict a 50 basis hike each in May and June and further 50 basis point hikes later in the year to close the year with a 2-2.25% interest rate.

The consensus is shifting over the practicality of rate hikes. The inflation we are seeing is transitory, and accelerated hikes would dampen the already slow growth. Economists who were going for rate hikes a few months ago are now warning of stagflation or recession due to accelerated hikes. The market is pricing in the impact of the hikes in the short term. The long-term story is building and has to be closely watched.

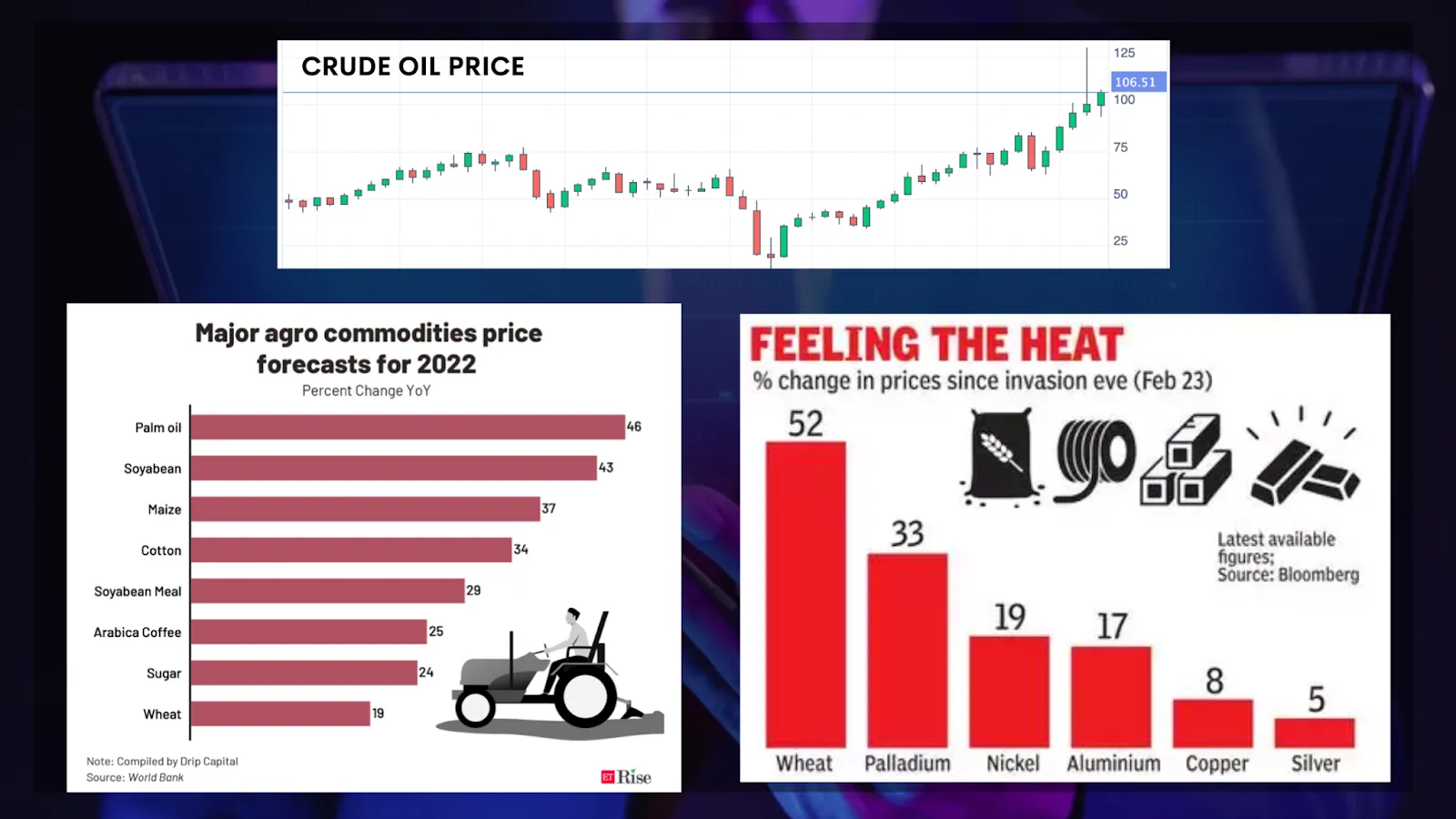

Commodity-linked Sectors

Would commodity-linked sectors do well in coming quarters, given the sanctions imposed on Russia by Europe and the US?

There will be an upwards bias on commodity prices until the Ukraine crisis cools off. The sanctions themselves will take an extended time to go away even after the conflict resolution.

We do expect commodity-linked sectors to make the most of this. As crude oil prices have skyrocketed and still hover over the 100$/barrel level, Indian oil & gas manufacturing and refineries will see margin expansion and revenue growth. Metals and Steel manufacturers have picked up post the crisis, but the long-term outlook is cautious because of global demand slowdown and high cooking prices.

Ukraine is a major exporter of wheat, sunflower, barley, rapeseed, and maize, and Russia has substantial control over global exports of sunflower, wheat, and barley. The ongoing conflict will favour Indian agri-commodity producers.

IPOs

Several IPOs are in the pipeline, what could be the amount of fundraising expected in the year 2022?

In the year so far only Rs 7,800 crore has been raised through IPOs. The sentiment in the public market is highly correlated to the secondary market. This year, the secondary market has been volatile due to FED rate hikes, concerns of overvaluation in Indian equities, and obviously, the Ukraine crisis. As a result, the primary market has become more cautious, and fundraising has paused.

We expect the fundraising to start afresh at a healthy pace in the second half of this year. The massive 6.6 billion $ LIC IPO is the big one that is coming, and some other significant technology unicorns will also join the list.

GDP Growth Rate

India's growth can be below 7 percent for the current financial year? What could be the reasons?

The Reserve Bank of India has pegged the economic growth rate for 2022-23 at 7.8 percent, down from 9.2 percent expected in 2021-22, because of uncertainties on account of the pandemic and elevated global commodity prices. Hence, there is a low chance of the growth rate hitting below 7%. The triggers for the same could be - a heightened geopolitical situation, US rate hikes leading to FII sell-off, high inflation, low rural demand, and employment.

Banking & Financial Services

How to approach the banking & financial services space now given the rising expectations for rate hike in the second half of FY23?

The banking and financial services industry is sweet, with the corporate sector picking up growth, manufacturing staying strong, and the government pushing for growth. As a result, the loan books are expanding, and the credit quality is better than ever.

If the RBI decides to hike rates in the second half of the year, it will be a positive sign for the banking and financial sector as the interest income increases. Therefore, we are very optimistic about the outlook of the banking and financial sector.

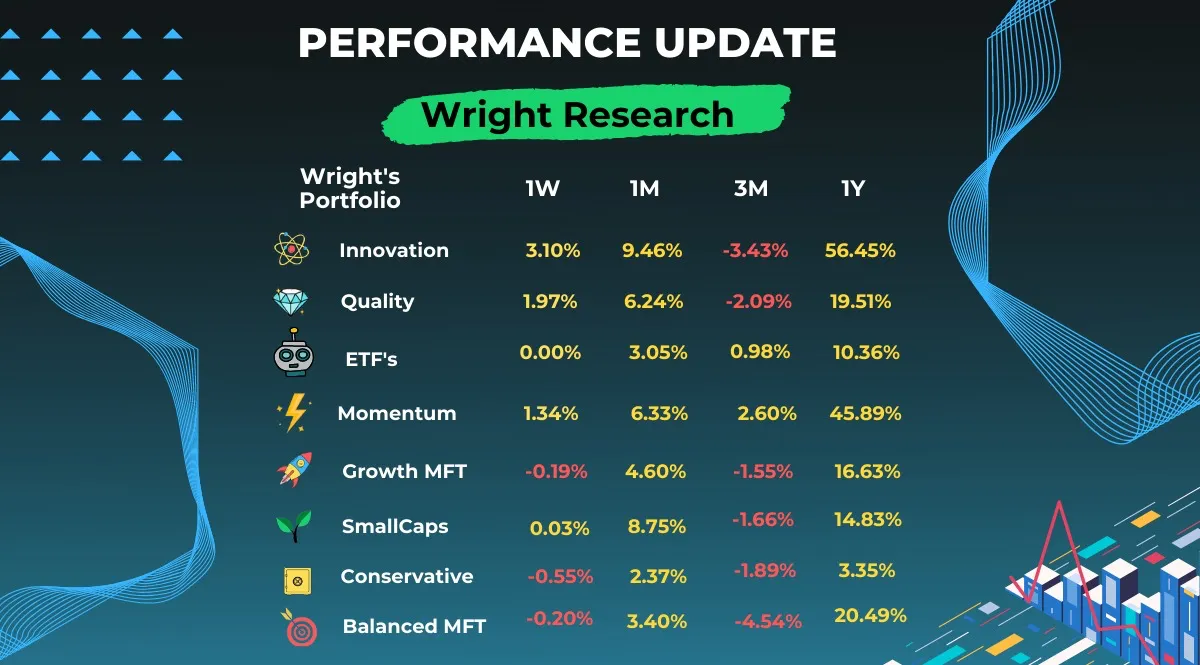

Our Portfolios

All our portfolios are recovering well. Innovation, Smallcaps and Momentum are leading in the recent month and there is strong recovery across the board.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart