by Naman Agarwal

Published On Jan. 27, 2026

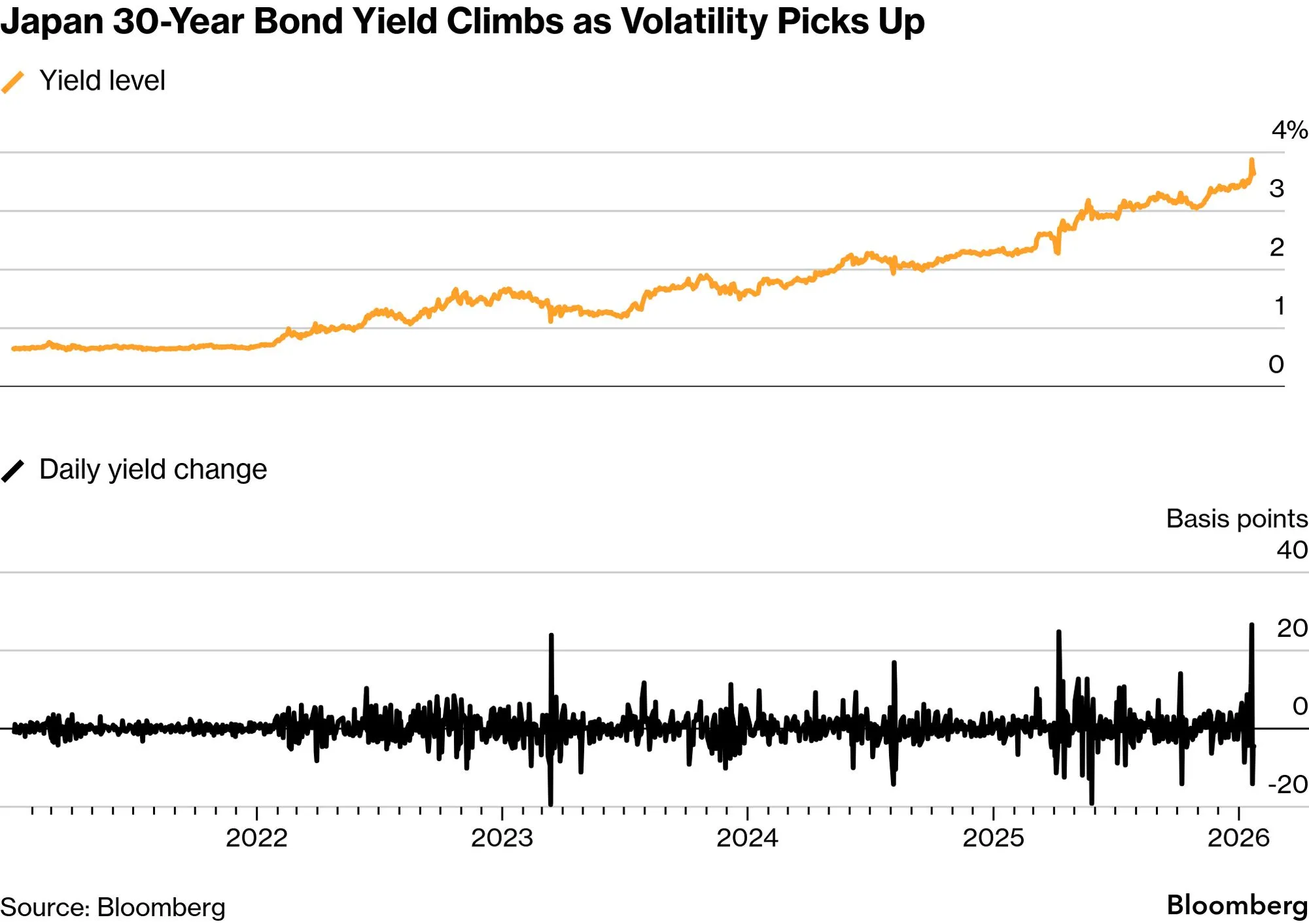

Japan's government bond (JGB) market experienced an unprecedented collapse in January 2026, sending shockwaves through global financial markets. In a single trading session on January 20, the 40-year bond yield surged above 4% for the first time since the maturity was introduced in 2007, while the 30-year bond saw a quarter-point jump in yields, the largest daily move since 1999. The trigger was Prime Minister Sanae Takaichi's announcement of a snap election combined with her pledges for aggressive fiscal expansion through tax cuts and increased spending, occurring at a time when Japan's debt-to-GDP ratio already sits at 236.7%. This crash is not merely a domestic Japanese concern; it has reverberated across US Treasury markets, European bonds, and emerging economies like India, particularly through the unwinding of the massive yen carry trade that has funded global asset investments for over a decade.

On January 20, 2026, Japan's bond market experienced what traders described as "pure chaos." The 40-year JGB yield exploded to 4.0% breaching the psychological level that hadn't been seen in over three decades. The 30-year yield simultaneously jumped approximately 25-30 basis points to 3.8-3.9%, marking its largest single-day movement since at least 1999. What made this event particularly striking was how little volume was required to trigger such carnage: a mere $170 million in 30-year bonds and $110 million in 40-year bonds orchestrated a $41 billion destruction in value across the yield curve.

Japan Government Bond Yields: Record Surge in January 2026

Maturity | Current Yield | Previous Yield | Basis Point Change | Significance |

10-Year | 2.29% | 2.18% | +11 bps | Highest since 1999 |

20-Year | 3.45% | 3.35% | +10 bps | Multi-year peak |

30-Year | 3.85% | 3.55% | +30 bps | All-time record |

40-Year | 4.00% | 3.95% | +5 bps | First time above 4% |

The underlying structural fragility of Japan's bond market became exposed at this moment. The JGB market, traditionally one of the world's most stable where yields might shift by mere basis points over weeks, had become characterized by violent dislocations. Since the Bank of Japan ended negative interest rates in March 2024, the market had experienced nine separate trading days where losses exceeded two standard deviations from normal ranges. The January crash, however, represented an order of magnitude beyond typical volatility.

Prime Minister Sanae Takaichi's announcement on January 20 that she would call a snap election for February 8 coincided with her campaign platform promising to "break free from the spell of excessive fiscal austerity." Her specific pledge to reduce taxes on food and expand government spending ignited investor fears about mushrooming budget deficits precisely when bond markets were already pricing in inflation persistence.

The fiscal arithmetic is daunting. Japan's central government debt stands at 236.7% of GDP in 2024, projected to decline marginally to 228% by 2026 still by far the highest ratio among developed economies. Takaichi's proposed ¥122.3 trillion budget for fiscal 2026 marks a record, though Finance Minister Katayama has emphasized maintaining discipline. However, market participants are discounting the political rhetoric rather than the government's written fiscal framework. The concern crystallizes around whether Japan already saddled with debt servicing burdens can credibly sustain additional stimulus without losing control of the fiscal situation.

A critical structural shift distinguishes this bond crash from previous market dislocations. Japan's inflation, which had been virtually absent for decades, has persistently beaten the Bank of Japan's 2% target for four consecutive years, reaching 3.1% in recent months. This is no longer a transitory global shock; Japan faces genuine domestic price pressures from weak yen-driven import costs, supply-side constraints, and tightening labor markets.

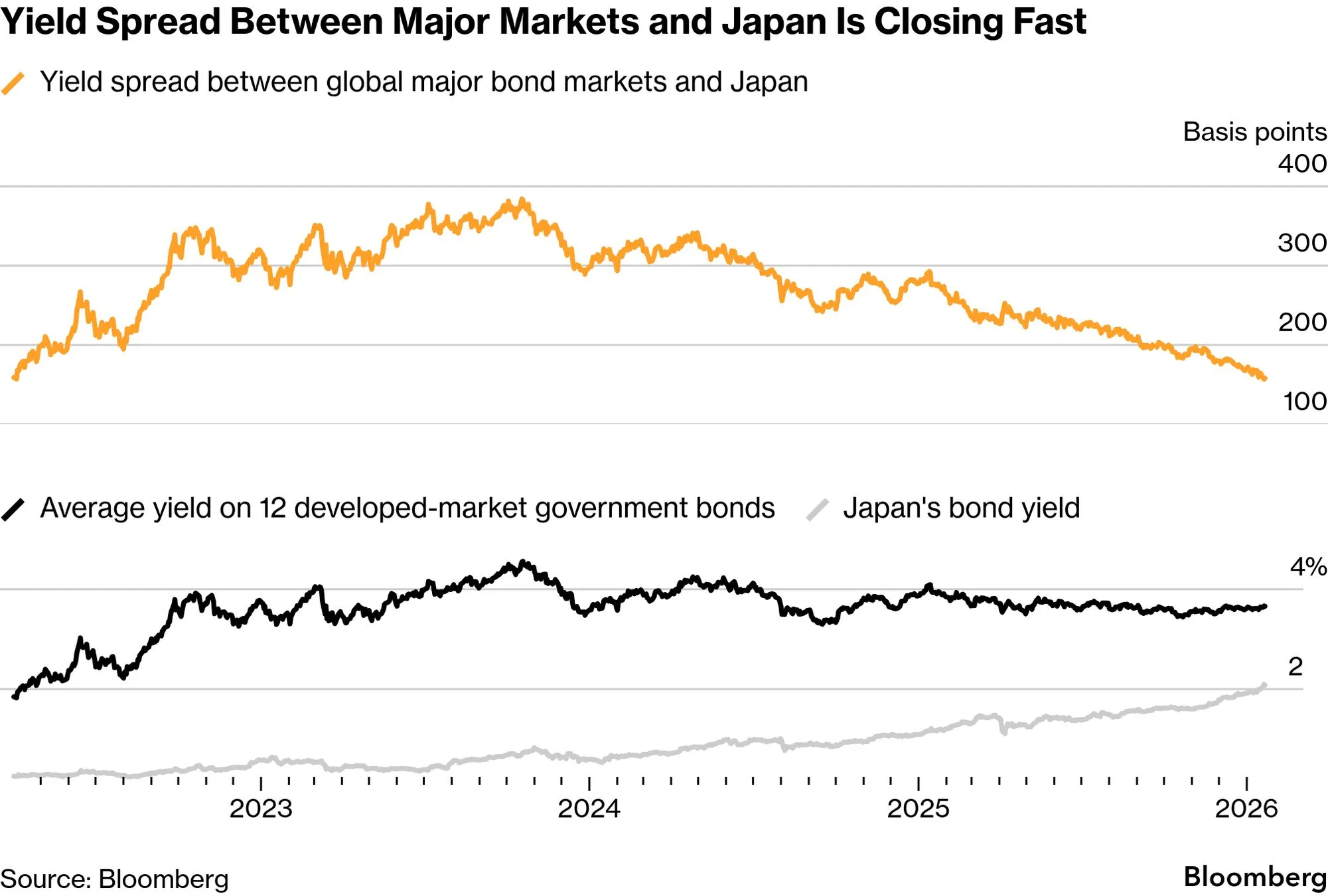

The BOJ responded in December 2024 by raising its policy rate to 0.75% the highest level since September 1995 signaling a genuine tightening cycle. Analysts now price in additional rate increases for 2026. This monetary tightening fundamentally altered the calculus for bond investors who had grown accustomed to negative real rates. If nominal yields rise while inflation remains sticky, real yields become positive for the first time in two decades, changing the entire opportunity set for Japanese institutional investors currently holding $5 trillion in foreign assets.

The reverberations extended immediately to US Treasuries. The 10-year US Treasury yield surged nearly 6 basis points following the JGB selloff, climbing toward levels not seen since August 2025. The 30-year US Treasury, already elevated amid Trump administration tariff concerns, approached pre-2008 financial crisis highs at 4.918%.

This transmission occurs through multiple channels. First, Goldman Sachs' cross-market analysis suggests that every 10 basis points of JGB yield shock propagates approximately 2-3 basis points of pressure onto US yields and other global sovereigns. Second, Japan holds over $1 trillion in US Treasuries as its largest foreign asset, making it the second-largest external holder of American debt after China. A repatriation of even a modest fraction of this portfolio would materially impact global bond supply-demand dynamics.

Third, and most critically, the unwinding of the yen carry trade forces a reverse flow: investors who borrowed in cheap yen to fund investments in higher-yielding assets must now liquidate those foreign positions to repay their yen liabilities as borrowing costs surge. This creates synchronized selling of US Treasuries, European bonds, and emerging market debt precisely when risk appetite is fragile.

German 10-year Bund yields added 2.8 basis points in the immediate aftermath. While this might appear modest relative to the JGB magnitude, the back-end of the European curve experienced more pronounced pressure, reflecting broader concerns about debt sustainability across aging developed economies. The Eurozone, already grappling with structural fiscal challenges in countries like Italy and rising energy costs, now faces the prospect of higher global real rates coinciding with softer growth expectations.

The ECB's stance remains accommodative, with markets pricing only a 25% probability of additional rate cuts in 2026 essentially unchanged from prior expectations suggesting the central bank views the JGB volatility as a temporary financial stability event rather than a signal requiring policy accommodation.

The deeper macroeconomic story involves the unwinding of one of history's most consequential financial trades: the yen carry trade. Since the BOJ initiated ultra-loose monetary policy under Abenomics in 2013, financial engineers estimated the carry trade had grown to between $350-500 billion in notional size by 2024. The mechanics are straightforward: borrow in yen at near-zero rates, convert to dollars, euros, or rupees, and invest in higher-yielding assets globally, capturing the interest rate differential while the weak yen provides additional currency gains.

As JGB yields have surged and the yen has strengthened, the economics of this trade have inverted violently. The cost of carry has evaporated. Worse, for investors who initially borrowed yen at 0.25% and now face borrowing costs approaching 0.75%, the margin compression is severe. The mathematical logic demands unwinding: sell foreign assets, convert proceeds back to yen, repay the loan, and accept losses.

This unwinding has direct consequences for India and emerging markets broadly. The MSCI Emerging Markets Index experienced its steepest monthly decline in a year in November 2025, falling 2.4%, as foreign investors scrambled to reduce EM exposure. India, already the recipient of record FII outflows in 2025, faces an acute challenge: the very capital flows that had sustained rupee support and equity valuations are reversing.

India experienced an unprecedented FPI (Foreign Portfolio Investor) outflow of ₹166,286 crore during calendar year 2025, the worst annual performance in the history of Indian capital markets. This sustained exodus has continued into 2026. Through January 22, FIIs have sold ₹40,704 crore worth of Indian equities in the month alone, with a further ₹14,651.99 crore sold in just one week.

FII Outflows from Indian Markets: Monthly Selling Trend (July 2025 - January 2026)

Month | Monthly Outflow (₹ Crore) | Cumulative Outflow (₹ Crore) |

July 2025 | 47,667 | 47,667 |

August 2025 | 35,000 | 82,667 |

September 2025 | 28,000 | 110,667 |

October 2025 | 2,347 | 113,014 |

November 2025 | 17,500 | 130,514 |

December 2025 | 34,350 | 164,864 |

January 2026 | 40,704 | 205,568 |

The scale is historically significant in another dimension: FIIs have built record short positions of 227,573 contracts in index futures an all-time high and only the second instance of such positioning in available data history. This suggests institutional investors are not merely reducing exposure passively but are actively betting on further Indian equity market depreciation.

The stated reasons for selling are multifaceted: relatively elevated valuations in Indian equities compared to peers, disappointment over the delayed US-India trade agreement, and broader reallocation toward AI-linked trades and other developed market opportunities. However, the Japan-triggered yen carry trade unwinding adds a structural headwind. As Japanese investors redirect capital back home to capture newly attractive JGB yields, global funds that had deployed yen-denominated leverage into Indian assets face margin calls and must liquidate.

The Indian rupee has become collateral damage in this process. The currency hit a record low of 91.70 per US dollar on January 21, 2026 a 2% depreciation in January alone. Over the full year 2025, the rupee depreciated nearly 5%, emerging as the worst-performing major currency globally. This weakness persists despite the Reserve Bank of India's historical willingness to intervene in currency markets.

The RBI's intervention capacity is constrained by structural realities. India's foreign exchange reserves stand at approximately $700 billion substantial in absolute terms but insufficient relative to India's current account structure and the scale of potential capital outflows. In contrast, China maintains $3.3 trillion in reserves, providing a massive buffer against capital flight. This asymmetry means the RBI can only moderate the rupee's decline, not arrest it completely, particularly when yen carry trade unwinding creates synchronized demand for dollar liquidity across all emerging markets.

The currency weakness has material consequences. Imported inflation rises as the rupee weakens, affecting everything from petroleum product costs to electronic components. Indian companies with dollar-denominated debt face higher servicing costs. Foreign investors calculating rupee-hedged returns find their net returns compressed as hedging costs rise alongside rupee volatility.

A notable silver lining is that Indian government bond yields have remained relatively stable. The 10-year Indian benchmark yield eased by 5-7 basis points in recent weeks to around 6.51%, supported by sustained domestic demand from pension funds, insurers, mutual funds, and banks. This domestic institutional support provides a floor that is absent in many other emerging markets.

However, this resilience is fragile and contingent. If global real rates continue to rise substantially say, if the US 10-year Treasury moves toward 4.5% or higher the relative yield spread between Indian and US sovereigns could narrow sufficiently to trigger foreign selling of Indian bonds. Additionally, if yen carry trade unwinding accelerates, foreign investors currently holding Indian debt might liquidate to raise rupees for repatriation to Japan or to meet margin calls on other positions.

The Indian equity market, represented by the Nifty 50, has declined sharply amid the FII selling and yen carry trade unwinding. The index fell to 25,048.65 as of January 22, reflecting broad-based selling across sectors with real estate down 11% and mid-caps/small-caps declining 4-6% over the period.

The deterioration reflects not merely sentiment but a genuine reassessment of valuations. The valuation premium that Indian equities had commanded relative to the MSCI Emerging Markets Index has compressed below its long-term average technically a positive development for future buyer sentiment, but offering cold comfort to current holders experiencing losses.

The January 2026 bond crash represents more than a technical dislocation or a cyclical event. It signals a fundamental shift in the global financial architecture. For nearly two decades, Japan has been the world's perpetual source of low-cost funding. Investors could borrow yen at negative rates (and then at 0.1-0.25%), convert to foreign currency, and deploy capital globally, confident that the BOJ's ultra-loose stance would persist indefinitely.

That era has ended. The BOJ's shift ending negative rates in March 2024, raising to 0.75% in December 2024, and signaling further increases combined with persistent inflation, marks a genuine pivot toward monetary tightening. As this reality crystallizes, the carry trade that funded perhaps $500 billion in global leveraged positions must reverse. This deleveraging, while necessary to prevent financial instability, is deflationary for risk assets and inflationary for funding costs globally.

The Bank of Japan faces an excruciating policy trilemma. Tighten further to combat inflation and support the yen, and you risk a bond market crisis and financial instability given the fragile demand structure (declining foreign participation, reduced domestic bank buying, and massive outstanding supply). Pause tightening to stabilize markets, and you risk losing credibility on inflation and watch the yen depreciate further, amplifying imported price pressures.

In response to the January 20 crash, BOJ Governor Kazuo Ueda signaled that the central bank might intervene with bond purchases to stabilize the market. This partially calmed the immediate selling, but at a cost: the yen weakened sharply on the intervention announcement, extending the carry trade losses for yen-borrowers.

Central banks globally are watching closely. The US Federal Reserve, already navigating the Trump administration's tariff threats and growth uncertainty, must decide whether rising US Treasury yields signal appropriate market-driven repricing or problematic financial stability risks requiring coordinated response. A repeat of the August 2024 yen carry trade unwind could trigger equity market selloffs severe enough to force Fed pivot, but official guidance currently suggests patience.

Perhaps the most significant tail risk embedded in current market conditions is the potential for large-scale repatriation of Japanese investor capital from foreign markets. Japanese institutional investors, life insurers, banks, pension funds, and investment managers hold approximately $5 trillion in overseas assets. This figure dwarfs even the notional size of the yen carry trade because it represents years of accumulated foreign investment by Japanese entities acting as patient capital.

If newly elevated JGB yields at 4% (for long maturities) attract a meaningful reallocation from overseas assets back to domestic bonds, the implications for global markets are severe. A 5-10% repatriation would represent $250-500 billion in net selling pressure on US Treasuries, European bonds, and emerging market equities simultaneously. Unlike the carry trade unwind, which is driven by leverage and forced liquidation, repatriation would be deliberate repositioning by rational long-term investors responding to changed return expectations.

India's challenges, while severe, are not unique. Emerging markets broadly face synchronized headwinds: unwinding carry trades, rising global real rates reducing the relative attraction of EM assets, and currency depreciation against the strengthening dollar (and potentially stronger yen). Countries with external vulnerabilities high current account deficits, dollar-denominated debt, or low FX reserves face acute pressure. India is relatively better positioned due to its growth fundamentals and large domestic institutional investor base, but it is not insulated from global financial conditions.

The Japan bond crash and ensuing yen carry trade unwinding present a complex landscape for Indian wealth managers and investors. The immediate implications are sobering: equity valuations face further pressure from FPI selling, the rupee likely to remain weak (offering some hedge for rupee-based investors with foreign currency expenses but hurting those with foreign currency earnings), and global rates elevated.

However, several medium-term opportunities emerge:

Valuation Reset: The Indian equity market's valuation discount to its historical average and the compression of its premium to broader emerging markets creates an eventual entry point. Investors with conviction in Indian growth fundamentals and multi-year time horizons can accumulate weaknesses.

Currency Positioning: A weak rupee is not purely negative. For Indian exporters and companies with hard currency revenues, the depreciation improves competitive positioning. For wealth management products marketed to high-net-worth individuals, the rupee weakness is a reminder that currency diversification benefits a sales narrative for offshore allocations and gold.

Fixed Income Opportunity: The 6.5% yield on Indian 10-year government bonds, combined with likely RBI policy stability (the RBI is not raising rates aggressively into this environment), offers reasonable returns for conservative investors. If the rupee stabilizes or appreciates as carry trades unwind and global growth data firms, the total return profile improves substantially.

Digital and Wealth-Tech Growth: The turmoil in global markets and currency volatility is likely to accelerate demand for wealth management solutions both for high-net-worth individuals seeking to diversify exposure and for retail investors seeking to understand and hedge these risks. This is precisely the opportunity space where fintech wealth platforms are positioned to capture value.

The critical unknowns heading into late February and beyond are:

BOJ Policy Path: Will the BOJ continue hiking, hold steady, or pivot dovish in response to bond market stress? If hiking continues, JGB yields will likely push higher, accelerating carry trade unwinding globally.

US Treasury Dynamics: Will US yields stabilize around current levels or continue to drift higher? The Trump administration's tariff plans, which could be inflationary, may keep long-term rates elevated even if near-term rate cuts are on the table.

Yen Carry Trade Reversal Magnitude: Has the bulk of the carry trade already unwound (as some analysts suggest), or are there further waves of forced liquidation to come? The scale of remaining unwind will determine how long emerging markets face headwinds.

Japanese Fiscal-Monetary Coordination: Can the BOJ and government find a stable equilibrium, or will political pressure for stimulus collide with bond market discipline repeatedly, creating further volatility?

Rupee Stabilization: Can FPI inflows resume in subsequent months, or will structural reallocation from EM to DM dominate? The answer determines whether the rupee tests lower levels or stabilizes.

Japan's January 2026 bond market crash marks a watershed moment in global finance. The simultaneous surge in ultra-long JGB yields (40-year above 4%), combined with Prime Minister Takaichi's fiscal expansion pledges amid elections, shattered the complacency that had characterized bond markets for years. The transmission mechanism to global markets via yen carry trade unwinding, Japanese repatriation of foreign assets, and upward pressure on US and European sovereign yields is direct and consequential.

For Indian markets, the immediate impact has been acute: record FPI outflows accelerating in January, the rupee hitting all-time lows, and equity valuations under pressure. However, India's domestic institutional investor base, RBI policy flexibility, and medium-term growth fundamentals provide resilience that many emerging markets lack.

The broader lesson is that the era of Japan-as-cheap-funding-source is ending. Global investors must adjust to higher real rates, tighter liquidity conditions, and a more fragile political-monetary equilibrium in the world's third-largest economy. For wealth managers and fintech entrepreneurs in India, this volatility creates both challenge and opportunity: challenge in navigating currency depreciation and capital outflows, and opportunity in serving the increased demand for hedging, diversification, and financial advisory services in uncertain times.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart