When leaders in New Delhi unveiled the long-awaited India–EU Free Trade Agreement (FTA), it was a strategic realignment in a more protectionist world and labelled as the “mother of all deals.” The scale is hard to dispute. India and the European Union together represent roughly two billion people and about a quarter of global GDP.

But the question that matters most at home is whether this agreement is truly beneficial for India, and if so, which sectors actually gain?

A close read of the numbers suggests a nuanced answer: yes, India stands to gain meaningfully, particularly in labour-intensive manufacturing and select agri/processed food exports, but the upside depends on whether Indian firms can overcome Europe’s non-tariff barriers and sustainability rules and whether India can absorb sharper import competition in sensitive pockets without undermining domestic industrial policy.

At its core, the agreement is a large-scale tariff and market-access bargain.

On the EU side, a central promise is that India’s exports will receive preferential treatment across almost the entire tariff universe. India’s official briefing states that India gains preferential access across 97% of EU tariff lines, covering 99.5% of trade value, with a large chunk eligible for immediate duty elimination, especially for labour-intensive sectors.

On the India side, India offers significant tariff liberalisation for European goods. A key headline is that India is offering 92.1% of its tariff lines, covering 97.5% of EU exports; around half of tariff lines see immediate duty elimination, while a large portion is phased out over 5–10 years.

India’s fact-sheet emphasises trade facilitation measures like product-specific rules of origin, self-certification mechanisms to cut compliance friction, and cooperation on technical barriers and sanitary/ phytosanitary measures, areas that often decide whether FTAs are usable in practice.

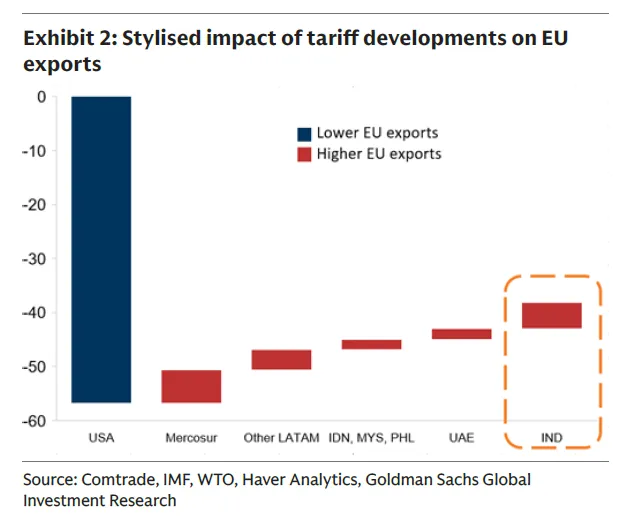

The timing is not accidental. Global trade is fragmenting through tariffs, export controls, “friend-shoring,” and green industrial policy. Analysts note that uncertainty in US tariff policy and a broader turn toward protectionism created incentives for both sides to lock in a strategic economic partnership.

That geopolitical logic matters for India because the EU is not just a buyer of goods; it’s a regulatory superpower. A tighter relationship can mean improved access to high-income markets and value chains but it can also mean navigating demanding standards on safety, environment, labour,

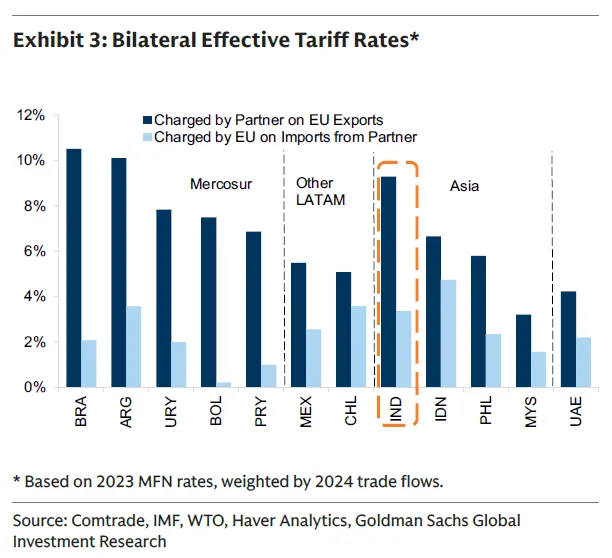

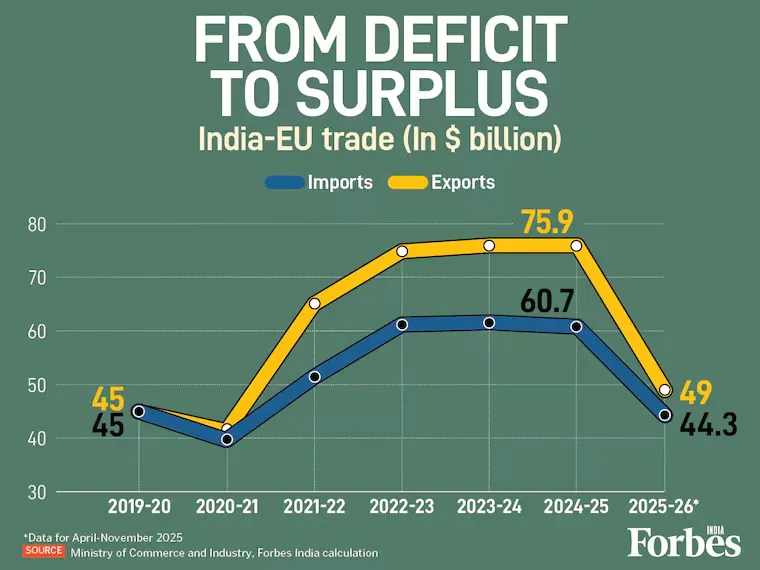

India’s goods trade with the EU has shifted markedly: from roughly balanced in 2019–20 to a $15.2 billion surplus in 2024–25, with exports rising to $75.9 billion while imports were $60.7 billion. The EU’s share of India’s exports has also risen (14.4% to 17.3% over the same period). India’s merchandise trade with the EU in 2024–25 is $136.5 billion, with services trade around $83.1 billion.

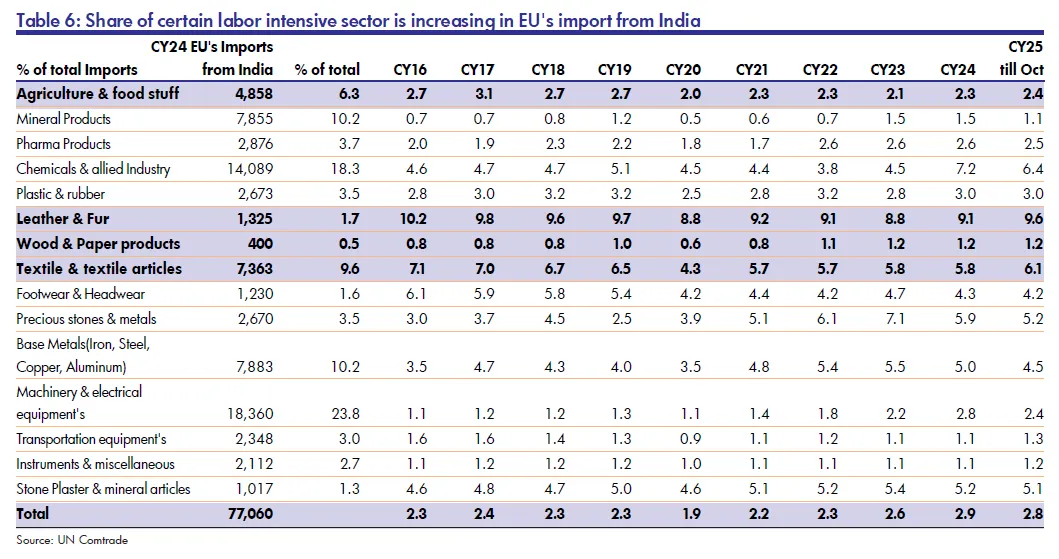

Yet there’s a caution in the same dataset: India’s penetration of the EU market remains shallow. India accounts for 2.9% of EU imports in 2024 (up from 2.3% in 2019). That gap between growing bilateral trade and modest EU market share, is exactly where an FTA can help if firms can scale, comply, and compete.

So this isn’t a “small trade partner” deal. It is a big deal in the wider context. And it lands at a moment when India wants to diversify export markets, away from the US. And the EU wants to reduce strategic dependence on the US and expand in other fast-growing economies.

This the most direct India-side win.

India’s government states that 70.4% of tariff lines covering 90.7% of India’s exports will see immediate duty elimination, explicitly naming labour-intensive sectors such as textiles, leather and footwear, tea/coffee/spices, sports goods, toys, gems and jewellery, and certain marine products.

This matters because India has long faced a competitiveness penalty in Europe relative to peers like Vietnam and Bangladesh that already enjoy better tariff access. India’s apparel and textile competitors benefited from reduced tariffs earlier, giving them an edge; elimination of tariff barriers is expected to narrow that gap.

Why the labour-intensive focus is economically significant:

These sectors employ large numbers of semi-skilled workers, including women, and are often concentrated in MSME clusters.

Even a few percentage points of tariff differential can shift sourcing decisions in EU retail and manufacturing supply chains.

For India, this is one of the few export categories where scaling up can translate into high employment multipliers.

European buyers care as much about compliance as price. Rules around chemicals (REACH), product safety, labour standards, and increasingly deforestation-linked inputs (for leather/rubber) can become binding constraints. So tariff relief is necessary, but not sufficient.

Gems and jewellery are explicitly singled out by Indian authorities as a major beneficiary of immediate duty elimination and improved competitiveness.

This sector has two characteristics that make an FTA especially valuable:

Value density (high export value relative to shipping costs), and

MSME participation, where small cost differences and predictable access can unlock scaling.

But the sector also faces reputational and compliance pressures: from responsible sourcing norms to traceability which may rise in importance over time even if tariffs fall.

Marine exports appear among the most prominent “winners” in India’s official framing, including immediate elimination and phased duty-free access for certain categories.

Europe is a high-value market for seafood, but it is also one of the strictest on SPS controls (residues, antibiotics, cold chain traceability). Cooperation on food processing norms and standards along with recognition/ equivalence mechanisms which can reduce barriers and improve predictability. If that cooperation becomes operational (not just aspirational), marine exports could see a step-change.

Indian authorities argue the pact supports preferential access for agriculture and processed food exports like tea, coffee, spices, grapes, gherkins/cucumbers, onions, and vegetables while protecting sensitive domestic sectors such as dairy and certain cereals/poultry.

This is a classic trade-off: India gets better access in categories where it has export potential, while carving out protection where it fears domestic disruption.

Beyond the headline labour-intensive segments, the India fact-sheet and press note also point to sectors like chemicals and engineering goods as beneficiaries of preferential access and competitiveness improvements.

These segments are particularly important for upgrading India’s export basket from low-tech to mid- and high-value manufacturing. They also align with “Make in India” ambitions, if Indian producers can meet EU standards and scale consistently.

While most headlines focus on goods tariffs (cars and wine make better copy), services are structurally crucial. India’s services are a “key growth driver” and there are deeper EU commitments across 144 subsectors, alongside improved certainty of market access and “ease of mobility.”

In the long term, if this translates into easier contracting, fewer discriminatory barriers, and smoother mobility for skilled professionals, it strengthens one of India’s most globally competitive areas.

If the agreement improves:

recognition of qualifications,

contractual service supplier movement, and

predictability for IT/ITeS and professional services,

then India’s services exports to Europe could deepen faster than goods.

Services in FTAs often deliver benefits through rules, recognition, and reduced uncertainty rather than dramatic overnight export jumps.

Winners will likely be larger IT services firms first, then mid-sized consultancies, engineering services, and specialist providers, provided the compliance and data/standards requirements are navigable.

India’s concessions are not trivial, and understanding them clarifies both the benefits and the political sensitivities.

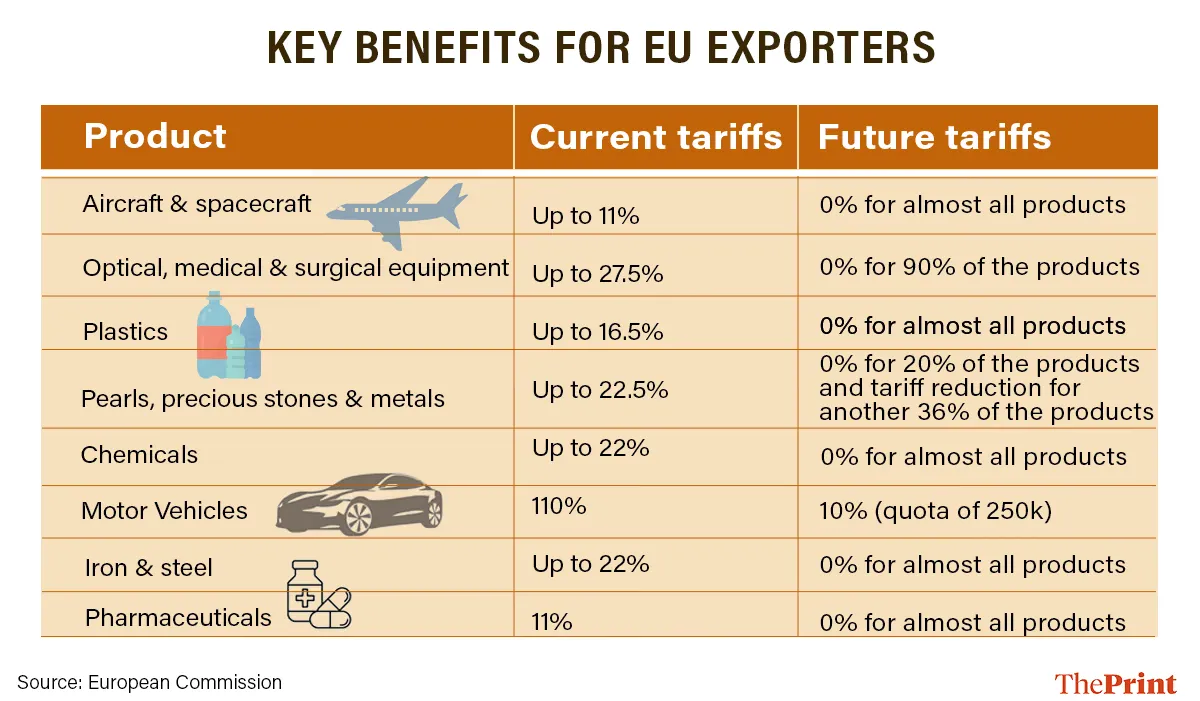

India will eliminate or reduce tariffs on 96.6% of EU goods exports, with estimated savings of roughly €4 billion per year for EU exporters. EU exports to India are expected to grow significantly over time.

Specific EU-side wins include:

Autos: tariffs dropping from as high as 110% to 10% under a quota (250,000 vehicles is frequently cited).

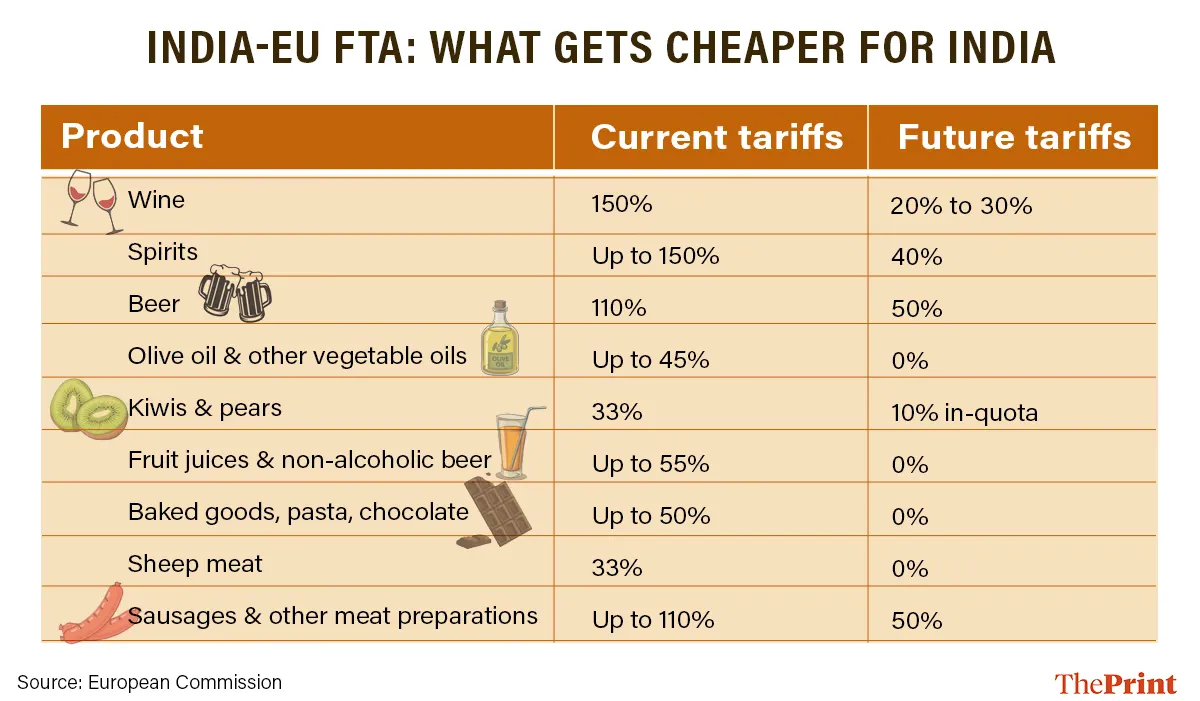

Alcohol: wine tariffs falling from 150% to 20–30%, spirits from 150% to ~40%, beer from 110% to ~50%.

Machinery/medical equipment/chemicals/pharma/aerospace: many tariffs falling toward zero over time.

The breadth of reductions and the exclusion of sensitive agricultural products, underscoring the political balancing act.

Why India should care about EU gains: Because EU wins create the pressure points in India domestic industries that will face sharper competition and may demand safeguards, phased implementation, or strategic support.

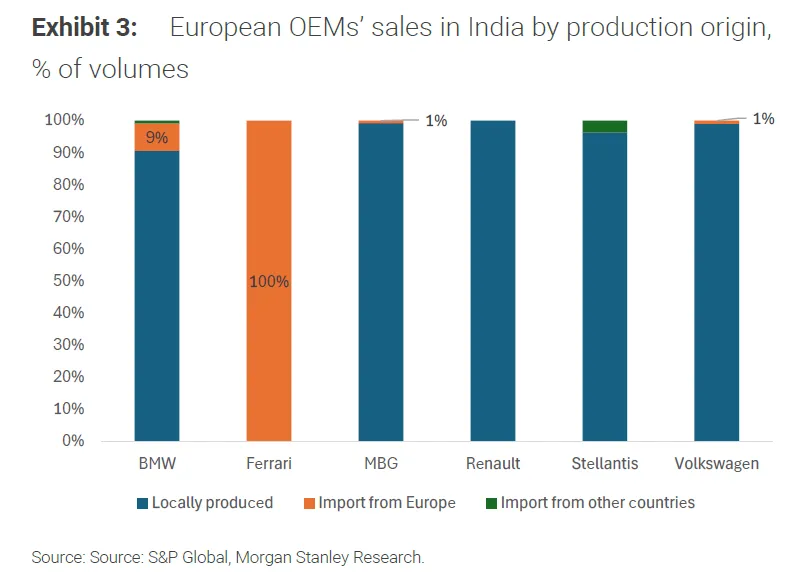

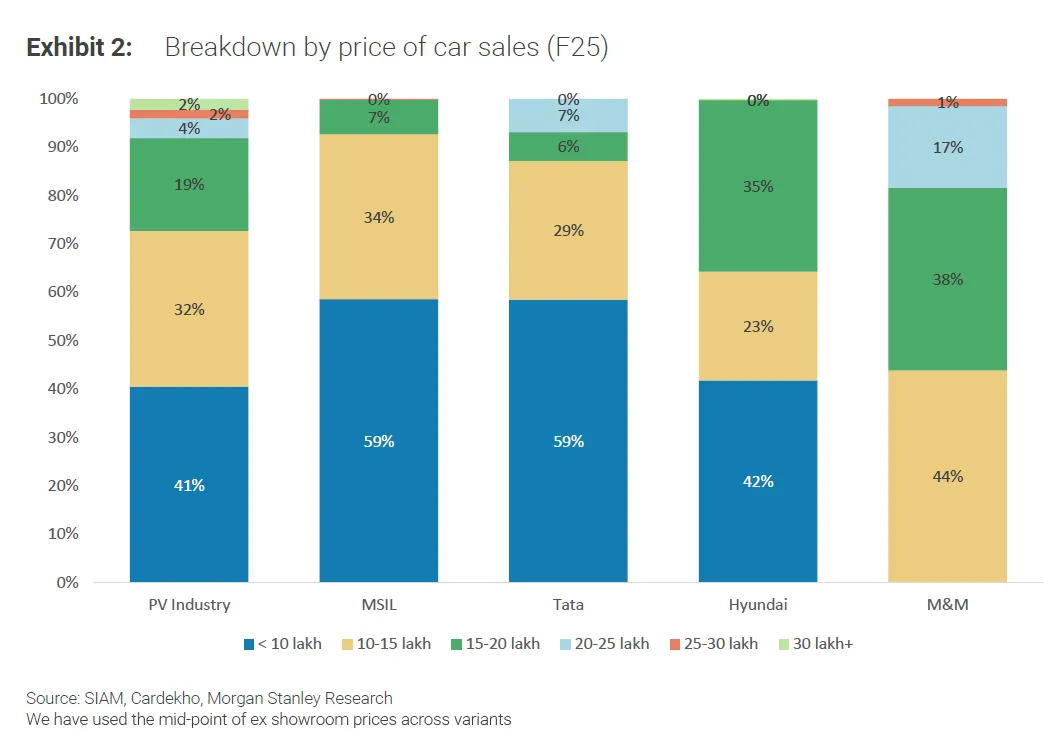

Autos are the classic “sensitive” sector because India has historically used high tariffs to push local assembly and manufacturing.

On one hand, consumers benefit from lower tariffs on premium imports. On the other, India has used high auto tariffs to incentivise domestic manufacturing and localisation.

The near-term impact on Indian OEMs may be limited because:

(a) Many European brands already assemble locally where duties are comparatively low, and

(b) The quota is a small relative to India’s annual passenger vehicle market. EU car tariffs can fall sharply (with quotas), especially for premium vehicles with a quota of 250,000 vehicles.

At the same time, the same analysis says the deal opens the door over time potentially raising competitive intensity especially in the luxury segment. Initially, with no duty reduction for the first five years, implying India is protecting the EV transition period. However, the luxury market could expand as the biggest duty cut is for expensive cars, and EU premium brands could bring more models without deep localisation.

So is autos a “loss” for India? Not necessarily. It depends on what India optimises for:

If the goal is purely to shield incumbents, any liberalisation looks threatening.

If the goal is to raise quality benchmarks, accelerate tech diffusion, and push component ecosystems up the value chain, controlled competition can be beneficial, provided industrial policy supports local suppliers and compliance.

There were many Import-side consumer wins due to tariff elimination. There are also cuts for optical, medical and surgical equipment, machinery/electrical equipment, and other industrial goods.

For India, this import liberalisation is a double-edged sword:

Pro: cheaper capital goods and advanced inputs can reduce costs for Indian manufacturers and improve productivity. India’s government explicitly frames EU high-tech imports as a way to diversify sources and reduce input costs.

Con: specific domestic producers (especially small-scale or less efficient ones) face stronger competition.

Even if tariffs fall, Europe’s standards and regulations can still shape who benefits and what are the outcomes.

The EU’s Carbon Border Adjustment Mechanism (CBAM) is designed to apply a carbon price to certain imported goods, which affects carbon-intensive exports like steel and aluminium. The European Commission states CBAM has a transitional phase and moves into a definitive regime from 2026.

CBAM could particularly impact Indian industries and the CBAM can act as import protection by applying emissions pricing symmetry. International reporting also indicates CBAM remained intact in discussions continuing on technical details of the deal.

Indian firms affected by CBAM did not get exemptions. This matters because it means India’s competitiveness in certain industrial exports will depend not just on tariffs but on credible decarbonisation, measurement, and verification systems.

For India, that means:

labour-intensive exports may get an immediate tariff boost, but

carbon-intensive expors in Europe unless production decarbonises and measurement/reporting systems improve.

So the FTA can open doors for India, but exporters that can’t meet compliance requirements may find those doors only half-open.

The EU’s deforestation regulation (EUDR) is another evolving constraint. The EU environment page indicates application dates have been updated, with large/medium operators applying from 30 December 2026 (and later for micro/small operators).

For Indian exporters, this can affect supply chains involving commodities like coffee, cocoa, rubber, leather, and wood-derived products. Even if tariffs are reduced, compliance costs and traceability demands can determine competitiveness.

Yes on balance, but it is not automatic, and the winners are uneven.

Here’s, why it’s beneficial:

Tariff parity with competitors: Especially in apparel/textiles and other labour-intensive sectors, where India has faced a disadvantage versus countries already enjoying EU preferences.

Job intensity: Many of India’s immediate-gain sectors are employment-rich (textiles, leather, footwear, gems & jewellery

Strategic diversification: Deepening access to a high-income market reduces dependence on any single bloc in a volatile global trade environment.

Cheaper, better inputs and tech: India’s own offer anticipates EU high-technology goods and capital goods can reduce input costs and support integration into global supply chains.

Services potential: If mobility and digital trade commitments function in practice, India could gain in services an area where India is structurally strong.

Here’s, why the benefits could disappoint:

Compliance capacity is the bottleneck: For many SMEs, the biggest hurdle in Europe is not tariffs, it’s standards, certification, audits, traceability, and consistent quality.

CBAM and green rules change the playing field: Heavy industry exports may face costs that offset tariff preferences.

Market penetration remains low: Even with a trade surplus, India’s EU import share is still small, meaning scale-up requires competitiveness, not just preference margins.

Import competition can bite in pockets: Autos and some high-value industrial imports could increase competitive pressure; managing transition costs will be politically sensitive.

Ratification and implementation lags: Benefits materialise only after ratification, and the path includes legal review and internal processes.

But the deal will not “work” on tariffs alone. The real contest is the ability of Indian firms to meet EU standards, handle traceability and sustainability compliance, and scale reliably. In a world where regulation is trade policy, India’s payoff from this “mother of all deals” will depend less on what’s signed in principle and more on what gets implemented on the factory floor, in testing labs, in customs systems, and across supply chains.

If India pairs the FTA with aggressive domestic reforms testing infrastructure, standards harmonisation, export credit, logistics improvements, and targeted support for MSME compliance the agreement can become a genuine jobs-and-exports engine. If not, it risks becoming a deal that looks historic on paper, while the largest gains accrue to the best-prepared firms, many of them, at least initially, on the European side.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart