India is being framed by global allocators as a “global anti-AI play” just as the rest of the world leans hard into an AI-driven capex super-cycle. That framing matters because it influences cross-border flows, sector multiples, and ultimately the cost of capital for Indian firms.

The key investor question isn’t whether AI is real (it is), but whether India captures, hedges, or is bypassed by the returns from it.

Watch the full video here:

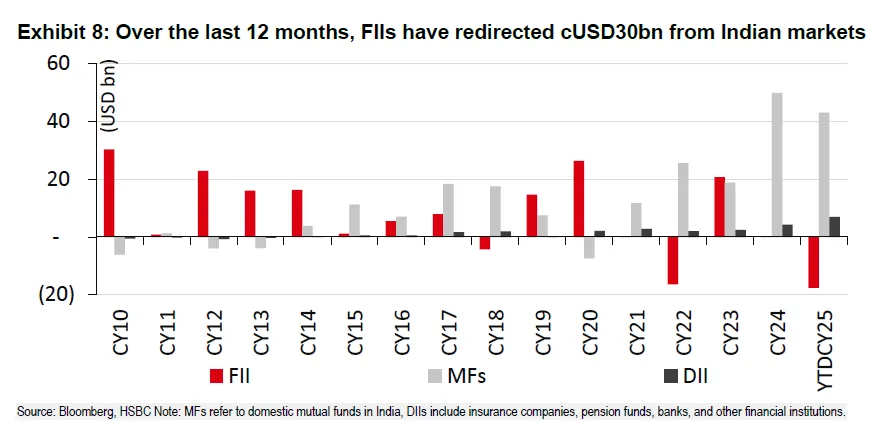

Through the last year, foreign investors consistently sold Indian equities, a rotation driven by rich domestic valuations, global geopolitics and the magnetism of AI beneficiaries abroad. USD 30bn swung out of India, with foreign inflows into Taiwan (c.USD 15bn in 3Q25, a record) and multi-year highs in Korea exposure. This isn’t a verdict on India’s fundamentals so much as a re-rating toward markets directly levered to AI (semis, components, power).

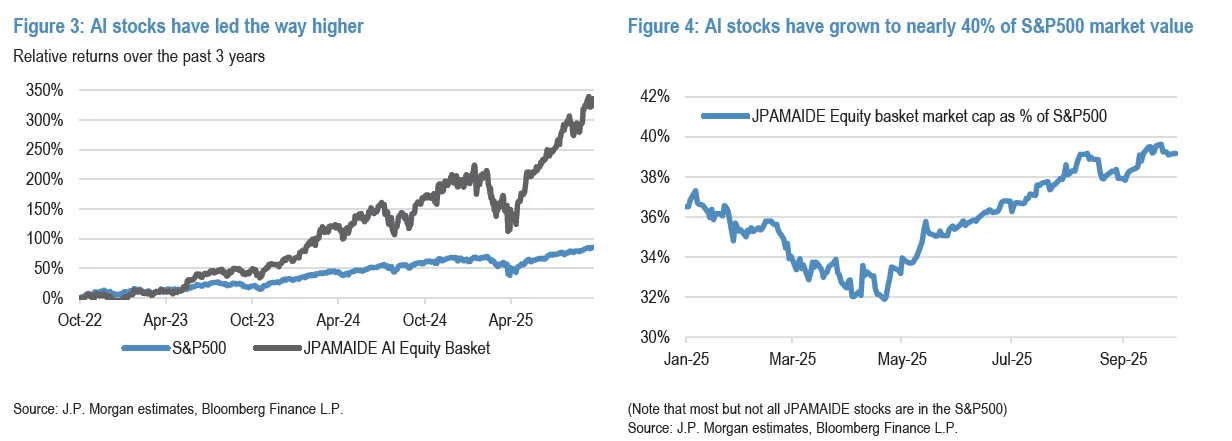

AI has been the dominant engine of U.S. equity performance since 2022, driven by a small cohort of companies whose weight and fundamentals far outpaced the rest of the market. A 30-stock AI group swelled to about 43% of S&P 500 market cap and accounted for >70% of the index’s performance contribution (ex-NVDA), with 31% cumulative sales growth versus 8% for non-AI peers and margin expansion from 17.3% → 25.2% (ex-AI margins drifted 11.4% → 11.1%). This leadership concentrates global equity beta into AI, amplifying the opportunity cost for investors underweight the theme. And in the absence of AI linked growth, performance of certain indices such as S&P 500 and earnings momentum would look materially weaker.

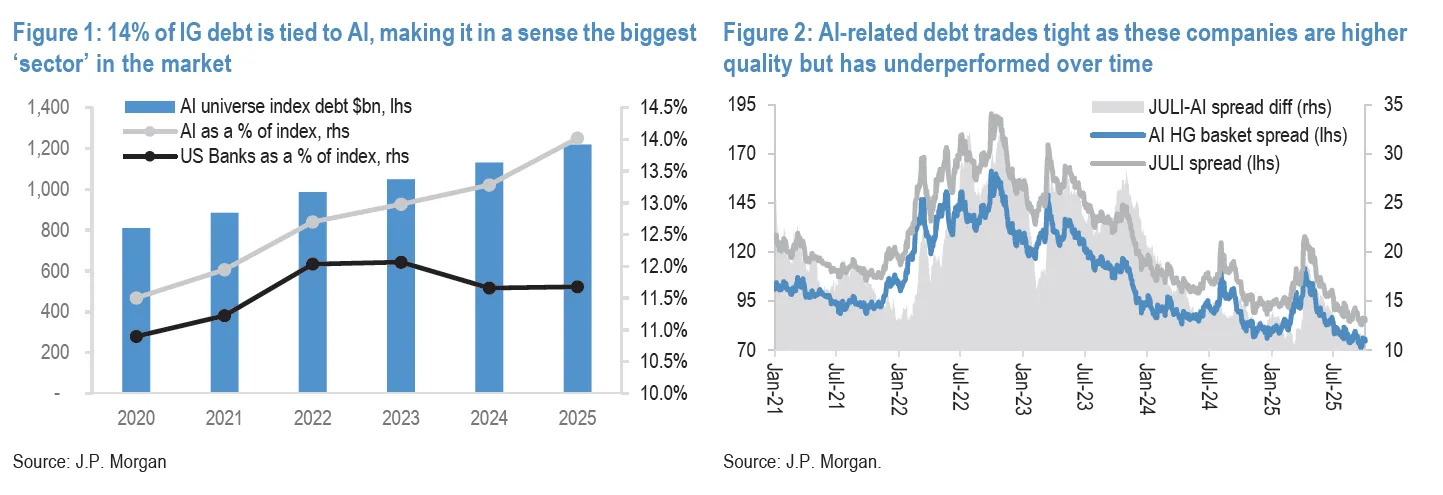

Credit tells a different story with investments in AI no longer being niche. USD 1.2 trillion of investment-grade debt now sits with companies most tightly tied to AI, taking the “AI cohort” to 14% of the investment grade (IG) index which is bigger than U.S. banks at 11.7% in that index. Yet this debt still trades like quality.Spreads on this AI basket trade around 74 bps, roughly 10 bps tighter than the broad index, and notably outperformed in the Q2-2025 selloff—consistent with high-quality balance sheets.

From a credit investor’s standpoint, fears of an AI “bubble” haven’t translated into fragile balance sheets. The core AI cohort in investment grade features cash-rich tech (low net leverage) and highly regulated utilities (with high gross leverage but rate-regulated cash flows). The average Tech bond maturity ~12.25 years, about 2.25 years longer than index, creates exposure to the path of capex monetization; gross leverage sits ~0.9× above net given large cash buffers.

AI has concentrated equity returns, while in credit it has grown into a large, tight-trading, higher-quality slice of investment grade debt. A disorderly derating in AI equities would still widen spreads, but the first-order effects may show up in cyclicals (e.g., energy) rather than the quality-tilted AI cohort. For equity allocators, this means the AI capex engine is currently credit-sustainable and a tailwind to the duration of the theme unless equity multiples disconnect from cash. For Indian equities, this matters: as long as AI credit stays tight, the global crowding-out of flows into AI leaders can persist.

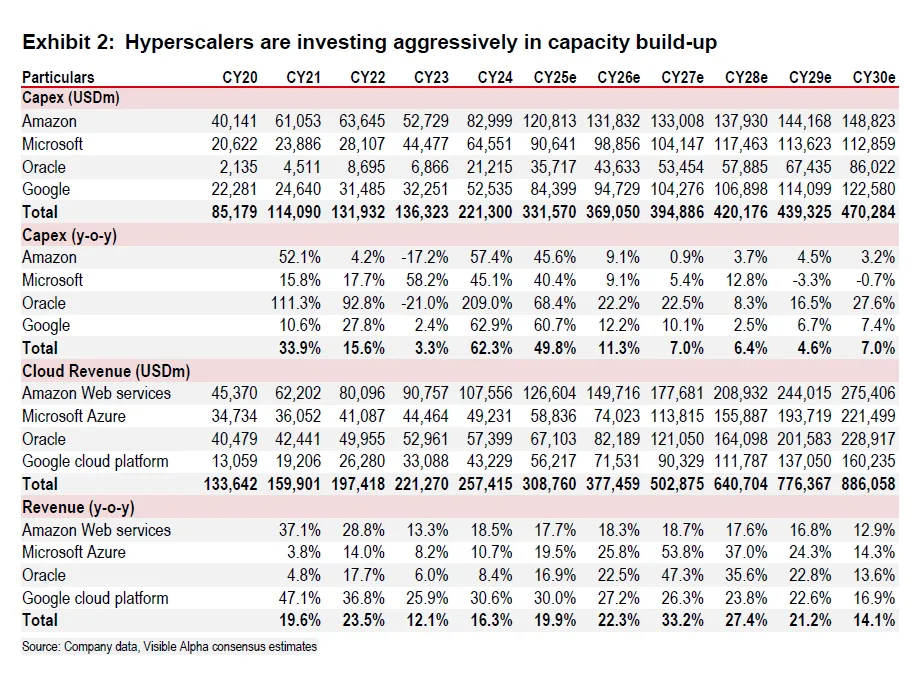

The global AI build-out is not small: top hyperscalers’ capex could sum to about USD2 trillion over five years, with annual spend around USD300bn in 2025 and trending toward USD500bn by 2030; associated depreciation could reach ~USD300bn by 2030, implying a very large revenue base inside the platforms most able to internalize software productivity. Historically, each USD of upstream software has created multiple USD of downstream services demand (3–6x in prior eras), but even a 0.5–1.0x multiplier in AI would still be material for services vendors if they win the work.

India’s own AI capex is modest. The IndiaAI Mission targets ~USD 1.25bn over 2024 to 2029. This is but a rounding error beside the hundreds of billions in the US (mostly private) and large state-led pushes in China and substantial public plans in the UK.

There are also domestic corporate capex announcements such as TCS USD 6 to 7bn for a 1GW co-location data centers and Reliance GPU/ data-center initiatives with global partners. But they are tiny relative to the global capital that is moving towards AI capex and infrastructure. It also means India is dependent on foreign platforms for compute and frontier models—at least this cycle.

Overall, India appears to be under-indexed to AI capex and over-indexed to automatable services employment, with a policy stance that is inclusive but funding-light.

In equity markets, narratives move money long before fundamentals fully reprice. The current narrative shows India as a global anti-AI play, as it is a relative under-beneficiary of the AI investment super-cycle. This is naturally shaping cross-border flows, sectoral earnings expectations, and relative valuations across Asia.

In the last year, foreign institutional investors (FIIs) have recycled capital out of India and toward AI-levered markets such as China, US, Korea and Taiwan. By 3rd quarter of 2025, Taiwan alone saw record net FII buying of roughly USD 15 Billion, while India experienced a cumulative outflow on the order of USD 30 Billion since mid 2025, and FPI ownership on the NSE universe has edged down ~40bps from Sep 2024 levels.

Three exogenous triggers could pull capital back into India:

Growth or supply-chain wobble that pricks AI exuberance in North Asia

Weaker USD with emerging market wide rotation

Trade policy outcomes that reduce perceived risk premia

With India’s structurally high ROE/ROCE franchises and deep domestic bid, even a modest FII return can compound quickly in midcaps and rate-sensitive cyclicals.

India’s tech sector is big, export-led, and people-intensive ($282–283B FY25 revenue; ~$224B exports; ~5.8M employees). The real question here is whether India's growth levers from IT services, BPO, a vast white-collar workforce, and cost arbitrage are able to outperform when AI progress is choppy or slow. If AI adoption is slower/messier, that pyramid keeps compounding into an “anti-AI” hedge. If not, Indian corporations are already productizing AI and selling “AI-as-margin” so it also works as a pro-AI lever.

People-led operating leverageIndia’s IT and BPO exports are anchored in large delivery pyramids. If generative AI disappoints or enterprise adoption is slower than headlines, clients keep paying for humans. That sustains utilization, protects pricing, and preserves margins in services heavyweights and mid-tier vendors.

Process complexity buys timeMuch of outsourced work lives inside messy, regulated, multi-system environments. Automating end-to-end workflows (not just drafting text) requires integration, change management, and risk sign-offs. The friction delays displacement, favoring human-in-the-loop delivery models where India is strong.

Cost arbitrage remains compellingEven with AI copilots, enterprises still need analysts, SDETs, solution architects, and program managers. If AI yields 20–40% productivity but not full automation, low-cost, English-speaking talent remains a durable edge for India.

Compute and power constraints elsewhereIf global AI progress is supply-constrained (GPUs, power, data center build-outs), the pace of automation slows. Services demand persists—and so does India’s share.

AI makes Indian services more competitiveThe same pyramids that look vulnerable can become force multipliers. Firms that productize internal tools (code assistants, test generators, L1 support bots, migration accelerators) can lift labor productivity 25–50% and pass some savings to clients.

Public digital infrastructure helps distributionIndia Stack (Aadhaar, UPI, Account Aggregators, ONDC, etc.) gives AI products native “plumbing” for identity, payments, and consented data sharing. That compresses go-to-market cycles in fintech, health, commerce, and public services which are an underappreciated AI advantage.

A massive, young, AI-literate talent poolWith millions of STEM grads and an ecosystem that learns fast, India is well-positioned to adopt frontier tools, fine-tune domain models, and run services around AI which can turn potential displacement into new categories of work.

Shift from cost center to product hubThe rise of India-led SaaS, developer tools, and infra startups suggests a pivot beyond pure services. AI-native startups can ship globally from day one, with unit economics improved by domestic costs and global pricing.

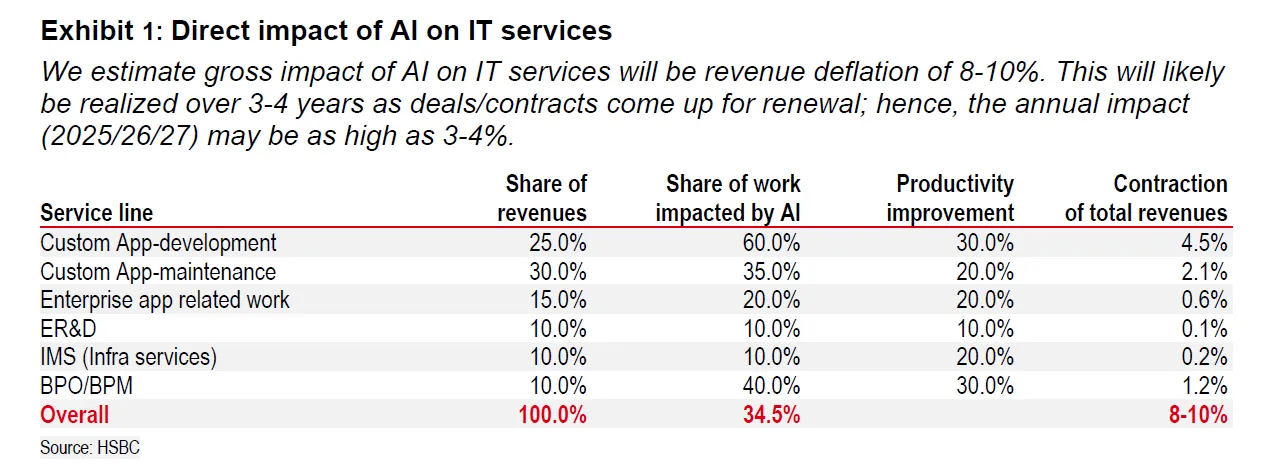

At the heart of the “anti-AI” framing is the deflationary effect of agentic and generative AI on labor-intensive IT services. There is, however, a nearer-term sting. As AI tools permeate the delivery stack, Indian IT services revenues face 8 to 10% deflation spread over 3 to 4 years as contracts reprice to AI-enabled productivity, implying 3–4% annual headwinds over 2025–27. That deflation is cyclical (contract reset) and technological (automation), and it disproportionately hits application development/ maintenance and BPO which are precisely the bread-and-butter service lines where India has global share.

Under pay-for-outcomes or unit-priced constructs, productivity accrues back to clients as price deflation unless vendors can expand scope (e.g., AI modernization programs) or climb the stack (e.g., architecture re-design for multi-agent systems). In other words, cost deflation becomes revenue deflation unless offset by net new spend—and that offset rarely arrives immediately.

The AI transition could rhyme: as enterprises graduate from single agents to multi-agent systems, they will re-architect data, orchestration, security, and observability—all high-value services. But there is a timing gap; productivity is realized earlier than incremental scope. This timing mismatch underpins the next 12–24 months of estimated risk for services vendors heavily skewed to legacy BPOs.

Early enterprise pilots indicate digital agents can operate at roughly 1/3rd the cost of human agents in specific lower level support and collections contexts. Initially, firms are reinvesting this gain to raise service levels (faster responses, higher coverage, more consistent quality) rather than to cut headcount outright, muting immediate layoffs but still compressing vendor hours as throughput per seat rises.

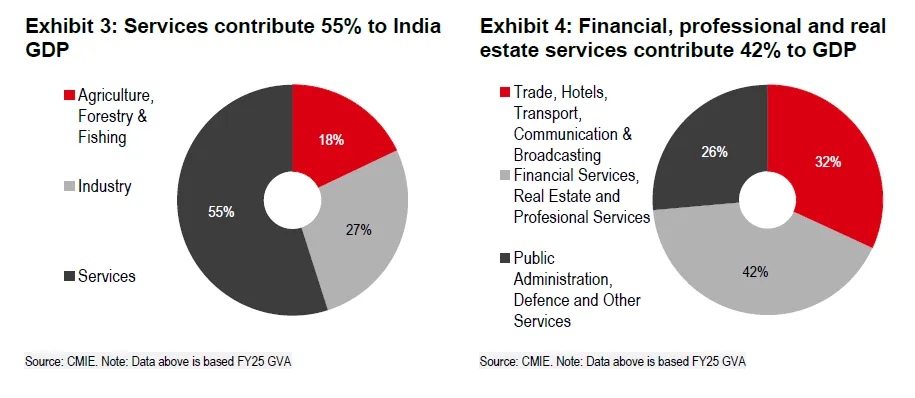

At the macro level, services are 55% of India’s GVA, substantially above the global average, so a technology that substitutes or augments knowledge work is macro-sensitive. Financial, professional, and real estate services alone contribute ~42% to the services sector. And are ripe to amplify AI’s effect on white-collar employment and wage dynamics relative to global averages.

The first wave of automation (customer support, low-end finance/back-office) is already visible, with initial economics showing digital agents costing about one-third of human agents. Management teams, notably in financial services, are deploying AI to lift throughput and quality rather than to drive immediate headcount reductions, but the hiring cadence is likely to slow materially as AI embeds into mid- and back-office workflows.

Global AI is no longer a thematic “option”; it is an asset-class-level capital formation story with tangible debt footprints and improving cash-flow visibility. India, today, is under-allocated to the capex and over-exposed to near-term service-line deflation, hence the “anti-AI play” moniker among global funds.

In the near term, global AI capex concentration and tight-trading AI credit can continue to crowd flows into North Asia and US, while India’s low AI spend and people-intensive export mix leave it looking like a hedge. That creates a cyclical pricing and revenue headwind for legacy IT services as AI productivity resets contracts before new scope fully arrives.

But the same dynamics also set up the compounding path: services vendors that compress pyramids, productize internal AI tooling, and price outcomes can turn deflation into margin mix. India’s strong public digital infrastructure and talent depth provide distribution and operating leverage once multi-agent architectures hit the mainstream.

If AI adoption is messy and incremental which could very well be the base case, then India hedges well and participates over time. If adoption accelerates faster than expected, domestic winners will be the firms that convert AI into durable pricing power and cash flow.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart