by Naman agarwal

Published On Dec. 10, 2025

India's energy and commodities landscape in 2025-26 presents a mixed outlook of declining crude prices, rising LNG costs, volatile chemical markets, and significant tariff challenges. With Brent crude expected to average $66-68 per barrel throughout 2025 (down from $84 at year-end 2024), Indian refiners are experiencing margin compression despite earlier relief from lower input costs. Simultaneously, LNG prices are surging to $14.3 per MMBtu, threatening to inflate energy bills for power plants and industries. The chemicals sector faces supply chain disruptions and port constraints, while aggressive US tariffs, particularly the 50% duty on refined petroleum, are undermining India's competitiveness in global energy markets.

The crude oil market entered 2025 on a bearish note, with Brent crude prices sliding from $84 per barrel at the end of 2024 to an estimated $66 by the fourth quarter of 2025. WTI crude followed a similar downward path, declining from $71 to $60 per barrel. This consistent softening reflects multiple headwinds: slower-than-expected global demand growth, particularly from China and developed economies facing macroeconomic uncertainties, combined with OPEC+ members gradually unwinding production cuts to maximize revenue. The International Energy Administration projects crude prices to fall further to $55-59 per barrel through 2026 as global oil inventories continue building.

Crude Oil Prices Chart : Trading Economics

For India the world's third-largest oil importer and consumerlower crude prices should theoretically benefit the economy by reducing import bills and easing inflation pressures. However, the reality is more nuanced. Indian refiners' gross refining margins (GRM), which measure profit from converting crude into finished products like petrol and diesel, have already begun contracting from the exceptional levels seen in 2025. While Indian Oil Corporation reported an impressive GRM of $10.6 per barrel in the September quarter of 2025 (compared to $4.08 in the previous year), analysts project margins to compress to $3.5-4.5 per barrel by FY2026. This structural decline is driven by global refining overcapacity with countries like China, Iran, and India all expanding production pushing crude processing profit margins toward historical lows.

Indian refiners are pivoting their strategy to compensate. Gross marketing margins (GMM) the profit earned from selling petrol and diesel at the pump have surged to unprecedented levels. Petrol marketing margins reached ₹11.7 per liter while diesel touched ₹9.4 per liter in FY26, compared to normalized historical levels of ₹3-3.5 per liter. This shift represents a structural transformation: refining is no longer the primary profit driver for state-owned OMCs like Indian Oil Corporation (IOCL), Bharat Petroleum (BPCL), and Hindustan Petroleum (HPCL). Instead, these companies are increasingly leveraging their marketing networks, crude sourcing strategies, and cost control mechanisms to maintain profitability. The ability to access discounted Russian crude which has accounted for up to 40% of India's crude imports provides a crucial competitive advantage, allowing refiners to protect margins even as global benchmark prices weaken.

India's refining capacity utilization and export strategies are also reshaping industry dynamics. Major refiners have accelerated fuel exports to historically high levels, leveraging increased production capacity and India's achievement of 20% ethanol blending (E20) in petrol reached five years ahead of the original 2030 deadline. This export-oriented approach positions India as an emerging refining and fuel export hub, capitalizing on global supply disruptions caused by geopolitical tensions and sanctions on competing producers.

While crude oil prices are declining, liquefied natural gas (LNG) prices are moving in the opposite direction, creating significant headwinds for India's power generation, fertilizer, and industrial sectors. The Platts JKM (Japan-Korea-Marker) price for LNG is forecast to average $14.3 per MMBtu in 2025, a substantial increase from $11.8 per MMBtu in 2024. This 21% price surge reflects a fundamentally tight global LNG market, exacerbated by Europe's urgent need for additional LNG supplies following the cessation of Russian pipeline flows via Ukraine and delays in new LNG project commissioning expected in 2024 and 2025.

Source : https://www.iea.org/data-and-statistics/charts/total-lng-imports-and-volumes-under-long-term-contracts-by-source-and-by-calendar-year-in-india-2015-2030

India's LNG import volumes are simultaneously expanding, creating a price-volume squeeze that inflates aggregate import costs. India's LNG imports reached approximately 27 million metric tons in 2024, surpassing the 26 million ton record set in 2020. Forecasts suggest imports will rise another 4-10% in 2025, reaching 28-29 million metric tons, as robust domestic consumption and economic growth drive demand. By 2026, India is expected to import nearly 29.5 million metric tons of LNG. This growth reflects increased consumption from compressed natural gas (CNG) distribution networks (CGDs), power plants, and industrial users, all competing for limited global LNG supply.

The economics of LNG competitiveness in India's power sector remain precarious. Indigenous coal costs $3-5 per MMBtu, while imported coal ranges from $4.5-6 per MMBtu. For LNG to become economically competitive with coal for power generation, prices must fall to the $6-8 per MMBtu range. At current projections of $14.3 per MMBtu, LNG is substantially more expensive, limiting its adoption in the power sector and constraining demand-side flexibility. This price gap underscores why natural gas currently represents only 6-7% of India's primary energy mix, far below the government's ambitious target of 15% by 2030.

Pipeline infrastructure expansion represents a critical enabler for future gas demand growth. The government is commissioning multiple projects in 2025, including the Urja Ganga Gas Pipeline and partial development of the Indradhanush Gas Grid in India's northeast. These infrastructure investments will connect refineries, fertilizer plants, large industries, and city gas distribution networks currently off-grid, potentially unlocking additional demand. Additionally, India's LNG regasification capacity is expected to grow by at least 25% year-over-year, addressing supply-side constraints and enabling the country to absorb higher import volumes. Despite these investments, the sector faces a critical reform need: inclusion of natural gas in India's Goods and Services Tax (GST) framework. Currently, city gas distribution companies face dual VAT levies on interstate transportation, creating compliance complexity and inflating consumer prices. GST inclusion would enable input tax credits for all stakeholders exploration and production companies, consumers, and distribution entities rendering gas pricing more competitive relative to alternative fuels.

India's chemicals and petrochemicals sector faces a multifaceted challenge characterized by raw material price volatility, supply chain disruptions, and shifting demand patterns across key segments. The sector is experiencing uneven price movements across its diverse product portfolio, with some commodities strengthening while others weaken.

Methanol markets remain bullish, driven by sustained high global demand from construction and industrial applications. Acetic acid has stabilized as feedstock costs remain manageable, reflecting equilibrium between crude oil influences and demand patterns. Conversely, acetone prices have declined as downstream pharmaceutical demand weakens, easing short-term inventory pressures. Ethyl acetate confronts upward pressure stemming from raw material shortages and port congestion affecting shipment throughput. Toluene, closely tied to crude oil price fluctuations, remains rangebound as competing price pressures offset each other.

Port constraints have emerged as an unexpected supply chain bottleneck. Key ports handling chemical exports have experienced congestion, delaying shipments and forcing suppliers to hold inventory longer, raising working capital costs. These operational disruptions have disproportionately impacted ethyl acetate, a key solvent used in paints, adhesives, and pharmaceuticals. Indian acetic acid producers like GNFC and Laxmi Organics have reported rising prices amid these constraints, with the issue expected to persist through early 2026 as port capacity remains strained.

India's petrochemical industry sits at an inflection point. The sector's domestic consumption stands at just 12 kg per capita approximately one-third of the global average highlighting vast untapped growth potential as India's middle class expands. Demand for petrochemicals is projected to nearly triple by 2040, driven by packaging, automotive, construction, and consumer goods sectors. Industry capacity is forecast to grow from 47.82 million tons in FY2023 to 59.71 million tons by FY2028, representing a 4.5% compound annual growth rate.

A persistent feedstock bottleneck, however, constrains expansion. Intermediates like propylene, ethylene, and toluene remain in structural deficit, limiting production capacity utilization and forcing higher-cost imports. To address this gap, India requires approximately 10 new olefin crackers over the next 15 years a massive capital requirement estimated at $87-142 billion over the current decade. The government's Petroleum, Chemicals and Petrochemicals Investment Region (PCPIR) policy and Production-Linked Incentive (PLI) schemes are designed to attract this investment and accelerate domestic capacity expansion. At current crude oil prices of $60-70 per barrel, India's feedstock cost structure remains globally competitive, providing an opportunity window for capacity additions before prices normalize upward.

The US tariff architecture introduced in 2025 represents a material headwind to India's energy and commodities sectors, though impacts vary substantially by sub-segment. The headline 50% tariff rate on Indian goods comprising a 25% baseline "reciprocal" tariff plus an additional 25% penalty for India's crude oil purchases from Russia creates an unprecedented competitive disadvantage for India's energy and chemicals exports.

Refined petroleum faces the most acute challenge, with the 50% duty directly threatening India's position as a top-5 global supplier to US markets. In 2023, India exported $5.15 billion in refined petroleum products to the US, making it a critical market. The 50% tariff effectively eliminates India's cost advantage relative to Persian Gulf and US Gulf Coast refiners, redirecting refined fuel flows toward other markets and constraining Indian refiner export volumes. This tariff regime also threatens to derail potential cooperation between US refiners and Indian fuel manufacturers on ethanol blending initiatives and advanced fuel specifications. The 27% ethanol blend mandate being pursued domestically was envisioned as a pathway for collaborative development with US partners a route now effectively blocked by prohibitive tariff structures.

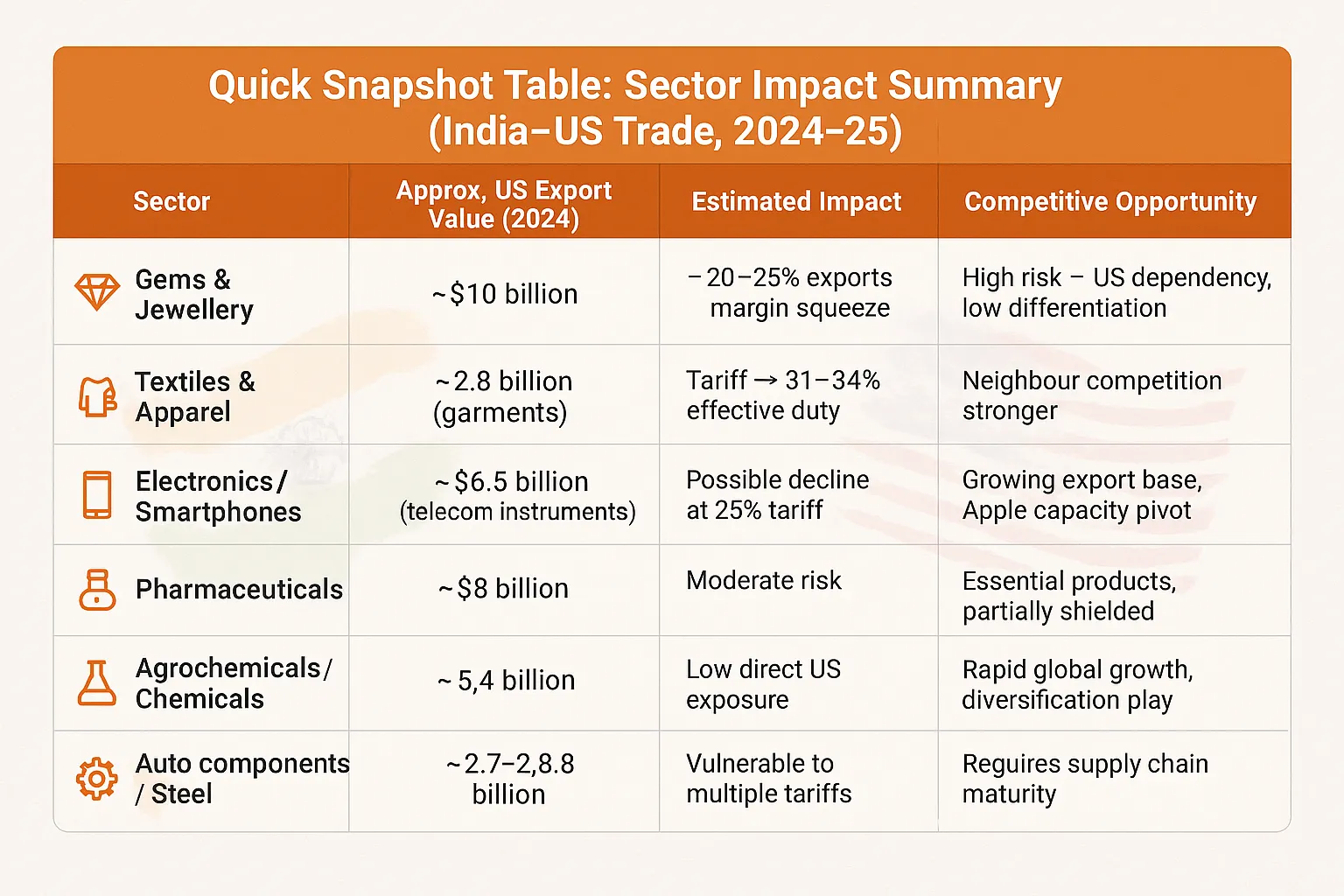

US Tariff Impact: Export Loss Across Key Indian Sectors

Chemicals and fertilizers face 25% tariffs, imposing material cost pressures across India's chemical value chain. The tariff rate applies broadly to acetic acid, methanol, ethyl acetate, toluene, and other commodity chemicals, increasing delivered costs to US industrial customers and displacing Indian suppliers in favor of competitors from Mexico, Southeast Asia, and the Middle East. For specialty chemical exporters serving the pharmaceutical and agrochemical sectors, tariffs are less uniformly applied due to various exclusion lists, but broad commodity chemical exporters face significant margin compression. Fertilizer exports, particularly ammonia and complex nutrients, confront tariffs that render Indian producers uncompetitive relative to Canadian and Middle Eastern suppliers. The US government has explicitly provided tariff exclusions to certain fertilizer products from Brazil, further disadvantaging Indian fertilizer manufacturers seeking market access.

The broader macroeconomic impact of tariffs on India remains contested. While some analyses suggest limited headline impact with projected cumulative GDP growth reduction of 0.3-0.5 percentage points from tariff measures sectoral dislocations are substantial. Export losses are forecast at $4-5 billion, with refined petroleum accounting for approximately $2.5 billion of losses, electronics $1.4 billion, gems and jewelry $0.9 billion, and chemicals $0.8 billion. These concentrated sectoral losses pose acute challenges for labor-intensive industries and capital-intensive refining operations that operated on thin margins before tariff imposition.

Indian industry responses include supply chain diversification, capacity relocation toward tariff-advantaged regions, and strategic pivots toward non-US markets. The government has provided limited policy support through tariff exclusion requests and, in the case of crude oil imports, demonstrated willingness to modify procurement patterns. (The government reduced Russian crude imports substantially following August 2025 tariff escalation, with Trump administration officials confirming consideration of tariff reductions in response to this shift.) However, structural tariff burdens remain in place, constraining medium-term investment in export-oriented energy and chemicals capacity.

India's energy and commodities outlook for 2025-26 reflects a market in transition marked by declining crude prices providing relief to refiners' input costs, yet offset by rising LNG expenses, chemical supply disruptions, and tariff-driven competitiveness pressures. Crude oil's downward trajectory offers short-term relief to India's import bill, but refining margins are structurally compressing as global overcapacity weighs on the industry. Simultaneously, LNG prices are at elevated levels, constraining India's ability to expand natural gas's role in the energy mix toward the government's 15% target. Chemical markets remain volatile, with supply chain disruptions and port constraints creating isolated pockets of strength and weakness across the value chain.

US tariffs represent the most material policy headwind, with refined petroleum exports facing existential competitive threats and chemicals exporters confronting 25% margin compression. These tariffs, while potentially subject to negotiation and revision, create medium-term uncertainty affecting investment decisions in export-oriented capacity. The success of Indian industry in navigating these challenges will depend on supply chain diversification, margin optimization through marketing leverage and cost control, and effective policy advocacy for tariff relief.

India's path forward rests on leveraging its natural competitive advantages cost-effective crude sourcing, emerging refining export hubs, and vast petrochemical demand growth potential while simultaneously advancing policy reforms that enhance gas competitiveness, reduce tariff distortions, and accelerate clean energy adoption. The sector remains resilient, yet faces a critical juncture where strategic capital allocation and policy coherence will determine whether India emerges as a stronger energy player or loses competitive position to alternative suppliers.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart