India’s defence budget is set to receive a substantial ₹50,000 crore boost through a supplementary grant, taking the total allocation past a historic ₹7 lakh crore. This significant enhancement is directly linked to the military's recent success in Operation Sindoor, a bold and targeted response to the April 22 Pahalgam terror attack that left 26 civilians dead.

The additional funds are expected to be formally introduced during Parliament’s Winter Session, and will be earmarked primarily for R&D, weapons procurement, and enhanced military infrastructure, underscoring a growing commitment to defence modernisation and strategic autonomy.

So let’s look at India’s Defence sector in detail.

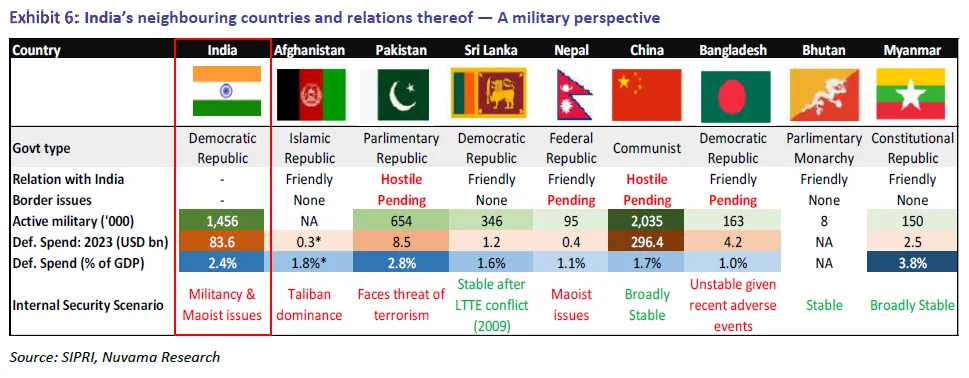

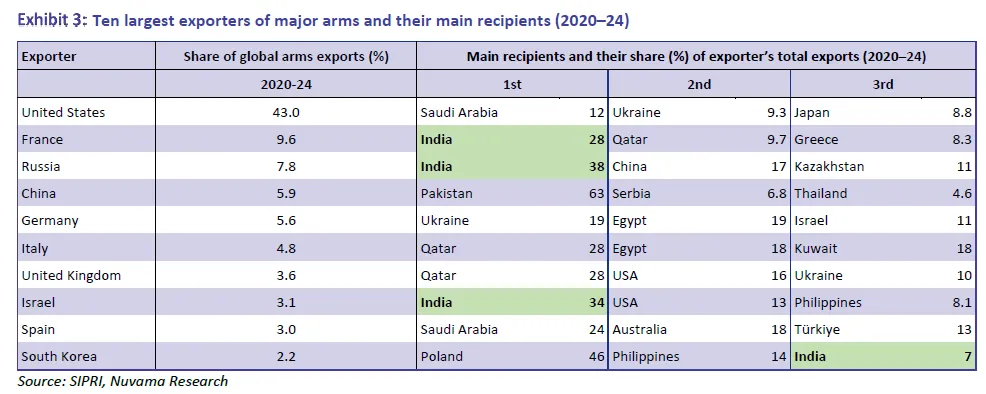

India’s defence ambitions are deeply rooted in its strategic pivot from being the world’s second-largest arms importer to becoming a self-reliant manufacturing hub. This shift is being facilitated by robust policy initiatives, strategic global partnerships, and a focus on developing indigenous capabilities. The domestic ecosystem is being reshaped by efforts to encourage technology transfers from defence giants in the US, Israel, Russia, and France, thereby creating joint ventures and partnerships that strengthen the supply chain and foster innovation.

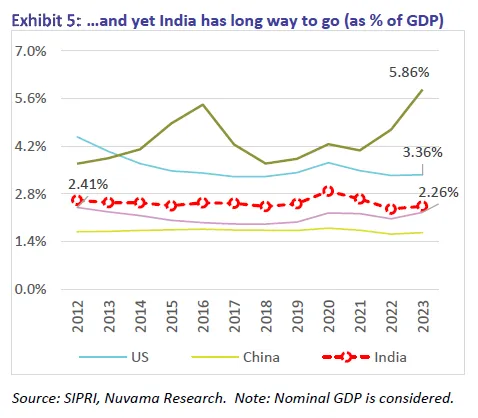

India, despite growing threats from Pakistan and China, still allocates a relatively low portion of its GDP to defence compared to the U.S., and far below countries like Russia. India’s defence spending as a percentage of GDP has remained relatively flat over the years, hovering between 2.3% and 2.5%, with a slight rise to 2.26% in 2023 from 2.17% in 2022. The United States consistently allocates a larger share of its GDP to defence. Though on a downward trend until 2018, U.S. spending climbed again to reach 3.36% in 2023. China, despite having the second-largest defence budget globally in absolute terms, spends a smaller share of its GDP on defence—around 1.5% consistently.

Given its geopolitical environment, this modest allocation may limit India’s ability to rapidly modernize its military unless supplemented with targeted investments—like the recent ₹50,000 crore supplementary grant.

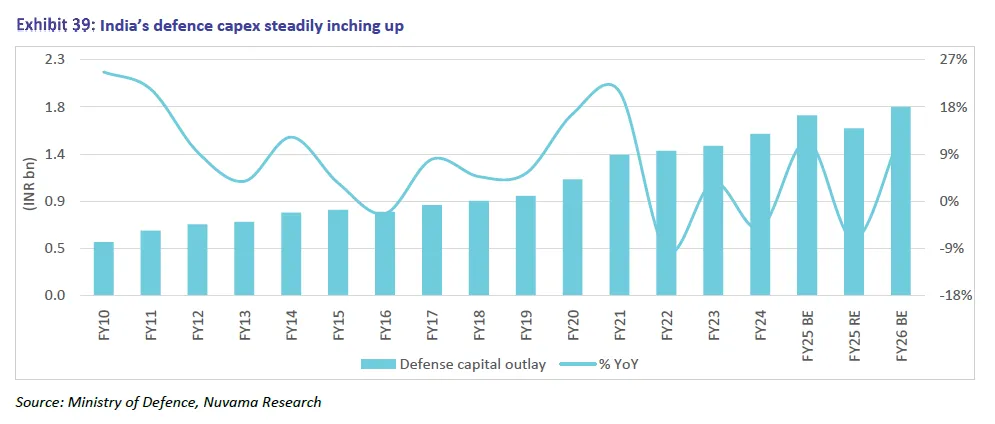

In 2014/15, when the Narendra Modi government first came to power, India’s defence budget stood at ₹2.29 lakh crore. Over a decade, this has more than tripled. The ₹6.81 lakh crore earmarked in the 2025/26 budget marked a 9.2% increase over the ₹6.22 lakh crore in 2024/25, reflecting India’s strategic prioritisation of national security amid an increasingly volatile geopolitical environment. Now, with the proposed supplementary allocation, India’s defence outlay will climb past the ₹7 lakh crore threshold, consolidating its position as one of the top five global military spenders.

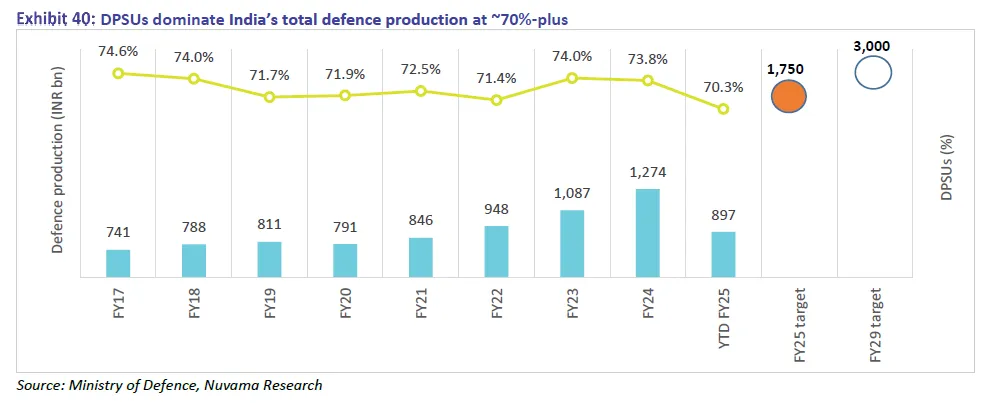

A growing private sector is increasingly seen as the engine of growth in this space, expected to outperform Defence Public Sector Undertakings (DPSUs) with an anticipated earnings CAGR of 25–40%, compared to 15–18% for DPSUs. Within this ecosystem, the defence electronics segment is emerging as a standout, projected to grow at 1.5 to 2 times the pace of overall defence capital expenditure.

Historically dominated by DPSUs, India’s defence production is undergoing a paradigm shift. Companies like HAL, BEL, and BDL continue to play vital roles. However, private-sector giants such as Larsen & Toubro, Tata Advanced Systems, Mahindra Defence, and Adani Defence are now integral to the manufacturing landscape.

The Tata-Airbus C-295 aircraft project and L&T’s K9 Vajra howitzers exemplify this shift. The Tejas fighter jet project alone has over 85 private firms supplying components. As of FY2023–24, private companies accounted for ₹16,411 crore—22% of the total defence production value. DPSUs are also reforming. The 2021 corporatisation of Ordnance Factories into seven units aimed at improving efficiency and collaboration with private firms. The defence sector is thus evolving into a robust public-private partnership ecosystem.

When we look at the global arms trade from 2020 to 2024, India is the top arms importer for France (28%), Russia (38%), and Israel (34%), and ranks 3rd for South Korea. This reflects India’s strategic importance to multiple exporters and its efforts to diversify suppliers. However, it also underscores India’s heavy dependence on foreign defence equipment - especially from Russia - posing risks amid global uncertainties. In contrast, the U.S. leads exports globally with a diversified client base. The table below reinforces the urgency of India’s push for self-reliance in defence through Aatmanirbhar Bharat and its ambition to become a global exporter.

India stands at a pivotal juncture. With the political will, industrial capability, and global interest in a non-aligned defence partner, India can transition from being a major buyer to a reliable builder and exporter of defence technology. The success of Operation Sindoor and the subsequent budget boost send a clear message: India is not just defending its borders—it is shaping its strategic destiny.

India’s ambition to transform from a defence importer to a global manufacturing powerhouse is gaining traction. Defence production hit ₹1.27 lakh crore in FY 2023-24, with exports contributing a record ₹21,083 crore—proof that India’s quality and competitiveness are being recognised globally. Yet, challenges remain. Despite progress, India remains the world’s largest arms importer, accounting for 9.8% of global arms imports from 2019 to 2023. This underscores a lingering strategic dependency on foreign suppliers, even as domestic capability expands.

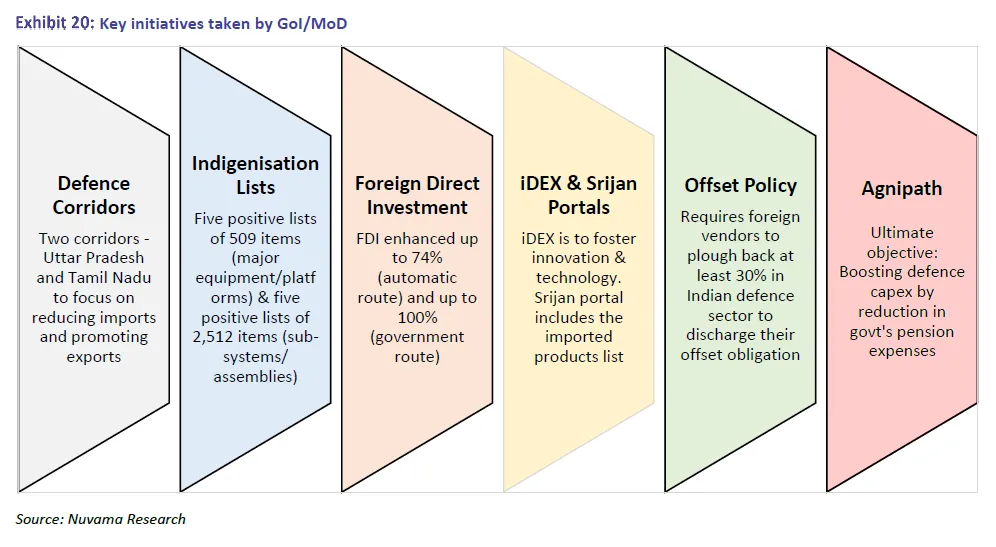

The Positive Indigenisation Lists have banned imports of over 500 key platforms and components, steering demand towards domestic firms. By mid-2024, nearly 3,000 of 4,666 DPSU-listed items were successfully indigenised. FDI reforms have further catalyzed growth. The FDI cap was raised to 74% under the automatic route and 100% with approval for high-tech transfers. These measures have attracted 46 joint ventures with foreign OEMs.

Initiatives like iDEX (Innovations for Defence Excellence) have spurred innovation. With over 600 startups onboard, iDEX has enabled 40+ prototypes and 31 procurement contracts by early 2025. Defence Industrial Corridors in Uttar Pradesh and Tamil Nadu have attracted over 250 MoUs, creating manufacturing hubs with over ₹20,000 crore in targeted investments. The revamped Defence Acquisition Procedure (DAP) 2020 prioritizes "Buy Indian (IDDM)" and mandates higher indigenous content. Combined, these measures are reshaping the defence procurement and production landscape.

Operation Sindoor, launched in retaliation to the brutal Pahalgam terror attack, marked a dramatic shift in India’s counter-terrorism doctrine. Precision strikes were executed on nine terror camps deep within Pakistan and Pakistan-occupied Kashmir (PoK), leveraging India's advanced air defence and strike capabilities.

Pakistan's counter with drone and missile barrages was effectively neutralised by systems like the indigenous Akash missile defence system and the Russian-made S-400s—demonstrating the strength of India's multi-layered defence architecture. India’s counter-response, which damaged Pakistani radar stations and military installations, showcased unprecedented tactical precision and indigenous capability—a key factor behind the supplementary budget push. Following Operation Sindoor, India also tested the Bhargavastra system—a low-cost, hard-kill counter-drone defence solution using micro-rockets. Tested at Odisha’s Seaward Firing Range, the system hit all its intended objectives and represents a growing trend toward homegrown innovation in asymmetric warfare. These advancements reinforce the need for sustained investment in defence R&D, a focus area for the additional ₹50,000 crore allocation.

From ₹866 crore in 2013 to ₹23,622 crore in FY2024–25, India’s defence exports have multiplied 30-fold. The government targets ₹50,000 crore (~$6 billion) by 2029. Success stories include the $375 million BrahMos deal with the Philippines, and ongoing interest in Akash missiles, Dhruv helicopters, and coastal radars. The government is actively promoting exports through Defence Expo events, streamlined clearance, and dedicated export portals.

Geopolitical realignments post-Ukraine war and the need for diverse arms sources have opened new markets. India’s affordable and reliable offerings appeal especially to the Global South.

India’s defence export potential hinges on synchronising its industrial output, policy framework, and diplomatic initiatives. Agreements like the Security of Supply Arrangement (SOSA) with the U.S. are promising, but they must result in real export outcomes.

While components are being exported to nations like France and the U.S., complete systems like Akash missiles and Prachand helicopters struggle due to operational history requirements and fierce competition from established players.

Currently, only 3.9% of the defence budget is allocated to R&D—far below the global standard of 10-15%. Raising this to 10% within five years is commendable, but without a cultural shift that embraces risk and failure, innovation will remain stunted.

India’s maritime legacy and Indian Ocean presence offer huge opportunities, particularly through regional forums like QUAD and BIMSTEC. But with only 1% contribution to global shipbuilding, India must incentivise public-private investments and declare shipbuilding as critical infrastructure.

To meet the ambitious ₹50,000 crore defence export goal by 2029, long-term procurement contracts for SMEs and startups are vital. This will build the supply chain resilience needed for sustainable innovation.

Stock | Focus Area | FY24 Highlights & Metrics |

Hindustan Aeronautics (HAL) | Fighter jets, helicopters, aircraft engines | ₹83,178 Cr order book, ROCE 28%, PE 10.5, profit up 14.7% |

Bharat Dynamics (BDL) | Missile systems | ₹20,054 Cr order book, exports growing, PE ~50, profit down 29.5% |

Bharat Electronics (BEL) | Radar & communication systems | ₹65,000 Cr order book, ROCE 26.38%, PE 23.85, profit up 24.4% |

Paras Defence | Optics, satellites, drone tech | Strong export pipeline, profit up 32.8%, ROCE 13.2%, PE 50+ |

Cochin Shipyard | Warship/submarine manufacturing | Rapid order growth, 55% YTD return (market), high margin commercial contracts |

Data Patterns | Defence electronics, satellites | Profit up 31.9%, revenue up 45.7%, PE 57.8, ROCE 22.2% |

Zen Technologies | Defence simulators | Early mover in niche, strong YoY growth, contracts with armed forces |

IdeaForge Technology | Drones & surveillance systems | Big gainer post IPO, government contracts on drone deployment |

India's defence journey, from heavy import dependency to indigenous capability and export ambition, is remarkable but incomplete. To fully realise its vision of ‘Make for the World’, India must:

Increase R&D investments

Simplify procurement

Strengthen commercial diplomacy

Support small enterprises

Accelerate co-development

The ₹50,000 crore boost is not just a financial infusion—it’s a strategic signal, and perhaps a turning point. The clock is ticking, and the global defence landscape waits for no one.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart