by Naman Agarwal

Published On Nov. 26, 2025

The Indian automotive component sector has emerged as a powerhouse of resilience and transformation, capturing global attention as a critical player in the worldwide automotive value chain. With FY25 marking a pivotal milestone of USD 80.2 billion (Rs 6.73 lakh crore) in turnover, a robust 9.6% year-on-year growth .The sector has not only recovered from previous headwinds but has positioned itself as a cornerstone of India's manufacturing ambitions. This remarkable recovery, driven by record vehicle production, strategic policy interventions, and a decisive shift toward electric mobility, reflects a sector in transition from cost-based competition to technology-driven innovation. By 2030, with NITI Aayog projecting the industry to nearly double to USD 145 billion, India's auto ancillaries are poised to capture an unprecedented 8% of global automotive component trade, up from the current 3%, while creating between 2 to 2.5 million additional employment opportunities.

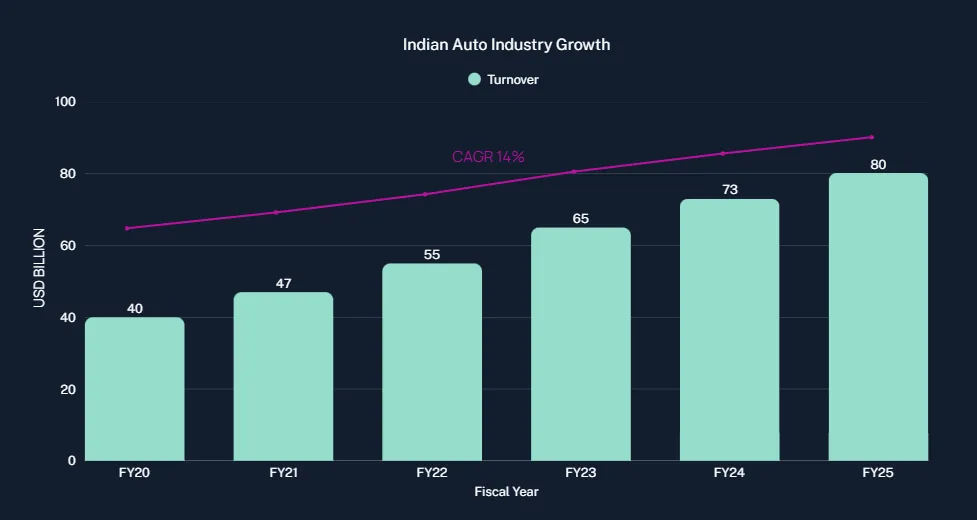

The Indian auto component industry has demonstrated extraordinary growth momentum over the past five years. From an estimated USD 40 billion in FY20, the sector has nearly doubled in size to reach USD 80.2 billion in FY25, achieving an impressive 14% compound annual growth rate (CAGR). This growth trajectory reflects not just recovery but fundamental structural strengthening of the industry's manufacturing capabilities and competitive positioning.

The domestic market remains the backbone of the auto component sector's performance. Component supplies to original equipment manufacturers (OEMs) reached Rs 5.70 lakh crore in FY25, posting a robust 10% year-on-year growth. This strong OEM demand was propelled by an 8% increase in overall vehicle production to 31 million units, reflecting India's status as the world's fourth-largest vehicle manufacturer. The industry has benefited significantly from increasing consumer preference for larger, more powerful vehicles with higher value-added components, as well as the growing penetration of advanced features and technologies in mainstream vehicles.

The growth in domestic OEM supplies demonstrates the sector's ability to scale production in line with vehicle manufacturing expansion. Consumption of premium components, advanced electronics, safety systems, and emission control technologies has driven significant value addition per vehicle, translating into higher turnover despite stable unit volumes in certain segments.

The aftermarket segment, which caters to replacement parts and repair requirements for vehicles already on the road, has emerged as a critical growth engine. With turnover of Rs 99,948 crore (USD 11.8 billion), the aftermarket grew by 6% in FY25, outpacing initial expectations. This segment's growth is supported by multiple favorable factors, including the expanding base of used vehicles in circulation, increasing formalization of the vehicle repair ecosystem, and growing rural demand bolstered by e-commerce penetration.

The rise of online platforms and digital marketplaces for auto parts has democratized access to genuine spare components, particularly in tier-two and tier-three cities and rural areas. This shift toward organized aftermarket services has not only improved product quality and consumer trust but has also generated incremental demand that traditional dealer networks might not have captured.

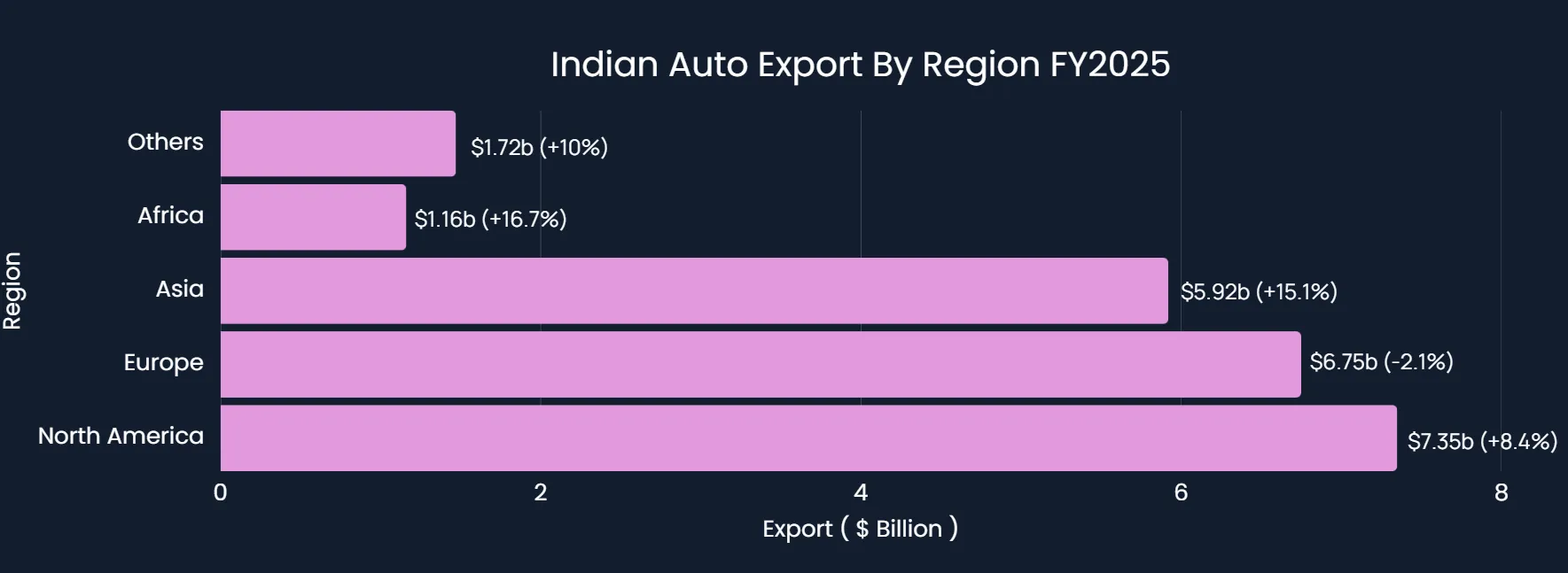

India's auto component exports have achieved a critical inflection point, with shipments growing 8% to USD 22.9 billion in FY25 from USD 21.2 billion in the previous fiscal. This export growth is particularly remarkable given the challenging global trade environment, geopolitical tensions, and ongoing supply chain realignments. The geographic distribution of exports reveals an intriguing story of diverging regional dynamics and shifting strategic opportunities.

Asia has emerged as the sector's fastest-growing market, with exports surging 15.1% to USD 5.92 billion, representing 26% of total shipments. This strong Asian performance reflects India's growing competitiveness in regional automotive supply chains, particularly in drivetrain components, transmission systems, and emerging EV-related parts. Vietnam, Indonesia, and Thailand represent emerging opportunities in the ASEAN region, where India is increasingly preferred as a geopolitically diversified alternative to Chinese suppliers.

Europe accounts for 29.5% of exports at USD 6.75 billion, but has experienced a modest decline of 2.1% year-on-year. This European softness reflects cyclical demand challenges in mature markets and increased competition from Eastern European suppliers. However, India's growing focus on premium, technology-intensive components and EV-related systems presents opportunities to revitalize the European market.

In a landmark decision effective September 22, 2025, India's GST Council implemented historic rate reductions that have fundamentally altered the tax structure for vehicles and auto components. Small cars (petrol ≤ 1200cc, diesel ≤ 1500cc, length ≤ 4m) now attract a flat 18% GST, down from 28% GST plus 1-3% compensation cess. Similarly, two-wheelers up to 350cc, three-wheelers, and commercial vehicles now face the 18% standard GST rate.

This reform has immediately stimulated demand across vehicle segments, with price cuts of up to Rs 1.5 lakh announced by manufacturers. For the auto component sector, this demand surge directly translates into higher production volumes and capacity utilization. Additionally, the unification of GST on auto components at 18% has simplified the tax compliance burden on suppliers and improved cash flow management.

The GST reforms represent more than fiscal adjustment; they embody a strategic commitment to affordability, manufacturing competitiveness, and the "Make in India" initiative. By lowering the effective tax burden, the government has incentivized replacement of older, polluting vehicles with modern, efficient models, simultaneously supporting environmental goals while stimulating component demand.

Beyond GST reforms, the Indian government has deployed multiple policy instruments to support the auto component sector. The Production-Linked Incentive (PLI) scheme for automobiles and auto components received an allocation of Rs 3,500 crore in the 2024-25 budget, encouraging domestic manufacturing and attracting global suppliers. The FAME (Faster Adoption and Manufacturing of Hybrid & Electric Vehicles) India scheme, supported by Rs 2,671.33 crore in allocations, continues to incentivize electric vehicle purchases and component innovation.

Electric vehicle sales in India have expanded dramatically, reaching 1.97 million units in FY25, up 16.9% from 1.75 million in FY24. Electric two-wheelers have shown the most explosive growth, jumping 21.2% to 1.15 million units, while electric three-wheelers increased 10.5% to approximately 700,000 units, and passenger EV sales surged 18.2% to reach the 100,000-unit milestone.

This rapid EV adoption has fundamentally restructured component demand. Traditional engine components, carburetors, fuel injection systems, and exhaust systems face declining demand, while demand for EV-specific components has skyrocketed. The critical components in high demand include motors and e-axles, wiring harnesses and electrical systems, lithium battery cells and battery management systems, sensors and telematics, power electronics controllers, and lightweight materials.

The shift toward EV components creates enormous opportunities for Indian component suppliers. Five Indian auto ancillaries have already won significant global EV orders, including Sona BLW Precision Forgings (e-axles and differential assemblies), Samvardhana Motherson (wiring harnesses and connectors), and others producing motors, controllers, and specialized fasteners.

India's demand for EV lithium batteries is projected to reach 139 GWh by 2035, up dramatically from just 4 GWh in 2023, driven primarily by the light vehicle segment. This explosion in battery demand creates both opportunities and vulnerabilities. While battery cell manufacturing is being localized through PLI schemes and government support, component suppliers continue to depend on critical materials.

A critical vulnerability has emerged in the form of rare earth magnets, essential for Permanent Magnet Synchronous Motors (PMSMs) used in EVs and hybrid vehicles. China, which controls over 70% of global rare earth element production and over 90% of refining capacity, imposed stringent export restrictions in April 2025, mandating export licenses, detailed end-use disclosures, and 45-day clearance processes. India, which sourced over 80% of its approximately 540 tonnes of rare earth magnets from China in FY25 (USD 221 million worth), faces acute supply constraints.

India's Auto Component Industry: Growth Projection to 2030 (NITI Aayog Vision)

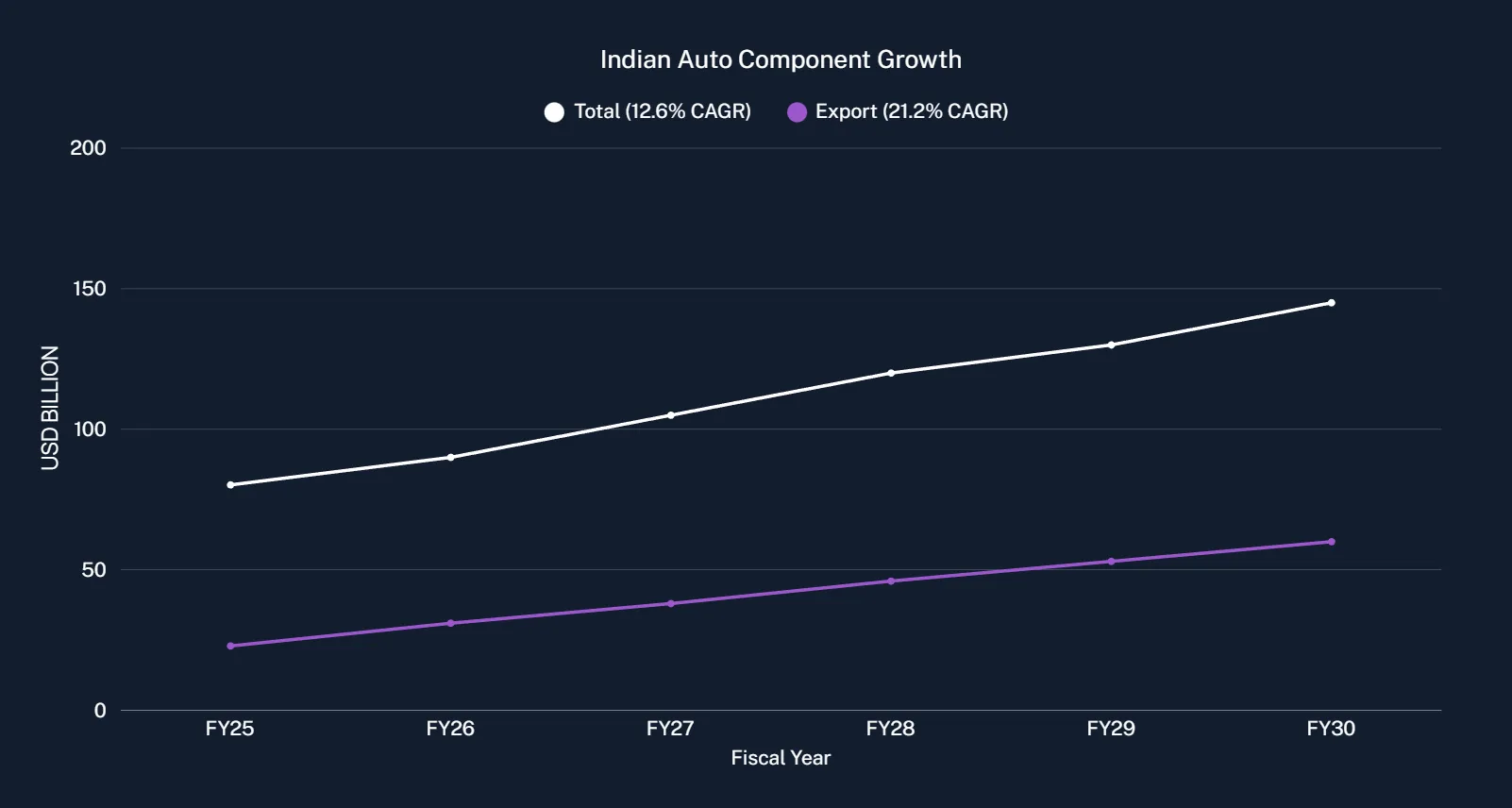

India's auto component sector is poised for transformative growth guided by NITI Aayog's ambitious vision outlined in the report "Automotive Industry: Powering India's Participationā in Global Value Chains." The report projects India's auto component industry to reach USD 145 billion by 2030, nearly doubling from the current USD 80.2 billion. Simultaneously, exports are projected to triple from approximately USD 20 billion to USD 60 billion, while India's share in global automotive component trade is expected to surge from the current 3% to 8%.

This growth trajectory would generate a trade surplus of approximately USD 25 billion, up from the current USD 0.5 billion, signifying India's emergence as a net exporter of advanced automotive components. The vision encompasses the generation of 2 to 2.5 million additional employment opportunities, bringing total direct employment in the sector to 3 to 4 million people.

The most acute near-term challenge confronting the auto component sector is the rare earth magnet shortage stemming from China's export restrictions. With approximately 85% of India's rare earth magnets sourced from China and facing a 45-day clearance process plus certification requirements, the sector faces production risk. Many manufacturers report magnet inventory sufficient only until mid-July 2025, creating urgent supply chain pressure.

The mitigation strategy involves multiple pathways: expedited government approvals for import licensing, tripling government incentives to build domestic rare earth metals capacity, strategic sourcing diversification from Australia, Vietnam, and South Africa, and technological alternatives including rare earth magnet-free motors.

The potential imposition of US tariffs of up to 50% on imported automotive components poses a significant risk, potentially affecting approximately 20% of India's exports. However, the sector is demonstrating resilience through geographic diversification, with Asia and Africa emerging as high-growth markets. Additionally, the focus on higher-value, technology-intensive products reduces the impact of tariffs on commoditized, price-sensitive components.

Freight costs, raw material price volatility, and supply chain complexity remain ongoing challenges. However, the sector's move toward localization, advanced manufacturing, and digital supply chain management is progressively reducing these vulnerabilities

India's auto ancillaries sector stands at a critical inflection point, transitioning from a cost-driven supplier base to a technology-led, innovation-focused manufacturing hub with global aspirations. FY25's strong performance, characterized by 9.6% turnover growth to USD 80.2 billion, robust OEM supplies growth of 10%, exports expansion of 8%, and emerging aftermarket momentum, validates the sector's resilience and growth potential.

The convergence of favorable factors , record domestic vehicle production of 31 million units, historic GST rate reductions that have stimulated demand, aggressive government policy support through PLI schemes and FAME incentives, and the explosive growth of electric vehicles creates a powerful growth environment. NITI Aayog's vision of USD 145 billion by 2030, with exports tripling to USD 60 billion and global market share expanding to 8%, is no longer aspirational but grounded in demonstrable industry momentum.

However, realizing this vision requires strategic navigation of emerging challenges, particularly rare earth magnet supply constraints, potential US tariff exposure, and the imperative to invest continuously in technology, digitalization, and high-value manufacturing. Indian auto component manufacturers who successfully localize critical materials, invest in EV-specific components, embrace digital transformation, and establish resilient global supply chains are positioned to capture disproportionate value from India's rise as a global automotive manufacturing hub. For India's economy, the auto ancillaries sector's transformation promises generation of 2 to 2.5 million new employment opportunities and emergence as a USD 145 billion global manufacturing powerhouse by 2030.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart