by Naman Agarwal

Published On Nov. 16, 2025

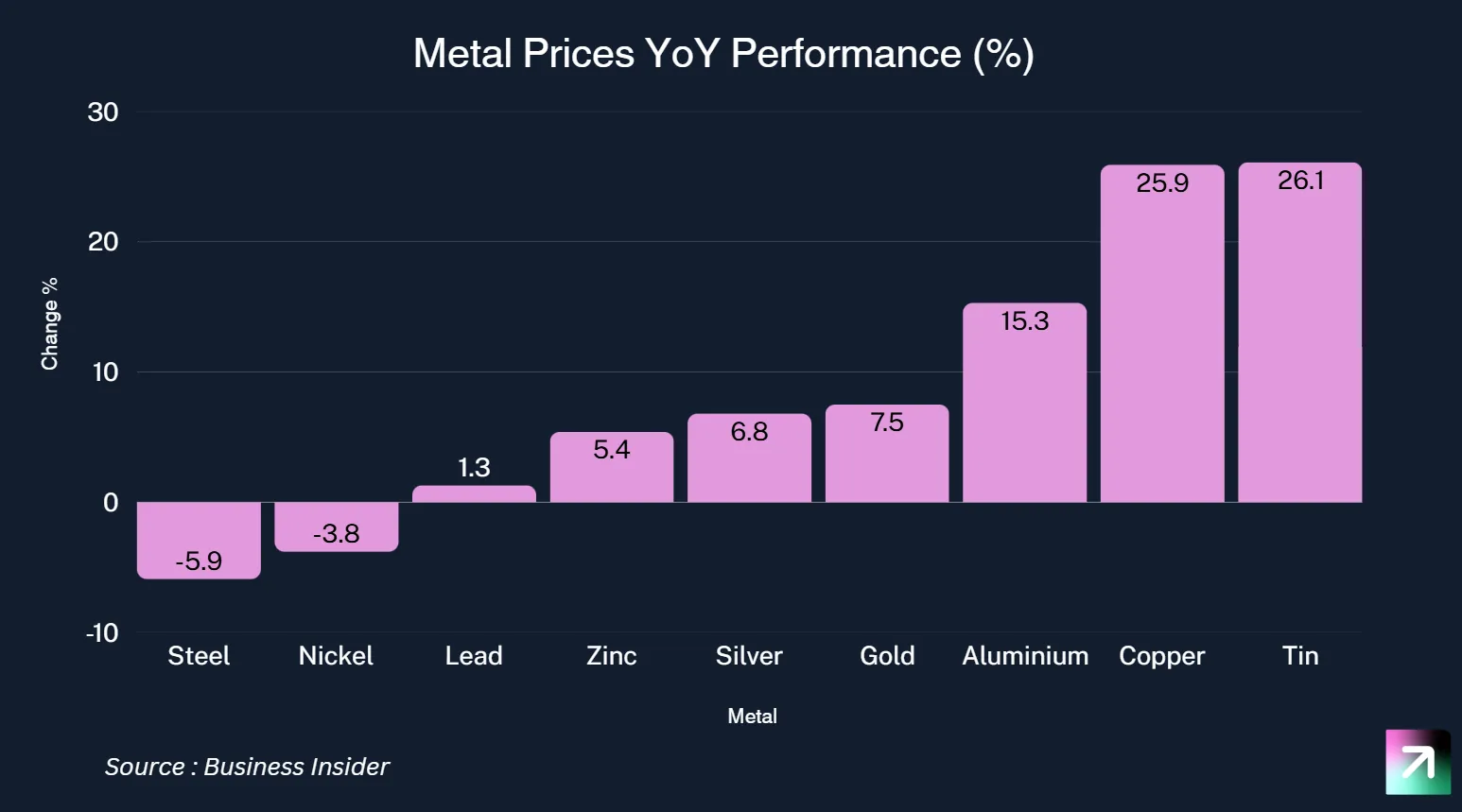

The global metals market continues to display robust momentum in November 2025, with most commodities posting strong gains driven by a weakening US dollar, supply constraints, and improving demand fundamentals across key sectors.

The Nifty Metal Index advanced 3.34% month-over-month to reach 10,588 points, while the BSE Metal Index gained 4.10% to settle at 35,060, with the sector's total market capitalization surging by ₹30,070 crores to reach ₹18.86 lakh crores, reflecting strong investor confidence in India's metal sector. This performance was driven by strong Q2 earnings, favorable government policies, and improving global commodity prices.

Gold prices have maintained exceptional strength throughout November 2025, trading at $4,190.34 per ounce as of November 14, representing a 7.53% year-over-year gain. In the Indian market, MCX gold futures settled at ₹1,26,813 per 10 grams, up 0.28% for the day. The yellow metal's rally has been underpinned by multiple factors including US dollar weakness, geopolitical uncertainties, and robust central bank purchasing.

Major global investment banks have revised their gold price forecasts significantly upward. Goldman Sachs projects gold reaching $5,055 per ounce by Q4 2026, representing a 19.5% upside from current levels. Bank of America has set an even more bullish target of $5,000 per ounce by end-2026, citing strong Western ETF inflows and continued central bank buying as primary drivers. JP Morgan maintains gold as their "conviction long for the year," forecasting prices to average $3,675 per ounce by Q4 2025 and rising toward $4,000 per ounce by Q2 2026.

Central bank gold purchases have emerged as a critical support factor, with institutions adding 200 tonnes year-to-date to their reserves. Western ETF inflows reached $8.2 billion in October 2025 alone, demonstrating strong investment demand despite elevated price levels. However, some near-term headwinds have emerged, particularly from China's new VAT rules on gold transactions aimed at curbing speculation, which may temporarily dampen retail demand.

Silver prices have exhibited greater volatility, currently trading at $52.66 per ounce, down 1.16% month-over-month but still up 6.84% year-over-year. In India, MCX silver futures settled at ₹1,62,350 per kilogram, gaining 0.14% intraday. Silver's dual nature as both a precious and industrial metal creates unique price dynamics, with the metal recently underperforming gold after surging 28% from mid-September levels.

The industrial applications of silver in electronics, solar panels, and manufacturing create sensitivity to global manufacturing PMI data, which has shown mixed signals across major economies. However, safe-haven demand continues to provide underlying support, with silver benefiting from the broader precious metals rally driven by geopolitical tensions and economic uncertainties.

Copper has emerged as one of the strongest-performing metals in 2025, with prices reaching $10,942 per tonne (LME 3-month) as of November 13, representing an impressive 25.89% year-over-year gain. The Indian MCX copper futures traded at ₹1,012 per kilogram, showing relative stability in domestic markets.

The copper rally has been driven by global supply disruptions reducing production by an estimated 525,000-800,000 metric tonnes in 2025. Major mining operations faced challenges including labor disputes, environmental regulations, and operational issues at key facilities. On the demand side, energy transition initiatives continue to drive structural consumption growth, with copper essential for electric vehicles, renewable energy infrastructure, and grid modernization.

However, the market faces near-term headwinds with inventories climbing at COMEX and trending higher in Shanghai. Chinese copper premiums have declined while LME prices remain at elevated levels, creating arbitrage opportunities that may lead to increased Chinese exports of refined copper. Goldman Sachs maintains a relatively cautious stance with a year-end 2026 target of $10,200 per tonne, citing both structural deficits anticipated later this decade and near-term inventory pressures.

Aluminum futures have rallied to $2,900 per tonne , approaching the three-year high of $2,915 touched on November 1. Indian aluminum prices on MCX settled at ₹271 per kilogram, up 0.17%. The metal has gained 5.89% month-over-month and 15.30% year-over-year, making it one of the best-performing base metals.

Supply constraints have emerged as the primary price driver, with China reiterating its priority of preventing overcapacity in metal production to curb deflationary pressures. China's aluminum output cap of 45 million tonnes annually is on track to be breached by next year, prompting regulatory attention. Production disruptions in Iceland and weakness in Canadian exports (down 54% year-to-date) have further tightened global supply.

Analysts expect aluminum to maintain its upward trajectory, with potential to reach $3,000 per tonne in the near term. The World Bank forecasts aluminum prices to increase by 4% in 2025, driven by supply constraints and growing demand from construction, transportation, and packaging sectors. However, the global market remains in a slight surplus, suggesting current price levels may face correction before resuming their upward trend.

Zinc futures have climbed to $3,093.65 per tonne, up 4.99% month-over-month and 5.41% year-over-year. The metal reached an 11-month high of $3,310 on November 3 before pulling back slightly. MCX zinc traded at ₹283.75 per kilogram in the Indian market. Reductions in zinc refining capacity have maintained most of the metal's rally since April, with the International Lead and Zinc Study Group reporting refined zinc production falling more than 2% this year despite a 6.3% increase in mine output.

Tin has emerged as the top-performing base metal with a 26.08% year-over-year gain, reaching $37,399 per tonne. The metal gained 4.68% month-over-month, driven by its critical role in electronics manufacturing and limited new mining development creating supply constraints. Tin's strategic importance for technology sector applications has created premium volatility, with strong demand from semiconductor and electronics industries supporting elevated price levels.

Nickel has underperformed other base metals, trading at $14,910 per tonne, down 1.58% month-over-month and 3.79% year-over-year. The metal faces pressure from oversupply conditions, with the market expected to remain in surplus for a third consecutive year into 2026. Desjardins has revised its 2026 nickel price forecast downward to $16,000 per tonne, reflecting persistent supply-demand imbalances.

However, medium-term prospects remain encouraging as the energy transition continues to advance, with nickel essential for electric vehicle batteries and energy storage systems. The shift toward lithium iron phosphate (LFP) batteries in some applications has created competition for traditional nickel-based battery chemistries, adding uncertainty to demand projections.

Steel prices in China traded at CNY 3,046 per tonne as of November 13, up 1.20% month-over-month but down 5.93% year-over-year. Indian steel prices have performed better, with domestic rates reaching ₹39,060 per tonne, gaining 0.75% week-over-week. However, the global steel market faces significant challenges from Chinese overcapacity, with the country expected to have a surplus of 50 million tonnes in 2025 that could balloon to over 350 million tonnes long-term.

China's steel production in the first seven months of 2025 fell 3.1% year-over-year to 594.47 million tonnes as authorities implement production cuts aligned with carbon emission reduction goals. The National Development and Reform Commission announced plans to close metallurgical plants with total capacity of 50 million tonnes by end-2025, with an additional 150 million tonnes to be decommissioned by 2030. These capacity reductions reflect China's efforts to address chronic overcapacity that has long pressured global markets.

Despite production cuts, China's domestic steel consumption in 2024 reached 863 million tonnes, with production at 1.005 billion tonnes, indicating approximately 200 million tonnes of "excess" capacity when accounting for exports. The property sector crisis continues to weigh on Chinese steel demand, with both housing starts and average home prices falling. Construction accounts for 40% of China's steel consumption, making the sector's weakness particularly impactful.

India presents a sharply contrasting picture, with steel consumption projected to increase to 220 million tonnes by FY30 and further to 390 million tonnes by FY50 from current levels of 136 million tonnes. Infrastructure and construction sectors drive most of India's steel consumption, accounting for nearly two-thirds of total demand. Government-led infrastructure projects alone contribute one-fourth to one-third of overall steel usage, making public investments a crucial growth engine.

The Production-Linked Incentive Scheme for Speciality Steel is promoting manufacturing technology upgradation and attracting investments in the steel industry. India produced 143.6 million tonnes of crude steel and 138.5 million tonnes of finished steel in FY 2023-24, maintaining its position as the second-largest steel producer globally. Major steel companies including Tata Steel, JSW Steel, and Hindalco have outlined significant capacity expansion plans to meet growing domestic demand.

The Nifty Metal Index has demonstrated strong performance in November 2025, advancing 1.37% week-over-week and 3.34% month-over-month to reach 10,588.45 points as of November 13. The index has delivered 16.13% returns over the past year and impressive 299.81% returns over five years, significantly outperforming broader market indices. The BSE Metal Index similarly gained 4.10% month-over-month to settle at 35,059.99, with the sector's total market capitalization surging by ₹30,070 crores to reach ₹18.86 lakh crores.

On November 13, the Nifty Metal Index outperformed the broader Nifty 50 index significantly, rising 1.70% to 10,721.30 while the Nifty 50 gained only 0.14%. The Relative Strength Index (RSI) for the metal index stood at 62.79, indicating strong positive momentum without reaching overbought conditions. This performance was driven by strong Q2 earnings, favorable government policies, and improving global commodity prices.

The weakening US dollar has emerged as a primary supportive factor for metal prices across the complex. A weaker dollar makes commodities more affordable for holders of other currencies, stimulating international demand. The US Federal Reserve's anticipated rate-cutting cycle provides additional tailwinds, as lower interest rates reduce the opportunity cost of holding non-yielding assets like gold while supporting economic activity that drives industrial metal demand.

Manufacturing activity has shown resilience in key economies, though with regional variations. China's manufacturing PMI data has been mixed, with the manufacturing steel consumption production index reaching 149 points in March 2025, up 16 points year-over-year and representing the highest level in nearly six years. However, US tariff escalation to 145% on Chinese goods has created headwinds for export-oriented manufacturing. North American aluminum demand fell 4.4% year-over-year in H1 2025 due to reduced industrial activity.

Central bank policies continue to play a crucial role, with major institutions maintaining accommodative stances to support economic growth. Central bank gold purchases have reached 200 tonnes year-to-date, demonstrating official sector confidence in precious metals as reserve assets. The shift toward multipolarity in global reserve holdings supports sustained central bank demand for gold as a neutral reserve asset.

India's metal consumption is being propelled by massive infrastructure investments under various government initiatives. The PM GatiShakti National Master Plan aims at multimodal connectivity through planned expansion of railway lines, new inland waterways, roads, and ports. Highway construction, metro rail networks, airports, bridges, and industrial corridors remain the largest consumers of structural steel and reinforcement materials.

Steel demand in India is expected to grow by approximately 10% annually as the government's augmented focus on infrastructural development continues. The demand for zinc is expected to double in the next five to 10 years on the back of huge investments in infrastructure, according to the International Zinc Association. Aluminum consumption is similarly projected to rise significantly, driven by applications in transportation, construction, and power transmission.

The Production-Linked Incentive Scheme for Speciality Steel and initiatives promoting decarbonization of steel industries are attracting investments and modernizing production capabilities. India's strategic advantages include vertically integrated operations, extensive mineral reserves, and 95 minerals produced across 1,319 operational mines with total mineral production value of $13.4 billion. The government has launched critical and strategic mineral auctions covering 38 blocks spread across 14 states and union territories.

China's steel sector faces a historic overcapacity crisis with an expected surplus of 50 million tonnes in 2025 potentially ballooning to over 350 million tonnes long-term if left unaddressed. The government has announced plans to close metallurgical plants with total capacity of 50 million tonnes by end-2025, with an additional 150 million tonnes to be decommissioned by 2030. These represent the most aggressive capacity reduction targets in the sector's history.

Steel consumption in China is projected to decline by an average of 5% annually as the economy transitions from investment-driven to consumption-driven growth. The property sector, which accounts for 40% of steel consumption, remains in crisis with both housing starts and average home prices falling. However, China will remain a dominant force in global supply dynamics despite potential output reductions of 240 million tonnes between 2024 and 2050.

China's aluminum sector faces similar challenges, with aluminum output approaching the 45 million tonne annual cap and authorities prioritizing prevention of overcapacity to curb deflationary pressures. Chinese refined zinc production fell more than 2% in 2025 despite mine output growth, reflecting capacity constraints from environmental regulations and profitability pressures. The government's focus on carbon emission reduction and industrial upgrading will continue to shape production decisions across the metals complex.

The global energy transition is creating substantial long-term demand for key metals essential to renewable energy, electric vehicles, and grid infrastructure. Copper demand is expected to grow by 70% by 2050 according to BHP Group, driven by electrical applications in renewable generation, transmission, and electric mobility. The metal's excellent conductivity makes it irreplaceable in most electrical applications.

Green steel demand in India is projected to reach 4.49 million tonnes by FY30, driven primarily by the construction sector at 2.52 million tonnes, infrastructure at 1.5 million tonnes, and automobiles at 0.48 million tonnes. By FY35, demand is expected to reach 24.89 million tonnes, more than doubling to 73.44 million tonnes by FY40 as decarbonization initiatives intensify. The adoption of green hydrogen-based DRI technology, electric arc furnaces, and molten oxide electrolysis will be essential to meeting this demand.

Aluminum's role in vehicle lightweighting for improved fuel efficiency and its applications in solar panel frames and electrical transmission make it a key beneficiary of the energy transition. Nickel's importance in battery technology creates long-term growth potential despite near-term oversupply, with the energy transition expected to lend support to prices over the medium term. However, competition from lithium iron phosphate batteries adds uncertainty to nickel demand projections.

The metals market in November 2025 presents a compelling investment landscape characterized by divergent regional dynamics and structural shifts in global demand patterns. While China's overcapacity challenges create headwinds for some commodities, India's infrastructure boom and the global energy transition are generating robust demand growth that supports elevated price levels across most of the complex.

Precious metals continue to benefit from central bank accumulation, geopolitical tensions, and monetary policy shifts, with gold particularly well-positioned for further gains by 2026. Industrial metals face more nuanced outlooks, with supply constraints in copper, aluminum, and zinc offsetting demand concerns and creating opportunities for selective accumulation.

For Indian investors, the domestic metal sector's strong Q2 2025 earnings and favorable government policies supporting infrastructure development create an attractive backdrop for investment. The Nifty Metal Index's 16% annual return demonstrates the sector's robust performance, with leading companies well-positioned for continued growth as India's steel capacity doubles toward 300 million tonnes.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart