India's economy has entered a phase of accelerated expansion, with Q2 FY26 delivering a remarkable 8.2% real GDP growth, marking a six-quarter high that significantly exceeded all consensus estimates of 7.3%. This extraordinary performance, coupled with 8.7% nominal GDP growth, has prompted leading rating agencies and economists to revise their full-year FY26 growth forecasts upward to 7.4%. Beyond the headline numbers, the economic picture reveals a complex narrative of consumption-driven resilience, structural deflationary pressures, and the transformative impact of recent fiscal reforms, particularly the landmark GST 2.0 rationalization that has fundamentally altered India's consumption and pricing dynamics.

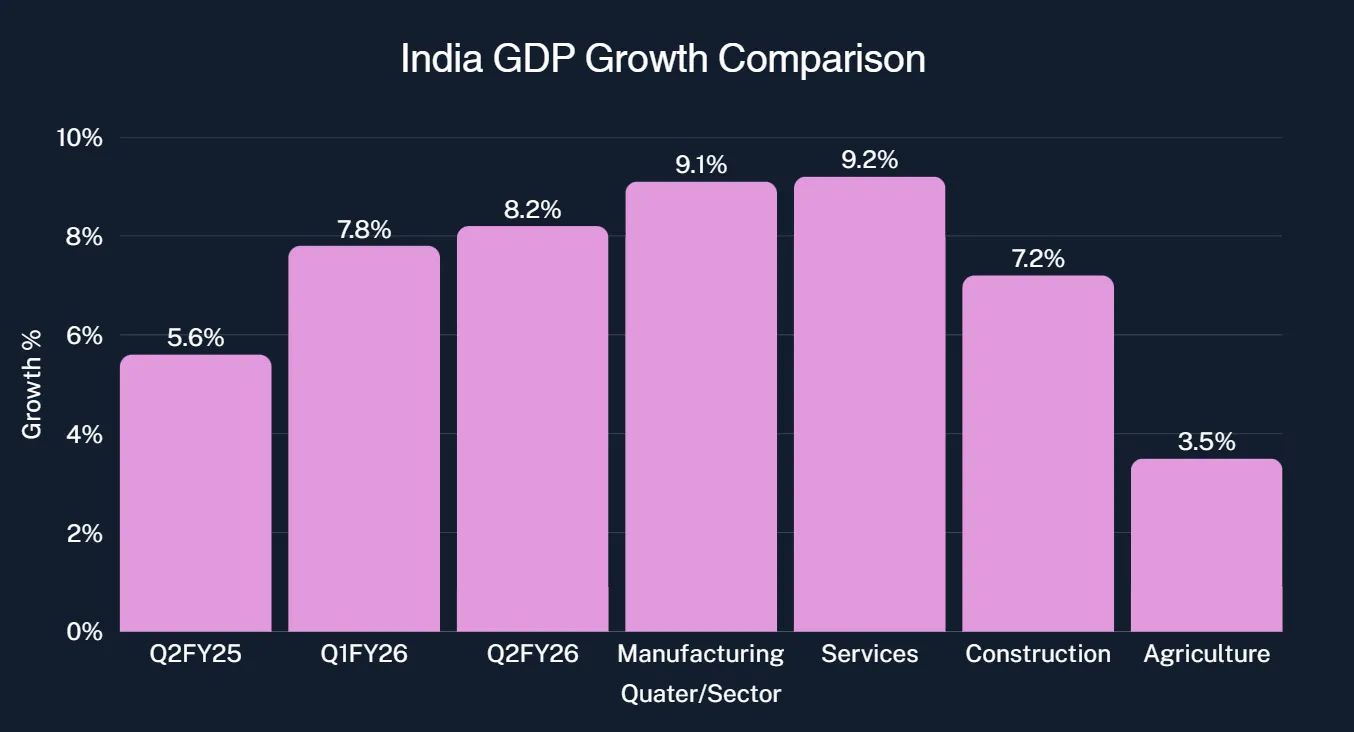

India's second quarter real GDP growth of 8.2% represents a decisive departure from earlier slowdown fears. This performance is particularly noteworthy because it emerged from a weak base of just 5.6% recorded in Q2 FY25, yet it still comfortably surpassed even the most optimistic market expectations. The growth trajectory has shown remarkable consistency across the first half of FY26, with real GDP expanding at 8.0% during April-September 2025, a significant improvement from the 6.1% recorded during the same period in FY25.

The underlying drivers of this beat were multifaceted and broad-based, extending well beyond any single sector or demand component. Government data indicates that both the supply-side and demand-side factors contributed meaningfully to the expansion. The Reserve Bank of India had projected only 7% growth for Q2, making the actual performance a notable upside surprise that has triggered immediate calls for upward revisions to the full-year outlook by multiple forecasting agencies.

The most striking aspect of India's Q2 FY26 performance lies in the sector-wise distribution of growth, which reveals a well-balanced and resilient economy. Manufacturing emerged as a key engine of expansion, delivering 9.1% growth the fastest pace in six quarters. This represents a dramatic turnaround from the 2.2% recorded in Q2 FY25, demonstrating that India's industrial base has overcome the headwinds that plagued the sector during the previous fiscal year.

The Services sector (Tertiary) complemented this manufacturing strength with an equally impressive 9.2% expansion. Within the services sphere, the standouts were Financial, Real Estate & Professional Services, which surged 10.2%, and Public Administration, Defence & Other Services, which expanded 9.7%. These service sector dynamics reflect buoyant urban demand, growing financial intermediation, and accelerating professional activity in India's major metropolitan centres.

Construction activity expanded by 7.2%, supported by sustained infrastructure push and real estate recovery, while Agriculture and Allied Activities grew more modestly at 3.5%, constrained by seasonal variability and weather factors. Notably, Utilities (Electricity, Gas, Water Supply) rebounded to 4.4% growth in Q2 from just 0.5% in Q1, indicating improving capacity utilization across the energy sector.

One of the most significant positives from Q2 FY26 data is the marked acceleration in Private Final Consumption Expenditure (PFCE), which grew 7.9% up from 6.4% in Q2 FY25. This represents the strongest quarterly performance in three quarters and accounts for approximately 57% of all GDP output. The consumption recovery reflects a fundamentally improving backdrop for household purchasing power, driven by moderating inflation, GST-linked price reductions, and moderation in interest rates.

Rural demand has shown particular strength, with economists highlighting that strong rural wage growth and income support schemes have bolstered village-level consumption. Urban consumption has also firmed, supported by stable employment, improved consumer sentiment, and the spillover effects of festive season buying that commenced ahead of the official festival calendar.

The quality of consumption growth is noteworthy in that it represents a shift toward discretionary spending rather than merely necessity-driven consumption. High-frequency indicators including record festive-season automobile sales, robust UPI transaction values, and notable rises in tractor sales all point to broad-based improvements in demand conditions across both urban and rural segments. The e-way bill generation, a key indicator of goods movement across India's economy, also showed elevated levels, reinforcing the narrative of strengthened demand momentum.

The September 22, 2025 implementation of GST 2.0 has emerged as a transformative catalyst for consumption dynamics. The reform reduced GST rates on approximately 375 items, with nearly 99% of all goods now falling into the zero, 5%, or 18% tax brackets. This simplification reducing the complex multi-slab structure to effectively two rates (5% and 18%) has delivered immediate relief to consumers while also significantly improving compliance and reducing complexity for businesses.

The estimated revenue loss of ₹48,000 crore from GST cuts has been more than offset by enhanced consumption, improved compliance, and the tax buoyancy generated by higher economic activity. Research from the National Institute of Public Finance and Policy (NIPFP) demonstrates that GST rate cuts carry a fiscal multiplier of -1.08, compared to -1.01 for personal income tax and -1.02 for corporate tax, indicating that GST reduction is a more potent lever for stimulating aggregate demand.

The full impact of GST rationalization on spending behavior is expected to unfold over subsequent quarters, though already the Q2 data shows material benefits. When combined with the earlier income tax cuts (worth approximately 0.3% of GDP) and lower debt servicing burdens from repo rate reductions (approximately 0.17% of GDP), the total consumption boost reaches approximately 0.6% of GDP.

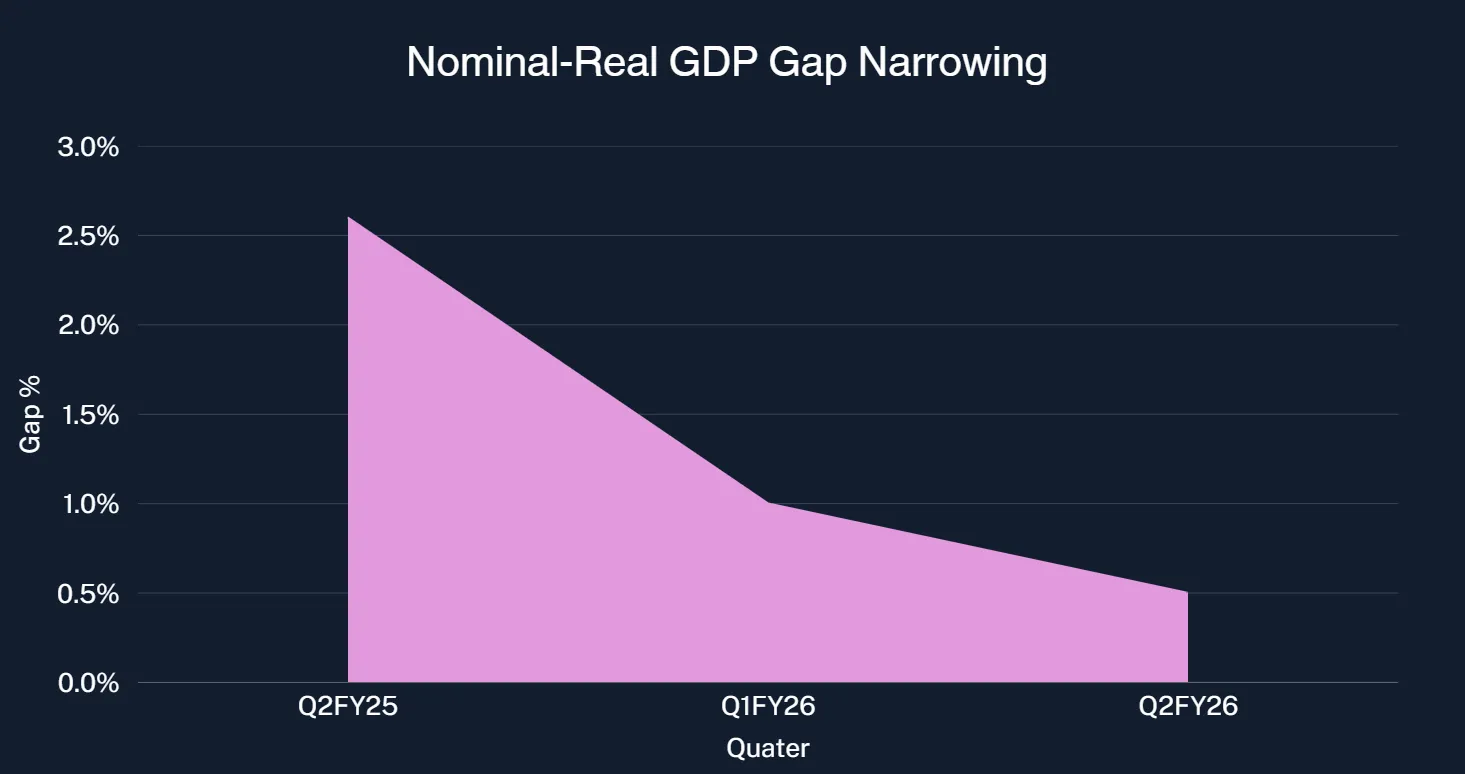

Perhaps the most intriguing aspect of India's Q2 FY26 performance is the remarkably narrow gap between nominal GDP growth (8.7%) and real GDP growth (8.2%) just 0.5 percentage points. This represents the smallest divergence since Q3 FY20 and signals profound deflationary pressures pervading the Indian economy. Historically, inflation creates a 3-4 percentage point gap between nominal and real GDP growth; the current gap is highly unusual and warrants careful interpretation.

The implicit price deflator (IPD) of GDP has been declining on a trend basis, falling from 5.52% in Q3 FY21-22 to just 2.88% in Q1 FY25-26. This compression reflects deeper structural changes in India's pricing dynamics, with particular weakness in capital goods deflation (0.41% inflation in Q1 FY26) compared to private final consumption expenditure deflation (2.11%).

The collapse in India's headline inflation to a historic low of 0.25% in October 2025 requires nuanced interpretation. While this achievement represents a victory for the Reserve Bank of India's inflation-fighting credibility, it also masks concerning trends regarding demand, pricing power, and corporate revenue growth.

Wholesale Price Index (WPI) deflation stands at -1.2% year-over-year, with food prices falling 5.02% and vegetables declining a sharp 27.6%. This agricultural surplus, while beneficial for consumers, has compressed pricing power across numerous sectors of the economy. The question facing Indian businesses is whether the deflationary environment represents temporary supply-side easing or the harbinger of demand-side weakness.

There is evidence suggesting that many companies have captured the margin benefit from lower input costs without proportionally passing benefits to consumers. The Index of Industrial Production (IIP) growth of just 4.8% in September 2025, despite 8.2% real GDP growth, implies that manufacturers have prioritized margin expansion over volume growth. This pricing behavior, if sustained, could indicate concern about demand elasticity and future revenue growth.

The persistent nominal GDP slowdown presents meaningful challenges for fiscal sustainability and corporate tax collections. The Finance Ministry's full-year FY26 budget assumption was nominal GDP growth of 10.1%, but Q2 data suggests full-year growth may only reach 8.0-8.5%. This approximately 150-210 basis point shortfall from budget assumptions implies meaningful pressure on direct tax collections, GST receipts, and overall government revenues.

Economists at CareEdge Group have flagged that while real GDP is impressive, nominal GDP is a more direct indicator of corporate pricing strength and tax revenue potential. The limited corporate earnings growth relative to volume expansion could constrain capital investment by businesses and complicate government financing of fiscal consolidation targets.

Revised Growth Projections Point to 7%+ FY26 Expansion

In the wake of Q2 FY26's blockbuster performance, leading rating agencies have substantially revised their full-year growth outlooks. Fitch Ratings upgraded India's FY26 GDP forecast to 7.4% from 6.9%, citing stronger private consumption and the positive impact of GST reforms. Similarly, CRISIL raised its FY26 forecast to 7%, while the Chief Economic Advisor has revised the projection to at least 7%, up from the 6.3-6.8% range.

The consensus now suggests that even with expected normalization of growth in H2 FY26 due to adverse base effects, normalizing government capital expenditure, and persistent US tariff pressures, the full-year performance will likely exceed 7%. This would represent a meaningful acceleration from FY25's 6.5% expansion and restore India's position as the fastest-growing major economy globally.

Risks and Moderating Forces for H2 FY26

Despite the optimism, economists expect growth to moderate to approximately 6.1% in H2 FY26 due to several converging factors. Base effects will become increasingly adverse as the comparison period strengthens, particularly in Q3 and Q4. Government capital expenditure is expected to normalize from the elevated pace maintained during H1, reducing one of the key growth drivers. Additionally, the 50% US tariffs on Indian exports, implemented during Q2, may have delayed impact on outbound shipments and corporate investment decisions.

The RBI, recognizing these dynamics, has signaled openness to rate cuts despite strong Q2 GDP numbers. With inflation at historic lows and growth expected to moderate in H2, the central bank may deliver one additional 25 basis point cut in December 2025, bringing the policy repo rate to 5.25%.

India's economy has demonstrated remarkable resilience in Q2 FY26, delivering an 8.2% real GDP growth that reflects broad-based strength across manufacturing, services, and consumption components. The acceleration in private consumption to 7.9%, coupled with the transformative impact of GST 2.0 rationalization, suggests that domestic demand will remain the primary engine of growth through FY27.

However, the peculiarly narrow gap between nominal and real GDP growth, collapsing inflation, and limited pricing power raise important questions about the sustainability and depth of this expansion. While headline growth appears robust, the underlying inflation compression and deflation in wholesale prices hint at demand constraints and corporate margin pressures that could eventually throttle investment and employment creation.

For policymakers and businesses, the strategic imperative is clear: leverage the window of strong consumption growth and accommodative monetary conditions to undertake structural reforms, bolster private investment, and create sustainable job growth. The Q2 FY26 beat represents an exceptional quarter, but translating this into sustained medium-term expansion requires vigilant attention to demand dynamics, pricing pressures, and the execution of India's growth transformation agenda.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart