by Siddharth Singh Bhaisora

Published On Nov. 9, 2025

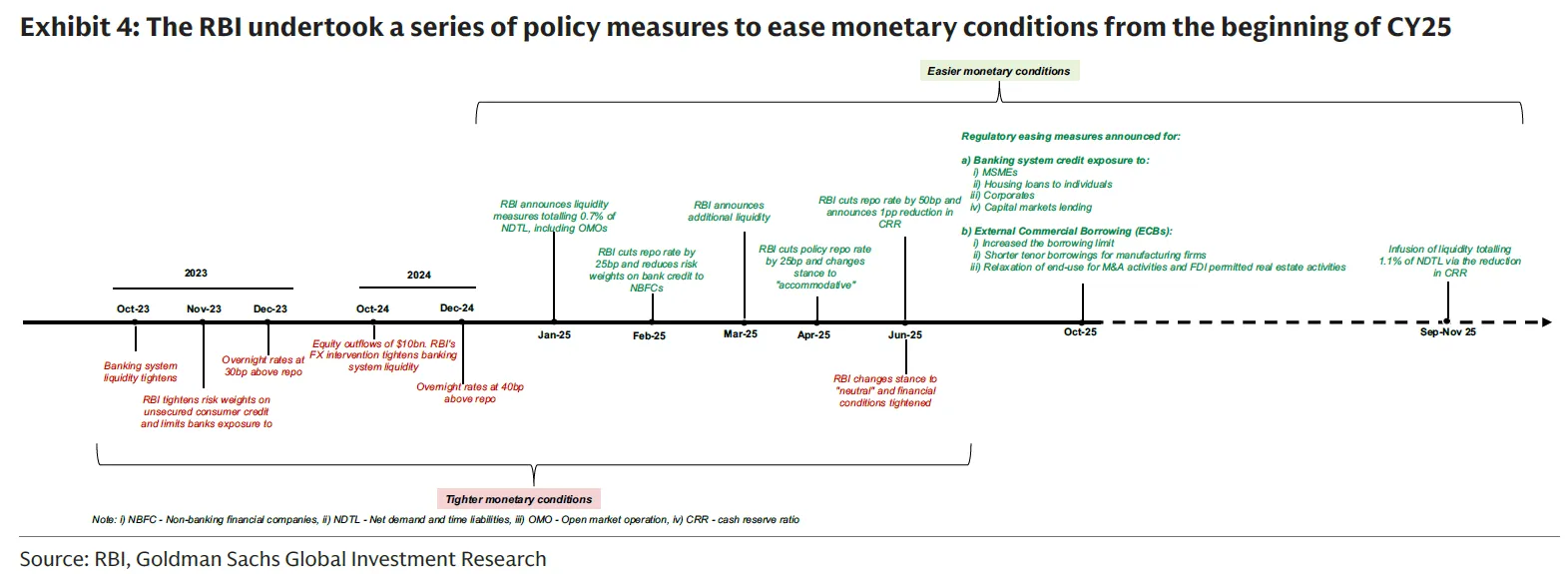

India’s financial system has just crossed an inflection point. There has been a simultaneous easing in monetary policy, liquidity, and deregulation, effectively a “triple transmission” to credit supply. After an extended period of tight conditions through 2024, RBI cut policy rates by a cumulative 1% in 2025, injected liquidity (including a phased 1 percentage point reduction in the cash reserve ratio), and unveiled sweeping, growth-friendly recalibrations to capital and external borrowing regulations.

The investment implication is straightforward but powerful. The financial sector’s earnings cycle likely troughs in FY26 and accelerates into CY26–CY28 as loan growth normalizes, funding costs fall, and risk-weighted assets lighten - while equity valuations remain only mid-cycle. For long term investors, Indian Financials could be entering a rally on the back of the deregulation dividend.

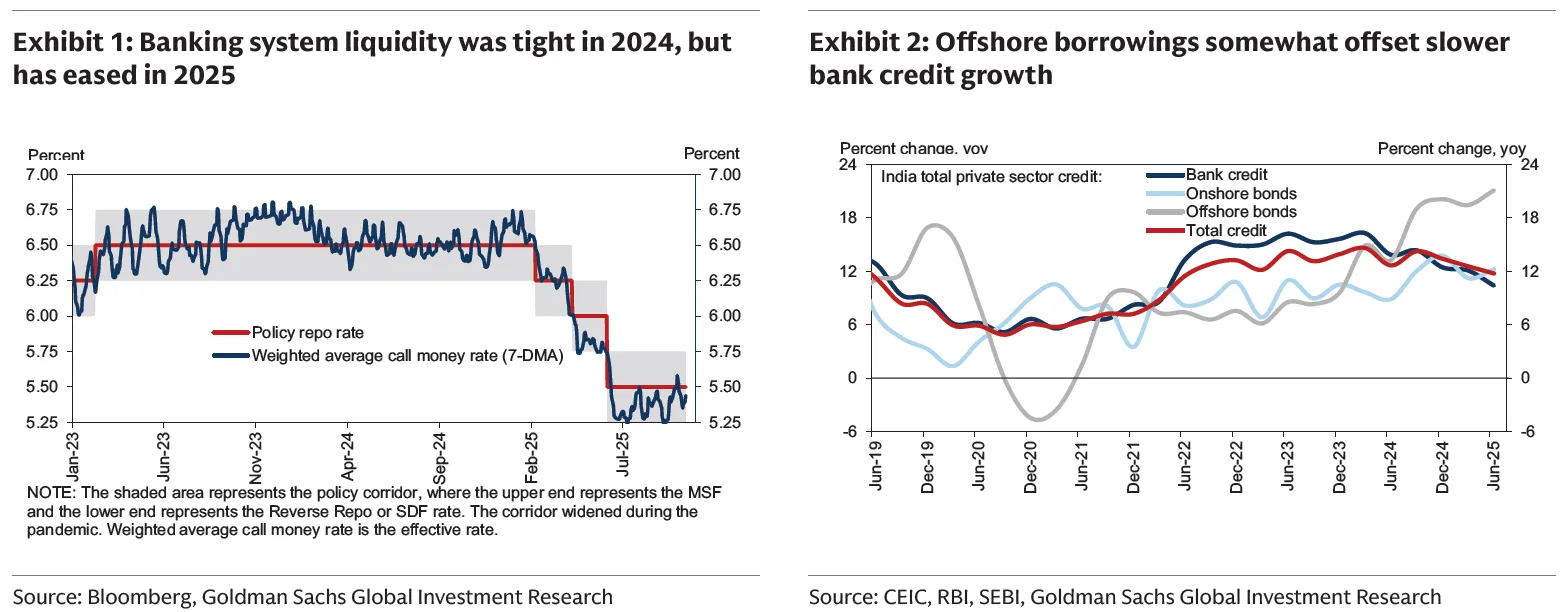

In 2024, India’s financial conditions tightened meaningfully. The policy repo rate was held at 6.50%, ex-post real rates hovered near 1.5%, macro-prudential curbs throttled unsecured retail credit, and liquidity scarcity pushed overnight funding rates well above the policy rate. Deposit growth slowed, and banks’ marginal cost of funds stayed sticky. Credit transmission, always lagged, consequently bit into growth.

There are 3 levers that moved together in 2025:

Rates: The RBI executed the fastest non-crisis easing cycle since the GFC, cutting policy rates by 1% during 2025.

Liquidity: A 1-pp CRR cut (phased across Sep to Nov 2025) released system liquidity roughly equal to 1.1% of NDTL, lowering wholesale funding costs.

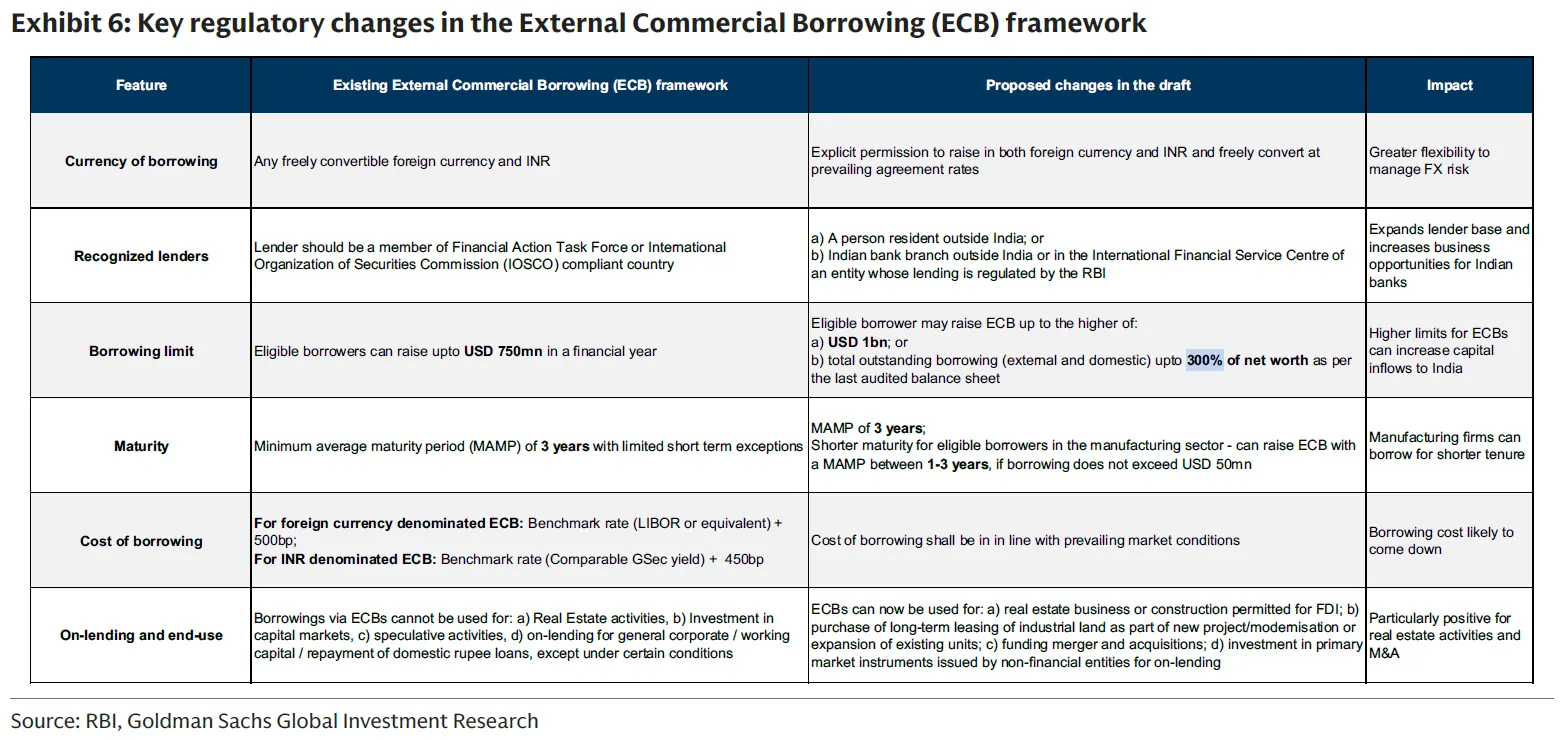

Regulation: The RBI sequenced capital-lightening measures lower risk weights across MSME, housing, high-quality corporate/project finance, and bank credit-card receivables plus relaxed ECB norms, collectively estimated to reduce banking-system capital needs by ~2 percentage points of total bank credit when fully effective (most provisions in FY27).

The marginal cost of creating a rupee of credit is falling via both price (policy rate, liquidity) and capital channels. That sets up a rebound in total private-sector credit as 2026 unfolds, with the growth impulse felt more decisively from 2H FY26 and strengthening into FY27–FY28.

Bank lending is constrained by both funding and capital. In 2025, the RBI’s capital-easing decisions reduced risk weights in targeted segments and introduced glide-paths for expected-credit-loss adoption. The cumulative effect is to free up capital equivalent to ~2% of system credit, enabling banks to either redeploy into higher-spread assets or narrow pricing to gain share, without diluting capital ratios. For investors, that means better lending-deposit spreads and higher risk-adjusted volume growth even if headline NIMs drift lower in early cut-cycles.

The CRR cut and open-market operations stabilize short-end rates closer to policy, lowering the marginal cost of liabilities. With transmission lags, asset yields reprice faster than liabilities on the way down; but as the cycle matures and deposit rates reset, structural funding cost falls. Combined with capital relief, this improves PPOP resilience and cushions PAT through the transition.

The proposed ECB framework expands lender eligibility, lifts borrowing limits (to the higher of USD 1bn or 300% of net worth including domestic plus external debt), permits shorter tenors for manufacturers (1–3 years up to USD 50mn), and relaxes end-use for activities like FDI-permitted real estate and M&A. The policy intent is clear: keep the total cost of capital competitive and reduce the crowding-out of bank balance sheets by allowing NBFCs and corporates to tap offshore funding when domestic liquidity tightens. In 2024, ECB inflows accelerated to a 9-year high, especially for on-lending, cushioning total private-sector credit even as bank credit growth slowed. The 2025 rule updates formalize that safety valve.

Supply-side constraints are easing decisively. The remaining question is borrower demand. External headwinds higher U.S. tariffs on Indian exports, tighter U.S. visa costs affecting IT services, and global uncertainty could temper corporate appetite. But the domestic supports are mounting: a near-complete rate-cutting cycle, improving real incomes alongside pro-consumption fiscal tweaks, and a progressive normalization in retail asset-quality.

Retail credit excesses post-pandemic especially in unsecured and microfinance prompted RBI’s 2023–24 tightening. The consequence was a visible slowdown: unsecured credit growth decelerated from 26% YoY (Nov 2023) to 8% (Aug 2025); microfinance swung from +27% (Mar 2024) to −17% (Jun 2025). These brakes, while painful, did their job: PAR ratios have stabilized or improved across key categories, and lenders recalibrated underwriting and growth. The asset-quality cycle thus looks past peak, allowing earnings to refocus on growth rather than provisions.

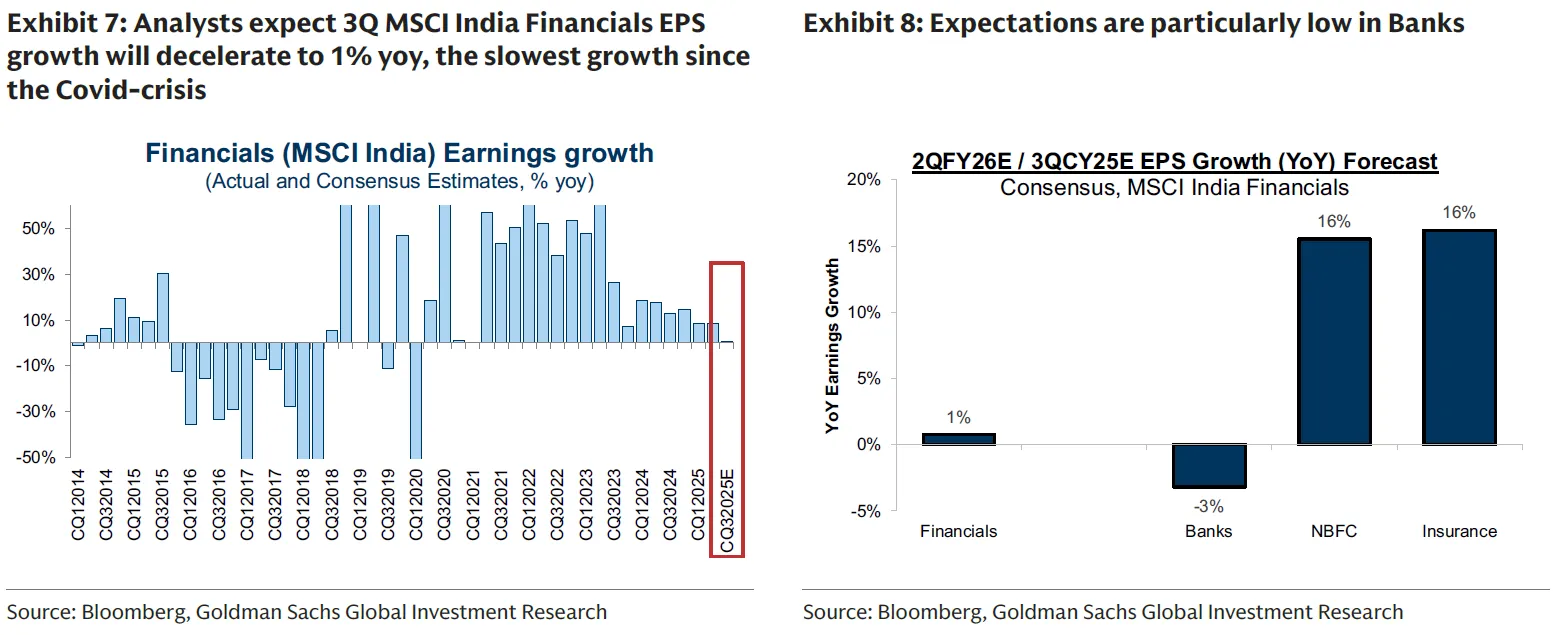

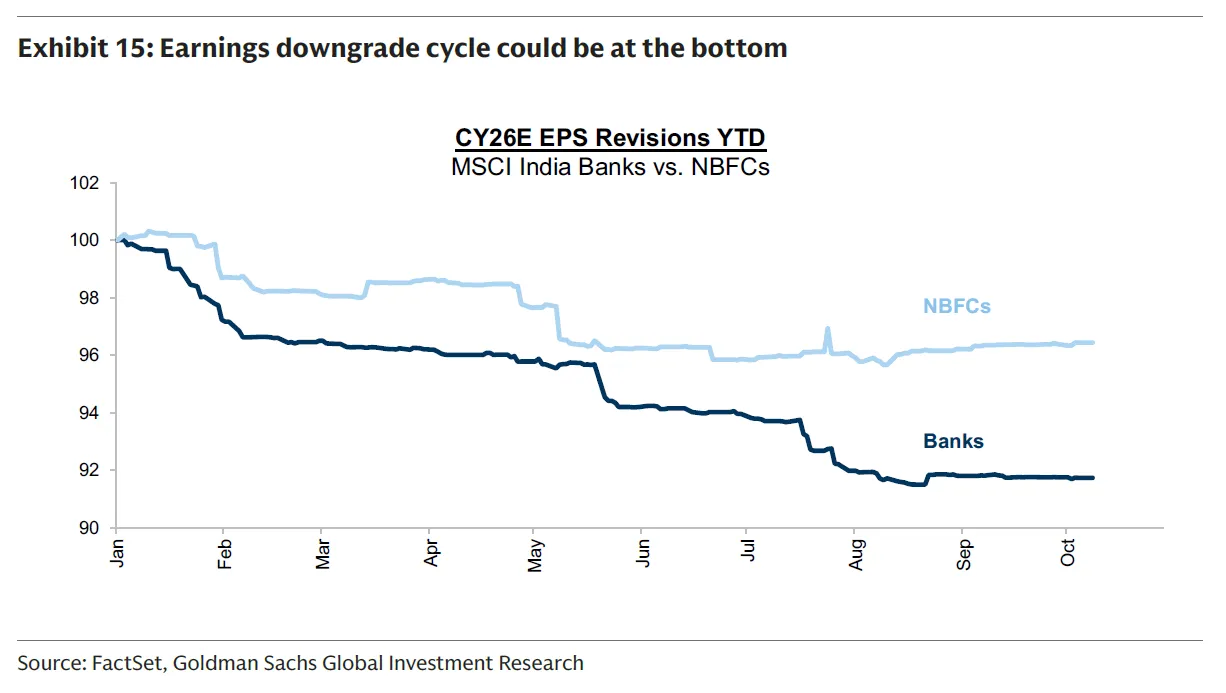

Into 2Q FY26, analysts cut Financials’ EPS to near-pandemic lows +1% YoY for Financials and −3% YoY for Banks amid worries on NIM compression, slower credit growth (~10% in Aug 2025), and higher credit costs in select segments.

RBI appears to be nearing the end of its current easing cycle, which lowers the forward drag on NIMs as deposit costs begin to roll down with a lag and lending spreads stabilize. In other words, rate-cut headwinds give way to transmission tailwinds, a typical inflection point for bank earnings power. 2025 has seen the steepest earnings revisions downward in 5 years.

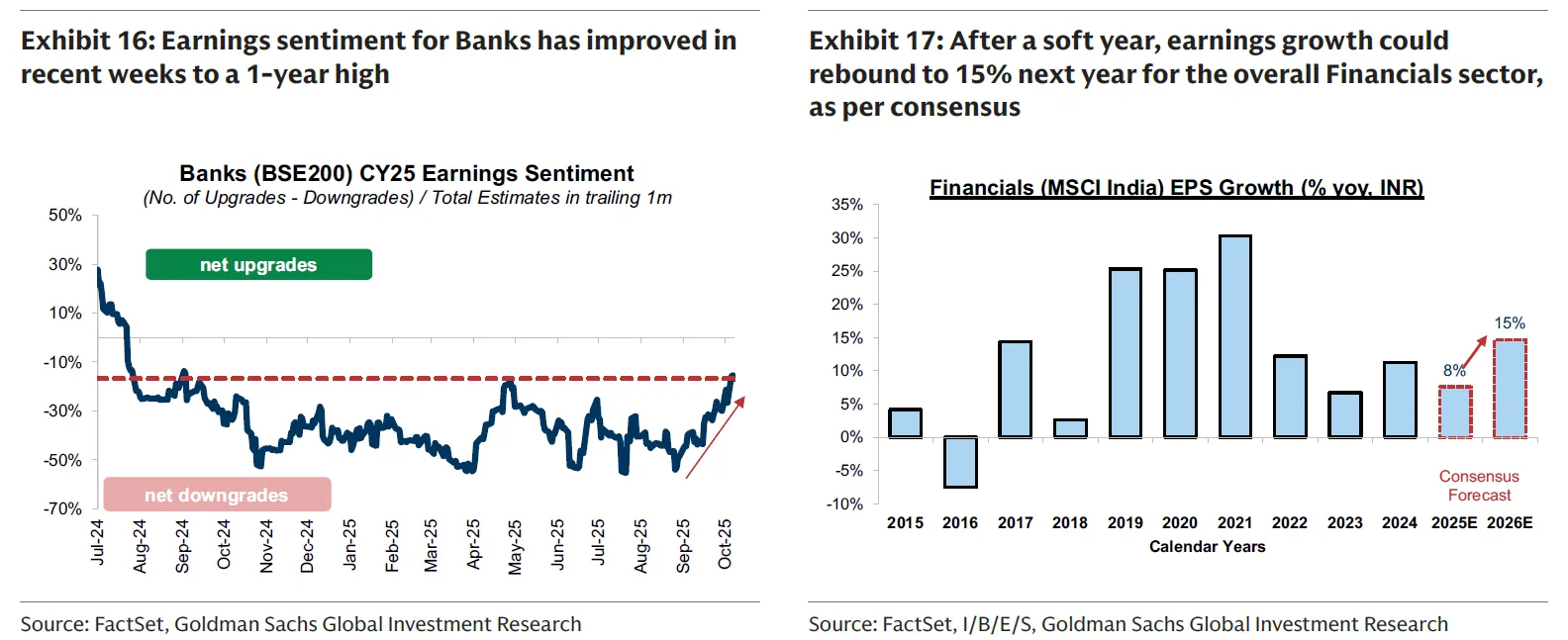

NBFC earnings revisions have stabilized since mid-year as asset quality has steadied, and earnings sentiment for banks has improved to a one-year high, indicating fewer net downgrades. From an economist–investor lens, that shift matters because credit cycles typically bottom when funding conditions ease and forward-looking loss expectations stop deteriorating.

Pro-consumption fiscal measures add a modest boost to demand at exactly the moment when monetary policy turns less binding. For lenders, that means origination volumes can recover into 2H FY26 as household cash-flows and confidence improve again, a classic sequencing in which fiscal support amplifies monetary easing rather than fights it.

Earnings sentiment for banks has already rebounded to a 1-year high, and consensus now expects sector profits to accelerate from +8% in CY25E to +15% in CY26E as credit growth normalizes and asset quality steadies.

On the volume side, the 6 largest banks roughly 63% of system credit are expected to see aggregate loan growth stabilize around 10.4% in 2QFY26E, tick up by ~70 bps by FY26-end, and then grind toward ~13% by FY27–FY28. That path is consistent with the macro sequencing above: demand responding with a lag to easier money and friendlier regulation. For equity holders, this is the “early-cycle” phase in which earnings revisions turn, but multiples are not yet stretched.

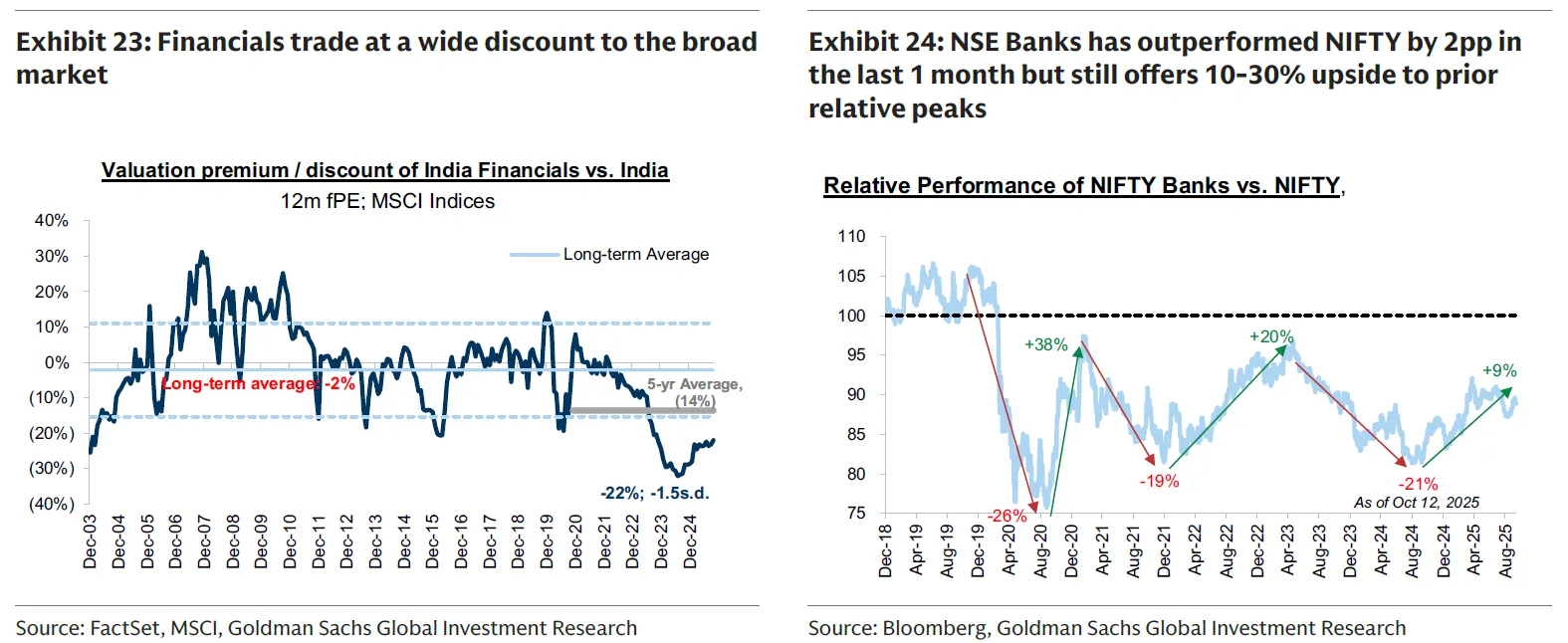

Tactically, the set-up favors banks over the broader market. The NSEBANK index has outperformed NIFTY by about 2 percentage points over the past month but still offers material headroom: roughly 11% to reclaim the 2023 relative peak and 34% to the 2019 peak. Relative valuations versus MSCI India remain appealing: MSCI India Financials trade at a ~22% discount about 1.5 standard deviations below the historical average leaving room for multiple normalization if earnings keep surprising on the upside.

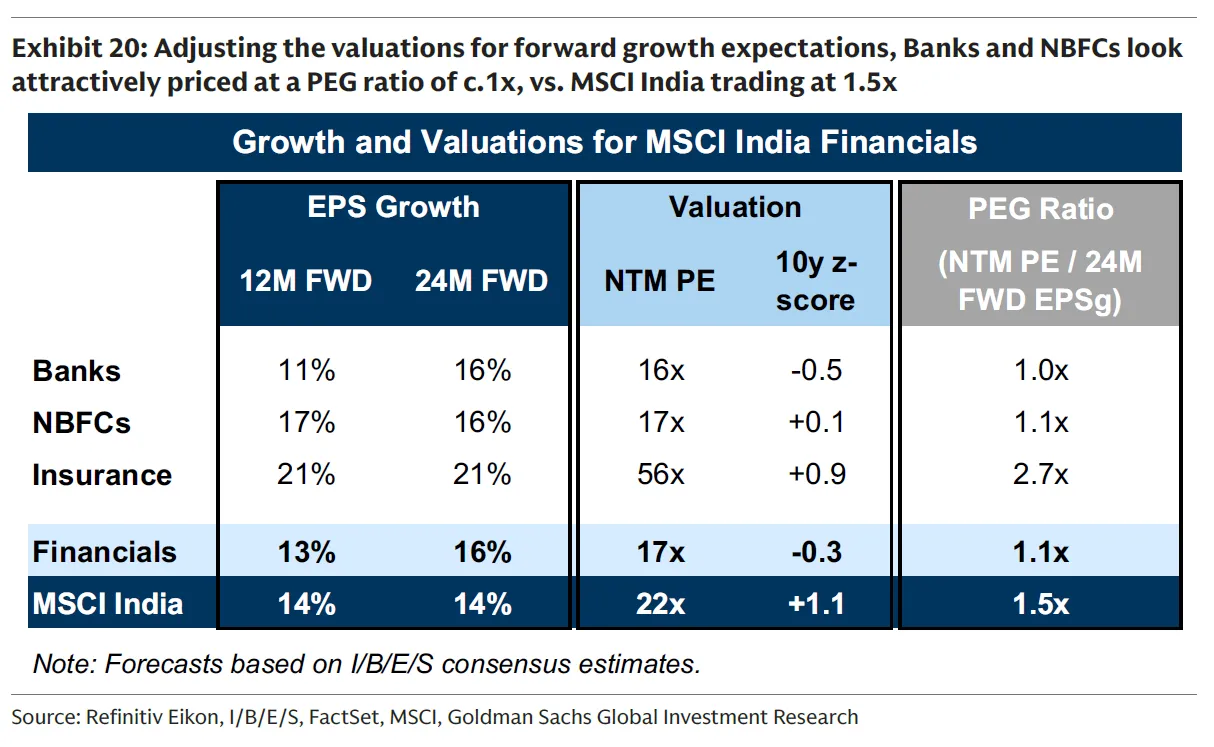

Despite the improving forward earnings picture, the sector trades at ~17× forward earnings below the ~19× five-year average and close to its long-run mean since 2004 (≈16.9×). Adjusted for growth, Banks and NBFCs screen on a PEG of ~1×, versus ~1.5× for MSCI India, implying investors are not paying a premium for the expected re-acceleration in profits.Financials is sitting at a 10-year NTM PE z-score of −0.3, i.e., slightly below mid-cycle.

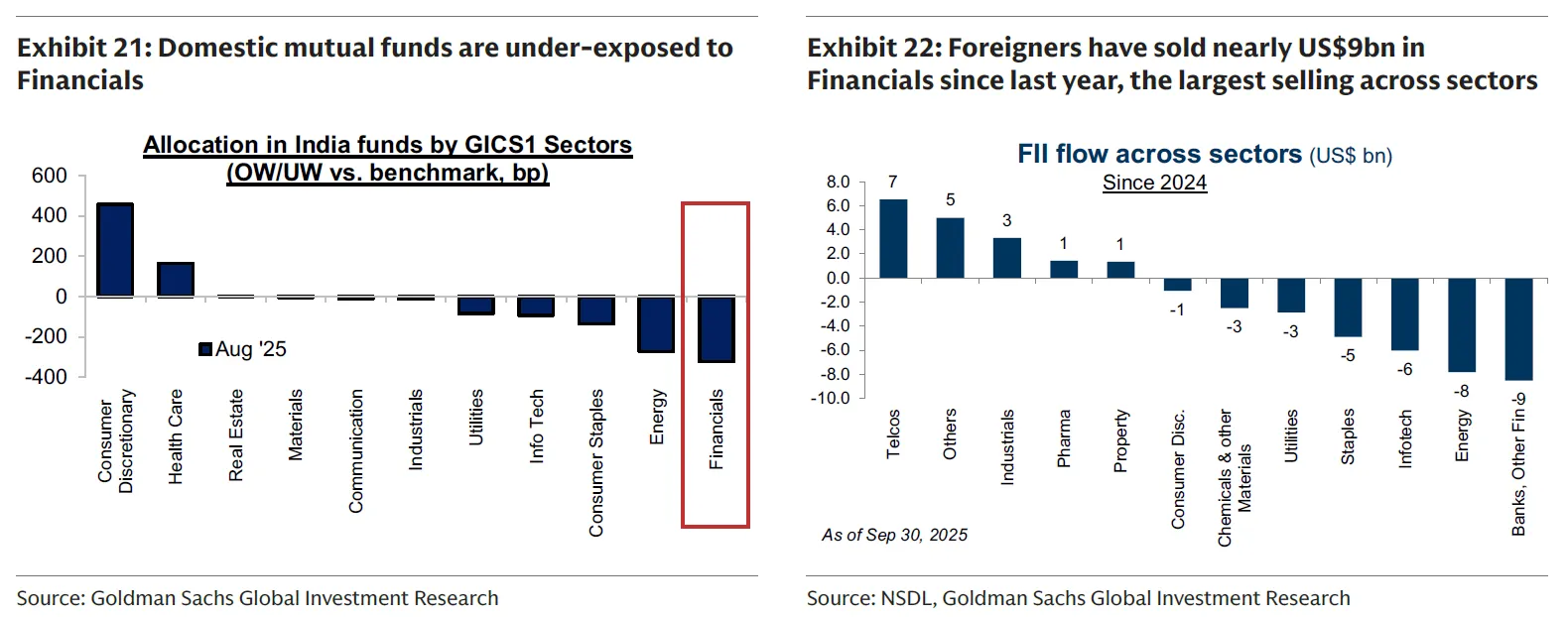

Active domestic equity funds are ~2% underweight Financials relative to benchmarks, and foreign investors have been heavy net sellers about US$9 bn of outflows since last year, the largest across sectors. Under-ownership creates incremental demand for a sector once revisions improve and macro conditions become less adversarial.

What makes this cycle attractive is not just the direction but the order of changes. The RBI first stabilized the system (2024), then cut rates and added liquidity (early–mid 2025), and only then re-optimized capital rules and external funding channels (late 2025, with full effect in FY27). That sequencing reduces tail risks and promotes a durable rather than sugar-high recovery in credit.

3 margin levers should shape FY26–FY28:

Funding Cost Normalization: As time deposits reprice down with a lag and liquidity conditions stay easier post-CRR cut, banks/NBFCs’ blended cost falls.

RWA-Efficient Growth Mix: Lower risk weights in MSME/housing/high-grade corporate allow lenders to grow assets with less capital drag, increasing ROE at a given NIM.

Non-Interest Income: Recovery in origination volumes, payments, distribution (insurance/mutual funds), and capital-markets intermediation helped by the extended scope for capital-market lending adds fee ballast.

Net-net, the cycle can sustain PPOP stabilization in FY26 and a PAT uptrend into FY27 even if headline NIMs don’t expand dramatically in early CY26.

India’s financials are shifting from a world constrained by capital and liquidity to one where capital, liquidity, and regulation are aligned with growth. In that world, banks and high-quality NBFCs should compound earnings in the mid-teens, with ROE protected by lower RWA density and steadier credit costs.

Assuming macro headwinds do not intensify and the policy path stays on track, the deregulation dividend for India’s banking system is both real and investable and, crucially, not yet fully priced.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart