by Siddharth Singh Bhaisora

Published On May 4, 2025

While India is now the world’s third-largest automobile market, its EV ecosystem is still in its adolescence — which makes it an important place to capture market share and grow a brand. Domestic players like Ola Electric and Ather Energy are battling financial losses, governance scrutiny, and increasing consumer expectations. Against this backdrop, India’s stance on foreign entrants is both a reflection of self-reliance goals and the need to balance innovation with protectionism - especially as the world is facing an increasing trade barrier environment.

The EV market itself is poised for tremendous growth. Government incentives, improving charging infrastructure, and rising fuel costs are accelerating the shift to electric mobility. Industry forecasts project India’s EV two-wheeler sales to grow at a 30–40% CAGR in the next few years, crossing the 1 million units/year mark and moving toward mass adoption.

Gensol-BluSmart fraud episode revealed how governance failures can derail even the most exciting EV ventures, prompting calls for tighter oversight as more startups tap public funding. Global players like Tesla and BYD are eager to stake their claim in India, but they must contend with India’s policy priorities and geopolitical tensions & trade wars. While, domestic players like Tata & Mahindra are expanding investments. With Ather's upcoming IPO, this is a good time to deep dive into this sector & see what's happening!

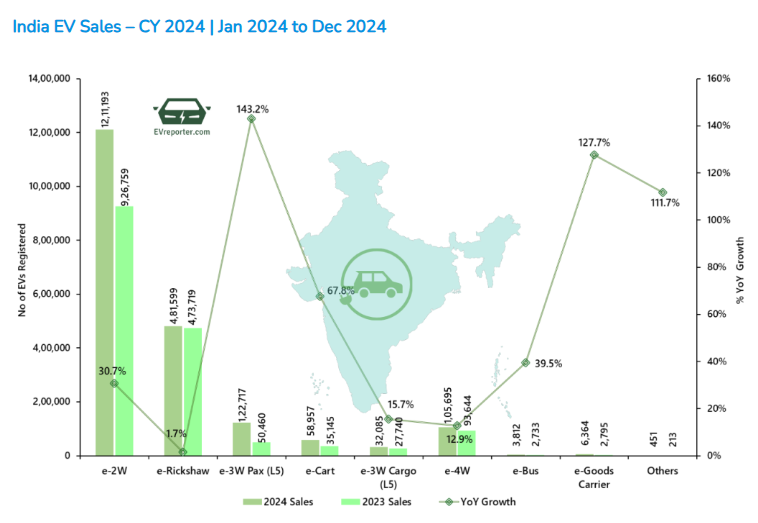

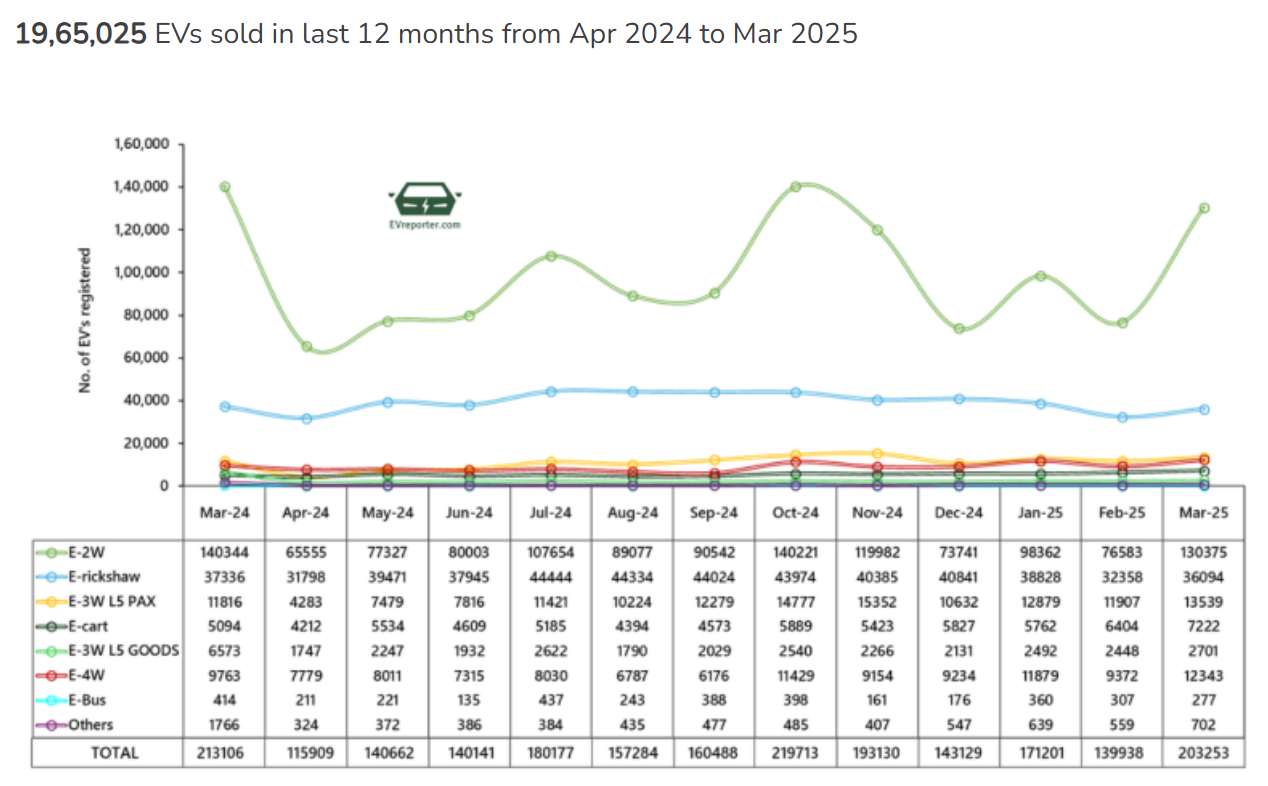

India’s electric vehicle market recorded its highest-ever annual sales in 2024, crossing the 2 million-unit mark for the first time. A total of 2,022,873 EVs were sold, reflecting a 25.4% year-on-year growth over 2023’s 1.61 million units. EVs made up 7.7% of India’s total automobile sales in 2024, showing steady progress toward broader adoption.

This growth is in line with global EV momentum. Globally, 17.1 million EVs (BEVs + PHEVs) were sold in 2024, a 25% increase over 2023. While China led the charge with 11 million EV sales (+40% YoY), India stood out as a unique emerging market driven not by four-wheelers but by two- and three-wheelers.

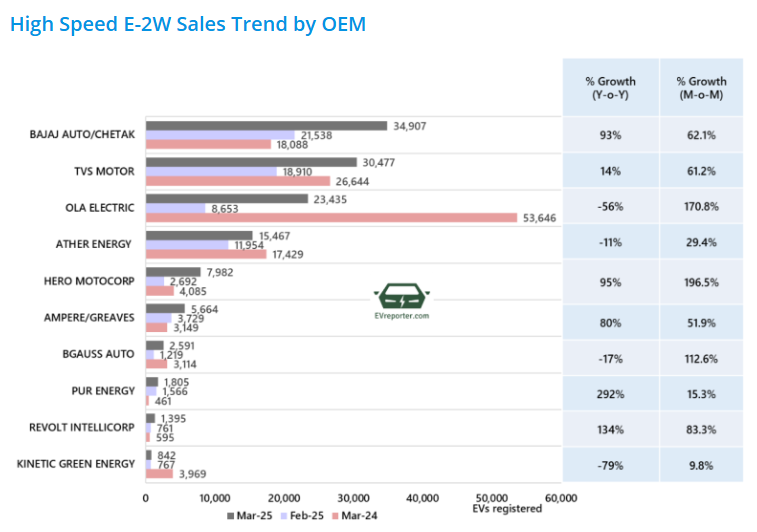

High-speed e-2Ws dominated the market, with Ola Electric leading the segment (427,206 units sold, +49.5% YoY). Its market share climbed to 35.3%, followed by TVS, Bajaj, and Ather, which each crossed 100,000 units.

| Vehicle Segment | Units Sold | YoY Growth | % Share of EV Market |

|---|---|---|---|

| e-2W | 1,211,193 | +30.7% | 59.9% |

| e-Rickshaw | 481,599 | +1.7% | 23.8% |

| e-3W (Passenger) | 59,460 | +143.2% | 2.9% |

| e-3W (Cargo) | 27,440 | +15.7% | 1.4% |

| e-Cart | 58,957 | +15.7% | 2.9% |

| e-4W (Cars) | 105,695 | +12.9% | 5.2% |

| e-Goods Carrier | 3,654 | +127.7% | — |

| e-Buses | 3,812 | +39.5% | — |

The data shows robust EV penetration in the 3W segment, especially cargo (24.2%) and passenger (20.8%), where operational cost savings drive faster adoption. In contrast, electric 4W penetration remains at 2.5%, though rising steadily.

| Vehicle Category | EV Penetration (2024) | 2023 | 2022 |

|---|---|---|---|

| 2-Wheelers | 6.2% | 5.1% | 4.0% |

| 3W - Passenger (L5M) | 20.8% | 9.6% | 7.0% |

| 3W - Cargo (L5N) | 24.2% | 22% | 17% |

| 4-Wheelers | 2.5% | 2.1% | 1.5% |

India is now among the top five EV markets globally by volume, with a model completely different from the West. Its two-wheeler-first approach gives it an edge in urban mobility and affordability — something global players like Tesla or BYD struggle to adapt to due to their premium positioning and tariff restrictions.

| Market | 2024 EV Sales | YoY Growth | Notes |

|---|---|---|---|

| China | 11 million | +40% | Dominated by BYD; 1.3M in Dec alone |

| Europe | ~3.8 million | -5.9% | Stabilized; UK overtakes Germany |

| US + Canada | ~2.1 million | +9% | Driven by tax credits, EPA standards |

| India | 2 million+ | +25.4% | Two-wheeler led, price-sensitive market |

| RoW | ~1.2–1.5 million | +26.4% | ASEAN, LATAM, and Africa emerging fast |

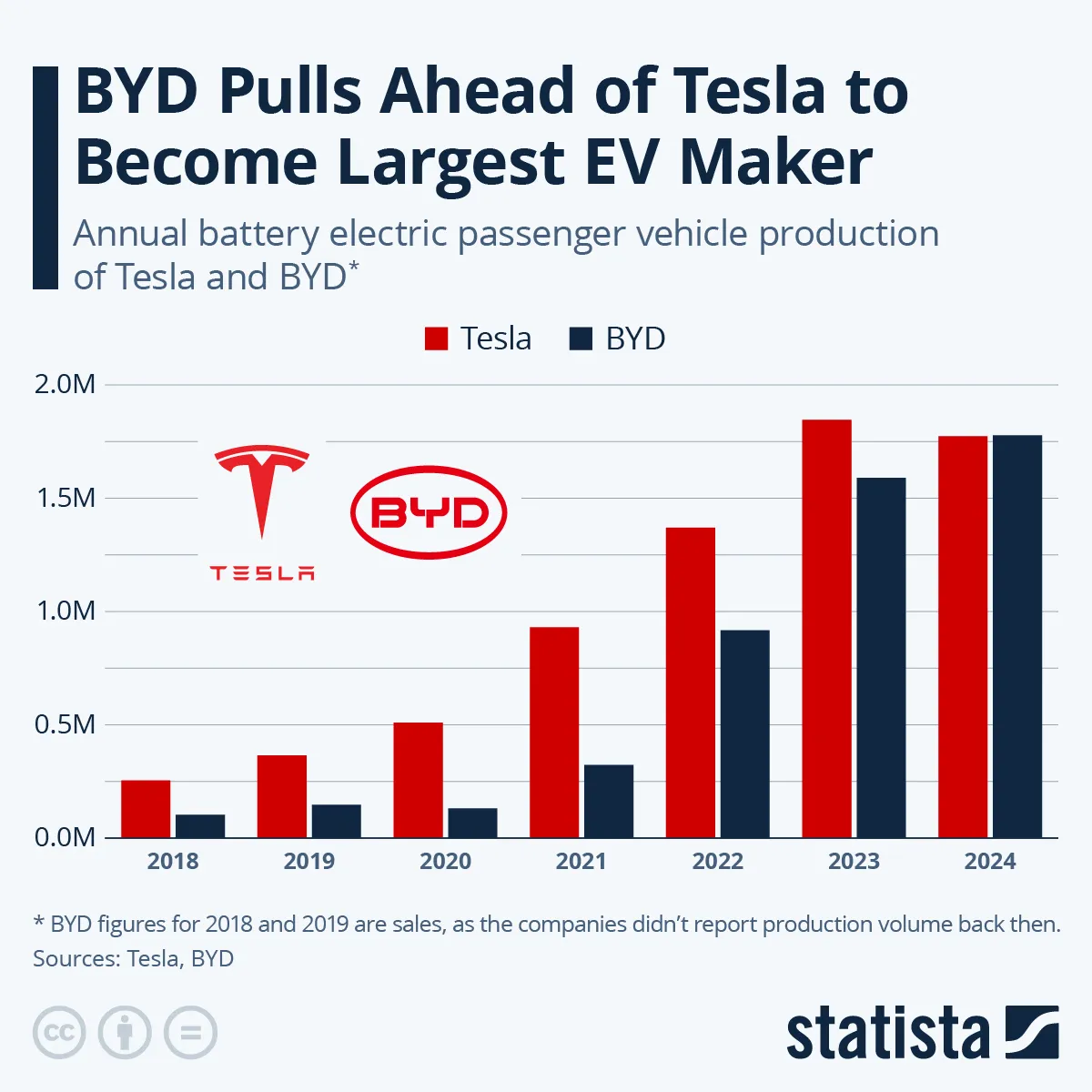

BYD has already taken over Tesla’s sales numbers.

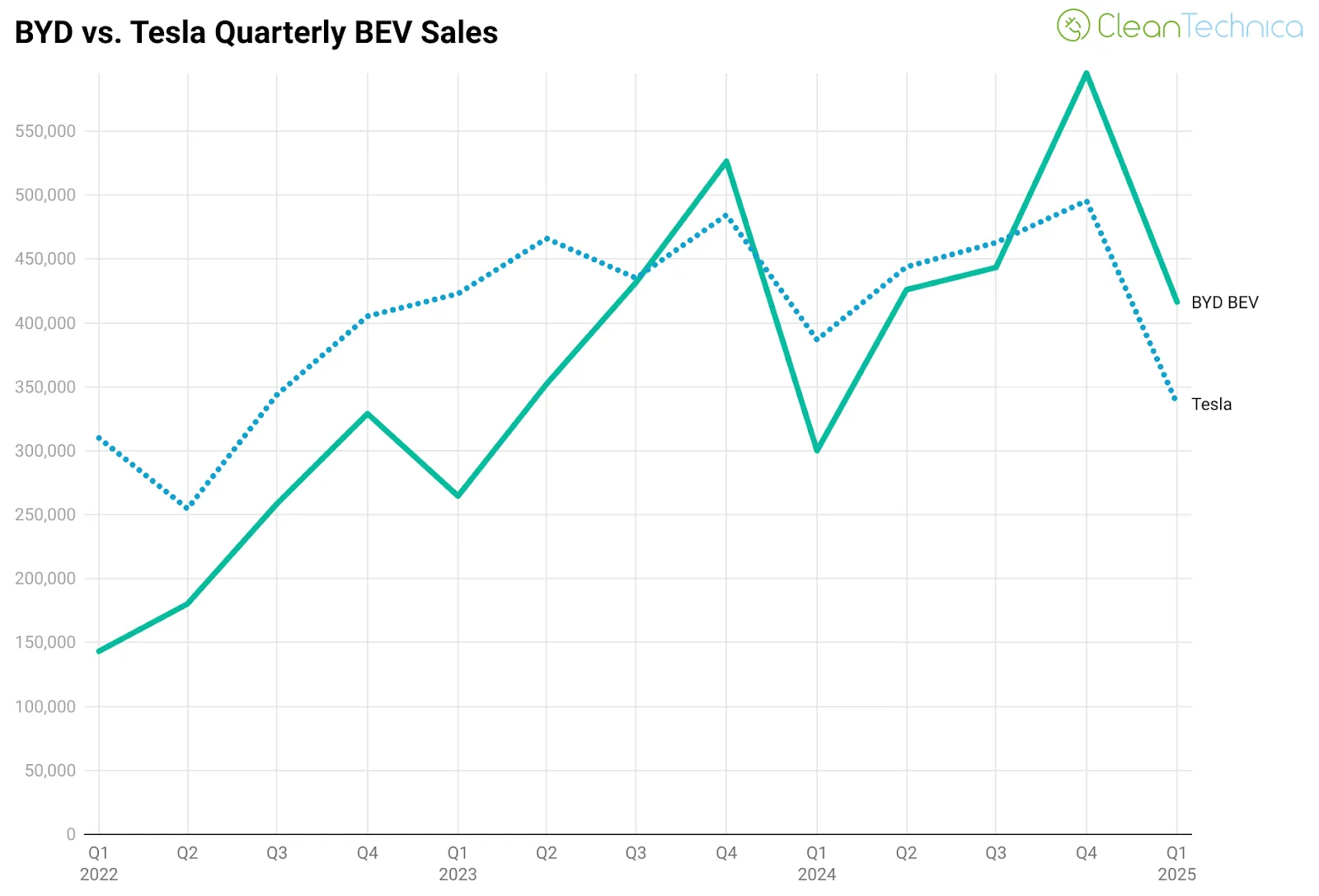

After years of on-and-off courtship, Elon Musk renewed focus on India as “a very hot market”, but 100% import tariffs on fully built cars remain a critical sticking point. Tesla’s Chief Financial Officer noted that duties double the price of imported Teslas – a Model Y shipped at $46,000 ends up effectively $92,000 – making Indian consumers “feel they’re paying too much”. These steep levies, among the world’s highest, have deterred Tesla in the past and continue to make the company “very careful” about timing an official launch. There are signs of progress: in early 2025 Tesla finally secured showroom spaces in New Delhi and Mumbai and began hiring for operations. It also imported sample vehicles for homologation tests and initiated talks to source components locally (including a potential partnership with Tata Group).

Moreover, India and the U.S. opened discussions on lowering automotive trade barriers. Prime Minister Modi’s government has been negotiating a deal that could trim tariffs, though not eliminate them entirely. India is unlikely to drop duties to zero immediately given fierce opposition from domestic automakers like Tata Motors and Mahindra, which fear losing home-market share to Tesla’s high-end EVs. Musk has floated a $2–3 billion investment (including a local assembly plant) if import conditions improve, nearly announcing it during a planned India trip last year before talks fell through. Geopolitical and internal dynamics also color Tesla’s India push. Notably, former U.S. President Donald Trump publicly criticized Musk’s India ambitions, arguing that building a Tesla factory in India would be “unfair” due to India’s tariff regime and calling it “impossible to sell a car” there under current terms.

Period | Sales |

Q1 2025 | 336,681 |

Q4 2024 | 495,570 |

Q3 2024 | 462,890 |

Q2 2024 | 443,956 |

Q1 2024 | 386,810 |

Q4 2023 | 484,507 |

Q3 2023 | 435,059 |

Q2 2023 | 466,140 |

Q1 2023 | 422,875 |

Q4 2022 | 405,278 |

Q3 2022 | 343,830 |

Q2 2022 | 254,695 |

Q1 2022 | 310,048 |

Additionally, Tesla’s global business in 2025 is under stress – first-quarter net profit plunged 71% amid softer demand and price cuts. Musk’s attention is split among his ventures (from SpaceX to running social media platform X), raising questions about bandwidth to execute an India strategy. Despite these challenges, the sheer size of the Indian auto market (now the world’s 3rd largest) and its nascent luxury EV segment make it a prize Tesla cannot ignore. The company’s calibrated approach – lobbying for tariff relief while laying groundwork with minimal commitment – indicates that Musk is playing a long game. If trade talks between Washington and New Delhi bear fruit, 2025 could finally see Teslas on Indian roads, but on terms that Tesla deems viable for its bottom line.

BYD’s rapid global expansion has raised both admiration and alarm. Backed by significant Chinese state support, BYD has grown into one of the world’s largest EV makers, selling 4.3 million new energy vehicles globally in 2024 alone. Its strategy of aggressive international expansion – from massive “megafactories” at home to forays into Europe, Southeast Asia, and Latin America – has positioned BYD as the standard-bearer of China’s EV push. However, this rise has not been without pushback. In Europe, regulators launched anti-subsidy probes amid concerns that Chinese EVs (BYD included) benefit from unfair government support and could undercut local manufacturers. The EU is weighing tariffs that could add ~17–35% on Chinese-made electric cars to level the playing field. However, with USA’s global trade war, China & Europe could be making bilateral treaties to reduce tariffs between them - even in EV.

In India, BYD’s ambitions have run headlong into geopolitical barriers. The company made an audacious proposal in 2022 for a $1 billion joint venture factory with a local partner to produce EVs. But by mid-2023, the Indian government rejected BYD’s plan on national security grounds, exercising a policy that mandates scrutiny of Chinese investments.

This stance has effectively put BYD at a red light in the Indian market. BYD’s presence in India is currently limited to a token import business. The company sold only 3,500 cars in India in 2024, a negligible figure (less than 0.1% of its global sales) comprising models like the Atto 3 electric SUV. Without government clearance, BYD cannot scale up local manufacturing or investments, leaving it unable to compete on price in a tariff-protected market.

While Chinese EV makers dominate global volumes and drive prices down, India is erecting barriers to ensure its EV transition isn’t dependent on Chinese companies. This reflects a broader industrial policy to nurture domestic EV capabilities (and non-Chinese alliances) in the interest of supply chain security. BYD thus faces a paradox – booming success globally but a shut door in India. To overcome this, it may need to bide its time and diplomatically convince Indian authorities that it will “play by the rules of the game”, possibly via smaller partnerships or technology sharing without direct investment. Until then, India remains one of the few major markets where BYD’s electric revolution is kept at bay.

Ola Electric, Ather’s chief domestic rival, offers a contrasting story of rapid scale and market dominance coupled with volatility in investor sentiment. Ola Electric went public in August 2024 amid tremendous buzz – the IPO was priced at ₹76 per share and saw a strong debut, with the stock jumping 20% on listing day. In FY2024, Ola Electric sold 329,618 scooters, roughly 30–35% of all e-two-wheelers in India. By FY2025, it further grew sales even as overall market growth slowed.

However, Ola Electric’s post-IPO journey has been turbulent. The company’s fundamentals reveal heavy cash burn. In FY2024, revenue nearly doubled (Ola delivered over 3.29 lakh vehicles that year) and operating revenue jumped ~90%, yet net loss widened slightly to ₹1,584 crore. By the first 9 months of FY2025, Ola already logged a loss of ₹1,406 crore. These continued losses, despite scale, have raised concerns about the viability of Ola’s pricing and expansion strategy. Investor confidence, initially euphoric, began wavering as the reality of slim margins and intense competition set in, along with consumers reporting issues with their bikes, delays in repair, poor after sales service and many such issues.

Strategically, Ola Electric is making bold moves to sustain its leadership. A cornerstone of its plan is vertical integration in battery technology. Ola is one of the few Indian startups to invest in a local battery cell gigafactory – it secured a government PLI (Production-Linked Incentive) award for 20 GWh of advanced cell manufacturing capacity. If successful, this would make Ola Electric the first Indian EV firm to make its own cells at scale – a potential game-changer for cost reduction and supply chain independence. This complements Ola’s existing battery pack engineering; together, they aim to give Ola an edge in driving down the cost per km and mitigating risks from global battery supply disruptions. They are also expanding into electric motorcycles with launches coming up soon.

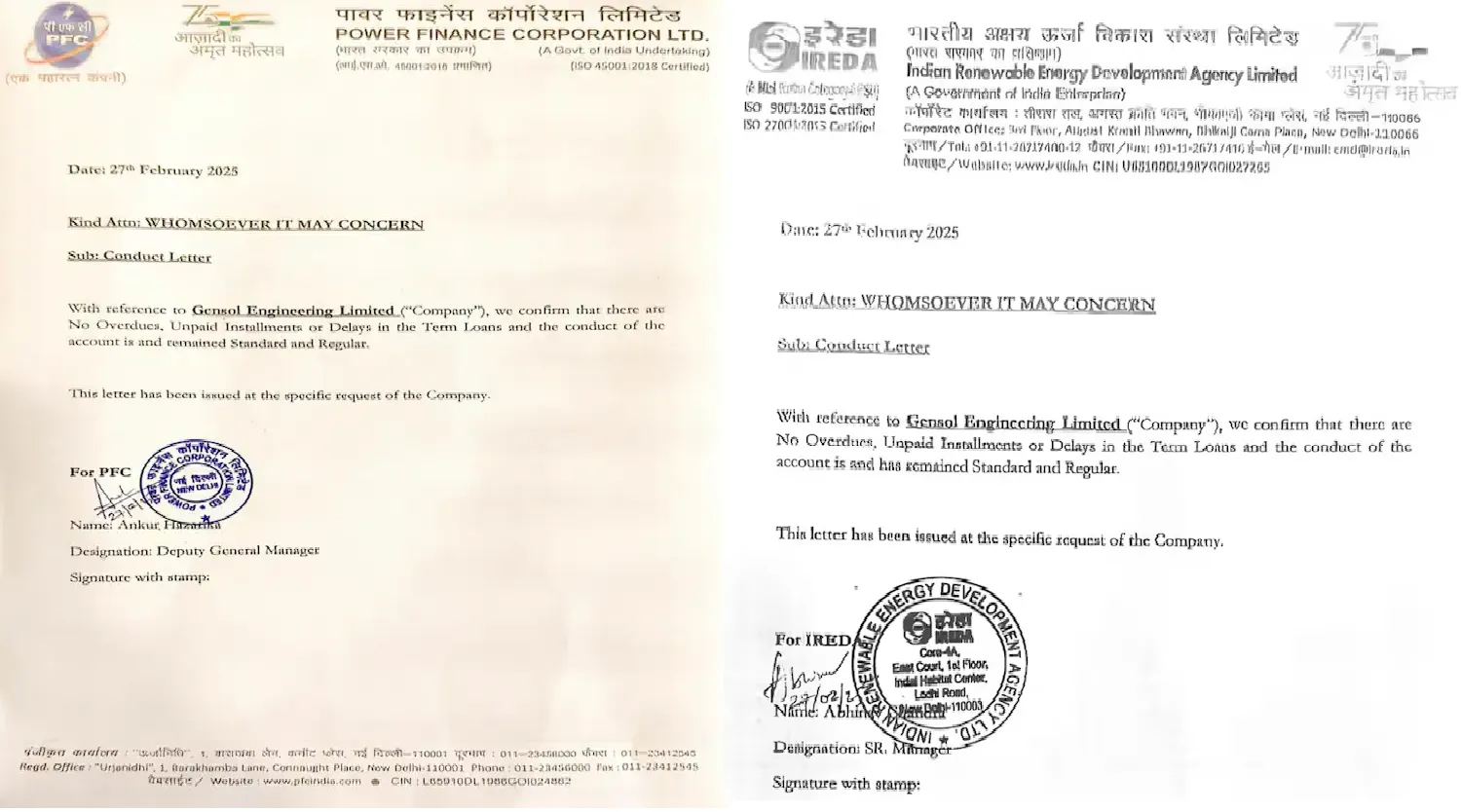

BluSmart, an all-electric ride-hailing service, suffered an abrupt collapse in early 2025 after its key backer, Gensol Engineering, became embroiled in a massive loan fraud scandal. SEBI found that Gensol’s promoters had treated the publicly-listed company as their “own piggy bank,”forging lender documents and diverting ₹975 crore in EV project loans into personal and related-party accounts.

An interim SEBI order in April 2025 barred Gensol’s founders (the Jaggi brothers) from the securities market, noting a “complete breakdown of internal controls and corporate governance” at the firm. Over ₹200 crore meant for purchasing electric cars was routed through a car dealership and siphoned off for personal luxuries like expensive real estate, in a fraud that was “plain vanilla” in its brazenness. The impact on BluSmart was immediate and devastating.

BluSmart had been one of India’s promising EV startups, operating a fleet of electric taxis across Delhi-NCR, Bengaluru, and Mumbai. But as the Gensol probe unfolded, BluSmart halted cab bookings entirely – stranding thousands of users and trapping their prepaid wallet balances. Investigations revealed that BluSmart’s growth had been propped up by Gensol’s misused funds, and by April 2025 the service had effectively shut down.

Customers were instructed on how to claim refunds for their Blu Wallet balances, as the company reportedly explored pivoting to a fleet partnership model instead of direct ride-hailing. The Ministry of Corporate Affairs also launched a suo motu inquiry into Gensol, given “prima facie findings” of fund diversion by its directors. This saga has become a cautionary tale, prompting investors to scrutinize startup governance more closely. It underscores the importance of financial transparency in the EV sector, where heavy capital needs and rapid expansion can tempt malfeasance. While BluSmart’s vision of electrified ride-sharing attracted significant funding, the fallout from Gensol’s fraud has left both companies in regulatory crosshairs and cast a shadow on India’s startup ecosystem.

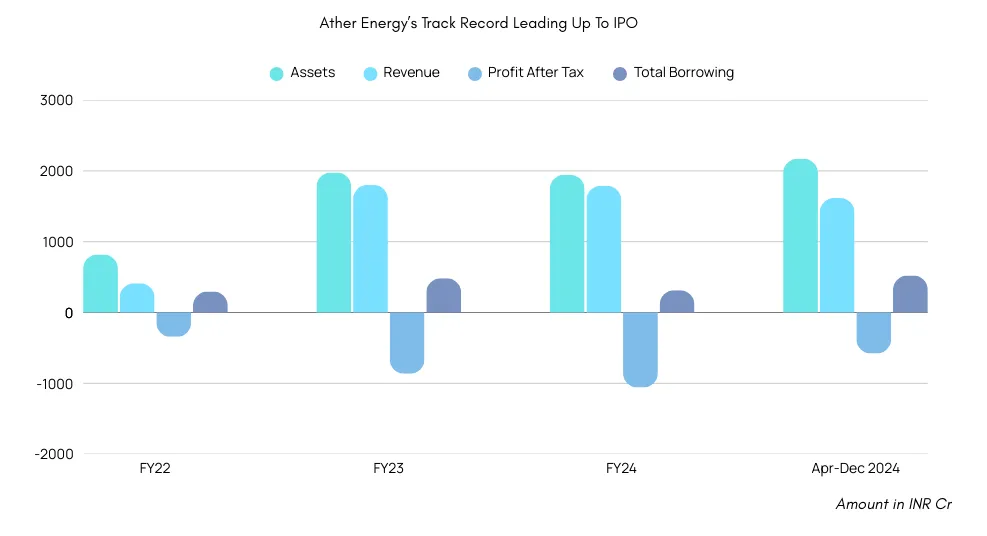

Ather Energy, one of India’s leading electric two-wheeler manufacturers, made headlines in April 2025 with its initial public offering (IPO). Known for its premium Ather 450X and 450S electric scooters – The IPO is expected to raise roughly ₹2,980 crore (about $360 million). Priced at ₹304–321 per share, the IPO valued Ather at a rich multiple of ~6 times sales, reflecting high investor expectations for growth.

As of FY2024, Ather held 11.5% share of India’s electric two-wheeler market – making it the third-largest EV scooter maker after Ola Electric and TVS – with over 109,000 units sold that year. Revenues have grown from just ₹408 crore in FY2022 to ₹1,780+ crore in FY2023, as EV adoption accelerates. However, Ather remains deeply in the red. In FY2024 it posted a net loss of roughly ₹710 crore, and even as revenue plateaued around ₹1,754 crore, the EBITDA margin was a negative 39%.

By the first 9 months of FY2025, losses continued (₹578 crore) albeit with some margin improvement. The company’s net worth has been eroding due to accumulated losses, making the infusion of IPO funds critical to shore up its balance sheet.

Ather’s IPO prospectus and analyst coverage painted a mixed picture. On one hand, the company is seen as a pioneer of India’s EV two-wheeler revolution, with strong R&D capabilities and an early-mover advantage in a market expected to grow exponentially. Management highlights upcoming products that could drive volumes and help achieve economies of scale. On the other hand, there is recognition that “the path to profitability is long and full of challenges”. To turn profitable, Ather must significantly ramp volumes, improve cost structures (especially battery costs), and withstand intense competition from both electric rivals and incumbent petrol scooter makers.

At its IPO pricing, some analysts felt the stock was overvalued. Ather’s implied valuation (~₹20,000 crore market cap) factors in optimistic growth and margin expansion that are far from guaranteed. Success for Ather will depend on how quickly it can convert IPO capital into new products, cost efficiencies, and market expansion before the competitive gap closes.

However, traditional two-wheeler companies like TVS Motor (with the iQube scooter) and Bajaj (with the Chetak) also pose competition, as do new entrants (Hero MotoCorp’s Vida, etc.). This competitive intensity is ultimately good for consumers and the government’s EV adoption targets, but it means no company can rest easy. Both Ola and Ather must navigate a delicate balance of growth and profitability in the coming years.

Traditional automakers—Tata Motors and Mahindra & Mahindra in the four-wheeler segment, and Bajaj Auto and TVS Motor in two-wheelers—are aggressively expanding their EV portfolios to compete with startups and global giants. Tata Motors leads the EV car market with over 60% share and is now scaling up with higher-end models. It is also investing in battery cell manufacturing through its group company to ensure cost control and supply security. Tata Group also has global supply agreements with Tesla.

Mahindra, a later entrant, is catching up rapidly with its Born Electric SUV lineup and powered by a major technology partnership with Volkswagen. Mahindra’s upcoming EVs are aimed at premium segments and global exports, and its investments in EV manufacturing, R&D, and supply chain localization.

In the two-wheeler space, Bajaj Auto and TVS Motor have successfully transitioned into leading EV players, rivaling early movers like Ola Electric and Ather Energy. Bajaj’s Chetak e-scooter, backed by brand nostalgia and a vast dealer network, surged in sales through 2024–25, making Bajaj the monthly market leader by early 2025. TVS, meanwhile, expanded its iQube lineup and launched the performance-oriented TVS X, establishing itself as a premium EV brand with broad market reach. Both firms are leveraging strong manufacturing capacity, R&D capabilities, and nationwide distribution to scale EV adoption, while also exploring exports and new segments like electric motorcycles and three-wheelers.

The next phase of India’s EV journey will hinge on how policymakers balance openness with protectionism, how startups manage growth with governance, and how the biggest names in mobility adapt to one of the most complex, high-potential markets in the world.

In four-wheelers, much will depend on how quickly companies like Tata (the current EV car leader), Mahindra, Tesla, and others bring compelling models to market at the right price. Policy support remains strong – from FAME subsidies to production incentives – but there is an increasing emphasis on local value addition (cells, components) and financial accountability for subsidy recipients, as seen by recent audits. Investors, both domestic and global, remain bullish on the EV space but with a discerning eye.

India aspires to be not just a large EV market but also a manufacturing hub and innovation center for EV and battery tech. The next 2–3 years will be crucial in determining whether today’s EV frontrunners can turn scale into sustainable profits and technological leadership:

2.5–3 million EV sales expected

Increased competition in 4W from Maruti, Hyundai, Mahindra

More local battery production, lower prices

Greater policy scrutiny on subsidies, localization

India’s role in the global EV shift will likely be defined not by scale alone, but by how it innovates around affordability, mobility needs, and domestic manufacturing. The Indian EV sector is maturing – turbulent at times, but ultimately moving forward on the road to electrification. Each crisis and breakthrough, from fraud crackdowns to IPO milestones, is shaping a more resilient ecosystem that will drive India’s green mobility revolution in the years to come.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart