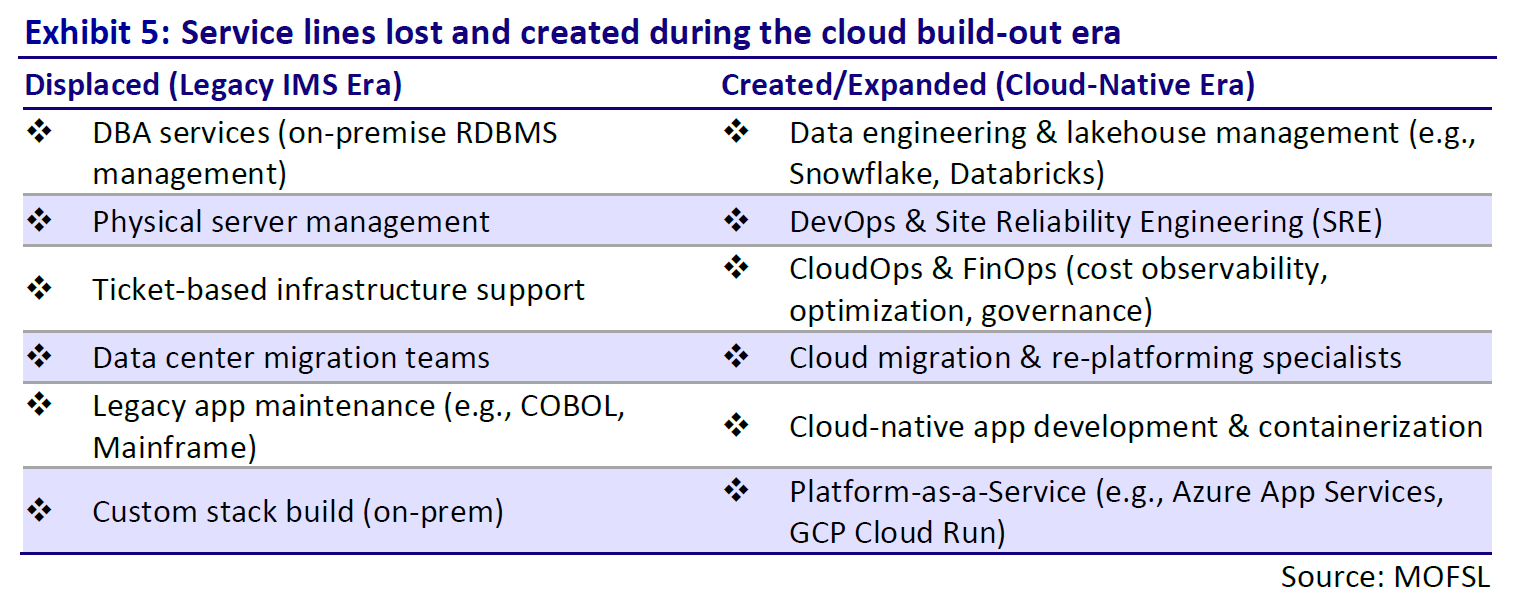

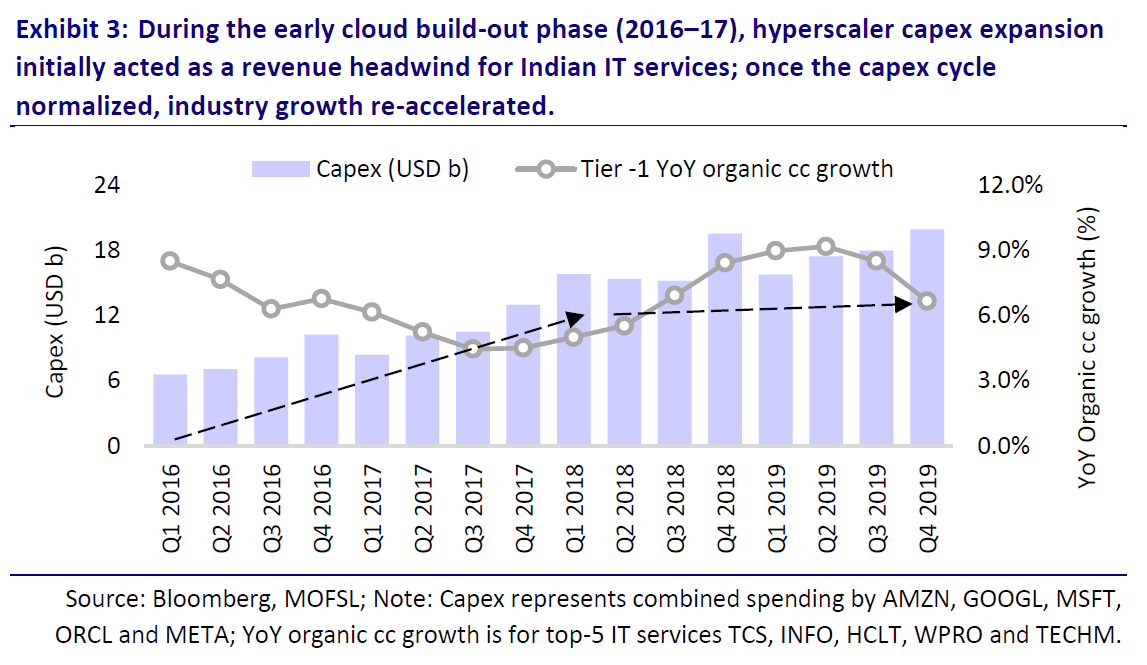

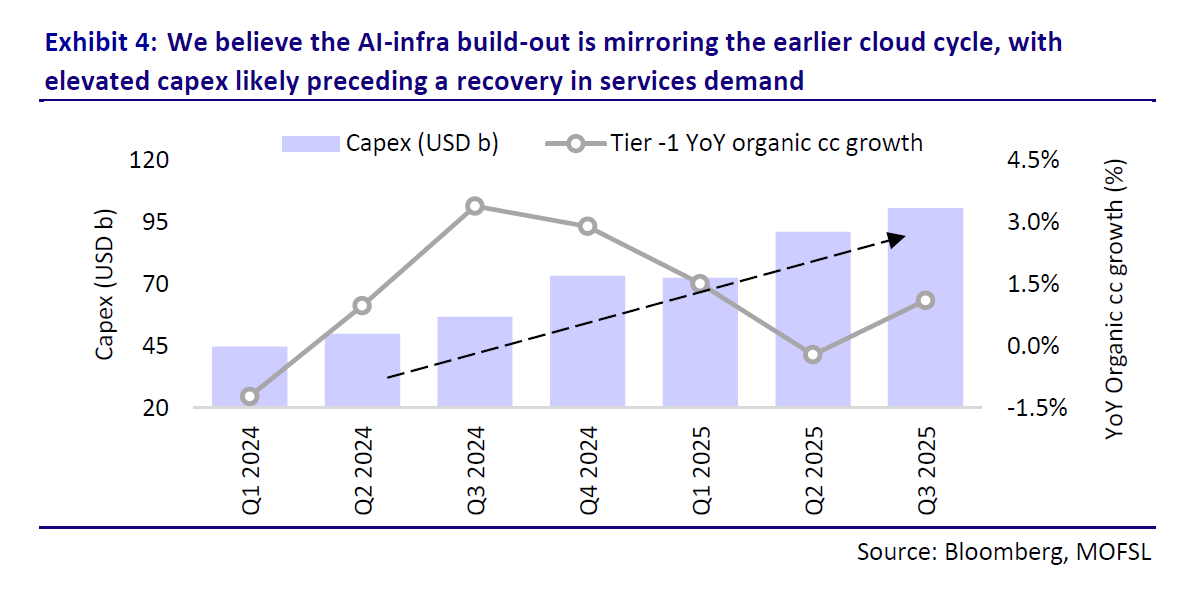

Indian IT has seen this movie before. During the early cloud build-out (2016–18), cloud migration and consolidation displaced traditional service lines and pressured pricing.

But once infrastructure stabilized, new revenue areas emerged which outweighed the initial revenue loss. The key is that these new categories were not “nice-to-have”; they became prerequisites for using cloud at scale.

Indian IT historically scales well when the market shifts from buying technology components to buying transformation programs. AI deployment is likely to behave like a multi-year modernization wave which supports a longer services runway.

So there are a few important questions:

Will the AI cycle follow a similar pattern to the cloud infrastructure?

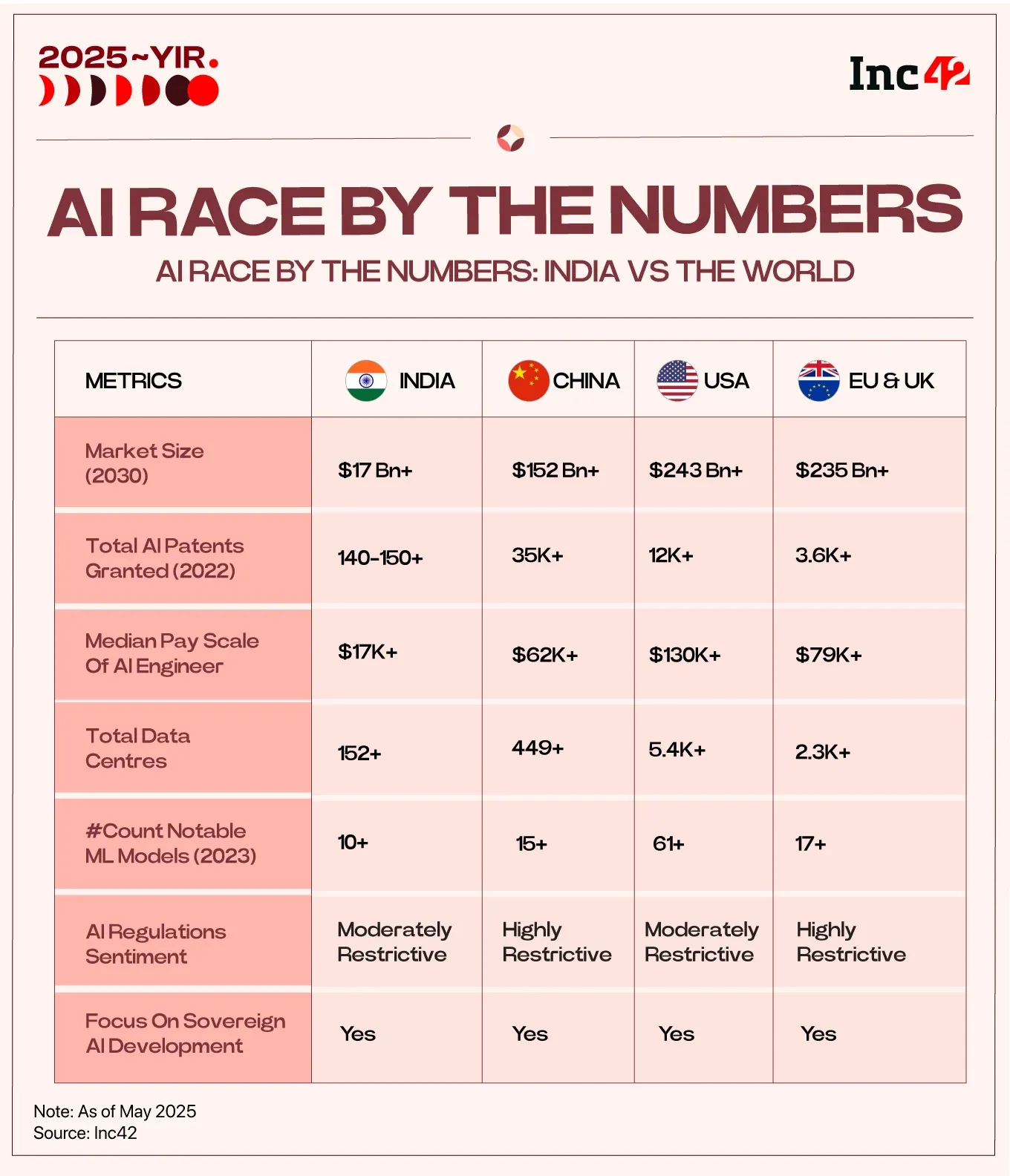

How fast can India integrate AI and where does it change outcomes?

What trends are we seeing from the latest IT earnings reports wrt AI?

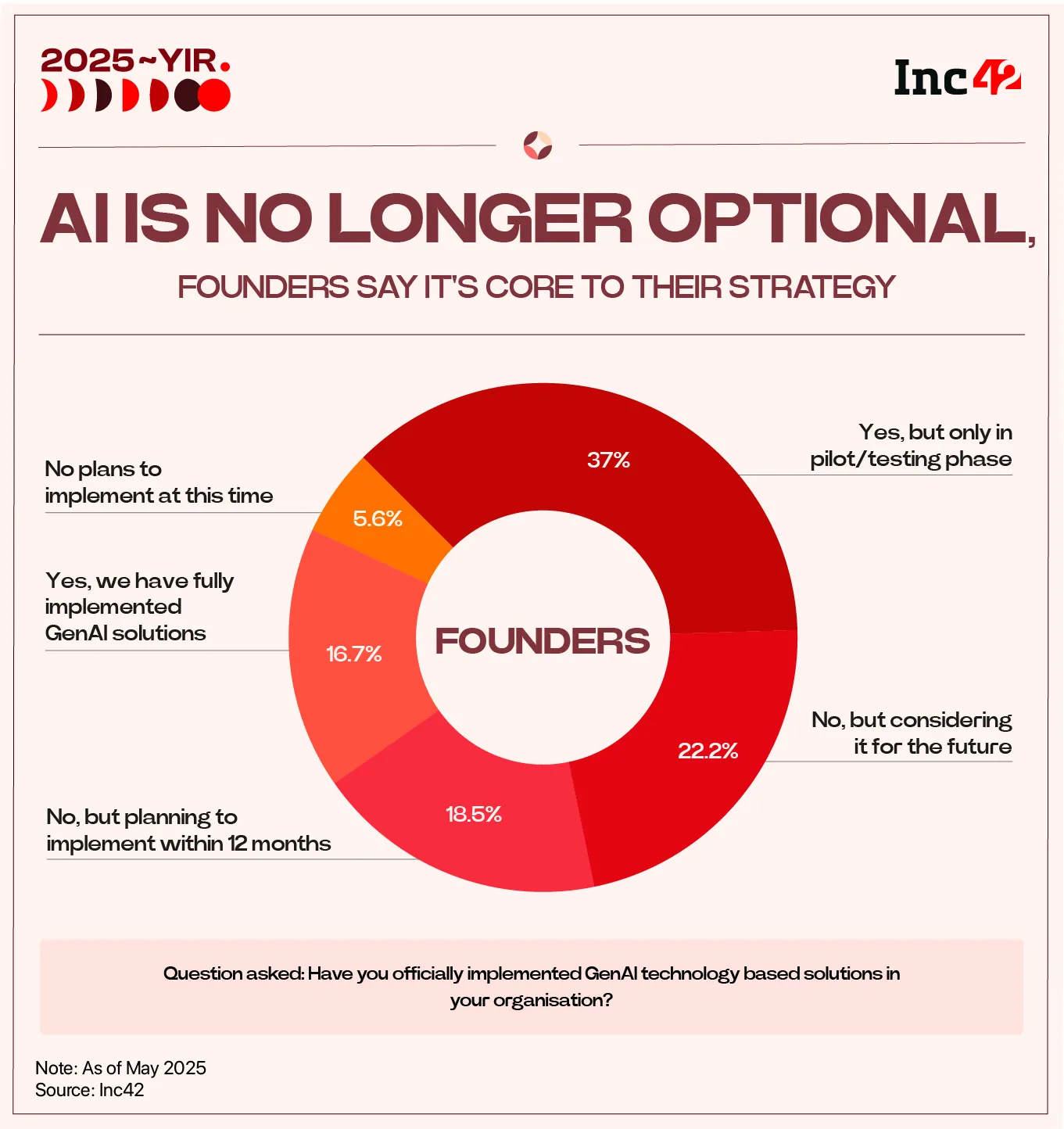

In 2025, AI adoption in India shifted from experimentation to routine use. The question for many organisations is how quickly AI can be integrated into day-to-day work without breaking control, cost, or compliance. Inc42 reports that tools such as copilots and early autonomous agents are already used for drafting, data analysis, customer interactions, developer support, contract review, and demand prediction.

47% of organisations have multiple AI deployments running, 10% are scaling use cases at an enterprise level, and close to half say a meaningful share of GenAI proof-of-concepts have moved into production.

However, AI is often layered onto existing processes rather than embedded into core decision architecture. Teams use AI to speed up old workflows instead of redesigning them end-to-end, which traps value at the use-case level. India has moved past hype, but many enterprises are still in a “pilot-heavy” when it comes to enterprise-wide operating model change.

One major 2025 shift is localisation. AI systems now work with Indian languages, business context, and infrastructure realities. Multilingual capability is described as non-negotiable, spanning major languages and usage beyond Tier 1 cities. The article also points to demand for AI that works with limited or intermittent connectivity—driving more edge AI and on-device intelligence across settings like rural clinics, government schools, and smaller manufacturing units.

Localisation is also linked to sovereignty and enterprise constraints. Google’s expansion of AI infrastructure in India to enable training and deployment of advanced Gemini models within the country, addressing data residency needs, and notes SAP’s sovereign cloud capabilities in India for local storage and processing. Alongside global moves, it mentions domestic efforts such as a custom edge-intelligence chip initiative (ARKA GKT-1) targeted at energy and utilities.

As adoption matures, “more GenAI everywhere” is giving way to “right-sized AI.” GenAI can be expensive and can hallucinate, so enterprises are designing composite architectures instead of forcing a one-model-fits-all strategy.

Agentic AI is the next frontier, but with uneven adoption. Interest is high, yet many deployments remain tightly controlled pilots in areas like customer support, IT operations, or internal analytics. The barriers are less about availability of technology and more about readiness to delegate control across legal, organisational, and psychological. A near-term transition will depend on stronger governance and leadership comfort before agents move from support functions into core business processes.

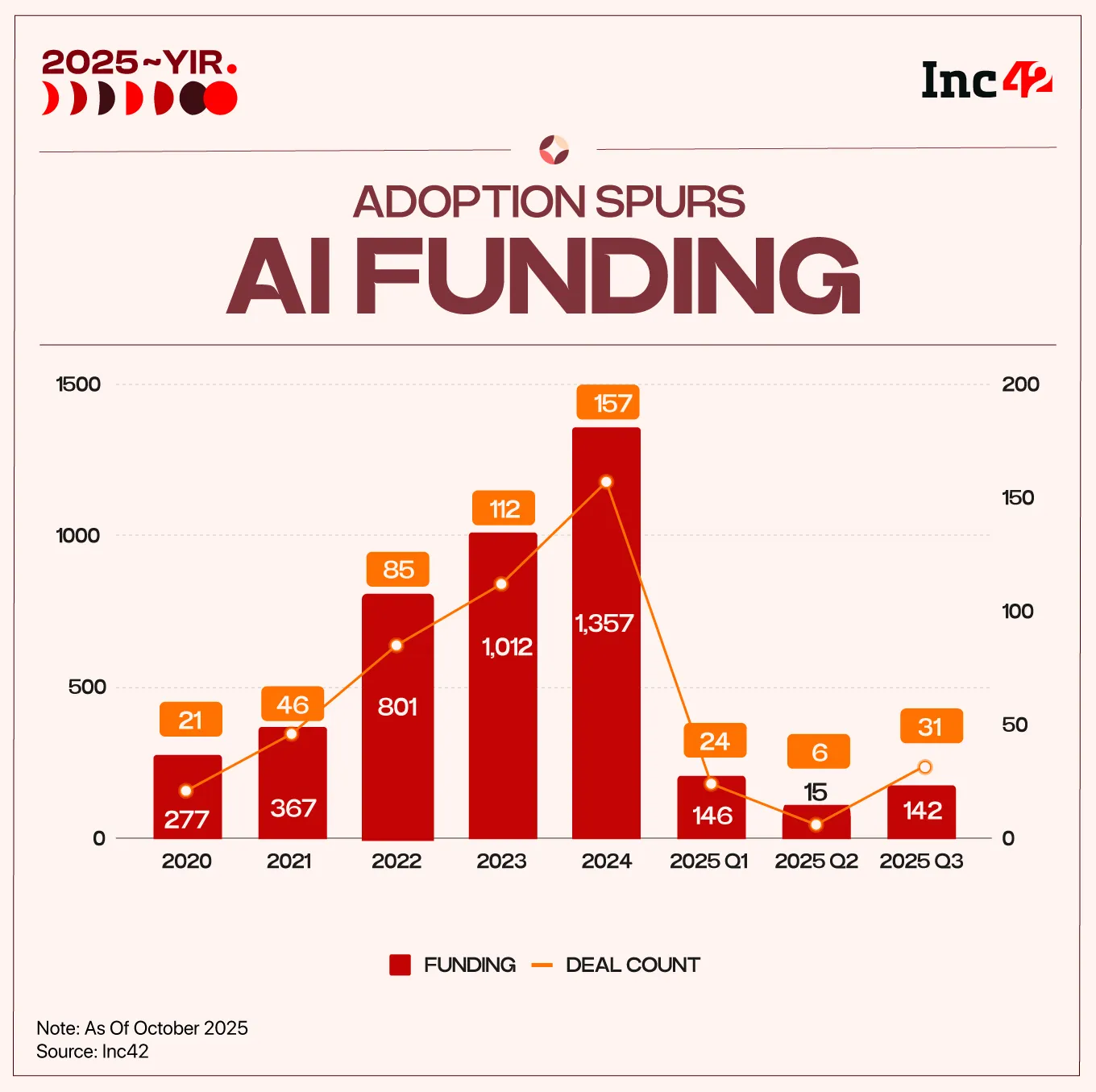

Most enterprise AI budgets so far have been pulled toward infrastructure—data centers, compute, and foundational tooling. The next stage begins when incremental gains from “more hardware” start flattening and attention shifts to software, platforms, and modernization programs. This transition—experimentation to deployment—is the inflection point for services demand.

Similar to earlier technology cycles: heavy capex first, then services once the infrastructure layer stabilizes. Hyperscaler capex growth has been very high recently (50% and 66% over the last two years) and services spending should finally start picking up as capex intensity moderates.

Timing matters because it determines whether “AI deflation” dominates the story or is offset by new AI-driven work. The base case is a staged recovery: near-term deal deferrals, scaling beyond pilots in 2H CY26, revenue impact in 2H FY27, and a broader acceleration in FY28 as enterprises move into full deployment mode.

Indian IT’s strongest position is at the enterprise application layer: large estates, complex integration, operating models, and domain-heavy workflows. AI deployed at scale needs data pipelines, guardrails, orchestration, and cost-optimized inference integrated into existing systems. The GenAI stack across models, vector databases, orchestration frameworks, and guardrails is now largely built, and that alignment with hyperscalers is a key differentiator because the stack sits natively on cloud ecosystems.

Where Indian IT is less likely to “win” is in owning the core model layer in a way that captures outsized platform economics. Most large enterprises will buy or subscribe to model access through hyperscalers and leading model providers, then spend heavily to adapt, integrate, secure, and govern AI in production. That downstream work is exactly where services firms can lead—if they package capability in repeatable ways instead of selling raw effort.

IT services’ share of Nifty profits has stayed around 15% while the sector’s benchmark index weight has fallen to a decadal low (around 10%). That suggests expectations are muted; a credible services-led AI cycle can re-rate the sector if growth visibility improves.

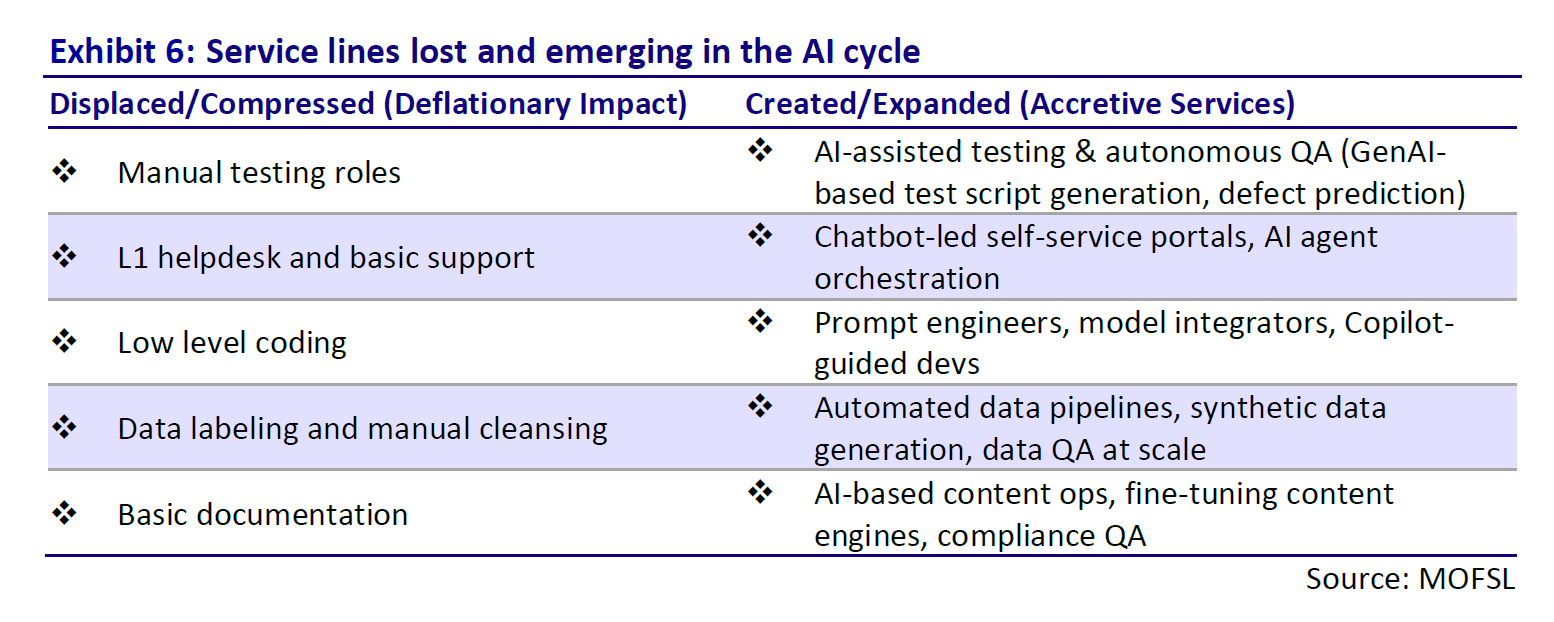

AI will compress parts of the traditional pyramid. Manual testing, basic support, low-level coding, and manual data tasks are large employment and revenue pools across the industry.

At the same time, accretive services that expand: AI-assisted testing and autonomous QA, AI-led self-service and agent orchestration, model integration and “copilot-guided” development, automated data pipelines and synthetic data generation, and AI-based content operations and compliance QA.

The question is how quickly firms replace shrinking work with higher-value AI modernization, integration, and governance programs. And how well they industrialize delivery so margins do not erode while doing it.

AI adoption pushes clients toward outcome-based expectations: fewer people, faster cycles, measurable productivity. That creates a real margin risk if services firms move to fixed-price or outcome contracts without strong tooling, clear scope control, and reusable assets. The report cites a historical warning: between FY15 and FY19, large-cap vendors increased fixed-price exposure and sector EBIT margins fell by about 150 basis points, implying a margin drag from that contract mix shift.

The implication is blunt: you cannot “win” in AI if you win revenue but lose economics. Firms that treat AI as a bolt-on to the same delivery model risk scope creep, delivery overruns, and weaker margins. Firms that embed AI into delivery—automation, standardized components, stronger governance, and repeatable platforms—have a better chance to price for outcomes and protect profitability.

The report’s prescription is also blunt: the winners are likely to be those “ready to disrupt their models and sell services as software.” That means more IP-led offerings, platforms, accelerators, and managed AI operations that scale beyond headcount.

Indian IT’s quarterly earnings are less about one quarter’s profit and more about whether the services model is holding up under three pressures: tighter global discretionary spend, client uncertainty (especially in the US), and rapid AI adoption changing how work gets done and priced.

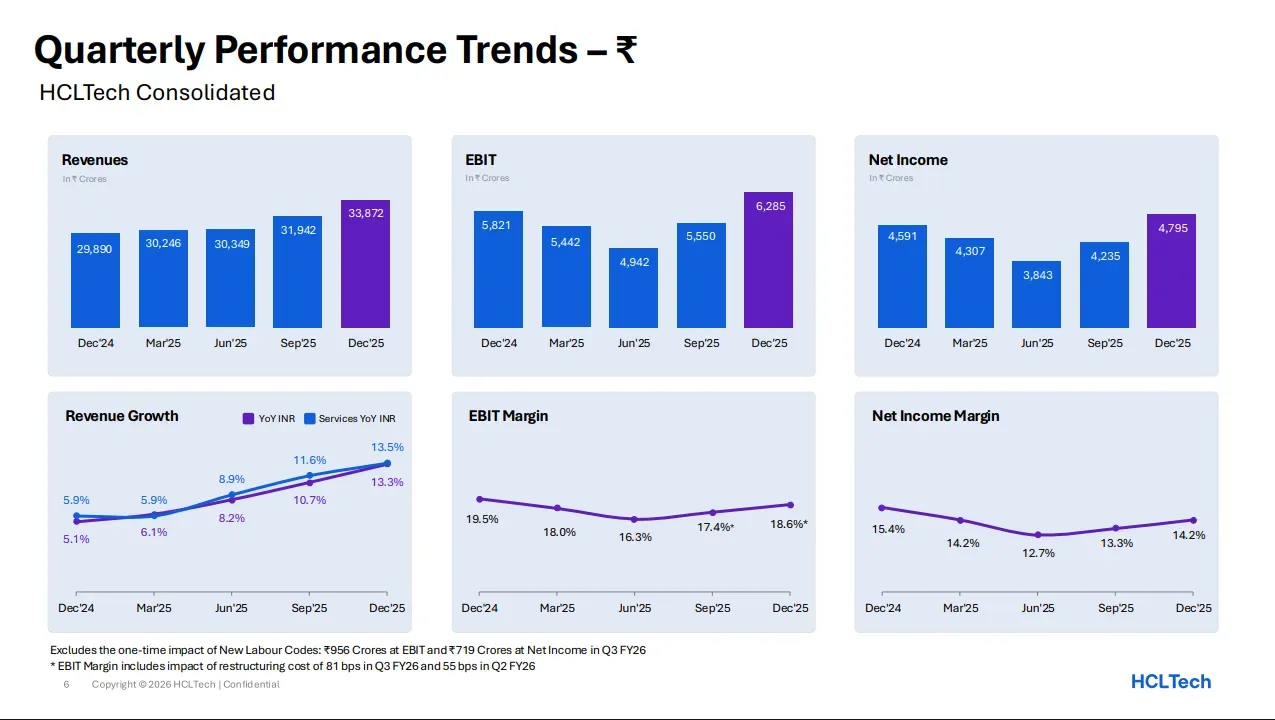

This earnings season multiple companies took one-time hits linked to India’s new labour codes, which can distort reported profit trends. The better read is to separate underlying operating performance (revenue, margin, deal wins, cash conversion) from these adjustments. Infosys and HCLTech explicitly call out labour-code-linked adjustments in their disclosures, and media coverage of TCS has also tied part of the profit dip to these costs.

Against that backdrop, the big takeaway is not “IT is back” or “IT is broken.” It’s that large-cap Indian IT is trying to shift from pilot-heavy AI conversations to deployable AI work, while also pushing productivity hard enough that headcount is no longer moving in lockstep with revenue.

TCS reported revenue of ₹67,087 crore in Q3 FY26 (about 4.9% YoY growth), while net profit fell 14% YoY to ₹10,657 crore—widely linked to one-time items including labour-code changes and restructuring/legal costs.

Operating margin stayed steady at 25.2%, which matters because it signals the company is defending profitability even in a seasonally weak quarter.

Infosys posted reported revenue of ₹45,479 crore (8.9% YoY) and highlighted strong large-deal traction: $4.8 billion in large-deal TCV, with 57% of that net-new, and headcount up by 5,043.

Most important for forward expectations, Infosys raised FY26 constant-currency revenue growth guidance to 3.0%–3.5%, implying it saw enough pipeline conversion to be more confident than the prior quarter.

HCLTech reported ₹33,872 crore revenue (13.3% YoY; 6.0% QoQ) and an EBIT margin of 18.6%, with deal wins (TCV) of $3,006 million (+43.5% YoY).

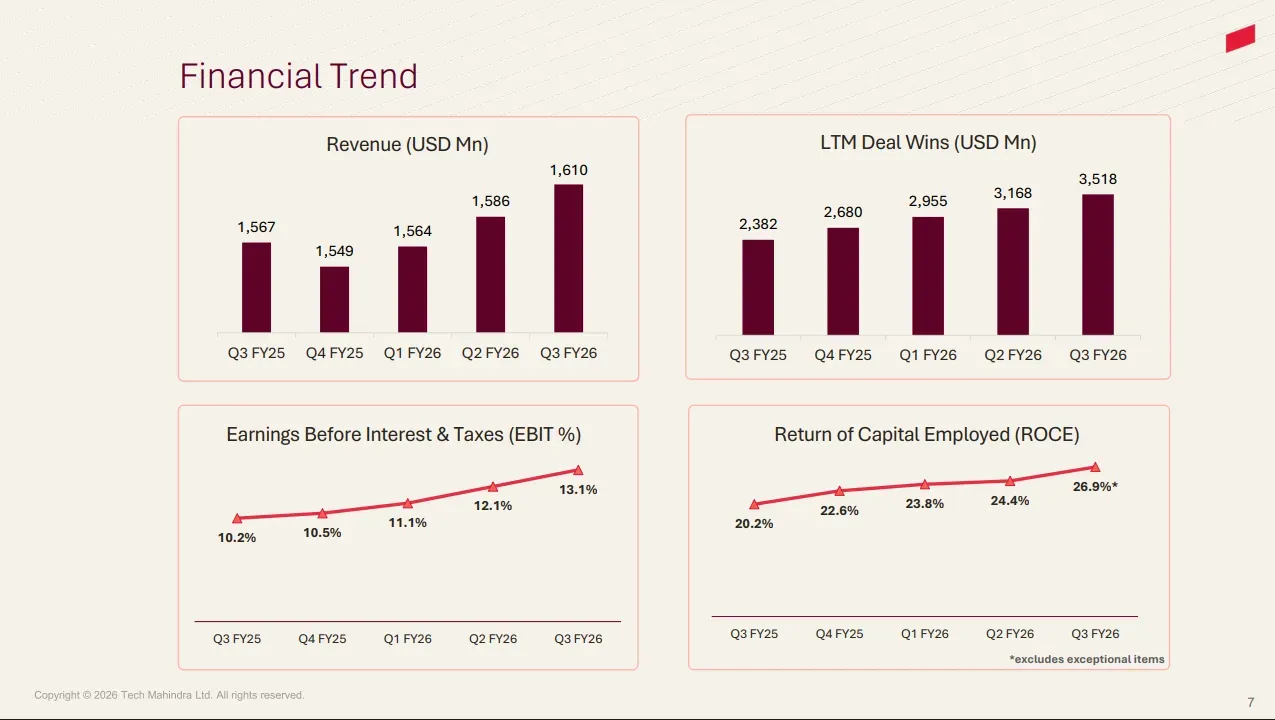

Tech Mahindra reported revenue of ₹14,393 crore (+8.3% YoY) and profit of ₹1,122 crore (+14.1% YoY), alongside margin expansion that it and market coverage describe as continuing a multi-quarter improvement trend.

This quarter, AI started showing up more concretely in disclosures.

TCS said annualized AI services revenue is $1.8 billion, and its own press release frames that as a fast-growing stream within its broader services business.

HCLTech’s reported “Advanced AI” revenue of $146 million, up 19.9% QoQ in constant currency, while also stating that bookings and revenue momentum helped push it past $15B in annualized revenues.

Infosys emphasized enterprise AI through Infosys Topaz and positioned that as part of what is driving performance and client perception, which is how these firms are trying to defend relevance as AI adoption accelerates.

AI services are a meaningful but still single-digit share of overall revenue.

The harder question is monetization and pricing. If AI compresses low-level work (testing, maintenance, basic coding), the old headcount-and-hours model weakens.

Indian IT is responding by pushing fixed-price and outcome-based constructs. Tech Mahindra now gets about half its revenue from fixed-price, outcome-based deals. That’s strategically logical, but we keep a keen eye on whether outcome-based deals improve margins sustainably or simply shift risk onto the vendor during volatile demand cycles.

Infosys was the outlier this quarter, adding more than 5,000 employees net, and signaling continued hiring. That suggests it expects steady delivery needs and wants capacity ready for pipeline conversion rather than waiting for demand to fully normalize.

Others are showing restraint or outright reductions. HCLTech reported a slight net decline in people count (net addition of -261) while adding freshers, which is consistent with a “replace and rebalance skills” approach. These reductions at other IT players are partly cyclical and partly structural (skill mismatches and AI-driven productivity).

The main question is what happens to utilization, subcontracting, and margin as AI tooling improves throughput. If revenue holds steady while headcount stays flat or declines, margins can improve, unless pricing resets downward faster than productivity rises.

The next few quarters should reveal whether “AI productivity” is translating into either (a) higher margins at similar growth or (b) lower costs that are competed away via lower billing rates.

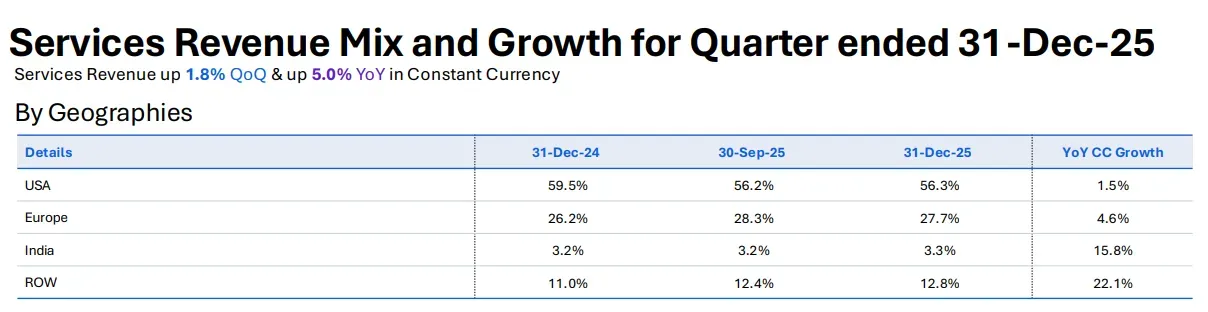

As US-centric uncertainty persists, Europe was a brighter spot for multiple IT firms. This geographic shift isn’t only defensive, it’s where incremental growth is showing up. European growth for Infosys and Tech Mahindra was stronger than the US. There was faster growth in markets beyond the US and Europe, such as Japan, Southeast Asia, and Australia (for Tech Mahindra) and “other regions” for HCLTech. These geographical areas are becoming a meaningful swing factor when North America pauses.

Sovereign AI cloud/ infrastructure is a recurring client need now, largely driven by governments and firms wanting less dependency on US hyperscalers. If this continues to grow, IT firms could see strong revenue pipelines due to larger, multi-year programs (build, migrate, secure, operate) that look more like platform-led transformation work. Something that Indian IT historically does well, rather than short-cycle discretionary projects.

Indian IT’s path to winning in AI is not to outspend hyperscalers or model labs. It is to own the deployment layer: turning enterprise AI from pilots into production through modernization, data readiness, integration, governance, and AI operations.

The demand cycle is transitioning from infrastructure spend to services spend, with meaningful impact building into FY27–FY28 which supports a scenario where services growth accelerates as AI moves into full deployment.

But the win is earned, not automatic. AI will compress low-end work, and the contract model will shift toward outcomes. The durable winners will be firms that

move up the stack into AI modernization and platform-led delivery

align deeply with hyperscalers while staying valuable at the integration and governance layer

protect margins by industrializing delivery and packaging capability as reusable software-like assets

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart