The union budget is one of the most significant events in Indian capital markets. However, this year the budget lost most of its sheen because of the Adani woes. The budget, on its own, received a lot of praise from the analysts.

The budget reinforces the India growth story and India's growing position in the global economy. The finance minister did not turn full welfare mode and delivered on the key expectations that the market had - fiscal prudence, infrastructure spending and no change in capital gains taxes.

The big announcements were a 33% increase in Capex, which was beyond estimates. Another significant announcement typical for the election year was increasing tax exemption up to 7 lac per year from 5 lac per year in the next tax regime and further rationalising taxes.

Let us understand the long-term impacts of the budget announcements.

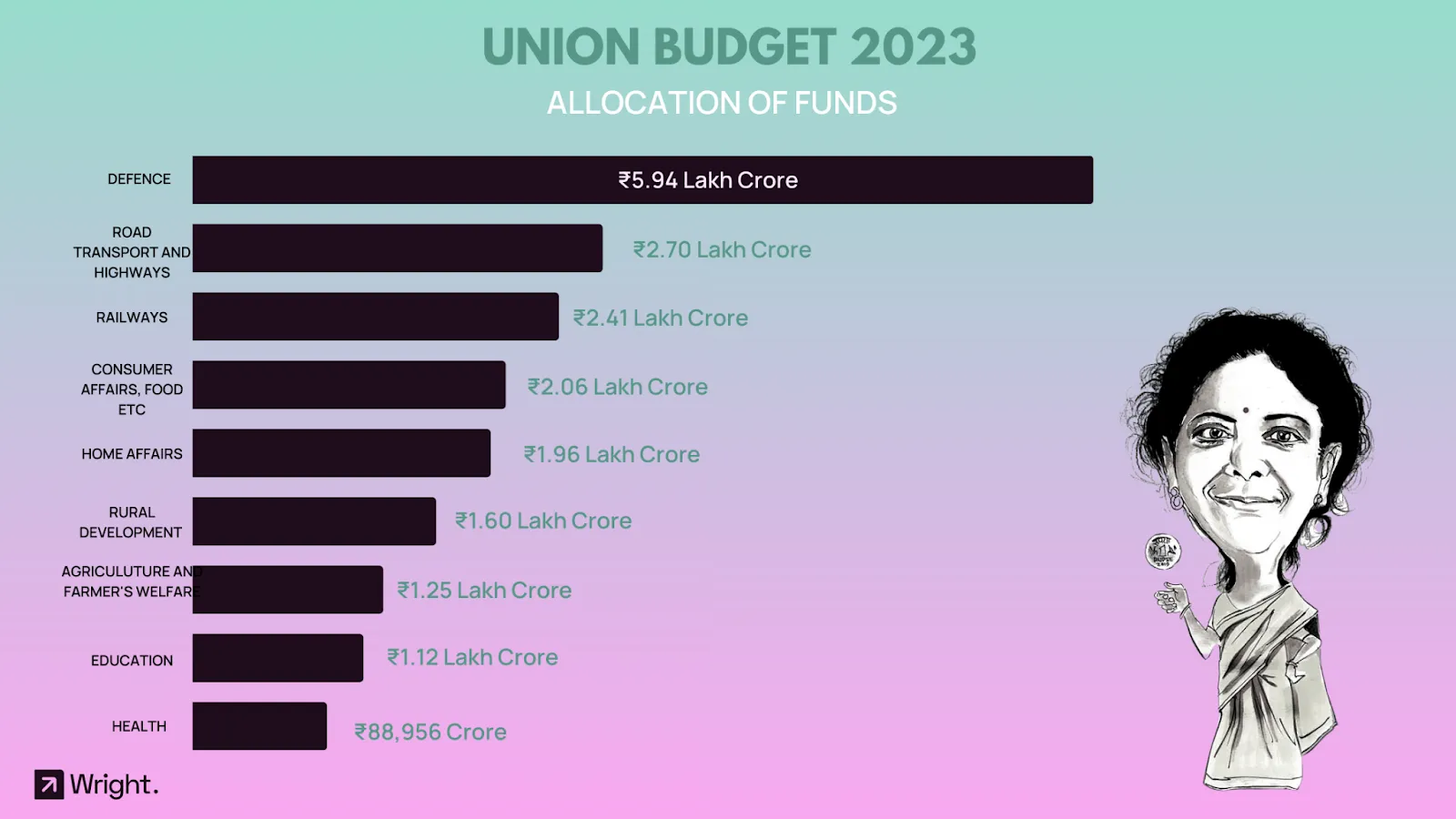

The government is leading the investment cycle by increasing spending, believing that private sector investments will follow, resulting in a longer lasting cycle. The government's focus remains on railway, urban infrastructure, and housing development. Infrastructure companies can expect an increase in incoming orders and strong earnings momentum. The government has also allocated funds for new initiatives like green hydrogen and energy storage. Investing in infrastructure funds with a high weightage in these sectors provides the best opportunity to take advantage of this theme, which is expected to remain strong for the next 3 to 5 years.

Infrastructure seems like the theme of choice after the budget, but we should be cautious when picking stocks in the sector due to its cyclical and volatile history. Other beneficiaries of infrastructure spending are related sectors which are more transparent like capital goods, cement, steel, energy and banking.

The railway's stocks had a muted reaction, maybe because of profit booking but Jindal Steel, Dixon and other infrastructure-linked stocks cheered the news.

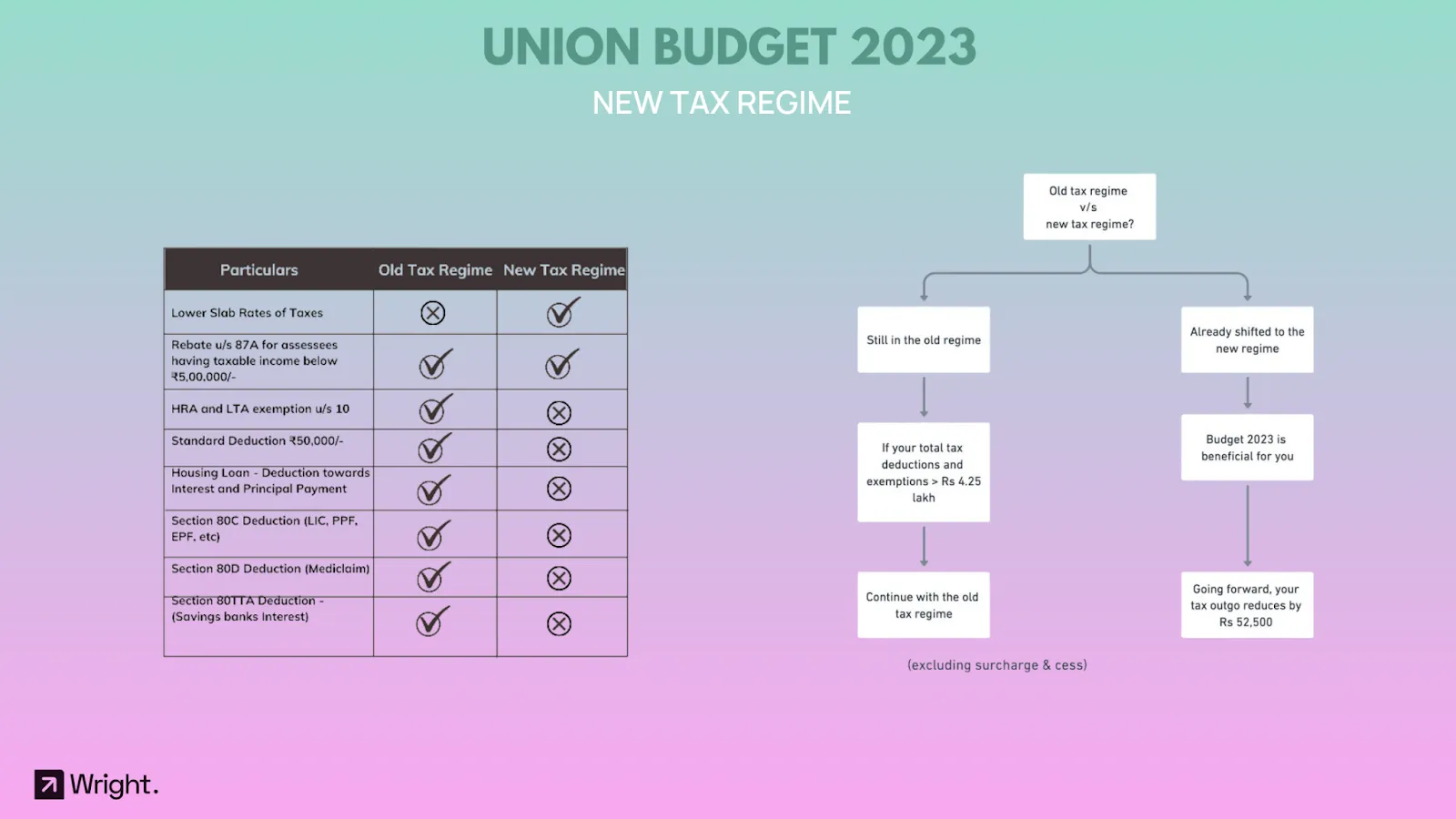

In an announcement typical for the pre-election budget - in the new tax regime, she increased the tax exemption up to 7 lac per year from 5 lac per year. She has also reformed the taxation rates in the new regime to be lower.

However in the new regime, savings-based exemptions, insurance based exemptions, housing interest and principal payment exemptions are not applicable, hence, the middle-class taxpayer who avails the tax exemption on insurance and savings should not be not too excited. The FM also reduced the tax surcharge rate to 25% from 37%, which makes the tax saving for the high-income tax payers larger in the new regime.

The government seems to want India to shift to the new taxation regime. Adopting the new regime will see money go out from the ELSS funds, pension products, insurance and housing loans in the long run, as a large part of the investments in these products is to avail the tax benefits. This would bring more money in the hand of the taxpayer and might boost consumption and investment in investment products with the pure intention of capital appreciation. The government might also get the deposit rates in the banking sector to inch up with this move, which has been struggling.

More than 39,000 compliances have been reduced to enhance the ease of doing business, and over 3,400 legal provisions have been decriminalised. The government has also stated its intent to review and rationalise existing compliances with public participation.

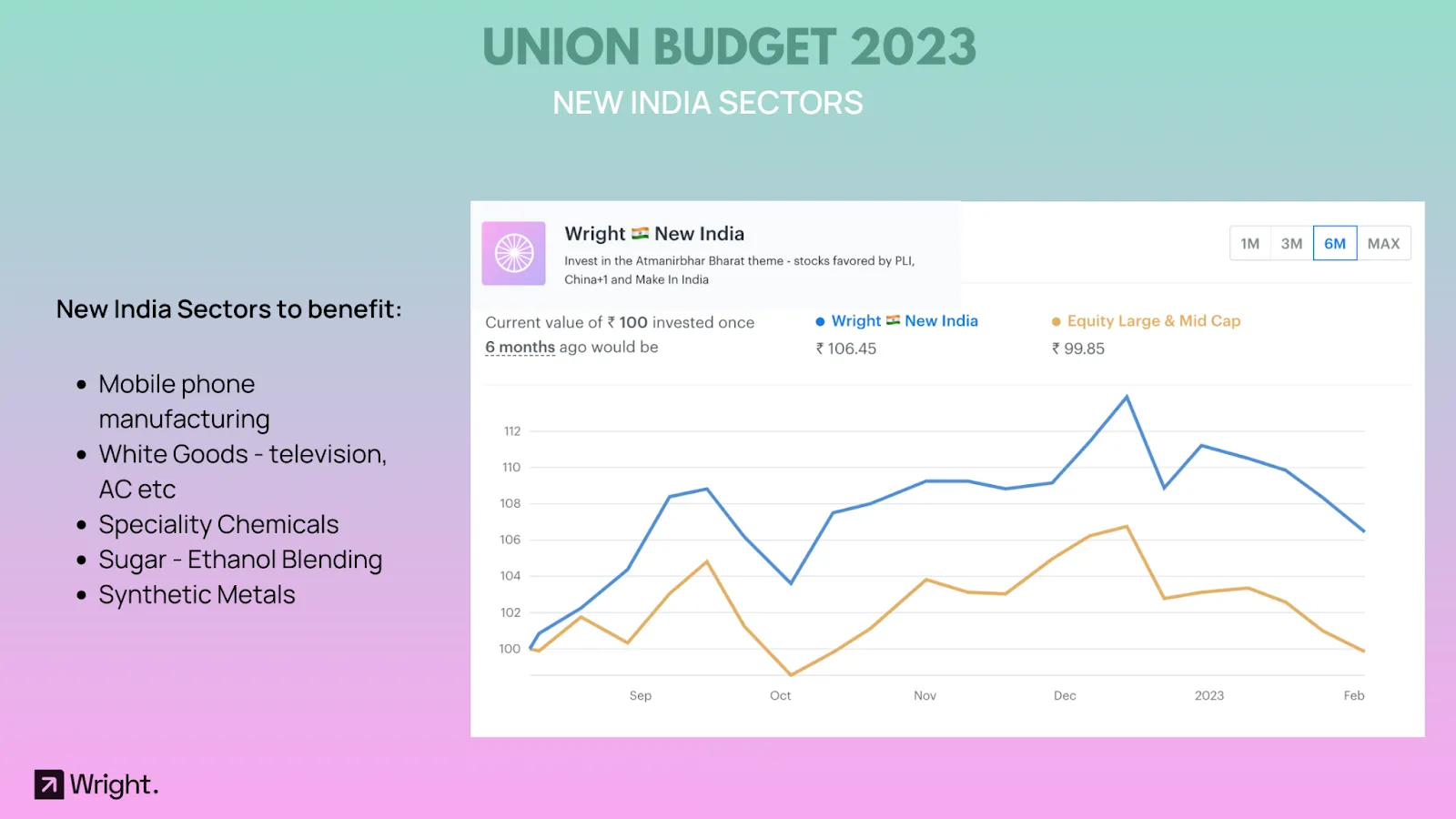

These moves would make India get a better ranking in the ease of doing business rankings, welcome the foreign industries looking to move out of China, and make India a beneficiary of the China+1 incentive.

New industry industries to benefit from this:

Mobile phone manufacturing

White Goods - television, AC etc

Speciality Chemicals

Sugar - Ethanol Blending

Synthetic Metals

Our New India portfolio cheered these moves, and component stocks like Blue Star, and Fiem Industries rallied.

Invest in the New India portfolio: .

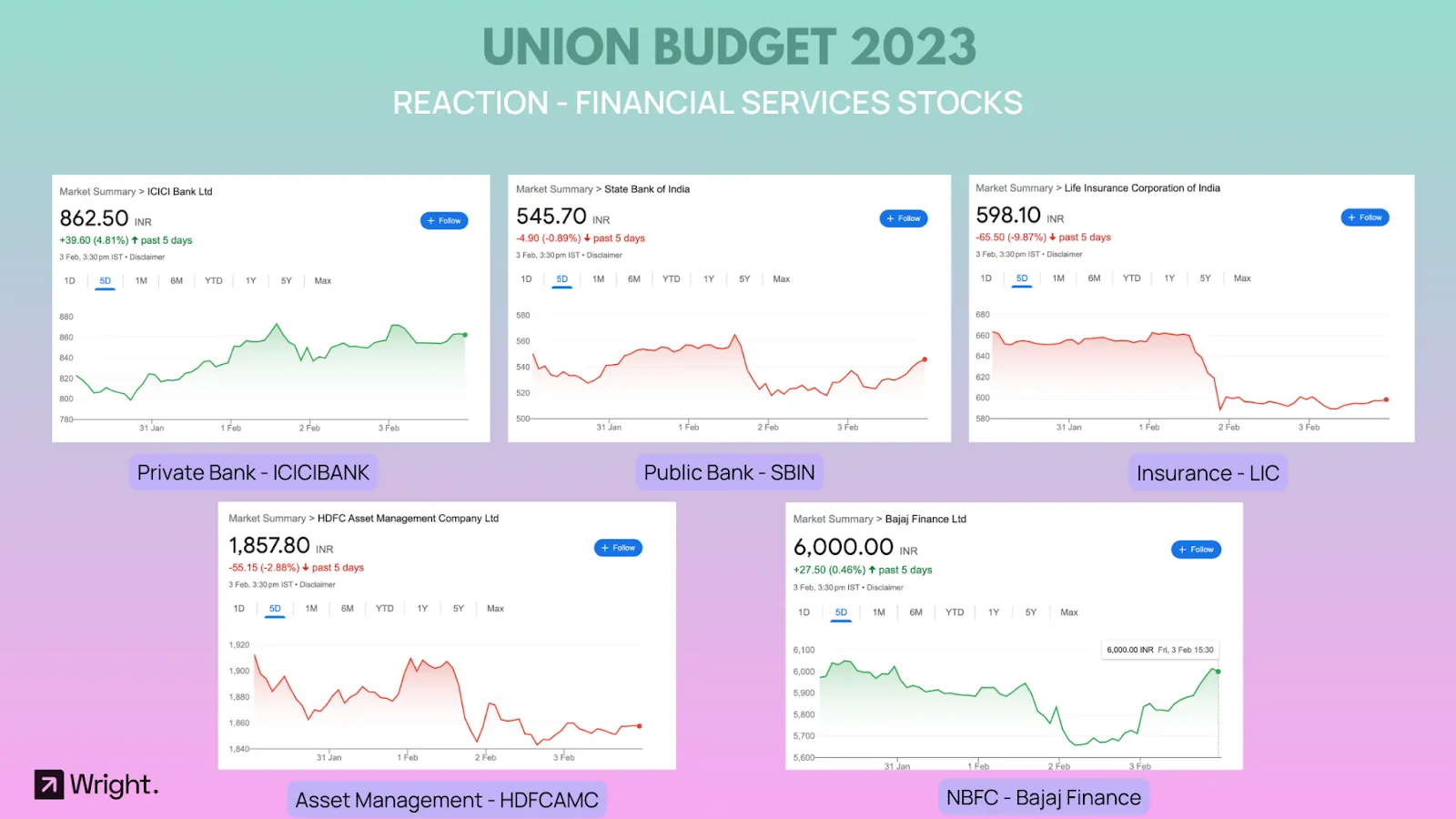

The budget discussed a comprehensive review of existing regulations for the financial sector and focused on including private sector contributions to regulatory reviews. No capitalisation of the banking sector was announced, or capital tax structure changes were announced.

The PSU Banks received no mention, and the PSU Bank index is under pressure. The Adani exposure has also been a continuing woe for the sector.

The insurance sector was the most impacted by the budget. Stocks like SBI Life, HDFC Life, and GICRE took a big hit as the FM proposed to remove tax-free status on specific insurance policies with premiums above Rs 5 lakh. The new tax regime would also suppress the insurance policies being taken to avail tax benefits. The asset management & housing finance sectors might also see the new tax regime impacting their growth.

The Private Banking sector has welcomed the moves to expand credit in the economy. The movement to new regime will also make more money coming to the banking sector and incentivise the growth of bank deposits. Chola Finance, and M&M Finance were big gainers in the Financial Services space, and among private banks, ICICI Bank and HDFC Bank gained big.

Maintaining the focus on green energy, the FM announced Rs 35,000 crores in priority capital for energy transition and achieved India's net zero carbon emission goal by 2070. She also announced an additional Rs 19,700 crore towards the government's Green Hydrogen Mission to lower carbon intensity and reduce fossil fuel use. She also announced a five million tonne target for green hydrogen production by 2030. The Centre is also supporting the setting up of battery energy storage of 4,000 MwH, she said, adding that a green credit programme will be also notified under the Environment Protection Act.

Stocks in the renewable energy sector, especially batteries like Amararaja Batteries and Exide, are cheering the budget announcements.

India hotel is the biggest gainer in the mid and large-cap space as the Union Budget 2023 increases tax collection at source for overseas tour packages. The TCS (tax collection at source) for overseas tour packages has been increased from 5 per cent to 20 per cent for high-cost tour packages above 50 lac. This would rationalise the pricing in the tourism sector, incentivising domestic travellers who have come back in force after the pandemic.

With the new tax regime coming into force, tax payers will not park their cash in the pension, insurance, ELSS and housing load products and instead might consume more and could, therefore we could see growth in the FMCG, Ecommerse & Consumer Discretionary sectors.

Have a loook at our New India portfolio that is positioned to take advantage of the stocks gaining from the government incentivization schemes:

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart