by Sonam Srivastava

Published On July 23, 2022

The banking sector should be at the centre of investor focus right now. Not only is the rising interest rate environment favourable for the banks, but several catalysts make banking extremely attractive - from the growth of digital payments to improving credit quality to supportive government incentives.

In this post, let’s dive deeply into the Banking and Financial services sector.

This sector comprises various financial firms, including banks, investment houses, lenders, finance companies, real estate brokers, and insurance companies.

The banking sector is crucial for the economy as it provides capital and liquidity for the growth of all the other sectors.

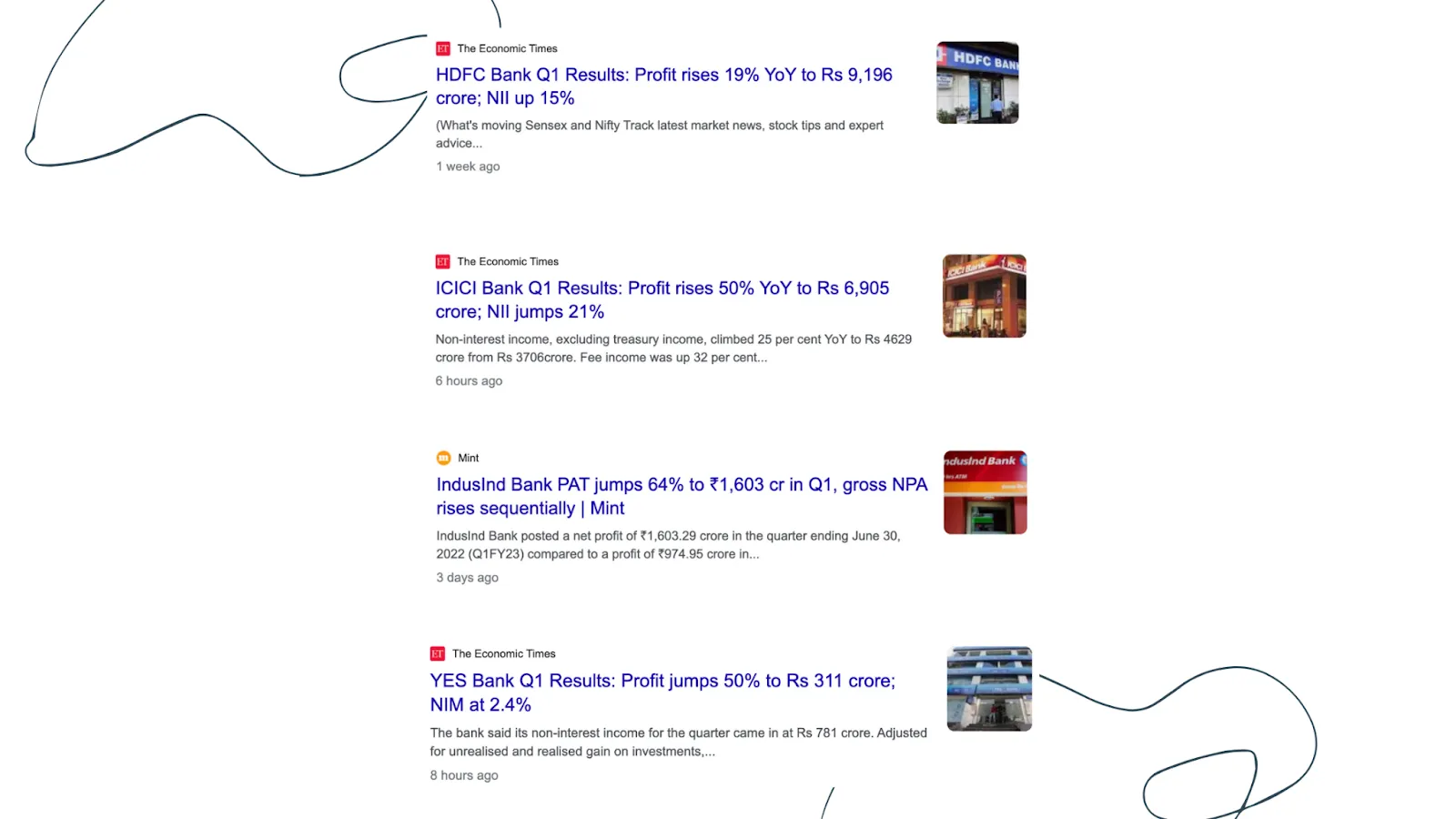

And banking sector is flourishing in this earnings season:

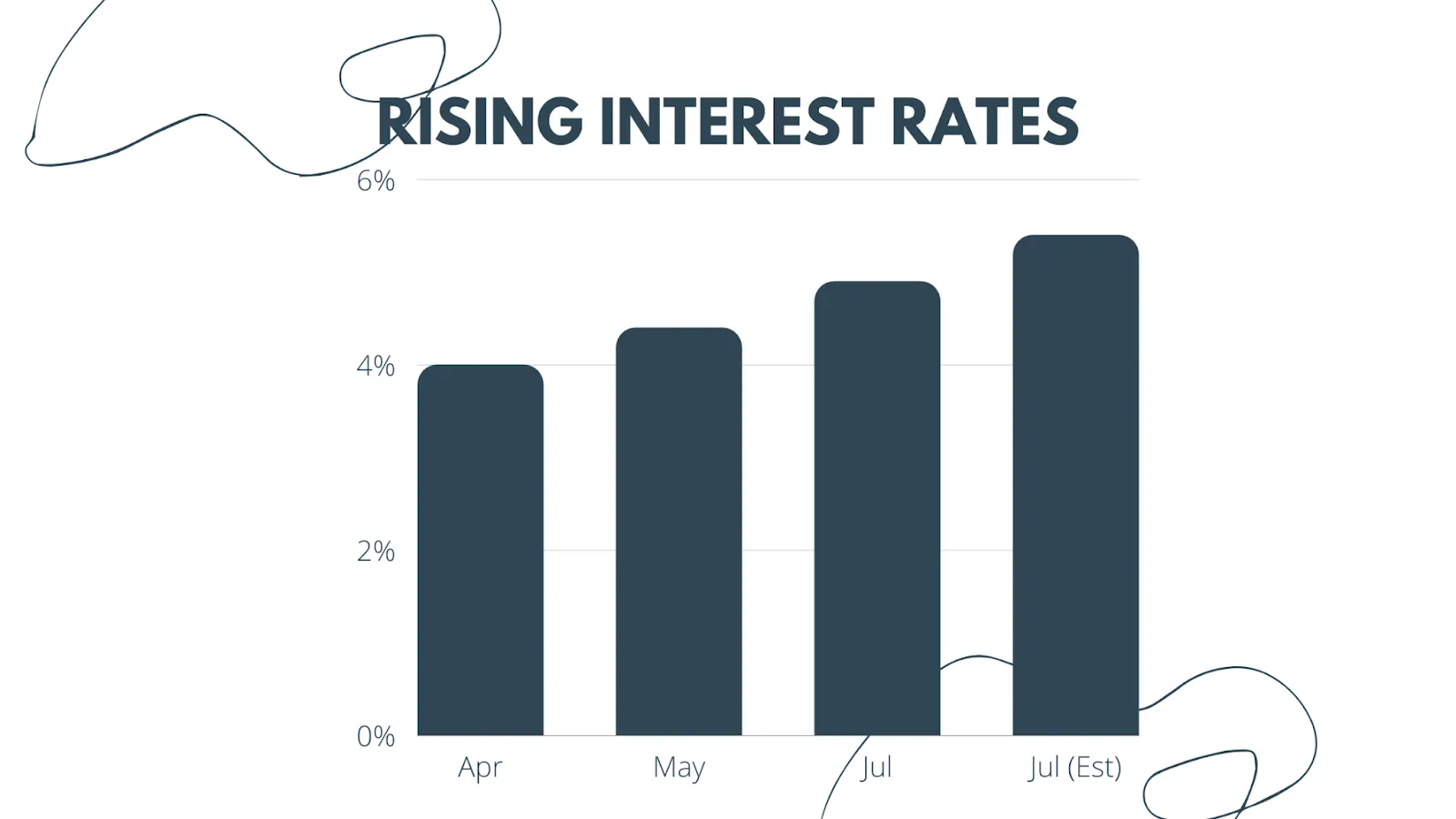

The increasing rate cycle will typically be favorable for the banking industry as a primary source of revenue and the tightening of liquidity will provide pricing power for banks to drive demand in the near term.

With the interest rate rising, the floating rate loans for banks will be repriced at a higher loan rate as against the fixed rate liabilities hence driving better net interest margins.

Banks might feel more at ease with growing their portfolios of unsecured loans as their asset quality improves. This could lead to an increase in interest margins as a result.

Growth in overall bank credit will be able to assist businesses in generating above-average earnings growth via optimally utilising leverage. The incremental power for corporates will, in turn, generate revenue streams for the banking sector.

Not just that, there are many other reasons to get excited about the banking sector:

1. Digital Transaction Growth

The financial sector’s profitability and efficiencies are improving with the shift from physical to digital. As a result, the RBI expects UPI payments to comprise 8% of India’s total GDP in 2025.

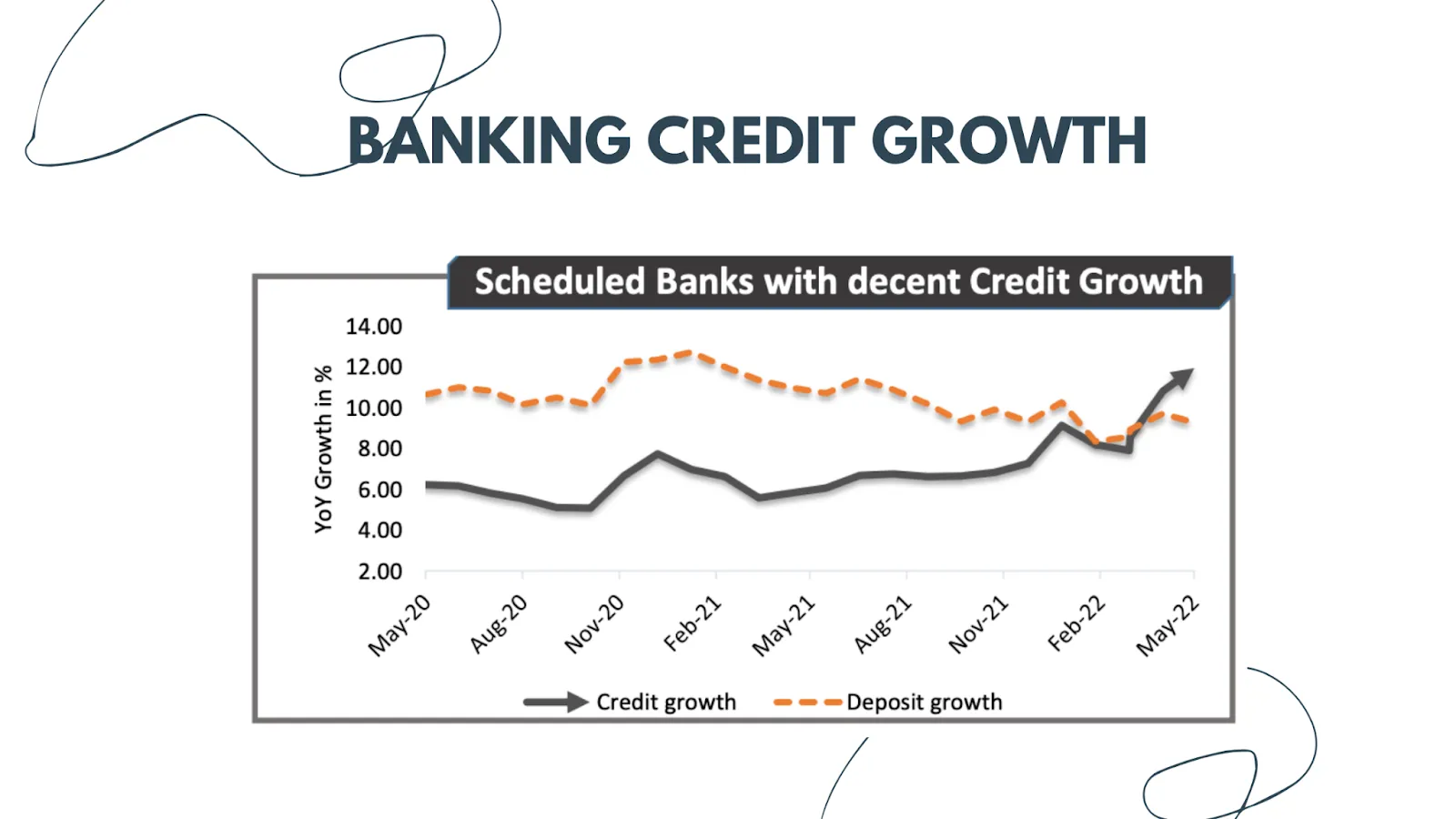

2. Bank Credit Growth

After three to four years of single-digit growth, loan growths have seen double-digit growth of ~12-14%. House and consumer loans are browning post covid, and businesses are borrowing more, thus enhancing bank credit.

3. Supportive Government Initiatives

Initiatives like the Pradhan Mantri Jan Dhan Yojana provide easy access to financial services to the poor & needy. As of June 2022, the scheme has 45.89 Crs beneficiaries with Rs 169,879 Crs worth of deposits in the account and 31.83 Crs Rupay debit card issued.

4.The rising importance of Insurance

The post-pandemic era has shifted the importance towards Insurance, and the insurance industry has grown 9.74% in the previous year.

5. NBFC’s on the rise

Over the years, the growing asset sizes of the NBFC and HFC segments are significant indicators of the progressive theme of shadow banking planting its roots in the Indian business.

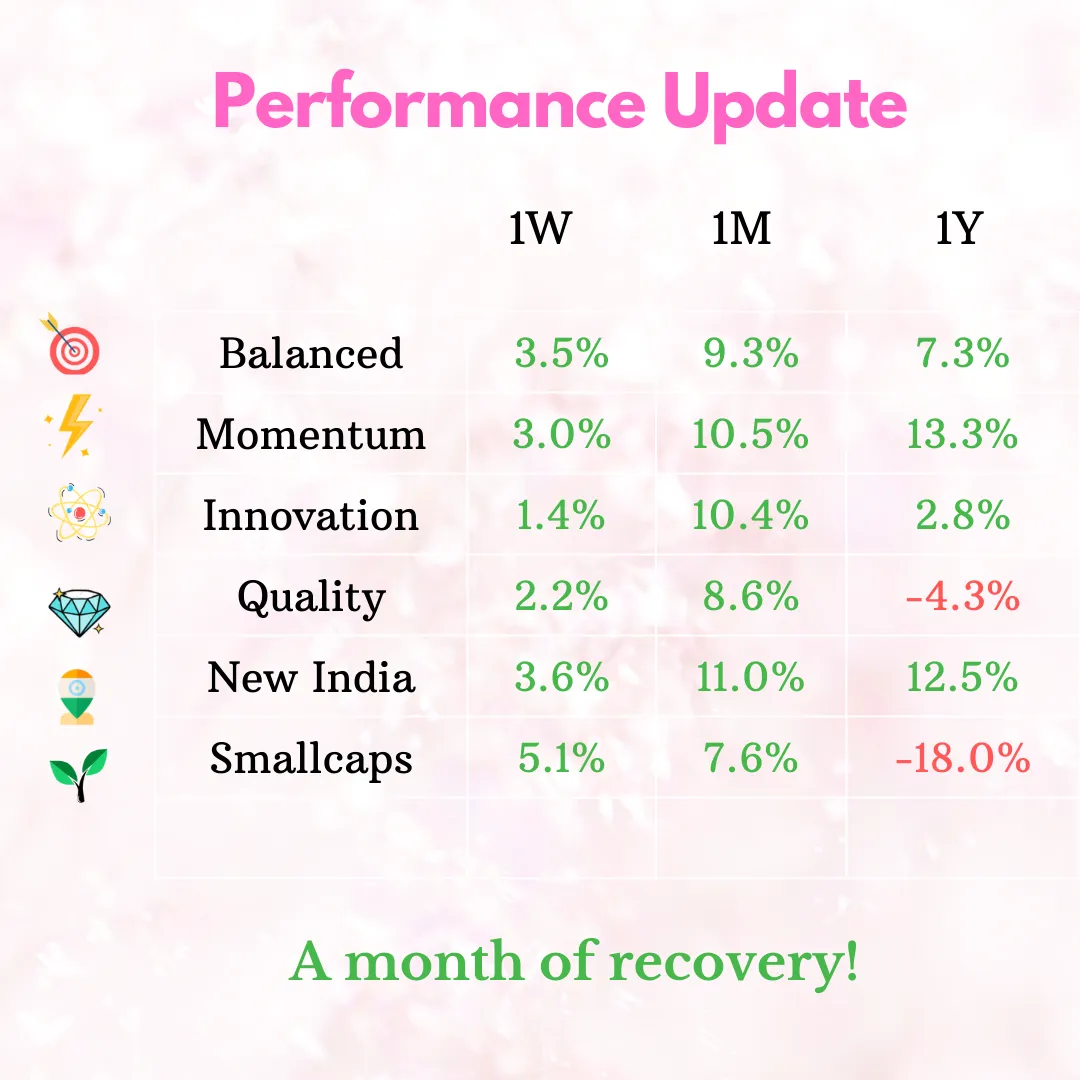

Most of our portfolios have healthy bank exposure, expected to increase in the next week's rebalance. And talking about portfolios, here’s the performance update!

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart