At Wright Research we create equity portfolios based on tactical allocation to equity factors & ETFs of other asset classes with the goal of finding the best factor or theme to outperform the market at any given market regime. We wondered if a similar exercise could be done using the diverse universe of mutual funds to create portfolios for the growing population of investors who are comfortable in investing in mutual funds.

We started by a data analysis of the data for 884 direct mutual funds that we found from AMFI.

Categories

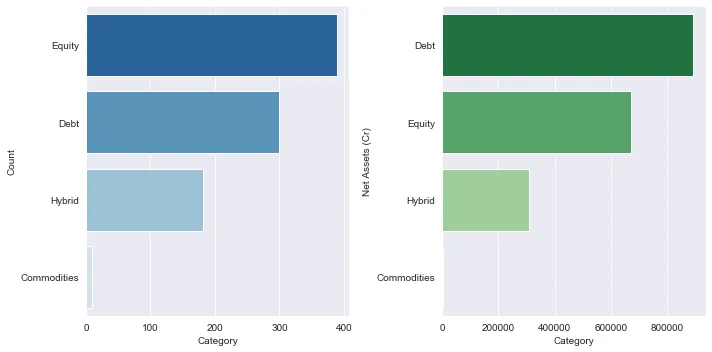

There are 4 broad categories of mutual funds — debt, equity, hybrid & commodities.

While the maximum number of funds are in the equity category, the debt category has the maximum assets under management. This is because a lot of corporates invest only in debt funds.

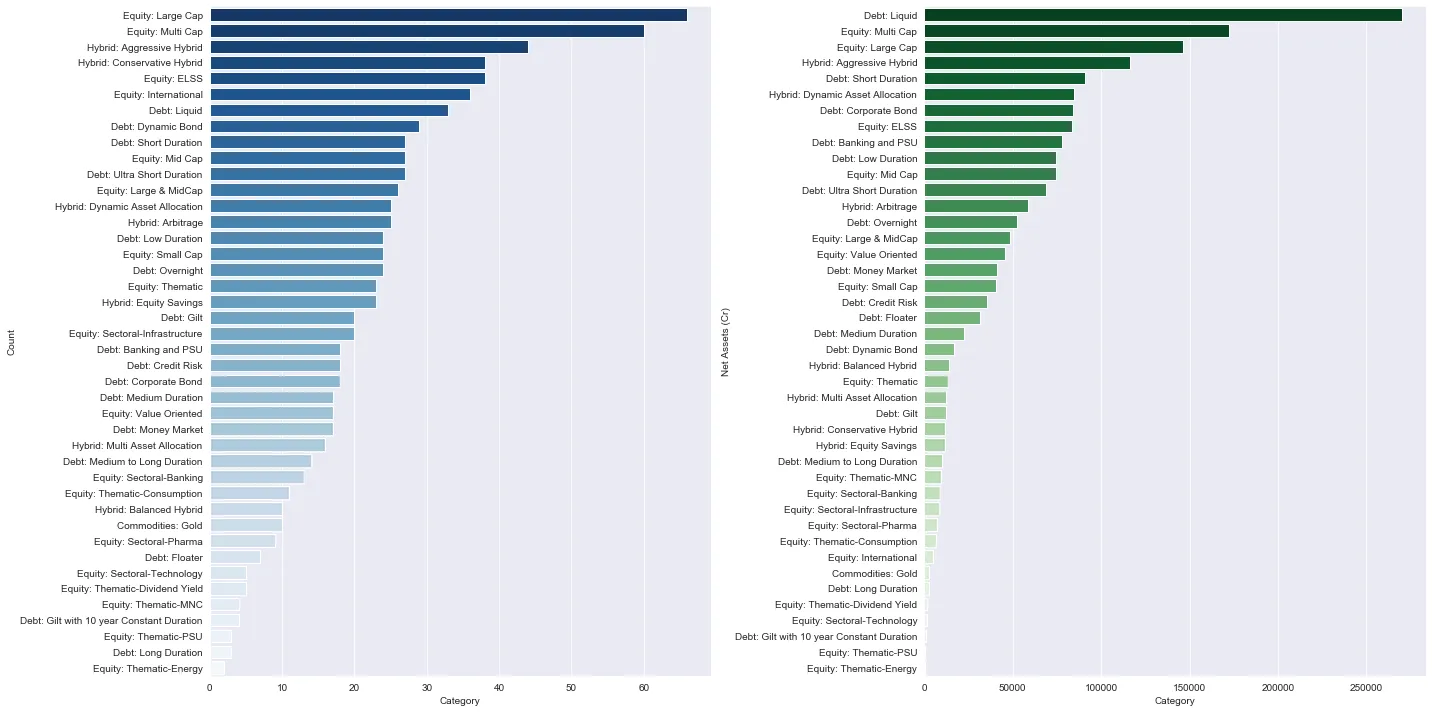

Types

Looking at types or sub-category of funds, there are 42 unique types of direct mutual funds! Equity large cap has the maximum number of funds, followed by equity multi cap and hybrid aggressive. In terms of net assets, liquid debts funds have the largest assets under management followed by equity multi cap and equity large cap.

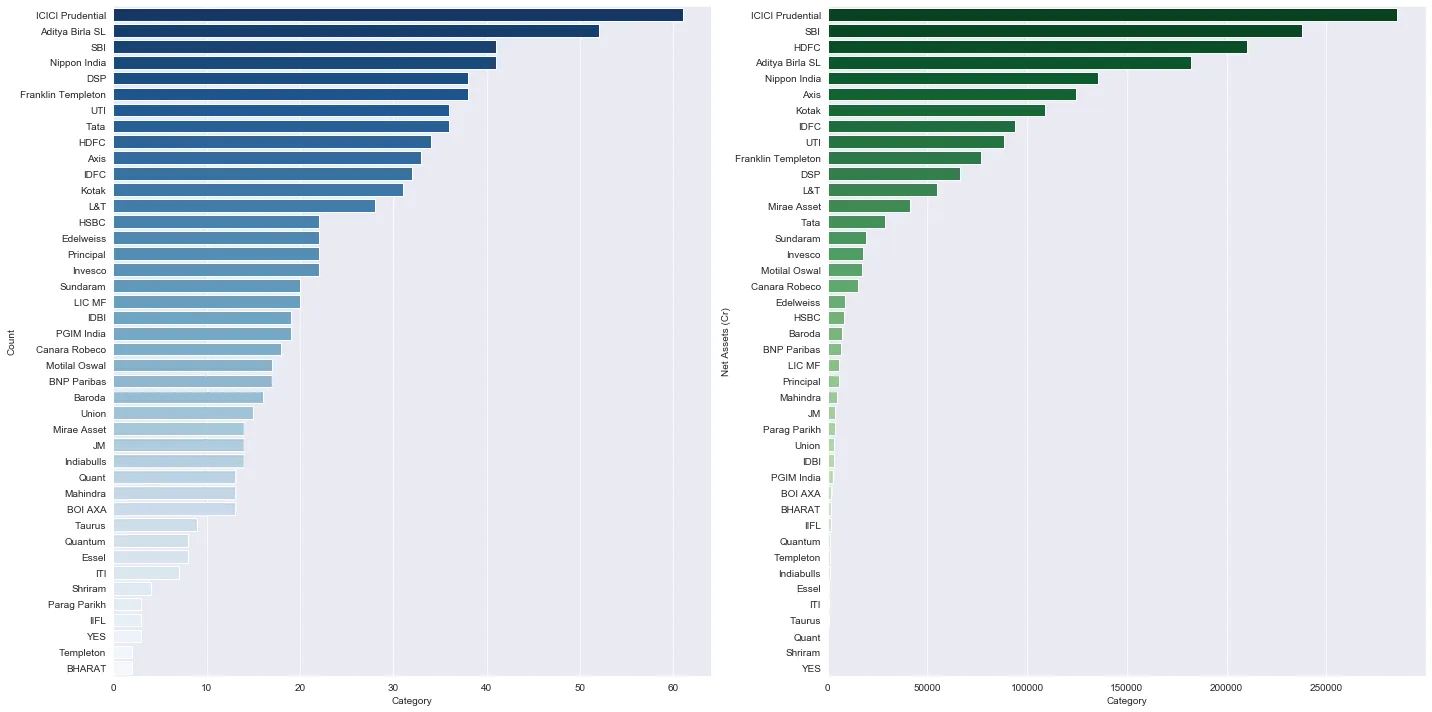

Fund Houses

We found 42 unique AMCs or Fund Houses managing mutual funds— ICICI Prudential has the largest number of funds, followed by Aditya Birla SL and SBI while the largest assets under management are with ICICI Prudential, SBI and HDFC in that order. The tiniest fund houses (in terms of assets in direct MFs) are YES, Shriram & Quant.

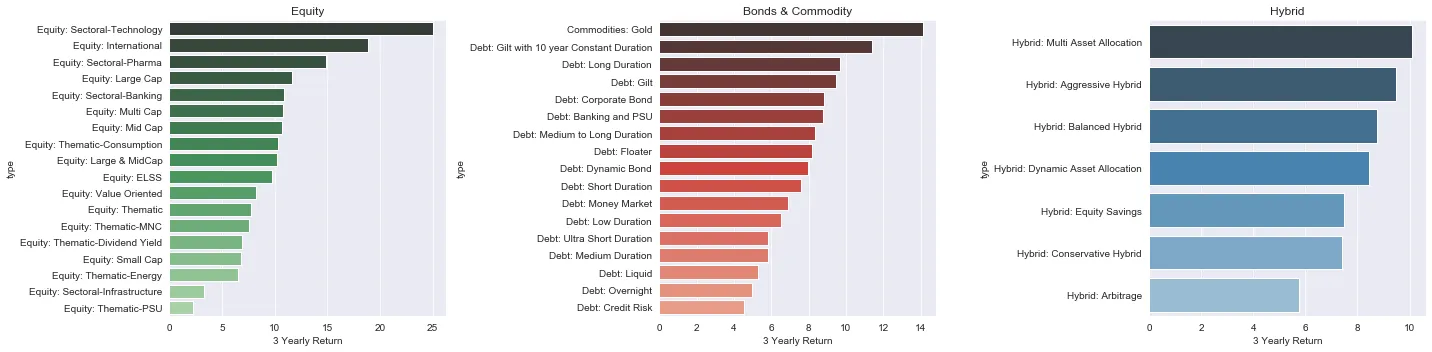

Performance

How do these 884 funds perform in terms of risk and return? We looked at the average return of the sub-category of funds in each of the categories — equity, bonds & commodity, hybrid. (we shortlisted funds with atleast 3 years of history and 100 cr in AUM)

Among equity funds — Technology, International and Pharma funds have given the highest mean returns over 3 years and Infrastructure, PSU & Smallcap the lowest. Among Bonds & Commodities — Gold, 10 year Gilt and Long Duration Debt gave highest return, credit risk and overnight the lowest return. Among Hybrid funds — hybrid arbitrage gave highest return and hybrid aggressive the lowest returns.

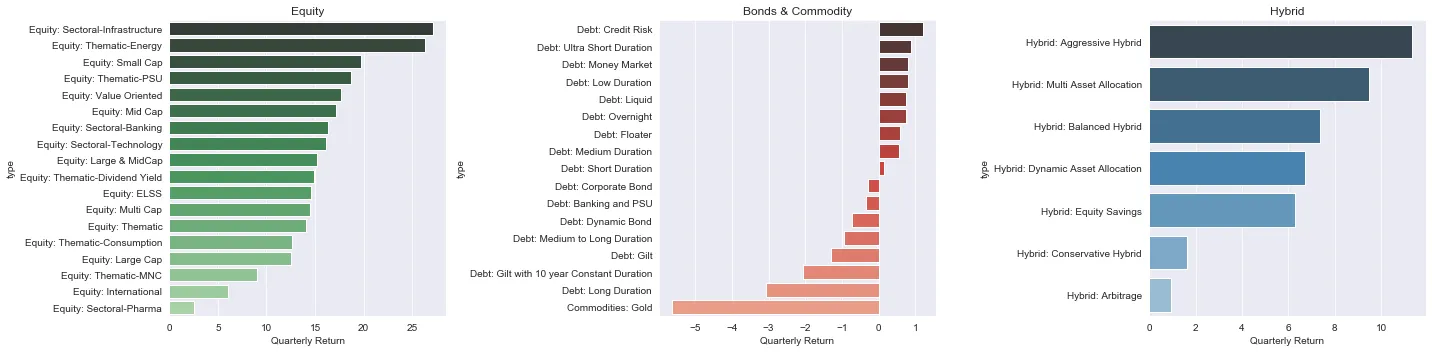

Year Till Date Returns

This year, with covid recovery and budget push on infrastructure, sectoral funds on infrastructure, energy, smallcaps & PSUs are out performing and worst performing were pharma, international & MNC funds. Credit Risk Funds gave the highest performance in the Bonds & Gold category and worst performance was given by gold. Among Hybrid funds, aggressive hybrid funds gave highest return and arbitrage funds the lowest.

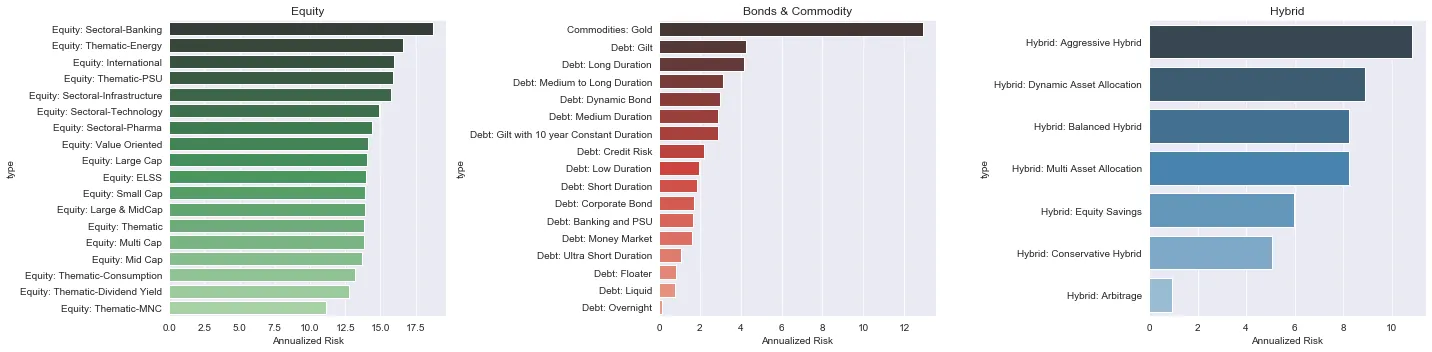

Risk

For constructing a portfolio you also need to look at the risk of the components. Banking & Energy are highest risk equity funds, Gold & Gilt are highest risk in bond & gold category and aggressive funds have highest risk in hybrid category.

Other Factors

While constructing a model portfolio of mutual funds, one has to be congnizant of some very important factors like:

Expense Ratios — the annual maintenance charge levied by mutual funds to finance its expenses

Tax — tax treatment of various category of funds is different, depending on its asset class- equity, debt or hybrid, secondly on duration of holding- short term (less than a year) or long term (more than a year); Indexation benefits are received for holding a debt fund for long term

Entry Exit Load — the entry and exit load of most of the MFs is high due to which the portfolio of MFs cannot be a high turnover one.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

“I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product.”

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

“I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product.”

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

“I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product.”

By Prashant Sharma

CTO, Zydus

“I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product.”

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

“I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product.”

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

“I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product.”

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart