by Sonam Srivastava

Published On June 19, 2022

Let’s no longer play around with it and call a spade a spade. We are in a bear market!

Spoiled by bull markets most of our lives, many have no idea what bear markets are, how long they last, and what to do with our money when in one.

In this post, we will enlighten you all about them.

One definition of a bear market says markets are in bear territory when stocks, on average, fall at least 20% off their high.

Another definition of a bear market is when investors are more risk-averse than risk-seeking.

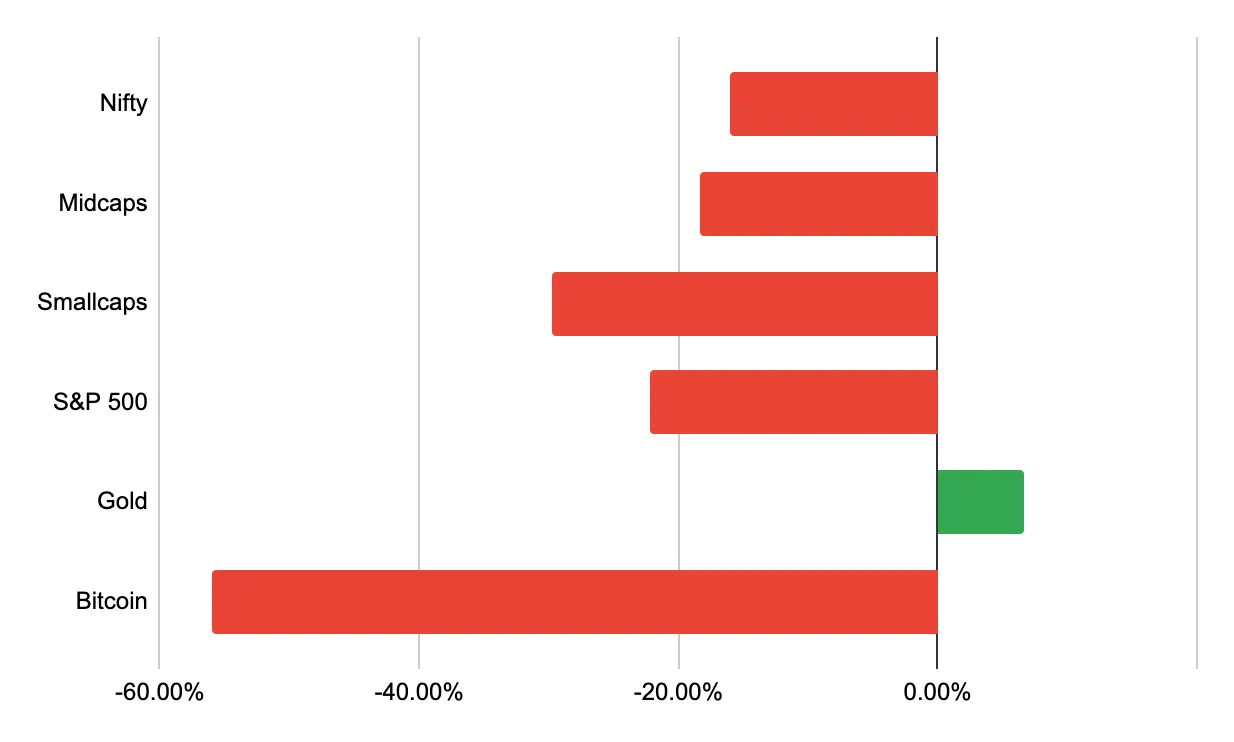

We can see that the indices have been making lower lows since January of this year, which would be a clear point where the bear market started. So we have been in this phase for more than 180 days!

While India remains robust even in the face of trouble and the economy seems strong, most of this trouble stems from the US market, which has reached record inflation and is hiking rates rapidly.

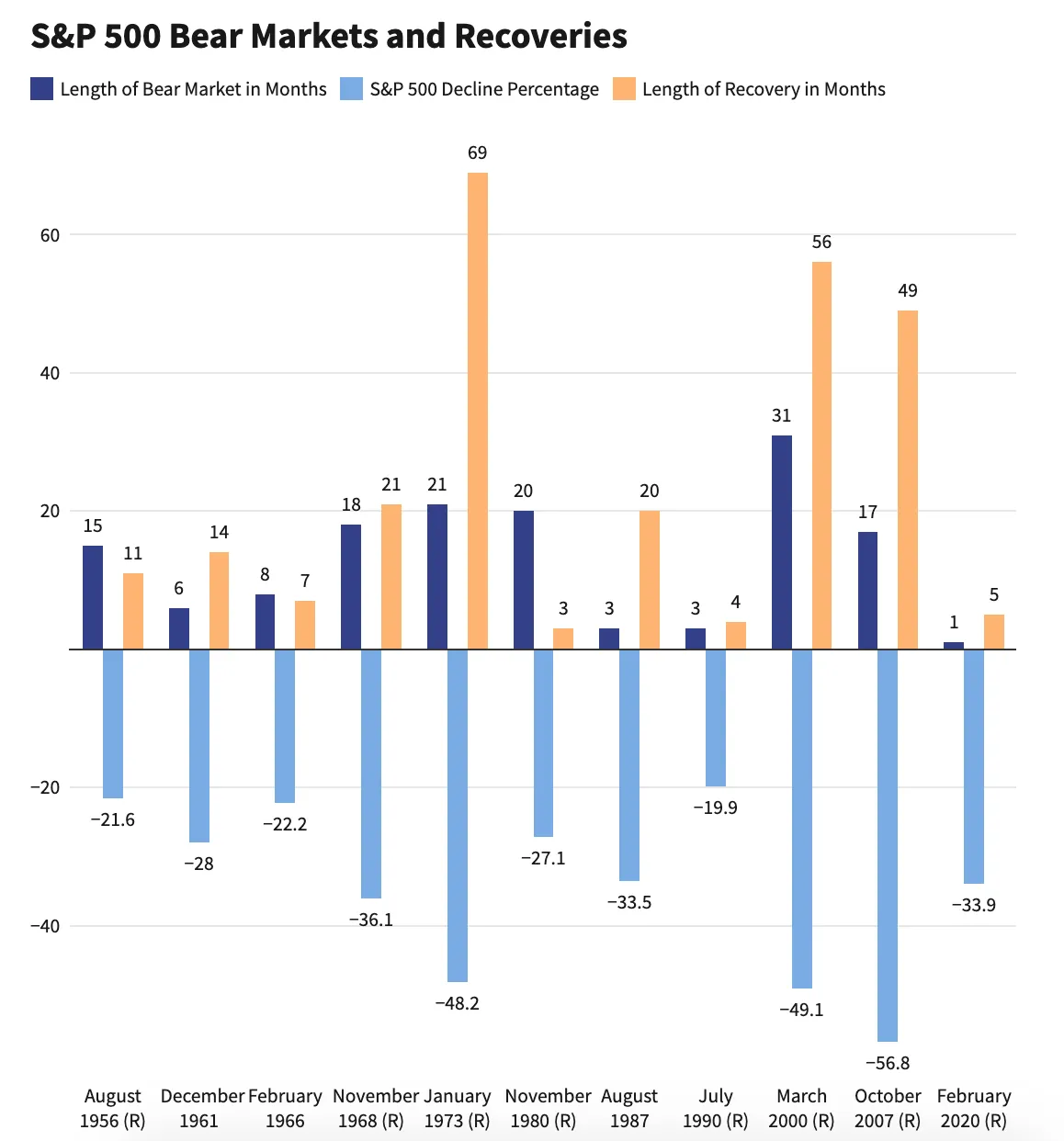

Our last bear market was in 2020, and it lasted a month! But this time, the bear market might not be that small.

As per LPL Research, Bear Markets usually last for 11 months, but if the markets do not cross more than a 20% fall, a bear market can end in an average of seven months. We are already six months in and desperately looking for a positive sign like an easing of US inflation or the end of the Ukraine-Russia war. But the data out of the US is grim, and it impacts everyone.

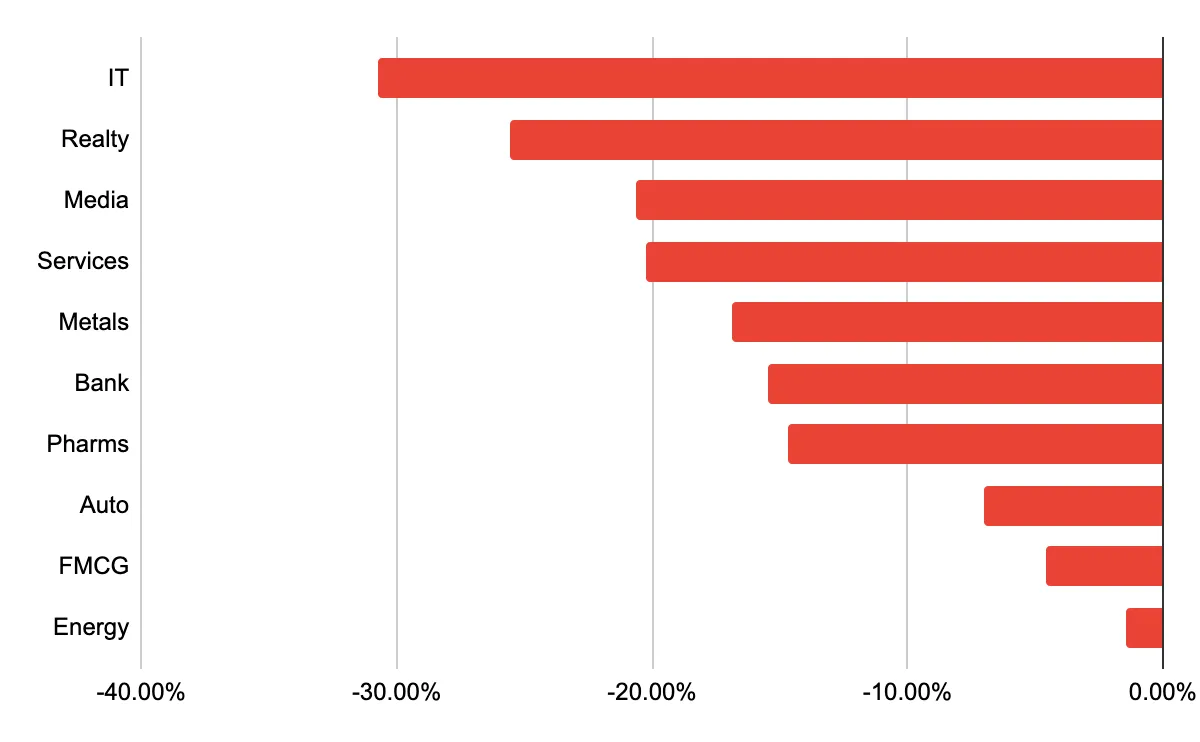

High-valued equity stocks are the worst to suffer, as seen in the IT sector.

High rates and high inflation slow demand

The companies that win will have pricing power and low leverage

Commodities are going to have a good run

Consumer demand which is vital right now, might suffer for discretionary items.

1. Avoid the Urge to sell in Panic.

During the market correction, the urge to sell off your portfolio might seem like the best idea, but the best & worst days of the stock market are pretty close to each other, and we suggest our investors avoid taking such drastic steps.

2. Resist the Urge to Average your Portfolio stocks

When you see a market fall, your mind might prompt you to make investments indiscriminately. You should resist this temptation and wait for advice from us regarding when to make Lump-sum investments or start SIPs. Protecting your assets is our top priority.

3. Timely Portfolio Rebalance

Timely rebalancing is a strategy that helps reduce the overall risk in your investment portfolio and provides superior returns on your investments. Hence, we urge our investors to timely rebalance their small cases with us and keep their portfolios updated.

4. Focus on Holding your Investments for the Long Term

Every market correction makes you question your Long term investments with questions like:

Will the stock market ever go up?

Will the Russia-Ukraine war ever stop?

Will the Indian economy survive and recover from these levels?

Markets are volatile in the short term, but how this volatility impacts your portfolio is in your hands.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart