by Sonam Srivastava

Published On Nov. 27, 2022

Ever since the inflation numbers have eased and the US FED has hinted at a slower rate hike, the market euphoria has returned. Nifty is almost touching the all-time high of 18600, and we have seen the FIIs return to India!

This has been a curious rally where only the large-cap. Nifty stocks have risen due to passive buying by FIIs. Scenarios like these are usually a precursor for a broader rally across stocks. Let’s understand the numbers and consider what factors we can watch going forwards.

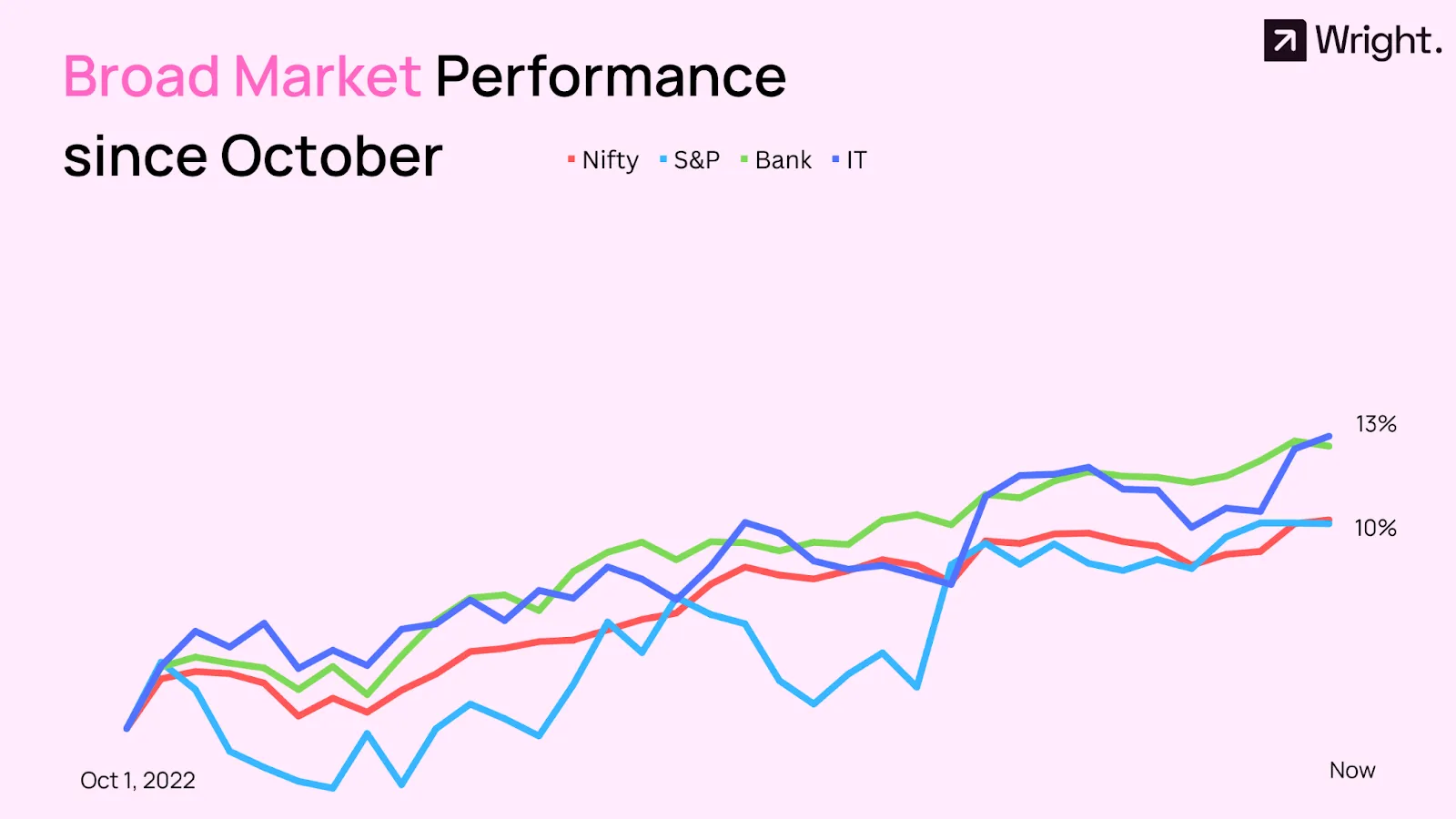

The rally has seen the large-cap stocks in the banking and IT sector leap, and the Nifty and the S&P 500 rally 10% from the lows.

The recent commentary by the FED that the rate hikes might slow from 75bps to 50 bps hints at an inflexion point in the shifting of the market regime towards the continuing trend.

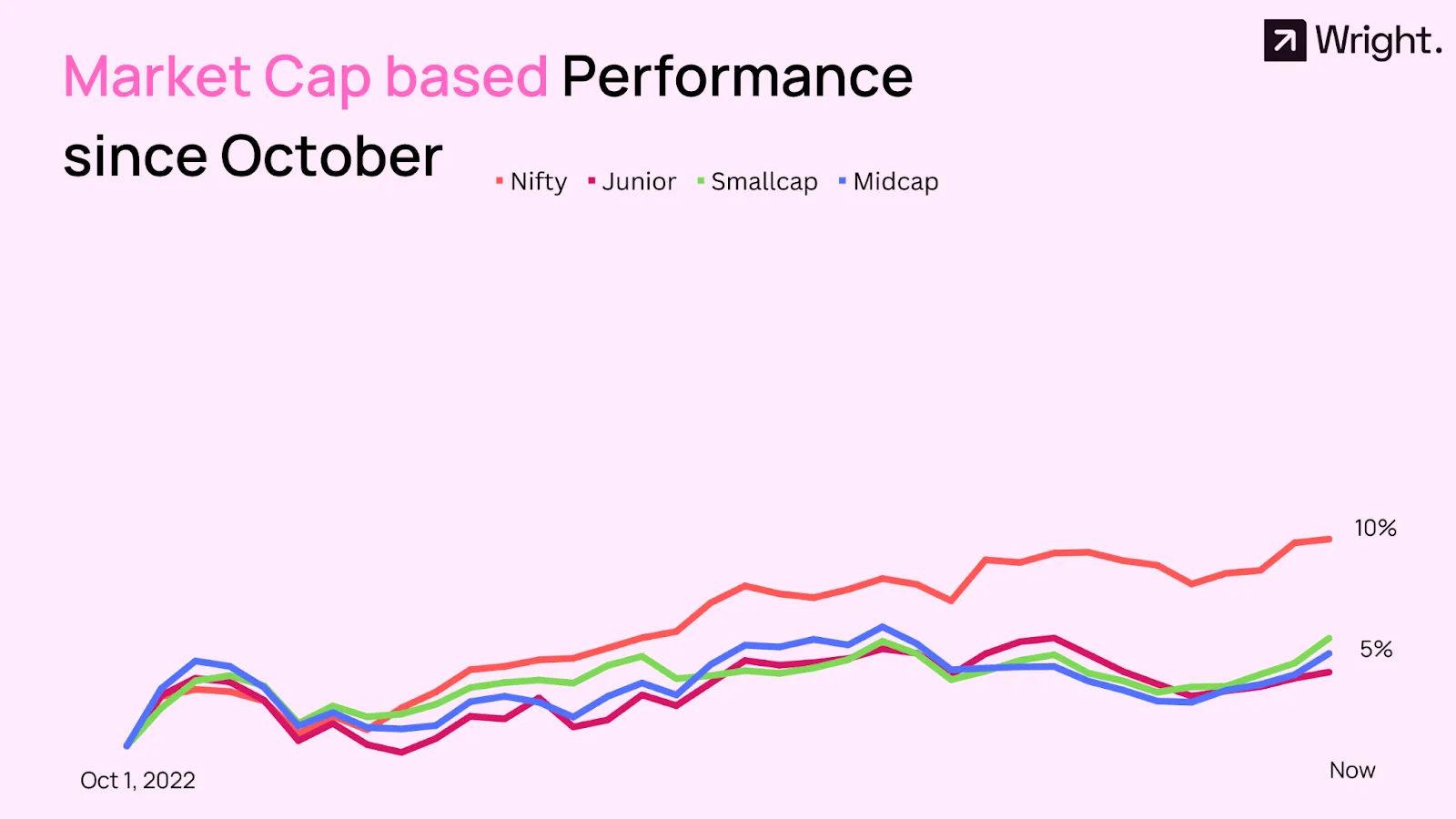

During this 10% rally by the Nifty, the smaller stocks, the Midcaps and the Smallcaps have lagged. Not only that, even the Nifty Junior or Nifty Next 50 have also lagged.

This indicates that the buyer has only happened by the FIIs in the more extensive index passively with on stock picking element.

If we look at the FII/DII numbers, the FIIs bought 11,000 crores in November, while the DIIs have sold a little bit.

What is encouraging, though, is that the rally in the large caps usually leads the rally in midcaps and small caps; mostly, in such scenarios, the midcap and smallcaps rally shortly after. We saw last week as a big pickup event for the smaller stocks.

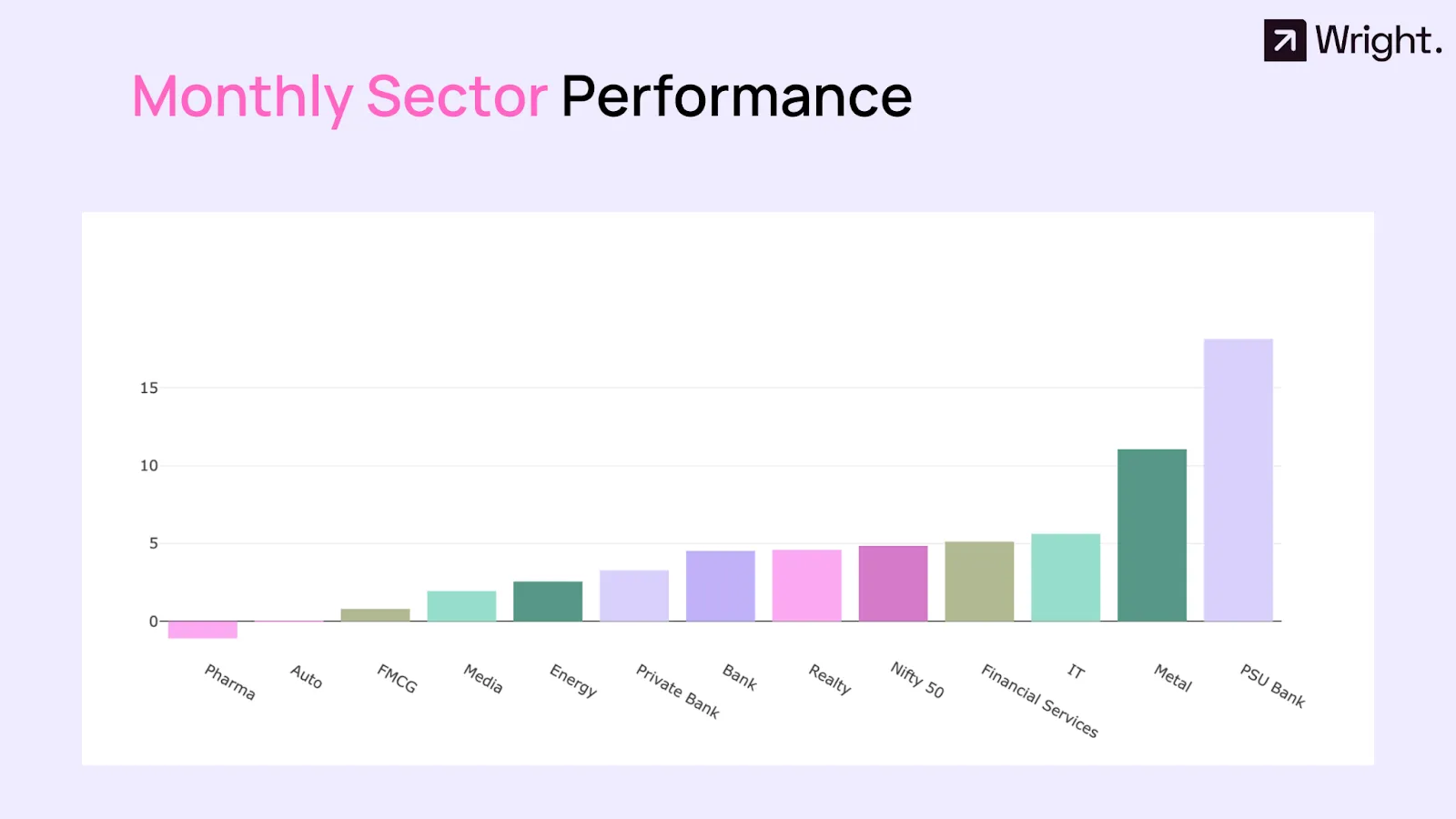

In the last month, PSU Banks and Metals have given stellar performance. And the prominent performers of last year, Autos, FMCG and Pharma, have been sold.

High-flying stocks like Eichermotors and Tube Investments India have seen consolidation, while the PSU Bank stocks have given explosive growth. The IT sector is also growing and might keep the momentum going forward.

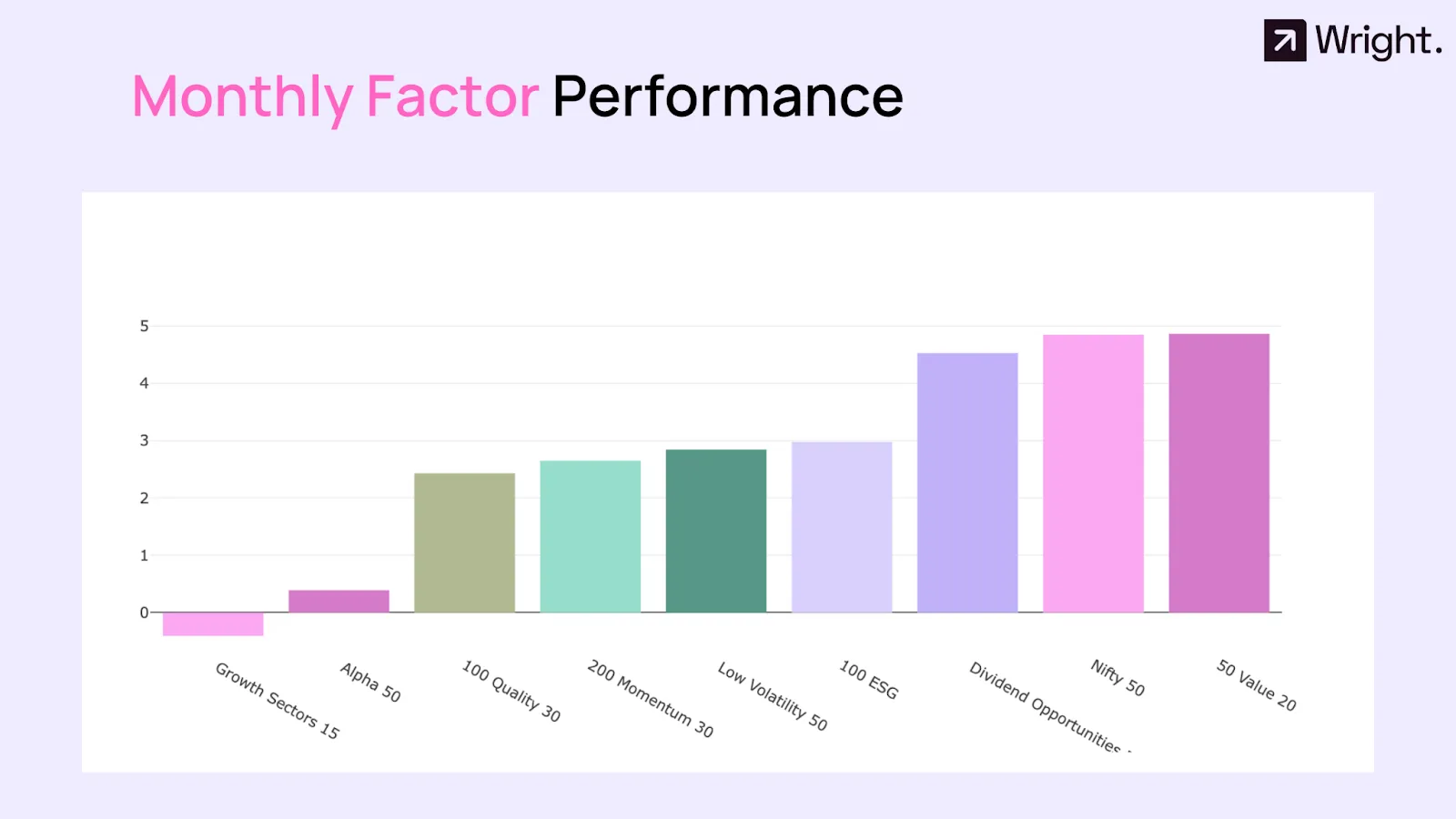

Factor portfolios have mostly lagged behind the Nifty as any specialised stock picking has yet to work, and only passive has done well in the last two months.

The year's best performers - Growth, Alpha, Momentum - have all lagged during the last month.

But if the momentum sustains from these levels, the high-flying Momentum and Alpha factors will return.

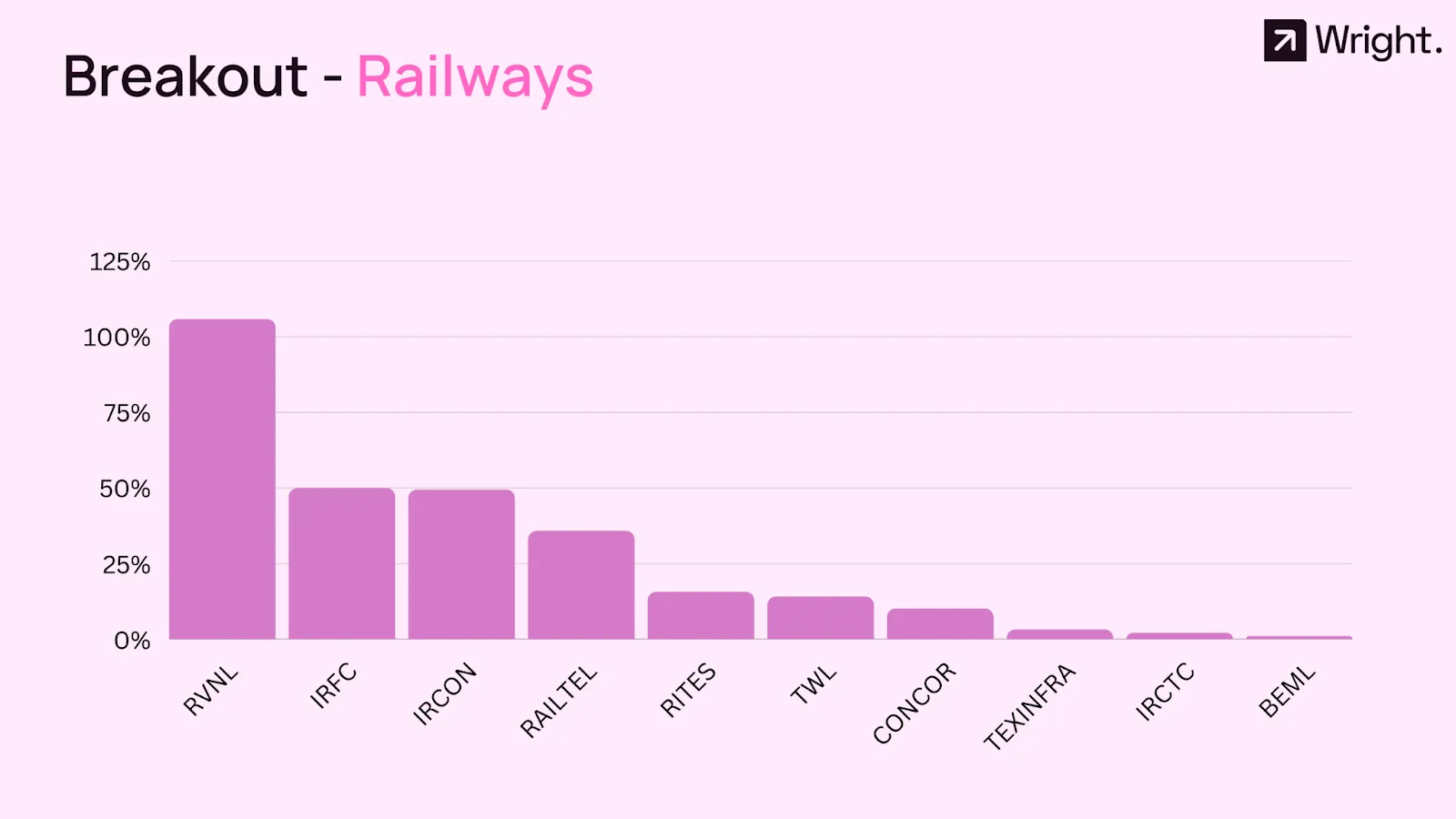

Railways stocks have had a breakout few months. While IRCTC has not shown the numbers, stocks like RVNL and IRFC have rallied massively.

Why are rail stocks trending? First, massive Capex announcements have already been made, and more are in the offing. If India must grow at 8%-9% consistently, we need to invest in all kinds of infrastructure, including rail. And if rail infrastructure is given a massive push, sector companies will be the prime beneficiaries.

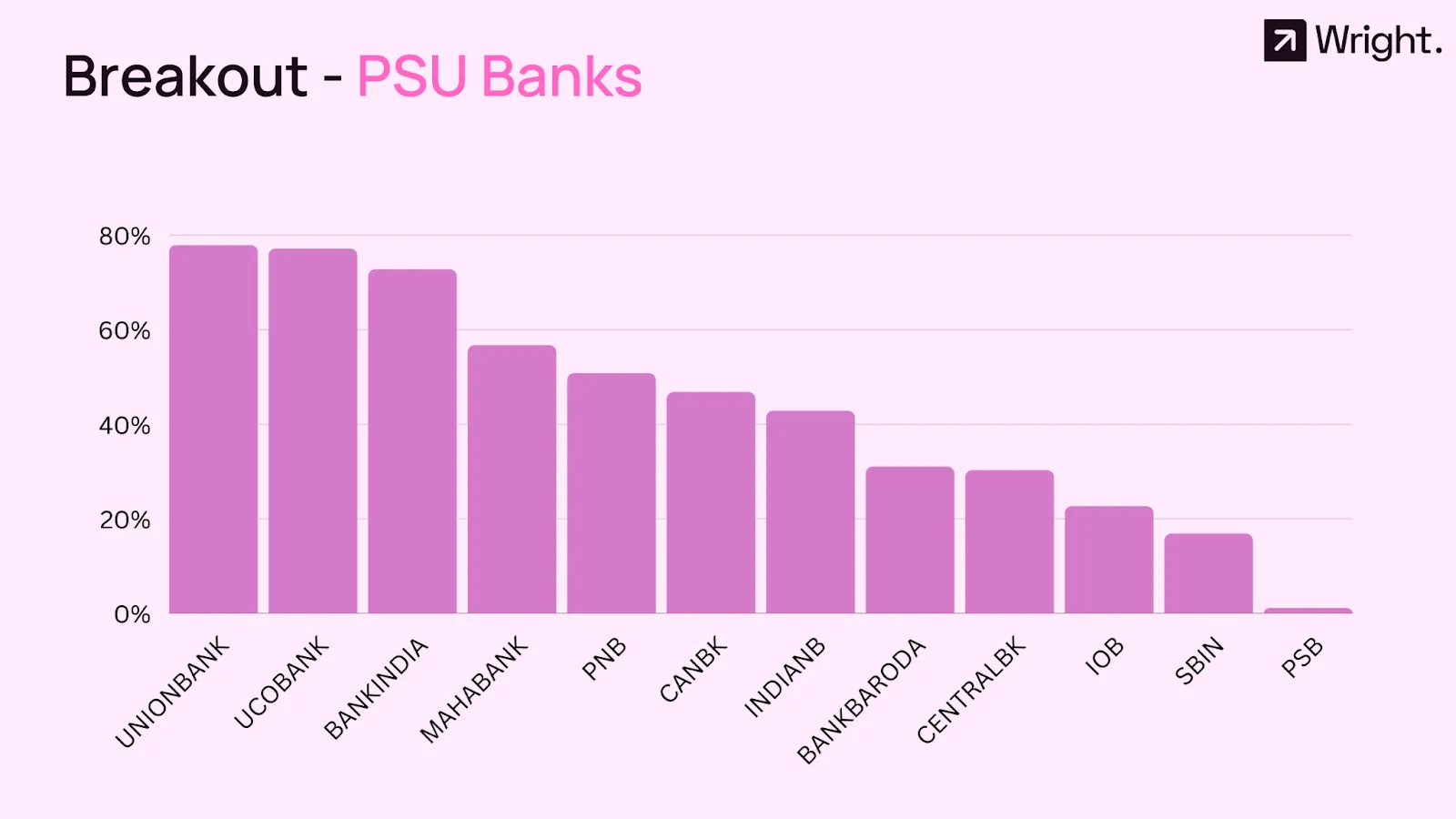

Public sector banks (PSBs) reported a stellar performance in the July and September quarters. The asset quality of PSBs has improved, their profits have been robust, and they have recorded an impressive pace of credit growth in the July-September quarter. The same is being reflected in the stock prices.

What to watch out for?

While crossing the all-time high is a significant bullish signal, it can also cause a short-term reversal. Some technical indicators like RSI have turned overbought, and there could be a calm down on the rally.

Midcap & Smallcaps have been laggards till now but last week saw a quick recovery, and the same could sustain going forwards.

The IT sector has started showing early signs of recovery since the better-than-expected data came in on inflation last month. Many worries bog down the industry, but the trend could still continue.

The US Fed has the FOMC meeting next week, indicating how they will move about the rate hikes. Along with this, the US bond yields also need to be watched.

MAcroeconomic Numbers - GDP numbers and Auto sales will come out next week to give a direction about the broader economy.

FII flow - FII flow is deciding the market trend right now, and we will have to keep an eye out for the same.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart