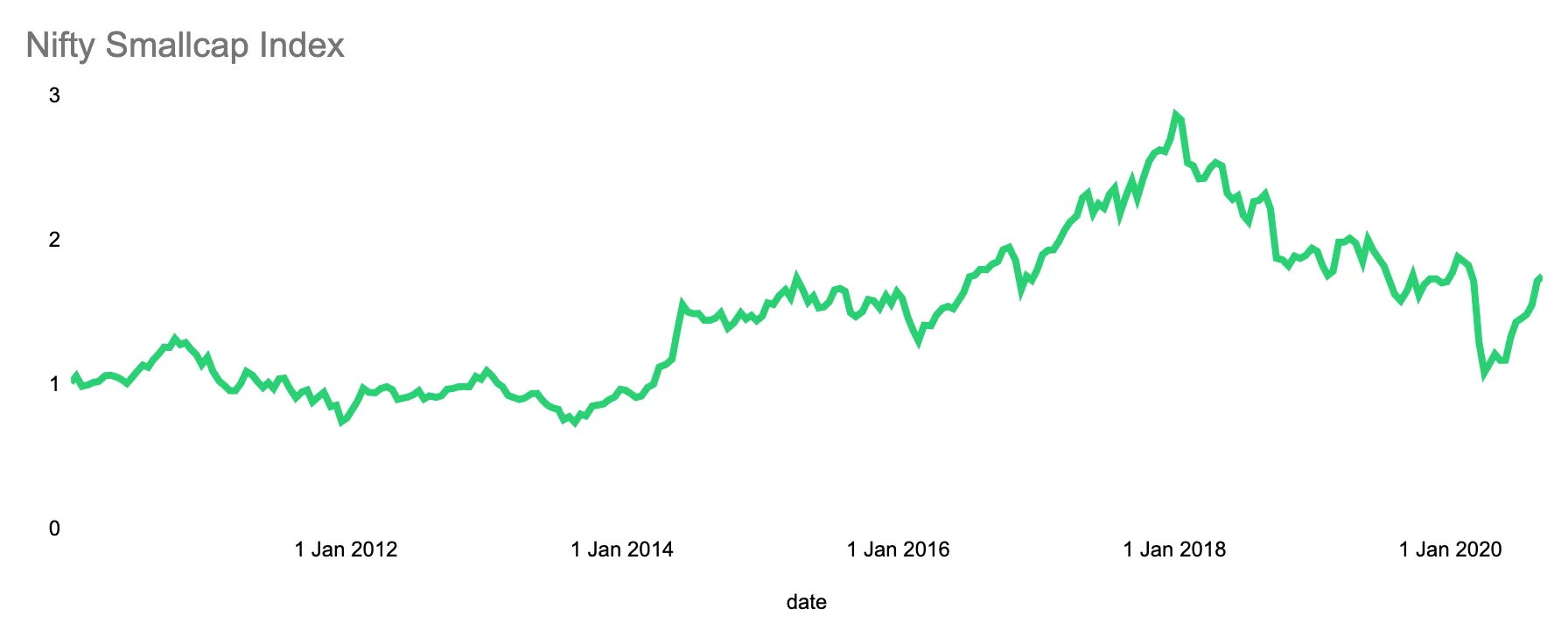

The equity markets during 2013–18 witnessed the most spectacular smallcap rally where stocks doubled their value in a matter of days like it was nobody’s business. Smallcap investing is one of the most active investment themes in the Indian markets, with strong smallcap companies being recognized for their worth by institutions & FPIs, and creating breathtaking stories in the process.

I sat on the trading floor at a big brokerage house during the last smallcap bull run and saw this from the front seat, every one of us in the market was picking multibaggers and many of us doubled our bonuses by investing in these gems till the rally finally stopped in 2018.

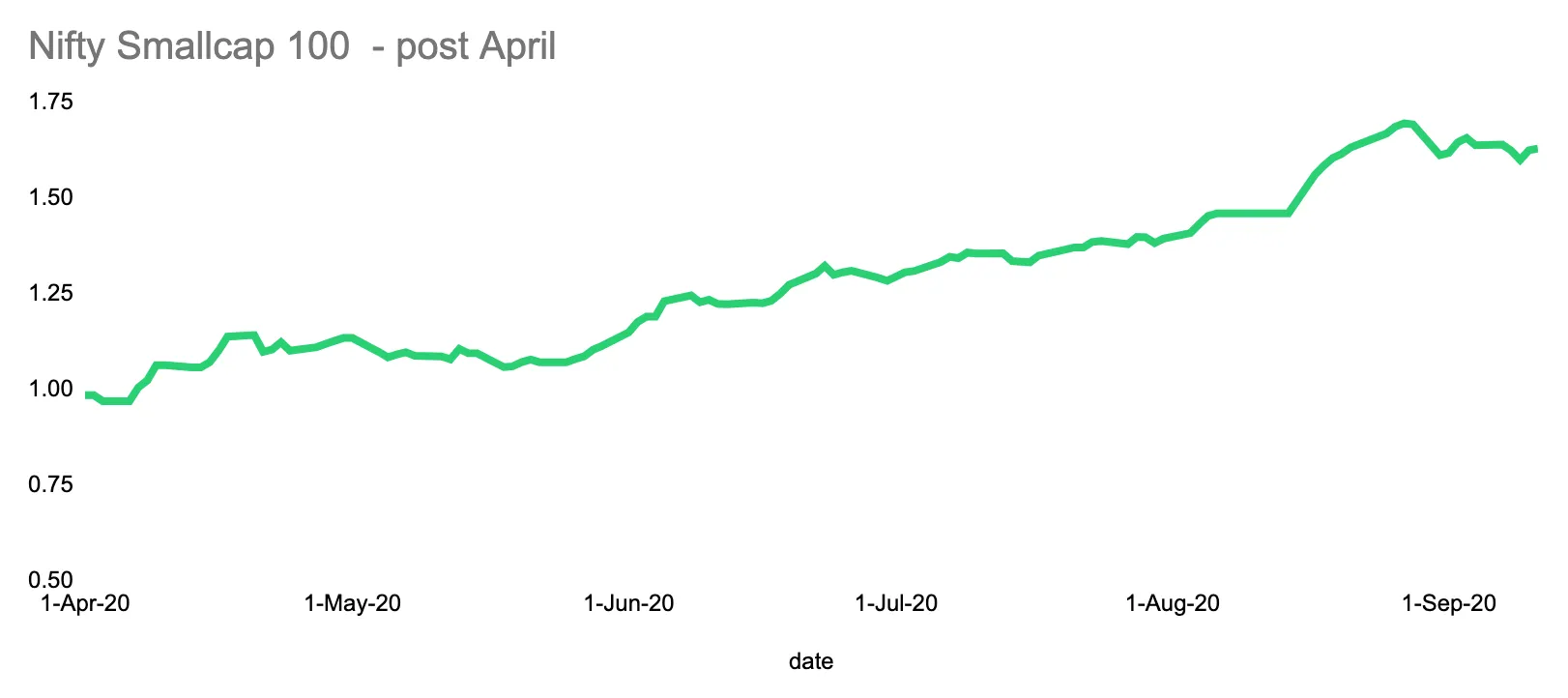

In 2020, post COVID, in the recovery rally in the markets, we see a similar rally and I cannot help but dig back my old passion for smallcap strategies to get this flavour. The recent notification of changes in SEBI regulations for mutual funds, calling for greater participation by multi cap mutual funds in smallcaps has also consolidated this rally and hopefully the smallcap upcycle continues in full swing.

Our subscribers know that Wright has been publishing flagship “Multi Factor Tactical” strategies for more than a year now that focuses on long term steady market beating returns as the core of the offering. We have decided to offer a smallcap strategy as a satellite portfolio to not miss out on this irresistible rally.

The criteria for selecting stocks in this portfolio are:

We use some advanced statistical concepts for the final selection of stocks that are based on the above criteria.

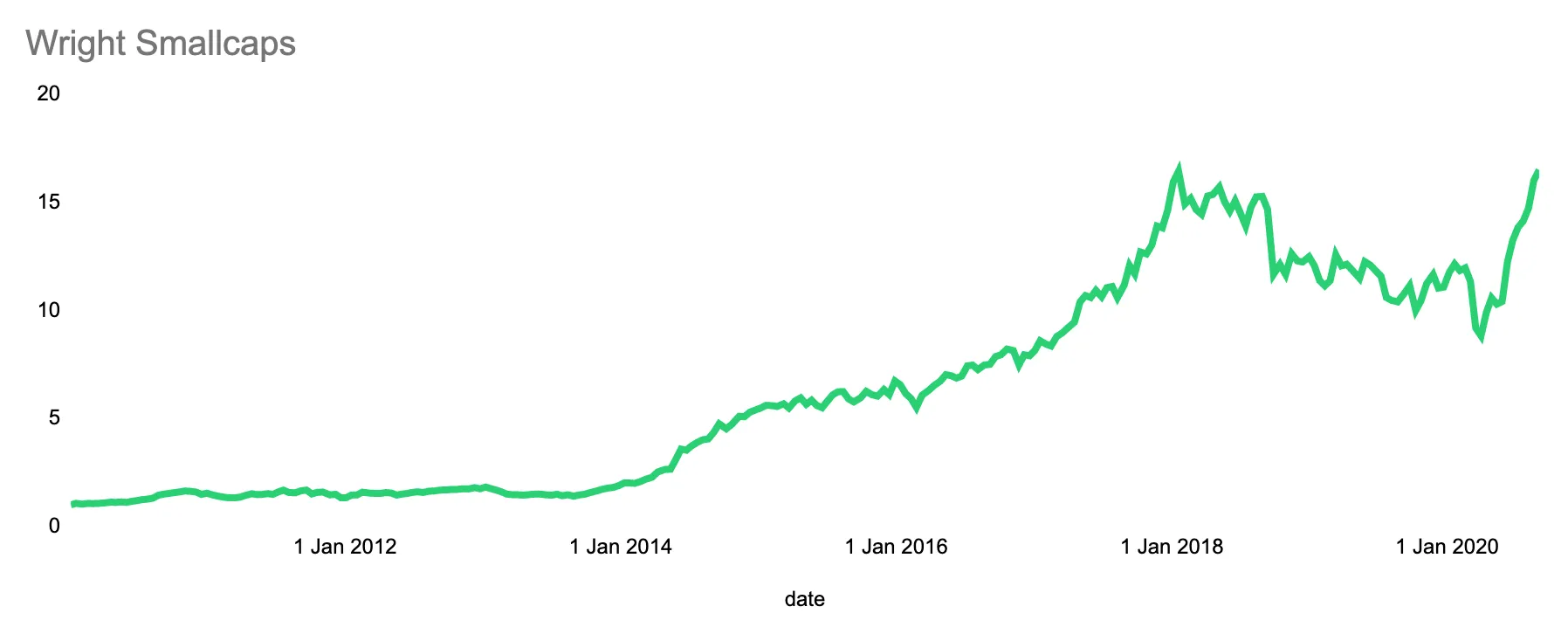

So here’s how the performance of our smallcap startegy looks historically (in the backtest)

This portfolio launched as a satellite portfolio on top of our core offerings a way for us to give our investors a chance to take advantage of the high growth smallcap rally. We understand that that smallcaps are already at high valuations but with the liquidity being pumped in the system by central banks and the regulatory support there is a potential for growth.

Here’s hoping for fireworks ahead!

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart