by Siddharth Singh Bhaisora

Published On July 20, 2025

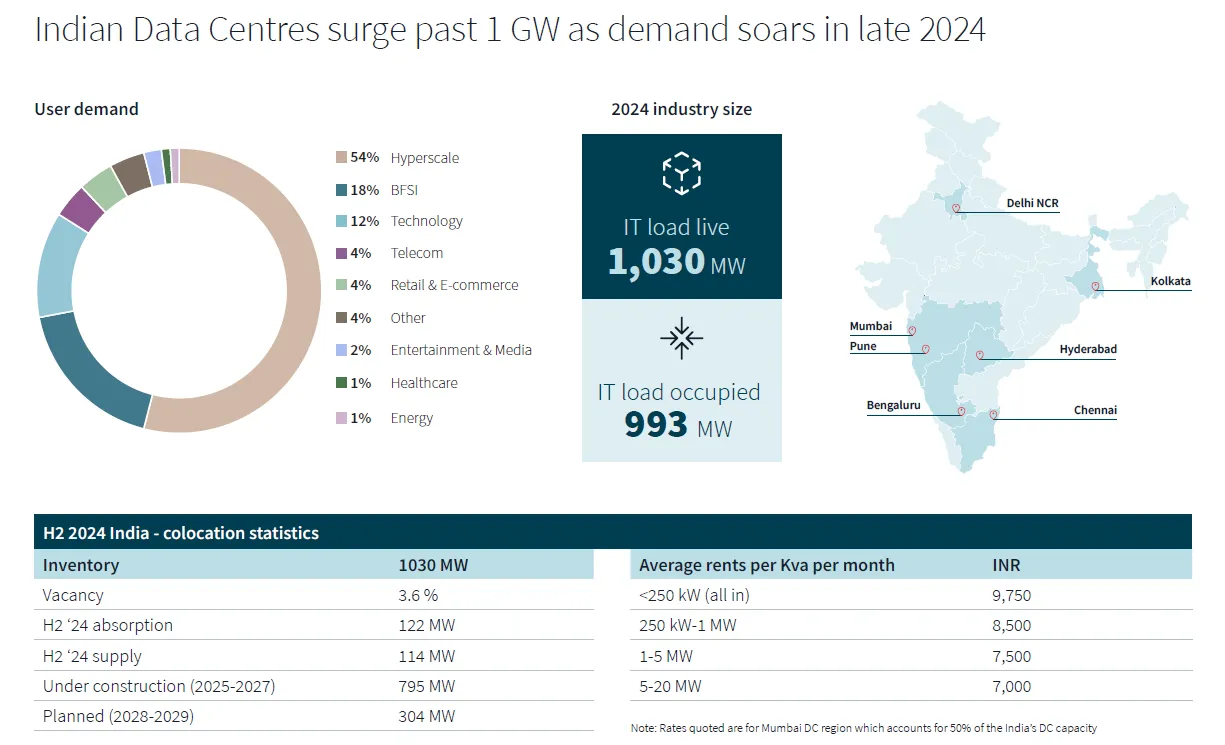

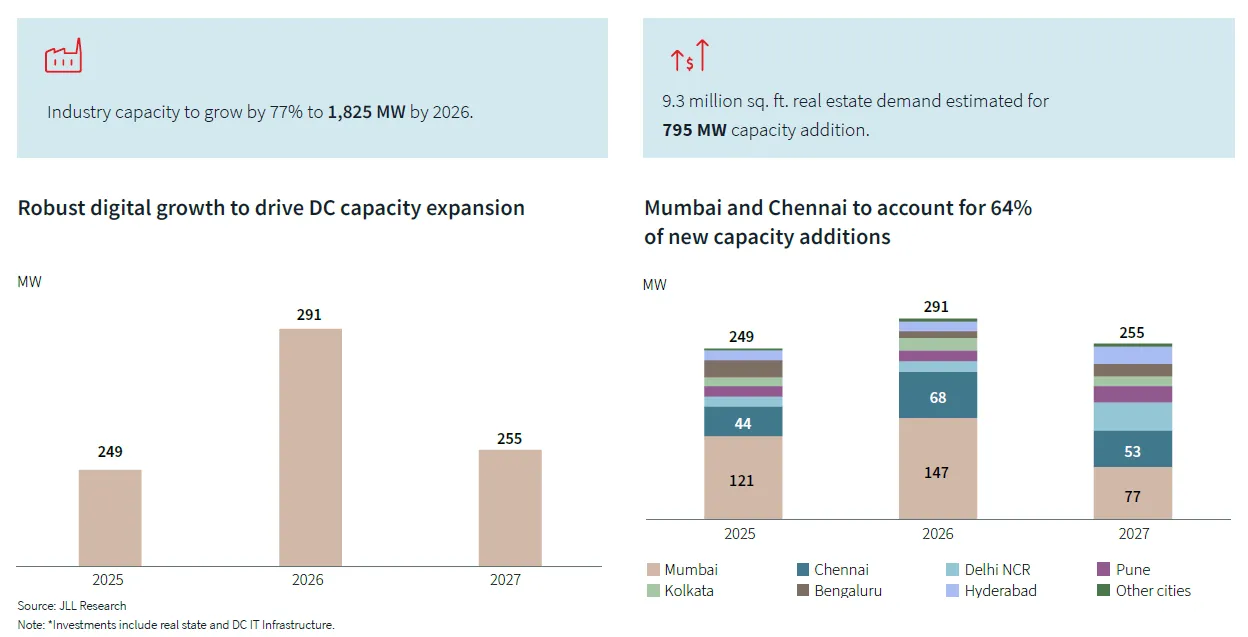

India’s data centre industry is barreling toward an unprecedented expansion. It crossed the symbolic 1 GW installed IT load mark late last year. Demand is compounding at double digit rates, propelled by AI workloads, sovereign cloud mandates and a USD 1 trillion digital economy ambition. Installed IT power forecast to leap from 1.26 GW in April 2025 to more than 4.5 GW by 2030. To meet this demand will require fresh capital of $20 to 25 billion over the next five to six years and a tripling of built up real estate footprint from today’s 15.9 million sq ft to roughly 55 million sq ft.

With Airtel recently offering Perplexity Pro to its users, usage and consumption of AI related resources will continue to rise exponentially. Let’s look at what’s happening in this industry.

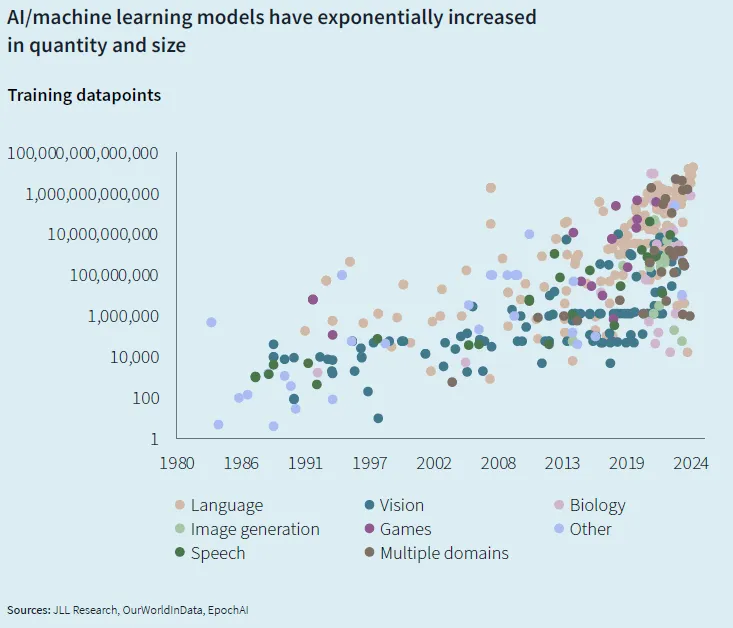

Machine learning hardware performance has been doubling roughly every two years, propelled by specialised GPUs and AI accelerators. Training tasks that once took 32 hours now finish in a single second on the latest GPUs, enabling models to ingest ever larger data sets and iterate faster. This explosive demand for compute is the primary energy and space “pull” on new Indian capacity.

Modern AI chips consume up to 300 % more power than their predecessors, and analysts expect global data centre energy demand to double within 5 years. To cope, operators are pivoting from air cooling to hybrid liquid solutions (rear door heat exchangers and direct to chip loops) that can support racks beyond 100 kW. Facilities built or upgraded for these densities command premium take up in Mumbai, Chennai and Pune.

The compute layer is being re architected around next generation GPUs that consume up to 300 % more power than prior nodes, forcing a transition from air to hybrid liquid cooling and driving rack densities beyond 40 kW . Simultaneously, the “Neo Cloud” paradigm is pushing capacity to the edge to reduce latency for 5G, IoT and generative AI inference.

The emergence of NeoCloud is distributing computing to the network edge, reducing latency for 5G, IoT and AI workloads. By sowing clusters of smaller data centres across tier 2 and tier 3 cities, NeoCloud is expected to bring in fresh investment and widen the geographic footprint of India’s industry.

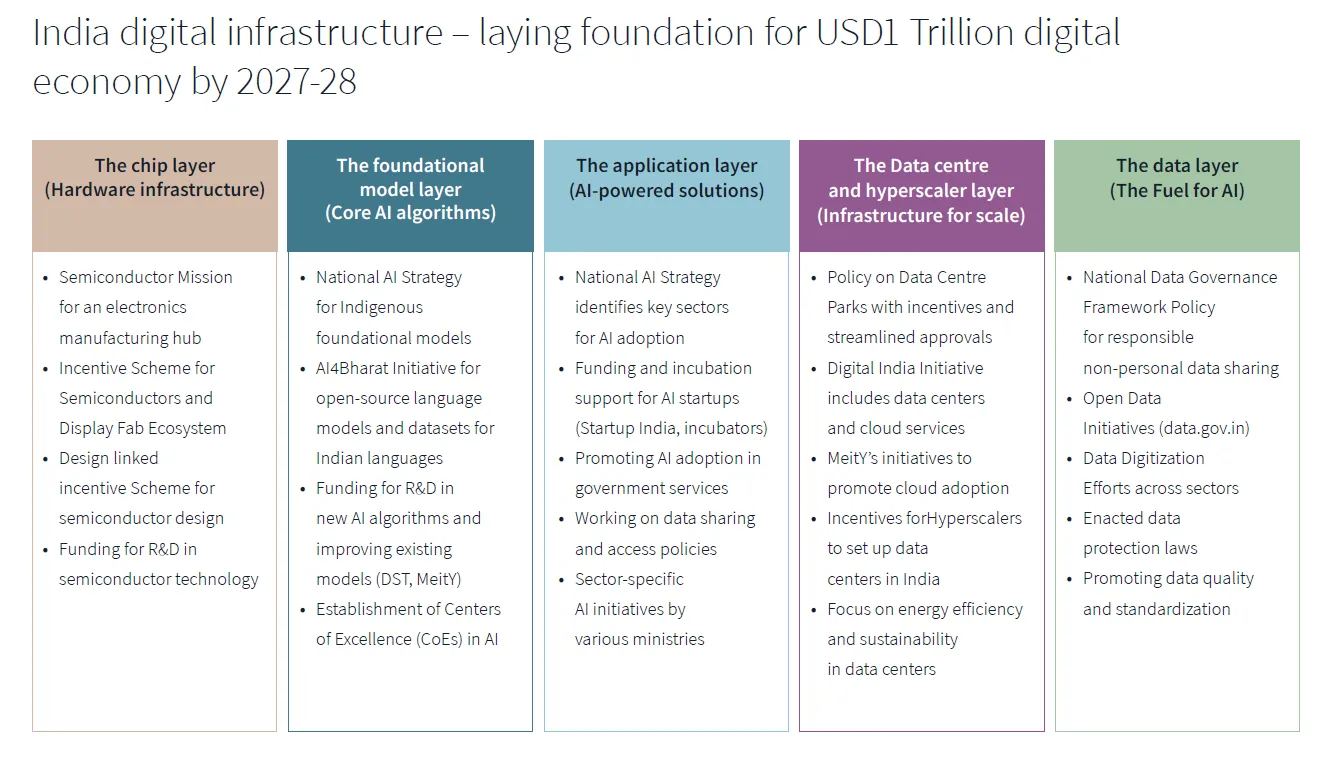

New rules under the Digital Personal Data Protection Act, 2023 emphasise data residency, informed consent and graded fiduciary obligations; Significant Data Fiduciaries must perform annual protection impact assessments. RBI rules, MeghRaj and sectoral mandates now require sensitive Indian data to be stored domestically, making “India first” capacity a compliance necessity. This is accelerating “in-country” capacity procurement by BFSI, public sector and OTT platforms. The National AI Mission, Data Centre Park policy, and state level schemes (e.g., Maharashtra’s green data centre incentives) collectively subsidise land conversion, stamp duty, and renewable energy sourcing.

India’s AI mission funds chip fabrication, indigenous foundational models, open source language datasets and a nationwide network of Centres of Excellence. Incentive schemes for data centre parks, energy efficient designs and hyperscaler investments underpin a US $1 trillion digital economy target by 2027 28. India’s 17 active subsea cable landings and another half dozen planned give Mumbai, Chennai and the upcoming hub of Kochi direct low latency routes to Asia Pacific, Europe and the Middle East.

Hyperscalers & GPU clusters: Cloud giants continue to pre commit massive blocks in Mumbai, treating the region as a training hub for large language models.

BFSI migration: Banks and insurers are moving into colocation halls to meet stricter localisation norms, driving strong offtake in Navi Mumbai and Chennai.

AI pre commitments: Operators report an 800 MW pipeline of AI specific demand in the next few years, locking in future utilisation ahead of build outs.

Here are some data centre companies that have established capacity in India:

Company Name | Established in | Headquarters in India | Number of Datacenter Projects As of 2025 | Total IT Load/ Capacity As of 2025 |

STT Global Data Centers India | 2014 | Mumbai | 30 | 400 MW |

CtrlS Data Centers Ltd | 2007 | Hyderabad | 19 | 250 MW |

NTT Communications | 2015 | Mumbai | 18 | 268 MW |

Tata Communications | 1986 | Mumbai | 12 | Not Available |

Sify Technologies | 1995 | Chennai | 11 | 190 MW |

Nxtra Data Limited | 2013 | Gurugram, Haryana | 12 | 200+ MW |

Reliance Group | 1973 | Mumbai | 9 | Not Available |

Web Werks India | 1996 | Navi Mumbai | 6 | 40 MW |

AdaniConnex | 2021 | Ahmedabad | 6 | 33 MW |

ESDS Software Solution Limited | 2005 | Nashik | 5 | 7 MW |

NxtGen Cloud Technologies | 2012 | Bengaluru | 4 | Not Available |

Yotta Data Services | 2016 | Mumbai | 3 | 434 MW |

L&T Cloudfiniti | 2024 | Mumbai | 3 | Not Available |

Equinix India | 2009 | Mumbai | 3 | Not Available |

DigitalConnexion | 2022 | Mumbai | 2 | 150 MW |

Tier III halls with N + 1 redundancy still host roughly four fifths of active floorspace because they balance uptime with cost, especially in capital intensive markets such as Mumbai, Bengaluru and NCR. Yet Tier IV, the highest “fault tolerant” grade, is the fastest growing slice: CtrlS already controls most of India’s Tier IV footprint and is doubling down with new renewable powered campuses, while Equinix, Pi Datacenters and Yotta invest heavily in similar 2N architectures that weave in liquid cooling and on site solar or wind power.

Capex intensity: Turn key Tier III builds now average US $7 to 8 m per MW inclusive of liquid cooling piping and 50 % renewables mix.

Operating leverage: EBITDAR margins at mature facilities remain >60 % despite a 15 to 20 % power pass through mark up ceiling; GPU racks priced at 1.4 to 1.6× CPU racks.

Financing: Domestic infra funds and global data centre REITs are active; rupee debt at 10.5 to 11.5 % VS. cross border green loans at SOFR+250 bps.

Exit multiples: Recent M&A prints (e.g., APAC platforms) imply EV/EBITDA 20 25×; India is still trading at 16 to 18×, offering cap rate compression upside.

The Indian market is racing towards an estimated 1.2 billion smartphone users by 2029, each streaming ever heavier video, gaming and commerce workloads that must ultimately live on servers housed inside domestic racks. That traffic would stall without bandwidth, yet India’s connectivity backbone is keeping pace. BharatNet has already threaded more than 600,000 kilometres of optical fibre through the country, bringing true broadband to nearly 190,000 village councils and lifting total fixed lines from just 61 million in 2014 to more than 816 million by 2022.

Mumbai remains the main data centre hub, commanding 41 % of live capacity, followed by Chennai at 23 % and Delhi NCR at 14 %. Together, the 2 western ports of Mumbai and Chennai already host nearly 2/3rds of the Indian data centre power. Yet analysts see the next leg of growth cascading into Hyderabad, Pune and Bengaluru each poised to add 300 MW plus of new supply, with Hyderabad alone projected to match Mumbai’s 1 to 1.2 GW pipeline by 2030. Pune has become a spill over valve for Mumbai’s land constraints, and Kolkata is finally on the map thanks to an east coast cable landing due in 2026.

Self-built hyperscaler parks, smaller “micro edge” sites of two to five megawatts are popping up in cities such as Jaipur, Chandigarh and Coimbatore, bringing content and AI inference closer to end users and public sector workloads mandated to stay within state borders.

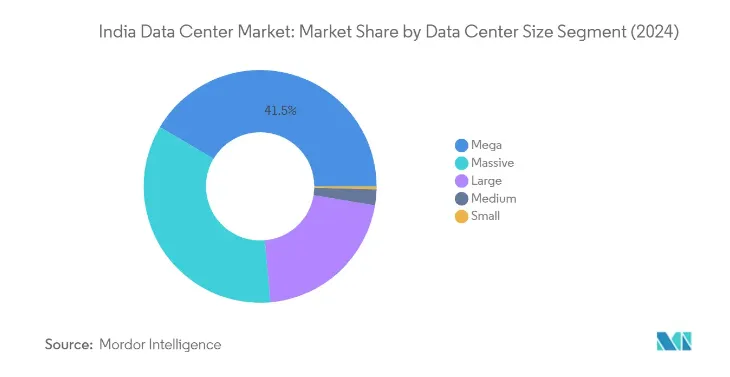

Facilities larger than 50 MW are expected to form almost two thirds of India’s DC inventory by the end of the decade, mirroring hyperscaler appetite for single campus capacity. A report from Colliers noted that “green penetration” (centres holding at least one recognised sustainability certification) should climb from 25 % today to 30 to 40 % by 2030 as operators chase Power Usage Effectiveness targets below 1.4, secure open access renewable PPAs and deploy liquid cooling for AI clusters.

Share of Data centre capacity in 2024 | Growth 24 29 (CAGR) | Typical players | Key metros | |

Mega (≥ 50 MW IT load) | 42 % (≈ 836 MW) | 29 % | AdaniConneX, Yotta, STT GDC, CtrlS, Sify | Mumbai, Chennai, Hyderabad |

Massive (25 to 49 MW) | < 40 % | 20 % | NTT Ltd, Nxtra (Bharti), Reliance | Mumbai, NCR, Bengaluru |

Large (10 to 24 MW) | < 20 % | 15 % | STT GDC, NTT Ltd, Sify | Tier 1 & Tier 2 cities |

Medium & Small (< 10 MW) | < 10 % combined | Single digit | Regional providers, edge specialists | Tier 2/3 cities |

Fibre’s multi gigabit capacity not only feeds households but stitches together hyperscale campuses, carrier neutral Internet Exchanges and a growing web of metro edge sites at terabit speeds crucial if cloud storage, SaaS and low latency AI services are to stay responsive. Mega sites set the pace. Six AdaniConneX campuses alone will inject another 1 GW once fully energised, while Yotta’s D1 in Navi Mumbai already delivers Asia’s highest single building IT load (72 MW).

Power procurement: Data centres will need an additional 25 to 30 TWh annually by 2030; securing firm, green power at competitive tariffs is critical.

Grid and water stress: Several high growth corridors sit in power deficit or water scarce zones, forcing operators to invest in on site renewables, energy storage and advanced cooling.

Talent pipeline: The industry will require up to 160,000 specialised engineers and technicians triple today’s workforce spurring new skilling initiatives.

FX mismatch on USD linked contracts: Companies will need to hedge through USD EPC imports and export earnings of SaaS tenants; optional INR step up clauses.

US tech export “diffusion” controls: This could delay bleeding edge GPU imports. Players will need to diversify chip supply, design modular halls that can be retrofitted later.

With GDP per capita approaching USD 3,000 and mobile data consumption already the world’s highest, India’s digital backbone is shifting from “best effort” cloud to mission critical infrastructure. The next 3 years will be decisive: capital will be rewarded for speed to market, sustainability credentials and regulatory fluency.

Estimates project a 20 % CAGR in installed IT load through 2027, moderating to 14 % thereafter as edge nodes cannibalise metro growth. Investors that secure power rich sites, weave in renewables, and structure hyperscaler partnerships today will set the floor for a platform re-rating once the first Indian data centre REIT lists likely before 2028.

With its unique mix of submarine cable gateways, abundant land parcels, a young STEM talent pool and an internet user base headed toward one billion, India is positioning itself as the next hyperscale frontier in Asia Pacific. If execution keeps pace with projections, the country could rank among the world’s top 3 data centre markets by installed megawatt capacity well before 2030.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart