by Siddharth Singh Bhaisora

Published On Dec. 1, 2025

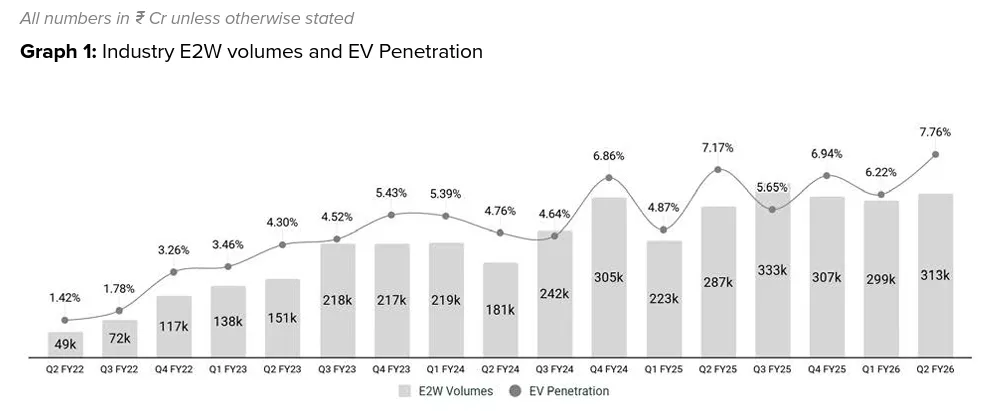

India’s electric two-wheeler story has moved from experiment to stress test. In just five years, the segment has gone from almost nothing to about 8% of total two-wheeler sales, making India the world’s second-largest market for electric scooters and bikes. But the last few months have shown that scale alone isn’t enough. Supply shocks from China, policy changes at home, and the growing clout of legacy players are reshaping who actually wins in this market.

Two-wheelers are the backbone of Indian mobility. From office commutes and gig-work deliveries to rural access to jobs and markets, they quietly power hundreds of millions of lives. Economists even use two-wheeler sales as a proxy for how rural India is doing financially.

It made perfect sense, then, for India’s EV transition to start here. If you can electrify scooters and bikes at scale, you lower fuel imports, reduce urban pollution, and directly impact household economics.

Watch the full video here:

Over the last quarter, four companies show where the sector really stands: Ather, Ola Electric, TVS Motor, and Bajaj Auto.

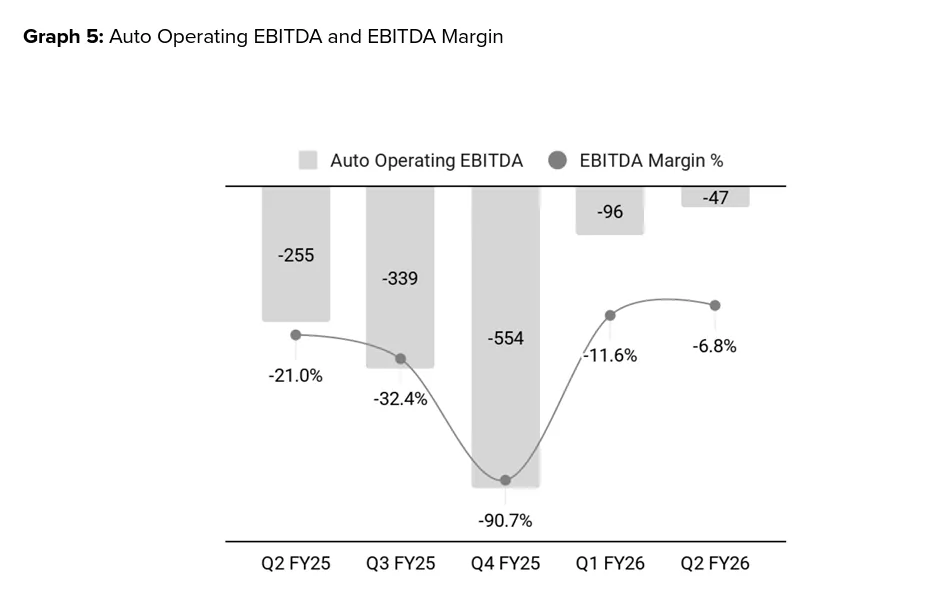

Ather is growing fast and improving its unit economics, but it still doesn’t have the profitability cushion of the legacy giants.

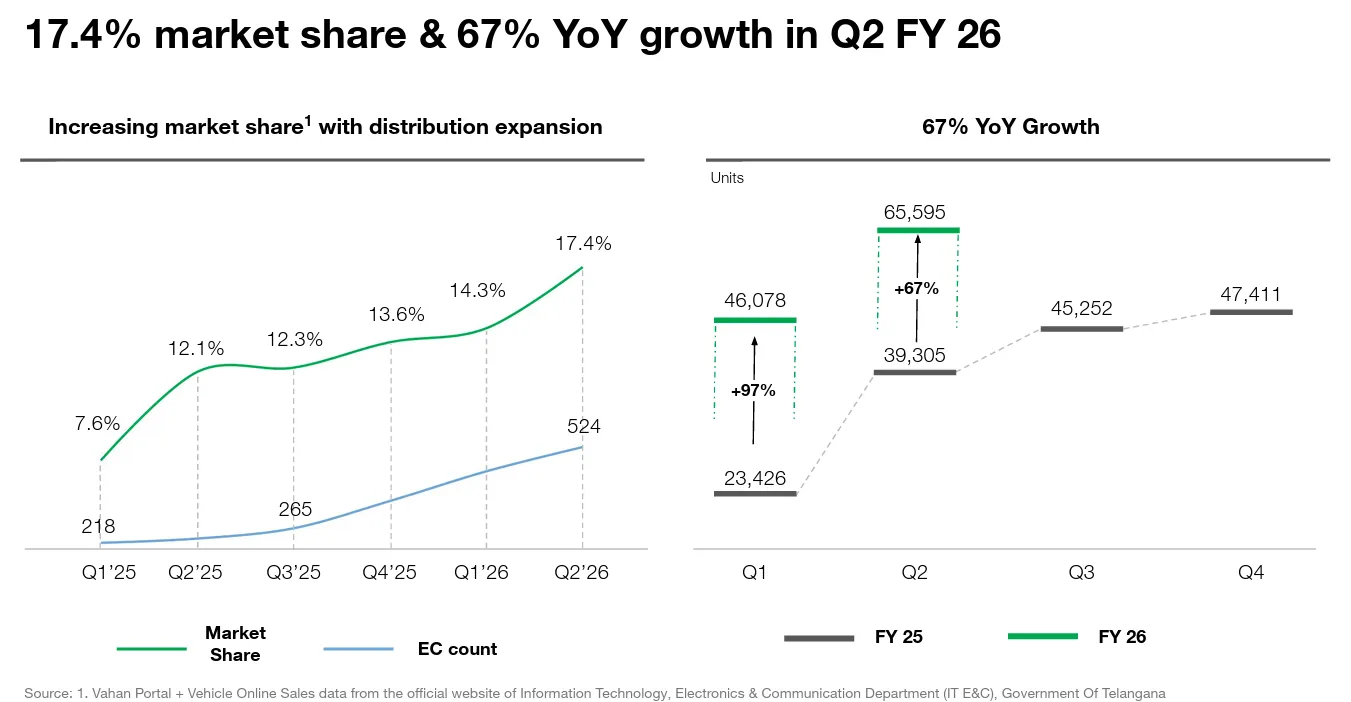

Sold ~65,600 vehicles in the quarter, up about 67% year-on-year.

Revenue is at ₹941 crore.

Market share increased from 12.1% to 17.4%.

Still loss-making, but its EBITDA margin improved from around –21% to –10%, meaning it is burning less cash per scooter than before.

Ola was once the face of India’s EV scooter boom, but several issues have resulted in market share and reputation loss.

Sold ~52,700 vehicles in the same period — almost half of what it sold a year ago.

For the first time, though, it reported a slightly positive EBITDA of about 0.3%, likely driven by aggressive cost cuts rather than booming sales.

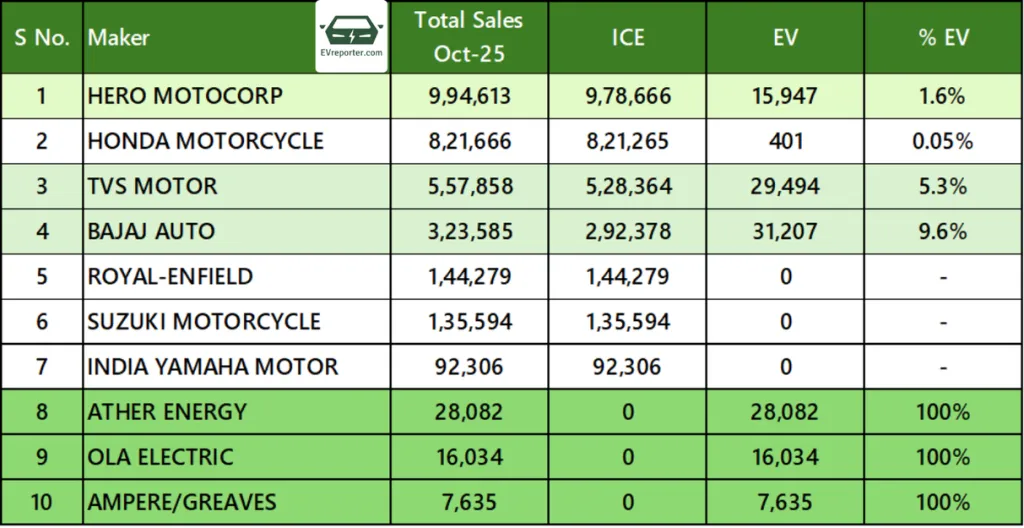

EVs are still small inside TVS — but TVS is huge and has become the segment’s market leader.

Last quarter was its best ever for EVs and for the company overall. It generated record operating revenue of about ₹11,095 crore and profit-before-tax of ₹1,226 crore.

Sold around 15 lakh vehicles across categories; roughly 80,000 of these were electric scooters, about 5.3% of total volume.

That 5% sliver of TVS’s business is already larger than the entire quarterly volume of either Ola or Ather.

Bajaj’s EV brand is ramping up on top of its very profitable core business.

EVs are its fastest-growing category.

Overall, it sold about 12.94 lakh vehicles in the quarter.

EBITDA margins hit around 20.5%, and revenue touched roughly ₹14,922 crore — both all-time highs.

The simple takeaway: the days when Ola and Ather defined the EV scooter market alone are over. TVS and Bajaj have arrived, and they bring scale, cash, and distribution muscle that startups can’t easily match.

One of the biggest stress tests this year came from something most buyers never think about: magnets.

China tightened exports of rare earth magnets, which are critical for EV motors because they’re powerful, compact, and heat-resistant. With China dominating this supply chain, Indian manufacturers suddenly felt how fragile their dependence was.

The four companies reacted very differently:

Ola says it has developed a new motor that completely eliminates rare earth magnets. Instead, it uses ferrite magnets — older, cheaper, iron-based magnets that are usually weaker and heavier. Ola claims that by optimising the motor’s magnetic circuit and design, it can match the performance of rare-earth motors in the 7 kW and 11 kW range.

If this holds up in real-world Indian conditions — heat, heavy loads, bad roads — it would be a genuine breakthrough. But it’s a big “if”. The trade-offs in efficiency, weight, durability, and long-term performance will only be visible over years of use.

Ather took a more conservative route. It shifted away from “heavy” rare earth elements like dysprosium and terbium, which China tightly controls, and moved towards “light” rare earth compositions that are less constrained.

This cuts supply risk but may reduce efficiency at high temperatures — a serious consideration for Indian summers. Ather itself calls this a stopgap while it works on long-term solutions, and it has already had to defer over ₹26 crore of state incentives due to supply-chain issues.

Bajaj has openly said the magnet shortage hurt its EV business, especially the Chetak lineup, though it eventually recovered earlier than expected. TVS hasn’t gone into technical detail but has acknowledged that the industry would’ve grown “much, much bigger” if magnets were freely available.

Net effect: companies that can redesign technology, diversify suppliers, and absorb shocks now have a structural edge. Those that can’t will see disruptions every time geopolitics flares up.

Policy choices have quietly changed the playing field this year.

Under the Production-Linked Incentive (PLI) scheme for advanced automotive and EVs, companies that meet tough investment and localisation criteria can get 13–18% of their EV sales value back as cash incentives.

Bajaj Auto is a major winner. It has 13 approved PLI applications and could claim around ₹630 crore in incentives this year — the highest among all automakers, including four-wheelers. This directly boosts margins.

Ola Electric got PLI certification for its entire Gen-3 scooter lineup through 2028 and has filed claims worth about ₹380 crore on eligible FY25 sales. But these benefits haven’t fully flowed into its reported margins yet and may show up later.

The outlier is Ather.

Despite being India’s 2nd largest EV 2 wheeler manufacturer, it doesn’t qualify for PLI. That has forced it to delay product launches and puts it at a clear cost disadvantage versus peers who are effectively getting a state-funded margin boost.

So policy is not neutral. It is actively rewarding some business models and balance sheets over others.

In September, GST on petrol two-wheelers under 350 cc was cut from 28% to 18%, while EVs remained at 5%. On paper, EVs are still taxed far lower, but the price gap between petrol and electric narrowed at the exact moment when festive demand kicks in.

Yet, EV makers haven’t panicked. Industry-wide electric scooter sales hit a record ~1.44 lakh units in October, showing that demand held firm even after petrol bikes became cheaper upfront.

The long-term logic still favours EVs: electricity is cheaper than petrol, and operating costs over a few years usually matter more than the price tag alone. But in the short term, companies like Ather expect they may have to offer discounts or sharper pricing to stay competitive as petrol bikes become more tempting for price-sensitive buyers.

As volumes rise, two weak spots are starting to dominate boardroom conversations: charging and service.

Most EV scooter owners today simply plug in at home, overnight, on a regular 15A socket. That works well for personal urban use but breaks down for commercial riders and delivery fleets who need to charge quickly during the day.

To solve that, companies have built their own proprietary fast-charging networks:

Ather has the Ather Grid.

Ola has its Hypercharger stations.

Others are building their own systems.

The catch? These networks don’t talk to each other. A Chetak owner can’t use an Ola charger; an Ola scooter can’t use an Ather fast charger. Until there is some standardisation, every company is trapped in its own mini-ecosystem, limiting the overall density of usable chargers from a customer’s perspective.

Battery swapping is a potential alternative — swap out a drained battery for a charged one and be back on the road in minutes. But here too, each company has its own battery size, design, and connector. A few pilots exist for three-wheelers; there are none at scale for scooters yet.

Without common standards, charging infrastructure will keep growing in small, fragmented pockets instead of forming a dense nationwide grid.

Service is emerging as another big differentiator.

Ola has admitted to a large after-sales backlog — parts shortages and insufficient technicians have led to delays beyond the usual post-monsoon surge seen by the industry. To respond, it has launched “HyperService”, allowing third-party garages to service Ola scooters with access to genuine parts.

This is a smart pivot, but it also underlines the problem: building a reliable service backbone from scratch is hard.

Legacy players don’t have this issue. TVS and Bajaj already have decades-old dealer and service ecosystems which they can adapt for EVs. Bajaj alone has 390 Chetak-only stores and over 4,000 retail points across the country — coverage that would take a young startup years and massive capital to replicate.

As EVs move from early adopters to mass buyers, these things matter more than app UIs or launch events. People worry about where they’ll fix their scooter, not just how fast it goes from 0 to 40.

The last quarter, plus the record October that followed, proves one thing clearly: India’s EV two-wheeler market is not a fad. It has enough customer demand to hold its own even when policy or supply throws curveballs.

But the nature of competition is changing:

Growth at any cost is out; profitable scale is in. TVS and Bajaj show that you don’t need to be “EV-only” to win. Being a cash-rich incumbent with a strong ICE business can be an advantage, not a handicap.

Supply chains are now strategy. Companies that crack magnet independence, localise components, and hedge geopolitical risks will be more resilient than those simply chasing volumes.

Policy can make or break contenders. PLI benefits and GST tweaks aren’t just footnotes — they change cost structures and product roadmaps. Missing out, as Ather has with PLI, can delay launches and weaken competitiveness.

Infrastructure will separate promises from reality. Standardising charging protocols, scaling public and semi-public charging points, and building deep service networks will be key to winning mainstream buyers.

In short, India’s electric two-wheeler space is graduating from hype to hard work. The winners will be the companies that can combine technology with old-fashioned business discipline: robust supply chains, healthy margins, strong dealer and service networks, and the ability to navigate policy — not just the ones with the loudest marketing or the most futuristic designs.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart