by Siddharth Singh Bhaisora

Published On Sept. 21, 2025

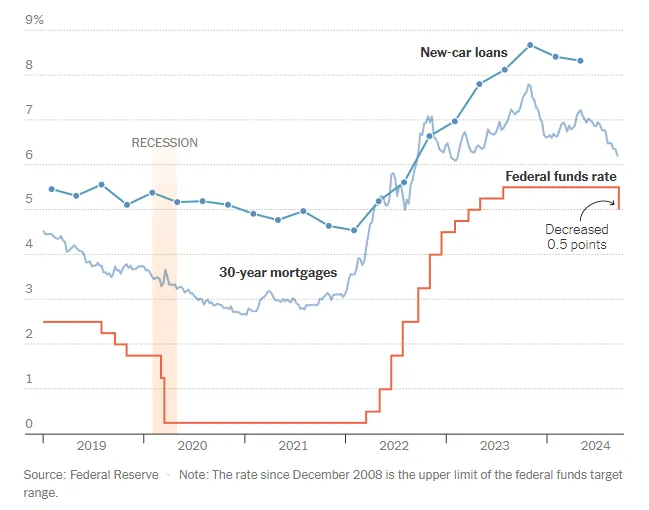

The Federal Reserve’s September 2025 decision to trim the federal funds rate by 25 basis points to a 4.00% – 4.25% target range which marks a pivot from “higher for longer” toward cautious easing. That move came against a backdrop of hotter than expected inflation readings, softening labor markets, and mounting concerns about whether the economy can avoid a recession while keeping inflation in check.

At the same time, the Fed kept balance-sheet runoff in place but with smaller caps, signaling an easing bias without abandoning prudence. For investors and executives, this mix of policy easing, still-elevated inflation, and a cooling job market is the macro stew that will set the tone for the rest of 2025.

The decision, and the rhetoric around it, has major implications for inflation dynamics, employment, financial markets, and policy credibility. Let's look at what the US Fed rate cut means for inflation, labor market and stock markets.

Watch the detailed video here:

In the run‐up to the Fed’s September meeting, there was considerable tension between inflation data and labor market signals.

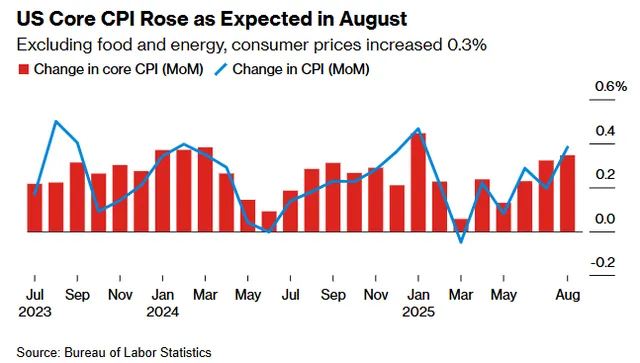

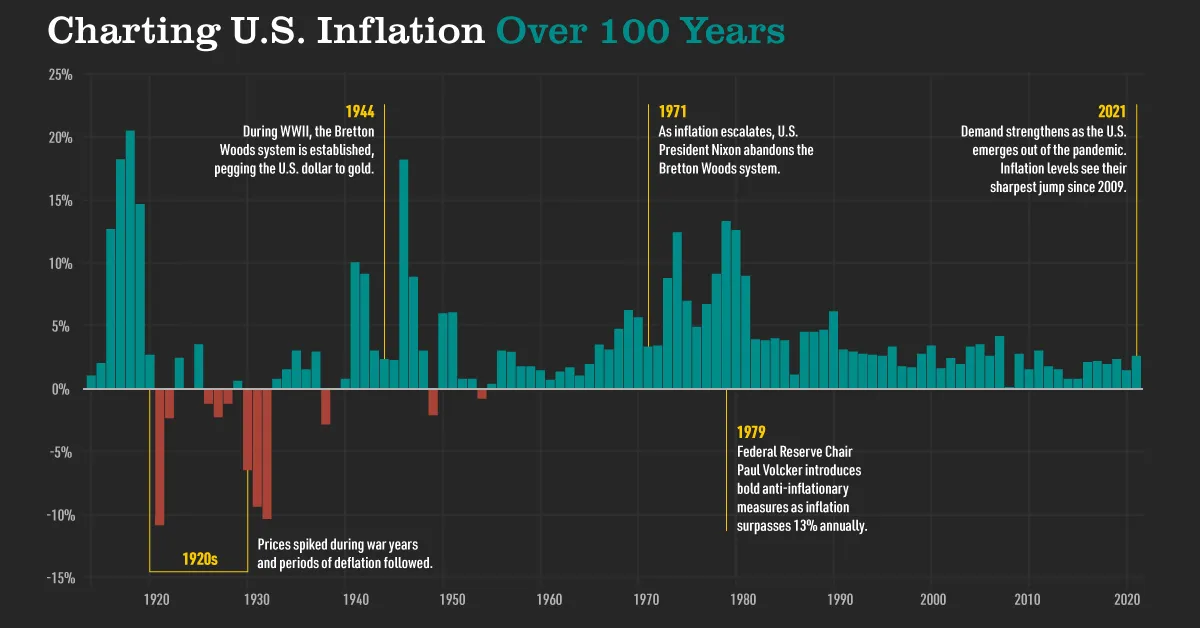

The August 2025 Consumer Price Index (CPI) came in hotter than what many forecasters expected: a monthly increase of about 0.4%, versus about 0.3%. Year‐on‐year, headline inflation rose from 2.7% to 2.9%. Core CPI (excluding food & energy) was at ~3.1%. Inflation had bottomed in April at roughly 2.3% for headline and 2.8% for core, so this rise was seen as a reversal of disinflationary momentum. PCE inflation, the Fed’s preferred gauge, ran +2.6% y/y in July (core also sticky), with trimmed-mean and median inflation measures hovering in the mid-2s.

These are well above the 2% target that the Fed targets and raised concerns: tariffs and supply chain issues were still feeding into price pressures, and inflation appeared more “sticky” than some earlier, more optimistic forecasts had assumed.

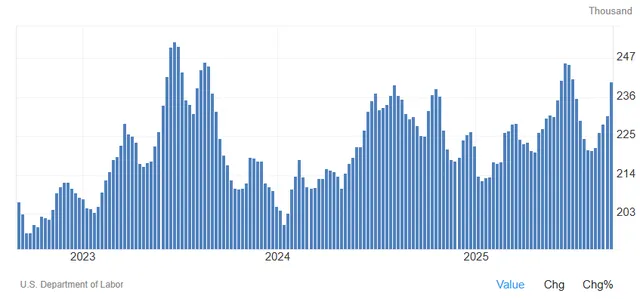

There is a pretty stark shift in the U.S. labor market. It went from adding 200,000 jobs every month pretty consistently to just 22,000 new jobs in August. Unemployment ticked up to 4.3%, and wage growth slowed to +3.7% y/y. Participation is flat, and long-term unemployment has drifted higher over the past year - subtle signs of slack the Fed can’t ignore.

Parallel to inflation, labor market data was showing weakness. More broadly, job growth had slowed significantly. In short, inflation was trending upward; employment was cooling. A classic tension for the Fed’s dual mandate.

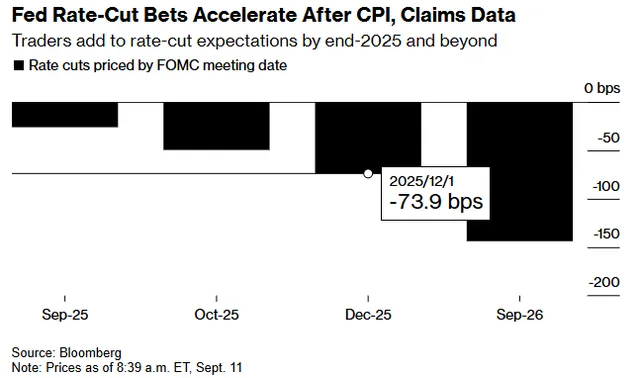

Yet, despite inflation that might have warranted additional tightening, many investors believed that the labor market softness would dominate the Fed’s decision matrix. As such, rate cuts are being priced in, not just for September, but also for additional easing later in 2025 and early in 2026.

By law, it must pursue maximum employment and stable prices (defined as 2% inflation over time). Those goals can conflict in the short run, but the Fed’s strategy is to balance them dynamically as the data evolve. What changed this week is not the mandate but the “balance of risks” assessment: policymakers signaled that labor-market weakness now poses a more immediate threat than inflation overshoots hence the decision to cut. The Fed's projections suggest that inflation pressures may persist, but not run away so long as policy doesn’t loosen too much. The “higher‐for‐longer” inflation scenario remains a concern.

The concern seemed to be: inflation is worrisome, but a weakening labor market can lead to worse outcomes, including a recession or worse in unemployment. The trade‐off here tipped toward employment risk.

The wording of the statement does the heavy lifting: the Committee is “attentive to the risks to both sides of its dual mandate” but judges that employment risks have increased. Cutting 25 basis points rather than something larger keeps pressure on inflation in check while leaning toward job support. It’s the archetypal “risk-management” cut. The implementation note that followed sets the plumbing (e.g., interest on reserve balances, repo facilities) around the new 4.00%–4.25% range signals consistent with an incremental, not emergency, easing cycle

If jobs are the near-term worry, why not a bigger cut?

Because inflation is still above target and has ticked up from its spring lows. A deeper move would risk loosening financial conditions too quickly, stoking demand before supply has fully adjusted to shocks (tariffs, immigration shifts, and energy volatility among them). The Committee also isn’t united on the pace. One newly seated governor argued for a half-point reduction, illustrating the internal debate, but the consensus opted for gradualism to preserve credibility on price stability.

“Stagflation” is when there is high inflation plus stagnant growth and rising unemployment - a scenario every central banker wants to avoid. Is the U.S. there? Not by the textbook: inflation is mid-2s on PCE, not double-digits, and unemployment is low-4s, not high-single digits. But both are above Fed’s target rate and have been rising gradually.

The risk of a stagflationary turn can rise when supply shocks (tariffs, trade frictions, energy) collide with fading demand. Fed research earlier this year mapped those risk probabilities: as 2024 progressed, a soft-landing looked more likely; by mid-2025, renewed tariff concerns nudged stagflation risks back up. Market commentators, for their part, have argued the Fed’s “fear meter” may be flashing more “stagnation” (slow growth) than true stagflation. The nuance matters: stagnation plus moderate inflation calls for different medicine than a 1970s-style spiral.

In practical terms, that means the Fed will tolerate inflation temporarily near or slightly above 2% if that stance reduces the probability of a sharper employment downturn. But it will not tolerate an upward drift in inflation expectations.

If PCE inflation were to re-accelerate meaningfully while joblessness rose, the policy trade-off would worsen and the Fed’s reaction function would get tougher: less easing, more reliance on credibility and communication to anchor expectations. The Fed’s likely response in such a scenario would be:

Protect credibility on prices. Even in a stagflation scare, inflation control comes first; without anchored expectations, the cost of restoring employment is higher later. That means pausing or slowing cuts and leaning on forward guidance to resist de-anchoring.

Targeted financial-stability tools. If stress appeared in credit markets while policy stayed tighter than growth alone would justify, the Fed could use liquidity and supervisory tools to keep finance functioning without stoking demand.

Data-dependent asymmetry. Cuts resume only as inflation momentum clearly cools think consecutive months of softer core PCE or if job losses accelerate to the point where the employment side of the mandate clearly dominates again.

Given the data and risks, here are plausible scenarios out to mid-2026.

Scenario | Description | What Needs to Go Right / Wrong | Implications |

Base Case | Modest easing continues (maybe one or two more cuts), inflation slowly comes down (but remains above target), labor market stabilizes, no recession. | Inflation moderates due to easing supply shocks; the labor market doesn’t deteriorate sharply; global economic risks are contained. | Stocks likely perform well; consumer spending decent, although income inequality in gains more visible; inflation still a concern. |

Upside (Goldilocks) | Inflation falls faster than expected; the labor market holds up; Fed manages to ease without feed-through inflation; modest growth. | Successful disinflation, stable jobs, favorable global conditions. | Strong equity returns; improved consumer real incomes; more policy room for other initiatives. |

Downside (Stagflation/ Recession Risk) | Inflation remains sticky or reaccelerates; labor weakness worsens; Fed cuts either too little or too late; external shocks; recession. | High input costs, wage-price spirals, policy miscalculations, geopolitical/trade disruptions. | Returns hit; bond yields volatile; possibly recession; losses in vulnerable sectors; political tailwinds/pressure increase. |

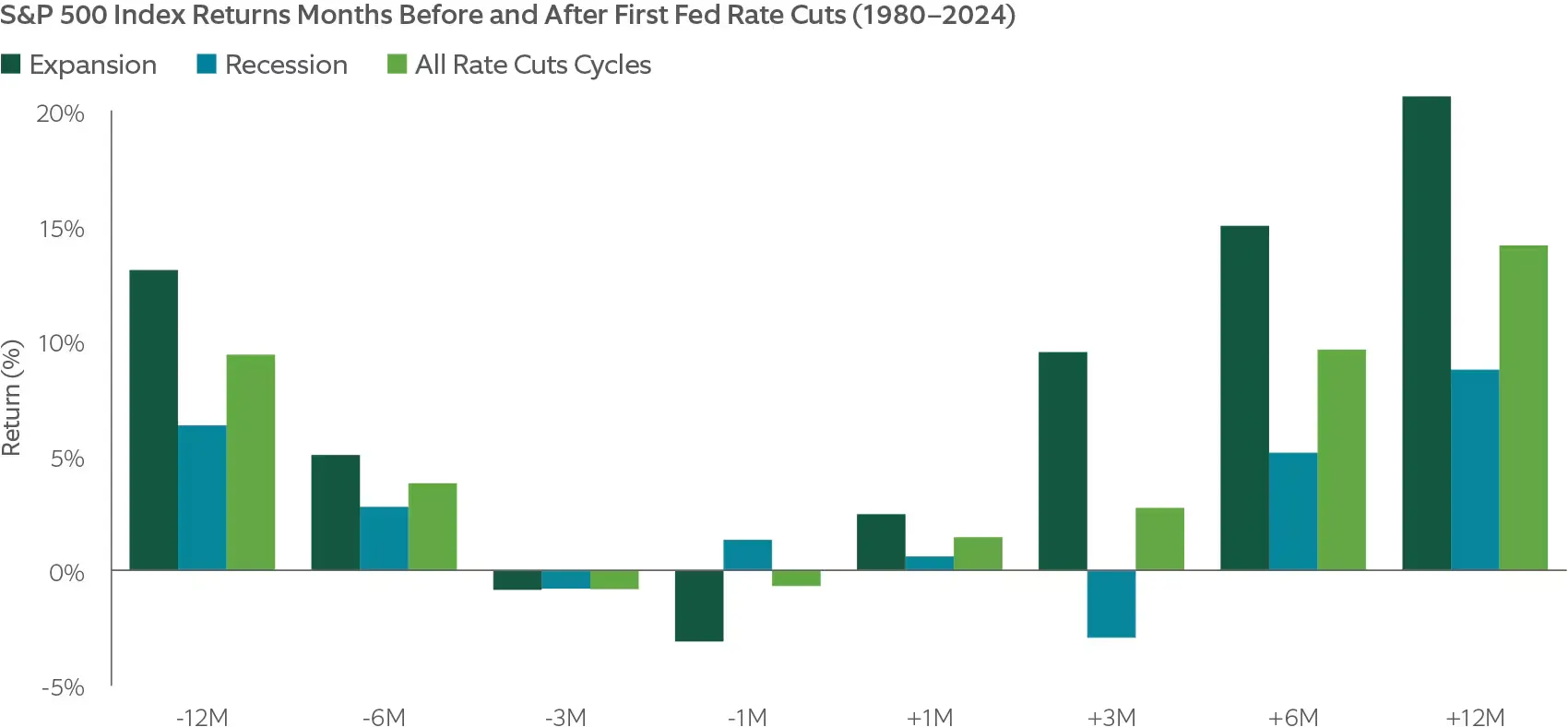

Rate-cut cycles often begin when growth is slowing, so investors naturally worry about near-term stock returns. History since 1980 offers some reassurance: across 11 first-cut episodes, the S&P 500 returned an average of 14.1% in the 12 months after the initial cut, with gains also positive on average at the three- and six-month marks. In short, while the macro backdrop can be uneasy, equities have tended to advance after the first move down in rates.

Outcomes vary with the business cycle. When the economy avoided recession and kept expanding, the S&P 500 averaged a robust 20.6% one year after the first cut and was positive in every such instance. During recessions, returns around cuts were more muted and drawdowns could be sharp sometimes outside the rolling one-year window yet the index still averaged a positive one-year result and finished higher in three of six recession cases.

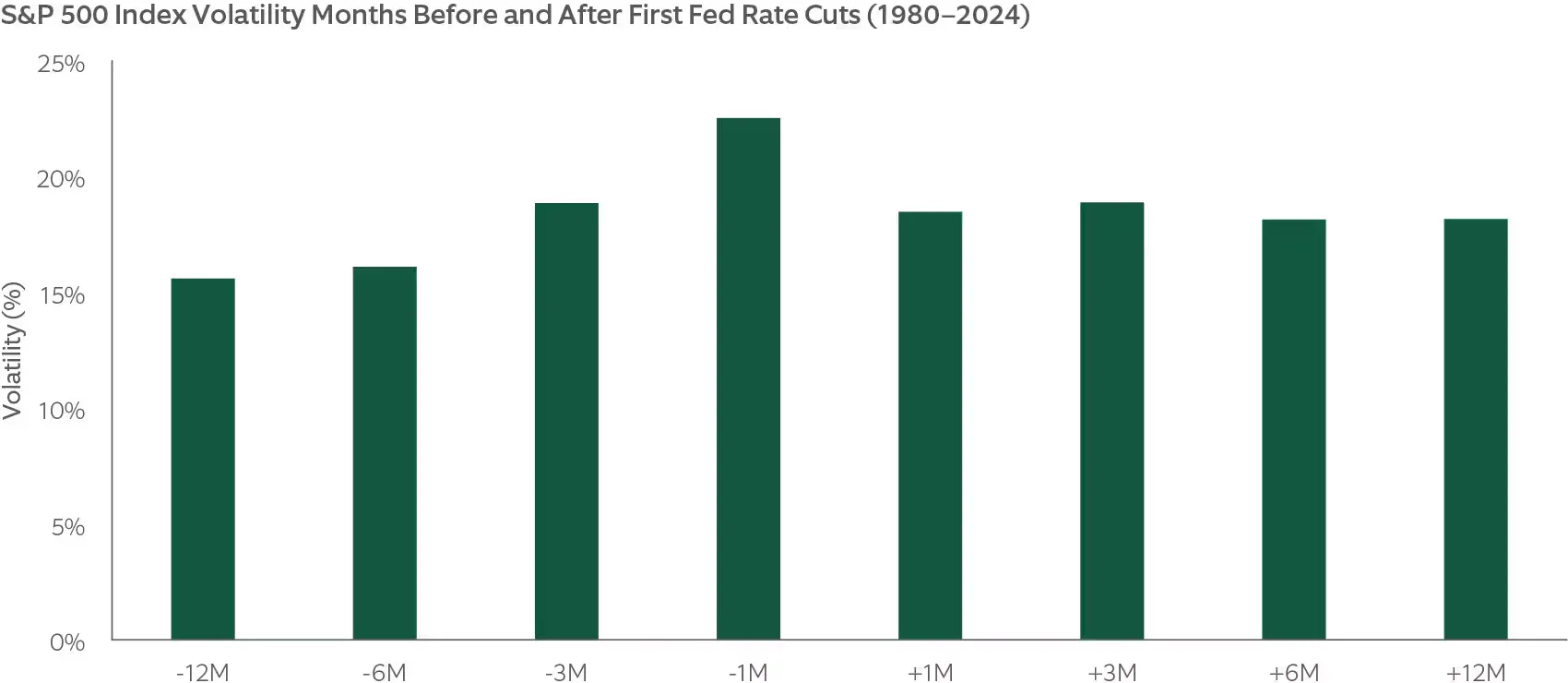

Expect choppiness: volatility typically climbs in the three months heading into the first cut and remains elevated for a year; for example, one month before the cut, realized volatility has averaged 22.5% versus a long-run norm near 15%. In 2024, that playbook showed up again, with volatility picking up into the September 18 cut after selloffs in early August and September, even as markets subsequently recovered.

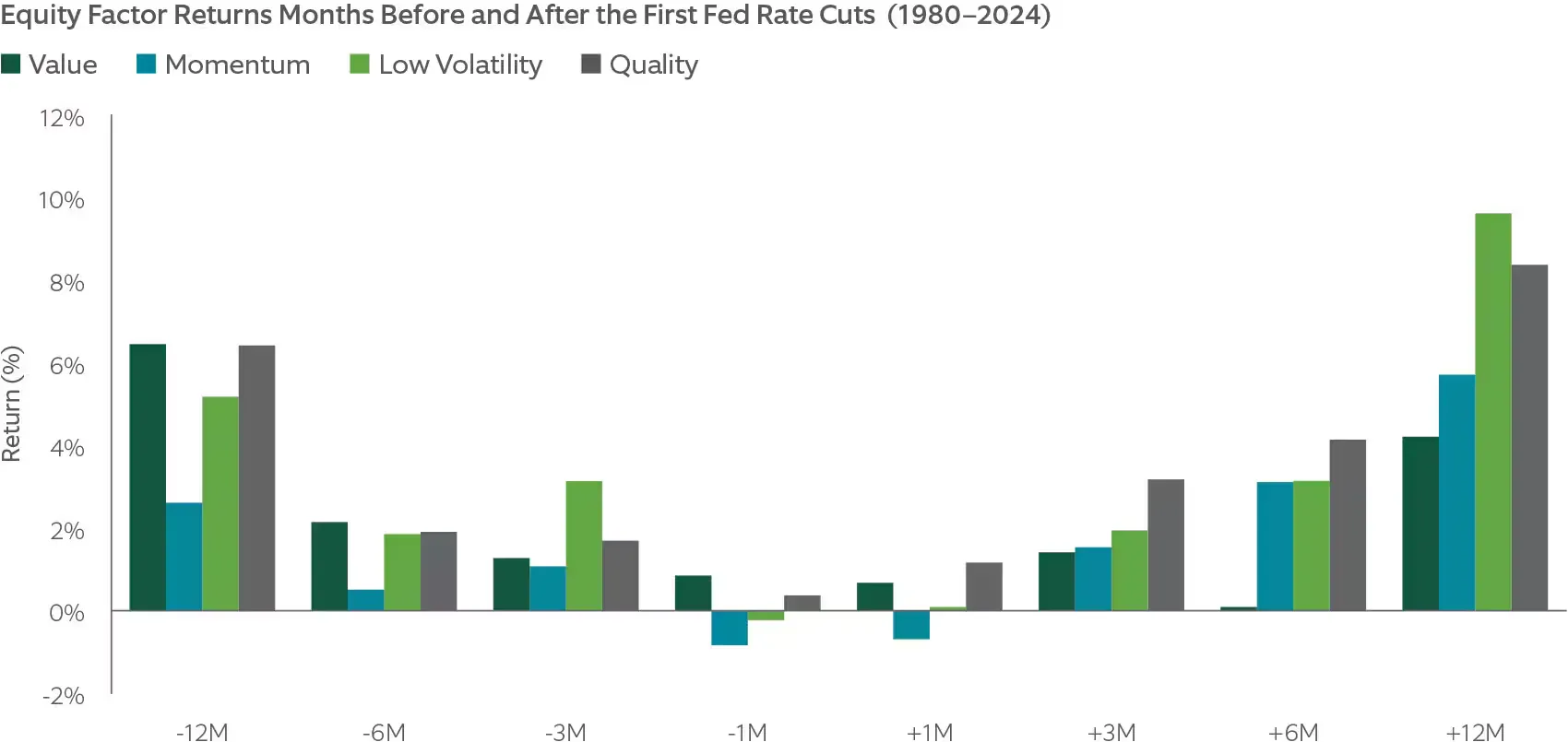

Factor behavior has been broadly constructive but uneven.

Quality firms with efficient management, durable profitability, and strong cash flows have been the most consistent performer around rate-cut cycles, with average 12-month returns before and after the first cut in line with long-term trends.

Value, momentum, and low-volatility factors have also been positive on average, but with wider dispersion depending on the cycle’s quirks.

Low-volatility lagged amid the late-1990s tech bubble, then strongly outpaced high-volatility peers after the 2000 peak and into the early-2001 cutting phase.

The takeaway: averages are helpful guides, but each cycle’s path and the factor winners depend on the specific economic and market context.

US Fed’s rate cuts shifts the global cost of capital down a notch and matters for India’s currency, oil bill, and domestic borrowing costs - the 3 biggest near-term levers of household demand.

Currency & flows: Lower U.S. yields typically nudge capital toward emerging economies. The rupee has hovered near record lows (~₹88.3/$) as the dollar stayed firm and FPI equity flows remained negative through August and mid-September. Equities popped to 10-week highs after the decision, but sustained foreign participation is still a question. Imported goods prices and travel remain sensitive to FX, damping some discretionary spend until the rupee steadies.

Oil & inflation: Brent has slipped to the high $60s. India imports ~88% of its crude. A softer oil tape plus discounted Russian barrels already cut India’s crude import bill ~19% y/y in Apr–Jun FY26, freeing purchasing power and easing freight and input costs. With headline CPI at 2.67% y/y in August, real incomes are quietly improving; if oil stays sub $70 and the rupee stabilizes, that relief should pass through to staples and mass-market FMCG over the festive quarter.

Rates & EMIs: The RBI has paused at 5.50% after front-loading cuts earlier this year. Even before the Fed move, banks’ weighted-average lending rate on fresh rupee loans fell to 8.62% in June before edging up to 8.80% in July as spreads wobbled. If the Fed’s easing continues and domestic liquidity improves (CRR cuts are staged through the autumn), transmission should re-accelerate - supporting home loans, autos, and consumer durables.

India’s consumption upturn can broaden if these 3 conditions hold:

Oil near $65 to $70

A steadier rupee as U.S. cuts proceed and FPI selling slows

Further domestic pass-through of lower rates into EMIs

Baseline growth in consumption remains intact given private consumption growing at 7% year-on-year and strong GDP. But FX volatility and trade frictions could blunt some of the Fed’s tailwind. Net-net, the Fed’s pivot is a positive for Indian households - more so for mass market categories and credit sensitive buys over the next two quarters.

The Fed’s September 2025 rate cut, though widely expected by markets, remains a risky maneuver. Inflation is still above target, supply chain distortions and tariffs continue to exert upward pressures, and labor market softening is palpable. What matters now is whether the Fed can navigate the space between cutting rates enough to sustain economic growth and jobs, yet avoiding an inflation “reacceleration” that would force it to reverse course in a heavier way.

For the markets, the first rate cut tends to bring excitement, especially when recession is avoided. But upside gains may be tempered by volatile inflation, uneven strength across sectors and households, and risk of complacency. Discipline on valuation, risk management, portfolio diversification will likely be more valuable than trying to “ride” the rate cuts blindly.

If inflation comes down gradually and labor markets stabilize, this move could mark the beginning of a smoother easing path and a favorable environment for equities. If not, the next few quarters may test how resilient the American economy really is.

Watch our detailed video on: Fed's Paradox: Rate Cuts Could Trigger Stagflation?

Built for India’s household demand boom, our latest multi-cap portfolio targets companies that monetize everyday spending such as staples, durables, autos, retail, QSR, hotels, consumer healthcare and beverages plus selective “enablers” such as payments/ processors, premier private banks/NBFCs, and organized retail platforms that expand access and ticket sizes.

The Consumer Theme portfolio is constructed with a disciplined, data-driven framework. Wetrack top down signals, track disinflation, income effects, rural/urban breadth, credit availability, commodity inputs, and high-frequency indicators. This new portfolio offers a data driven, research led and diversified exposure to India’s consumption revival.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart