25th July 2021 marks two years of the existence of your favorite quantitative investment advisor, Wright Research. While some think that Wright is named after the Wright Brothers, we named ourselves Wright because the word means “a maker or a craftsman,” It was the passion for crafting Quant strategies that made us start Wright Research.

Here are some of the key things that have made this 2-year journey spectacular for us!

Love for our Investing Philosophy

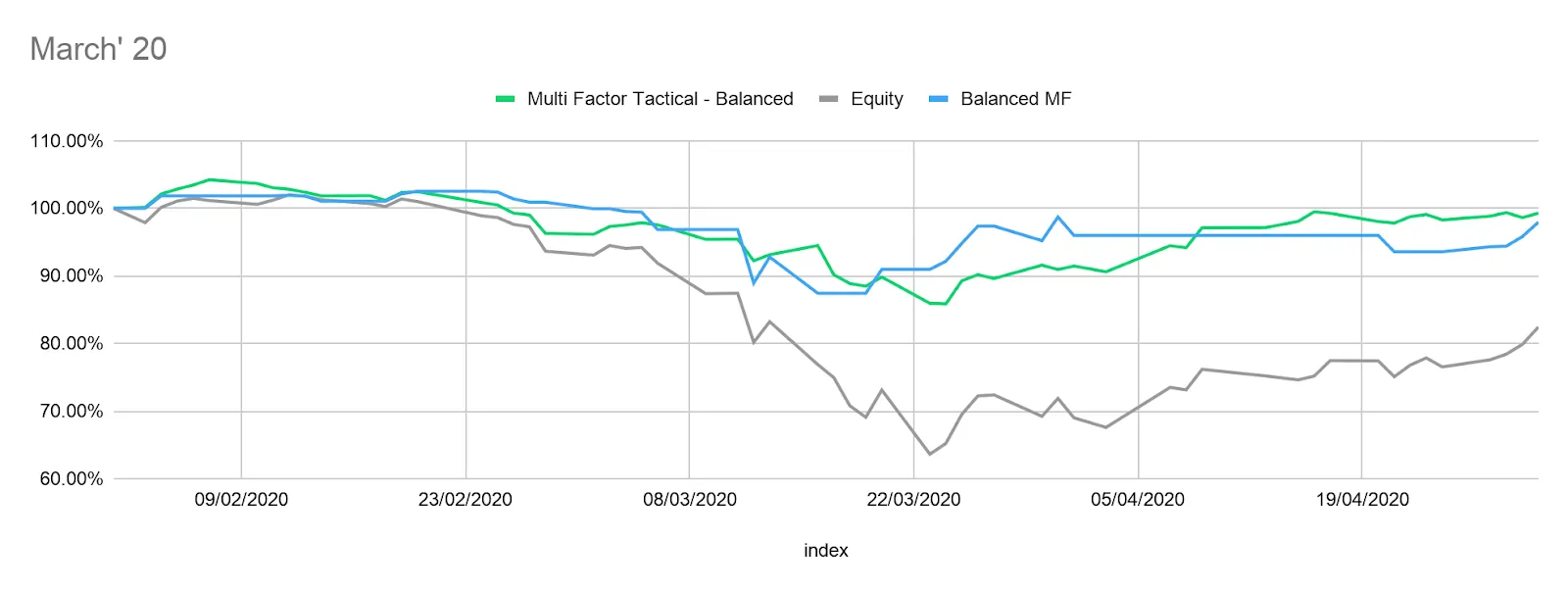

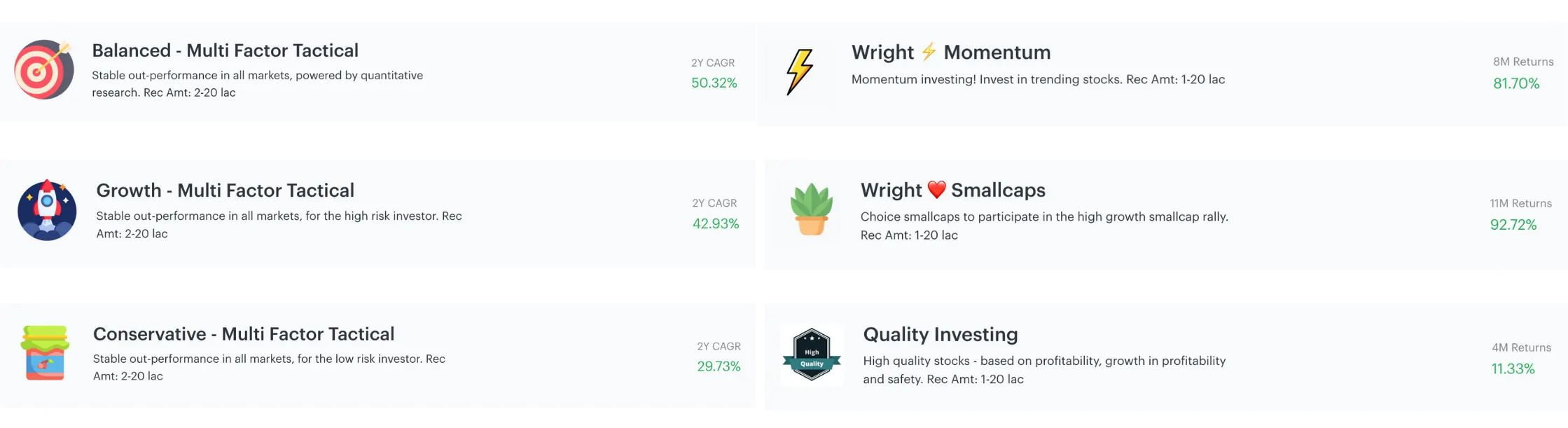

The love that Wright Research receives from the investors is the real reward of this venture. When we started, “quant” was something that people said Indian audiences wouldn’t trust. So it is a big revelation that our audiences love us for our investment philosophy. We cater to all types of investors - high risk, low risk, or balanced and we put effort into being transparent and making the investor aware of the risk and returns of equity investing.

The investor on smallcase is passionate about investing and is aware of the opportunities out there. Our effort is to indulge people’s love for the markets and safeguard their wealth while ensuring that they don’t miss out on ongoing opportunities in the market.

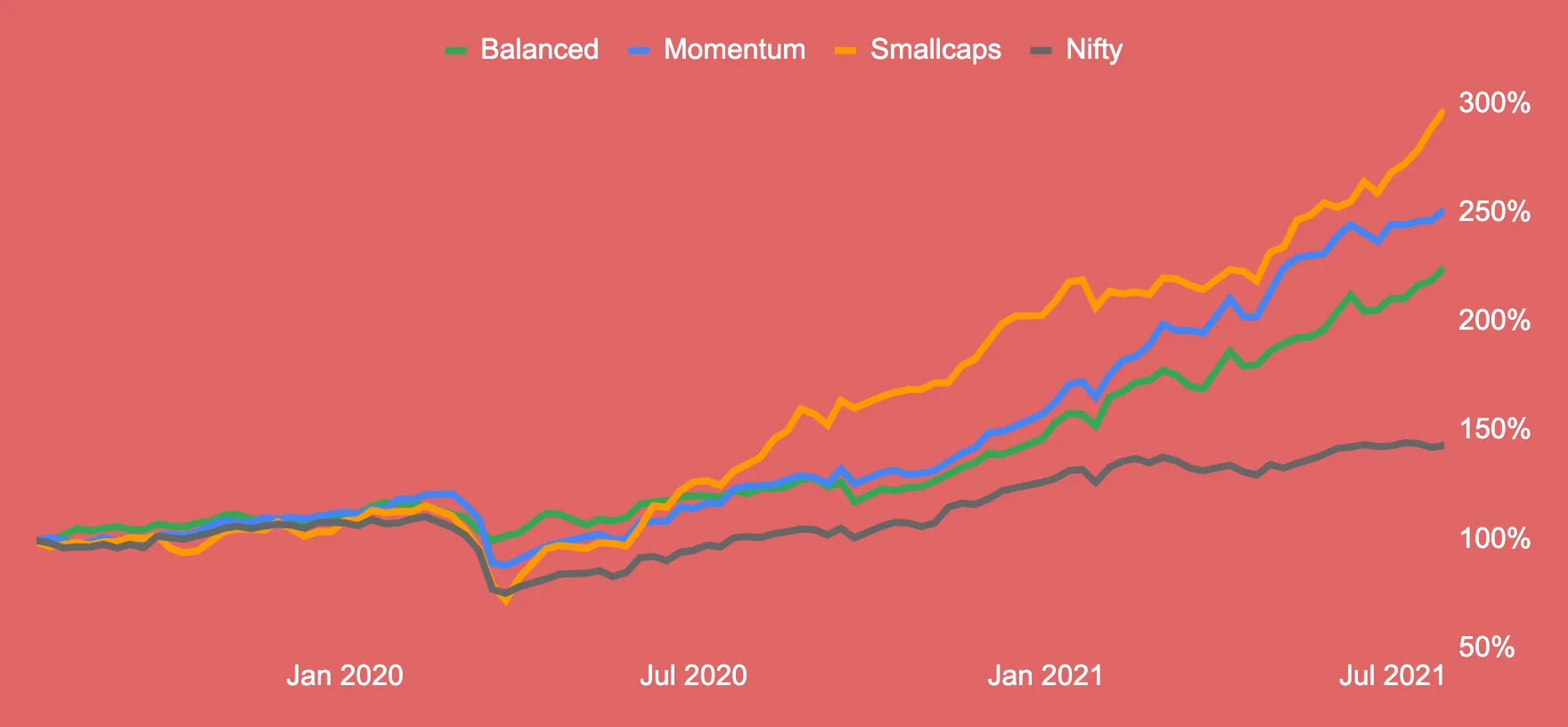

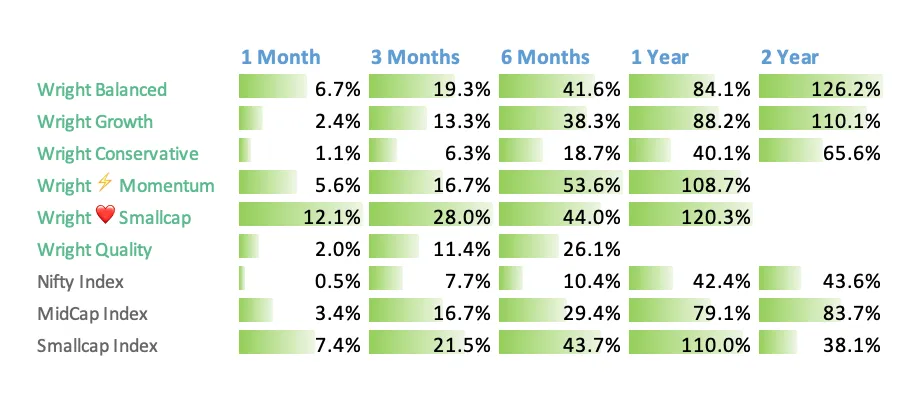

Scale & Performace

We have achieved a decent scale with more than 3000 active investors, 7500+ subscribers and 50 crore+ Assets under Advisory, and we think that we can grow many folds from here. We believe that the critical things about our product that led to growth for us are:

Team

The Wright team is full of rockstars. Sonam is a quant specialist who’s super passionate about her craft. Ashish is a champion of Technology. There is no tech challenge that he cannot often solve in 15 minutes! Himanshuis one of the best quant researchers at his age. His knowledge of quant concepts is astounding. Finally, Shweta is an investor relations rockstar. She is a lifesaver, making the experience so much better.

Why Wright?

Check out Wright Research, we are trying to do something good, and we are making money for you! Go with the strategy that suits your wants and needs and consult with your advisor. This whole thing is built to fulfill your investment goals and aspirations in the end. Approach it with a positive mindset, and things will click.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart