by Sonam Srivastava

Published On June 29, 2025

After months of cautious positioning, macro cues are decisively improving — and fast.

RBI’s 50 bps Front Loaded Rate Cut

The Reserve Bank’s surprise 50 bp repo cut and 100 bp CRR reduction, combined with an explicit shift back to a “neutral”‑stance, signals that policy makers now see inflation risks contained and are willing to lean harder on growth. A lower real policy rate, easing liquidity and the prospect of another cut by calendar‑year end meaningfully improve the cost of capital picture for Indian corporates.

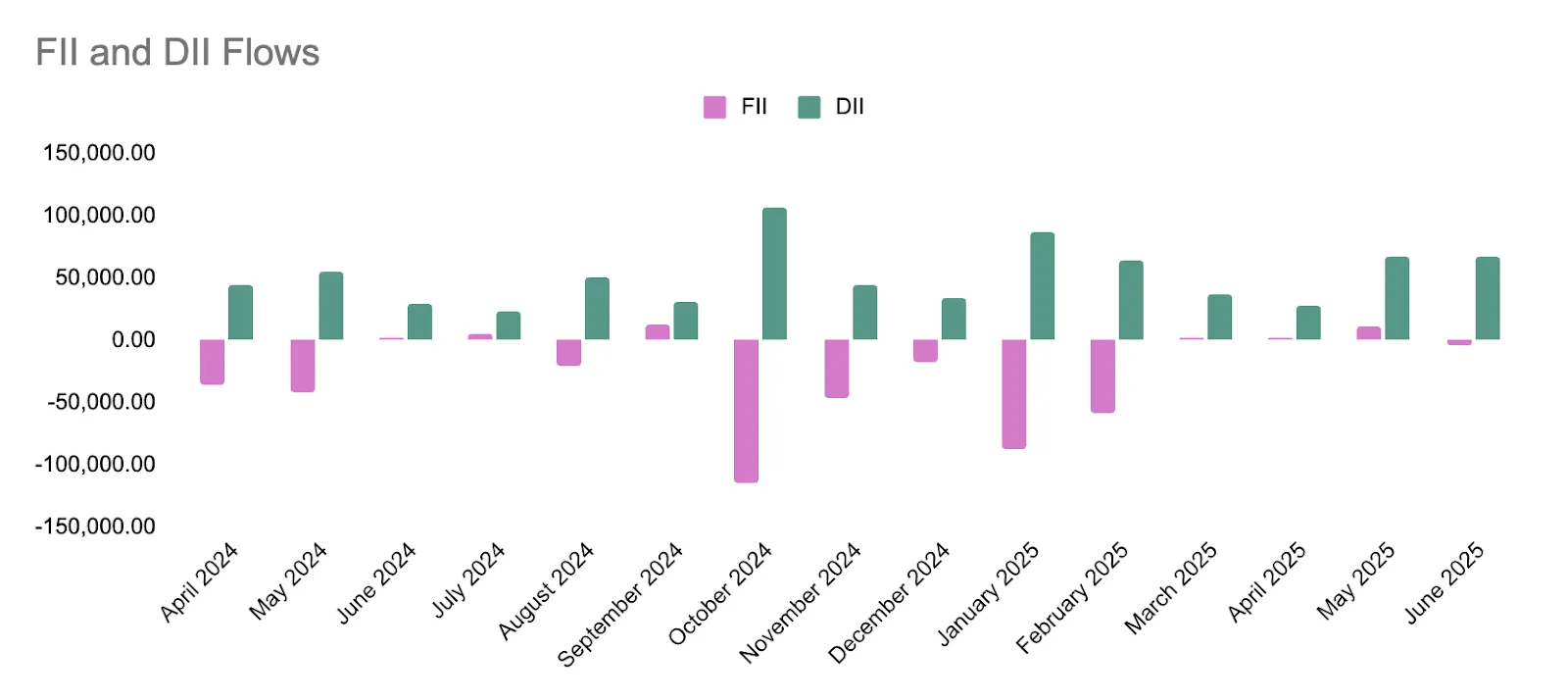

Liquidity and Foreign Inflow

On the liquidity front, the Rs 9.5 trillion infusion since January, alongside benign commodity prices and easing core inflation, is greasing the wheels of credit and investments. In response, FIIs reversed course in May, pumping ₹400 billion into Indian equities, while SIP flows stayed strong above ₹125 billion

Earning Upgrades

Meanwhile, forward earnings downgrades have stabilised: only 22 % of the 504‑stock universe saw ≥10 % EPS cuts last quarter versus 49 % previously and consensus now looks for a healthy 11 % Nifty EPS expansion in FY‑26 after the recent reset. In short, the economy, the flows and the earnings cycle are pointing in the same — positive — direction. What was amazing was the exceptional set of numbers posted by our portfolio companies this quarter.

Markets have understandably front‑run that good news: the Nifty’s ~10 % sprint since the April tariff‑pause has lifted 1‑year‑forward valuations to 20.9 × — bang on long‑term averages but no longer cheap, while SMID caps trade above the 5‑year mean on most metrics Geopolitical flare‑ups in the Middle East and tariff rhetoric from the U.S. election trail remain live risk‑off triggers, so the immediate set‑up is “pricey optimism” rather than “irrational exuberance”.

We shared the May Performance in our last strategy update, as we will be sharing the June performance in the next bi-weekly newsletter.

Let’s understand the nature of our strategies. These are not passive, index-hugging allocations — they are opportunistic, high-momentum, and high-performance systems designed to rotate quickly into strength and exit weakness with discipline. They are built to respond to market regimes, not just ride the beta.

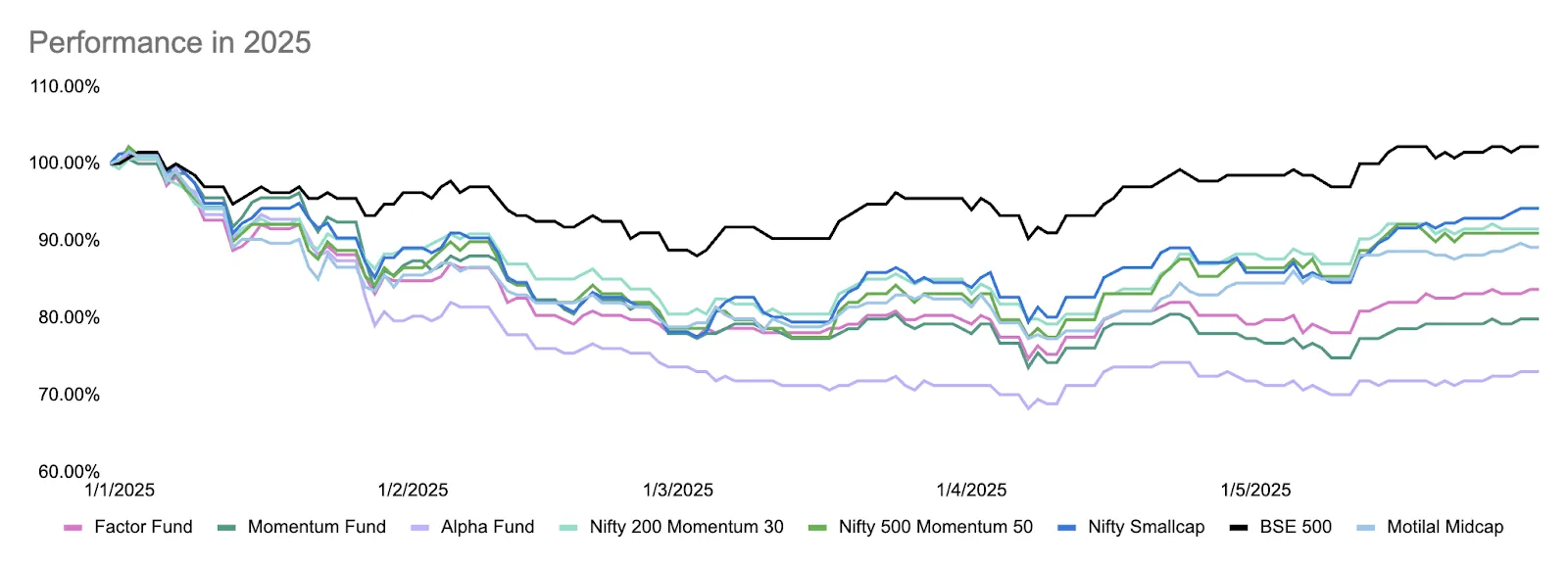

That’s why the real benchmark for these strategies isn’t something like the Nifty 50 or even the BSE 500. These broad indices move slowly, are weighed down by sector laggards, and often mask the true dispersion in underlying equities. Our portfolios — especially the Factor and Alpha strategies — behave much closer to Nifty Momentum benchmarks.

If you look at the performance chart, you’ll notice how our strategies sync up more closely with the sharper, more rotational benchmarks. That's the essence of what we do: capture bursts of alpha, while managing downside with agility.

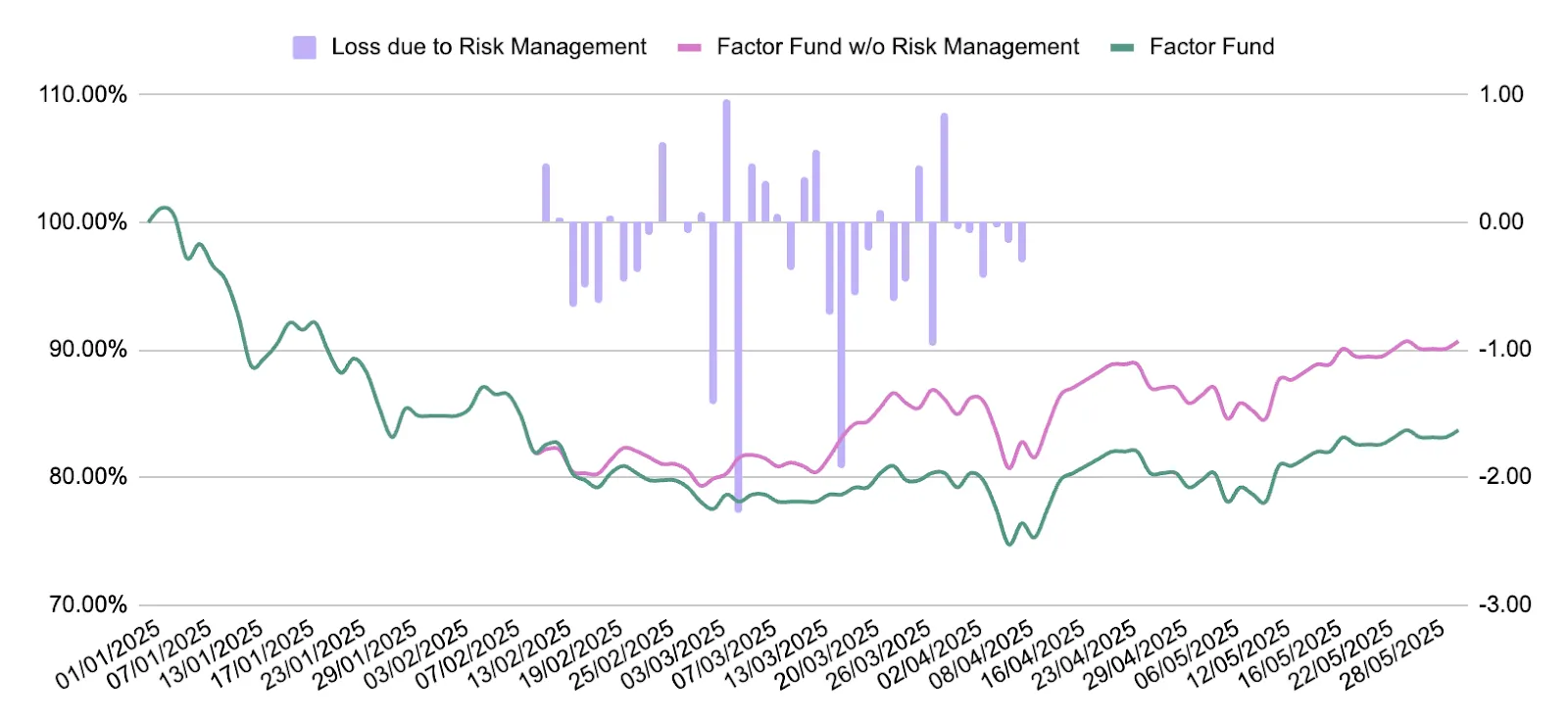

Let’s talk about what didn’t go our way. The February–March period was tough — markets corrected sharply, and at one point, our strategies were down nearly 20%. That’s something we hadn’t seen in the last five years. We took that seriously.

Given the uncertainty back then — especially around the US tariff announcements, global tensions, and not knowing what the new regime in the US might do — we chose to act cautiously. We added hedges through futures and also sold some positions to reduce risk. The idea was to protect capital in case the situation got worse.

But what happened instead was that the markets bounced back quickly, and our hedged strategy lagged behind. If you look at the chart below, the difference is clear — the unhedged version of the factor strategy did much better during the rebound, while the version with hedging stayed flat for a bit longer.

In hindsight, if we hadn’t hedged or had sold earlier in February, things might have played out differently. But we did what we thought was right at the time.

We live and learn. This experience has helped us rethink our hedge triggers and be more flexible. We’re working on being better prepared next time, so that we can manage risk without missing the recovery.

We’ve always had strong conviction in our strategies. The models are solid, the signals work, and the long-term performance has proven that. In fact, as we said earlier — we would’ve done better this year had we not taken the tactical call to hedge or reduce positions in Feb–Mar. That call came from caution, not doubt in the strategy itself.

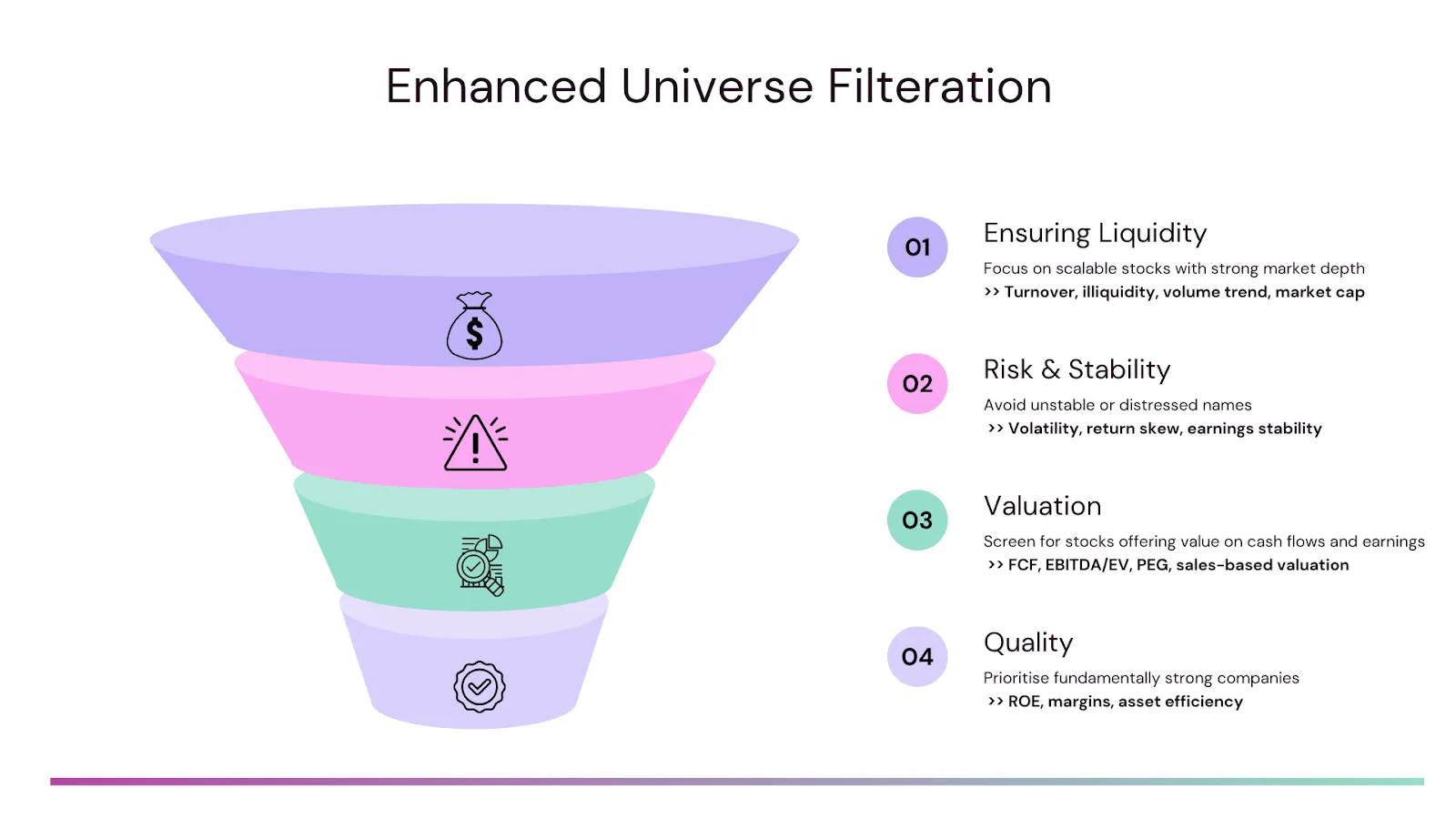

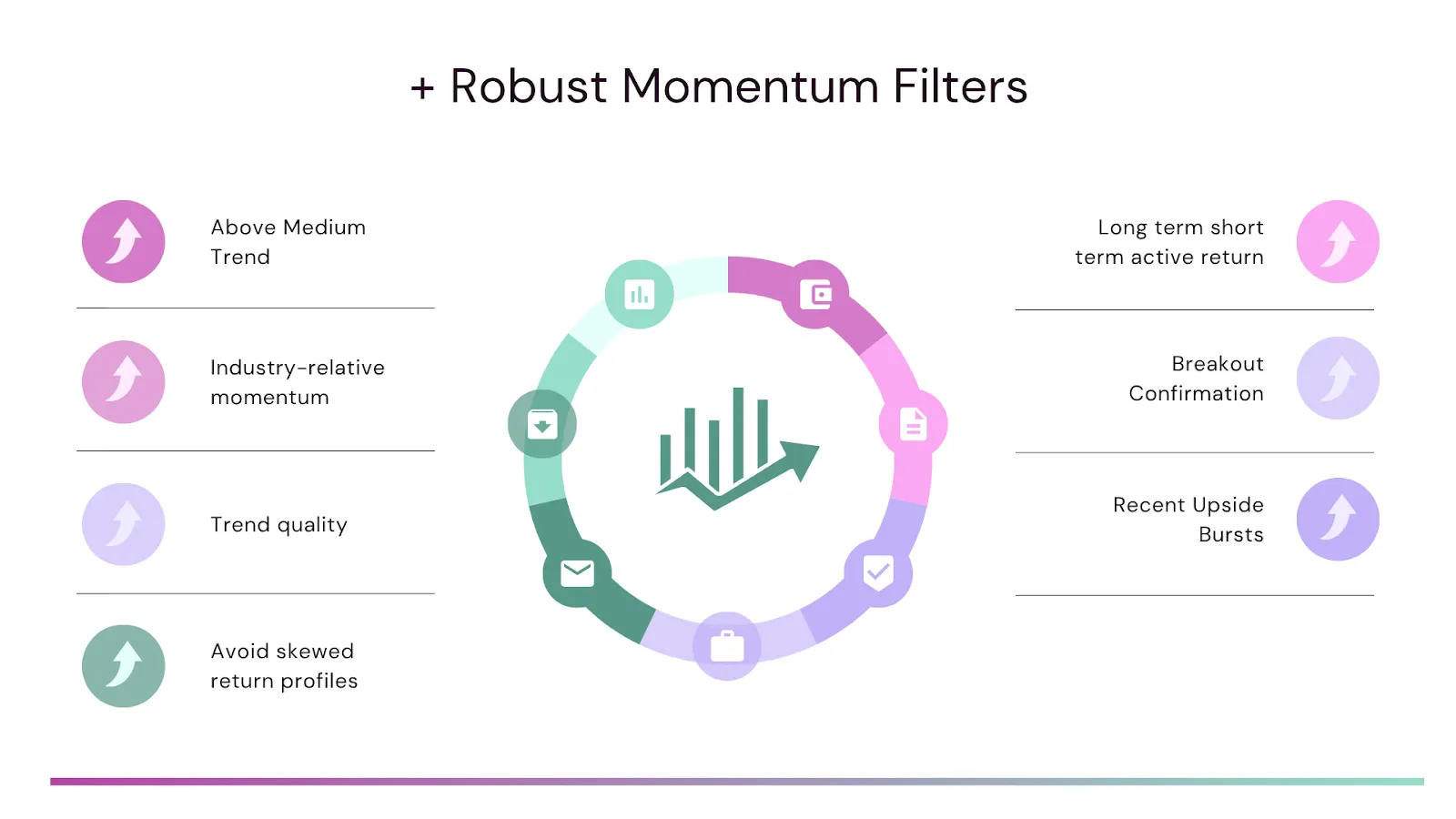

Now, we’re not just managing risk — we’re improving the strategy itself. The focus is on refining the system so that it becomes more robust and needs less intervention in the future. The more conviction we build through better filters and stronger signals, the more we can trust the model to run without stepping in to override it.

Universe selection: We’ve cleaned up the stock universe further using stability, liquidity, volatility, and quality filters. This helps reduce noise and improve consistency.

Momentum signals: We now look at industry-relative momentum, trend structure, and upside burst patterns. This makes the momentum stack more meaningful and less reactive.

Growth filters: We’ve added layers like earnings upgrades, analyst strength, and long-term EPS slope to better align with sustained fundamental trends.

These enhancements are already showing positive results in backtests and live runs. And with these in place, we’ll be even more comfortable letting the model run without adding tactical hedges or overrides — because it’s getting stronger and smarter.

The last few months have been a learning phase — not for the core of our strategy, but for how we manage it around the edges. The strategy itself remains strong. It’s built to capture high-momentum opportunities with discipline, and over the years, it has consistently delivered. This time, what held us back wasn’t the model — it was the tactical decision to hedge during a period of uncertainty.

Now, we’re taking steps to ensure that the strategy becomes even more self-sufficient. The improvements in stock selection, momentum evaluation, and growth filtering are making the model sharper, more selective, and less reliant on human overrides. The more we build conviction through these refinements, the more we can let the strategy run — without reacting emotionally to short-term volatility.

We’re confident about the path ahead. The market setup is improving, our systems are getting stronger, and we're staying focused on execution. No shortcuts — just steady, systematic progress.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart