U.S. immigration and labor market rules have historically carried outsized weight, especially for India’s vast IT services industry. The H-1B visa program, long regarded as the pipeline through which Indian engineers and consultants powered American enterprises, is undergoing a dramatic transformation. President Trump’s September 2025 executive order has hiked the H-1B visa application fee from USD 1,000 to USD 100,000 per applicant, effective for new applications.

As a result, near term operational disruption looks limited because the measure is prospective in nature. The more important questions are about how Indian IT will re-optimize its cost stack, talent pipelines, and client pricing over the next renewal cycle. The center of gravity in delivery was already shifting offshore and toward local U.S. hiring - the new fee accelerates trends in motion rather than creating an entirely new paradigm. Let’s look at this in depth in today’s article.

Watch our detailed video here:

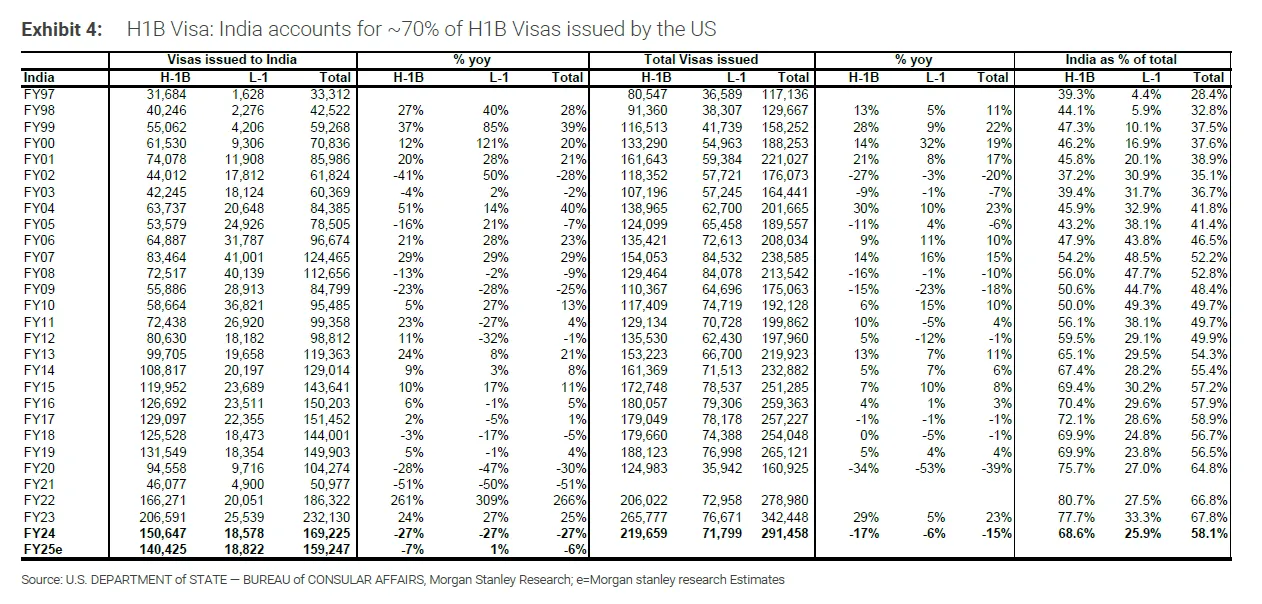

For decades, the H-1B program has symbolized the flow of talent from India to the United States. Roughly 70% of all H-1B visas issued go to Indian nationals. These workers form the backbone of IT outsourcing, project delivery, and consulting assignments for Indian vendors.

The USD 100,000 per petition fee represents a 100-fold increase over the existing fee. For perspective, if a company were to file for 5,000 H-1B visas in FY27, it would face USD 500 million in fees annually. Such costs are prohibitively high, and research consensus suggests that most Indian IT firms will choose to avoid new H-1B filings altogether.

That prospectivity matters: it means current on-site staff with valid visas or petitions are not suddenly stranded, and project ramps planned against existing approvals should proceed. Because H-1B petitioning follows a seasonal cadence (lottery and filings clustered around Q4 to Q1), the first material operational impact will surface in the next eligible filing window, i.e., for FY27 petitions rather than FY26, where applications are already “locked.” In practical terms, the industry has a bridge period to plan mitigations: rebalance onshore/offshore mixes, accelerate local recruitment, or switch to alternative routes.

The fee is assessed per petition (not per year). Given the standard three-year validity (with typical 3+3 renewals), the cost is lumpy at the point of petitioning rather than an annualized operating expense. That design has two implications. First, it disincentivizes new filings en masse - especially for vendors whose on-site roles can be done from global delivery centers without breaching SLAs. Second, it elevates the bar for those roles that must be filled on-site: only genuinely specialized, high-value positions will justify the upfront fee.

The executive order is framed around protecting American jobs by discouraging the use of foreign workers. It also directs U.S. agencies to revise prevailing wage levels and prioritize higher-paid, high-skilled applicants. While the stated intent is to tilt the program toward innovation-led employment, the immediate effect is to raise barriers for cost-sensitive outsourcing firms.

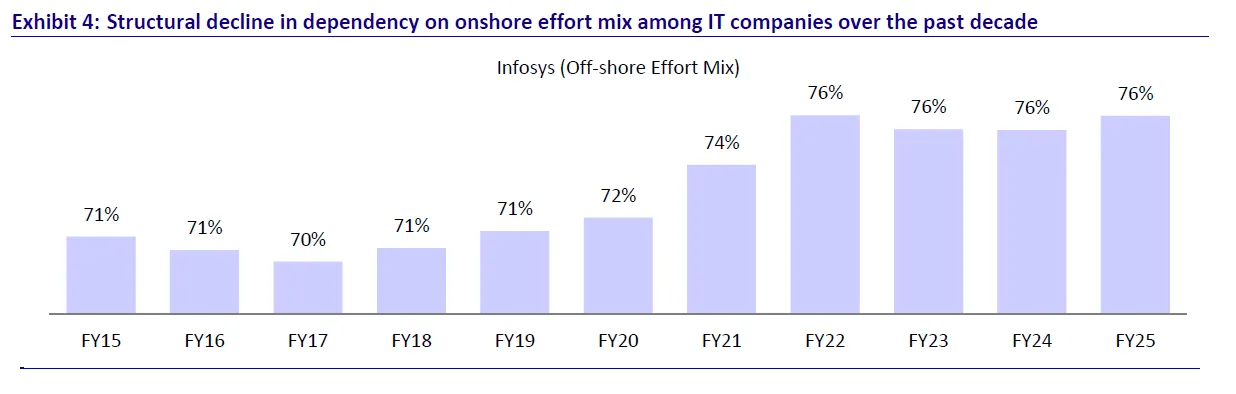

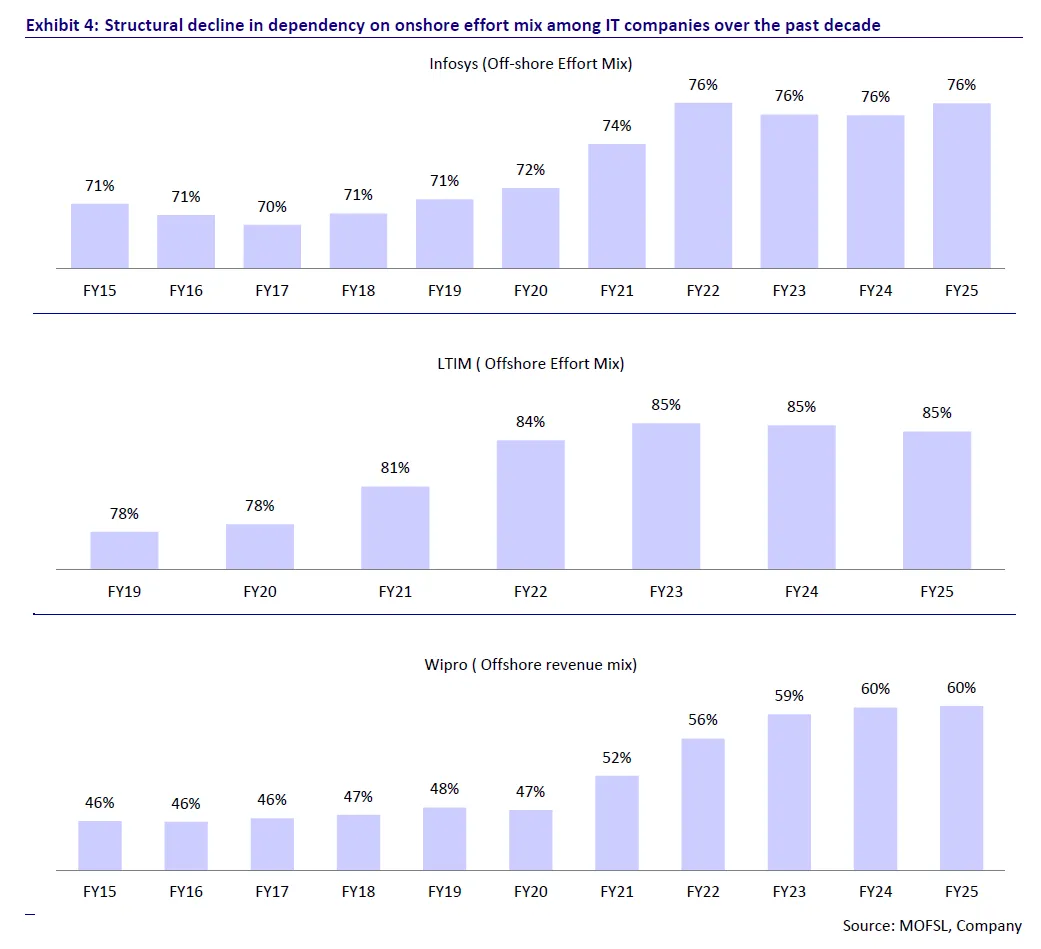

Indian IT has spent a decade lowering structural dependence on visa-tethered on-site labor. Large vendors now run with ~70–85% offshore effort mix, depending on business mix and client base. Off-shoring rose materially post-COVID, as both clients and regulators became more comfortable with distributed delivery at scale; several large vendors report steady increases in offshore effort/revenue shares through FY23–FY25.

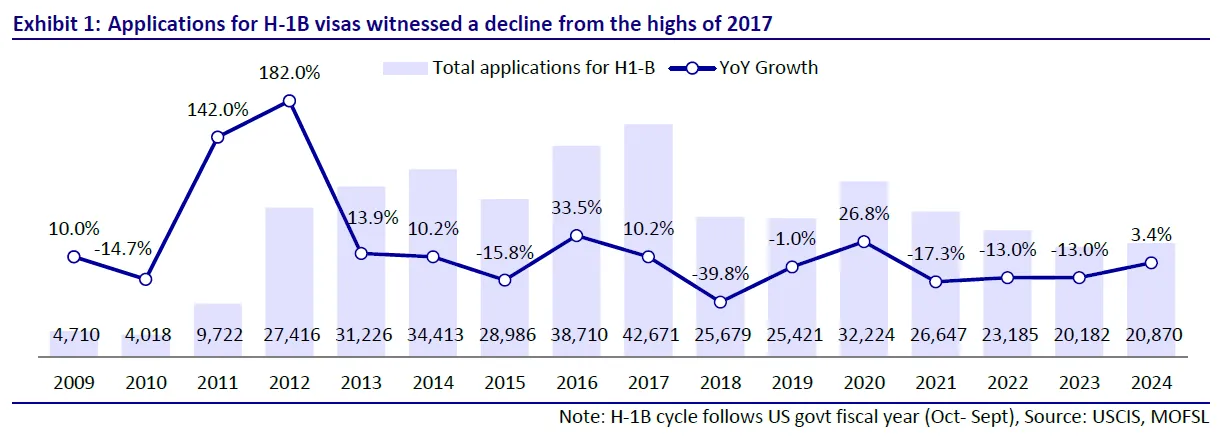

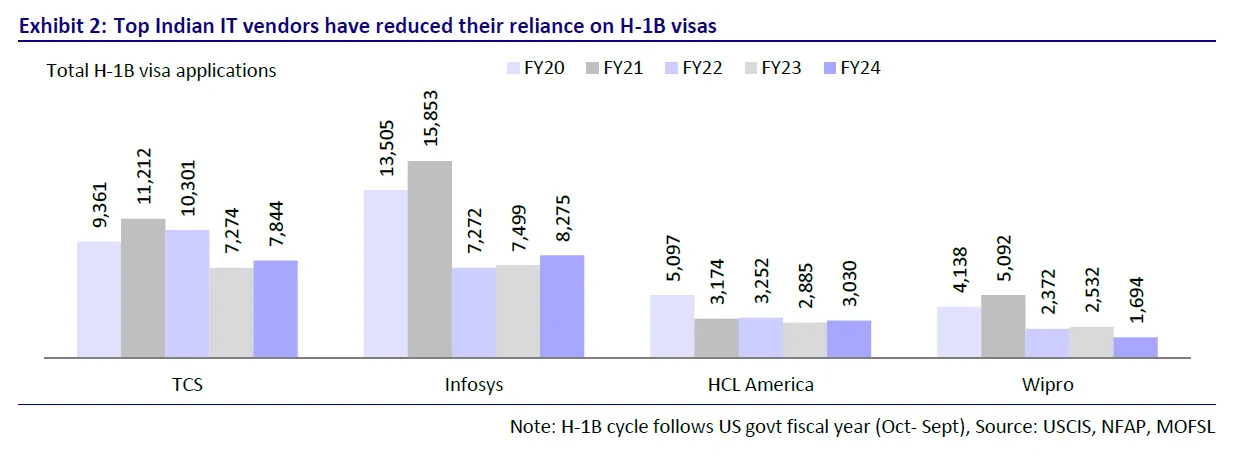

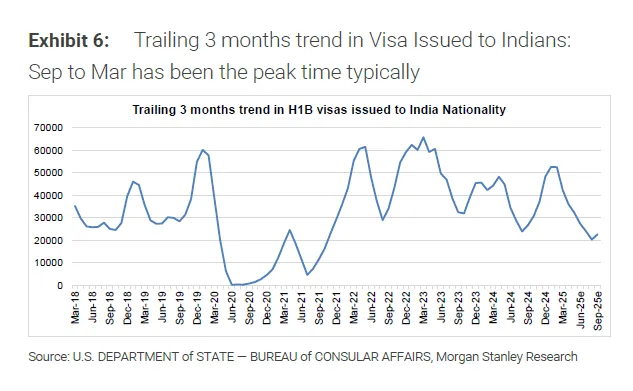

In parallel, programmatic localization in the U.S. reduced the share of H-1B-dependent staff onshore; for a typical Tier-1 vendor, H-1B holders may comprise only ~3–5% of the total global workforce, because only about a fifth of employees are on-site and, within that cohort, a minority carry H-1Bs. This is not a green-field shock to an “on-site-heavy” model; it is a big fee landed on a model already tilted away from visa dependency. Overall, the number of H1B applications have decreased from the highs of 2017.

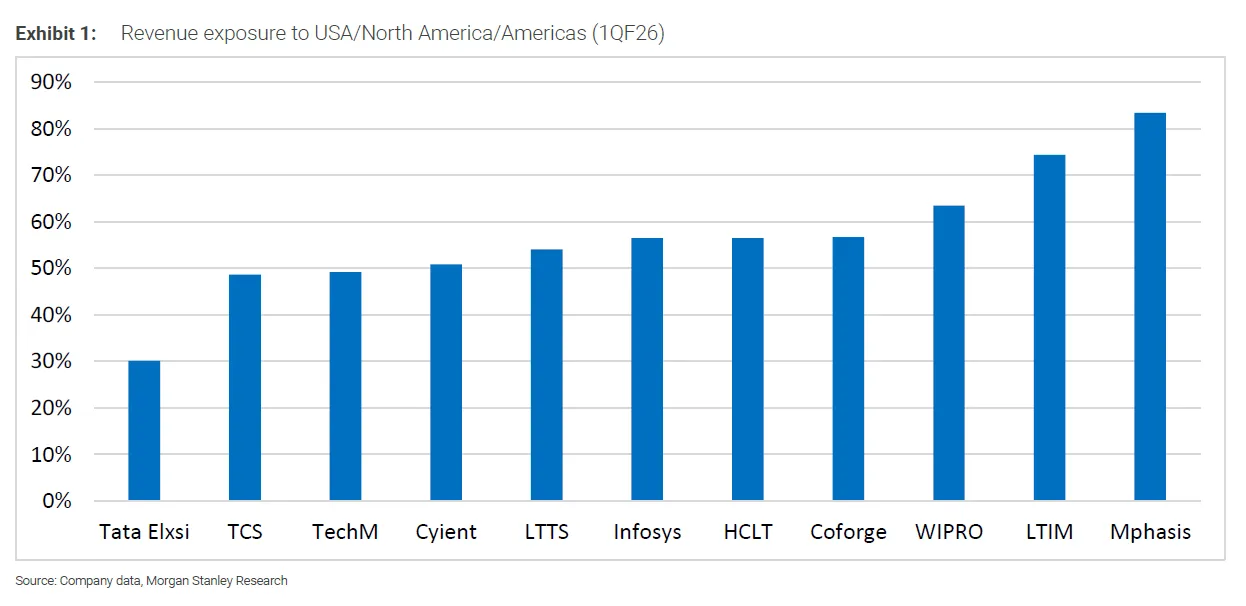

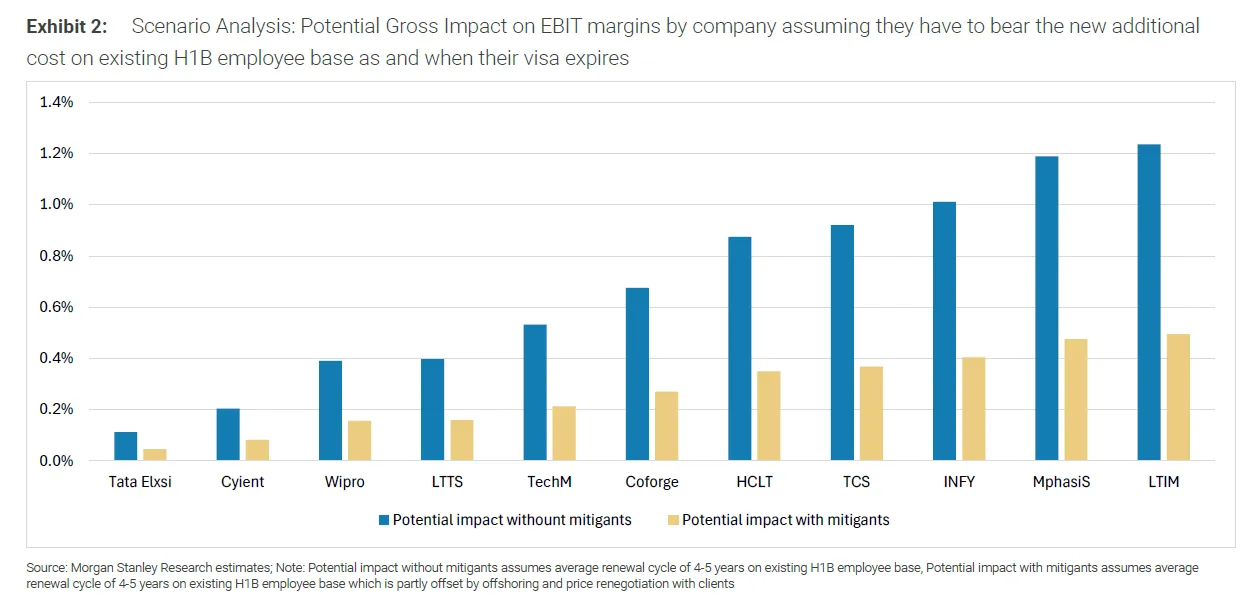

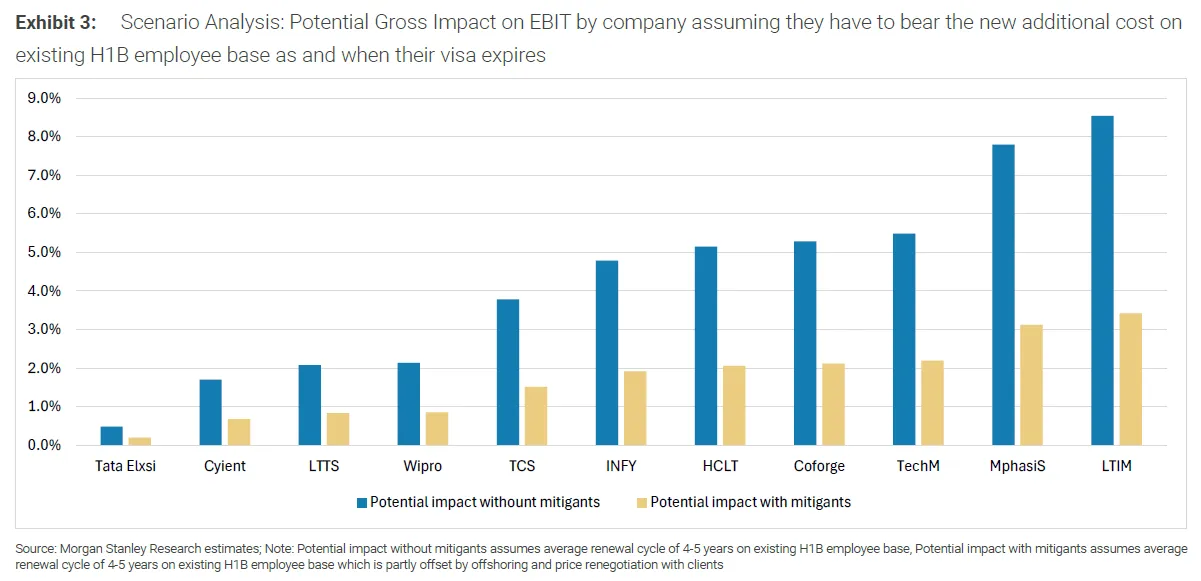

Heterogeneity across Indian IT is meaningful. Vendors with diversified ER&D book, higher offshore intensity, and deeper U.S. localization will be relatively insulated; those with mid-cap profiles, heavier reliance on on-site staff, or a client mix skewed to projects that historically demanded in-person presence will feel more pressure. A simple proxy is the current revenue exposure to North America and the modeled EBIT sensitivity to an H-1B replacement cycle over 3–6 years. Sector-level analysis suggests least impact for ER&D firms and highest for some mid-caps, with Tier-1 names in the middle of the range due to scale and bargaining power.

This variance also reflects the differing ability to push pricing. Larger vendors with outcome-priced transformation deals can tuck on-site price changes into broader value commitments; smaller firms with staff-augmentation-heavy portfolios will find that harder, increasing the urgency of mix shift and local hiring.

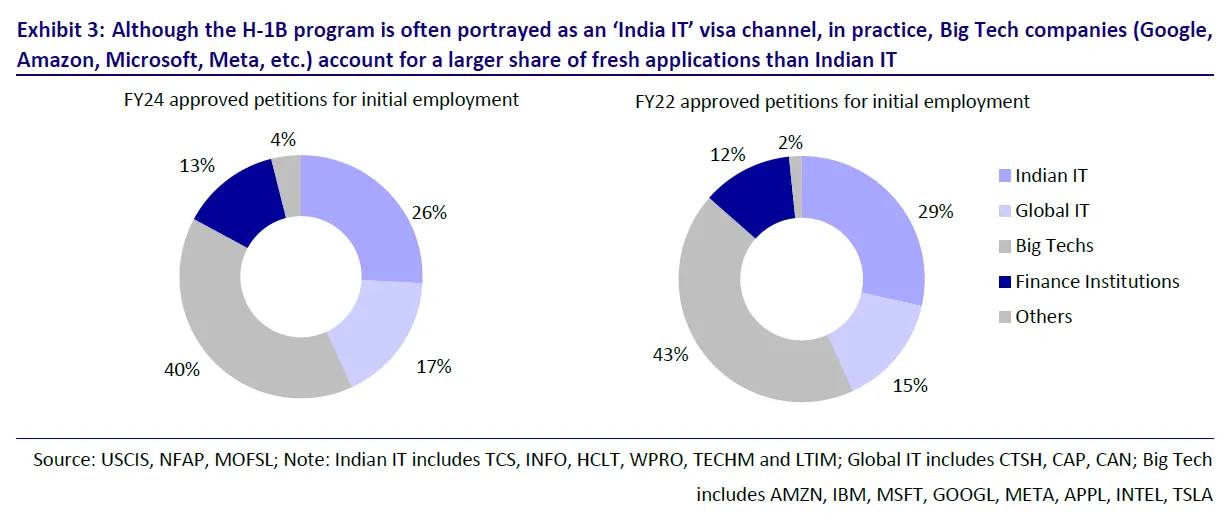

It also matters that “H-1B = India IT” is a misconception. Contrary to popular perception, U.S. Big Tech companies file more fresh H-1B applications than Indian IT firms. Google, Amazon, Microsoft, and Meta collectively dwarf the Indian share. As a result, the brunt of the fee hike may fall disproportionately on Big Tech, even though the policy debate often centers around Indian outsourcing. There are also several global IT integrators, finance institutions and other industries that apply for H1B visas and share the demand pool.

On the margin, the new fee will also force Big Tech to triage filings, potentially loosening competition for local talent in certain U.S. geographies and slightly improving hiring conditions for vendors pursuing “hire local, train local” tracks.

Because the policy is prospective, most near-term travel and staffing plans anchored to existing petitions remain intact. Vendors are not scrambling to evacuate on-site teams or halt go-lives; rather, they are re-running multi-year workforce and location plans to reduce the number of new H-1B petitions they will need to file across the next 3–6 years as current visas expire. The empirical cadence of U.S. visa issuance to Indian nationals typically peaking between September and March suggests a manageable planning window to stagger transitions. That window is critical to de-risk delivery and communicate changes to clients without jeopardizing service levels. Furthermore, Indian IT players have also reduced their reliance on H1B visas as offshoring has increased.

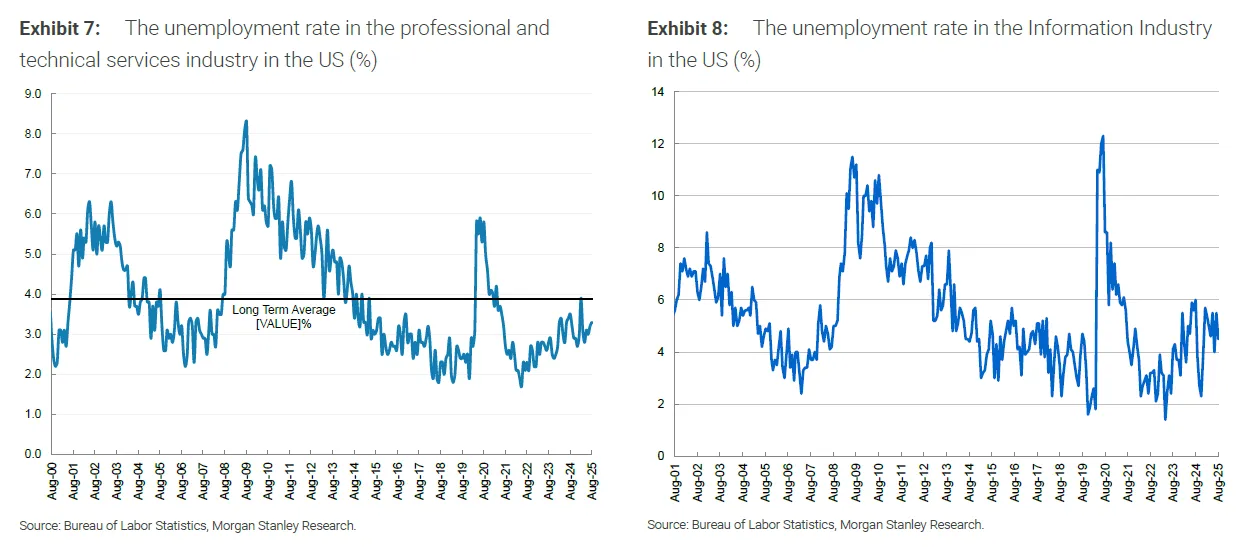

In addition, U.S. labor-market conditions in professional and technical services, while cyclical, are not at extreme stress. Periods of tighter job markets can complicate local hiring, but vendors have been steadily scaling campus and lateral intake in the U.S. for years and adjusting onshore compensation bands; the incremental challenge is cost, not feasibility.

Two reputable scenarios frame the financial effect. On the conservative end, assume a company aims to maintain its current H-1B on-site population constant through the renewal cycle, pays the USD100,000 fee for each replacement petition over ~4.5 years, and only partially offsets the shock via offshoring and pricing. In this stylized case, gross EBIT-margin impact spans ~10–120 bps across coverage, translating to ~0.5–8.5% EBIT headwinds depending on business mix, with mitigations (offshoring; modest price resets on new deals) trimming net impact to ≤50 bps for most a 3–4% EBIT effect. Companies with higher ER&D exposure appear least impacted; mid-caps with relatively higher on-site intensity are most exposed.

Large-Cap Resilience: Companies like Infosys, TCS, and HCL Technologies are better positioned. Their scale, brand recognition, and diversified talent pools enable smoother transitions to offshore-heavy models. They also possess stronger client relationships, making it easier to renegotiate pricing.

Mid-Cap Vulnerability: Firms such as Mphasis and LTIMindtree are more exposed. With less bargaining power and narrower delivery footprints, they may feel greater pain from disrupted on-site revenues.

Engineering R&D Firms: Entities like Tata Elxsi and LTTS are least affected, since their work is less dependent on visa-heavy models.

A more adaptive scenario emphasizes that the sheer magnitude of the fee (USD500m for 5,000 filings) creates a strong economic incentive to avoid new H-1B filings almost entirely, pushing delivery further offshore or into local hiring. Because offshore teams are structurally more profitable, mix shift can stabilize or even enhance operating margins, even if on-site revenue slows. The net effect on EPS can be neutral over the medium term, with the trade-off being slightly slower top-line growth if clients resist higher pricing for on-site components.

One drawback is that on-site consultants often play a critical role in client engagement and upselling. Reduced presence in the U.S. could slightly weaken Indian IT firms’ ability to win large transformational deals.

The likely equilibrium is in between: fewer new H-1Bs, more local and near-shore hiring, continued offshoring, and calibrated pricing actions where the market will bear them. Vendors will differentiate by how quickly they can rebalance the pyramid without disrupting delivery or eroding client intimacy.

The policy lands against several countervailing macro currents:

Demand environment. While cyclical spend moderation persists in pockets, multi-year transformation around data, cloud, AI, and cybersecurity remains intact. Projects that can be delivered offshore will likely proceed with minimal friction; projects that require on-site workshops or co-location will need redesigned engagement models (e.g., shorter on-site sprints, more virtual collaboration, larger offshore pods).

Visa seasonality. U.S. issuance to Indian nationals typically peaks around Sep–Mar; vendors can exploit this calendar to phase transitions and minimize disruption to in-flight programs.

Labor markets. Unemployment rates in professional/technical services and information industries ebb and flow, but the long-run averages and recent prints do not preclude local hiring at scale though compensation pressure is a given. The strategic response is not simply “replace H-1Bs with Americans,” but “redesign the pyramid,” reserving on-site for the top of the skill stack while pushing standardized execution to offshore/near-shore sites.

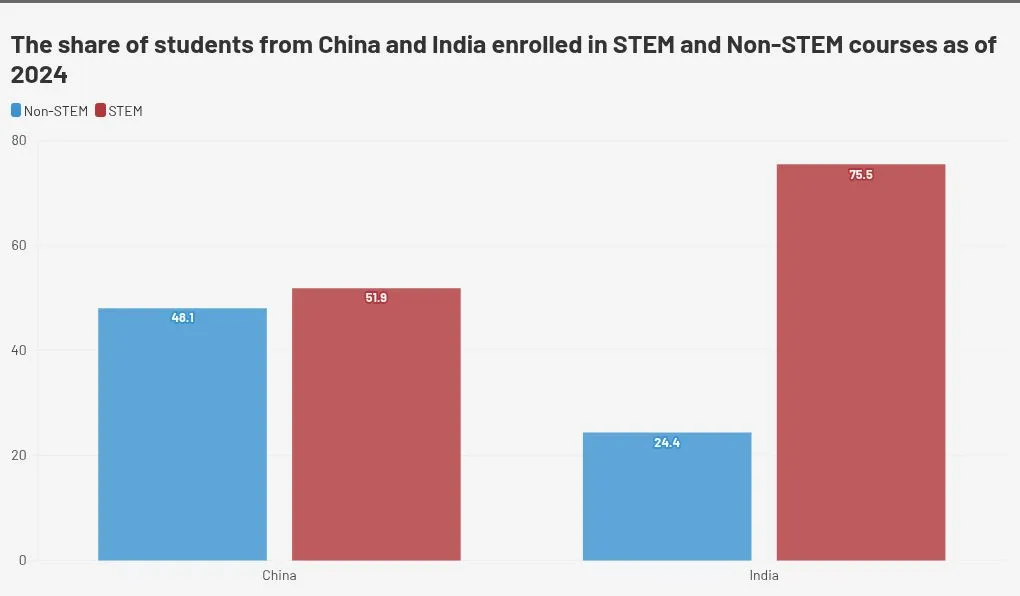

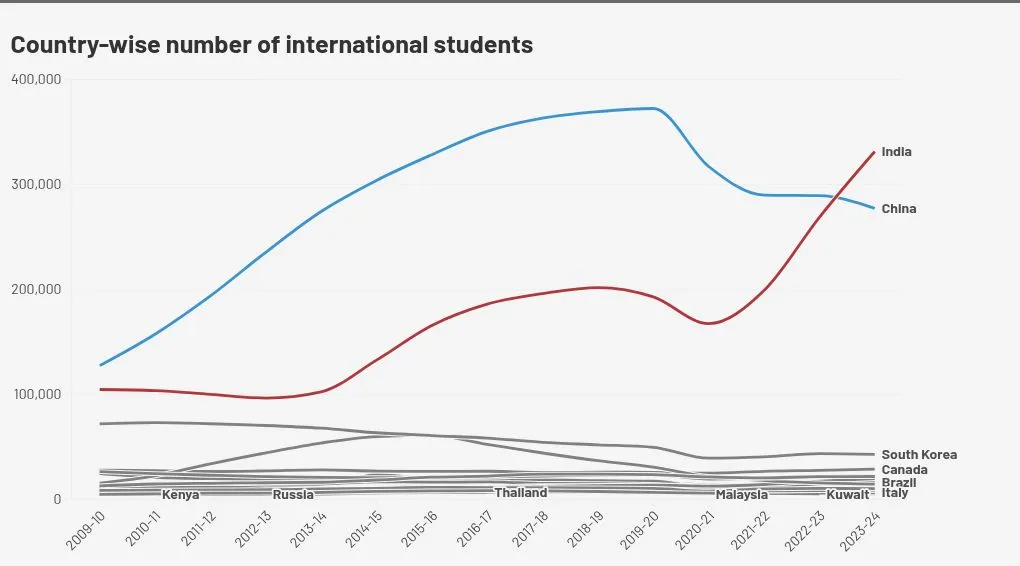

The impact will be especially pronounced for Indian STEM graduates, who are the backbone of the H-1B pipeline. Over three-quarters of Indian students in the U.S. are enrolled in science, technology, engineering, or mathematics programs, and many typically seek H-1B sponsorship two to three years after graduating. In recent years, foreign students transitioning from F-1 to H-1B status have accounted for up to 45% of all new petitions, with Indians forming a dominant share. Given that 57% of all new H-1B beneficiaries in FY24 were Indian nationals, it is clear that Trump’s order disproportionately affects this group, effectively placing a financial barrier on a talent pool that U.S. employers have long depended upon.

Beyond immigration policy, the rule has broader economic consequences. International students contributed nearly $44 billion to the U.S. economy last year, with Indians among the largest spenders on tuition, housing, and daily living expenses. A large portion of this comes from personal or family savings, underscoring the sacrifices made by households to finance overseas education. By raising the cost of transitioning from student to skilled worker, the U.S. risks discouraging future enrollments from India and undermining a pipeline that has sustained both American universities and its high-tech labor market. For many aspiring students, what once seemed like an open door to opportunity now feels increasingly like a closed one.

Indian real estate feels this through non-resident demand and domestic tech-hub incomes. In the near term, effects should be muted: the rule is prospective, existing on-site staff aren’t forced home, and companies expect limited immediate disruption to staffing or travel plans.

Over the medium term, however, if employers largely avoid new H-1B filings, fewer fresh migrants may translate into softer incremental NRI homebuying in key micro-markets (Mumbai MMR, Pune, Bengaluru premium segments) - partly offset by continued local U.S. hiring (which preserves some NRI purchasing power) and, crucially, by a bigger push to run work from India.

The trend toward offshore delivery is set to accelerate. Indian IT companies have already raised their offshore revenue mix significantly over the past decade. For example, Infosys’s offshore mix rose from ~71% in FY15 to ~76% in FY25, while LTIMindtree’s climbed from 78% in FY19 to 85% in FY25.

This is likely to create more jobs and higher wage demand in India’s tech hubs, particularly Bangalore, Hyderabad, Pune, and Chennai. Ancillary benefits include growth in real estate, infrastructure, and consumption in these urban centers. As delivery shifts offshore, payrolls in Indian tech centers can expand relative to a “status quo” path, supporting mid-income housing demand in Tier-1/Tier-2 corridors even if ultra-premium NRI segments cool at the margin.

For Indian consumption overall, the mix matters more than the headline. If vendors curb on-site hiring and pivot to offshore and local U.S. recruitment, top-line growth tied to on-site work could slow, but sector EBIT and payrolls in India need not fall - margins can hold up or even improve as delivery tilts to more profitable offshore work.

That combination points to a modest near-term macro effect: less pressure on aggregate urban consumption in tech hubs than headlines imply, with some rotation inside the basket (steady-to-firmer spends from India-based tech employees, potentially softer “aspirational” buys tied to NRI inflows). Because the first real filing shock appears only with FY27 petitions and the rule could face legal challenge, the consumption impact line is likely to slope gently rather than break giving firms and households time to adjust.

The USD 100,000 H-1B fee shock is dramatic but not fatal for Indian IT. The industry has already reduced its reliance on U.S. visas and is structurally shifting toward offshore models. Large-cap firms are well positioned, mid-caps face challenges, and retail investors should remain cautious but not alarmed.

For the broader Indian economy, the changes could reinforce India’s role as a global technology hub, stimulate urban growth, and deepen the services export engine. The transition will not be without friction, but the long-term trajectory for India appears stronger, not weaker.

The regulation may increase costs and force business model adjustments, but it is also an industry-wide issue that companies can mitigate through offshoring and pricing power. EPS neutrality is achievable, with margins potentially improving if offshore execution scales efficiently.

For Indian retail investors and policymakers alike, the message is clear: embrace adaptability, focus on fundamentals, and recognize that what may appear as a policy setback could, in the Indian context, become an accelerator of domestic economic strength.

Watch the full video and analysis on Does $100,000 H1B Visa Really Impact Indian IT Stocks?:

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart