by BB

Published On Oct. 27, 2025

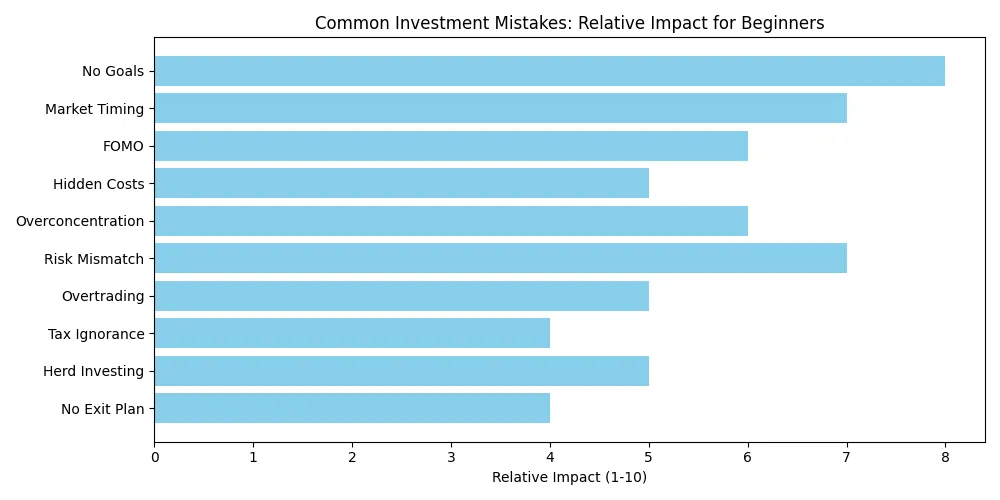

Starting your investment journey can be both exciting and daunting. Many first-time investors assume that simply picking the right stock or fund will guarantee success. The truth is, investing is about much more than individual choices, it’s about understanding your financial goals, knowing your risk tolerance, and having a clear plan for navigating market ups and downs. Avoiding common investment mistakes early on is key to long-term success.

These common investment mistakes happen because beginners often lack a structured approach. Without clearly defined goals, it’s easy to choose assets that don’t align with your needs. Without understanding risk, short-term volatility can trigger panic selling or emotional decisions. And without a plan, it’s tempting to chase trends or follow the crowd, often buying high and selling low. Recognizing these patterns and understanding their consequences is the first step toward building a disciplined, long-term investment strategy that allows your money to grow steadily and safely.

This article walks through ten financial mistakes to avoid make and more importantly, why they happen. By understanding the reasons behind these mistakes, you’ll be equipped to make smarter choices and build a disciplined, research-backed portfolio. Solutions like Wright Research’s approach exist to help navigate risk, manage emotions, and stay focused on long-term growth rather than short-term hype. Let’s explore the common investment mistakes beginners make and how to avoid them.

Without a destination, any path will do. Many new investors jump into equities or mutual funds without first clarifying why they are investing. A clear financial goal acts like a compass, guiding your decisions and anchoring your expectations.

For example, if you plan to buy a car in three years, allocating all your money to an equity mutual fund exposes you to volatility at the wrong time. On the other hand, parking your retirement savings in a low‑yield savings account when retirement is 30 years away can mean missing out on compounding. Set specific short‑term (less than five years) and long‑term (more than five years) goals, assign realistic amounts to each, and choose investments accordingly. Goal-setting is one of the most overlooked yet critical common investment mistakes beginners make.

Who doesn’t dream of buying low and selling high? Unfortunately, trying to predict when markets will rise or fall is notoriously difficult. Many times, missing just a few of the best days in the market can significantly reduce overall returns. Market timing not only requires exceptional foresight but also imposes transaction costs and taxes every time you jump in and out.

Instead of attempting to guess short‑term market movements, consider systematic investment plans (SIPs) or rupee‑cost averaging. By investing a fixed amount at regular intervals, you buy more units when prices are low and fewer when prices are high, smoothing out volatility. Portfolios that use regime modelling identify structural trends and maintain discipline. Investors are encouraged to stay invested through market cycles rather than react emotionally to daily news. Trying to time the market is another classic example of common investment mistakes.

The fear of missing out (FOMO) has become a powerful driver of investment decisions, especially in today’s age of social media. FOMO often pushes people to buy hyped assets impulsively, prioritising short-term gains over long-term planning. Whether it’s an overhyped IPO, a meme stock, or the latest cryptocurrency, succumbing to FOMO usually leads to buying at peak prices and selling in panic when the hype fades.

Emotions can also trigger biases like loss aversion and confirmation bias, holding on to losing investments because it’s hard to accept a loss, or only seeking information that confirms what you already believe. To counteract these behavioural pitfalls, create a written investment plan and stick to it. Research the underlying business, its financials, and competitive advantage before investing. If you’re tempted by a tip from a friend or a group chat, take a step back, wait, read independent analyses, and make a reasoned decision. Factor‑based strategies that rely on quantitative signals rather than gut feelings can also help investors remain disciplined, even when market sentiment swings.

Even small fees can quietly eat into your long-term returns. In India, mutual funds and ETFs come with expense ratios, brokerage charges, account maintenance fees, and exit loads that can reduce the growth of your portfolio over time. For example, a fund promising 7 % annual returns might only deliver 5 % once expenses are factored in. Over decades, these seemingly minor differences can add up to a significant opportunity cost.

To keep costs under control, pay attention to expense ratios when choosing funds, and consider direct plans if you’re comfortable investing without a distributor. Understand all charges upfront so there are no surprises. Minimising these costs allows more of your money to stay invested and work for you, helping compounding do its job. Overlooking costs is another of the common investment mistakes first-time investors often make.

Putting too much money into one stock, theme, or asset class is like putting all your eggs in a single basket. Diversification is about spreading those eggs across different baskets i.e. combining stocks, bonds, gold, and other alternatives, as well as mixing sectors and geographies that don’t move in sync. By including assets that react differently to market conditions, you can reduce volatility and avoid a single setback wiping out your gains.

In India, first-time investors often gravitate toward familiar names, like popular tech stocks, or culturally preferred assets such as gold and real estate. While these investments have their place, overconcentration can be risky. For example, a portfolio invested entirely in mid-cap IT companies would take a big hit if that sector slows down. Similarly, holding only physical gold may leave you short of liquid funds when you need them. When building your own portfolio, try to limit exposure to any single stock or sector and aim for a healthy mix of assets to balance risk and potential returns. Diversification helps protect you from common investment mistakes like overexposure to one sector.

Your investment choices should align with your goal’s, timelines and your comfort with market ups and downs. Think of it this way: short-term money is like a carry-on bag, you need it accessible and safe, while long-term money is like checked luggage, able to endure more turbulence. The shorter your timeline, the less risk you should take; conversely, the longer your horizon, the more volatility you can tolerate in pursuit of higher returns. Putting short-term money in volatile equities or keeping long-term savings in low-yield accounts can lead to missed growth or unnecessary losses when you need cash.

Start by categorising your goals into short-term (within five years), medium-term (five to ten years), and long-term (more than ten years). For short-term goals, prioritise capital gain preservation through options like high-quality bonds, fixed deposits, or low-volatility funds. Medium-term goals benefit from a balanced mix of equities and debt, while long-term goals can handle higher volatility to capture growth from equities, real estate investment trusts (REITs), or international stocks. The key principle remains: match your investment choice to the timeline, and let each bucket do the job it was designed for.

Constantly tinkering with your portfolio can feel productive, but it often works against your long-term returns. Overtrading adds unnecessary costs and can lead to a cycle of poor decisions, especially when driven by a desire to recoup losses or by short-term market news.

Successful investing isn’t about reacting to every market move; it’s about following a well-thought-out plan. Review your portfolio periodically, perhaps once or twice a year, to rebalance and ensure it still aligns with your goals. Avoid checking prices daily if it sparks anxiety or temptation to make impulsive trades. By staying disciplined and focusing on the long term, you give compounding time to work in your favor.

Taxes may not be as exciting as stock tips, but ignoring them can quietly eat into your returns. In India, capital gains taxes vary based on how long you hold an asset and the type of investment. Short-term capital gains, usually from assets held less than a year, are taxed at a higher rate, while long-term capital gains benefit from lower rates and certain exemptions.

For example, selling an equity mutual fund after 10 months could mean paying a higher tax, whereas holding it just a few months longer might qualify for a lower rate. Being mindful of these timelines and keeping a clear record of purchase dates can make a significant difference to your after-tax returns. Planning your investments and withdrawals around these thresholds helps you maximize what actually ends up in your pocket, rather than letting taxes quietly chip away at your capital gains.

Human beings are social creatures, and it’s natural to feel safer moving with the crowd. But in investing, herd behaviour can be dangerous. Jumping into a sector or stock only after it has already surged often means you’re the last one in and the first to feel the pain when prices fall. Likewise, selling in panic when everyone else is doing the same locks in losses instead of letting your investments recover.

Instead of chasing trends, focus on your own goals and risk tolerance. Ask yourself whether a hot sector or stock fits into your overall allocation and whether you truly understand the fundamentals behind it. History is full of examples: investors who rushed into tech IPOs or hyped digital stocks in recent years often saw their portfolios halve in value within months. Meanwhile, those who diversified and stayed invested through volatility typically fared better. By thinking independently and sticking to a disciplined plan, you can avoid the pitfalls of herd mentality and make decisions that truly support your long-term financial goals.

Entering an investment is often the easy part; knowing when and how to exit is just as important. Without a clear exit strategy, it’s easy to hold on to underperforming assets for too long or sell winners prematurely. Start by defining why you own a particular investment and what conditions would prompt you to sell. For example, you might decide to exit a stock if its fundamentals deteriorate or its valuation becomes extremely high.

You can also set a target return or a time-based plan like selling a thematic fund after a set number of years or once it has doubled. Periodically reviewing your holdings ensures they still serve their intended purpose and remain aligned with your goals. Having a predetermined plan removes emotion from decision-making, helping you act strategically rather than impulsively when markets swing. By thinking ahead, you make it far easier to stay disciplined and protect the growth you’ve worked to build.

Investing is as much about avoiding mistakes as it is about picking winners. By defining clear goals, staying invested rather than trying to time the market, keeping emotions in check, managing costs, diversifying across assets, aligning risk with your time horizon, avoiding overtrading, understanding tax implications, resisting herd mentality, and planning your exits, you create a strong foundation for long-term growth. Each of these principles helps protect your portfolio from unnecessary setbacks while allowing your investments to work for you steadily over time.

At Wright Research, we take these principles seriously. Our team combines quantitative models, factor investing, regime analysis, and AI-driven risk management to construct portfolios that are diversified, cost-efficient, and adaptable to changing market conditions. Whether you’re looking for core portfolios, thematic baskets, or carefully curated mutual fund combinations, we provide solutions designed to match different goals and risk profiles.

Investing is a journey and a disciplined process of learning, adapting, and growing. With thoughtful planning, the right guidance, and a focus on avoiding common investment mistakes, you can confidently navigate markets and build wealth over time. Start your journey today with Wright Research and turn informed, disciplined investing into long-term financial success.

1. How much should a first-time investor in India invest each month?

Start with an amount you’re comfortable with, enough to build the habit consistently. Even small monthly contributions grow significantly over time through compounding.

2. Are SIPs a good starting point for beginners?

Yes, SIPs help you invest regularly, reduce market timing risks, and build wealth steadily without stressing over short-term fluctuations.

3. Should I choose mutual funds or direct stocks at the start?

Mutual funds are ideal for beginners, offering diversification and professional management, while direct stocks require more research and risk tolerance.

4. How can I lower risk as a new investor?

Diversify across asset classes, align investments with your time horizon, and avoid chasing short-term market trends.

5. How often should I check and rebalance my portfolio?

Review your portfolio once or twice a year to ensure it still matches your goals and risk profile, rather than reacting to daily market moves.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart