by Naman Agarwal

Published On July 30, 2025

Options expiry day represents one of the most volatile and opportunity-rich trading sessions in the Indian stock market. For intraday traders, these days offer unique profit potential through accelerated time decay, heightened volatility, and significant price movements. However, success requires specific strategies, precise timing, and disciplined risk management. This comprehensive guide explores the most effective approaches to capitalize on expiry day dynamics while protecting your capital.

The expiry day phenomenon creates a perfect storm of market forces. As option contracts approach their final hours, time decay accelerates dramatically, institutional positions get unwound, and retail traders scramble to manage their exposure. Understanding how to navigate these conditions can transform what many consider chaotic market behavior into consistent profit opportunities.

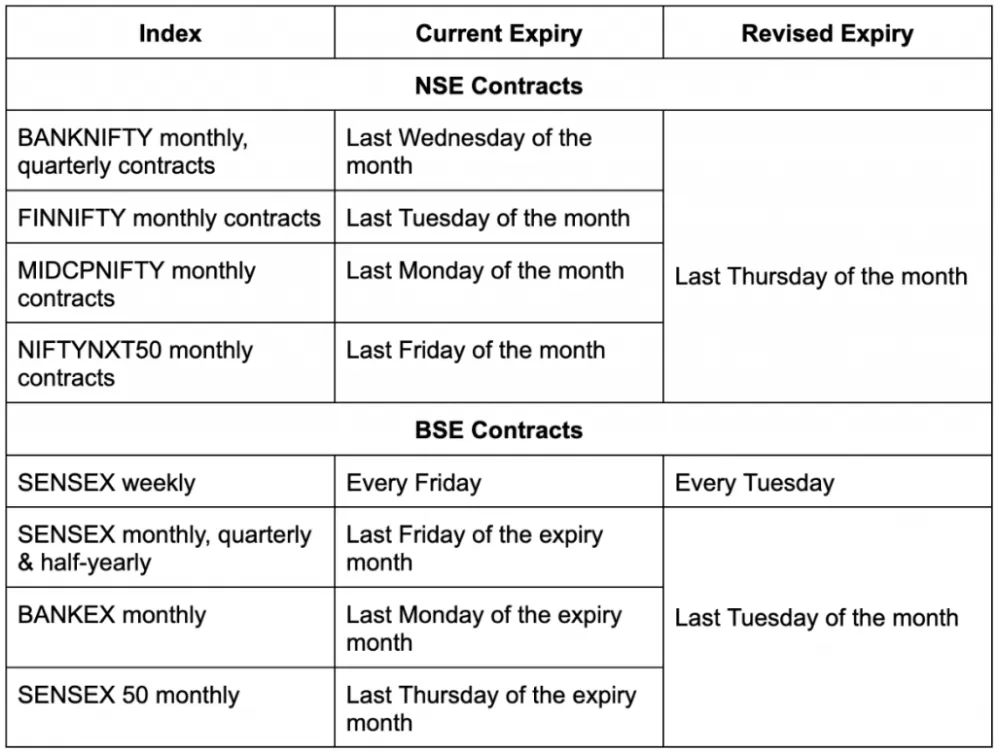

Options expiry day trading involves executing specific strategies on the final trading day of option contracts, capitalizing on the unique market dynamics that occur when contracts are about to expire. In India's derivatives market, this primarily focuses on weekly expiries every Thursday for Nifty and Bank Nifty options, along with monthly expiries on the last Thursday of each month.

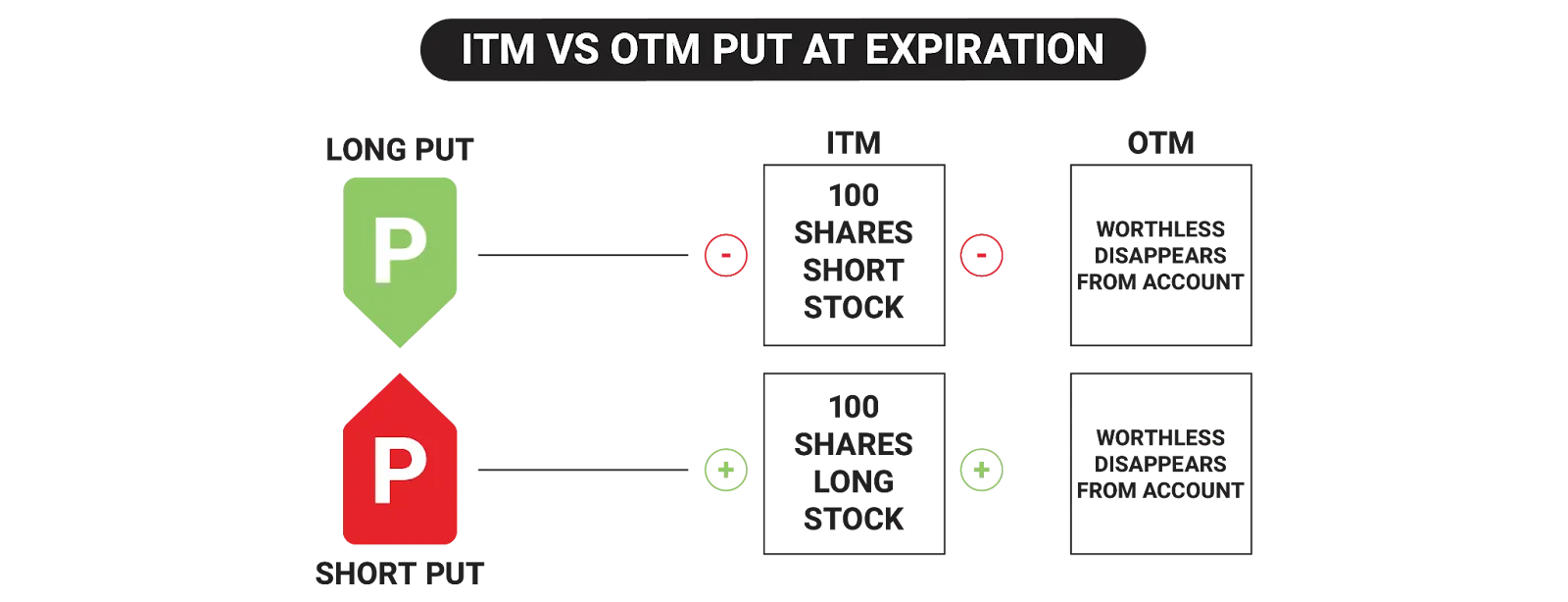

On expiry day, options lose their entire time value, leaving only intrinsic value for in-the-money contracts. This creates several distinct trading opportunities. Out-of-the-money options that appear worthless can suddenly become valuable with small underlying moves, while at-the-money options experience maximum time decay pressure. The acceleration of theta decay means that option premiums can collapse rapidly, creating opportunities for both buyers seeking lottery-ticket-style gains and sellers harvesting time decay.

The psychological aspect cannot be ignored. Many retail traders panic as they see their positions losing value rapidly, creating additional volatility that experienced traders can exploit. Institutional players often need to hedge large positions or roll them forward, creating predictable flow patterns that savvy intraday traders learn to anticipate.

Volume typically increases dramatically on expiry days, sometimes reaching 2-3 times normal levels. This increased liquidity generally improves bid-ask spreads, making it easier to enter and exit positions. However, the same volume can create sudden price gaps and unexpected moves that catch unprepared traders off guard.

Expiry dates serve as critical inflection points in options trading, creating time-bound pressure that fundamentally alters market behavior. Understanding their importance helps traders position themselves advantageously rather than being caught off guard by sudden volatility spikes.

Contract Settlement Dynamics

On expiry day, all option positions must be resolved through one of three methods: exercise, assignment, or expiration worthless. For Indian index options, this creates cash settlement obligations that institutional players must manage carefully. Large positions often need to be hedged or unwound, creating predictable order flow that experienced traders can anticipate and profit from.

Time Decay Acceleration

The most significant factor on expiry day is the dramatic acceleration of time decay, known as theta. While time decay occurs gradually over an option's life, the final day can see premiums collapse by 50-80% even without significant underlying movement. This creates opportunities for option sellers to capture premium quickly, but also poses substantial risks for buyers who need immediate directional movement.

Pin Risk and Max Pain Theory

Expiry days often witness "pinning" behavior, where the underlying price gravitates toward strikes with maximum open interest. This occurs because market makers and large traders attempt to minimize their assignment risk by trading the underlying. Understanding these dynamics helps traders identify potential support and resistance levels unique to expiry day.

Volatility Expansion and Contraction

India VIX typically spikes on expiry days, reflecting increased uncertainty and larger expected price moves. However, this volatility often contracts sharply in the final hour as positions get resolved. Traders who understand these volatility patterns can position themselves to benefit from both expansion and contraction phases.

Success in expiry day trading requires a systematic approach that accounts for the unique risks and opportunities present. Unlike regular trading days, expiry requires specific preparation, timing, and execution strategies.

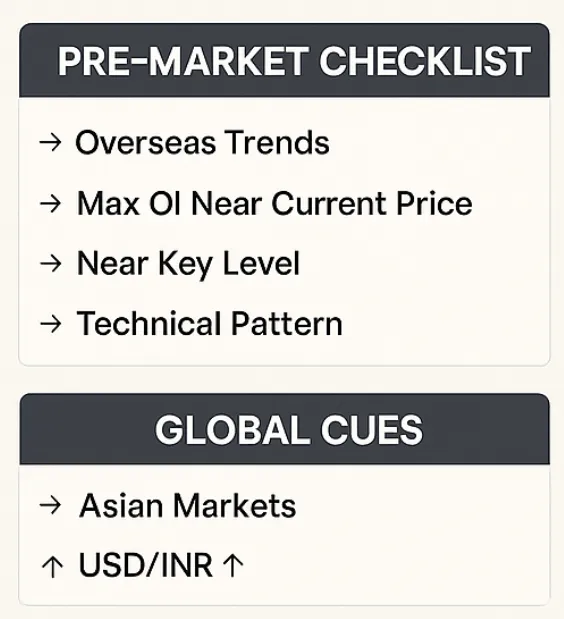

Pre-Market Preparation

Effective expiry day trading begins before the market opens. Traders should analyze overnight developments, check global cues, and examine open interest data to understand where large positions are concentrated. The Put-Call Ratio provides insights into market sentiment, while maximum pain calculations suggest potential pin levels.

Strike Selection Strategy

On expiry day, strike selection becomes crucial. At-the-money and slightly out-of-the-money options offer the best balance of premium and probability. Deep out-of-the-money options can provide lottery-ticket returns but carry extremely high risk. In-the-money options have intrinsic value but limited upside potential.

Position Sizing and Capital Allocation

Expiry day volatility demands conservative position sizing. Many successful traders risk only 1-2% of their capital per trade, using the high probability of multiple opportunities throughout the day. Overlevering on expiry day is one of the quickest ways to blow up an account, as unexpected moves can cause 100% losses within minutes.

Timing Your Entries

Market behavior changes dramatically throughout expiry day. The first hour often sees continuation of overnight sentiment but with high volatility. The 10:30 AM to 1:00 PM session typically shows more predictable technical patterns. Post-2:00 PM action can become extremely volatile as time decay accelerates and larger players actively manage their positions.

Successful expiry day trading requires a structured approach that addresses the unique challenges and opportunities of these high-volatility sessions. From pre-market preparation to post-2 PM execution, every phase demands specific strategies and tools.

Early Session Strategy (9:15 AM - 10:30 AM)

The opening session on expiry day often carries forward overnight sentiment while exhibiting high volatility. Smart traders typically avoid aggressive positions during this window, instead using it to gauge market direction and institutional flow. Gap openings are common, and initial moves often get reversed as the session progresses.

Mid-Session Execution (10:30 AM - 2:00 PM)

This period typically offers the most reliable trading opportunities. Volatility moderates somewhat, allowing for technical analysis to work more effectively. Trends established during this session often persist, making it ideal for directional strategies. Volume remains healthy, ensuring good liquidity for entries and exits.

Key tools for this session include Volume Weighted Average Price (VWAP) for trend confirmation, open interest changes to gauge institutional sentiment, and traditional support/resistance levels. Many successful strategies involve waiting for clear breakouts above or below key levels, confirmed by volume and open interest changes.

Critical Final Phase (2:00 PM - 3:30 PM)

The final 90 minutes of expiry day trading are when the most dramatic moves often occur. Time decay accelerates exponentially, and institutions make final adjustments to their portfolios. This period requires the most careful risk management, as moves can be both swift and decisive.

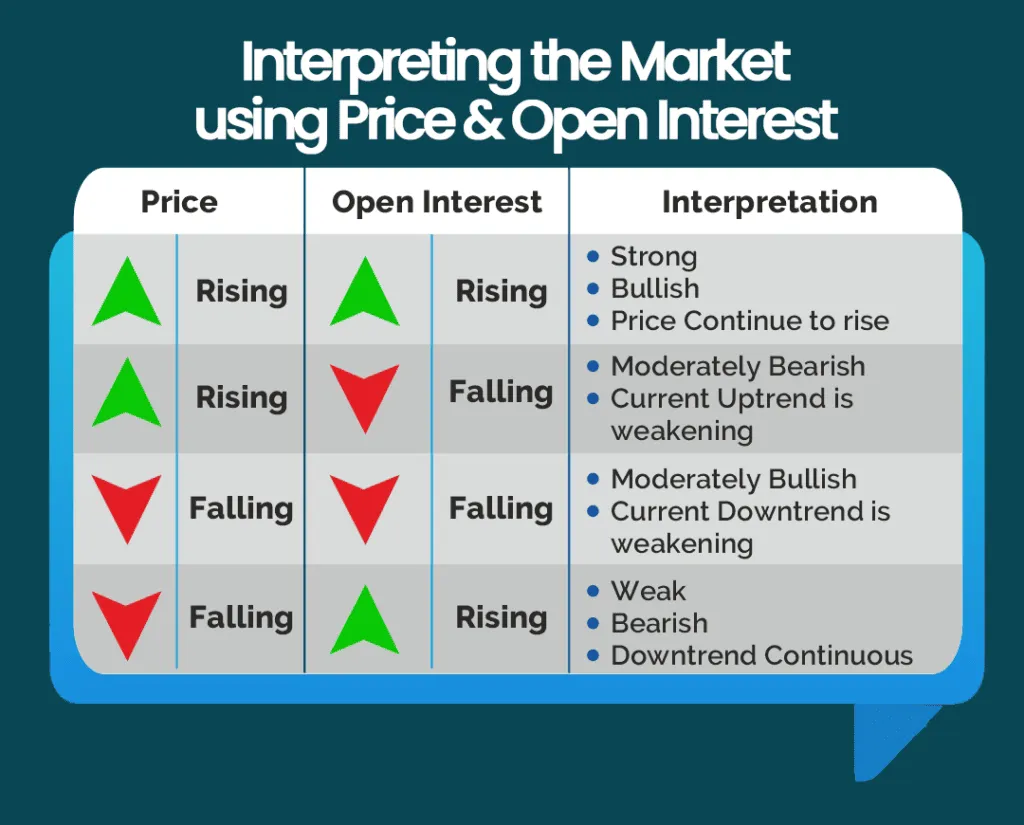

Open Interest Analysis Tools

Open Interest (OI) data becomes critically important on expiry day. Increases in OI at specific strikes indicate fresh positioning, while decreases suggest unwinding. The OI chain helps identify potential support and resistance levels, as strikes with high open interest often act as magnets for price action.

Chart Setup and Technical Analysis

Expiry day charts require different interpretation than regular trading days. Traditional support and resistance levels remain important, but traders must also consider option-specific levels like maximum pain points and high OI strikes. Candlestick patterns can be more reliable due to increased volume, but they also resolve more quickly.

Volatility Monitoring

India VIX typically spikes on expiry days, but understanding its intraday behavior is crucial. Rising VIX often indicates good conditions for option buying strategies, while declining VIX favors option selling approaches. Smart traders adjust their strategy based on volatility expectations rather than fighting against them.

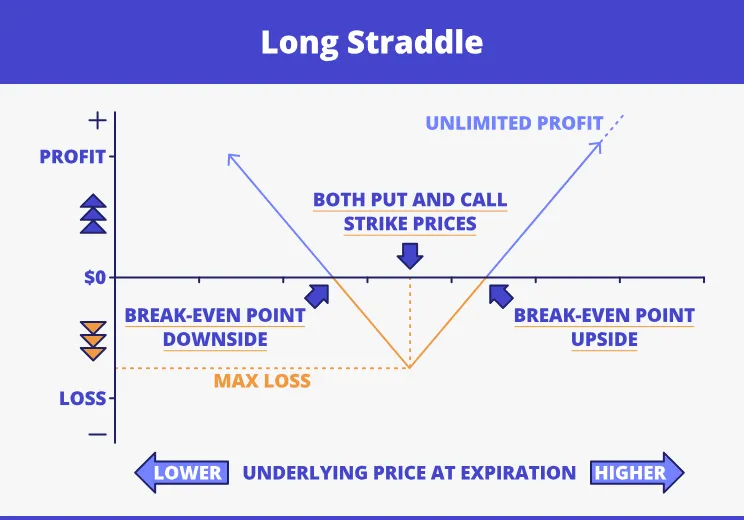

The ATM straddle sell strategy capitalizes on accelerated time decay by selling both call and put options at the at-the-money strike. This strategy performs best when volatility is elevated but the underlying remains range-bound.

Market Conditions: Works best when India VIX is above 12-13, the market opens within the previous day's range, and no major news events are expected. The strategy profits from time decay while betting that the underlying won't move significantly in either direction.

Execution: Enter positions around 9:30 AM after initial volatility settles. Sell equal amounts of ATM call and put options, setting stop-losses at 40-50% of premium received. Target 60-70% profit of premium collected, typically achievable by 2:30 PM if the underlying stays within range.

Risk Management: Use stop-losses religiously, as unlimited risk on both sides makes position management crucial. Consider converting to iron condor by buying protective options if the market moves against you. Maximum position size should not exceed 1% of capital due to unlimited risk profile.

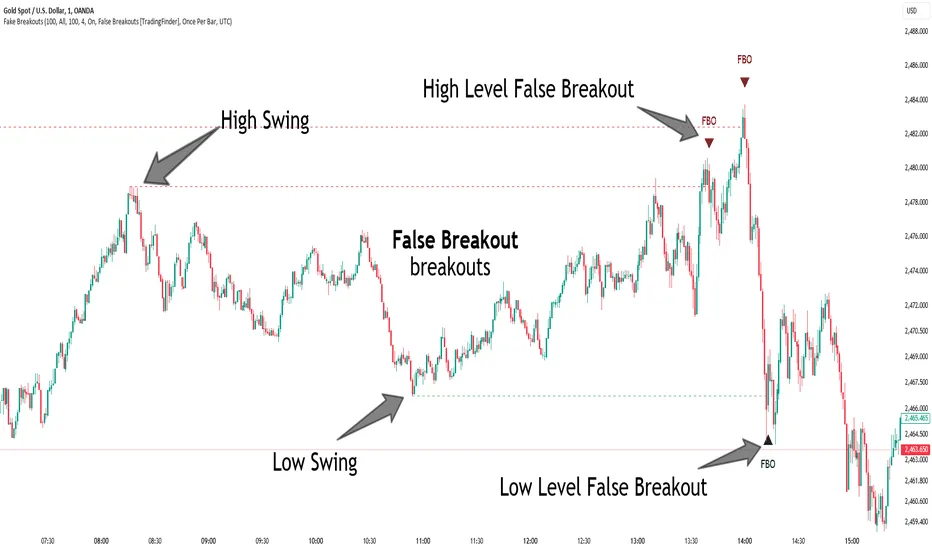

This strategy involves buying ATM call or put options when the underlying breaks out of identified ranges with volume confirmation. It's designed to capture large directional moves that often occur on expiry days.

Market Conditions: Most effective when the underlying has been consolidating and technical indicators suggest an impending breakout. Look for ranges established over several days, with clear support and resistance levels.

Execution: Mark previous day's high/low and first 15-minute range. Wait for a decisive breakout above resistance (buy calls) or below support (buy puts) with at least 30% above-average volume. Enter ATM options immediately after confirmation, setting stop-loss at the low of the breakout candle.

Risk Management: Tight stop-losses are essential, typically 15-20% of premium paid. Target 100-200% returns, as successful breakouts on expiry day can be dramatic. Trail stops aggressively once in profit, as moves can reverse quickly.

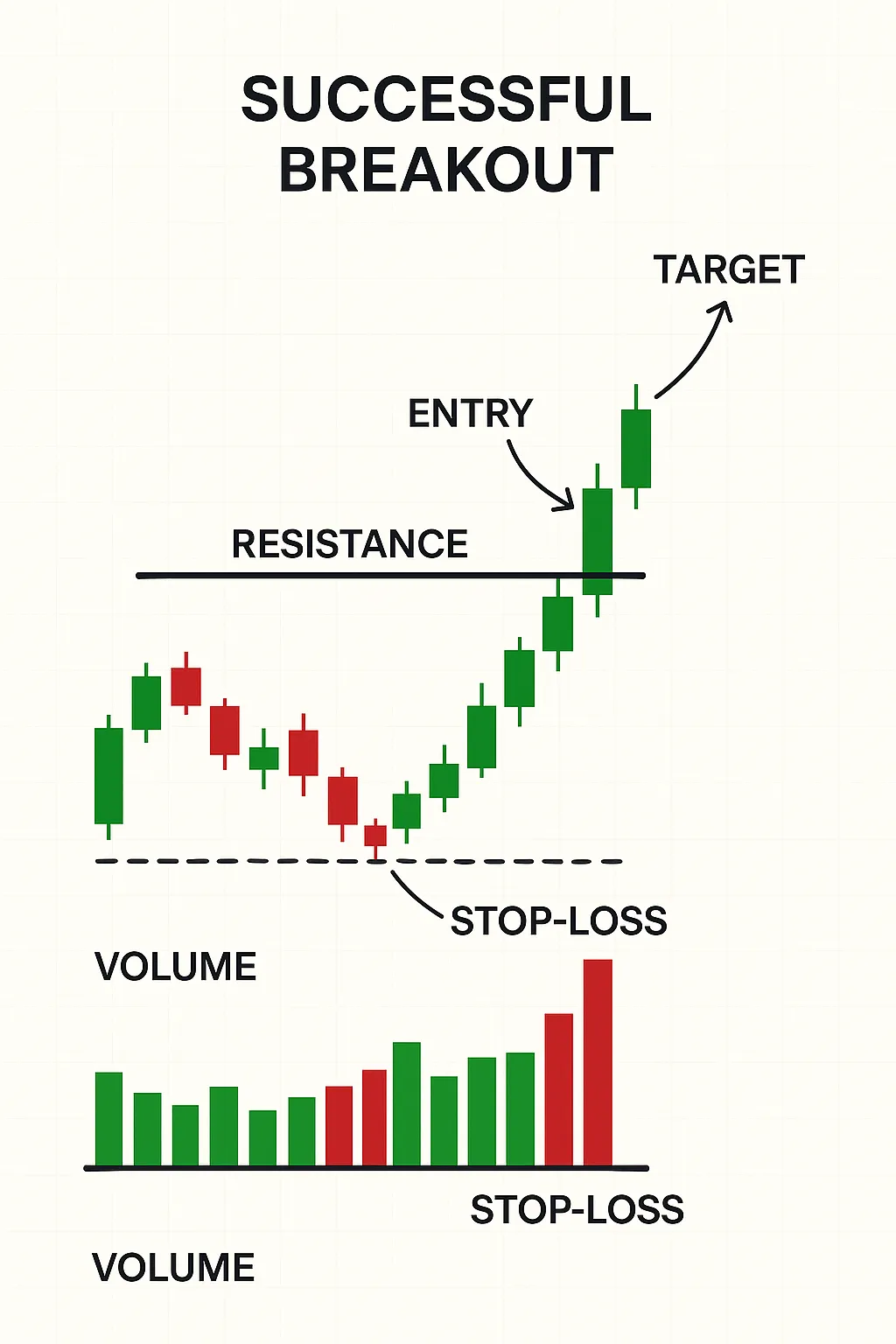

This sophisticated strategy uses open interest data to identify potential reversal points, betting against heavy option writer positions when technical conditions align.

Market Conditions: Most effective when there's heavy OI buildup at specific strikes that are being tested. Works best when price approaches these levels with declining volume, suggesting potential exhaustion.

Execution: Identify strikes with maximum open interest using OI data. When price approaches these levels, look for reversal candlestick patterns or momentum divergence. Buy options in the direction opposite to the expected pin, betting on a reversal away from the high OI strike.

[Image: Open Interest chain showing heavy buildup at specific strikes with price action near these levels]

Risk Management: This strategy has moderate win rate but good risk-reward ratio. Use 20% stop-losses and target 150% returns. Position size should be conservative as the timing can be challenging to perfect.

This strategy involves selling options when volatility is elevated, expecting it to decline as expiry approaches. It's particularly effective in the final hour when time decay accelerates dramatically.

Market Conditions: Works best when India VIX is above 15 and showing signs of peaking. Most effective in the 2:00-3:00 PM window when volatility often contracts as positions get resolved.

Execution: Sell out-of-the-money options (both calls and puts) when volatility appears to peak. Focus on strikes with moderate open interest but high implied volatility. Target quick 30-50% gains as volatility contracts.

Risk Management: Very tight time stops – exit by 3:15 PM regardless of P&L. Use small position sizes due to unlimited risk. Consider buying far OTM options as protection against unexpected moves.

This high-frequency approach involves multiple quick trades in the final hour, capitalizing on increased volatility and volume as positions get resolved.

Market Conditions: Most effective when volume is significantly above average and volatility remains elevated in the final hour. Works best when clear intraday levels have been established.

Execution: Focus on ATM options for maximum sensitivity to underlying moves. Make quick trades based on 5-minute chart patterns, holding positions for 5-15 minutes maximum. Use technical levels and momentum indicators for entries and exits.

Risk Management: Extremely tight stops (5-10% of premium) but allow for multiple attempts. Target small but frequent gains (20-40% per trade). Requires constant monitoring and quick decision-making abilities.

Options expiry day trading offers substantial profit opportunities for disciplined intraday traders who understand the unique dynamics at play. The combination of accelerated time decay, increased volatility, and institutional flow creates an environment where well-planned strategies can generate consistent returns.

However, expiry day trading is not suitable for beginners. The rapid pace, unlimited risk potential in some strategies, and need for quick decision-making make it essential to have solid options trading experience first. Start with paper trading or very small position sizes to understand the dynamics before committing significant capital.

Risk management remains paramount. The same volatility that creates opportunities can destroy accounts quickly. Never risk more than you can afford to lose, use stop-losses religiously, and maintain position sizes that allow you to survive multiple losses while capitalizing on winners.

The key to long-term success lies in treating expiry day trading as a specialized skill set requiring continuous learning and adaptation. Market conditions evolve, regulatory changes affect dynamics, and new patterns emerge regularly. Successful traders constantly refine their approaches based on experience and changing market structure.

Finally, remember that not every expiry day presents good trading opportunities. Sometimes the best trade is no trade. Patience, discipline, and selective engagement will serve you better than trying to force profits from every expiry session. Master these principles, and expiry day trading can become a valuable addition to your trading arsenal.

On the expiry date all open option contracts are settled: in-the-money index options are cash-settled automatically, in-the-money stock options move to compulsory physical delivery, while all out-of-the-money contracts lapse worthless. This compulsory settlement often triggers heavy position-closing, sharp volume spikes and intraday volatility.

Yes. You may open fresh positions right up to 3:30 p.m. on expiry day, but premiums decay rapidly and price swings can be violent. Most traders stick to at- or slightly out-of-the-money strikes and use tight stops because a small move can wipe the entire premium before settlement.

It can be ,if you are comfortable with fast markets. Accelerated theta decay and institutional unwinding create many short-lived opportunities, but the same volatility makes risk control critical. Experienced intraday traders thrive on the speed; beginners often find it overwhelming.

The 10:30 a.m.–2:00 p.m. window usually offers the most orderly, liquid moves, while the last hour (after 2:30 p.m.) sees the steepest decay and erratic spikes as positions are squared off. Many traders therefore initiate during mid-session and lighten or scalp in the final 60–90 minutes.

Trading in the expiring series stops with the cash-market close at 3:30 p.m. IST. Contracts are then settled by the exchange , cash for indices, physical for stocks after the session ends. There is no earlier public cut-off for entering or exiting positions on NSE/BSE.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart