by Akashdeep Bhateja

Published On July 17, 2023

Before we get into the exciting world of algorithmic trading, let's go on a fascinating trip back in time. Imagine the stock market floor as a wild symphony of traders shouting bids and offers, desperately trying to get the best deals. In the early days of trading, people used their instincts and maths to make decisions. This was exciting, but it also meant that people could make mistakes and be influenced by their emotions. Then, the digital revolution change brought about the age of algorithmic trading.

What is algorithmic trading, then? Imagine a group of computer programs working together to carefully make trades based on rules and mathematical models that have already been set. These programs use and process a lot of market info most efficiently, leaving little room for mistakes. Algorithmic trading is the art of making trade decisions automatically using the language of numbers and patterns to act quickly and correctly on chances. Algorithmic trading software are the best example of financial automation because it is no longer limited by what people can do.

In this article, we will demystify the concept of algorithmic trading, breaking it down into simple terms for beginners and providing valuable insights for those looking to sharpen their skills. We will talk about everything you need to know to get started in the exciting world of algorithmic trading, from the basics to the techniques, the tools, to the way you think.

Getting started with automated trading is both fun and challenging. Going into it with a good plan and knowledge of how financial markets work is essential.

To get started, you need to learn about things like fundamental analysis and technical analysis, as well as trading jargon like "short," "long," "stop loss," "take profit," and so on. One also needs to grasp mathematics and statistical concepts like mean, standard deviation, correlation, etc. Languages like Python, R, or C++ for writing code. Python is often used for algorithmic trading because it has many libraries for data analysis, backtesting, and automating trade. When you know all of this, you'll be in a good position to start making your own trade algorithms.

You can start by getting the real-time and historical data you'll need to implement your strategy and test it. There are many places to find info, such as Yahoo Finance, the Reserve Bank of India, Bloomberg, etc.

Now that you have the correct data set, you can start making algorithms that include your trade logic. Most trading methods have conditions for when to enter, trade, and leave. It could be a simple moving average crossover strategy or a more complicated algorithm with much math, like machine learning methods.

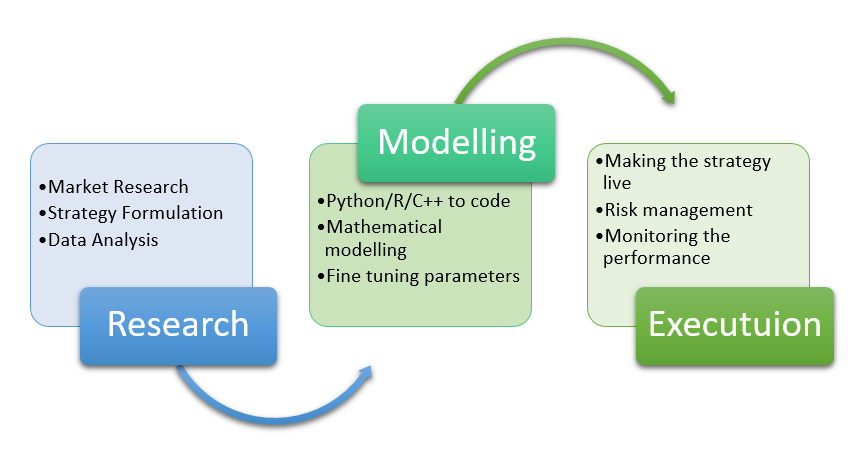

Algorithms make it possible to make trades based on thorough data analysis and respond quickly to price changes. It builds models that help us trade using mathematical and statistical methods. The algorithmic trading method is mostly made up of three steps.

1. Research and Strategy Formulation

1. Research and Strategy FormulationThis includes doing the initial study and coming up with a plan. Traders work to gather information like past prices, essential ratios, news sentiment, and articles about a particular stock or portfolio. They use this information to come up with trading ideas.

Market research is carried out first to explore potential inefficiencies in the market. It involves analysing historical data, macroeconomic indicators and other relevant market analysis.

This leads to formulation of trading algorithms. Traders will make mathematical models and set rules for when to enter and leave a trade. Strategies can be based solely on statistics and technical indicators or a mix of Machine Learning and fundamental analysis.

Once a trading strategy is developed, it can be put into a computer program using languages like Python, R, etc. Python is the most popular choice among traders because it is easy to use and has a lot of tools. The approach can be based on simple regression models, advanced machine learning techniques, or time series. It depends on how complicated the strategy is. Backtesting is done to understand the power of logic after the plan is implemented. Optimization tools are used to fine-tune strategy parameters so that returns are maximized, and risks are kept to a minimum.

Once the algorithms have been created and optimized, they can be used in the market. Risk management is the most critical part of any trading plan that wants to minimize losses. For a trading system to be profitable and reliable over the long term, it needs good risk management. Typical parts of risk management are stock size, stop loss limits, etc. Visit our blog to learn how we manage risk at Wright Research.

After putting a solid risk management plan in place, the next important step is to monitoring your trades. It checks to see if the algorithms are working as predicted and try to figure out how the market works so that changes can be made in the future. Read our article on What are the different types of Algo Trading?

There are many ways to trade using algorithms. Here are just a few examples:

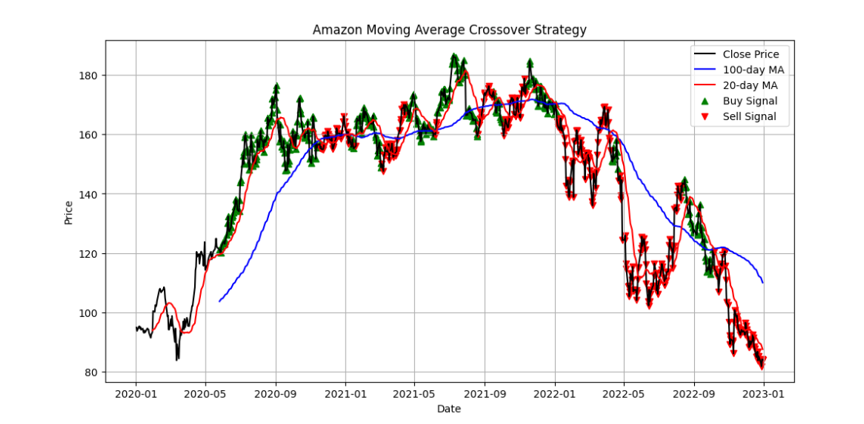

Let’s take a closer look at a simple strategy using python. It is called the Moving Average Crossover Strategy. Let’s take a stock of Amazon. We build a simple trading strategy based on short term and long-term moving averages crossover.

In this example we calculated 20-day MA and 100-day MA for amazon stock. The signals are generated using following logic:

20-Day MA > 100-day MA: Signal Buy

20-Day MA < 100-day MA: Signal Sell

Many algorithmic trading techniques exist, like Momentum , Mean-Reversion, and Pairs Trading. Visit our blog for an extensive guide on trading pairs with Python.

Using Python, the above example can be coded in minutes. So, let's consider why Python is the best choice for algorithmic trading. Python is becoming more and more famous these days. Since it has access to many integrated APIs and functions, it is the best choice for algorithmic trading. Some of the most important reasons to use Python are:

So, Python is undoubtedly the best way to start with algorithmic trading.

We all now know what algorithmic trading is and how it works. It has a lot of benefits, which is the main reason why it is so prevalent in the market. Here are some of the good things about it.

Read our article on Best Algo Trading Platforms in India: Our Recommendations

This piece gave us a general idea of algorithmic trading and how it works. We also looked at how Python is used in algorithmic trading today. To sum up, algorithmic trading allows traders to automate their trading activities and take advantage of technological advances to make more informed and efficient trades. Traders can make their approach fit their wants and goals by choosing different strategies. However, its crucial to carefully plan, backtest and monitor these strategies to ensure their effectiveness and manage risks.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

Get full access by signing up to explore all our tools, portfolios & even start investing right after sign-up.

Oops your are not registered ! let's get started.

Please read these important guidelines

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions

Sign-Up Using

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Set up a strong password to secure your account.

Skip & use OTP to login to your account.

Your account is ready. Discover the future of investing.

Login to start investing on your perfect portfolio

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Login to start investing with your perfect portfolio

Forgot Password ?

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Set up a strong password to secure your account.

Your account is ready. Discover the future of investing.

By logging in, you agree to our Terms & Conditions

SEBI Registered Portfolio Manager: INP000007979 , SEBI Registered Investment Advisor: INA100015717

Tell us your investment preferences to find your recommended portfolios.

Choose one option

Choose multiple option

Choose one option

Choose one option

Choose multiple option

/100

Investor Profile Score

Congratulations ! 🎉 on completing your investment preferences.

We have handpicked some portfolios just for you on the basis of investor profile score.

View Recommended Portfolios