Tata Steel India Expansion Plans 2025-26: Building a Steel Giant for Tomorrow

Tata Steel, one of India's largest and most strategically important industrial enterprises, has announced an ambitious expansion roadmap that will reshape India's steel landscape. In December 2025, the company's board of directors approved a series of transformative projects designed to boost domestic capacity by nearly 50 percent, positioning Tata Steel as the undisputed leader in India's rapidly growing steel market. With a capital expenditure commitment of ₹15,000 crore (approximately $1.76 billion USD) for fiscal year 2025-26 alone, and estimated total investment of ₹700-750 crore across the expansion projects, Tata Steel is making an unprecedented bet on India's long-term economic growth and industrial development.

India's steel demand is projected to grow at 9-10 percent annually through the coming decade, driven by surging construction activity, infrastructure development, automotive expansion, and renewable energy installations. Currently, Tata Steel holds the second-largest production capacity in India with 26 million tonnes per annum (MTPA) across all its facilities, commanding approximately 14.5 percent market share. However, the company recognizes that without aggressive capacity additions, it risks losing market share to competitors in a rapidly expanding market. More critically, several of Tata Steel's key iron ore mining leases including the important mines at Noamundi, Katamati, Khondbond, and Joda East expire by 2030. This creates both urgency and opportunity, as the company must expand capacity in regions where it can secure long-term raw material supplies.

The expansion also reflects confidence in India's trajectory. After producing 21.7 million tonnes of crude steel in fiscal year 2024-25, its highest output ever, Tata Steel is targeting 40 million tonnes per annum by 2030. This would increase the company's India-based capacity by 84 percent from current levels and solidify its position as India's leading steel producer, competing effectively with international steelmakers while meeting surging domestic demand.

The centerpiece of Tata Steel's expansion strategy is a 4.8 million tonne per annum capacity addition at Neelachal Ispat Nigam Limited (NINL) in Odisha's Kalinganagar region. NINL, which Tata Steel acquired through the government's disinvestment program in 2022, currently operates at just 1 million tonne capacity. Phase 1 of the expansion will increase this to approximately 6 million tonnes, making it one of the company's largest production centers. The project will take 3-4 years to complete and will focus on long products specifically rebars, coils, and wire rods which represent the most profitable segments of the steel business. This expansion will increase Tata Steel's total long products capacity across all Indian facilities from the current 5.4 million tonnes to over 10 million tonnes per annum.

The second major initiative involves setting up a 2.5 million tonne Thin Slab Caster and Rolling facility at Tata Steel's Meramandali plant in Odisha. This facility will produce thinner gauge flat products for demanding applications in automotive, appliances, and specialized industrial uses. The company is currently undertaking design and engineering work for this project while simultaneously pursuing the necessary regulatory approvals and environmental clearances.

The third project creates something entirely new for Tata Steel a 0.7 million tonne Hot Rolled Pickling and Galvanizing Line (HRPGL) at its existing Cold Rolling Complex in Tarapur, Maharashtra. This facility will be India's first of its kind at such scale and represents a critical strategic move into coated steel for automotive applications. International automotive companies manufacturing in India have long depended on imports for specific coated steel grades. By establishing this capability domestically, Tata Steel will enable import substitution while capturing high-margin business from major OEMs.

Finally, Tata Steel has approved engineering and regulatory processes to establish a 1 million tonne demonstration plant for the HIsarna technology in Jamshedpur. HIsarna represents a revolutionary breakthrough in steelmaking, enabling production with 50 percent lower carbon dioxide emissions compared to conventional blast furnaces and up to 80 percent reduction when combined with carbon capture technology. Recent joint trials with a major global steel producer have progressed successfully, and successful commercialization of this technology could revolutionize Tata Steel's sustainability profile.

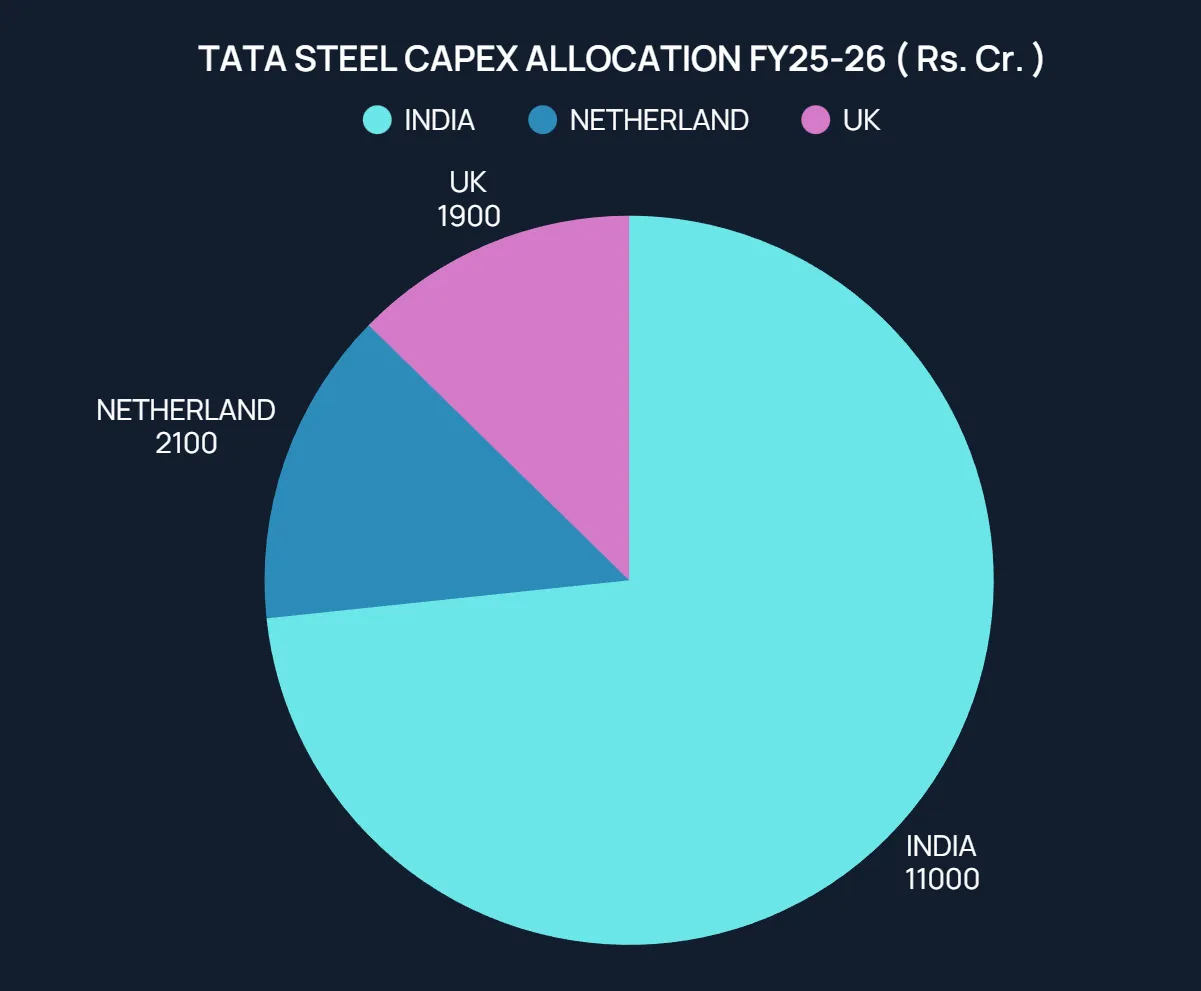

Tata Steel has committed ₹15,000 crore in capital expenditure for fiscal year 2025-26, with ₹11,000 crore (73.3 percent) directed toward Indian operations. Of this India capex, the majority will support the Kalinganagar 5 MTPA blast furnace expansion and the foundational work for the other expansion projects. An additional ₹1,900 crore will fund UK operations, primarily the Port Talbot electric arc furnace project that will transition the company away from coal-intensive blast furnace steelmaking. The remaining ₹2,100 crore targets Netherlands operations at IJmuiden.

Analysts estimate the total investment required across all announced expansion projects will reach ₹700-750 billion. However, Tata Steel's management has consistently stated that the company can fund this expansion primarily through internal accruals and cash generation, without significantly burdening the balance sheet. The company's net debt stood at ₹870 billion as of September 2025, and analysts at multiple brokerages expect the expansion capex to be internally funded, maintaining debt-to-equity ratios within comfortable ranges. This phased approach to capex deployment means the company can adjust investment timing based on market conditions and raw material availability while preserving financial flexibility.

Tata Steel's expansion plans are fundamentally built on a sophisticated raw material security strategy. The company has taken multiple strategic steps to ensure it can reliably source iron ore for the next two decades despite the expiration of existing mining leases.

First, the company is commissioning new captive mines. Kalamang West mine is scheduled for commissioning by the end of fiscal year 2025, while the larger Gandalpada mine will commence operations by 2029. Combined, these two mines will hold reserves of approximately 400 million tonnes, meeting roughly half of Tata Steel's projected iron ore requirements by 2030.

Second, Tata Steel acquired a 50.01 percent stake in Thriveni Pellets Private Limited, which operates a critical 4 million tonne pellet manufacturing plant and a long slurry pipeline in Odisha. Pellets are essential feedstock for steelmaking, and this acquisition secures a dedicated supply while eliminating dependence on spot market purchases. The acquisition also provides access to Brahmani River Pellets' infrastructure.

Third, Tata Steel signed a Memorandum of Understanding with Lloyd Metals & Energy Limited to explore partnerships in mining, logistics including slurry pipelines, pellet production, and steel manufacturing in Maharashtra's Gadchiroli district. Lloyd Metals operates India's single largest iron ore mine at Surjagarh and recently received environmental clearance to mine up to 26 million tonnes annually. Under the MoU, the companies are jointly evaluating a greenfield steel capacity of up to 6 million tonnes in two phases, contingent on resolving iron ore supply certainty and logistics challenges.

Finally, Tata Steel is in active discussions with state-owned miners including NMDC and Odisha Mining Corporation to secure additional iron ore supplies, creating a diversified procurement network that reduces dependence on any single source.

A crucial strategic element of Tata Steel's expansion centers on long steel products, which account for 55-60 percent of India's total steel demand. Despite this large market size, major integrated steel companies like Tata Steel capture less than 50 percent of long steel business, with the remainder fragmented among numerous smaller producers using induction furnaces and other secondary routes. Long products are less vulnerable to Chinese import competition most Chinese exports consist of flat products making this segment strategically attractive. Tata Steel aims to increase its market share in long products from the current 15-20 percent toward 25-30 percent, capturing growing demand from construction, railways, and infrastructure sectors.

The company's strategy extends beyond simple capacity additions. Through its 'Aashiyana' e-commerce platform, Tata Steel has revolutionized how retail customers access branded products. The platform, which delivered ₹3,550 crore gross merchandise value in fiscal year 2024-25 (a 60 percent year-on-year increase), is projected to achieve ₹7,000 crore GMV in 2025-26. With over 1.1 lakh registered users and orders from 24 countries, including significant demand from the US, UAE, and Netherlands, Aashiyana has become a key distribution channel. The platform targets both domestic consumers and non-resident Indians planning construction in India.

The timing of these expansions is strategically important. Most new capacities are expected to start contributing to production from fiscal year 2029 onward, precisely when India is projected to face steel capacity constraints relative to demand. This favorable demand-supply dynamic will help Tata Steel achieve strong profitability from the newly commissioned facilities. Analysts project that the NINL Phase 1 expansion will be completed within 3-4 years from final approval, with construction expected to commence once detailed engineering and environmental clearances are finalized.

Production Trajectory and Market Impact

In fiscal year 2024-25, Tata Steel produced 21.7 million tonnes of crude steel at its India facilities, a record for the company. In the first half of fiscal year 2025-26, the company produced 10.9 million tonnes, with growth constrained by scheduled maintenance activities including the relining of the G Blast Furnace at Jamshedpur and ongoing NINL operations normalization. By 2030, if all expansion projects proceed as scheduled, Tata Steel's India crude steel production could reach 40 million tonnes, nearly doubling current capacity.

This expansion trajectory has profound implications for India's steel sector. It will consolidate Tata Steel's market leadership while demonstrating commitment to the country's long-term industrial development. The company's emphasis on value-added products automotive-grade steel, coated products, and specialty alloys rather than commodity-grade steel reflects global manufacturing trends toward higher-value applications.

Sustainability and Innovation Focus

Tata Steel's expansion is not merely about volume growth but also about technological advancement and environmental responsibility. The HIsarna demonstration plant represents a world-class commitment to decarbonizing steel production. Conventional blast furnace steelmaking generates approximately 2 tonnes of carbon dioxide per tonne of steel produced. HIsarna technology cuts this to approximately 1 tonne, and with carbon capture integration, can reduce emissions by up to 80 percent.

The company has also secured multiple international certifications. Its Jamshedpur plant achieved Responsible Steel certification, and subsequently Kalinganagar and Meramandali plants also gained certification. As of 2025, over 90 percent of Tata Steel's India production comes from ResponsibleSteel certified facilities, positioning the company well for increasingly stringent environmental regulations and sustainability-focused customer requirements globally.

Financing and Balance Sheet Impact

Despite the scale of investment, analysts are confident Tata Steel can fund the expansion without materially weakening its financial position. The company generated substantial internal cash flows from operations, which historically have exceeded capex requirements. By spreading investment across 3-4 years, the company can align capex deployment with cash generation, maintaining financial flexibility. Brokerages including Motilal Oswal Securities and ICICI Securities have noted that capex intensity will rise but remain phased, keeping leverage within comfort zones.

Tata Steel's expansion announcement represents far more than a corporate capital allocation decision. It reflects deep confidence in India's economic trajectory, rising consumption patterns, and industrial development over the coming decade. The company is simultaneously addressing raw material security concerns by diversifying sources and developing new mining assets, technological advancement through HIsarna commercialization, and market leadership through focused capacity additions in high-growth segments.

If executed successfully, these projects will position Tata Steel as a 40 million tonne producer by 2030, nearly doubling current capacity while improving product mix quality and sustainability performance. The expansion demonstrates that despite global economic headwinds and volatility in steel markets, India's steel sector remains a cornerstone of the country's manufacturing ambitions. For Tata Steel, the expansion is both an investment in growth and an assertion of confidence that India will be among the world's leading industrial economies throughout the 2030s.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart