by Naman Agarwal

Published On Dec. 30, 2025

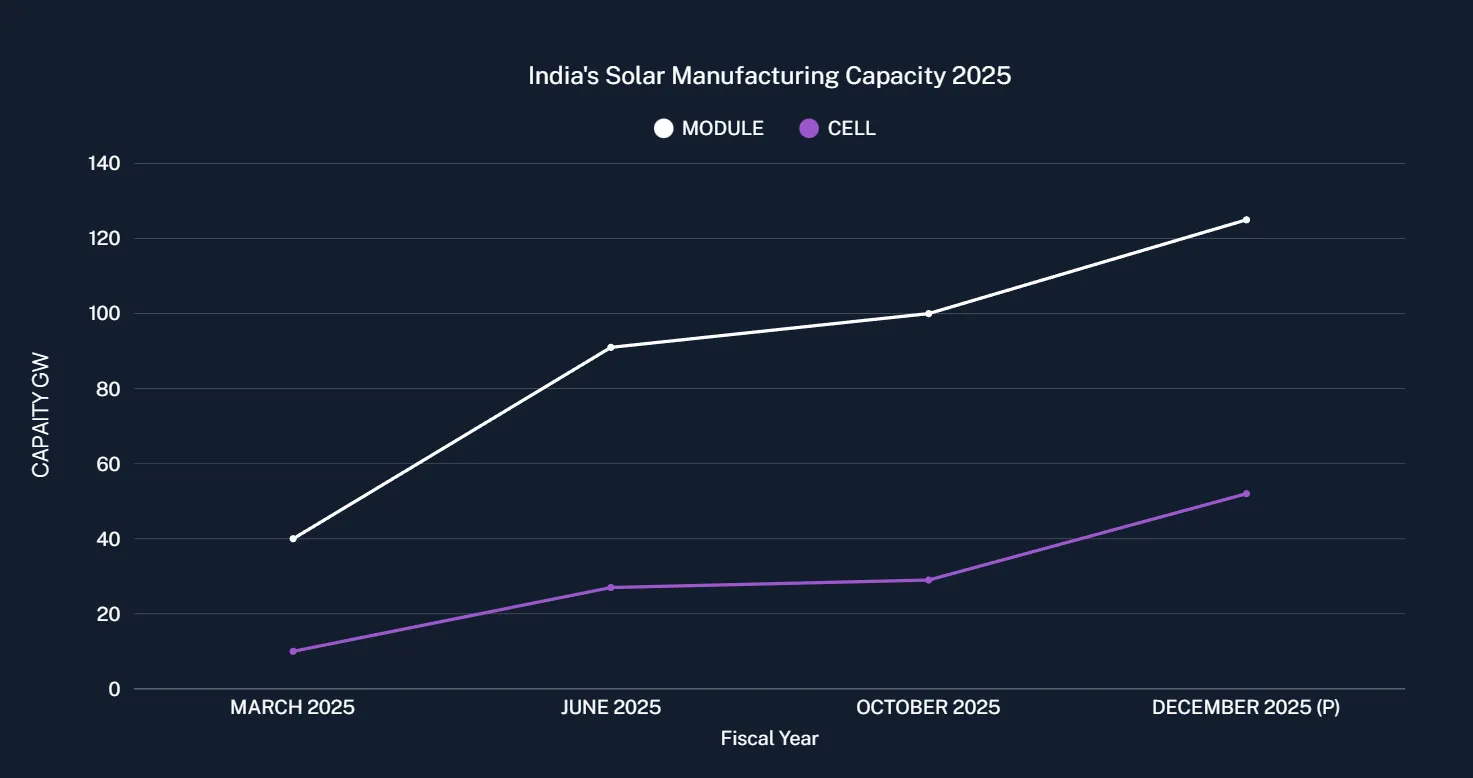

India's solar photovoltaic manufacturing sector has emerged as one of the fastest-growing industrial segments in the country, driven by transformative government policies and significant financial commitments. As of December 2025, the nation's solar manufacturing capacity has skyrocketed to unprecedented levels, with module manufacturing capacity expected to exceed 125 gigawatts (GW), representing a remarkable 229% increase from just 38 GW in March 2024. This explosive growth reflects the success of the Production Linked Incentive (PLI) Scheme, the Approved List of Models and Manufacturers (ALMM), and strategic tariff policies that have systematically reduced India's dependence on solar imports while establishing the country as a credible global alternative to Chinese manufacturing. The government's Union Budget 2025-26 allocated ₹26,549 crore (approximately $3.2 billion) to the renewable energy sector, with ₹242.24 crore dedicated specifically to solar PV manufacturing initiatives, signaling an unwavering commitment to achieving the 500 GW non-fossil fuel capacity target by 2030.

The Production Linked Incentive Scheme represents the cornerstone of India's domestic solar manufacturing strategy. Launched on April 28, 2021, the scheme was designed with an initial budget of ₹4,500 crore ($517 million) for its first tranche, and was subsequently expanded with ₹19,500 crore ($2.24 billion) in the second tranche announced in September 2022, bringing the total allocation to ₹24,000 crore. The PLI scheme operates by providing graded production-based incentives to manufacturers for five years after their manufacturing units become operational, creating a financial incentive structure that rewards actual production and sales of high-efficiency solar PV modules.

Under Tranche I of the scheme, the government issued Letters of Award to three leading companies Reliance New Industries, Adani New Industries, and Shirdi Sai Electricals for establishing 8.737 GW of fully integrated solar PV module manufacturing capacity. These three companies were provided with an incentive allocation of ₹4,455 crore, with the original commissioning deadline set for December 2024. In Tranche II, the government adopted a more aggressive expansion strategy, awarding Letters of Award to eleven companies for a combined 39.6 GW of fully or partially integrated manufacturing capacity across different value chain segments. The companies selected in Tranche II included industry giants like Waaree Energies, Avaada Ventures, ReNewSolar, JSW Renewable Energy, and Reliance New Solar Energy, among others, with a total incentive pool of ₹13,938 crore spread over five years of post-commissioning operations.

India's Solar Manufacturing Capacity Growth 2024-2025

The performance metrics of the PLI scheme demonstrate its remarkable success in catalyzing domestic manufacturing. As of June 30, 2025, the scheme had resulted in the establishment of 18.5 GW of operational solar module capacity, 9.7 GW of solar cell manufacturing capacity, and 2.2 GW of ingot-wafer manufacturing capacity. The government, recognizing the challenges faced by manufacturers in procuring capital equipment, supply chain disruptions, and technology transfer bottlenecks, granted a two-year extension to the commissioning deadlines in September 2025. This flexibility acknowledged that some segments like polysilicon and ingot-wafer production face higher technical and financial complexities, allowing manufacturers additional time to establish production without jeopardizing the ambitious expansion targets.

The Approved List of Models and Manufacturers (ALMM) represents a critical regulatory instrument that ensures quality control while simultaneously protecting domestic manufacturers from low-quality foreign imports. First introduced in 2019 through a Ministry of New and Renewable Energy order, ALMM List-I for solar PV modules was initially issued on March 10, 2021, with just 23 manufacturers possessing a combined capacity of 8,200 MW. By June 30, 2025, the latest edition of ALMM List-I had been updated to the 40th revision, expanding to include 93 approved manufacturers with a cumulative capacity exceeding 22,000 MW, while as of November 25, 2025, the list had grown to over 100 manufacturers with approximately 73,581 GW of production capacity.

The ALMM mechanism functions as a mandatory requirement for all solar projects installed under government schemes, subsidies, and development programs. Projects seeking financial support through government incentives must exclusively procure solar modules from ALMM-listed manufacturers, a domestic content requirement (DCR) that has proven instrumental in channeling demand toward domestic producers. In a significant expansion of the scheme, the Ministry of New and Renewable Energy announced that ALMM List-II covering solar PV cells would become mandatory from June 1, 2026, with six manufacturers FS India (First Solar's India arm), Jupiter, Emmvee, Mundra (Adani), Premier Energies, and ReNew initially approved with a combined capacity of 13 GW. This expansion of the ALMM framework to include cells represents a critical step toward building a more vertically integrated and self-reliant manufacturing ecosystem.

The compliance with ALMM has driven quality improvements across the sector, as manufacturers must demonstrate adherence to Bureau of Indian Standards (BIS) specifications and maintain minimum module efficiency levels. These quality controls have enhanced consumer confidence in domestically manufactured modules and reduced the frequency of defective installations. However, the ALMM-only approach has also created some constraints on international sourcing, which some analysts suggest could hinder India's ability to rapidly scale capacity to meet the 500 GW target by 2030, as the domestic manufacturing ecosystem must simultaneously expand production while maintaining quality standards.

The government's tariff strategy represents a nuanced approach to supporting domestic manufacturers while attempting to maintain affordability for solar installations. Historically, India imposed a Basic Customs Duty (BCD) of 25% on imported solar cells and 40% on imported solar modules, supplemented with a 2.5% Social Welfare Surcharge on cells and 4% on modules. These tariffs, introduced in April 2022, were designed to create cost advantages for domestic producers by increasing the landed cost of imported products by approximately 25-44% depending on the product category.

However, recognizing the tension between supporting manufacturers and maintaining project affordability, the Union Budget 2025-26 presented a significant policy adjustment. Finance Minister Nirmala Sitharaman announced reductions in the BCD effective February 2, 2025, lowering the duty on solar cells from 25% to 20% and on solar modules from 40% to 20%. While this represents a nominal reduction, the effective tariff rates became more complex with the introduction of the Agriculture Infrastructure Development Cess (AIDC). Solar cells now face 20% BCD plus 7.5% AIDC, while modules face 20% BCD plus 20% AIDC, resulting in total effective tariff rates of approximately 27.5% for cells and 40% for modules when combined. Additionally, on September 30, 2025, the Indian Ministry of Commerce and Industry imposed anti-dumping duties on solar cells and modules originating from China, with duty rates ranging from 23% to 30% depending on the manufacturing entity, creating a multi-layered protection mechanism.

These tariff measures coincided with continued exemptions on critical capital equipment required for manufacturing. The government maintains duty exemptions on specified machinery and equipment used in manufacturing solar cells and modules, previously attracting 7.5% BCD, thereby reducing the capital investment required for establishing manufacturing facilities. Additionally, exemptions were extended for silicon wafers, EVA sheets, and flat copper wire used in photovoltaic ribbon production through March 31, 2026, facilitating the development of upstream manufacturing capabilities. Conversely, the government imposed 10% customs duty on solar glass and 5% on tinned copper interconnects beginning October 1, 2024, recognizing sufficient domestic manufacturing capacity in these segments.

The expansion of India's solar manufacturing capacity across the entire value chain represents one of the most significant structural shifts in the country's industrial base. The growth trajectory reveals a deliberate strategy to achieve vertical integration, reducing import dependency at each stage of the value chain. From March 2024 to December 2025, module manufacturing capacity is projected to increase by 87 GW, representing an expansion rate of 229%. During the same period, solar cell capacity is expected to expand from 9 GW to approximately 52 GW, a growth of 478%, reflecting the government's focus on developing upstream capabilities where import dependency has historically been highest. Ingot-wafer capacity, the most capital-intensive and technology-demanding segment, is projected to grow from 0.5 GW to 5 GW by December 2025, though this remains a smaller segment compared to modules and cells.

The distribution of this manufacturing capacity across India's geography has also evolved strategically. While earlier tranches of the PLI scheme allowed companies flexibility in plant location, recent data indicates concentration in states with established industrial infrastructure and favorable policy environments. The leading manufacturers Waaree Energies, Adani Solar, RenewSys, and Vikram Solar have distributed their capacity across multiple locations, creating regional manufacturing hubs and supporting local employment generation. This spatial distribution has helped build a distributed manufacturing ecosystem that reduces logistical costs and creates redundancy in the supply chain, insulating India from localized disruptions.

One of the most tangible outcomes of the manufacturing policy has been the dramatic reduction in India's solar import expenditure. In fiscal year 2021-22, India imported solar modules valued at $3,363.21 million, representing a significant foreign exchange outflow. Through the combination of the PLI scheme, ALMM enforcement, and tariff protections, this import figure declined to $2,151.75 million in fiscal year 2024-25, a reduction of 36% in absolute value. More impressively, this import reduction occurred simultaneously with a near-doubling of domestic installations, indicating that the import compression resulted from increased domestic sourcing rather than reduced overall demand.

The composition of imports has also shifted meaningfully. While the total value of imports declined, the share of cell imports has increased relative to module imports, reflecting India's continued reliance on upstream components despite progress in module assembly. In Q3 2025, cells accounted for 82% of the total import value, while modules represented only 18%, revealing that while India has achieved substantial self-sufficiency in module assembly, the upstream manufacturing of solar cells remains more dependent on imports. This dynamic underscores the continuing importance of the PLI scheme's incentives for cell and wafer-ingot manufacturing, which typically require higher capital investments and more sophisticated technological capabilities than module assembly.

India's Solar Module Exports 2025 - Value and Volume Trends

India's solar manufacturing expansion has not only served domestic demand but has positioned the country as a significant global supplier, competing for market share in international markets increasingly seeking alternatives to Chinese manufacturing. India exported 7.6 GW of solar modules in Q3 2025, valued at approximately $344.5 million, representing a 65.2% year-over-year increase from $208.5 million in Q3 2024. Over the first nine months of 2025, India's total solar exports reached 15 GW, of which 10.4 GW was supplied to the United States and 1.6 GW to European markets, with the U.S. accounting for 97% of India's solar cell and module export market share.

However, this export trajectory faces significant headwinds from changing trade policies. In August 2025, the United States imposed additional reciprocal tariffs on Indian solar imports, increasing the total levy to 50% effective August 27, 2025. This tariff escalation substantially eroded India's price advantage in the U.S. market, causing module export volumes to decline 52% in the first half of 2025 compared to the same period in 2024. Despite the tariff challenge, Indian manufacturers remain competitive due to favorable cost structures driven by lower labor expenses, improving scale efficiency, and government support mechanisms. The leading export companies Waaree Energies, Adani Solar, and RenewSys have continued expanding capacity and investing in quality certifications to maintain market access despite higher tariff barriers.

The export success reflects India's strategic positioning within global supply chain diversification trends. Many countries and international organizations have made conscious efforts to reduce reliance on Chinese manufacturing following trade tensions and supply chain disruptions. India, with its stable political-economic environment, growing manufacturing base, and government-backed quality assurance mechanisms like ALMM, has emerged as a credible alternative source. The government recognized this opportunity and has emphasized building India's global brand in solar manufacturing, with particular focus on Africa, Latin America, and the Middle East as emerging markets where Indian products face less tariff resistance than in developed markets.

While manufacturing-side policies have driven capacity expansion, the government has simultaneously implemented demand-side programs to absorb this growing production capacity domestically. The Union Budget 2025-26 allocation of ₹26,549 crore to renewable energy reflects the government's commitment to sustaining domestic demand growth alongside manufacturing expansion. A key driver of this demand is the PM Surya Ghar Muft Bijli Yojana, launched in 2024 with the ambitious target of installing rooftop solar systems in 10 million households across India. This scheme offers subsidies up to ₹78,000 for a 3 kW rooftop solar system, enabling households to generate up to 300 units of free electricity per month.

The subsidy structure of the PM Surya Ghar scheme is graduated based on system capacity. Households installing 1 kW systems receive ₹30,000 in subsidies, 2 kW systems receive ₹60,000, and 3 kW and larger systems receive the maximum of ₹78,000. For systems above 3 kW, an additional subsidy of ₹18,000 per kW applies, providing financial accessibility across diverse household income levels. Complementing this residential program, the Grid-Connected Rooftop Solar Programme administered by the Ministry of New and Renewable Energy provides 40% subsidies for systems up to 3 kW and 20% subsidies for systems between 3 kW and 10 kW, supporting both residential and commercial installations.

The PM KUSUM Yojana represents another significant demand absorption mechanism, specifically targeting agricultural applications. This scheme has three components: Component A aims to establish 10,000 MW of decentralized grid-connected solar plants on barren or fallow farmland; Component B targets installation of 20 lakh (2 million) standalone solar pumps in off-grid areas; and Component C aims to convert 15 lakh (1.5 million) existing grid-connected agricultural pumps to solar power. The scheme provides subsidies covering up to 60% of solar pump costs with an additional 30% loan assistance, requiring farmers to contribute only 10% of the total cost. Beyond cost reduction, the scheme incentivizes farmers to feed excess solar-generated electricity into the grid at rates of ₹3.50 to ₹4.50 per unit, creating a revenue stream that transforms traditional farmers into "solar farmers" generating supplementary income.

The 2025 Quality Control Order issued by the Ministry of New and Renewable Energy mandated Bureau of Indian Standards (BIS) compliance across solar equipment categories. The order specifies that solar PV modules must demonstrate minimum efficiency levels, undergo rigorous testing for durability and performance, and receive BIS certification before being recognized under ALMM or eligible for government subsidy programs. Similarly, inverters used in solar installations must comply with BIS standards ensuring reliability, efficiency, and safety. This quality control regime addresses historical concerns regarding failures of substandard solar installations, which had previously dampened consumer confidence in distributed solar deployment.

The enforcement of quality standards has had mixed effects. While it has unquestionably improved the average performance characteristics of installed systems, it has also increased the regulatory burden on manufacturers, particularly smaller firms lacking the resources for comprehensive testing and certification. The requirement for physical factory inspections, submission of extensive technical documentation, and compliance with evolving efficiency standards has created barriers to entry that smaller manufacturers find challenging to overcome. However, the Ministry has argued that this trade-off between accessibility and quality assurance is justified by the need to maintain system reliability and consumer trust as the deployment of distributed solar accelerates dramatically through government subsidy schemes.

Recognizing that the 500 GW non-fossil fuel capacity target by 2030 cannot be achieved through manufacturing expansion alone, the government has allocated ₹60 billion specifically for Green Energy Corridors designed to strengthen transmission and distribution infrastructure. These corridors facilitate the integration of renewable energy sources into the national grid, addressing the intermittency and variability challenges that solar and wind resources present. The Green Energy Corridor initiative includes investments in high-voltage transmission lines, grid stabilization equipment, battery storage systems, and smart grid technology that enables real-time load balancing.

This infrastructure investment demonstrates the government's integrated policy approach, recognizing that manufacturing capacity is only valuable if the generated electricity can be effectively transmitted and distributed. The corridors are strategically planned to connect high-potential renewable energy generation zones particularly in Gujarat, Rajasthan, and Tamil Nadu where solar potential is highest to consumption centers in northern and western India. The estimated investment of ₹60 billion represents only a portion of the total infrastructure requirement, with the government expecting private sector participation and global infrastructure financing to fill the remaining funding gap.

Despite the remarkable success in expanding manufacturing capacity, India's solar sector faces several structural challenges that require ongoing policy attention. Wood Mackenzie's analysis suggests that India's manufacturing capacity expansion has outpaced domestic demand growth, creating an inventory buildup of approximately 29 GW as of Q3 2025. This overcapacity situation threatens the profitability of manufacturers, as excess inventory must either be exported at lower prices or held at carrying costs. The challenge is particularly acute given the 50% reciprocal tariffs imposed by the United States, which represent India's largest export market, requiring manufacturers to either absorb tariff costs or reduce export volumes.

Additionally, despite impressive progress in module and cell manufacturing, India remains substantially import-dependent for upstream components and raw materials. India's domestic polysilicon capacity stands at approximately 3.3 GW as of June 2025, representing less than 5% of total module manufacturing capacity, meaning that approximately 95% of polysilicon consumed by Indian manufacturers must be imported, primarily from China. Similarly, while ingot-wafer capacity has expanded to 5 GW by December 2025, this remains a small fraction relative to cell manufacturing capacity of 52 GW projected by year-end, indicating continued reliance on imported wafers.

Furthermore, the technology gap between Indian manufacturers and global leaders in areas like topcon cells, heterojunction technology, and advanced tandem structures requires sustained investment in research and development. The government has initiated technology development programs through agencies like the Solar Energy Corporation of India, but the pace of innovation needs to accelerate to ensure that domestic manufacturers remain competitive as global cell efficiency standards continue to advance.

The Ministry of New and Renewable Energy has indicated awareness of the overcapacity situation, cautioning banks and financial institutions against excessive lending for new capacity additions and suggesting that future investments should focus on cost reduction and technological advancement rather than capacity expansion alone. This represents a strategic shift in government policy from simply expanding manufacturing volume to improving the competitiveness and technological sophistication of the existing base.

India's solar PV manufacturing policy framework of 2025 represents a comprehensive and coordinated effort to achieve technological self-reliance while establishing the country as a globally competitive manufacturing hub. The combination of the PLI scheme providing direct financial incentives, ALMM ensuring quality and domestic sourcing, strategic tariff protection balancing competitiveness with affordability, and demand-side subsidies creating sustained domestic market growth has created a virtuous cycle supporting rapid capacity expansion. The manufacturing capacity increase from 38 GW in March 2024 to a projected 125 GW by December 2025 demonstrates the effectiveness of these policy mechanisms in catalyzing private sector investment and industrial development.

As India advances toward its 500 GW non-fossil fuel capacity target by 2030, the solar manufacturing sector will play an increasingly central role. The policy framework's emphasis on vertical integration, quality assurance, and global competitiveness positions India to capture significant market share in a rapidly growing global renewable energy market. However, sustained success requires continued focus on technological innovation, upstream manufacturing development, and adaptation to evolving global trade dynamics. The government's recent shift in emphasis from capacity expansion to cost competitiveness and innovation suggests a maturing policy approach that recognizes India's transition from an emerging manufacturing base to a serious global competitor in the clean energy transition.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart