by Siddharth Singh Bhaisora

Published On June 5, 2023

Investors in this railway stock have of late been like a dog with two tails! Decipher the recent fluctuations of RVNL's stocks with us. Unearth opportunities, understand risks, and make informed decisions about this railway stock. Join us on this insightful journey into the RVNL stock analysis case study!

Disclaimer: The investments or trades mentioned in this article are solely for educational purposes and should not be considered as personalized financial trading, or investment advice. The purpose of this article is to provide educational information and not to provide advice based on your individual circumstances. It is recommended that you consult with a qualified financial advisor to discuss your specific requirements and situation. Full disclosures here .

Hold onto your seats, folks, because we're about to dive into a story of jaw-dropping growth. Ever heard of the juggernaut called Rail Vikas Nigam Limited, or RVNL? It's been making waves in the stock market, with a sizzling 65% growth in just six months! That's not all, over the past year, it's surged by a staggering 269%, and since its IPO in 2019, it's up by an eye-popping 500%!

Source: RVNL Google Finance

RVNL's stock touched an all-time high of Rs 144 in early May. But hey, even the mightiest of trains need to take a breather. The stock's performance was sideways in the last month. But does that mean the party's over?

So, what's behind this massive surge? RVNL has been bagging some key bids, growing its total order book to a hefty Rs 56,000 crore as of March '23, and it's not showing any signs of stopping!

Now, I know what you're thinking. Can we bank on this for the long haul? Is RVNL worth the sleepless nights, the constant stock checking, the endless fretting about prices rising and falling, whether to average your position or book profits?

Don't worry, friends! We're here to help you understand RVNL inside and out, from the intricacies of its business to the managerial efforts powering it. We'll dig deep into RVNL's valuation, and for all you short-term traders out there, we'll even sprinkle in some technicals!

So stay with me, folks. Ready for this roller-coaster ride into the world of RVNL?

Now, I bet you're wondering: What's giving RVNL the momentum? Fasten your seat belts as we journey into the engine room of India's railways revolution.

The Indian government is fuelling this train with an ambitious push for railway and infrastructure development. We're talking new lines, double-tracking existing lines, electrification – and that's just the beginning! This drive ensures RVNL is constantly in business, constantly building the tracks to India's future.

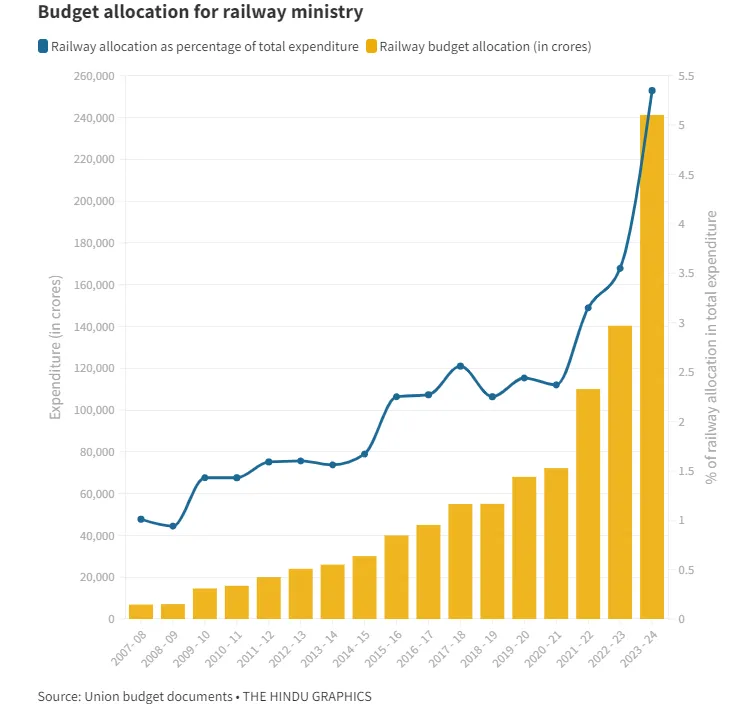

Remember when I said RVNL's order book has been growing? A lot of that has to do with the government's increased capex by 33.4%, allocating a staggering ₹10 lakh crore for infrastructure development, with record allocation to the Railways.

Source: Budget 2023 | Highest-ever capital outlay of ₹2.4 lakh crore for Railways, thehindu.com

We're seeing the highest-ever capital allocation for Railways – nearly nine times over FY14 allocations with an outlay of ₹2.4 lakh crore just for FY24!

On top of that, 100 transport infrastructure projects have been identified for end-to-end connectivity for ports, coal, steel and fertiliser sectors.

In a bid to meet increased passenger expectations, RVNL plans to give more than 1,000 coaches of premier trains like Rajdhani, Shatabdi, Duronto, Humsafar, and Tejas a major facelift. Expect modern interiors and enhanced comfort – a truly luxurious journey on the tracks.

According to the Economic Survey released on January 31st, there will be a substantial increase in capital investment in the railway sector over the next decade. The aim is to accelerate capacity growth and ensure that it surpasses demand by 2030.

Ever wonder what exactly RVNL does? Let's break it down. RVNL, or Rail Vikas Nigam, is the execution mastermind behind a multitude of railway projects. We're talking new lines, gauge conversions, railway electrification, metro projects, major bridges, workshops, even construction of cable-stayed bridges and institutional buildings.

Working mostly on a turnkey basis, RVNL covers the full spectrum of project development. They're the ones turning the cogs from conceptualisation to commissioning, navigating through design, estimates, contracts, project and contract management, and more.

Let's put some numbers to that: RVNL has commissioned over 15,500 kilometres of railway infrastructure and contributed to more than 30% of the total Indian Railway Infrastructure. Now that's some track record!

The RVNL business model is centered around the development and execution of railway infrastructure projects in India. Rail Vikas Nigam Limited (RVNL) is a public sector enterprise under the Ministry of Railways, established with the objective of fast-tracking the implementation of rail infrastructure projects. The core of the RVNL business model involves project management, engineering, procurement, and construction (EPC) of railway lines, bridges, and electrification projects. By leveraging its expertise in these areas, RVNL plays a crucial role in enhancing India's railway network, ensuring timely delivery and quality execution of large-scale projects.

One of the significant aspects of the RVNL business model is its collaborative approach. RVNL works closely with various stakeholders, including the Ministry of Railways, state governments, and private sector players, to identify and execute projects that align with the strategic goals of expanding and modernizing the railway infrastructure. This collaboration ensures that the projects undertaken by RVNL are not only economically viable but also meet the highest standards of safety and efficiency. The RVNL business model also emphasizes the adoption of innovative technologies and best practices in project execution, which helps in reducing costs and improving project timelines.

Additionally, the RVNL business model incorporates a strong focus on financial sustainability. RVNL employs a mix of funding mechanisms, including budgetary support from the government, public-private partnerships (PPPs), and market borrowings, to finance its projects. This diversified funding strategy helps mitigate financial risks and ensures a steady flow of capital for ongoing and future projects. Furthermore, the RVNL business model includes a robust risk management framework that identifies potential risks early in the project lifecycle and implements mitigation strategies to address them effectively. By maintaining a balance between strategic planning, efficient execution, and financial prudence, the RVNL business model aims to contribute significantly to the growth and development of India's railway infrastructure.

But it doesn't stop there! After two decades as a railway capex arm, RVNL is shifting gears. They're reinventing themselves, embracing open bidding and shaking off the old ways of the Ministry of Railways providing nominations.

This is where RVNL's competitive moat really shines. With their extensive expertise in diversified infrastructure projects – from railways to roads, from marine areas to metros, and even hill areas – RVNL brings a formidable set of skills to the table. Their project execution capabilities are second to none, and with a jam-packed project pipeline, it's hard to see who could take their place.

And guess what? They're not just confined to India. They're expanding their horizons, reaching out to new geographies like Maldives, Kyrgyzstan, and beyond.

Time to talk about what's under the hood of RVNL's operation - the business model. RVNL operates an asset-light model that minimises balance sheet stress and reduces inventory days. A smart move, right?

The Nomination model is a simple yet effective one - RVNL receives direct assignments from the Ministry of Railways. This means around 80% of projects are directly handed over by the government, resulting in solid revenue based on the project cost plus a fixed margin.

They're diversifying into the Open bidding model, where the lowest bidder wins the contract. To execute these projects, Special Purpose Vehicles or SPVs are set up, which can either be 100% RVNL-owned or established through public-private partnerships or joint ventures.

So, with business development towards open bidding strategy, and a strong order book, RVNL is targeting over 20% growth in revenue over the coming years. As more orders come in, both revenue and margins are set to improve.

Speaking of orders, the company started bidding about a year and nine months ago. And boy, have they hit the ground running! As of March '23, RVNL's order book was a colossal ₹56,000cr. The management even aims to take this to a whopping ₹100,000cr in just a couple of years.

What's attracting all this interest? A series of high-profile projects, that's what! Here are a few of them:

Month | Orders won | Order value |

March | Construction of 6-lane Greenfield Varanasi-Ranchi-Kolkata Highway in consortium with Tracks & Towers Infratech | ₹1,271cr |

March | Manufacturing-cum-maintenance of Vande Bharat Express trains | 200 trainsets and cost per set is ₹120cr |

March | Construction of Six-Lane Elevated Kona Expressway | ₹720cr |

April | Lowest bidder for provision of E1-based Automatic Signaling in stations between Jhansi - Gwalior | ₹121cr |

April | Mumbai Metro line | ₹300cr |

And out of this Rs. 56,000cr, orders worth Rs 36,977cr came from the Railway Ministry while Rs 20,000cr were by way of bidding. This order book promises solid revenue visibility for the next 2-3 years, given project completion times of around 2-3.5 years.

On to the financials, the latest quarter saw a slight dip with

Revenue decreased 11.1% to Rs 5,719.8cr.

Ebitda is Rs 374.4cr compared to Rs. 408cr; down 8.3%

Ebitda margin at 6.5% versus 6.3% a year ago

Net profit down 5% at Rs 359.2cr

The decline in net profit was due to a number of factors, including higher cost of materials and services, slowdown in execution of projects and delay in receiving payments from the government.

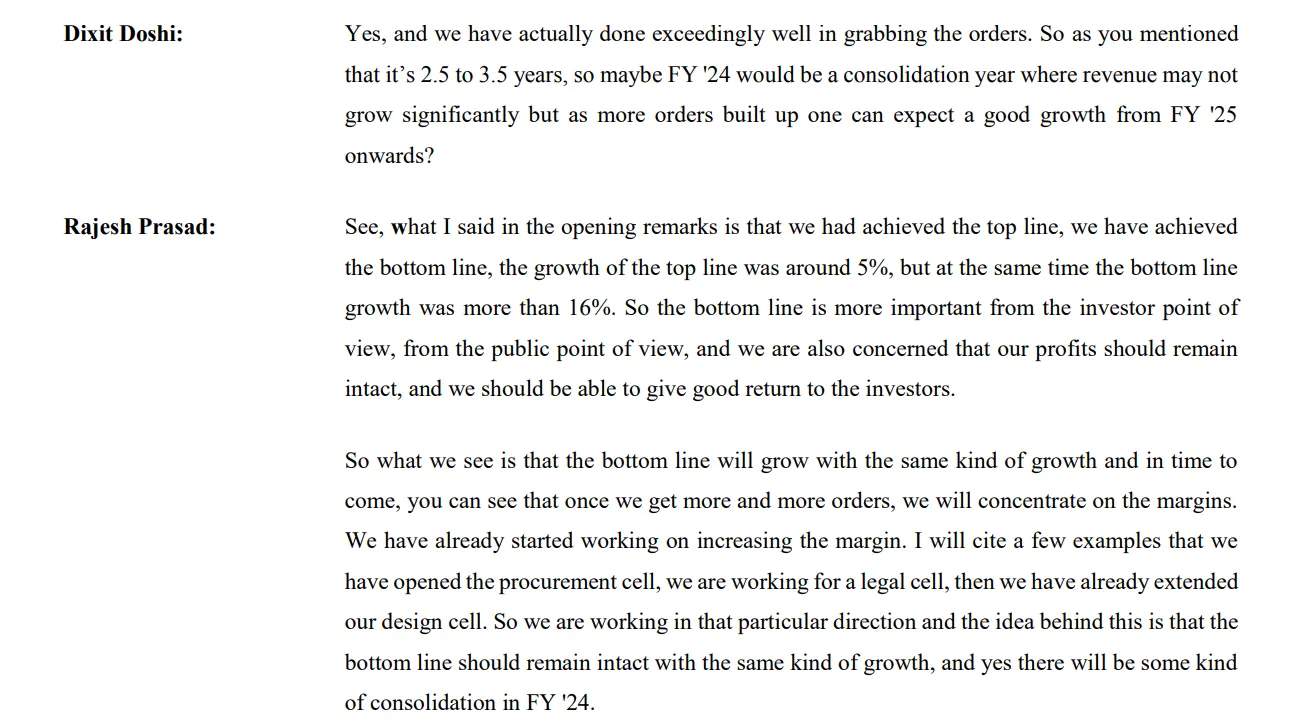

But here's where it gets interesting: RVNL's Q4 FY23 physical commissioning was actually higher than the previous year's, according to management. What does this mean? The projects are physically ready and this should start reflecting in the FY24 Q1 financials. Here’s a transcript from the RVNL’s FY23 ending investor conference call:

Source: Rail Vikas Nigam Ltd - 542649 - Announcement under Regulation 30 (LODR) - Earnings Call Transcript

Source: Rail Vikas Nigam Ltd - 542649 - Announcement under Regulation 30 (LODR) - Earnings Call Transcript

According to their latest investor call, the company is projecting a top line of ₹22,000-23,000 crores and a bottom line of around ₹1,300 crores for FY24. They're eyeing a 5.7% margin through a dual strategy - winning projects competitively and innovating for better margins.

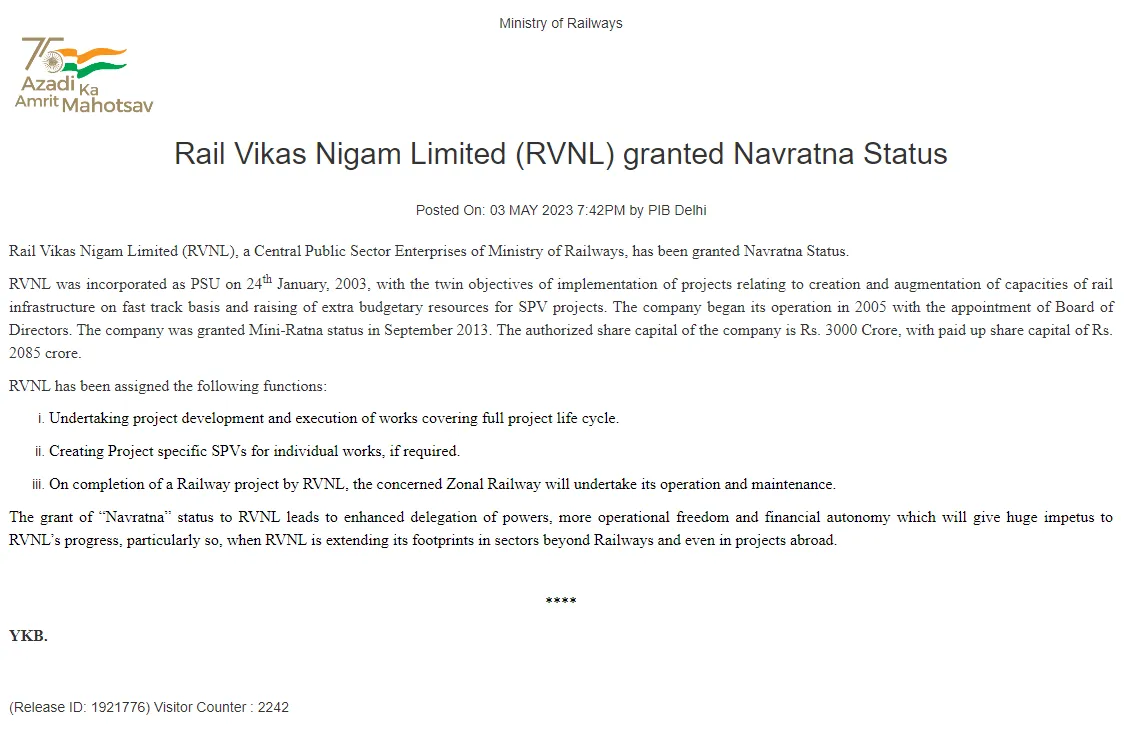

Did you know that RVNL has been granted the Navratna Status? Like the nine precious gems that the term Navratna signifies, the company is one of the shining stars in the crown of India's Central Public Sector Enterprises.

Source: Ministry of Railways, Press Information Bureau, Government of India

The Navratna status comes with some exceptional benefits:

Financial independence to invest up to ₹1,000 crore without central government approval

Permission to invest up to 15% of their net worth on a single project or 30% of their net worth in a year, capped at ₹1,000 crore

This increased financial autonomy puts RVNL in a competitive position globally and grants it greater operational freedom, as it expands beyond the railways sector and starts its international projects.

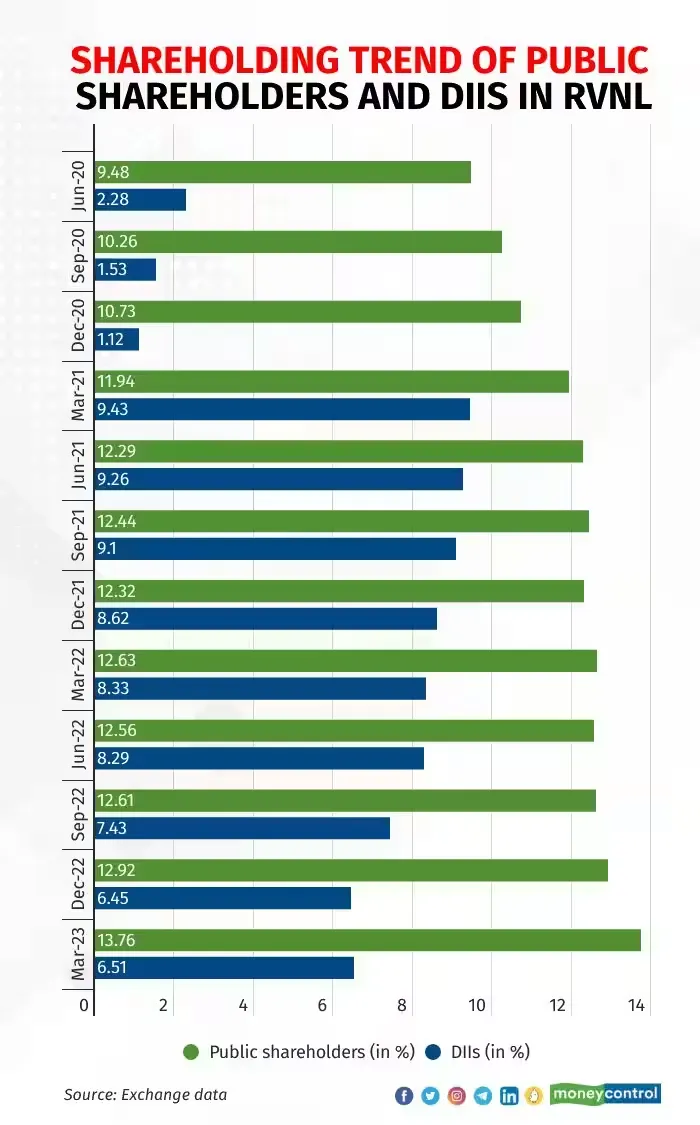

And investors have taken note! Domestic Institutional Investors and public shareholders have been increasing their stakes since June 2020. The stock has rallied over 500% since then. Here’s the shareholding trend of DIIs and public shareholders in RVNL

Source: Why RVNL recorded a decline in revenue when railways is fastest growing infra segment, Moneycontrol.com

RVNL's valuation might be higher than its peers, with a P/E ratio of 17.39 times, but it's below its historical average of 20 times. Also, the premium to its book value of 3.86 is justified by a robust order book and a proven execution track record.

Source: Zerodha

Source: Zerodha

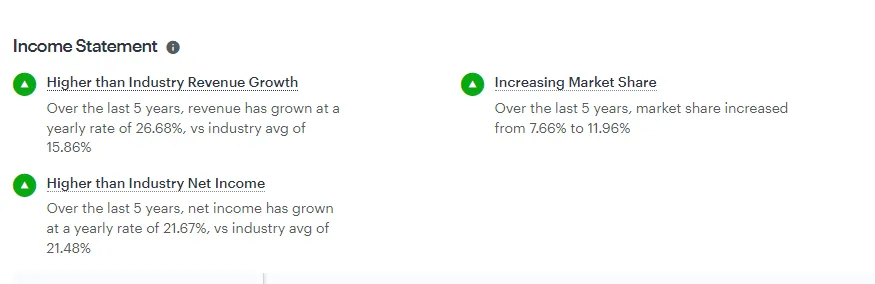

Revenue growth has been strong over a 5 year horizon - delivering higher than industry revenue growth and net income. Debt to Equity is slightly high at 87%, which is typically the case for the Infrastructure sector, but this should be keenly monitored. Source: Zerodha

Source: Zerodha

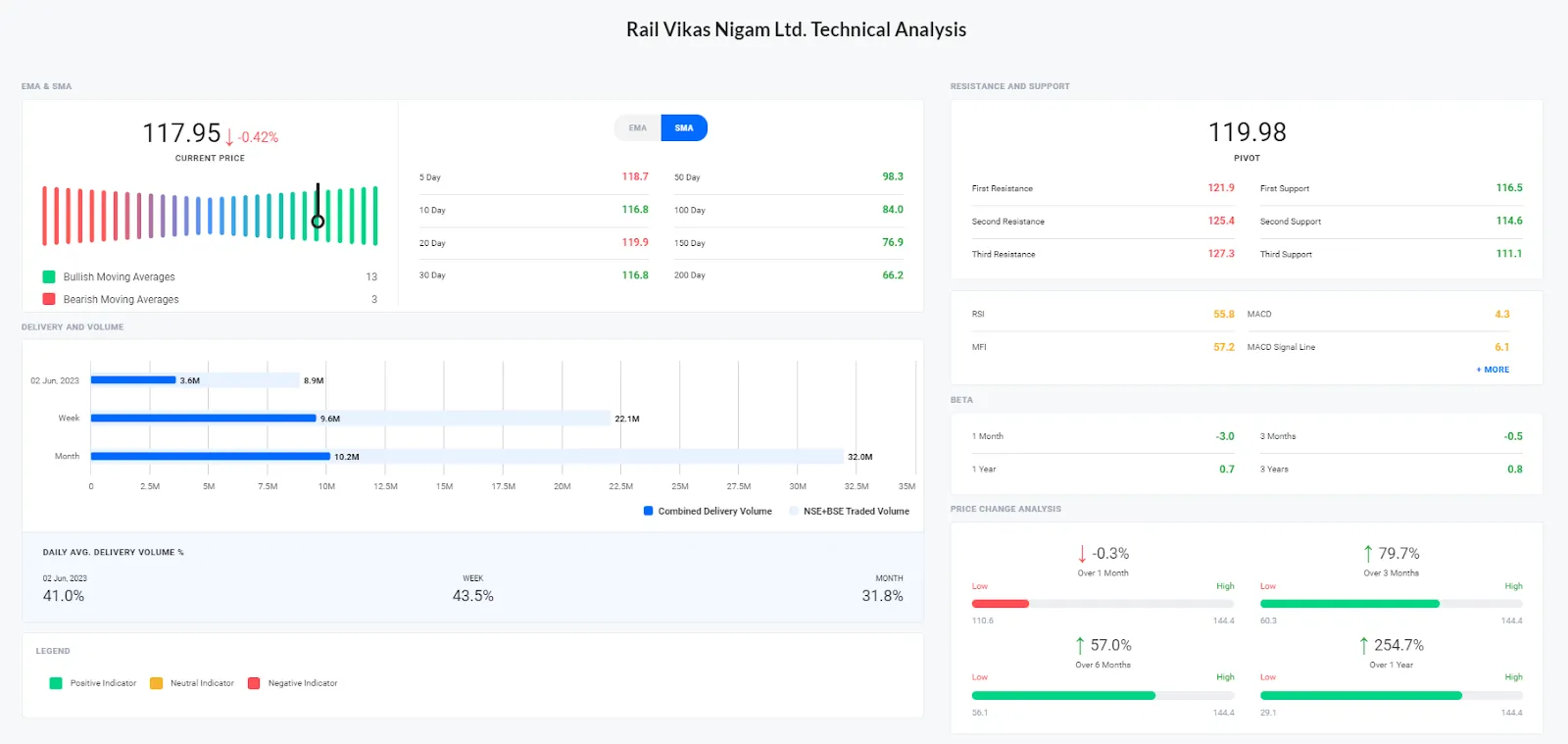

On the technical side, the price has corrected about 20% from its high of Rs 144,as bears were in control. Currently, the stock is moving sideways with volumes decreasing and we can see a pullback from here.

If the price moves above the resistance of Rs 120-123, we might see an upside level of Rs 150-180.On the lower side, Rs 110 is a support, below which, we can see a level of Rs 100.

RVNL is trading above 6 out of 8 SMAs. The stock is trading higher than the 10-day, 20day, 30-day, 50-day, 100-day, 150-day, and 200-day moving averages but lower than the 5-day and 20-day moving average. And it is trading above 7 out of 8 EMAs, with only the 5-day moving average being lower.

Source: Trendlyne.com

The RSI (14) is at 55.8 and is in neutral territory as RSI below 30 is considered as oversold and above 70 is overbought, Trendlyne data showed. MACD is at 4.3 which is below the signal line.

The Stochastics Oscillator trend and the movement of multiple SMAs suggest limited downside risk. It's a potentially good buy above Rs 123 and on dips to Rs 110, keeping a Stop Loss of Rs 100 on a weekly closing basis.

Even with a strong order book and a track record of execution, the stock is currently trading at a high valuation, and there are some risks to consider, such as government policy risks, delay in payment from the government, and a potential rise in the cost of materials and services. There is also the point of taking contracts in international markets which poses an interesting challenge for execution capabilities in new geographies.

Can RVNL leverage its competitive execution, design and innovation capabilities with these new challenges?

Based on our analysis, it appears to be a sound choice for a 3-5 year horizon. A good buying range could be around Rs.100.

But that is my opinion and not investment advice. We recommend you to apply the analysis we did on RVNL yourself, and to come up with your own opinion on such stocks. You should do your own in-depth analysis, research and the hard work to figure out if a stock makes sense for your portfolio.

Disclaimer: Investments or trades mentioned in this video are solely for educational purposes and should not be considered as personalized financial trading, or investment advice. The purpose of this video is to provide educational information and not to provide advice based on your individual circumstances. It is recommended that you consult with a qualified financial advisor to discuss your specific requirements and situation. All investments are subject to market risks. Please read all scheme related documents carefully before investing. Past performance is not an indicator of future returns. Full disclosures here.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

Get full access by signing up to explore all our tools, portfolios & even start investing right after sign-up.

Oops your are not registered ! let's get started.

Please read these important guidelines

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions

Sign-Up Using

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Set up a strong password to secure your account.

Skip & use OTP to login to your account.

Your account is ready. Discover the future of investing.

Login to start investing on your perfect portfolio

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Login to start investing with your perfect portfolio

Forgot Password ?

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Set up a strong password to secure your account.

Your account is ready. Discover the future of investing.

By logging in, you agree to our Terms & Conditions

SEBI Registered Portfolio Manager: INP000007979 , SEBI Registered Investment Advisor: INA100015717

Tell us your investment preferences to find your recommended portfolios.

Choose one option

Choose multiple option

Choose one option

Choose one option

Choose multiple option

/100

Investor Profile Score

Congratulations ! 🎉 on completing your investment preferences.

We have handpicked some portfolios just for you on the basis of investor profile score.

View Recommended Portfolios

on your first subscription