by Sonam Srivastava

Published On Oct. 2, 2022

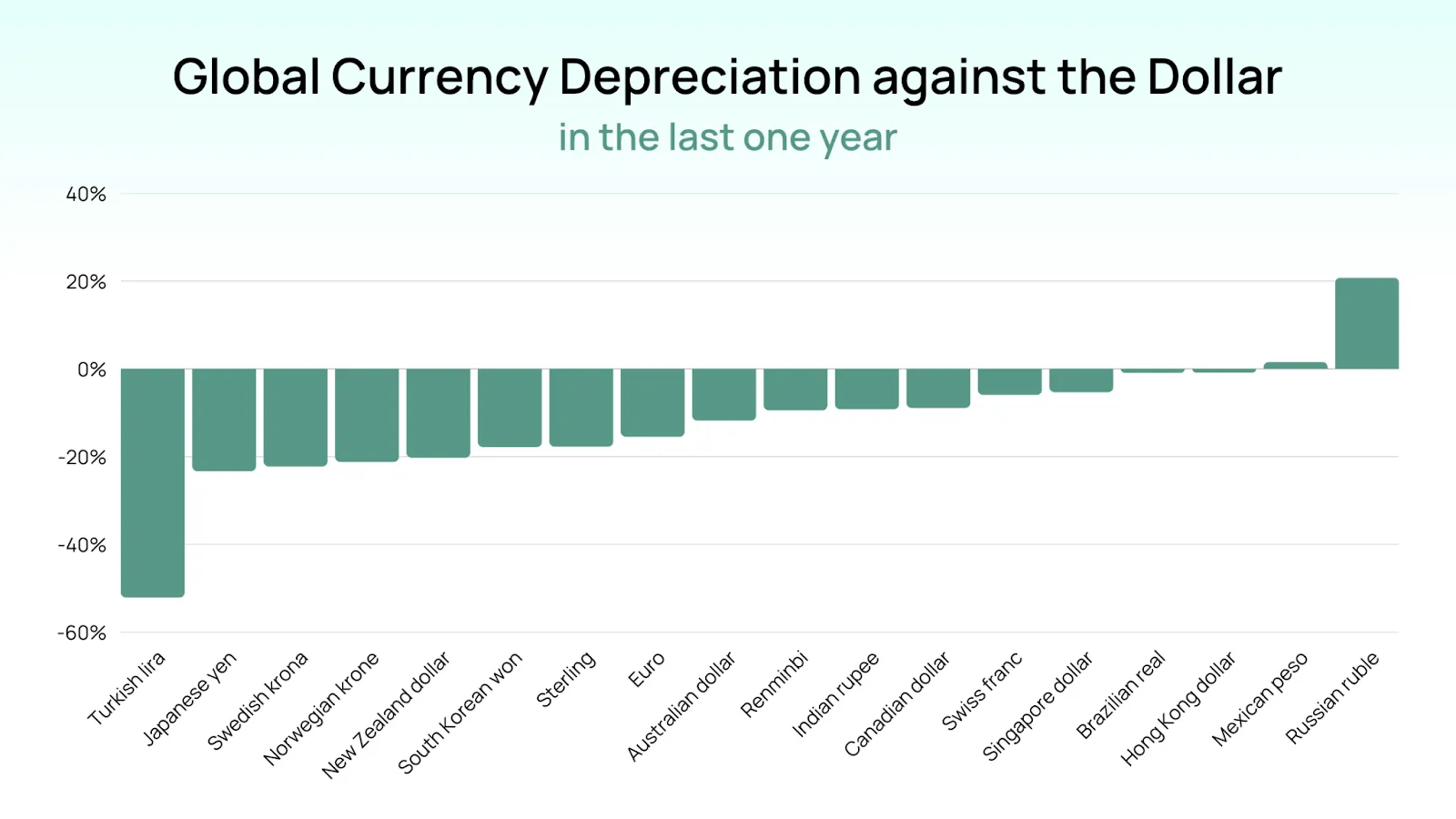

The dollar has had a drastic rise above all other major global currencies, and the rising dollar is a big concern that the RBI is facing.

The gradual increase in Federal Reserve interest rates leads investors to dump other assets and run to the haven of the US dollar. There are several ways that changes in the US dollar value might affect other assets. First, the US dollar, the world's primary currency exchange, impacts the goods and services in which imports and export are involved.

Businesses that export to the US will not earn more in local currency, and the companies that rely heavily on imports will see earnings slow down.

We need to understand the implications of a strong dollar to make wise investment decisions. Read more to know how the rising dollar impacts investments.

Investing in companies or businesses that receive most of their revenue from sources from the US can help you gain from a rising dollar. A business that earns in dollars will see the earnings go up by default, given the rising US dollar.

With the rising dollar, commodity prices are taking a hit. So betting on sectors that consume commodities - autos, cement, fertilisers- might also be interesting.

As the RBI would raise rates to match the US rates to protect the domestic economy, the banking sector that gains from the rising rates is also an exciting buy.

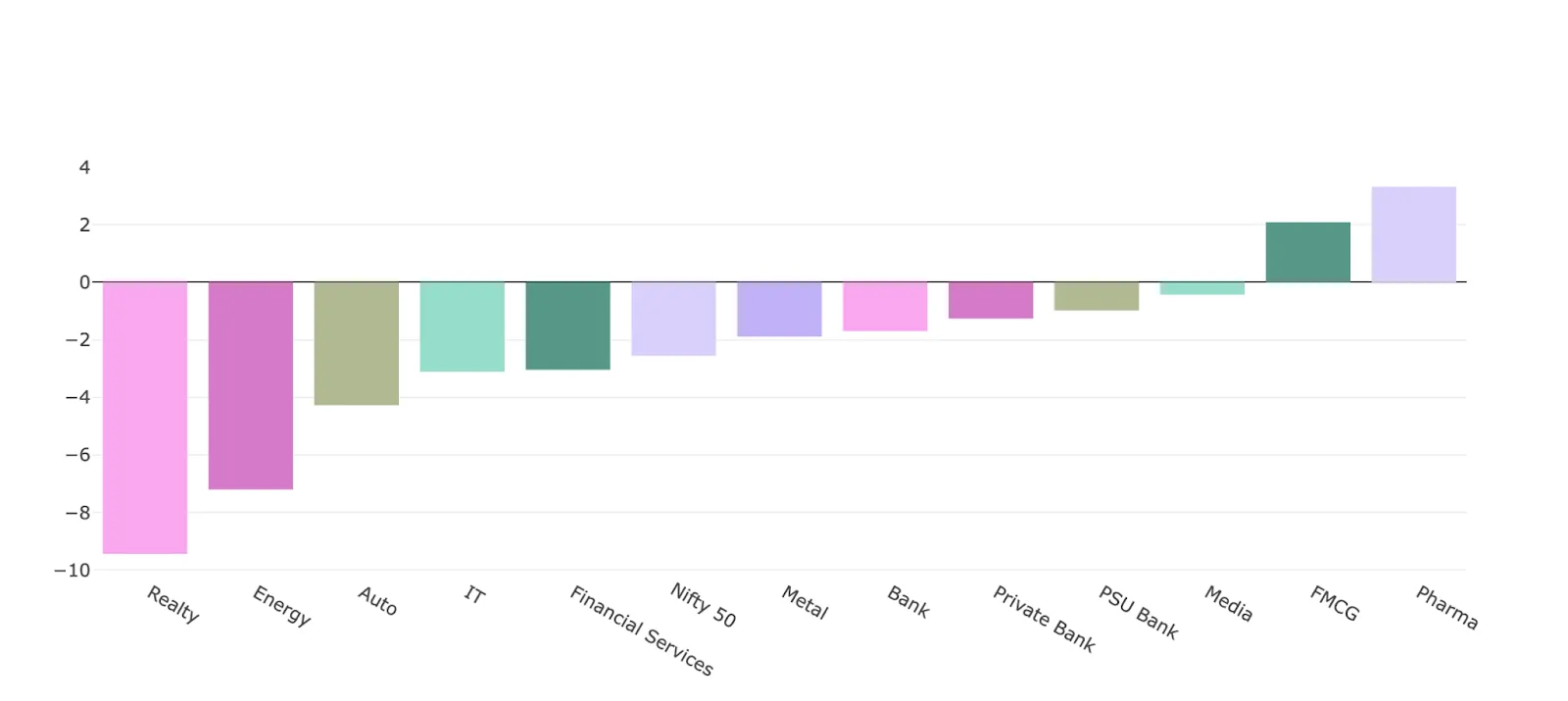

The major sectors that gain when the dollar gets strong are - Technology and Pharma. This is because these two sectors are the biggest exporters of goods and services to the US. We can see the momentum formation in Pharma stocks as proof of this theory. But on the other hand, the technology stocks are still lagging as the US technology companies, the consumers of Indian IT services, are also going through a recessionary phase.

Planning for the festive season?

The consumer space remains a more powerful theme given that the festive season is coming in. Consumer Discretionary, FMCG, Cement, and Autos are attractive. Discretionary and retail stocks have outperformed the index during the festive season in nine of the last 11 years, and the Medium-term outlook for these sectors looks strong. Stocks like Jubilant Foods, Nykaa, and Titan are attractive festive season buys.

It is challenging to forecast how long the value of the US dollar will rise because so many factors tend to affect it. Despite this, understanding how fluctuations in currency prices affect assets offers potential for short- and long-term gains. The foundation for profiting from the rising US dollar is investing in stocks that export to the US and the consumer of the falling commodity prices.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart