by Naman Agarwal

Published On June 2, 2025

India is once again facing an uptick in COVID-19 cases, raising concerns across public health systems and financial markets. While the virus itself may not be as deadly due to better immunity levels and medical preparedness, its ripple effects on the economy and capital markets are still potent.

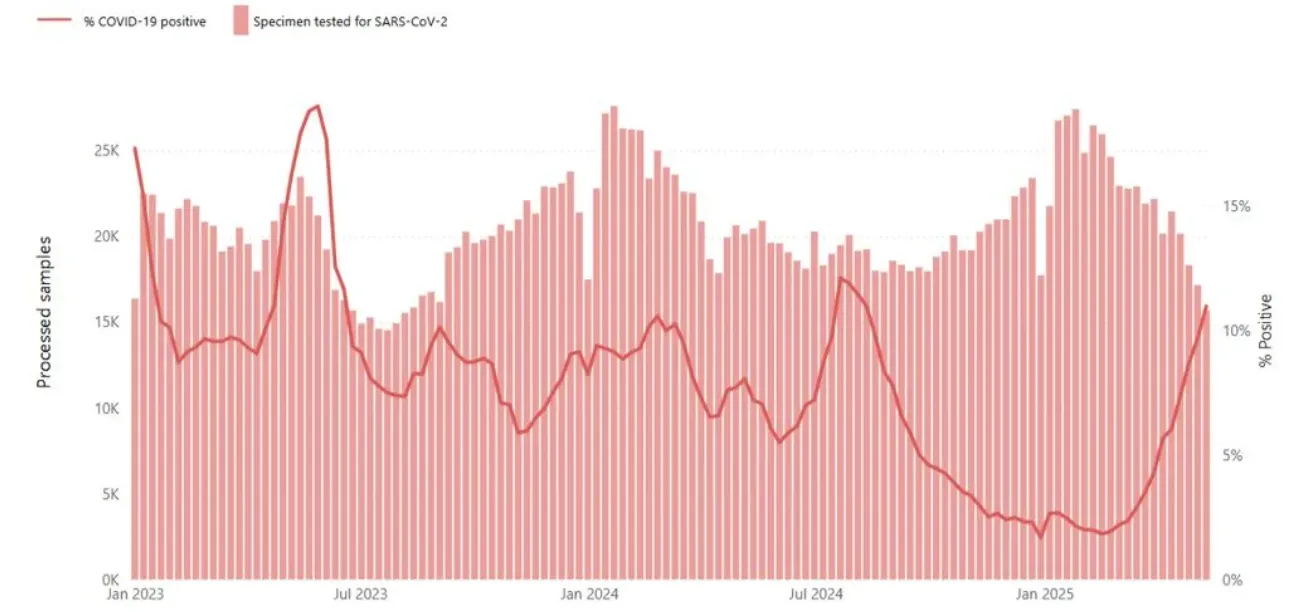

( Source : WHO - SARS-CoV-2 tested specimens and percent positive reported from sentinel sites to eGISRS from countries, areas and territories from January 2023 to May 2025 )

India has seen a significant spike in COVID-19 cases through May 2025. Daily new infections surged from under 500 on May 1 to over 3700 on June 1,2025, a seven-fold increase in less than a month. Maharashtra, Tamil Nadu, and Karnataka have emerged as new epicenters, contributing to over 60% of active cases.

The test positivity rate has reached 8.1% nationally, with urban pockets like Mumbai and Delhi experiencing localized surges over 10%, triggering containment measures. Despite this, hospitalization rates remain relatively low. ICU occupancy across tier-1 cities is still under 10%, thanks to improved vaccination coverage (83% of Indian adults have received at least two doses) and booster availability.

Government responses have evolved. Nationwide lockdowns, once the go-to strategy, have been replaced by localized micro-containment zones and aggressive testing. Indian Railways, metros, and airports are operational, albeit with updated health advisories. The central government has emphasized continuity in economic activity, and so far, no fiscal contraction or stimulus package has been announced.

Metric | 2020 Wave 1 | 2021 Delta Wave | 2022 Omicron Wave | 2025 Rise (Current) |

Daily Cases Peak | 97,000 | 400,000 | 350,000 | 3,700 (and rising) |

Death Rate (CFR) | 2.1% | ~1.8% | 0.3% | <0.2% |

Hospitalization Rate | High | Very High | Low | Very Low (<10% beds) |

Lockdowns/Restrictions | National Lockdown | City-Level Lockdowns | Minimal | None so far |

( For Live Tracking of Cases : https://zeenews.india.com/india/live-updates/coronavirus-cases-in-india-track-daily-active-covid-19-cases-death-status-kerala-maharashtra-tn-delhi-ncr-mumbai-bangalore-new-jn1-nb181-lf7-variant-symptoms-covid-certificate-health-ministry-guidelines-2908713.html )

Interestingly, the stock market has remained steady. Unlike the selloffs seen during the 2020 and 2021 waves, both NIFTY 50 and Sensex have remained range-bound within a ±1.5% band throughout May. This suggests a growing market resilience, or perhaps selective risk-taking by investors.

Institutional flows have remained positive. Foreign Institutional Investors (FIIs) have poured over ₹8,700 crore in Indian equities during May, indicating a long-term confidence in the country’s macroeconomic stability. Retail participation also remains strong , SIP inflows hit a record ₹12,500 crore in May, and trading volume on NSE remains healthy.

Google Trends data shows an 85% drop in searches for terms like “stock market crash COVID” compared to April 2021, reflecting improved investor psychology. Investors appear to be differentiating between headline health news and core economic performance.

Table: FII Flows, SIP Inflows, and Volatility Index (May 2025)

Metric | Value | Change vs. April 2025 |

FII Inflows | ₹8,700 crore | +12% |

SIP Inflows | ₹12,500 crore | +5% |

India VIX | 11.2 | -8% |

Retail Turnover (NSE) | ₹85,000 crore | +4% |

Beneath the surface-level calm of indices lies major sectoral realignment. Healthcare, diagnostics, and pharma have emerged as clear winners. Diagnostic chains have reported a 25–30% rise in testing volumes. Pharma companies supplying antivirals and respiratory drugs have seen double-digit revenue growth.

Technology firms especially those offering cloud solutions and digital collaboration tools are experiencing a revival as corporates reinstitute hybrid work models. FMCG stocks remain resilient with sustained demand for hygiene products and essentials.

On the downside, the aviation and hospitality sectors are seeing a pullback. The aviation sector saw a 15% fall in passenger load factors and a 9% drop in advanced ticket bookings. Multiplexes and luxury retail are witnessing reduced footfall in Tier-1 cities.

Detailed Sector Outlook Table

Sector | Q1 FY26 Outlook | May Price Performance | Investment Rating |

Diagnostics | Strong | +14.3% | Overweight |

Pharma | Moderate-Strong | +7.8% | Overweight |

FMCG | Stable | +4.1% | Neutral |

IT Services | Moderate | +6.5% | Neutral |

Aviation | Weak | -8.6% | Underweight |

Hospitality | Weak | -6.3% | Underweight |

India’s macroeconomic health remains largely intact. GST collections for April stood at ₹1.72 lakh crore up 10% year-on-year. Core sector output grew by 6.2% in April, led by power, steel, and cement. E-way bill generation was stable, pointing to uninterrupted goods movement.

The unemployment rate, as measured by CMIE, ticked up slightly to 7.3% in May, from 6.9% in April. However, this remains within tolerable limits and far below the 24% levels seen during the 2020 lockdowns.

The Reserve Bank of India (RBI) has maintained a cautious stance. With inflation hovering at 4.8% and GDP expected to grow at 6.8% for FY26, RBI is unlikely to change its policy stance unless COVID-driven demand shocks escalate. However, backchannel discussions suggest that targeted liquidity support for MSMEs and healthcare logistics may be on the table if infections rise dramatically in June.

COVID-19 may continue to rear its head occasionally, but India’s market and economy have clearly moved past the point of full-blown panic. Vaccinations, decentralised response strategies, and investor maturity are playing critical roles in buffering this shock.

Historical Performance of NIFTY 50 During COVID-19 Waves

Wave / Period | Key Events | Market Reaction |

March 2020 (Wave 1) | Nationwide lockdown, uncertainty | NIFTY fell ~38% from Jan to March 2020 |

April-May 2021 (Delta) | High deaths, oxygen shortage | NIFTY fell ~4%, pharma & FMCG outperformed |

Jan-Feb 2022 (Omicron) | Mild variant, no lockdowns | Market remained flat, IT & Healthcare rose |

May 2025 (Current) | Mild rise in cases, high preparedness | NIFTY stable, sector-specific movements |

For investors, the message is clear: Stay informed, stay diversified, and trust the data. In a world where viruses mutate and headlines shift, your portfolio can remain immune through smart allocation, robust modeling, and unwavering research discipline.

The current COVID-19 situation in India is a mild concern, not a full-blown crisis. The stock market is showing resilience, with investors differentiating between headline noise and real economic damage.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart