Are you tired of all the investment gyan ever present on the internet? I know that I am. Every other investment manager is rattling off about the long-term story and the strength of the Indian market. So we thought that this week, we would not join the bandwagon!

In this post, we will cut the noise with some high-quality data on the following:

The impact of the festive season

What’s happening in the Banking sector?

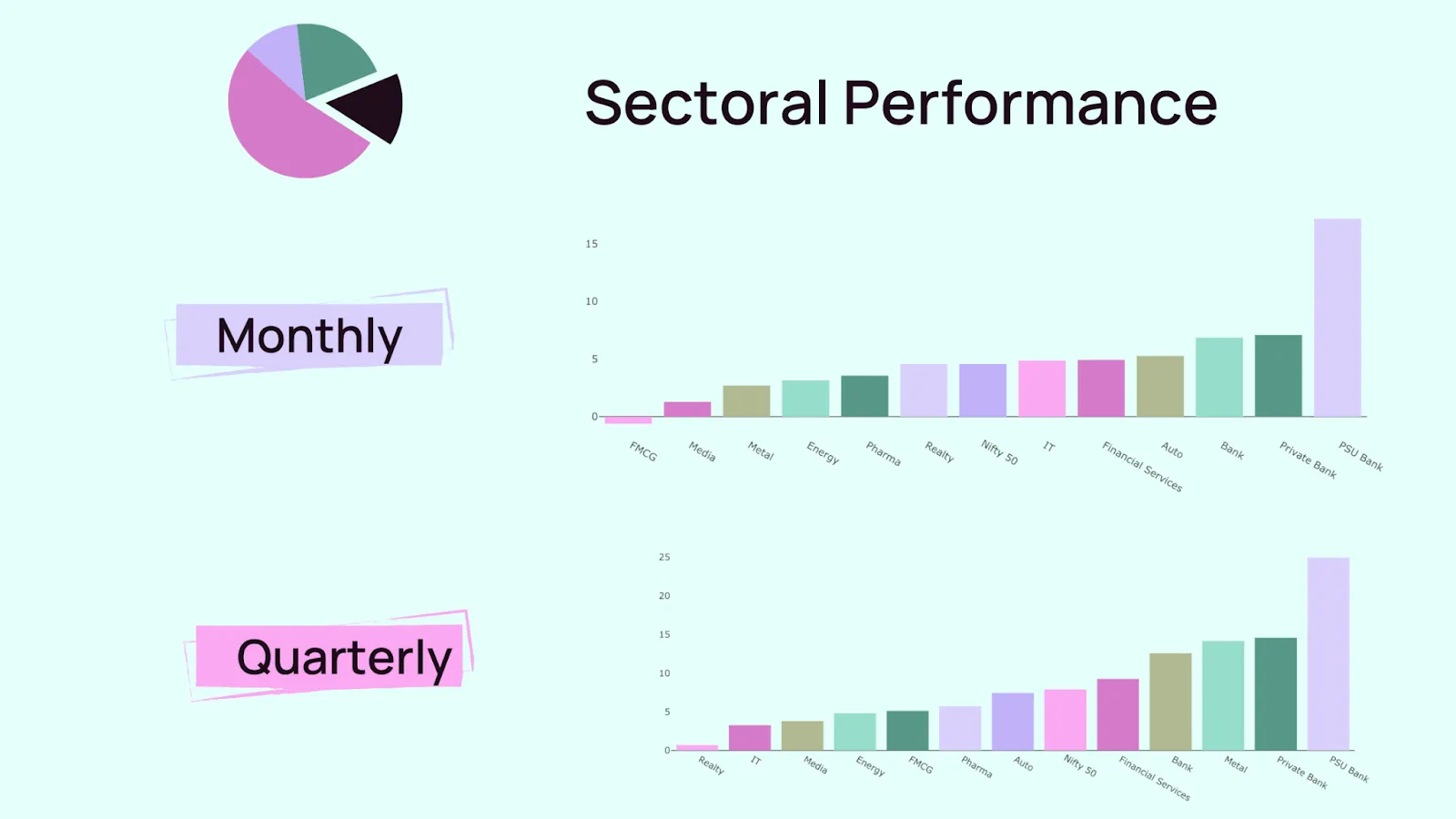

Sectoral trends

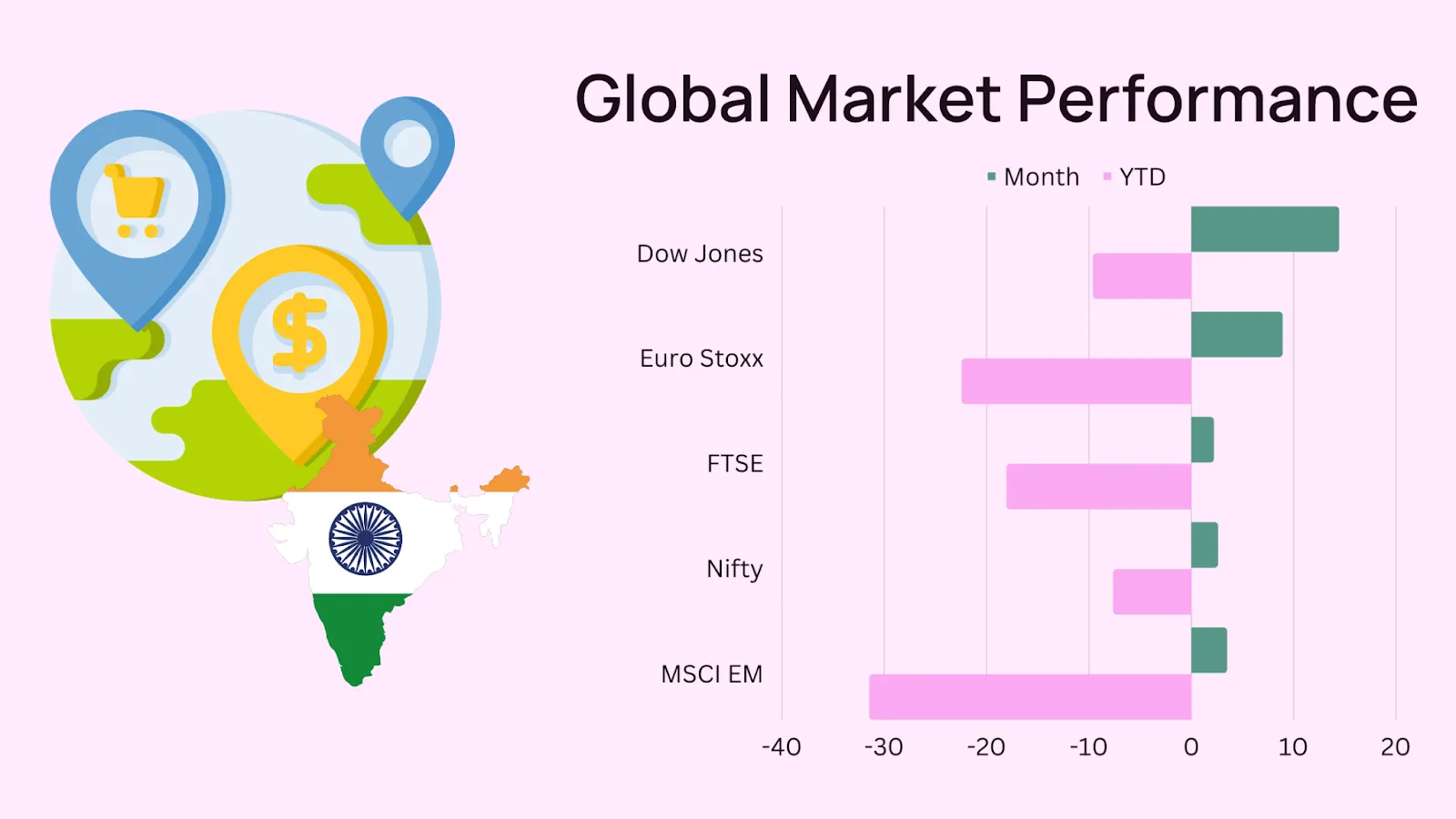

India vs Global markets

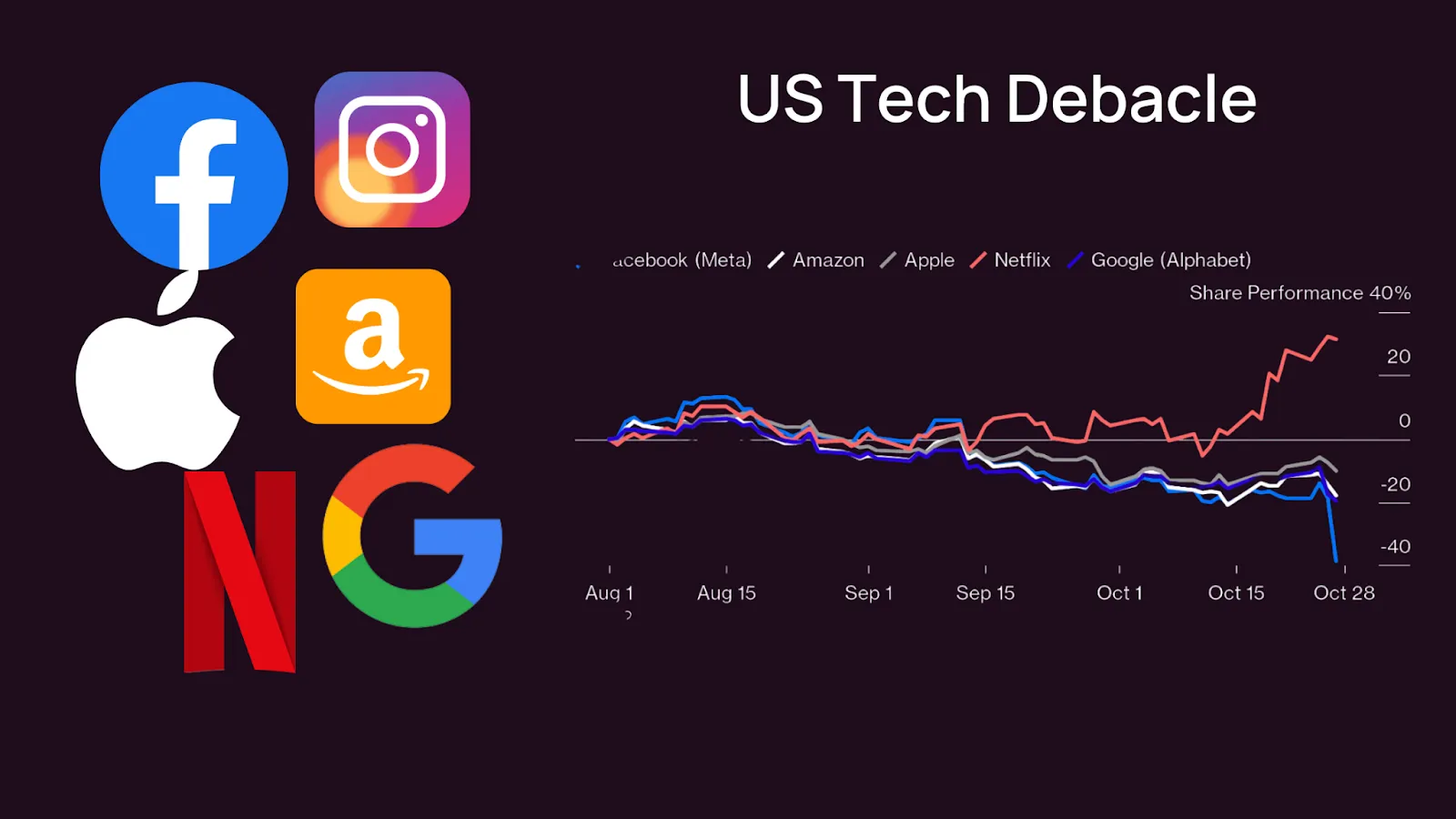

Global Tech Meltdown

So here we go!

Diwali came with a bang for the auto sector. Over four lakh buyers bought their dream car in 32 days between Navratri and Diwali to fulfil their personal mobility needs. This sale figure was 30% higher than the festive season last year.

This year's festive season is considered the first normal season experienced by the industry with zero restrictions since Covid-19 hit in 2020.

These numbers prove that the consumer sector of our large economy is getting from strength to strength and is the best place to buy.

Banks have wowed everyone with their earning numbers. The credit in the banking sector has jumped nearly five-fold to 9.3 trillion rupees between the April-September period from 1.7 trillion rupees a year ago, according to the Reserve Bank of India.

Banks are also posting impressive numbers on Diwali. Top banks have given 20-70% growth in earnings this season and a 20-50% growth in net interest income. The deposit rate has lagged behind the credit growth rate, though. The growth is expected to continue in the next quarter.

The performance of the Banking sector is a testament to these numbers. PSU Banks are leading the pack in terms of returns, and Private Banks are close behind. Sustained growth in the banking sector hints at a string economy, which is not bad news.

The global market picked up at a more rapid pace than India over the last month, but India is still in the lead on a YTD basis. Emerging markets continue to be laggards, and India, as an exception, has outperformed EMs by 25%.

The US Tech sector continued the meltdown. Everyone from semiconductors to social media to the cloud has cut down future projections, delivered abysmal growth, and seen the prices tank. Apple and Microsoft remain robust, and Meta has had the worst meltdown. The industry is hit by a strengthening greenback, supply-chain snarls, inflation yet to be controlled and economic growth figures that look increasingly grim.

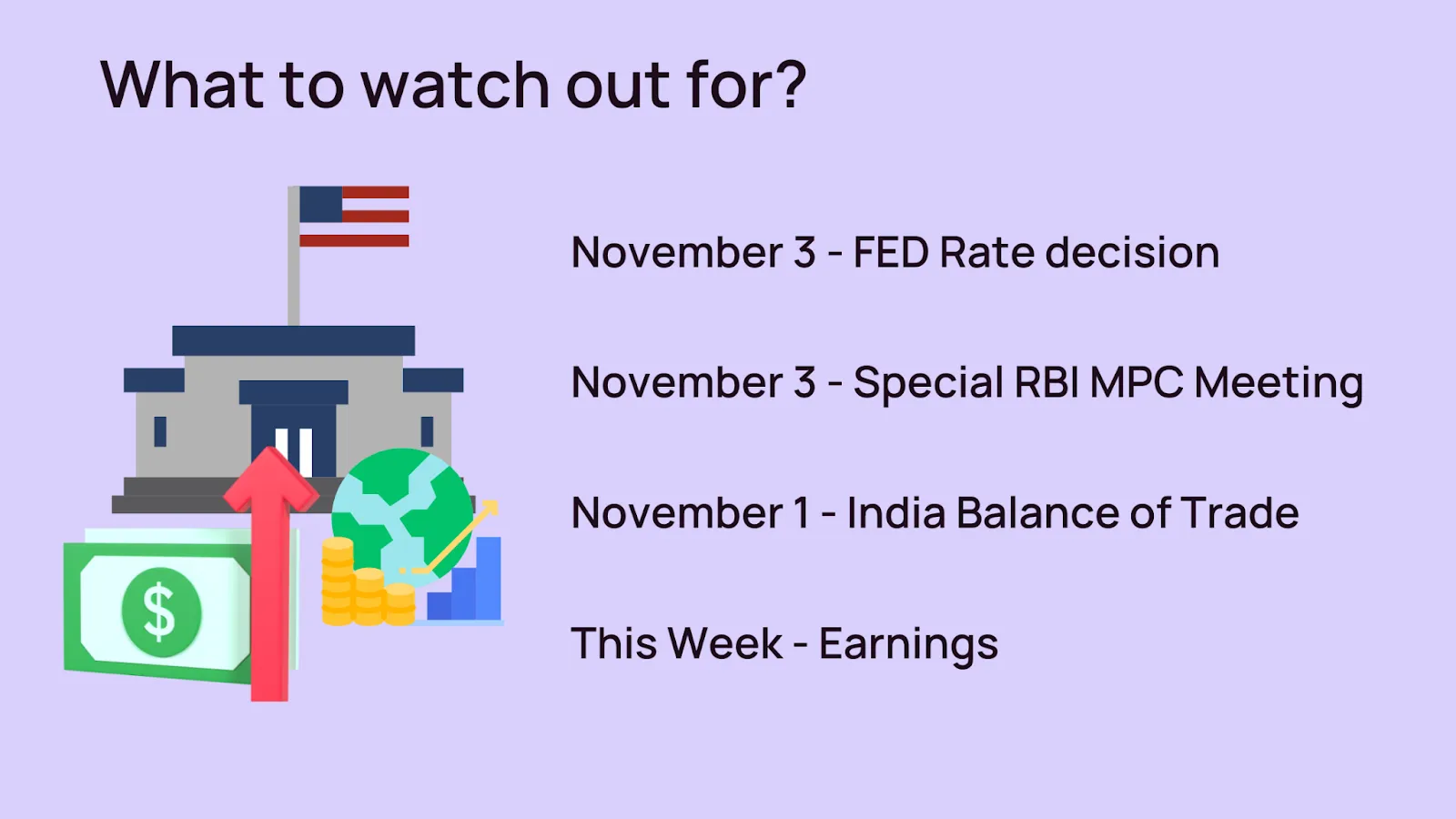

The ongoing quarterly earnings season, the Reserve Bank's special meeting of its rate-setting committee and the U.S. Fed interest rate decision are the significant events that would dictate trends in the equity market this week.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart