by Sonam Srivastava

Published On Nov. 6, 2022

We started Wright Momentum almost exactly two years ago, in November 2020, in a market ripe for Momentum investing. Momentum has been my favourite strategy to work on in the markets since I witnessed the 2013-14 bull run. So I started this strategy with giddy excitement, and the reception that momentum has received has also been beyond exciting.

So this week, we are celebrating the power of momentum investing with the Wright Research edge. We’ll explore how momentum has looked for the investors, the performance, the multi-baggers, the hits and the misses.

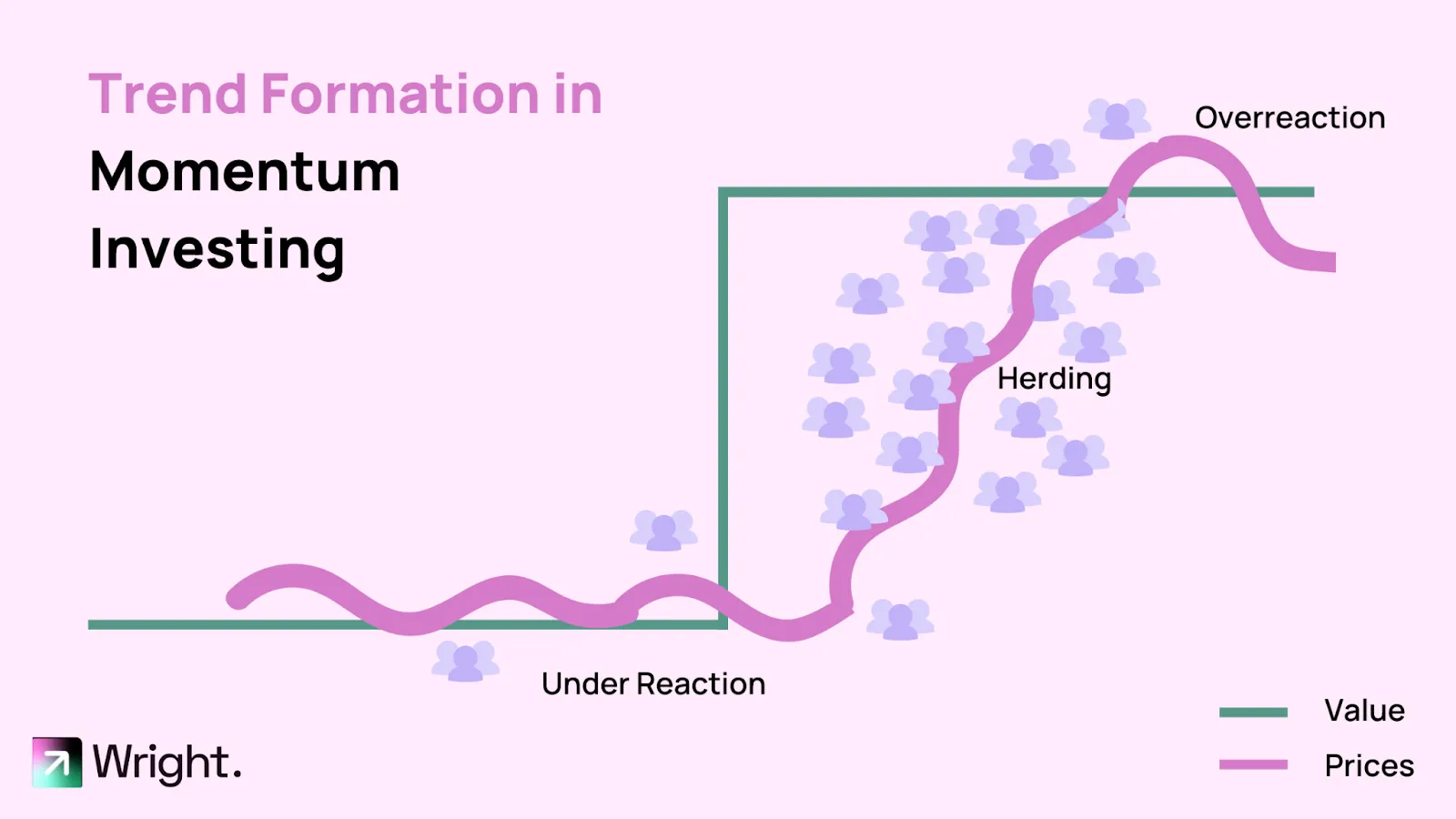

Momentum Investing means investing in stocks that are forming solid trends. When picking these stocks, Momentum is not concerned about the fundamentals but the trend's strength.

This seems a little strange, but if you understand the behaviour of investors in the markets, it all makes sense. Investors do not react rationally to any announcement of a change in value. There is initial underreaction when only a few investors jump into the stock, but as more and more people start herding into a stock, that is when the string trend forms.

Momentum Investors are trying to catch these trends, and we trust such trends to deliver long-term outperformance over the index.

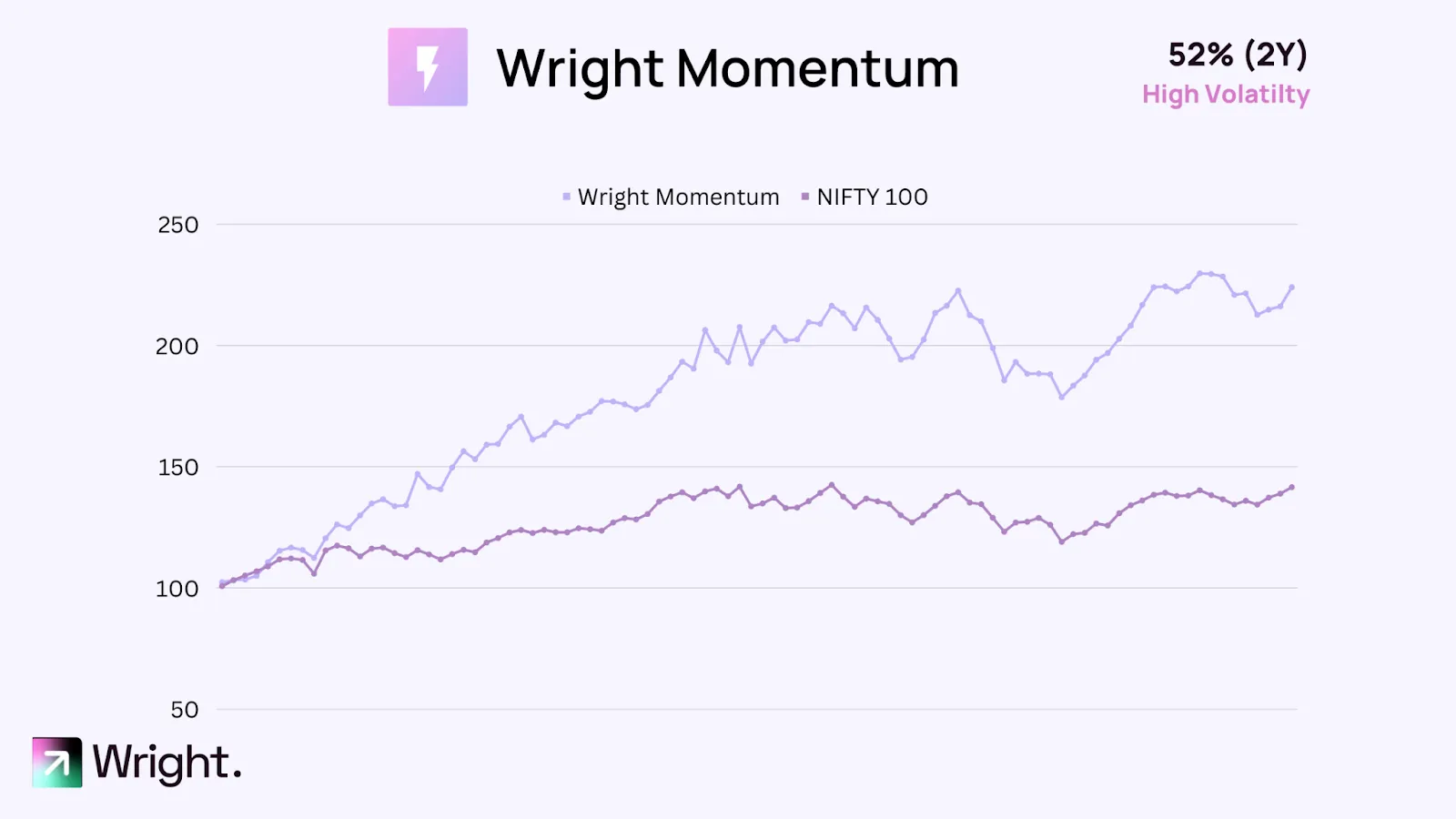

Wright Momentum has had a spectacular run in the last two years. As a result, many investors trust us, and we have delivered a 52% CAGR or 124% net returns in the previous two years.

The first year for Wright momentum was a dream run, with almost 100% returns within a year, but in the last 12 months, we have been tackling volatility, but still have fared much better than the index.

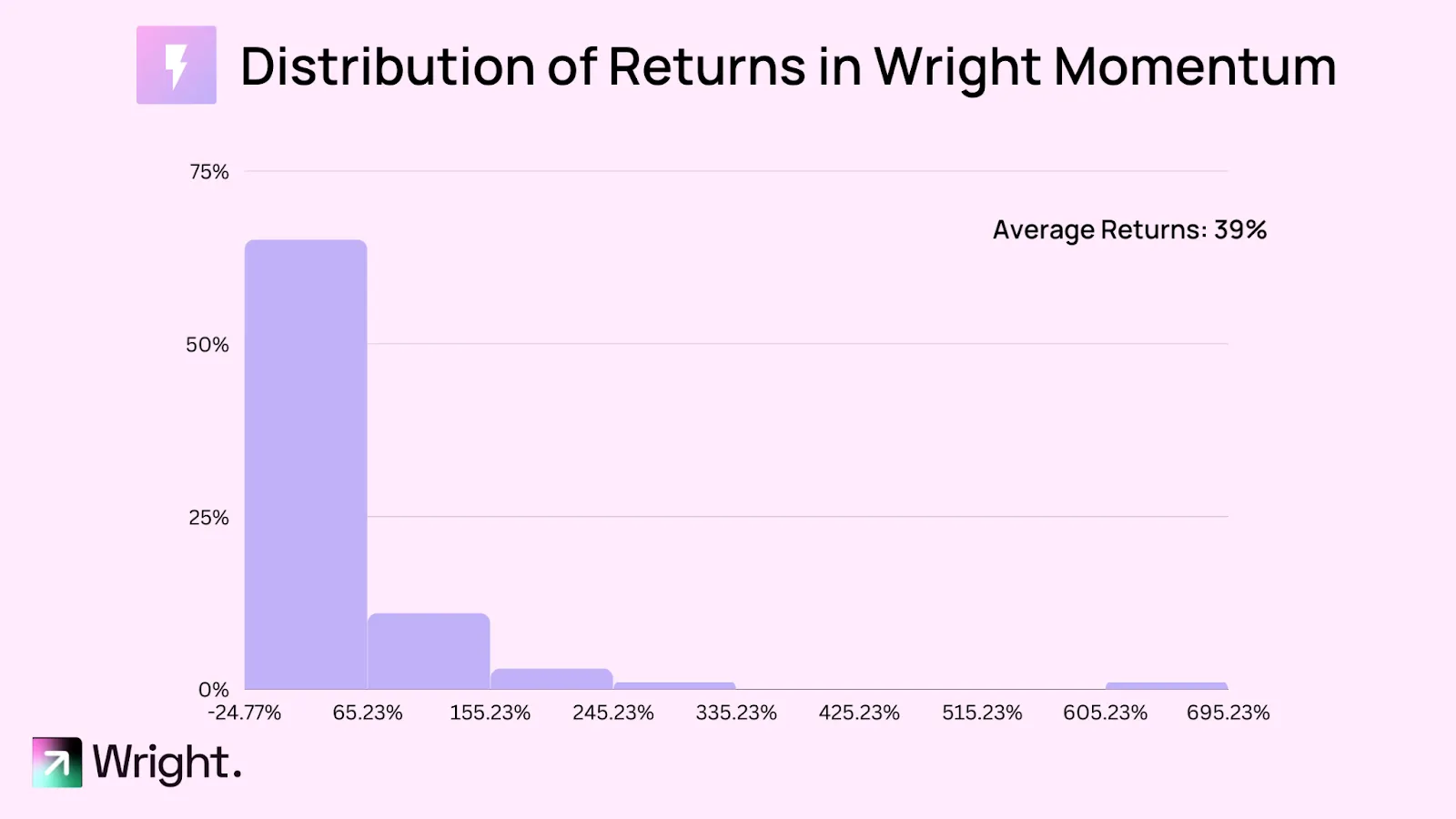

In this run of 124% returns, Wright Momentum has had eight stocks turn multi-baggers, and three of the multi-baggers have been in the portfolio for the whole two years. If we look at the distribution of the stocks in the portfolio, we’ll see that the average return has been 39% for the stocks, but the distribution is skewed by only a few stocks that have turned multi-baggers.

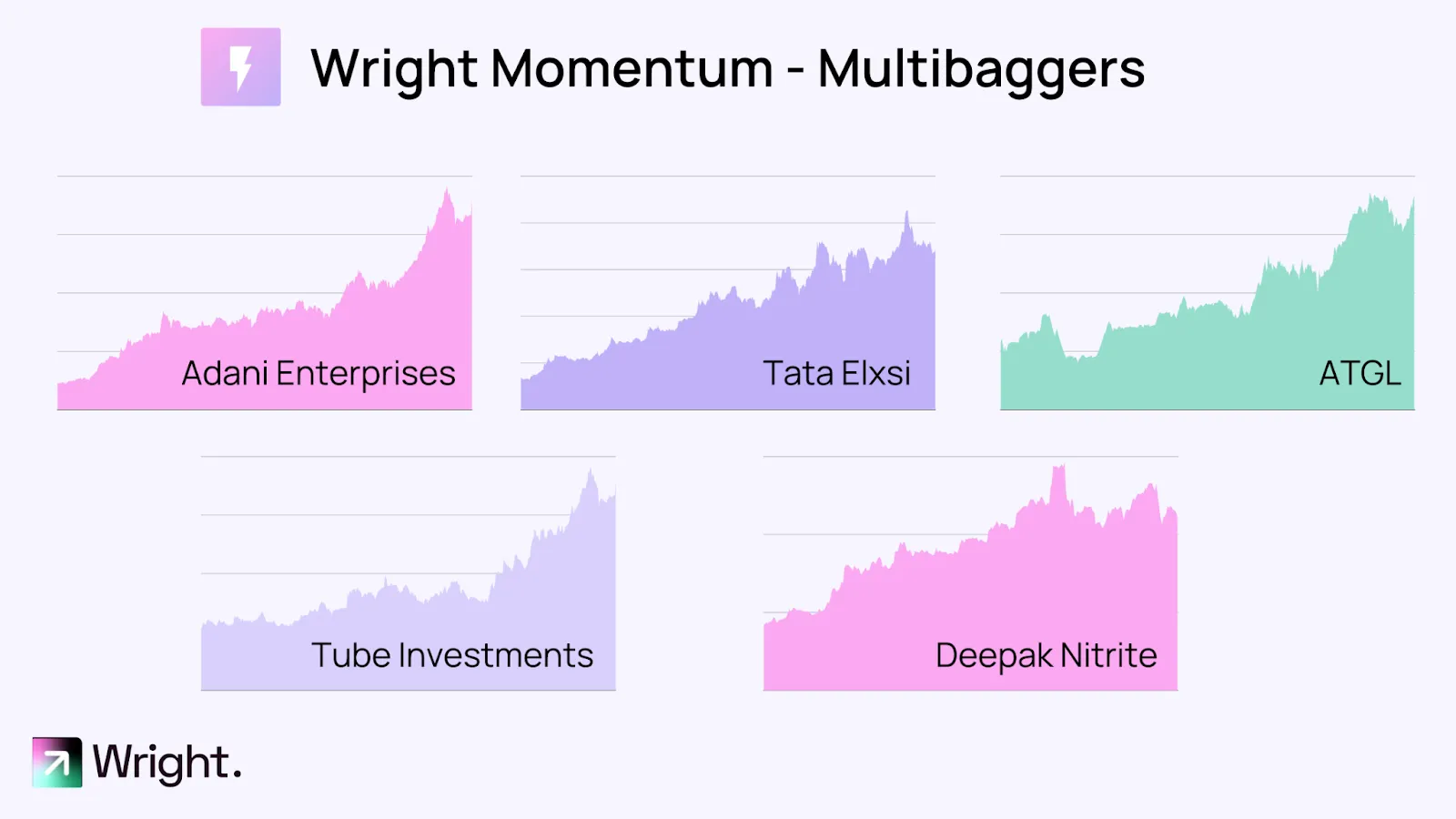

The Multibaggers in our portfolio will be widely recognised. But, as I said, Momentum stocks have had many investors herding them, so many of us would already know of these stories.

Our top performer of the pack has been Adani Enterprises, followed by Tata Elxsi. Both of these stocks have been part of our portfolio for two years, even though we offloaded Tata Elxsi at the beginning of November.

Adani Total Gas is the third multi-bagger of the pack, followed by another street favourite, Tube Investments. Finally, Deepak Nitrite is our fifth multi0bagger, even though we quit that stock a few months ago.

What is Multibagger Momentum?

Multibagger Momentum refers to an investment strategy that combines the principles of momentum investing with the objective of identifying and capitalizing on stocks with the potential for significant, sustained price appreciation—commonly referred to as "multibaggers." This strategy operates on the premise that stocks exhibiting strong momentum—meaning they are on an upward price trend—are more likely to continue their positive performance in the short to medium term.

In the context of Multibagger Momentum, the term "multibagger" signifies stocks that have the potential to deliver returns several times the original investment. These stocks often experience explosive growth, and investors aim to ride the momentum to achieve substantial profits.

Discovering potential Multibagger stocks in the Indian market involves a strategic approach to market analysis. Investors aiming for multifold returns should employ a combination of fundamental and technical analysis while considering the unique aspects of the Indian stock market. Here's a comprehensive guide on how to find Multibagger stocks in India:

1. In-Depth Fundamental Analysis:

Earnings Growth: Look for companies with consistent and robust earnings growth over the years. Multibagger stocks often have a history of strong financial performance.

Revenue Trajectory: Analyze the revenue trajectory of companies. Multibaggers typically exhibit a trend of increasing revenues, indicating business expansion.

Profitability Ratios: Assess profitability ratios, such as Return on Equity (ROE) and Return on Capital Employed (ROCE), to gauge how efficiently a company utilizes its capital.

2. Industry Trends and Growth Potential:

Emerging Sectors: Identify emerging sectors with strong growth potential. Multibaggers often emerge from industries experiencing rapid expansion.

Market Trends: Stay updated on market trends and macroeconomic factors influencing various sectors. A growing sector provides a conducive environment for potential Multibagger stocks.

3. Management Quality:

Management Track Record: Evaluate the track record of the company's management. Multibaggers are often backed by competent and visionary leadership.

Corporate Governance: Look for companies with a strong commitment to corporate governance. Transparent and ethical practices contribute to long-term success.

4. Technical Analysis:

Price Trends: Use technical analysis to identify stocks with strong price trends. Chart patterns, moving averages, and momentum indicators can help spot potential Multibaggers.

Volume Analysis: Analyze trading volumes. Multibaggers often witness increased buying interest, reflected in rising trading volumes during upward trends.

5. Market Capitalization:

Mid and Small Caps: Multibagger opportunities are frequently found in mid and small-cap stocks. These companies have higher growth potential but may be overlooked by larger investors.

6. Investor Conferences and Calls:

Company Disclosures: Attend investor conferences and listen to earnings calls. Companies often provide insights into their future plans during these events.

Analyst Reports: Read research reports from credible analysts. These reports can offer detailed analyses of a company's growth prospects.

7. Screening Tools and Platforms:

Stock Screeners: Utilize stock screening tools to filter stocks based on predefined criteria. Look for parameters such as earnings growth, low debt, and valuation metrics.

Online Platforms: Explore online platforms and investment websites that provide stock recommendations and analysis. Be cautious and verify information from multiple sources.

8. Risks and Challenges:

Risk Management: While seeking Multibagger opportunities, be aware of associated risks. Diversify your portfolio to mitigate risks associated with individual stocks.

Market Volatility: Understand that the stock market can be volatile. Multibagger stocks may experience price fluctuations, and a long-term perspective is crucial.

9. Stay Informed and Adaptive:

Continuous Learning: Stay informed about market developments and continuously upgrade your knowledge. The ability to adapt to changing market conditions is vital for successful Multibagger investing.

Finding Multibagger stocks in India requires a combination of analytical skills, market knowledge, and a disciplined approach. Investors should conduct thorough research, stay vigilant to market trends, and exercise patience for the long-term success of their investment strategies.

Investing in Multibagger stocks can offer significant advantages for investors seeking substantial returns over the long term. Multibaggers, stocks that deliver multiples of their original investment, provide unique benefits that distinguish them from regular stock investments. Here are the key benefits of investing in Multibagger stocks:

1. Exceptional Returns:

Multiplier Effect: Multibagger stocks have the potential to deliver exponential returns, multiplying the initial investment several times over.

Wealth Creation: Successful investments in Multibaggers can lead to substantial wealth creation, significantly outperforming broader market indices.

2. High Growth Potential:

Emerging Companies: Multibagger opportunities often arise from emerging companies with high growth potential. Investing in such firms allows investors to ride the wave of growth in their early stages.

Industry Outperformance: Multibaggers may belong to industries experiencing rapid expansion, offering superior growth prospects compared to mature sectors.

3. Portfolio Diversification:

Risk Mitigation: Including Multibagger stocks in a diversified portfolio helps mitigate risk. While they can be inherently volatile, the potential for high returns can offset the risks associated with individual stocks.

4. Long-Term Wealth Accumulation:

Compounding Benefits: Multibaggers, when held over the long term, benefit from the compounding effect. As the stock price appreciates, the compounding effect accelerates wealth accumulation.

5. Recognition of Early Trends:

Spotting Opportunities: Successful Multibagger investments often involve spotting trends and opportunities before they become widely recognized by the market.

Forward-Looking Investments: Investors in Multibaggers tend to be forward-looking, identifying companies poised for substantial growth in the future.

6. Strategic Investment Choices:

Active Stock Selection: Investing in Multibagger stocks requires active stock selection based on thorough research and analysis. This approach allows investors to strategically choose stocks with the potential for extraordinary returns.

Disciplined Investing: Multibagger investing encourages a disciplined approach, focusing on companies with strong fundamentals and growth catalysts.

7. Financial Freedom:

Accelerated Wealth Creation: Multibagger investments have the potential to accelerate the process of financial freedom. Substantial returns can contribute significantly to achieving financial goals and aspirations.

8. Market-Beating Performance:

Outperformance: Multibagger stocks, by definition, outperform the broader market indices. Investors benefit from superior performance compared to average market returns.

9. Psychological Satisfaction:

Investor Confidence: Successfully identifying and investing in Multibagger stocks boosts investor confidence and provides a sense of accomplishment.

Positive Psychological Impact: Experiencing significant returns from Multibagger investments can positively impact an investor's perception of risk-taking and financial decision-making.

10. Encourages Active Involvement:

Continuous Learning: Multibagger investing often requires continuous learning and staying informed about market trends. This encourages investors to actively engage with their investment strategies.

While the benefits of investing in Multibagger stocks are enticing, it's important to note that these investments come with risks. Investors should conduct thorough research, diversify their portfolios, and maintain a long-term perspective to maximize the advantages of Multibagger investing.

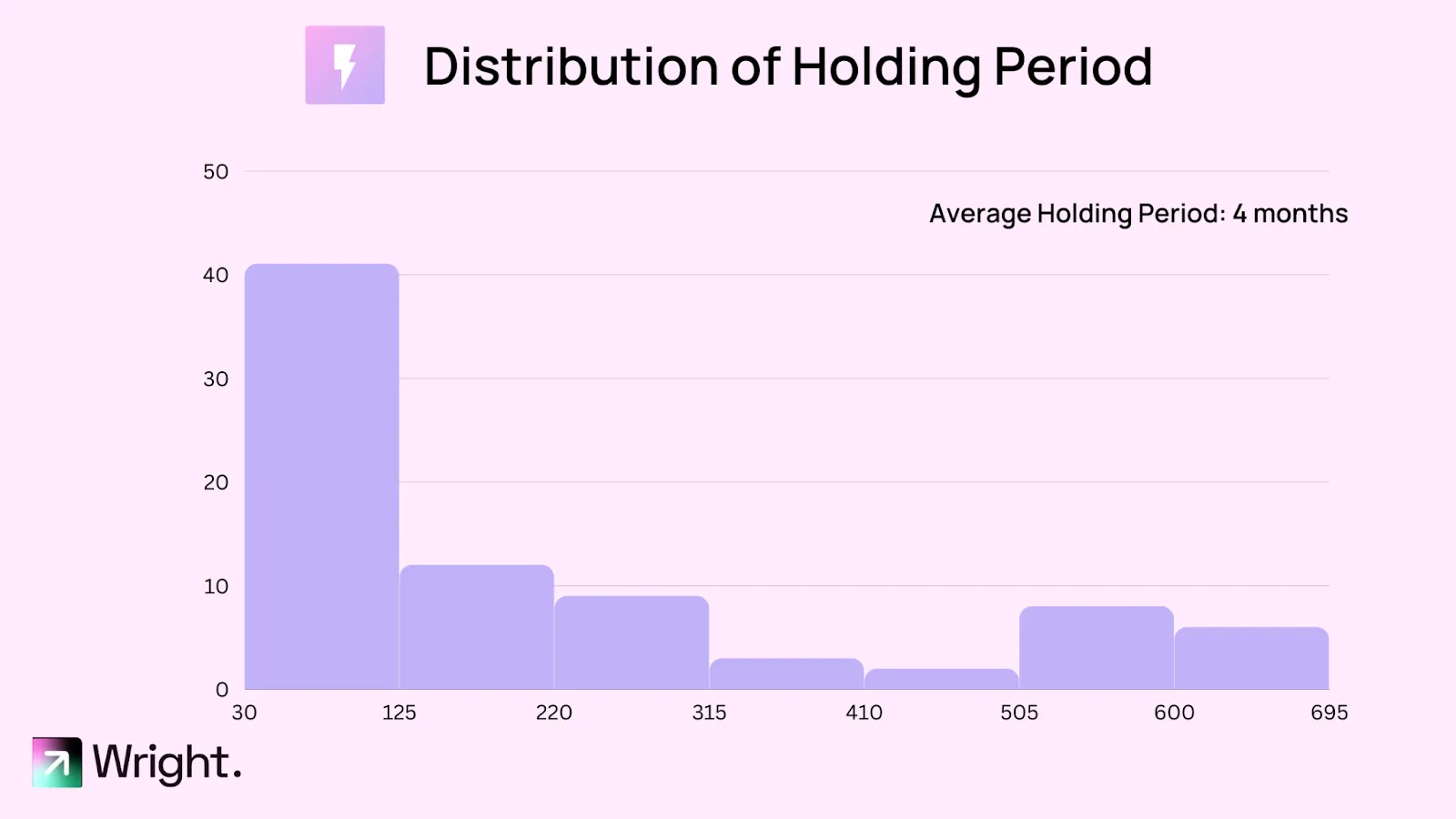

While we saw some examples of multi-baggers which we have held on to for two years, the average holding period of the portfolio had been four months. Again the distribution is skewed by a few long-term holdings while a more significant number of stocks are churned much more quickly.

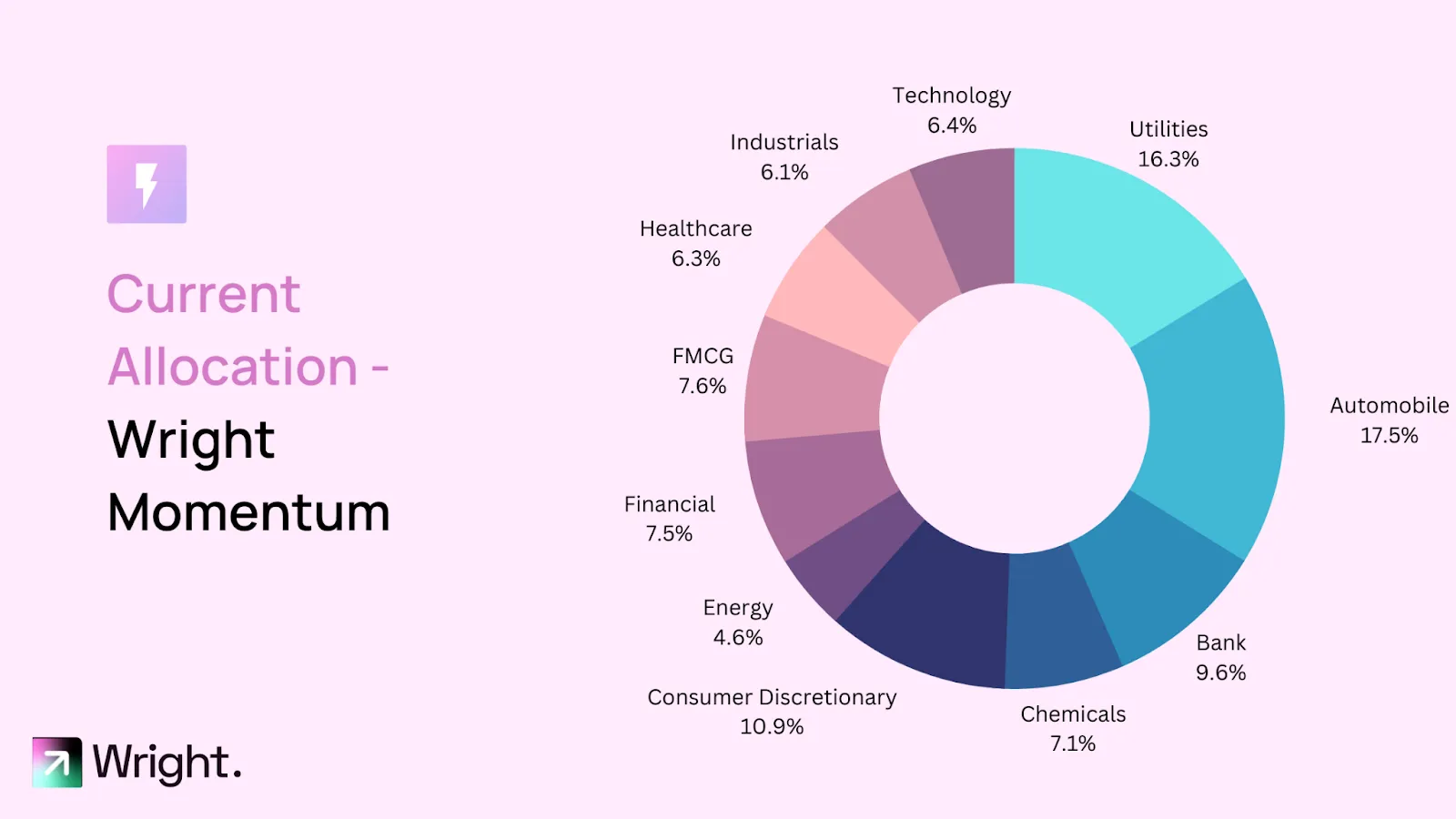

Our portfolio is highly allocated towards the Automobile and Banking and Financial Services sectors, with some additions in cyclical stocks that have come in recently. Banking and Financial services have turned the market’s favourites with fantastic earnings and strong projections. We see this sector to be strong soon. Consumption saw a boost in the festive season, and in a moderate inflationary environment, we expect autos, electronics and consumer discretionary to continue to be strong. We are also excited about the domestic cyclical due to the rising CAPEX in the economy, which makes us bet on logistics, oil & gas and other linked sectors.

Investing in Multibagger stocks in India requires a strategic approach and a thorough understanding of the stock market. Multibaggers, stocks that have the potential to multiply in value, can offer substantial returns over the long term. Here's a step-by-step guide on how to invest in Multibagger stocks in India:

1. Educate Yourself:

Understand Stock Market Basics: Gain a fundamental understanding of how the stock market operates, key financial metrics, and the factors influencing stock prices.

Learn Investment Strategies: Educate yourself on various investment strategies, including fundamental analysis, technical analysis, and a combination of both.

2. Set Investment Goals:

Define Your Objectives: Clearly define your investment goals, whether they are focused on wealth creation, retirement planning, or funding specific financial milestones.

3. Risk Assessment:

Assess Risk Tolerance: Evaluate your risk tolerance and investment horizon. Multibagger investing can be volatile, so understanding your risk appetite is crucial.

4. Research and Analysis:

Fundamental Analysis: Conduct in-depth fundamental analysis of potential Multibagger stocks. Evaluate financial statements, earnings growth, competitive positioning, and industry trends.

Technical Analysis: Use technical analysis to identify entry and exit points based on historical price movements, chart patterns, and trading volumes.

5. Diversification:

Build a Diversified Portfolio: Diversify your investments across sectors and industries to mitigate risk. Avoid putting all your capital into a single stock.

6. Stay Informed:

Continuous Learning: Stay informed about market trends, economic indicators, and global events. Continuous learning is crucial in adapting to changing market conditions.

7. Identify Growth Opportunities:

Spot Emerging Trends: Identify sectors or industries with high growth potential. Multibaggers often emerge from companies operating in expanding markets.

8. Track Financial Performance:

Quarterly Earnings Reports: Regularly monitor the quarterly earnings reports of potential Multibagger stocks. Positive earnings growth is a key indicator.

9. Monitor Market Sentiment:

Market Trends and Sentiment: Keep an eye on overall market trends and investor sentiment. Multibaggers often perform well in bullish market conditions.

10. Long-Term Perspective:

Invest for the Long Term: Multibagger investing requires a long-term perspective. Avoid reacting to short-term market fluctuations and focus on the company's growth potential over the years.

11. Use Systematic Investment Plans (SIPs):

Regular Investment: Consider using Systematic Investment Plans (SIPs) to invest fixed amounts regularly. SIPs help average out the purchase cost over time.

12. Seek Professional Advice:

Financial Advisors: Consult with financial advisors or professionals who specialize in stock market investments. Their insights can provide valuable guidance.

13. Utilize Stock Screeners:

Screening Tools: Use stock screening tools to filter stocks based on predefined criteria such as earnings growth, valuation ratios, and financial health.

14. Investment Platforms:

Online Brokerage Platforms: Open a demat account with a reliable online brokerage platform. These platforms provide access to a wide range of stocks listed on Indian stock exchanges.

15. Review and Adjust:

Periodic Portfolio Review: Regularly review your portfolio and adjust your holdings based on changing market conditions or shifts in your investment strategy.

Remember that investing always carries risks, and past performance is not indicative of future results. Conduct thorough research, stay disciplined, and invest with a long-term perspective to enhance your chances of identifying and benefiting from Multibagger stocks in the Indian market.

Wright Momentum is a popular investment strategy on Wright Research & on smallcase platform. If you’re looking to invest via the smallcase platform, please use our microsite. This enables Wright Research to retain a higher percentage of the subscription fee. Here’s our link: https://wrightresearch.smallcase.com/smallcase/WRTNM_0001

If you’re interested in checking out the direct execution using the Wright Research website, here’s the link to the portfolio on our website: https://www.wrightresearch.in/portfolio/momentum/

Here’s a quick video showcasing how you can use the Wright Research website to make a full investment using the broker gateway:

Which multibagger stock to buy now?

Specific stock recommendations change frequently based on market conditions. It's advisable to conduct thorough research or consult with financial experts for the most up-to-date recommendations tailored to your investment goals.

What is an example of momentum investing?

Buying stocks that have shown strong recent performance, expecting the upward trend to continue. For instance, purchasing stocks with rising prices and positive momentum indicators aligns with a momentum investing strategy.

How do you screen multibaggers?

Screening for multibaggers involves a comprehensive analysis of stocks based on criteria like strong trends, robust fundamentals, and positive market sentiment. Common screening factors include historical performance, earnings growth, and industry outlook.

How do I know if I have future multibaggers?

Identifying future multibaggers requires a combination of fundamental and technical analysis. Look for stocks with strong financials, a competitive edge in their industry, and positive market trends. Expert analysis and research can provide valuable insights.

What are the qualities of a multibagger stock?

Qualities of a potential multibagger include strong and sustainable earnings growth, a competitive market position, a capable management team, positive industry trends, and a sound financial health. Additionally, the stock should exhibit positive momentum and a potential for future appreciation.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart