Metals sit at the heart of every economic cycle, but within this universe, precious metals like gold, silver, platinum and palladium play a very different role from industrial metals such as copper or aluminum. For investors and allocators, understanding how these metals behave across macro regimes is increasingly important after a historic run-up in prices through 2024–25 and elevated volatility into 2026.

Broadly, metals are classified into two buckets: base (or industrial) metals and precious metals. Base metals such as copper, aluminum, zinc and nickel are abundant, highly reactive, and primarily used as inputs in construction, manufacturing, power and infrastructure, which makes their prices tightly linked to the global growth cycle.

Precious metals, in contrast, are rare, chemically more stable and command a much higher value per ounce, with gold, silver, platinum and palladium forming the core of this group. They derive demand from three pillars: jewelry and ornamentals, investment and wealth preservation, and specialized industrial applications such as electronics and autocatalysts. Because of their scarcity and monetary role, precious metals tend to move more with real interest rates, inflation expectations and geopolitical risk than with traditional growth indicators, making them a distinct asset class inside the broader commodities bucket.

The last few years have seen an unusually strong performance in precious metals relative to broader commodities and risk assets. World Bank data show that precious metal prices rose roughly 20% year‑on‑year in 2024, even as many industrial commodities struggled with slowing global manufacturing and tighter financial conditions. This outperformance accelerated in 2025 as investors sought safe‑haven assets amid geopolitical tensions and macro uncertainty, with gold, silver and platinum all “soaring” and reaching or approaching record levels.

For allocators, this has brought two questions to the front:

Are precious metals already “over‑owned” after this run‑up?

Do they still offer diversification benefits from here?

The answer depends on the metal. While aggregate precious metal prices are projected to stabilize or even ease slightly in 2026, underlying drivers differ across gold, silver, platinum and palladium, creating relative-value opportunities rather than a simple directional call.

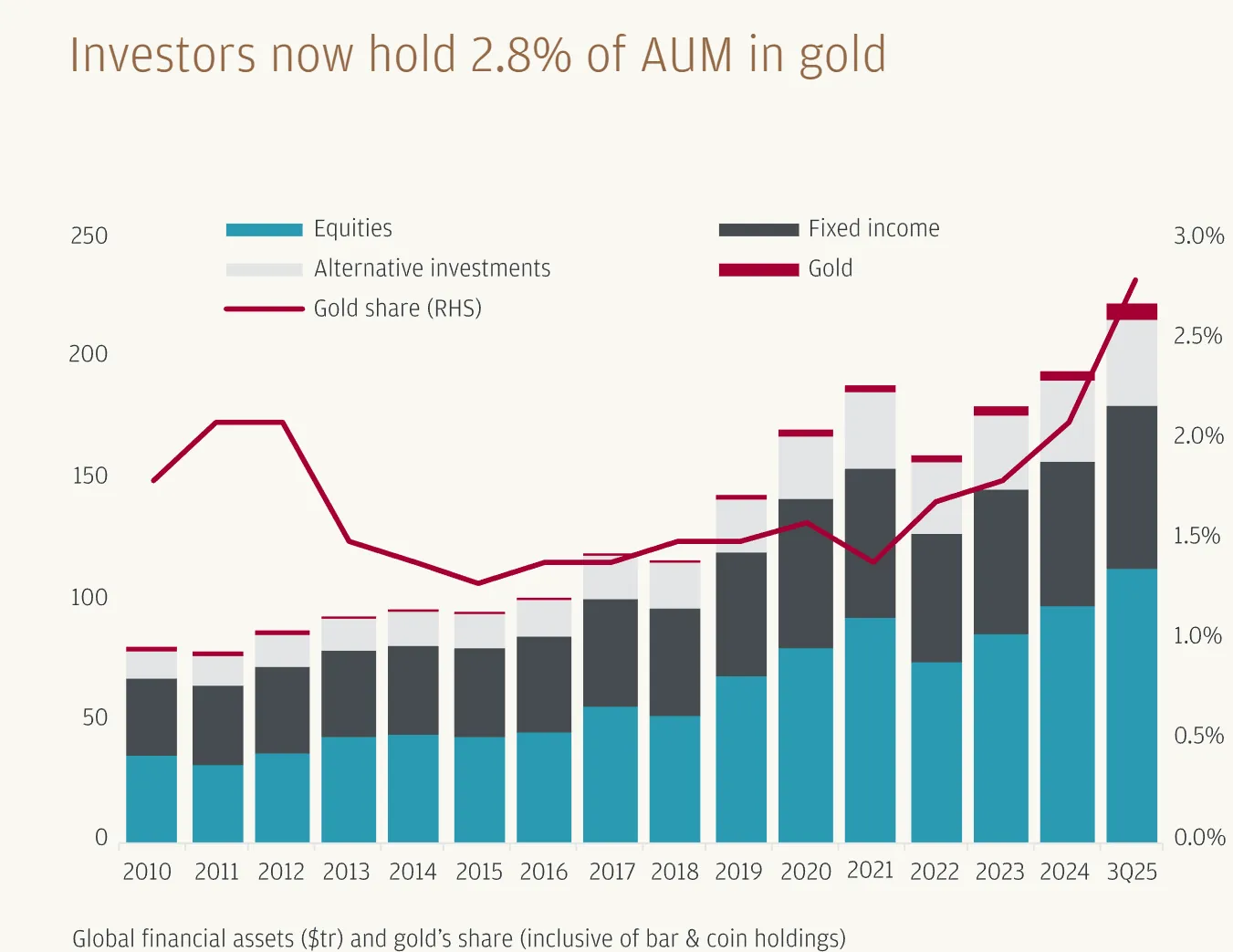

Gold remains the anchor of the precious metals complex, functioning as a quasi‑currency, reserve asset and portfolio hedge. In 2024–25, gold benefited from three reinforcing themes: elevated geopolitical risk, strong central‑bank buying, and persistent skepticism about fiat currencies in an environment of high debt and fluctuating real yields.

By late 2025, J.P. Morgan Research noted that gold prices had “soared” on the back of tariff uncertainty and strong demand from ETFs and central banks, and their outlook emphasizes that the 2026–27 trajectory will remain heavily dependent on real interest rates and policy paths. World Bank projections suggest that while the pace of gains may moderate, gold is likely to stay at elevated levels into 2026, supported by continued geopolitical tensions and reserve accumulation.

For multi‑asset portfolios, this keeps gold in a strategic role as:

A hedge against tail‑risk events and policy mistakes.

A diversifier that tends to shine when uncertainty spikes and real yields fall.

Tactically, however, late‑cycle investors need to be more valuation‑sensitive: after a multi‑year rally, forward returns are less about “mean reversion” and more about the path of real rates, the dollar and risk premia.

Silver is often seen as “gold’s high‑beta cousin”, but structurally it is a hybrid metal with both monetary and industrial characteristics. Alongside its use in jewelry and investment bars/coins, silver has critical roles in solar panels, electronics and various industrial processes, giving it meaningful exposure to decarbonization and electrification trends.

Unlike gold, silver’s fundamental backdrop has been characterized by a persistent supply deficit. An HDFC Securities outlook highlighted that the silver market is expected to record its fifth consecutive annual deficit over 2021–2025, with the cumulative shortfall nearing 800 million ounces – close to a full year’s global mine supply – as industrial and investment demand outpaces both mining and recycling. Despite relatively stable mine supply, this structural deficit has underpinned a powerful price move.

World Bank analysis notes that silver prices reached a 12‑year high by late 2024 and were expected to remain relatively firm into 2025 before a modest cooling in 2026, with the balance hinging on the strength of global industrial activity. That dual nature cuts both ways for investors: silver can rally with gold during risk‑off episodes but may underperform if industrial sentiment weakens, even when gold stays resilient.

For a quantitative strategy, silver can thus be treated as a higher‑volatility, more cyclical expression of the precious metals theme attractive when both risk‑off hedging and green‑industrial demand are in play, but vulnerable to manufacturing slowdowns.

Platinum and palladium form the platinum‑group metals (PGMs), widely used in autocatalysts for emission control, as well as in chemical, electronics and hydrogen‑related applications. While they share some characteristics with gold and silver as scarce, high‑value metals, their price behavior is more tightly linked to auto production, emissions regulation, and substitution dynamics between each other.

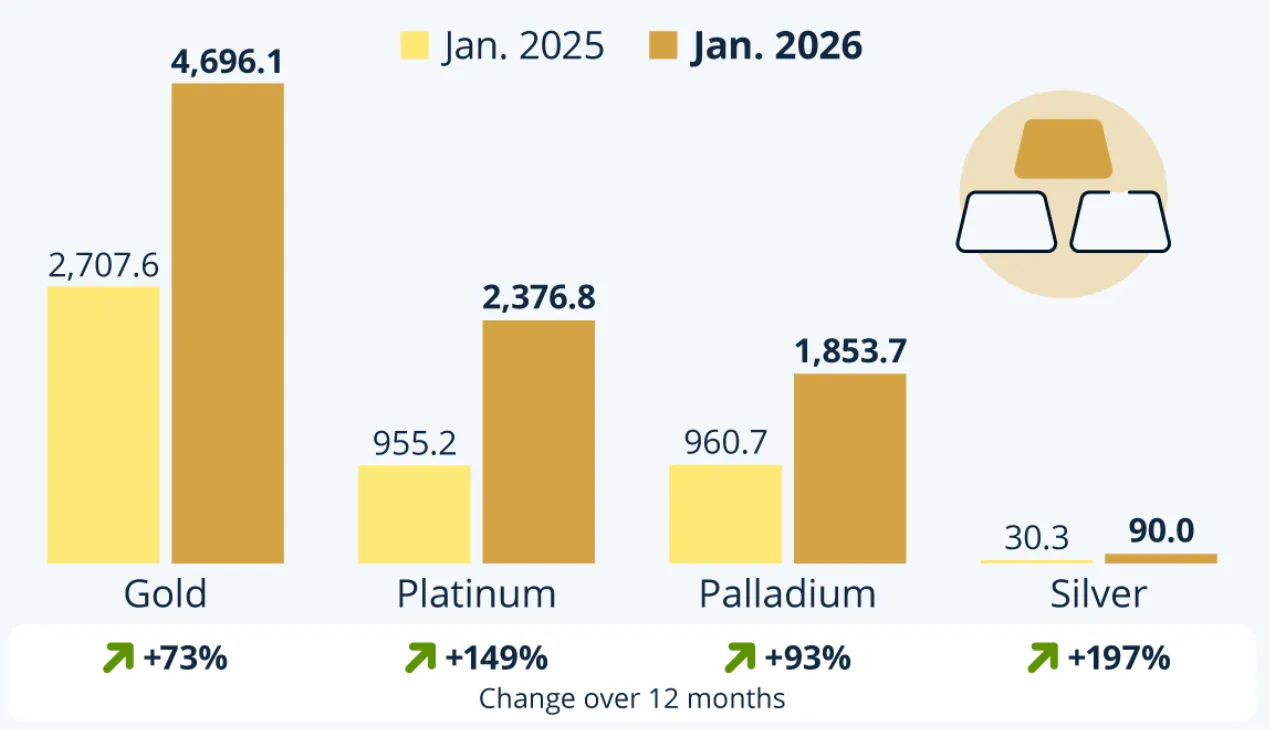

Recent data highlight how supply constraints and evolving industrial demand have reshaped this space. Statista reported that platinum prices rose from about 955 USD per ounce in January 2025 to nearly 2,400 USD per ounce on average by early 2026, an increase of around 150% over twelve months, driven by supply deficits, including disruptions tied to sanctions on major producers like Russia, and firm industrial demand. At the same time, longer‑term palladium narratives are turning more nuanced: while prices stabilized in 2024 after two years of declines and rebounded from mid‑2025, analysts see the 2025–2030 outlook as uncertain due to potential oversupply relative to demand, especially as gasoline engine volumes and autocatalyst intensity evolve.

Short‑term market pricing reflects that push‑and‑pull. BullionVault’s 2025–26 survey shows that while users remain bullish, projecting higher average prices for gold, silver, platinum and palladium by 2026, there is wide dispersion across metals and between retail expectations and analyst forecasts. TradingEconomics data indicate that palladium traded around 1,850 USD per ounce in early February 2026, down from a recent three‑year high near 2,200 USD in late January, as part of an aggressive pull‑back across PGMs. For systematic allocators, this creates a fertile ground for relative‑value trades between platinum and palladium, and between PGMs and gold, rather than simple long‑only exposure.

Copper is often called “Dr. Copper” because its price tends to diagnose the health of the global economy. It sits at the intersection of traditional industrial demand and the multi‑decade electrification and decarbonisation story.

Copper is a highly conductive, corrosion‑resistant metal used across power, construction and manufacturing. It is a core input in electrical wiring, transformers, motors, electronics, and HVAC systems, which makes it deeply tied to infrastructure and urbanisation. In construction, copper is embedded in residential and commercial buildings through wiring, plumbing and roofing. Because these sectors move with the business cycle, copper demand and prices typically rise in expansions and soften in slowdowns.

Beyond legacy uses, copper is also a critical mineral for the energy transition. Electric vehicles, charging networks, solar and wind installations, and grid upgrades all require multiples more copper than their fossil‑fuel counterparts. This gives copper a structural demand tailwind even if cyclical growth is patchy.

Copper has experienced a strong multi‑year run, hitting record or near‑record levels in recent years as markets priced in both tight supply and the energy transition narrative. Short‑term price action, however, has been volatile, whipsawed by changing expectations around global growth, China’s property cycle, tariffs and mine‑supply news.

Forward‑looking views are not uniform. Some institutions highlight recent or near‑term surpluses and argue that prices may consolidate or pull back from peaks in the immediate future. Others emphasize ongoing mine disruptions and tight inventories and expect renewed upside as deficits re‑emerge. Across most major forecasts, there is broad agreement on a structurally positive long‑run story for copper anchored in electrification and infrastructure, even if the path is choppy.

The macro narrative behind precious metals is familiar but currently amplified. Precious metals as a group tend to respond to:

Real interest rates: lower real yields reduce the opportunity cost of holding non‑yielding assets like gold.

Inflation expectations: sustained inflation or fears of debasement support demand for monetary metals.

Geopolitical risk and financial stress: crises usually coincide with flight‑to‑quality into safe‑haven assets.

The World Bank’s Commodity Markets Outlook notes that precious metal prices, after rising sharply in 2024, are likely to remain high but broadly stable in 2025, with a mild decline projected in 2026, assuming no major new shocks. CME Group commentary similarly argues that after a record‑breaking year in 2025, the relative performance of gold, silver and other precious metals in 2026 will hinge on the trajectory of inflation, interest rates and central‑bank policy.

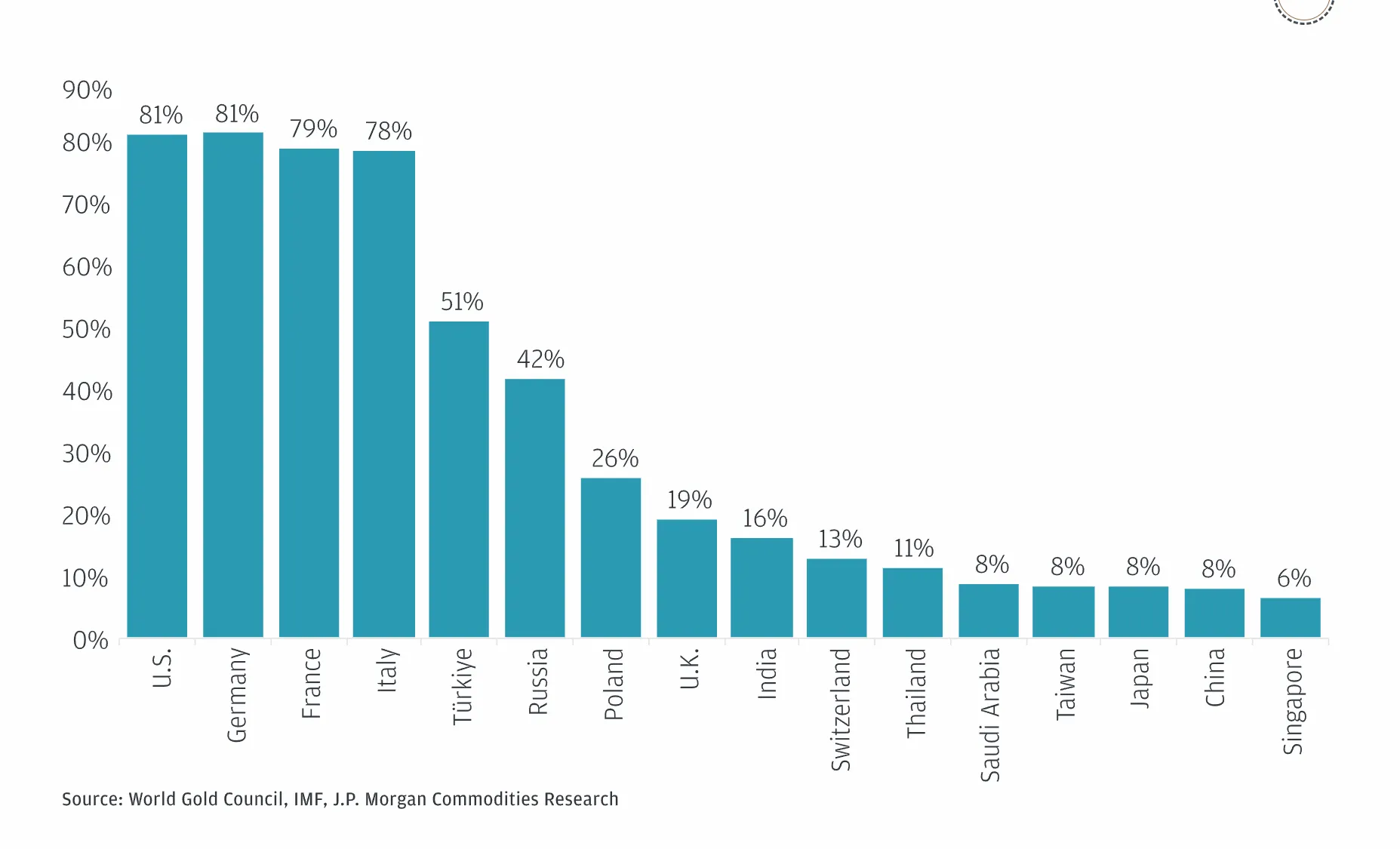

Source : WGC , JP Morgan

The global precious metals market is not a niche corner anymore; it is a sizable, growing segment of the investable universe. Coherent Market Insights estimates the precious metals market at approximately 351 billion USD in 2026, with an expected expansion to about 571.5 billion USD by 2033, implying a compound annual growth rate around 7.2% over 2026–2033. The sector could add roughly 105.3 billion USD in market size between 2024 and 2029, growing at around 6.4% annually, supported by ongoing demand for safe‑haven assets and industrial use.

From an allocator’s perspective, precious metals can serve multiple roles:

Strategic hedge: gold (and to a lesser extent silver) as long‑term protection against macro and policy tails.

Tactical trade: silver and PGMs as higher‑beta expressions of both risk‑off and industrial themes.

Relative‑value and dispersion plays: exploiting diverging fundamentals across gold, silver, platinum and palladium using systematic signals.

At the same time, the broader metal complex – including base metals – still anchors the growth and infrastructure side of the commodity basket, offering cyclical exposure and inflation sensitivity that complements the defensive nature of precious metals.

For investors watching metals after an extraordinary 2024–25, three points stand out:

Precious metals have re‑asserted their role as macro hedges, with prices elevated and sentiment strong, but forward returns will be increasingly path‑dependent on real yields and policy.

Within the complex, gold looks more “earnest hedge”, silver remains the higher‑volatility hybrid with a structural deficit story, and PGMs are increasingly idiosyncratic, driven by auto, green‑hydrogen and supply‑risk narratives.

For systematic strategies, metals offer rich cross‑sectional dispersion and regime‑driven trends, making them a fertile ground for trend‑following, carry, and relative‑value models rather than just static buy‑and‑hold exposure.

As uncertainty about growth, inflation and geopolitics persists into 2026, precious metals are likely to remain on the radar of both discretionary and quantitative allocators not just as a hedge of last resort, but as an active, signal‑rich component of modern portfolios.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart