“You get recessions, you have stock market declines. If you don't understand that's going to happen, then you're not ready, you won't do well in the markets” - Peter Lynch

Investing in stocks can help you make a lot of money. This is the ideology that attracts most investors to the stock market. There are multiple success stories of individuals who started with nothing and have built an empire just by investing in stocks. But for every success story, there is also the investor who quit at the wrong time.

Getting inspired is alright and taking the first step towards investing in stocks to grow your money is necessary. However, the problem arises when investors enter the stock market with unrealistic expectations. If an investor does not understand the market dynamics and does not account for risk, getting in at a unfavourable time can cause immense disappointment.

So, let’s dive in and understand the risks & rewards of investing in the stock market.

Why are stock markets an attractive investment?

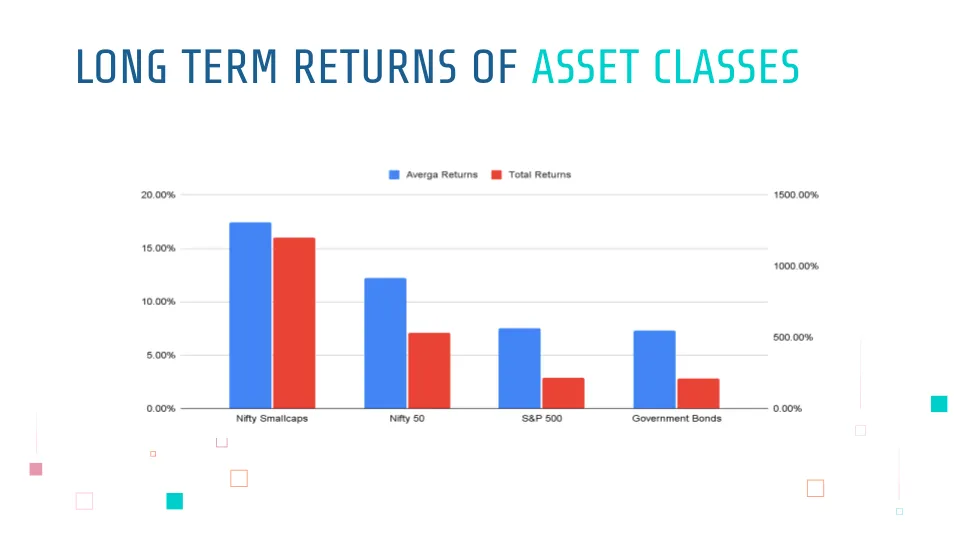

Look at the performance of all top asset classes in the last 15 years, the stock market index has given a compounded growth rate of 12% and the Smallcap Index of 17% this compared to a 7.3% return by the Government Bonds. Which means that 100 Rs invested in th Nifty would have become 530, 100 Rs in Smallcaps 1200 and 100 Rs in Bonds would have been only 210. So it’s a not brainer that stock markets are an extremely attractive investment to grow wealth.

Investing is not all fun and games

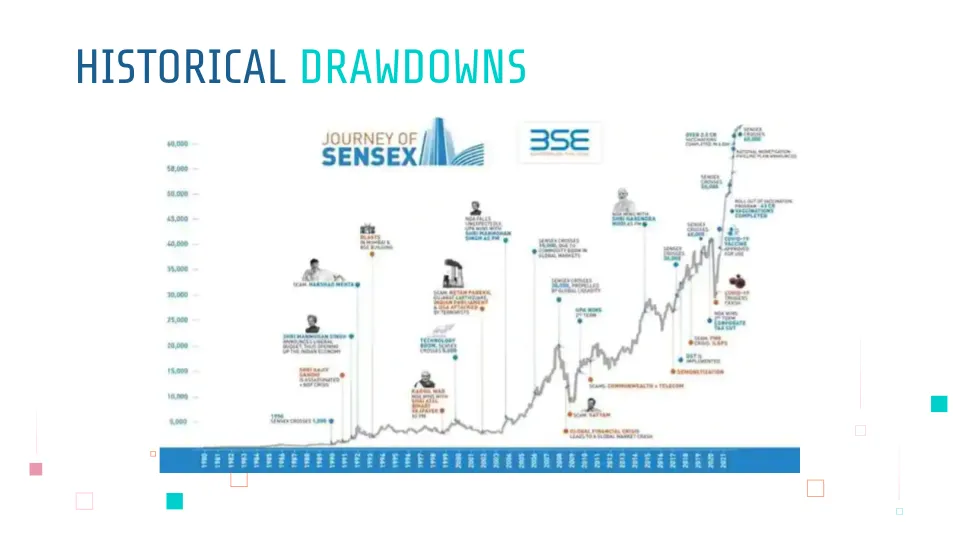

Look at the journey of the sensex, there are 18 instances of more than 10% correction in the 16 year history.

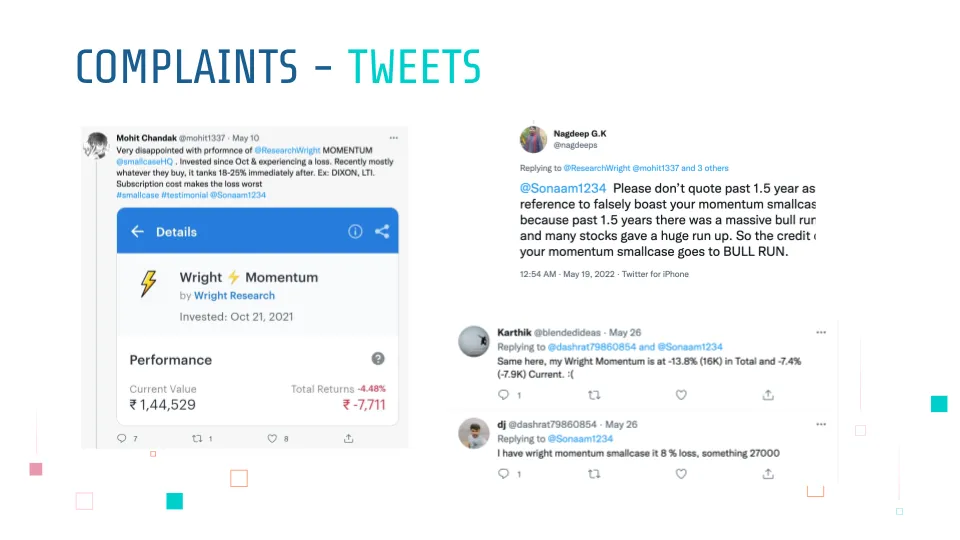

There is a expectation mismatch

Short term and even longer corrections are normal in investing and when the broad market is underperforming, expecting high returns is unreasonable. There’s no future for a investor who denies the existence of risk. To be a successful long term investor, be aware of the risks and the rewards that come with risk.

What are the types of Risks in Investing?

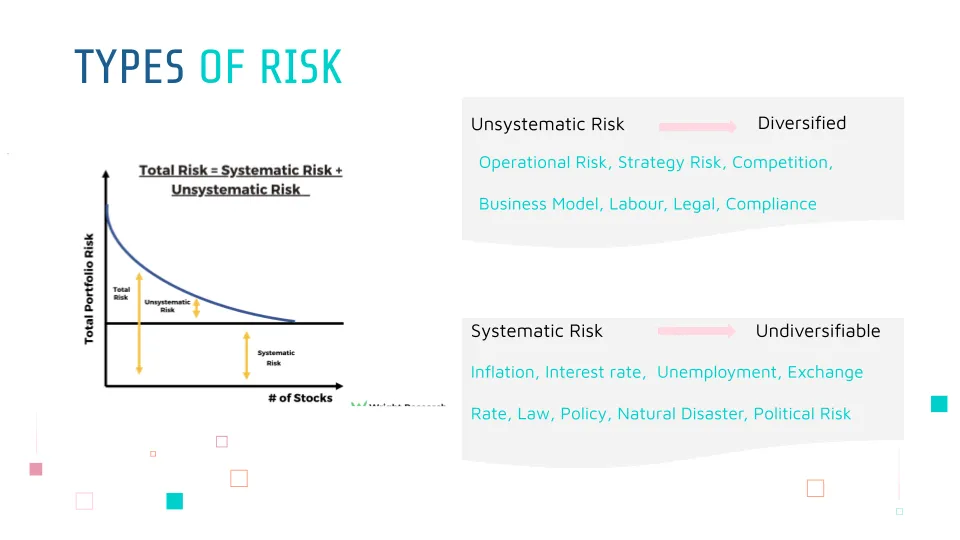

While, investment risk is the exposure of an investment opportunity where loss of capital or downturn might be factored in. Investment risk is still a broad term but can be understood when broken down into the parts, i.e Systematic & Unsystematic Risk.

Systematic Risk

Inherent risks in the stock market are known as systematic risks. These risks affect the whole market. Because they affect the entire asset class, they're also known as "non-diversifiable risk" or "market risks."

External factors such as the present geo-political situation, monetary policy changes, and natural disasters are common causes of these risks. COVID-19, for example, is a systematic risk since it has an impact on the entire stock market & these risks are non-diversifiable as a company can not control, avoid or minimise these risks.

Unsystematic Risks

Unsystematic risks are specific & diversifiable risks that are peculiar to a particular company or industry. These dangers develop as a result of a variety of internal and external causes that influence only the specific business and not the entire market. Systematic risks have components such as Business Risk & Financial Risk.

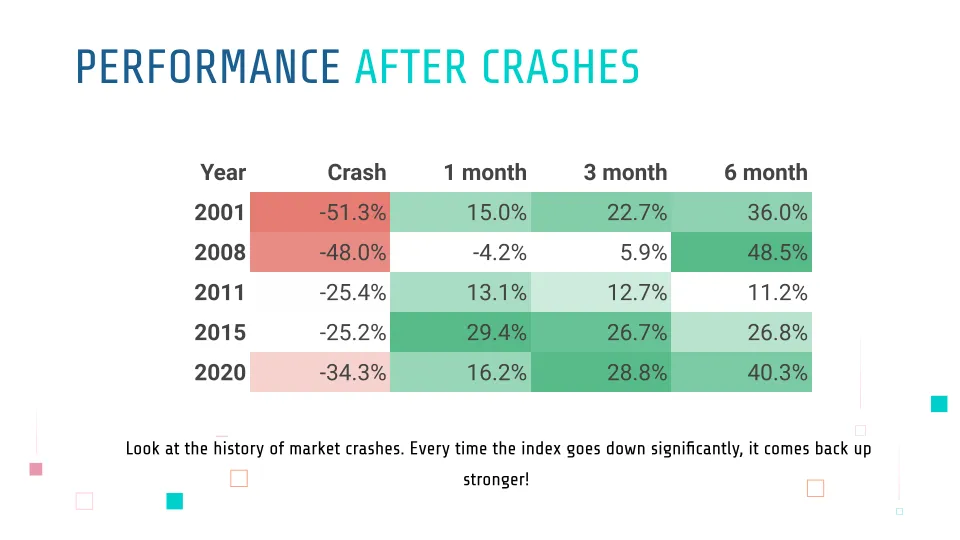

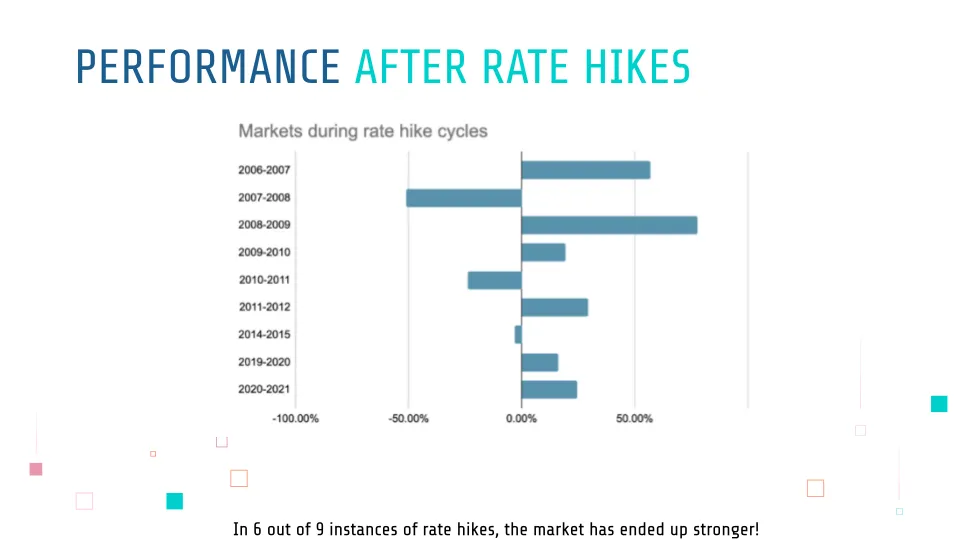

What happening now? What happens after crashes?

We are seeing systematic risks - growth is deceleration, inflation, recessionary fears etc.

Markets are uncertain and volatile.

If you got in on top you are struggling with the PNL.

But all is not lost. Obviously. Risk is part of the process. Everytime the market corrects, it comes back up stronger. What is needed is patience.

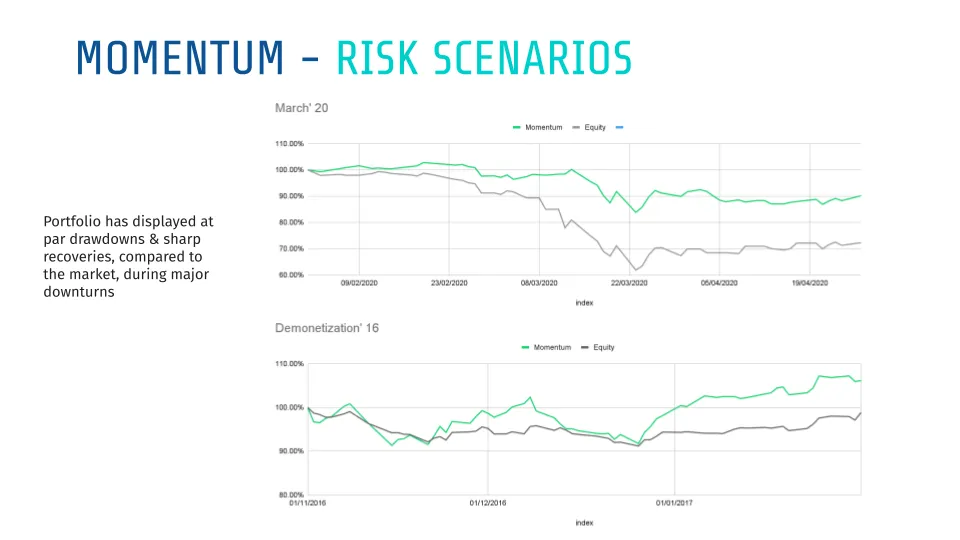

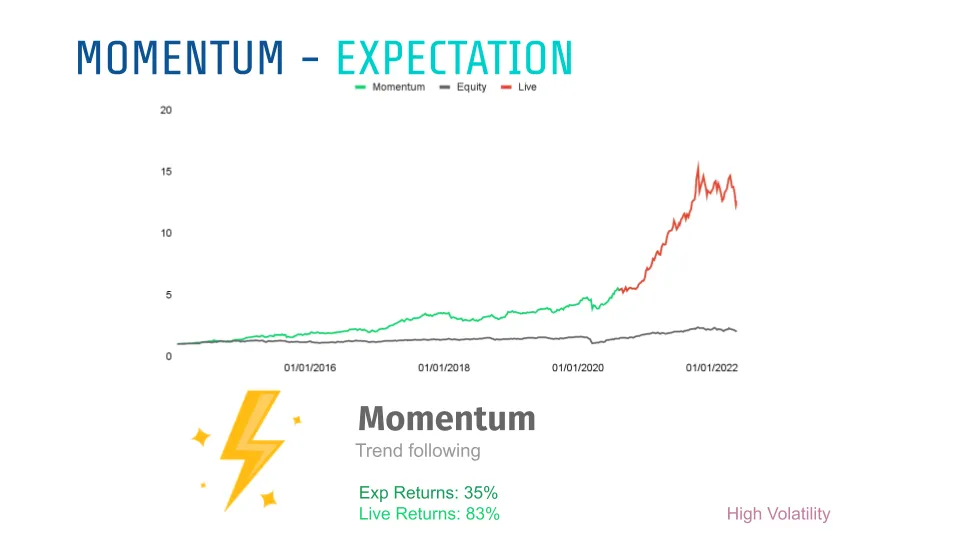

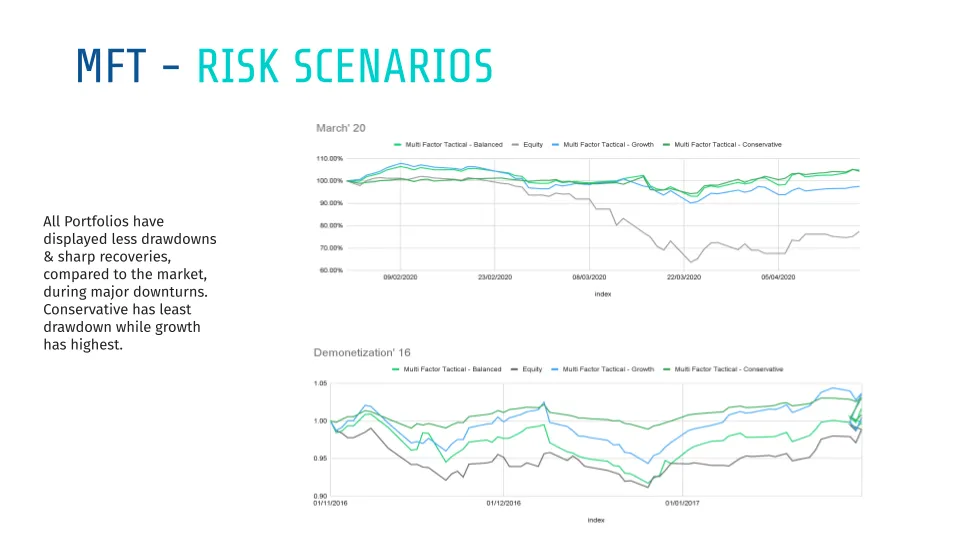

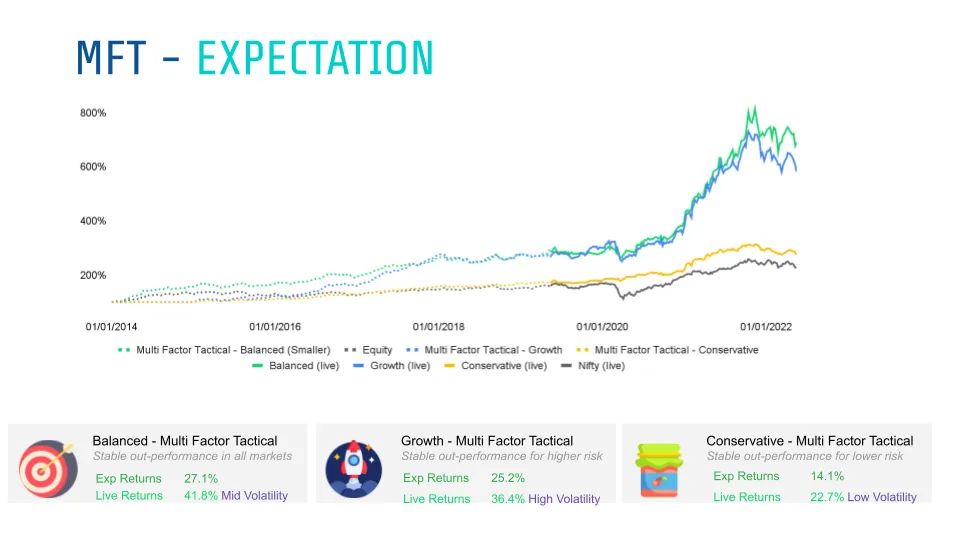

Scenario Analysis and Expectations

Let’s analyse our top portfolios and see how they work in different scenarios.

The Momentum stocks are high risk stocks. They crash when markets are crashing. But with our strong risk management we deallocate and adjust dynamically to minimize losses.

The expectations from these portfolios are based on purely data driven numbers, which makes us confident about the long term performance.

The Multi Factor Portfolios Are more conservative and sees lower drawdowns. With our strong risk management we deallocate to bonds, gold and adjust sectors dynamically to minimize losses.

The expectations from these portfolios are based on purely data driven numbers, which makes us confident about the long term performance.

Conclusion

As investors, being informed and not having unrealistic expectations from the markets is the right way to go. Unrealistic expectations will lead to disappointment and realistic expectations will give you confidence. There’s no future for a investor who denies the existence of risk. To be a successful long term investor, be aware of the risks and the rewards that come with risk.

Be a Long Term Investor

To incentivize investors to invest long term, we have increased the prices of short term plans and are discounting long term plans. If you subscribe for 6 months, you can get a 30% discount using coupon code LONGTERM. Long term investing has never been so attractive!

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart